Sisal Twine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432865 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Sisal Twine Market Size

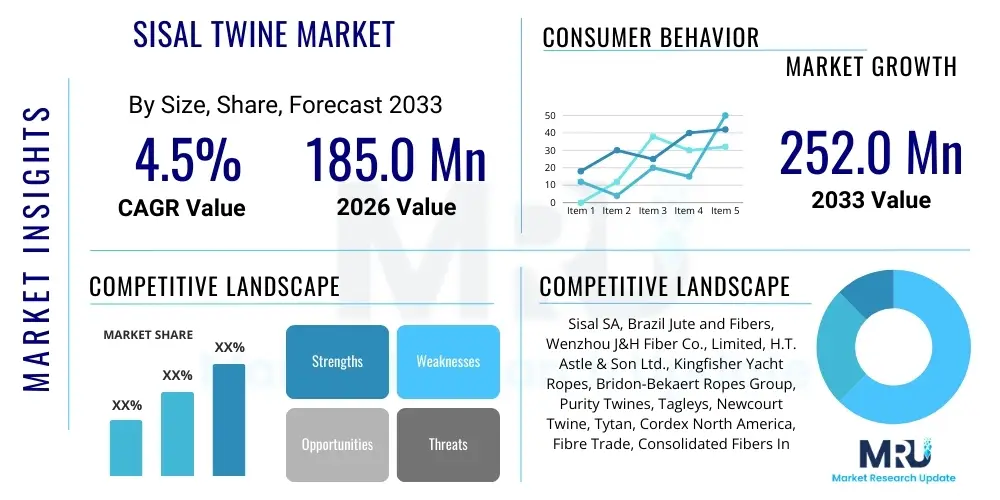

The Sisal Twine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 185.0 million in 2026 and is projected to reach USD 252.0 million by the end of the forecast period in 2033.

Sisal Twine Market introduction

Sisal twine is a durable, natural fiber product derived from the leaves of the Agave sisalana plant. Known for its strength, biodegradability, and resistance to degradation from sunlight, it serves as an environmentally conscious alternative to synthetic ropes and twines. The manufacturing process involves decortication, drying, brushing, and ultimately spinning the fibers into varying thicknesses suitable for diverse applications. Its inherent sustainability profile positions it favorably against polypropylene and nylon options, driving adoption across sectors increasingly focused on green initiatives and reduced environmental footprint.

The primary application of sisal twine resides within the agricultural sector, particularly in baling hay and straw, a function for which it is highly valued due to its robust knot strength and ability to fully decompose after use, eliminating plastic residue in fields. Beyond agriculture, sisal twine finds extensive use in industrial packaging, shipping, construction, and artisanal crafts, where its rustic appearance and high tensile strength are beneficial. Growing awareness regarding ocean plastic pollution and the shift towards bio-based materials in consumer packaging further solidify sisal twine’s market position, expanding its reach into retail and specialized horticulture.

Driving factors in this market include the global emphasis on sustainable farming practices, favorable government policies promoting natural fiber cultivation in emerging economies, and the inherent cost-effectiveness of sisal production compared to petrochemical-based synthetics. The twine’s anti-static properties and relatively high abrasion resistance also contribute to its steady demand in niche industrial applications. However, market growth remains closely linked to volatile agricultural output and commodity price fluctuations for sisal fiber, necessitating effective supply chain management and vertical integration among major market players.

Sisal Twine Market Executive Summary

The Sisal Twine Market is characterized by robust growth primarily fueled by the agricultural sector’s demand for biodegradable baling materials and a global macro-trend favoring sustainable and natural fibers over petrochemical derivatives. Business trends indicate an increased focus on traceability and ethical sourcing of sisal fibers, particularly from key producing regions in East Africa and South America. Furthermore, market participants are investing in advanced spinning and treatment technologies to enhance the moisture resistance and durability of the twine, broadening its application potential beyond traditional hay baling into heavy-duty industrial bundling and geotextile applications, thereby capturing higher-value segments.

Regionally, the market exhibits bifurcation. North America and Europe, while having limited sisal cultivation, represent major consumption hubs driven by large-scale mechanized agriculture and stringent environmental regulations favoring natural materials. Asia Pacific (APAC) and the Middle East & Africa (MEA), specifically countries like Tanzania, Kenya, and Brazil, are central to the supply chain, accounting for the vast majority of raw sisal fiber production. Strategic efforts include optimizing logistics between these production centers and consumption markets to mitigate transportation costs and ensure stable supply, particularly during peak harvest seasons in developed economies.

Segmentation trends highlight the dominance of the baler twine segment due to its essential role in hay and forage preservation. However, the industrial and commercial segments, encompassing specialized marine ropes, polished packaging materials, and interior decor twines, are registering faster growth rates. This acceleration is driven by consumer preferences for eco-friendly aesthetics and the industrial need for strong, non-polluting packaging solutions. Companies are segmenting their product lines based on fiber quality, gauge thickness (ply), and treatment methods (oiled vs. unoiled), catering specifically to the nuanced requirements of large commercial farms versus small-scale organic operations.

AI Impact Analysis on Sisal Twine Market

Common user questions regarding AI's influence in the Sisal Twine market often revolve around optimizing raw material cultivation, enhancing supply chain transparency, and predicting fluctuating commodity prices. Users are specifically concerned about how AI-driven predictive analytics can stabilize sisal fiber costs, which are notoriously volatile, and how automation can be introduced into the fiber processing stages (decortication and spinning) without compromising the traditional, organic nature of the product. The core theme is leveraging AI to manage agricultural risks and improve processing efficiency, thereby ensuring consistent quality and competitive pricing against synthetic alternatives, while maintaining the sustainable market promise.

- AI-Powered Yield Prediction: Utilizing satellite imagery and machine learning to forecast sisal harvest volumes, enabling better planning for fiber processing and procurement.

- Optimized Irrigation and Pest Control: Implementing smart sensor systems monitored by AI to minimize water usage and precisely target application of organic pesticides, improving yield health sustainably.

- Supply Chain Traceability: Deploying blockchain and AI integration to track sisal fiber from the farm to the final twine product, ensuring ethical sourcing and quality verification for B2B buyers.

- Price Volatility Mitigation: Developing AI models that analyze global agricultural output, weather patterns, and currency fluctuations to provide real-time pricing forecasts, aiding purchasing decisions.

- Automated Quality Grading: Using computer vision systems integrated with AI to grade raw sisal fiber bundles automatically based on length, strength, and cleanliness, standardizing raw material input quality.

DRO & Impact Forces Of Sisal Twine Market

The Sisal Twine Market is primarily driven by the escalating global demand for sustainable agricultural inputs, particularly in regions promoting organic farming and responsible waste management. The intrinsic biodegradability of sisal fiber is a major competitive advantage, especially given the rising regulatory pressure in North America and Europe to phase out plastic baling materials like polypropylene twine. Conversely, the market faces significant restraints, including the inherent volatility of sisal crop yields, which are highly susceptible to climatic changes such as droughts or heavy rainfall, leading to inconsistent raw material supply and price instability. Furthermore, the operational challenges associated with manually harvesting and processing sisal fiber in major producing regions also limit scalability and efficiency.

Opportunities for market expansion are substantial, rooted in diversifying sisal twine applications beyond traditional baling. Emerging uses include geotextiles for erosion control, composite materials reinforced with sisal fiber (e.g., automotive interior parts replacing fiberglass), and high-end consumer products like decorative ropes and premium packaging. Strategic investment in new processing technologies that reduce fiber wastage and improve the uniformity and tensile strength of the twine offers potential for premiumization. Additionally, the development of hybrid twines combining sisal with other biodegradable natural fibers (e.g., jute or hemp) presents a future avenue for enhanced performance tailored to specific industrial needs.

The dominant impact forces shaping this market include macroeconomic shifts toward circular economies and increasing consumer demand for transparent supply chains. The environmental impact force is particularly strong, pressuring farmers and processors to adopt natural alternatives. The competitive force is moderate, primarily revolving around the price comparison between sisal and mass-produced synthetic twines; therefore, maintaining cost efficiency in sisal production is paramount. The technological impact force focuses less on revolutionizing the fiber itself and more on optimizing cultivation, harvesting, and processing efficiency through automation and data analytics, ensuring sisal remains a viable and high-quality alternative.

Segmentation Analysis

The Sisal Twine Market is systematically segmented based on product type, application, thickness (gauge), and distribution channel, reflecting the varied requirements across the agricultural and industrial spectrums. The primary segmentation centers around whether the twine is treated (oiled or polished) for enhanced durability or left untreated for sensitive applications like organic gardening. The structural integrity and diameter of the twine, typically measured in ply or gauge, dictate its suitability for heavy-duty tasks such as large round bale production versus lighter packaging and crafting needs. Understanding these segments is crucial for manufacturers to tailor production runs and inventory management according to seasonal demand peaks in agriculture.

- By Type:

- Treated (Oiled) Sisal Twine

- Untreated (Unoiled) Sisal Twine

- Polished Sisal Twine

- By Application:

- Agricultural Baling (Hay, Straw, Silage)

- Industrial Packaging and Bundling

- Horticulture and Gardening (Trellising, Tying)

- Crafts and Decor

- Marine and Shipping

- By Thickness/Gauge:

- Single Ply (Light Duty)

- Double Ply (Medium Duty)

- Three Ply and Above (Heavy Duty/Baler Twine)

- By Distribution Channel:

- Direct Sales (B2B to Large Farms/Industrial Users)

- Distributors and Wholesalers

- Retail (Hardware Stores, Garden Centers)

- E-commerce

Value Chain Analysis For Sisal Twine Market

The Sisal Twine value chain begins with upstream activities focused on the cultivation and harvesting of the sisal plant, primarily concentrated in equatorial regions. This stage is labor-intensive and highly dependent on natural conditions. The harvested leaves undergo immediate processing—decortication—to extract the raw fiber. Efficiency in this upstream stage is paramount, as delayed processing can lead to fiber degradation. Key upstream challenges include maintaining fiber quality standards across various smallholder farms and ensuring sustainable farming practices to prevent soil depletion. Major players often engage in contract farming or operate large, vertically integrated plantations to ensure a reliable input supply, thereby managing the inherent risks associated with commodity crop production.

The midstream phase involves the industrial processing of the raw sisal fiber, encompassing drying, brushing, grading, and eventually spinning the fiber into various gauges of twine. This stage requires specialized machinery and expertise to achieve the necessary tensile strength and knotting properties required for high-stress applications like mechanized baling. Treatment processes, such as oiling, are applied here to improve weather resistance and reduce friction during machine operation. Quality control at this juncture is critical, influencing the perceived value and performance of the final product in end-user applications. Companies focusing on premium, high-strength twines invest heavily in advanced spinning technologies to optimize uniformity and minimize breakage.

Downstream activities involve the distribution, marketing, and sale of the finished sisal twine to end-users. Distribution channels are varied, involving both direct B2B sales to large agricultural cooperatives and indirect sales through extensive networks of agricultural suppliers, hardware wholesalers, and retail chains. The market relies heavily on seasonal logistics, particularly anticipating the peak baling season in the Northern Hemisphere. E-commerce platforms are gaining relevance for smaller quantity purchases, especially within the craft and horticultural segments. Effective supply chain visibility and strong relationships with regional distributors are essential for maintaining market penetration and rapidly responding to fluctuating agricultural demands, maximizing product placement across diverse geographical markets.

Sisal Twine Market Potential Customers

The primary consumers of sisal twine are entities requiring biodegradable, strong, and friction-resistant binding materials. The dominant customer base consists of large-scale commercial farming operations involved in producing hay, straw, and forage, particularly in developed agricultural economies such as North America, Europe, and Australia. These operations utilize high-speed, automated balers that require consistent and reliable twine performance, making quality specifications critical. The secondary, rapidly expanding customer group includes companies within the sustainable packaging and logistics sectors that are phasing out plastic straps and films in favor of natural bundling solutions to meet corporate sustainability mandates and address consumer demand for eco-friendly packaging.

Beyond the core agricultural and industrial packaging segments, a significant customer base exists in specialized niche markets. Horticultural businesses, including nurseries and greenhouses, rely on sisal twine for trellising, staking, and plant support, appreciating its natural aesthetic and environmental inertness. Furthermore, the retail market for crafts, DIY projects, and home décor represents a consistent source of demand. These consumers seek the material for its rustic texture and natural color, driving demand for specialized, polished, and dyed variations of the twine. Targeting these diverse end-users requires differentiated marketing strategies, emphasizing tensile strength and cost-effectiveness for agricultural buyers, and aesthetic appeal and environmental benefits for retail customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.0 million |

| Market Forecast in 2033 | USD 252.0 million |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sisal SA, Brazil Jute and Fibers, Wenzhou J&H Fiber Co., Limited, H.T. Astle & Son Ltd., Kingfisher Yacht Ropes, Bridon-Bekaert Ropes Group, Purity Twines, Tagleys, Newcourt Twine, Tytan, Cordex North America, Fibre Trade, Consolidated Fibers Inc., Greenman Sisal Products, The Twine Source, Fana Sisal, The Rope and Twine Co., East African Sisal, Sisal Fiber Mills, Universal Twine Solutions |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sisal Twine Market Key Technology Landscape

The Sisal Twine market's technological landscape is primarily centered on enhancing the efficiency of fiber processing and improving the mechanical properties of the final product, rather than fundamentally altering the natural material itself. Key advancements focus on optimizing the decortication process using semi-automated or fully automated machinery, which significantly increases fiber extraction yield and reduces labor costs associated with the initial, labor-intensive phase. Furthermore, sophisticated drying and brushing technologies are employed to ensure consistent moisture content and remove impurities, which directly translates to superior quality and uniformity in the spun fiber, crucial for preventing breaks during high-speed baling operations.

In the spinning and finishing stages, continuous innovation involves developing specialized lubrication and treatment technologies. For agricultural baler twine, the application of mineral or biodegradable oils is essential for reducing friction and protecting the twine from premature degradation by UV light and moisture. The latest technology involves bio-based lubrication systems that maintain the product's environmental integrity while achieving performance comparable to traditional mineral-oiled twines. Precision winding technology also plays a crucial role, ensuring that the twine spools are uniformly packed and knot-free, optimizing compatibility with modern, high-volume automated baling equipment and minimizing downtime for end-users.

Beyond manufacturing, digital technology is increasingly influencing the market's supply chain management. Integration of IoT sensors in sisal plantations for monitoring soil health and weather conditions, coupled with advanced analytics, allows producers to predict optimal harvest times and potential yield variations. Furthermore, the use of blockchain technology is emerging as a method to provide immutable records of fiber origin, processing parameters, and ethical sourcing certifications, addressing the growing consumer and industrial demand for high supply chain transparency. These technological deployments collectively aim to standardize quality, reduce environmental impact, and improve cost competitiveness against synthetic alternatives.

Regional Highlights

Regional dynamics are critical in the Sisal Twine market, separating the major consumption centers from the primary production bases, thereby shaping global trade flows and price mechanisms.

- North America (US and Canada): Highly significant consumption market driven by vast mechanized agriculture (hay and forage production). Demand is characterized by high requirements for quality, strength, and biodegradability. Stringent environmental regulations favor natural fibers over synthetics, stimulating continuous demand growth for premium baler twine.

- Europe (Germany, France, UK): A crucial consumption region emphasizing sustainable and organic farming practices. Demand is high for untreated and organically sourced sisal twine used in both agriculture and specialized horticultural applications. Europe also hosts advanced processing centers focused on niche, treated sisal products for industrial use.

- Asia Pacific (APAC) (China, India): While consumption is growing, APAC's main significance lies in low-cost fiber processing capabilities, utilizing sisal imported from Africa and Latin America. China is a major hub for manufacturing finished twine and rope for export, often blending fibers for cost efficiency.

- Latin America (Brazil, Mexico): Dominates as a critical global supplier of raw sisal fiber. Brazil, in particular, possesses vast, well-managed sisal plantations and significant processing capabilities, benefiting from favorable climates and large-scale agricultural infrastructure, positioning it as a powerful determinant of global sisal pricing.

- Middle East and Africa (MEA) (Tanzania, Kenya): The historical epicenter of sisal cultivation. Countries like Tanzania and Kenya are essential for providing high-quality raw fiber to the global market. Market focus here is on improving processing efficiency and achieving sustainability certifications to maximize export value.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sisal Twine Market.- Sisal SA

- Brazil Jute and Fibers

- Wenzhou J&H Fiber Co., Limited

- H.T. Astle & Son Ltd.

- Kingfisher Yacht Ropes

- Bridon-Bekaert Ropes Group

- Purity Twines

- Tagleys

- Newcourt Twine

- Tytan

- Cordex North America

- Fibre Trade

- Consolidated Fibers Inc.

- Greenman Sisal Products

- The Twine Source

- Fana Sisal

- The Rope and Twine Co.

- East African Sisal

- Sisal Fiber Mills

- Universal Twine Solutions

Frequently Asked Questions

Analyze common user questions about the Sisal Twine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Sisal Twine and why is it preferred over synthetic options?

Sisal twine is a durable, natural fiber rope derived from the Agave sisalana plant. It is highly preferred over synthetic options like polypropylene due to its 100% biodegradability, exceptional knot strength, and eco-friendly attributes, preventing non-degradable plastic contamination in agricultural fields.

How does the volatility of sisal commodity prices affect the market?

Price volatility, often caused by climatic instability and dependence on seasonal agricultural yields in key producing countries (e.g., Brazil, Tanzania), creates procurement challenges. This fluctuation impacts manufacturing costs and retail pricing, necessitating advanced supply chain risk management and predictive analytics tools for buyers.

What are the primary applications driving the current demand for Sisal Twine?

The primary driver is the agricultural sector, specifically mechanized baling of hay, straw, and forage, where its biodegradable nature is essential. Secondary growth drivers include industrial packaging, horticultural support (trellising), and consumer crafts seeking sustainable materials.

Is Sisal Twine environmentally sustainable, and does it receive special certifications?

Yes, sisal is highly sustainable as a rapidly renewable resource requiring minimal water and no chemical pesticides for growth. Many sisal producers adhere to environmental standards, and the finished twine is often certified as compostable and non-toxic, supporting global sustainability initiatives and ethical sourcing claims.

Which regions dominate the global production versus consumption of Sisal Twine?

Latin America (primarily Brazil) and East Africa (Tanzania and Kenya) dominate global raw sisal fiber production and processing. Consumption is dominated by developed agricultural regions, including North America and Europe, which rely heavily on sisal for large-scale baling operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager