Ski Wax Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437006 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ski Wax Market Size

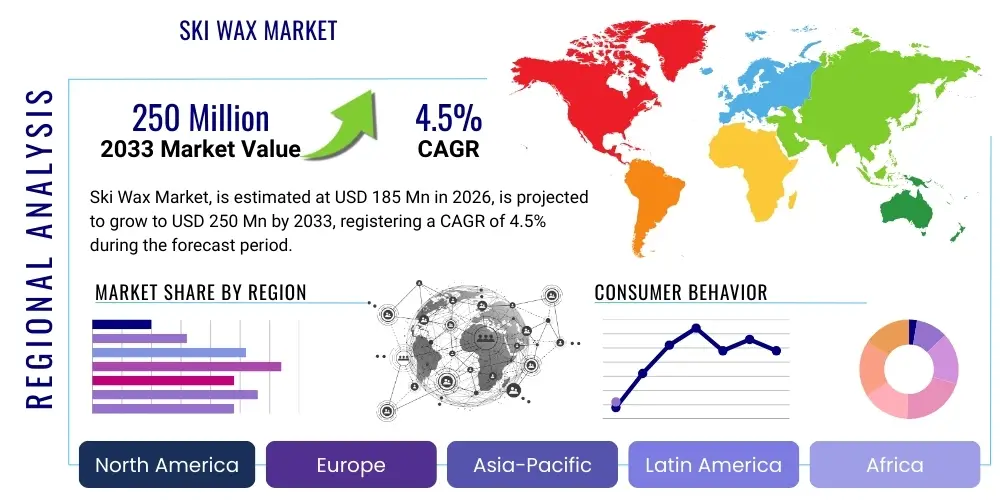

The Ski Wax Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $185 Million USD in 2026 and is projected to reach $250 Million USD by the end of the forecast period in 2033.

Ski Wax Market introduction

The Ski Wax Market encompasses the global trade of specialized chemical compounds applied to the base of skis or snowboards to improve glide performance, protect the base material, and optimize speed characteristics across varying snow conditions and temperatures. These products are crucial for both recreational enthusiasts seeking smoother, more enjoyable runs and competitive athletes aiming for marginal performance gains. The basic product composition typically involves hydrocarbons, synthetic polymers, and in some cases, fluorinated compounds, although the industry is rapidly transitioning towards eco-friendly and non-fluorinated alternatives due to environmental regulations and consumer demand for sustainability.

Major applications of ski wax span across alpine skiing (downhill), cross-country skiing (Nordic), and snowboarding. For alpine and snowboarding, the primary goal is maximizing glide (speed and friction reduction), while cross-country skiing requires both glide wax and grip wax (kick wax) to facilitate propulsion on inclines. The benefits derived from proper waxing include enhanced speed, improved maneuverability, reduction of static friction, prevention of base damage, and protection against oxidation. These performance benefits directly correlate with improved safety and user experience, particularly in harsh or rapidly changing winter environments.

Driving factors stimulating market expansion include the increasing participation rates in winter sports globally, especially in emerging economies demonstrating growing disposable incomes and developing ski infrastructure. Furthermore, continuous technological innovation, focused on creating faster, more durable, and temperature-specific wax formulations, alongside the aggressive push towards sustainable, biodegradable, and PFOA-free products, is significantly influencing purchasing decisions and market dynamics. The professional competitive skiing circuit also serves as a critical testing and promotional ground, maintaining high demand for premium, high-performance waxes.

Ski Wax Market Executive Summary

The Ski Wax Market is characterized by robust resilience driven by consistent participation in winter tourism and the sustained demand from competitive sports. Current business trends indicate a significant shift away from traditional highly fluorinated waxes (HF and LF) toward environmentally conscious alternatives, including hydrocarbon, plant-based, and ceramic-infused waxes. Manufacturers are heavily investing in R&D to match the performance attributes of legacy fluorocarbons using sustainable chemistry, positioning eco-friendliness as a core competitive differentiator. Supply chain optimization, particularly related to the sourcing of new, compliant raw materials, remains a strategic focus for leading market players navigating stringent international environmental protocols.

Regionally, Europe and North America remain the dominant markets, leveraging established winter sports cultures and sophisticated ski resort infrastructure. However, the Asia Pacific region, notably China and South Korea, is emerging as a high-growth area, fueled by government initiatives promoting winter sports participation and substantial investments in new ski facilities. This regional dynamic is compelling companies to tailor product lines to specific Asian climate profiles and expand localized distribution networks. Geopolitical stability and weather pattern unpredictability (affecting snow reliability) pose minor regional risks that manufacturers mitigate through diversification across product forms (liquid, paste, solid) designed for various snow conditions.

Segmentation trends highlight the increasing consumer preference for liquid and paste waxes, favored for their convenience and speed of application compared to traditional hot waxing methods, catering primarily to the recreational segment. Within the product type segment, non-fluorinated glide waxes are rapidly capturing market share. The distribution channel analysis shows continued reliance on specialized sports stores for expert advice and fitting, while online retail channels are experiencing accelerated growth, offering wider product accessibility and competitive pricing. The premiumization of performance-oriented, race-level non-fluorinated products represents a key revenue opportunity for targeted marketing campaigns.

AI Impact Analysis on Ski Wax Market

User queries regarding AI's influence in the Ski Wax Market primarily revolve around optimizing wax application, personalizing product recommendations, and enhancing competitive racing analysis. Consumers and industry professionals are keenly interested in how AI can process vast amounts of data—including snow temperature, humidity, air pressure, and terrain profiles—to provide precise, instantaneous wax selection recommendations, potentially through dedicated mobile applications or smart base sensors. Key concerns focus on whether such AI-driven personalization could automate the expert knowledge currently held by professional wax technicians, and expectations center on improved efficiency, reduced trial-and-error in racing preparation, and the development of next-generation, dynamically adjusting wax formulas.

- AI-driven personalized wax recommendations based on real-time environmental data (snow type, temperature, humidity, track conditions).

- Predictive analytics for optimal race day preparation, minimizing performance variability caused by minor environmental shifts.

- Enhanced inventory and demand forecasting for manufacturers, optimizing production schedules based on regional snow forecasts and climate trends.

- Integration of machine learning algorithms in R&D to simulate performance characteristics of new chemical compositions, accelerating the development of compliant, high-performance eco-waxes.

- Optimization of manufacturing processes through AI monitoring, ensuring consistent quality and minimizing waste in wax production.

DRO & Impact Forces Of Ski Wax Market

The market is propelled by significant growth drivers, balanced by inherent restraints, while numerous opportunities offer pathways for expansion, all influenced by pervasive impact forces defining the industry's trajectory. Key drivers include the global expansion of winter tourism, infrastructural improvements in emerging ski destinations, and the high performance demands set by professional racing circuits, which necessitate the consistent use of specialized wax products for optimal equipment functioning. These drivers foster a stable demand base that sustains market growth across economic cycles, especially in established ski regions where skiing and snowboarding are embedded cultural activities. Furthermore, the relentless pursuit of speed and marginal gains in competitive sports pushes manufacturers to innovate continuously, filtering advanced technologies down to the recreational consumer level.

Restraints primarily center on environmental regulations and the resulting transition costs associated with phasing out fluorinated waxes. The regulatory pressure, particularly the international ban on C8 (long-chain) fluorocarbons and restrictions on C6 (short-chain) fluorocarbons, requires substantial investment in R&D for compliant alternatives, temporarily slowing the introduction of revolutionary high-speed products. Additionally, the unpredictable nature of snow reliability due to climate change impacts specific geographic markets, potentially limiting participation rates in certain seasons and creating volatility in localized demand. Another restraint is the prevalence of highly technical application methods (hot waxing), which can be perceived as complex or time-consuming by the average recreational user, favoring easier, less effective options or base preparation services over self-application.

Opportunities for market growth lie predominantly in the rapid commercialization of non-fluorinated, high-performance eco-waxes that meet both environmental standards and competitive performance needs. The increasing market share of liquid and paste formats presents a major opportunity by addressing consumer convenience concerns and lowering the barrier to entry for novice users. Geographically, tapping into the burgeoning middle-class populations in the Asia Pacific region, particularly via tailored marketing and localized distribution, offers vast untapped potential. The industry also benefits from the opportunity to integrate smart technology, leveraging IoT and AI for personalized wax selection guidance, thereby enhancing the user experience and justifying premium pricing for advanced products. These interconnected factors determine the pace and direction of market development.

The impact forces shaping the market include technological advancements, where continuous material science research dictates product efficacy and consumer adoption. Regulatory forces, particularly those related to environmental stewardship, fundamentally alter the competitive landscape by mandating product reformulation and favoring companies capable of compliance. Economic impact forces relate to disposable income levels, which directly influence recreational participation and the willingness of consumers to invest in high-end, performance-enhancing wax products. Social trends, such as increasing awareness regarding ecological footprints and a growing focus on outdoor activities, also impact purchasing behavior, driving demand toward sustainable and transparently sourced products, making environmental credentials a critical axis of competition.

Segmentation Analysis

The Ski Wax Market segmentation provides a detailed structural analysis based on product type, form, application, and distribution channel, illustrating diverse consumer needs and specific competitive niches. Product segmentation, differentiating between glide and grip wax, highlights the varying requirements of Nordic versus Alpine disciplines. The form segment, separating solid, liquid, and paste formats, reflects consumer preference for convenience versus performance optimization. Application segmentation determines the primary end-user volume, heavily weighted toward recreational skiing and snowboarding, with competitive racing representing the high-value, low-volume segment crucial for brand reputation and innovation.

Detailed analysis of these segments reveals that the non-fluorinated glide wax category is poised for the most rapid expansion, driven by regulatory mandates and consumer adoption of eco-friendly alternatives, even at the cost of slight performance trade-offs compared to legacy fluorinated products. The shift in market dynamics is also evident in the distribution channels, where e-commerce is enabling direct-to-consumer sales, increasing price transparency, and challenging traditional brick-and-mortar retail dominance, particularly for non-specialized, maintenance-grade waxes. Understanding these segment dynamics is vital for manufacturers to allocate resources effectively and develop targeted marketing strategies.

Furthermore, the segmentation by wax temperature suitability (cold, universal, warm) remains foundational, reflecting the necessity of highly specific formulations to achieve optimal performance across the full spectrum of snow conditions encountered globally. Universal waxes, offering versatility, typically dominate the recreational mass market, while temperature-specific specialty waxes capture the high-end enthusiast and competitive segments. The interdependence of these segmentation variables underscores the complexity of product development and market positioning in the ski wax industry.

- Product Type:

- Glide Wax (Hydrocarbon, Non-Fluorinated, Fluorinated)

- Grip Wax (Kick Wax, Klister, Hard Wax)

- Base Prep Wax

- Form:

- Solid Wax (Block, Bar)

- Liquid Wax (Spray, Bottle)

- Paste Wax

- Powder Wax

- Application:

- Alpine Skiing

- Cross-Country Skiing (Nordic)

- Snowboarding

- Other Winter Sports

- Distribution Channel:

- Specialty Sports Stores

- Online Retail Channels

- Department Stores and Hypermarkets

- Direct Sales (Ski Resorts, Racing Teams)

Value Chain Analysis For Ski Wax Market

The Ski Wax Market value chain commences with the upstream analysis involving the sourcing and refinement of specialized raw materials, primarily petroleum-derived paraffin, synthetic polymers, and performance additives like molybdenum or ceramic compounds. With the pivot toward sustainability, the upstream focus has intensely shifted to sourcing non-petroleum alternatives, including plant-based oils and biodegradable polymers, which introduces new supply chain complexities and dependency on agricultural and chemical industry innovations. Suppliers capable of providing consistent, compliant, and environmentally certified raw inputs gain significant leverage, driving the initial cost structure of the final product. Quality control and material purity at this stage are paramount, particularly for high-performance waxes.

Manufacturing and formulation constitute the core midstream activities, where raw materials are compounded, melted, pressed, or processed into various forms (solid blocks, liquid emulsions, or paste tubes). This stage requires specialized mixing equipment and precise temperature control to ensure homogeneity and optimal performance characteristics. Companies often operate proprietary blending techniques to create their unique performance profiles. Downstream analysis involves packaging, logistics, and distribution. Packaging design must be robust, often including temperature-resistant containers or applicators, particularly for liquid and paste waxes, reflecting the consumer-facing nature of the product and its use in variable conditions.

The distribution channel is dichotomous, encompassing both direct and indirect routes. Indirect distribution heavily relies on a network of specialty sports stores, which provide essential expert advice, application services, and high-touch customer interaction critical for technical products like ski wax. Online retail (direct and third-party) provides high scalability and geographical reach, capturing the increasing segment of consumers who research and purchase products digitally. Direct channels, such as sales to professional racing teams or direct fulfillment via brand websites, represent the final, high-value segment, often involving custom formulations or bulk purchases. Effective logistics management, ensuring product availability at the start of the winter season, is crucial for maximizing sales.

Ski Wax Market Potential Customers

The potential customer base for ski wax is highly segmented, ranging from casual recreational skiers and snowboarders to highly dedicated, elite professional athletes and their technical support teams. Recreational users constitute the largest volume segment, typically prioritizing ease of application, durability, and versatility (universal temperature waxes). Their purchasing decisions are often influenced by convenience and price point, frequently favoring liquid or paste formats for quick, on-hill application. This segment seeks reliable performance without the significant time investment required for hot waxing.

A second crucial segment comprises competitive athletes, race teams, and professional ski service technicians. These buyers demand the absolute highest level of performance, requiring highly specific, temperature-calibrated specialty waxes (including accelerators and powders) tailored to extremely narrow environmental parameters. Their purchasing volume is lower, but their willingness to pay a premium for marginal performance gains is high, making them a critical segment for driving innovation and establishing brand credibility. This group is highly knowledgeable about the technical nuances of wax chemistry and application.

Beyond individual consumers, institutional buyers—such as ski resorts, rental shops, and specialized training academies—represent significant bulk purchasers of base prep and maintenance waxes. Rental fleets require durable, long-lasting universal waxes for base protection and consistent customer experience. These businesses prioritize cost-effectiveness, application efficiency, and product durability across hundreds of pairs of skis or boards, making bulk format purchases standard. Therefore, the market caters simultaneously to high-volume convenience needs and low-volume, high-precision performance requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million USD |

| Market Forecast in 2033 | $250 Million USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swix, Toko, Holmenkol, Dominator, Start Ski Wax, VAUHTI, Zardoz NotWax, Briko Maplus, Rode, Rex Ski Wax, Black Diamond, Kuzmin, Fast Wax, MountainFlow Eco-Wax, Hertel Wax, OneBallJay, Purl Wax, Ski-Go, Solda, FC-Imola |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ski Wax Market Key Technology Landscape

The contemporary Ski Wax Market technology landscape is defined by the critical transition away from long-chain and short-chain per- and polyfluoroalkyl substances (PFAS), which historically offered superior friction reduction. The core technological challenge is replicating the non-stick and hydrophobic properties of fluorocarbons using compliant, environmentally benign substitutes. Current research focuses heavily on developing advanced hydrocarbon blends, synthetic waxes infused with ceramic microspheres, and novel plant-based fatty acid derivatives. These innovations aim to achieve competitive glide times while ensuring regulatory adherence, particularly in high-stakes competitive environments where fluorocarbon usage is increasingly restricted or banned outright.

Another significant technological advancement lies in the formulation of liquid and paste waxes, which utilize highly specialized carriers (solvents and emulsions) to deliver high-performance solids to the ski base efficiently and without the need for heat. This technology addresses consumer demand for convenience and rapid application, significantly lowering the complexity associated with traditional hot waxing. Manufacturers are leveraging nanotechnology to ensure optimal bonding and durability of these cold-application waxes, striving to match the longevity and performance depth traditionally offered by ironed-in solid waxes. Furthermore, advancements in base preparation technology, including specialized brushing tools and cleaning agents, complement these new wax technologies by maximizing the absorption and efficiency of the applied product.

Beyond the chemical formulation, the technology landscape includes the development of diagnostic and application tools. Infrared heating systems are being introduced as a safer and more consistent alternative to traditional waxing irons, ensuring deeper wax penetration without overheating or damaging the ski base structure. Digital tools, including smartphone applications powered by AI and vast snow data databases, are emerging as essential components for the modern wax technician or advanced amateur. These tools use predictive modeling to recommend the exact wax based on real-time climate data inputs, integrating data science into the traditionally empirical art of ski waxing, thereby enhancing precision and performance consistency across various conditions.

Regional Highlights

The Ski Wax Market exhibits distinct consumption patterns and growth trajectories across major geographical regions, influenced by cultural affinity for winter sports, infrastructure development, and varying climate conditions. North America, encompassing the United States and Canada, represents a mature, high-value market driven by large-scale recreational skiing participation and a significant competitive racing presence. Demand in this region is increasingly focused on sustainable and non-fluorinated options, reflecting strong consumer environmental awareness. States and provinces with high ski resort density, such as Colorado, Utah, and British Columbia, serve as primary consumption hubs, where distribution networks are well-established through specialized retail chains and extensive online presence. The region benefits from early adoption of new application technologies like liquid waxes.

Europe, historically the cradle of skiing and home to the Alpine and Nordic competitive circuits, holds the largest market share globally. Countries such as Norway, Sweden, Switzerland, Austria, and France demonstrate deeply entrenched skiing cultures, fueling consistent demand for both premium race waxes and high-quality recreational products. European regulatory bodies, particularly the EU and various national skiing federations, have been pioneers in implementing fluorocarbon bans, forcing manufacturers with significant European operations (like Swix and Holmenkol) to lead the innovation in eco-friendly formulation. The market here is highly segmented, with a strong emphasis on cross-country (Nordic) waxing needs in Scandinavian countries, demanding specialized grip and kick waxes alongside glide products. The stability of demand is closely linked to the seasonal success of winter sports tourism.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, primarily fueled by rapid economic development and government strategies promoting winter sports, notably in China (post-2022 Winter Olympics hosting) and South Korea. While the overall participation rate remains lower than in North America and Europe, the rate of increase in new skiers and the rapid construction of modern resort facilities provide immense growth potential. Manufacturers are focusing on universal and mid-range performance waxes tailored to the relatively new consumer base, along with establishing specialized training programs for local technicians. Japan remains a mature market within APAC, known for its unique snow conditions (JaPow) requiring specific wax formulations, particularly in the powder skiing segment.

Latin America, the Middle East, and Africa (MEA) represent niche markets characterized by smaller, geographically concentrated skiing areas (e.g., the Andes mountains in Chile and Argentina, and limited indoor facilities in the Middle East). Demand is highly seasonal and focused largely on maintenance and universal waxes for resort operations and local enthusiasts. Growth relies heavily on infrastructure investments in these confined geographical zones. The MEA region’s contribution is minimal but shows potential growth related to luxury tourism and the expansion of indoor snow parks, which require consistent base wax application to protect equipment operating under controlled, often humid, environments.

- Europe: Largest market share; strict regulatory environment driving eco-wax innovation; strong demand for Nordic and Alpine waxes in Scandinavia and the Alps.

- North America: High recreational participation and mature infrastructure; rapid shift toward non-fluorinated products; substantial online sales channel penetration.

- Asia Pacific (APAC): Fastest growing region; driven by new winter sports participants in China and South Korea; high potential for market penetration and infrastructure investment.

- Latin America & MEA: Niche, high-seasonal markets focused on maintaining resort equipment and catering to specialized high-altitude skiing (Andes) or controlled indoor environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ski Wax Market.- Swix

- Toko

- Holmenkol

- Dominator

- Start Ski Wax

- VAUHTI

- Zardoz NotWax

- Briko Maplus

- Rode

- Rex Ski Wax

- Black Diamond

- Kuzmin

- Fast Wax

- MountainFlow Eco-Wax

- Hertel Wax

- OneBallJay

- Purl Wax

- Ski-Go

- Solda

- FC-Imola

Frequently Asked Questions

Analyze common user questions about the Ski Wax market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the shift away from fluorinated ski waxes?

The primary driver is stringent global environmental and health regulations, specifically targeting per- and polyfluoroalkyl substances (PFAS) found in fluorinated waxes, due to their persistence and toxicity in the environment.

Are non-fluorinated ski waxes comparable in performance to traditional fluorinated waxes?

While traditional fluorocarbons offered superior performance in certain high-humidity conditions, continuous R&D is rapidly closing the gap, with modern non-fluorinated, high-performance hydrocarbon and plant-based formulas offering near-comparable speed and glide characteristics.

Which format of ski wax (solid, liquid, or paste) is most popular among recreational users?

Liquid and paste waxes are rapidly gaining popularity among recreational users due to their convenience, speed of application, and reduced need for specialized equipment like waxing irons, making on-hill reapplication feasible.

How is the Ski Wax Market addressing climate change and variable snow conditions?

The market is responding by developing more versatile universal temperature waxes and highly durable base prep formulas. AI and digital tools are also being introduced to provide micro-calibrated wax recommendations based on unpredictable, localized snow and weather data.

Which region currently leads the global Ski Wax Market in terms of revenue?

Europe leads the global market in terms of revenue, supported by high participation rates, established winter sports infrastructure, and the high demand generated by professional competitive skiing circuits across the Alpine and Nordic countries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager