Size Exclusion Chromatography (SEC) HPLC Column Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434761 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Size Exclusion Chromatography (SEC) HPLC Column Market Size

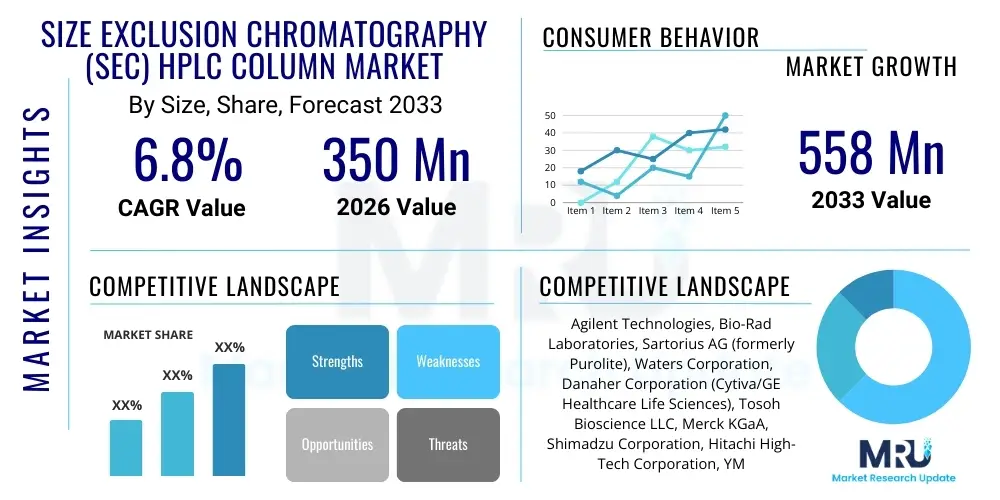

The Size Exclusion Chromatography (SEC) HPLC Column Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 558 Million by the end of the forecast period in 2033.

Size Exclusion Chromatography (SEC) HPLC Column Market introduction

The Size Exclusion Chromatography (SEC) HPLC Column Market encompasses specialized consumable separation technologies crucial for characterizing macromolecules, primarily in the pharmaceutical and biotechnological industries. SEC, also known as gel permeation chromatography (GPC) when applied to synthetic polymers, separates analytes based on their hydrodynamic volume (size) in solution, utilizing columns packed with porous stationary phase materials. These columns are indispensable tools for quality control (QC), research and development (R&D), and purity assessment of large biomolecules such as proteins, monoclonal antibodies (mAbs), conjugates, and viruses. The demand for highly efficient and reproducible SEC columns is intrinsically linked to the global expansion of the biopharma sector, particularly the rapid development of biologics and biosimilars which require stringent aggregate and fragment analysis.

SEC HPLC columns feature carefully controlled pore sizes that allow smaller molecules to penetrate the porous structure of the column packing material, resulting in a longer retention time, while larger molecules are excluded and elute faster. The stationary phase materials typically include hydrophilic silica, cross-linked polymers like polyacrylamide, or hydroxylated polymethacrylate, designed to minimize secondary interactions (such as ion exchange or hydrophobic binding) ensuring separation is purely based on size. Column performance metrics, including resolution, column lifetime, and inertness, are critical considerations for end-users, driving manufacturers to innovate with improved particle technologies, such as sub-2 µm particles for Ultra-High Performance Liquid Chromatography (UHPLC) systems, offering enhanced speed and efficiency for high-throughput screening applications in drug discovery and process monitoring.

Major applications of SEC HPLC columns include determining molecular weight distribution, separation of monomers from dimers and higher-order aggregates, analysis of protein degradation products, and purification steps in vaccine manufacturing. The primary benefits derived from using SEC include high resolution for complex mixtures, non-denaturing separation conditions crucial for maintaining protein integrity, and compatibility with various mobile phases. The market growth is fundamentally driven by the escalating pipeline of biopharmaceutical products, increased regulatory scrutiny requiring highly accurate impurity profiles, and continuous advancements in column technology that facilitate faster, more sensitive analysis of complex biological samples, positioning SEC as a gold standard technique for biotherapeutics characterization.

Size Exclusion Chromatography (SEC) HPLC Column Market Executive Summary

The Size Exclusion Chromatography (SEC) HPLC Column Market is experiencing robust growth fueled by the accelerating production of complex biotherapeutics, particularly monoclonal antibodies and gene therapy components, which require high-resolution separation and quantification of aggregates and fragments. Key business trends include a strong focus on developing columns compatible with UHPLC systems, minimizing analysis time and solvent consumption, and the introduction of advanced surface modification technologies to enhance column inertness and reduce non-specific binding, thereby improving accuracy in quantification. Strategic partnerships between column manufacturers and instrument vendors are becoming increasingly common, ensuring seamless integration and optimized performance for complete chromatographic workflows. Furthermore, sustainability initiatives are influencing product development, with manufacturers exploring greener solvents and longer-lasting column materials.

Regional trends highlight North America and Europe as the dominant markets, primarily due to the established infrastructure of major pharmaceutical companies, high R&D investments in biotechnology, and rigorous regulatory frameworks that mandate the use of high-performance analytical techniques like SEC. The Asia Pacific (APAC) region, however, is projected to exhibit the highest CAGR, driven by the rapid expansion of contract research organizations (CROs) and contract manufacturing organizations (CMOs), coupled with growing governmental support for the domestic biopharma industry, especially in countries like China, India, and South Korea. These emerging markets are increasingly adopting advanced analytical equipment to meet global quality standards, creating significant demand for specialized SEC columns for biosimilar characterization.

Segmentation trends reveal that columns based on porous silica and polymeric materials continue to dominate based on material, catering to different application ranges, with polymeric columns gaining traction for specific highly alkaline separation needs. In terms of application segmentation, quality control and routine analysis maintain the largest market share due to the daily requirement for batch release testing of biopharmaceuticals, while upstream process monitoring represents a high-growth segment, driven by the push for real-time process analytics (PAT) in biomanufacturing. The market remains competitive, with major players emphasizing portfolio diversification, offering columns optimized for different molecular weight cutoffs, particle sizes, and pH stability, ensuring they meet the diverse and highly technical demands of modern biopharmaceutical analysis.

AI Impact Analysis on Size Exclusion Chromatography (SEC) HPLC Column Market

User queries regarding AI's influence on SEC technology often revolve around several key themes: how AI can automate method development, optimize column utilization and lifetime, and enhance data interpretation, especially concerning complex aggregate profiles in biologics. Users are keen to understand if machine learning algorithms can predict optimal mobile phases, column temperatures, and flow rates more efficiently than traditional iterative processes, thus significantly reducing R&D time and material costs associated with method validation. Another major concern focuses on leveraging AI for predictive maintenance, anticipating column fouling or degradation, thereby ensuring consistent column performance and minimizing batch failures in GMP environments. The prevailing expectation is that AI will transform SEC from a manual optimization process to a smart, predictive analytical tool, particularly valuable in high-throughput environments where rapid, reliable data processing is essential for timely decision-making in biomanufacturing.

The primary impact of Artificial Intelligence (AI) and Machine Learning (ML) in the SEC column market is not a direct disruption of the column consumable itself, but rather a profound transformation in the way SEC methods are developed, validated, and operated. AI algorithms are being integrated into HPLC software platforms to facilitate automated chromatographic peak integration, deconvolution of complex overlapping aggregate peaks, and accurate baseline subtraction, significantly improving data quality and reducing manual analyst variability. This shift towards smart chromatography allows for faster generation of robust analytical methods, crucial for meeting aggressive timelines in biosimilar and novel therapeutic development pipelines. Furthermore, AI-driven process analytical technology (PAT) initiatives are increasingly using SEC data captured in real-time to adjust upstream bioreactor conditions, ensuring product quality consistency before purification.

The future trajectory involves integrating AI models trained on vast datasets of SEC retention times, protein structures, and buffer conditions to recommend the optimal column chemistry and operational parameters for a given molecule, moving beyond simple trial-and-error. For column manufacturers, this translates into a need to provide comprehensive digital data accompanying their products, allowing AI systems to better model column behavior and predict degradation mechanisms under various stress conditions. This intelligent integration increases the perceived value of high-quality, reproducible columns, as their consistent performance is paramount for successful AI modeling. Ultimately, AI enhances the utility and efficiency of SEC columns, reinforcing their central role in the biopharma analytical toolbox by making the entire separation process smarter, quicker, and more reliable.

- AI-powered automated method development reduces time-to-validation for new SEC methods.

- Machine learning improves peak deconvolution and quantification of low-abundance aggregates and fragments.

- Predictive maintenance models forecast SEC column degradation and optimal replacement timing, maximizing throughput.

- AI integration in PAT streamlines real-time monitoring of bioprocess purity using SEC data.

- Enhanced data analytics through AI provides deeper insights into protein aggregation mechanisms.

DRO & Impact Forces Of Size Exclusion Chromatography (SEC) HPLC Column Market

The market for SEC HPLC columns is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities. Key drivers include the exponential growth in the global biopharmaceutical industry, particularly the proliferation of complex biologics like monoclonal antibodies (mAbs) and antibody-drug conjugates (ADCs), which necessitate highly reliable SEC columns for structural integrity assessment and purity testing. Stringent global regulatory guidelines imposed by agencies such as the FDA and EMA for biotherapeutic characterization mandate the use of validated SEC methods, creating a foundational demand. Conversely, the market faces restraints such as the high initial cost of advanced HPLC systems and specialized columns, coupled with the need for highly skilled technical personnel to operate and maintain these complex chromatographic techniques. The constant challenge of achieving perfect inertness and eliminating secondary interactions with highly sticky or unstable proteins also represents a technical limitation that manufacturers are continuously addressing. Opportunities lie primarily in expanding applications in emerging fields like gene therapy and personalized medicine, developing miniaturized and high-throughput columns (UHPLC compatibility), and capitalizing on the rapidly expanding biosimilars market in Asia Pacific which demands cost-effective yet high-quality analytical solutions.

Impact forces currently shaping the market are multifaceted, driven by both technological progress and external economic factors. The pace of innovation in particle technology, specifically the shift toward smaller, more uniform porous particles (sub-2 µm), exerts a strong influence by enabling faster analysis times and superior resolution, compelling end-users to upgrade existing infrastructure. Regulatory demands act as a powerful external force, requiring manufacturers to maintain extremely tight quality control over column manufacturing processes to ensure batch-to-batch reproducibility, which is paramount in cGMP environments. Economic pressures often force biopharma companies to seek cost-efficient solutions, driving demand for columns with extended lifetimes and greater robustness. Furthermore, the increasing outsourcing trend to CROs and CMOs globally impacts distribution channels, making robust global supply chain logistics an essential force for column providers. These combined forces dictate investment in R&D, market entry strategies, and the competitive positioning of column manufacturers globally.

Segmentation Analysis

The Size Exclusion Chromatography (SEC) HPLC Column Market is broadly segmented based on the type of stationary phase material, the application area, particle size, and pore size. Understanding these segments is crucial for manufacturers to tailor product offerings to specific analytical requirements and for strategic investors to identify high-growth niches. The segmentation by material type reflects the fundamental chemical properties needed for separating different classes of molecules; silica-based columns are favored for high-efficiency, stable separations in general protein analysis, while polymeric columns offer stability across a wider pH range, often preferred for harsh solvent conditions or specific hydrophilic separations. Application segmentation delineates the primary use cases, with quality control being the most commercially significant due to high-volume routine testing, contrasting with R&D, which requires diverse, often customized, column specifications for novel molecule characterization.

The segmentation by particle size is a reflection of the transition from traditional HPLC to modern UHPLC, directly impacting throughput and resolution. Columns with particle sizes below 3 µm are rapidly increasing their market share because they enable analysts to achieve faster separations with reduced band broadening, a critical advantage in high-throughput biopharma screening and process monitoring. Pore size segmentation is perhaps the most technically critical, as it determines the optimal operating range for molecular weight separation; columns with smaller pores (e.g., 60-100 Å) are suited for peptides and smaller proteins, while larger pore sizes (e.g., 250-500 Å) are specifically engineered for large macromolecules like viral vectors, antibody aggregates, and protein complexes. This detailed market structure reflects the specialized nature of biopharmaceutical analysis, where no single column type can fulfill all separation needs, necessitating a diversified portfolio approach by market participants.

- By Material Type:

- Silica-based Columns

- Polymeric Columns (e.g., Methacrylate, Polyacrylamide)

- Hydrogel Columns

- By Particle Size:

- Below 3 µm (UHPLC compatible)

- 3 µm to 5 µm (Standard HPLC)

- Above 5 µm

- By Pore Size:

- Small Pore Size (e.g., Peptide/Oligosaccharide Analysis)

- Medium Pore Size (e.g., Standard Protein/mAb Monomer Analysis)

- Large Pore Size (e.g., Virus/Large Aggregate Analysis)

- By Application:

- Quality Control (QC) and Batch Release Testing

- Research & Development (R&D)

- Process Monitoring (PAT)

- Purification and Formulation Studies

- By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs)

Value Chain Analysis For Size Exclusion Chromatography (SEC) HPLC Column Market

The value chain for the SEC HPLC column market starts with the upstream activities of raw material procurement and highly specialized manufacturing. Upstream analysis focuses on the sourcing and preparation of high-purity base materials, including high-grade porous silica particles, specialized monomers for polymeric synthesis, and chemical reagents used for surface modification (ligand attachment or hydrophilization). The quality, uniformity, and purity of these raw materials are foundational, as any inconsistency directly impacts the chromatographic resolution and reproducibility of the final column. Manufacturers must invest heavily in proprietary particle synthesis and surface chemistry technologies to ensure the stationary phase maintains the desired pore structure and minimizes secondary interactions, adding significant intrinsic value at this initial stage. Strict quality assurance procedures, often exceeding basic ISO standards, are employed to manage the synthesis and packing processes, which are highly sensitive and technically demanding.

Mid-stream activities involve the actual column production, including slurry preparation, precise column packing under high pressure, and rigorous testing for efficiency, asymmetry, and reproducibility using standardized test mixtures. This manufacturing phase requires advanced robotic systems and specialized equipment to ensure packing consistency, a critical factor determining column performance and lifespan. Distribution channels then move the finished products to the end-users. Direct distribution channels, where the column manufacturer sells directly to large pharmaceutical companies or institutional customers, allow for customized technical support and tighter control over inventory. Indirect channels, involving authorized distributors and regional dealers, are essential for penetrating geographically dispersed markets, particularly in emerging regions where local expertise and localized logistics are paramount. These channels must manage complex cold chain or ambient temperature requirements, depending on the column type and its storage specifications, to maintain product integrity until it reaches the analytical lab.

The downstream analysis centers on the utilization and post-sale support provided to the end-user base—primarily R&D laboratories, QC departments, and biomanufacturing facilities. Key downstream activities include application development support, troubleshooting services, and providing comprehensive technical documentation necessary for regulatory filings. Customer satisfaction in the SEC market is highly dependent on column lifetime and reproducible performance across multiple batches. Consequently, manufacturers often offer extended warranties and technical consulting services, reinforcing the product's value proposition. The feedback loop established with downstream users is vital for product iteration, driving manufacturers to develop columns with enhanced pH stability, improved inertness, and optimal compatibility with increasingly complex biological matrices, thus completing the cyclical flow of value creation and refinement within the market ecosystem.

Size Exclusion Chromatography (SEC) HPLC Column Market Potential Customers

The primary consumers of SEC HPLC columns are organizations deeply involved in the development, manufacture, and regulatory assessment of large biological molecules, necessitating highly specialized analytical tools for quality assurance. Pharmaceutical and biotechnology companies represent the largest and most commercially significant end-user segment, utilizing SEC columns extensively for mandatory purity testing of therapeutic proteins, including monoclonal antibodies (mAbs), fusion proteins, and increasingly complex modalities such as cell and gene therapy vectors. Within these companies, the R&D departments use SEC for initial molecular characterization and stability studies, while Quality Control (QC) laboratories use them for critical batch release analysis, driving consistent, high-volume demand for reliable and reproducible columns that adhere strictly to cGMP (current Good Manufacturing Practices) standards.

A rapidly expanding customer base includes Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs), which handle outsourced analytical testing and production for smaller biotech firms and larger pharmaceutical corporations seeking to optimize operational efficiency. CROs/CMOs require a broad portfolio of SEC columns capable of handling diverse client projects, ranging from peptide analysis to large viral particle separation, making them flexible, high-volume buyers. Their growth is a significant market driver, particularly in Asia Pacific, where outsourcing activities are rapidly accelerating. These entities often prioritize cost-efficiency coupled with analytical robustness, leading to a strong demand for performance-driven, competitively priced columns with verifiable batch-to-batch consistency.

Furthermore, academic institutions, government research laboratories, and university core facilities constitute a substantial segment, utilizing SEC columns primarily for fundamental research in protein chemistry, structural biology, and polymer science. While these users typically purchase smaller quantities than industrial customers, their role in pioneering new applications and methodologies is critical, often driving the early adoption of highly innovative column technologies, such as columns designed for hyphenated techniques like SEC-MALS (Multi-Angle Light Scattering) or columns incorporating novel particle chemistries. These diverse groups of end-users share a fundamental requirement for high-resolution separation capabilities and columns with minimal non-specific adsorption, making the commitment to quality and technical support a defining factor in supplier selection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 558 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Bio-Rad Laboratories, Sartorius AG (formerly Purolite), Waters Corporation, Danaher Corporation (Cytiva/GE Healthcare Life Sciences), Tosoh Bioscience LLC, Merck KGaA, Shimadzu Corporation, Hitachi High-Tech Corporation, YMC Co., Ltd., Shodex (Showa Denko), Sepax Technologies, Inc., Jasco Corporation, Phenomenex, Inc., Avantor, Inc. (VWR), Hichrom Limited, General Biosystems, Restek Corporation, SunChrom GmbH, GL Sciences Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Size Exclusion Chromatography (SEC) HPLC Column Market Key Technology Landscape

The technological landscape of the SEC HPLC column market is characterized by continuous innovation aimed at increasing resolution, improving throughput, and extending column lifetime, driven largely by the evolving complexity of biopharmaceutical molecules. A critical technological advancement is the widespread adoption of smaller particle sizes, specifically sub-3 µm and even sub-2 µm particles, which are essential for compatibility with Ultra-High Performance Liquid Chromatography (UHPLC) systems. These smaller particles minimize eddy diffusion and mass transfer limitations, resulting in significantly increased peak capacity and reduced run times—often cutting analysis duration by up to 70% compared to traditional 5 µm columns. This shift addresses the industry demand for high-throughput screening in R&D and rapid batch release in QC laboratories, making UHPLC-compatible SEC columns a major growth area. Manufacturers are continually refining the mechanical stability of these small particles to withstand the extreme back pressures generated by UHPLC systems without compromising column bed integrity.

Another crucial technological focus is on the development of highly inert stationary phases. Biopharmaceuticals, especially therapeutic proteins, are prone to non-specific interactions (such as hydrophobic or ionic interactions) with the column material, which can skew accurate size separation data, leading to misquantification of aggregates or fragments. To counteract this, manufacturers employ advanced surface modification techniques, including proprietary bonding chemistries (e.g., diol, saccharide, or polyethylene glycol coatings) applied to the silica or polymer substrate. These modifications render the column surface extremely hydrophilic and neutral, minimizing undesirable secondary binding and ensuring that separation is solely size-based. The development of specialized stationary phases tailored for low-salt or high-pH applications, often involving robust cross-linked polymeric materials, further expands the analytical utility of SEC columns for challenging samples that cannot tolerate traditional buffered mobile phases.

The technological evolution also encompasses improvements in column packing methodologies and quality control. Achieving a highly homogeneous and stable column bed is paramount for optimal chromatographic performance, especially for highly demanding applications like biosimilar comparability studies where minute differences must be detected. Advanced slurry packing techniques are utilized to ensure uniform particle distribution and eliminate voids, which lead to peak tailing and asymmetry. Furthermore, the integration of columns with orthogonal detection methods, such as SEC coupled with Multi-Angle Light Scattering (MALS), Refractive Index (RI) detection, and Mass Spectrometry (MS), requires columns specifically designed for low-bleed characteristics and compatibility with these sensitive detectors. These synergistic technological developments cement the position of SEC as a highly versatile and indispensable analytical tool in the modern biopharmaceutical characterization workflow, necessitating continuous investment in materials science and engineering expertise by column manufacturers.

Regional Highlights

- North America: This region maintains the largest market share, primarily driven by the presence of a robust, highly innovative biopharmaceutical ecosystem, encompassing major global drug discovery companies and a high concentration of sophisticated research institutions. The stringent regulatory environment, particularly the guidance from the FDA regarding biotherapeutic characterization, necessitates consistent utilization of high-performance SEC columns for quality assurance and regulatory submissions. High R&D expenditure and widespread adoption of advanced technologies like UHPLC and hyphenated SEC techniques contribute significantly to sustained market dominance, particularly in the premium, high-resolution column segment.

- Europe: Europe represents the second-largest market, characterized by significant investment in biotechnology R&D, particularly in countries like Germany, Switzerland, and the United Kingdom. Market growth is supported by favorable governmental initiatives promoting pharmaceutical innovation and the strong presence of major global analytical instrumentation manufacturers. The focus on biosimilar production, driven by healthcare cost containment policies, ensures a consistent and growing demand for SEC columns utilized in comparability studies and routine QC testing across the continent.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, propelled by rapidly increasing biomanufacturing capabilities in China, India, and South Korea, coupled with significant foreign direct investment. The expansion of the regional biosimilars market is a major catalyst, requiring significant uptake of SEC columns for process development and quality control. Government policies aimed at achieving self-sufficiency in drug production, combined with the rising number of local CROs and CMOs, are driving rapid technology adoption and increasing the volume demand for both established and next-generation SEC column formats.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets characterized by lower current penetration but high potential growth. Growth is primarily stimulated by expanding healthcare infrastructure, rising investments in local pharmaceutical production, and increasing awareness of global analytical standards. Market expansion here depends heavily on successful distribution networks and providing localized technical support and training to facilitate the adoption of complex chromatographic techniques in nascent biopharma industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Size Exclusion Chromatography (SEC) HPLC Column Market.- Agilent Technologies

- Bio-Rad Laboratories

- Sartorius AG (formerly Purolite)

- Waters Corporation

- Danaher Corporation (Cytiva/GE Healthcare Life Sciences)

- Tosoh Bioscience LLC

- Merck KGaA

- Shimadzu Corporation

- Hitachi High-Tech Corporation

- YMC Co., Ltd.

- Shodex (Showa Denko)

- Sepax Technologies, Inc.

- Jasco Corporation

- Phenomenex, Inc.

- Avantor, Inc. (VWR)

- Hichrom Limited

- General Biosystems

- Restek Corporation

- SunChrom GmbH

- GL Sciences Inc.

Frequently Asked Questions

Analyze common user questions about the Size Exclusion Chromatography (SEC) HPLC Column market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for high-resolution SEC columns?

Demand is primarily driven by the rapid growth of the biopharmaceutical industry, particularly the complexity of biotherapeutics like monoclonal antibodies and ADCs. Regulatory requirements for precise quantification of protein aggregates and fragments necessitate columns offering superior resolution and high efficiency, especially those compatible with UHPLC systems, to ensure product safety and efficacy during batch release.

How does the choice of stationary phase material impact SEC separation performance?

The stationary phase material (typically silica or polymer) determines the column's pore structure, mechanical stability, and chemical inertness. Silica-based columns offer high efficiency but limited pH stability, while polymeric columns provide greater pH range stability, crucial for specific buffer requirements, minimizing undesirable secondary interactions and ensuring size-based separation fidelity.

What is the primary technical challenge manufacturers face in the SEC column market?

The major technical challenge is eliminating non-specific interactions (adsorption) between the analyte (especially sticky proteins) and the column packing material. Manufacturers continuously innovate through advanced surface chemistry and bonding techniques to create highly inert and hydrophilic surfaces, ensuring accurate quantification of critical quality attributes (CQAs) without sample loss or peak tailing.

Which geographical region is expected to show the fastest growth rate for SEC columns?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by significant investments in the biosimilars market, expanding local biomanufacturing capabilities, and the rapid establishment of contract research and manufacturing organizations (CROs/CMOs) adopting Western analytical standards.

How do UHPLC-compatible SEC columns provide a market advantage?

UHPLC-compatible columns (sub-3 µm particles) offer superior resolution and drastically reduced analysis times compared to traditional HPLC columns. This speed is vital for high-throughput screening in R&D and accelerating quality control procedures, providing a significant competitive advantage to laboratories seeking faster, more efficient, and resource-optimized chromatographic workflows.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager