Skateboard Chassis Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432324 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Skateboard Chassis Market Size

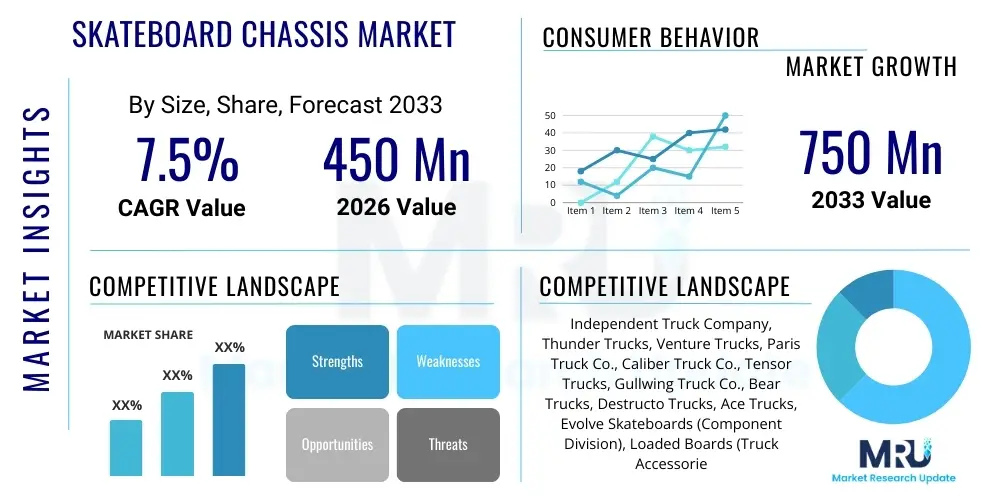

The Skateboard Chassis Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Skateboard Chassis Market introduction

The Skateboard Chassis Market encompasses the entire assembly responsible for connecting the wheels to the deck, primarily involving the skateboard trucks, axles, and mounting hardware. These components are critical for controlling direction, performing tricks, and ensuring structural integrity under dynamic stress. The chassis, often referred to simply as the "trucks," determines the responsiveness, stability, and overall weight distribution of the skateboard, fundamentally impacting the user experience across various disciplines, including street, park, vert, and longboarding. Product innovation centers around materials science, seeking to reduce weight while increasing durability and precision. Manufacturers utilize advanced materials like high-strength aluminum alloys, titanium, and specialized composites to meet the stringent demands of professional athletes and recreational users alike, providing better grinding capabilities and superior stress resistance.

Major applications for high-performance skateboard chassis components extend beyond traditional skateboarding into rapidly expanding segments such as electric skateboards (e-skates) and specialized urban mobility devices. For e-skates, the chassis must accommodate significant torque, battery weight, and integrated motor mounts, demanding robust and heat-dissipating designs. The growing popularity of skateboarding as both a sport (especially following its inclusion in the Olympics) and a leisure activity, particularly among younger demographics in urban environments, acts as a primary market catalyst. Furthermore, the rising trend of custom-built skateboards, where enthusiasts meticulously select every component for personalized performance, drives demand for high-end, differentiated chassis products.

The core benefits derived from advanced skateboard chassis technology include enhanced maneuverability, superior shock absorption, improved carving precision, and extended component lifespan. Driving factors fueling market expansion include technological advancements in precision casting and forging, resulting in stronger yet lighter trucks, as well as the increasing disposable income in developed and rapidly developing economies that encourages investment in premium sports equipment. The focus on safety and standardized performance testing further pushes manufacturers toward rigorous quality control and the adoption of certified materials, ensuring that the chassis can withstand extreme forces inherent in modern skateboarding techniques.

Skateboard Chassis Market Executive Summary

The Skateboard Chassis Market is poised for substantial growth, driven primarily by the intersection of traditional sports growth and the rapid expansion of the personal electric mobility sector. Business trends indicate a strong move toward customization and modularity, allowing users to fine-tune pivot angles, bushing hardness, and axle specifications. Key industry players are increasingly focusing on vertical integration, controlling material sourcing and advanced manufacturing processes to maintain quality and competitive pricing, while strategic partnerships between traditional skateboard companies and tech-centric e-skate manufacturers are becoming commonplace to address the technical complexities of motorized components integration. Innovation in material composite usage, such as fiber-reinforced polymers for baseplates and hanger cores, is a central theme, aiming to disrupt the long-standing dominance of aluminum alloys in specific low-impact applications, thereby optimizing weight distribution without sacrificing essential stability features, a critical factor for competitive skateboarding disciplines.

Regionally, North America and Europe maintain dominance owing to high consumer awareness, established skateboarding cultures, and robust retail infrastructure, including specialized skate shops and large sporting goods chains. However, the Asia Pacific (APAC) region, spearheaded by strong growth in countries like China, Japan, and Australia, is emerging as the fastest-growing market. This growth is attributed to increasing urbanization, rising adoption of skateboarding as a recreational sport, and significant manufacturing capacity expansion for both conventional and electric chassis components. These regions are also witnessing intense competition among local and international brands, forcing rapid iteration in design and functionality. Furthermore, governmental promotion of youth sports and the development of dedicated skateparks in major metropolitan areas are providing sustainable tailwinds for demand, specifically for entry-level and mid-range chassis sets.

Segment trends highlight the critical divergence between standard and premium product offerings. The standard truck segment, characterized by gravity cast aluminum, remains vital for entry-level users and mass-produced complete skateboards. Conversely, the premium segment, featuring forged or CNC-machined components made from aerospace-grade aluminum or titanium, is commanding higher average selling prices due to superior durability, lighter weight, and precision engineering demanded by competitive skaters and advanced longboarding enthusiasts. Moreover, the integration of sensors and smart technology, particularly within electric skateboard chassis for monitoring torque, battery health, and ride dynamics, represents a high-potential segment. Axle design variations, including solid, hollow, and titanium axles, further delineate segment boundaries based on performance requirements and price sensitivity, directly influencing the consumer's decision-making process regarding trade-offs between component weight reduction and overall fatigue resistance.

AI Impact Analysis on Skateboard Chassis Market

Common user questions regarding AI's impact on the Skateboard Chassis Market frequently revolve around design efficiency, material optimization, and personalized performance. Users inquire whether AI can design trucks that automatically adapt to riding styles, if generative design can create truly unbreakable yet lightweight components, and how predictive analytics might influence inventory management and demand forecasting for specialized parts. There is significant interest in understanding how Machine Learning (ML) algorithms analyze stress data from sensor-equipped skateboards to inform next-generation component geometry and material choices, specifically targeting stress points in the hanger and baseplate. Consumers also express curiosity about the role of AI in quality control during manufacturing, seeking assurance that automated systems can detect microscopic material defects better than traditional inspection methods. The core expectation is that AI will accelerate innovation, moving beyond incremental improvements in standard geometric design toward radical optimization tailored for individual rider biomechanics and environmental conditions, particularly concerning precision alignment and bushing performance under varying temperature profiles and loads.

The influence of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly reshaping the Skateboard Chassis Market, primarily through generative design and predictive analytics in manufacturing and material science. Generative design platforms, powered by AI, allow engineers to input performance parameters—such as maximum load, desired weight reduction, and stress tolerance—and rapidly generate thousands of optimized topological designs for hangers and baseplates. This process eliminates unnecessary material, leading to structures that are significantly lighter yet potentially stronger than traditionally engineered components, directly addressing the critical industry trade-off between weight and durability. This capability shortens the design cycle dramatically, enabling manufacturers to bring highly customized and performance-tuned chassis components to market much faster, responding dynamically to emerging trends in riding techniques and competitive standards. The ability of these algorithms to simulate real-world stress scenarios under dynamic loading conditions, far beyond standard finite element analysis, ensures a higher reliability quotient in the final product design.

Furthermore, AI plays a crucial role in optimizing manufacturing quality control and supply chain efficiency. Computer Vision (CV) systems integrated into production lines use deep learning models to inspect finished components for casting flaws, forging inconsistencies, or dimensional inaccuracies with far greater speed and precision than human inspectors, significantly reducing defect rates and improving overall product consistency. On the supply chain side, predictive analytics models leverage historical sales data, social media trends, and regional sporting event schedules to forecast demand for specific truck sizes, axle materials, and colorways. This sophisticated forecasting minimizes expensive inventory surpluses while ensuring adequate stock of high-demand items, leading to improved operational efficiency and reduced waste. The net result is a more responsive, quality-driven, and cost-effective manufacturing ecosystem for skateboard chassis components.

- Generative Design Optimization: AI creates topologically optimized chassis components (hangers, baseplates) that maximize strength-to-weight ratios based on performance constraints.

- Predictive Failure Analysis: Machine learning models analyze stress data from prototypes to predict fatigue life and potential failure points, informing material selection and structural reinforcement.

- Automated Quality Inspection: Computer Vision systems rapidly inspect components on the assembly line, identifying microscopic defects in casting, forging, and CNC machining processes.

- Personalized Component Recommendations: AI algorithms analyze rider profiles (weight, style, terrain preference) to recommend optimal truck geometry, bushing types, and axle combinations.

- Supply Chain & Inventory Forecasting: Predictive analytics optimizes stock levels for specialized materials (titanium, high-grade aluminum) and finished goods based on real-time market demand signals.

- Advanced Material Synthesis: AI models simulate molecular interactions to design novel alloy compositions that offer superior resilience and damping characteristics specifically for skateboarding applications.

DRO & Impact Forces Of Skateboard Chassis Market

The dynamics of the Skateboard Chassis Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces shaping industry growth and technological direction. Key drivers include the resurgence of skateboarding globally, spurred by the inclusion in major international sports events like the Olympics, which boosts mainstream visibility and participation rates. The continuous advancement in material science, particularly the development of lighter, stronger, and more resilient alloys and polymer composites, facilitates product differentiation and higher performance standards. Furthermore, the massive proliferation of electric skateboards, which require significantly heavier and more robust chassis assemblies to support battery packs and powerful motors, introduces a new, high-value demand stream distinct from traditional skate components. These factors create sustained momentum, pushing manufacturers toward innovation in both design geometry and manufacturing precision to secure market share in a highly competitive landscape that is increasingly polarized between professional-grade gear and consumer-grade leisure equipment.

However, the market faces significant restraints, primarily revolving around the high cost associated with advanced materials like titanium axles and CNC-machined components, which can limit adoption among budget-conscious consumers. The vulnerability of the market to fluctuating raw material prices, particularly aluminum, which is the foundational element for most trucks, introduces significant cost volatility and supply chain instability. Furthermore, intense market saturation, coupled with the prevalence of counterfeit and low-quality knock-off products, undermines pricing power for legitimate manufacturers and poses safety risks to consumers, compelling industry leaders to invest heavily in brand protection and quality assurance certifications. Addressing these restraints requires a dual strategy: optimizing mass production techniques to lower costs for standard components while simultaneously emphasizing the unique durability and safety advantages of premium products through targeted marketing and consumer education efforts.

Opportunities for expansion are abundant, particularly in emerging economies where skateboarding infrastructure is rapidly developing, and urban mobility solutions are in high demand. The growing trend of customization and the rise of niche markets, such as specialized downhill longboarding, offer manufacturers opportunities to develop highly specialized, high-margin products tailored to specific performance needs. The integration of smart technology, including sensors for impact monitoring and data collection, especially in the e-skate sector, provides a pathway for value-added services and next-generation product development focused on safety and performance optimization. Leveraging automation and AI in design and manufacturing represents a foundational opportunity to overcome current cost and material limitations, paving the way for chassis components that are not only stronger and lighter but also inherently safer and more durable under extreme operating conditions, thereby solidifying the competitive positioning of innovative market players.

Segmentation Analysis

The Skateboard Chassis Market is meticulously segmented based on Component Type, Material, Manufacturing Process, Application, and Distribution Channel, allowing for precise market targeting and strategic development. This granular analysis is crucial because the performance requirements and pricing structures vary drastically depending on whether the chassis is intended for professional street skating, high-speed downhill longboarding, or urban commuting via an electric board. For instance, the distinction between gravity-cast and forged/CNC-machined trucks significantly impacts durability and precision, directly influencing the target end-user demographic and corresponding market price point. Understanding these segment dynamics is essential for market participants seeking to optimize production portfolios and allocate resources effectively across different product tiers, ranging from mass-market volume products to highly specialized, high-margin performance hardware.

Segmentation by Application is particularly illuminating, separating the market into traditional skateboarding (street/park/vert), longboarding/cruising, and electric skateboards (e-skates). Each application segment places unique demands on the chassis: traditional skating requires high resistance to impact and grinding wear, longboarding emphasizes smooth turning geometry and stability at high speeds, while e-skates require extreme robustness to manage higher torque forces and overall component weight. This differentiation necessitates specific engineering solutions, such as different types of axle material thickness, baseplate designs optimized for heat dissipation in electric models, and varying pivot cup hardness specifications for specialized carving performance. Consequently, manufacturers often develop entirely separate product lines to cater effectively to the distinct performance envelopes and safety criteria of these divergent user groups, driving specialization within the overall market structure.

- Component Type:

- Trucks (Hanger, Axle, Baseplate)

- Bushings and Washers

- Pivot Cups

- Mounting Hardware (Bolts and Nuts)

- Material:

- Aluminum Alloys (Standard Grade, Aerospace Grade)

- Titanium

- Steel (Axles and Hardware)

- Composite Materials (Polymer Baseplates)

- Manufacturing Process:

- Gravity Casting

- Die Casting

- Forging

- CNC Machining

- Application:

- Traditional Skateboards (Street/Park)

- Longboards/Cruisers

- Electric Skateboards (E-Skates)

- Distribution Channel:

- Specialized Skate Shops

- Online Retail

- Sporting Goods Stores

- Direct-to-Consumer (D2C)

Value Chain Analysis For Skateboard Chassis Market

The Value Chain for the Skateboard Chassis Market begins with Upstream Activities, primarily focusing on the sourcing and processing of raw materials, predominantly high-grade aluminum billets, steel, and titanium. Specialized suppliers process these raw materials through forging, casting, or extrusion to meet the stringent quality specifications required for high-stress components like hangers and axles. Material quality is paramount; inconsistencies at this stage directly translate to product failure under typical skateboarding loads, necessitating rigorous material testing and certification protocols. Key players in this phase are metal alloy producers and specialized industrial material fabricators who often work under long-term contracts with chassis manufacturers to ensure a stable supply of materials conforming to specific dimensional and chemical standards, thereby establishing a critical dependency on upstream precision and reliability.

The core Midstream phase involves the design, manufacturing, and assembly of the chassis components. This stage includes complex processes such as CNC machining for precision trucks, specialized heat treatment for axles to enhance strength, and the application of advanced coatings for durability and aesthetic appeal. Direct and indirect distribution channels then facilitate the flow of finished products to the end consumers. Direct channels often include the manufacturer's own e-commerce platforms and exclusive brand stores, providing higher margins and direct consumer feedback. Indirect channels, which dominate the market, involve specialized skate shops, large sporting goods retailers, and online aggregators. Specialized skate shops remain vital as they offer expert advice, fostering community trust and serving as key influencers in purchasing decisions, especially for premium performance parts, while mass retailers handle high-volume sales of complete skateboards and entry-level components.

The Downstream phase is characterized by retail, branding, and after-market services. Branding and marketing are exceptionally important in this market, as the perceived quality and association with professional athletes significantly influence consumer choice. Effective product endorsement and sponsorship deals solidify brand loyalty. After-market services, including the sale of replacement bushings, pivot cups, and hardware, represent a stable revenue stream, ensuring the longevity and continued performance of the initial chassis investment. Furthermore, the burgeoning electric skateboard sector introduces new complexities downstream, requiring specialized technicians for motor mounting and integration, adding a layer of technical service support to the traditional retail model, thus extending the value chain beyond simple hardware sales into integrated mobility solutions.

Skateboard Chassis Market Potential Customers

The primary End-Users and Buyers of the Skateboard Chassis Market components can be broadly categorized into three distinct groups: individual recreational consumers and professional athletes, original equipment manufacturers (OEMs) of complete skateboards and e-skateboards, and specialized retailers acting as intermediaries. Individual consumers, ranging from beginners needing robust, low-cost options to professional skaters requiring ultra-lightweight, precision-engineered titanium trucks, form the largest volume base. These consumers often prioritize brand reputation, performance metrics like turn radius and grinding capability, and component weight, typically purchasing components individually through specialized retail channels to customize their setups for specific riding styles, thus driving demand for diverse product portfolios and continuous minor design innovations.

Original Equipment Manufacturers (OEMs) represent a crucial B2B segment, particularly those involved in producing mass-market complete skateboards and, increasingly, high-volume electric skateboards. These buyers prioritize cost-effectiveness, consistency in bulk supply, and adherence to specific design specifications, often engaging in long-term contracts with major chassis manufacturers. For the electric skateboard segment, OEMs require specialized, heavier-duty chassis components capable of handling motor mounting, integrated wiring, and the increased stress from faster speeds and heavier loads, often dictating bespoke design requirements that push the limits of current manufacturing tolerance and material science research, making this a highly technical purchasing relationship.

Specialized retail outlets and online distributors serve as critical intermediaries, acting as purchasers who aggregate demand and influence inventory stocking decisions based on regional trends and seasonal peaks. These buyers need reliable, high-margin products with strong brand backing and excellent warranty support, ensuring they can cater to the diverse needs of their customer base efficiently. Furthermore, specialized longboard and downhill enthusiasts constitute a high-value niche segment, demanding chassis systems (like precision trucks) optimized for stability and carving dynamics at extreme velocities, often requiring bespoke materials and manufacturing techniques that place them at the top tier of the market's price and performance spectrum, providing lucrative, albeit smaller, targets for premium manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Independent Truck Company, Thunder Trucks, Venture Trucks, Paris Truck Co., Caliber Truck Co., Tensor Trucks, Gullwing Truck Co., Bear Trucks, Destructo Trucks, Ace Trucks, Evolve Skateboards (Component Division), Loaded Boards (Truck Accessories), Rogue Trucks, Sabre Trucks, Boosted (Component Division), Atlas Truck Co., Ronin Trucks, Carver Skateboards (C7/CX Trucks), Tracker Trucks, Polished Trucks Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Skateboard Chassis Market Key Technology Landscape

The technology landscape of the Skateboard Chassis Market is dominated by advancements in material formulation, precision engineering, and specialized manufacturing techniques designed to enhance product performance, durability, and weight reduction. Precision CNC machining represents the pinnacle of current technology for high-end trucks, offering extremely tight tolerances and flawless component alignment, which is crucial for achieving consistent turning radius and stable axle placement demanded by professional downhill racers and competitive park skaters. Furthermore, specialized forging processes are increasingly used to create high-density, grain-refined aluminum hangers that are substantially stronger and more resistant to impact fatigue than traditional gravity-cast counterparts, providing a significant competitive advantage in the premium segment where component failure is unacceptable. These metallurgical enhancements are often proprietary and form a key part of the intellectual property held by leading market manufacturers, differentiating performance characteristics across various price points.

Material innovation plays an equally significant role, with manufacturers experimenting with lightweight alternatives to standard aluminum. The incorporation of titanium axles (hollow or solid) dramatically reduces the overall weight of the truck assembly without compromising load-bearing capacity, addressing the constant demand for lighter setups in street and park skateboarding. Additionally, advanced polymer and composite materials are being employed for bushings and pivot cups, utilizing polyurethane compounds optimized for specific durometers (hardness ratings) and rebound characteristics. This allows riders to fine-tune the turning response and stability of their boards with exceptional precision, necessitating specialized chemical engineering expertise. The development of proprietary formulas for these high-performance elastomeric components directly impacts the ride feel and user experience, representing a critical technological frontier for optimizing board control.

The rise of the electric skateboard sector has introduced technologies relating to motor integration, heat management, and sensor technology into the chassis design. E-skate chassis often feature integrated battery routing channels, dedicated mounting plates for hub or belt-drive motors, and specialized cooling fins within the baseplate or hanger structure to dissipate heat generated during high-speed operation or intense regenerative braking. The adoption of smart chassis technology, which includes embedded accelerometers and gyroscopes, allows for real-time data collection on impact forces and stress distribution. This data is invaluable for engineers utilizing simulation and AI to inform future design iterations, ensuring structural integrity under the much higher mechanical stresses inherent in motorized applications, thereby merging traditional mechanical engineering with contemporary IoT and data analytics capabilities.

Regional Highlights

Regional dynamics within the Skateboard Chassis Market illustrate a clear segmentation between mature, innovation-driven markets and rapidly developing, volume-centric markets. North America holds a commanding lead, primarily due to the deep-rooted skateboarding culture, high rates of professional participation, and the presence of numerous industry-leading brands and specialized component manufacturers. The region exhibits high consumer willingness to pay a premium for technologically advanced, forged, and CNC-machined components, particularly in California and surrounding states, which remain the global epicenter for extreme sports culture and innovation. This area also sees the highest concentration of specialized retail distribution channels and events, reinforcing its status as a critical market for product launch and trendsetting.

Europe, particularly Western European nations such as Germany, the UK, and France, represents the second-largest market. It is characterized by strong demand for both traditional high-performance trucks and advanced e-skate chassis systems, benefiting from robust urban infrastructure conducive to cruising and commuting. The European market places a strong emphasis on regulatory compliance and safety standards, particularly concerning electric mobility, pushing manufacturers to ensure chassis components meet rigorous testing protocols. Furthermore, Eastern Europe and Russia show promising growth potential as disposable incomes rise and urbanization increases the adoption of skateboarding as a recreational activity and viable mode of short-distance transport, stimulating demand for mid-range and entry-level products.

The Asia Pacific (APAC) region is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR) over the forecast period. This acceleration is fueled by rising youth engagement in urban sports, increasing urbanization, and significant investments in skatepark infrastructure, particularly in densely populated countries like China, Japan, and South Korea. While manufacturing hubs in China contribute substantially to global supply (often producing components for Western brands), domestic demand is also soaring. This region is a major growth driver for entry-level and mass-market complete skateboards, creating immense volume opportunities. The burgeoning e-skate market in urban centers across APAC, driven by traffic congestion and last-mile connectivity needs, further enhances the demand for specialized, highly durable chassis components capable of enduring demanding daily use.

- North America: Market leader, high demand for premium (forged/CNC) trucks, strong influence of professional skating culture, critical hub for e-skate innovation and early adoption.

- Europe: Stable market growth, strong regulatory focus on e-mobility safety, balanced demand for traditional and electric chassis components, high penetration in urban commuting.

- Asia Pacific (APAC): Fastest-growing region, driven by urbanization, youth participation, and manufacturing capability; major focus on volume production and rising domestic consumption across China, Japan, and Australia.

- Latin America (LATAM): Emerging market potential, driven by young population demographics and growing disposable income; highly sensitive to price, leading to strong demand for value-oriented casting technologies.

- Middle East and Africa (MEA): Lowest market penetration currently, but showing niche growth in urban centers (UAE, South Africa) supported by governmental initiatives to promote sports infrastructure and leisure activities, primarily focusing on mid-range equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skateboard Chassis Market.- Independent Truck Company

- Thunder Trucks

- Venture Trucks

- Paris Truck Co.

- Caliber Truck Co.

- Tensor Trucks

- Gullwing Truck Co.

- Bear Trucks

- Destructo Trucks

- Ace Trucks

- Evolve Skateboards (Component Division)

- Loaded Boards (Truck Accessories)

- Rogue Trucks

- Sabre Trucks

- Boosted (Component Division)

- Atlas Truck Co.

- Ronin Trucks

- Carver Skateboards (C7/CX Trucks)

- Tracker Trucks

- Polished Trucks Inc.

Frequently Asked Questions

Analyze common user questions about the Skateboard Chassis market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cast and forged skateboard trucks?

Cast trucks (gravity or die cast) are created by pouring molten metal into a mold, making them cost-effective and suitable for entry-level use. Forged trucks are manufactured by pressing solid metal under extreme pressure, resulting in a significantly denser, stronger, and lighter component with superior resistance to impact fatigue, primarily utilized in premium and professional setups.

How does the type of axle material impact skateboard chassis performance and price?

Axles are typically made of steel, but high-end models use hollow steel or solid titanium. Titanium axles offer exceptional strength while significantly reducing overall truck weight (up to 40% reduction compared to standard steel), directly improving maneuverability and jump height, but this comes with a substantially higher purchase price due to material and manufacturing costs.

Which segment of the Skateboard Chassis Market is experiencing the fastest technological advancement?

The Electric Skateboard (E-Skate) chassis segment is seeing the fastest technological advancement. This includes integration of robust motor mounts, specialized baseplates designed for heat dissipation and battery management, and the increasing use of generative AI design for optimizing high-stress, high-torque component geometries.

What are the key drivers for market growth in the Asia Pacific (APAC) region?

Growth in APAC is primarily driven by rapid urbanization, increased government investment in sports infrastructure (like skateparks), rising youth participation in recreational sports, and the emergence of China as a major manufacturing and consumption hub for both traditional and electric skateboard components, resulting in massive volume demand.

Why is the bushing hardness (durometer) critical for chassis performance?

Bushing durometer (hardness) dictates the responsiveness and stability of the trucks. Softer bushings allow for easier, tighter turning (better for carving/cruising), while harder bushings provide greater stability at high speeds and under heavy impacts (essential for downhill racing and vert skating), making them crucial for fine-tuning rider preference and style.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager