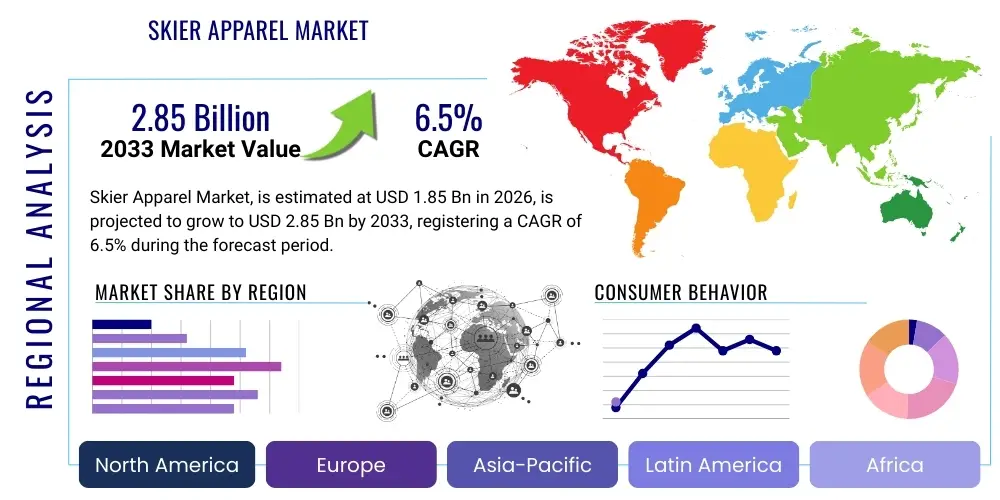

Skier Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436418 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Skier Apparel Market Size

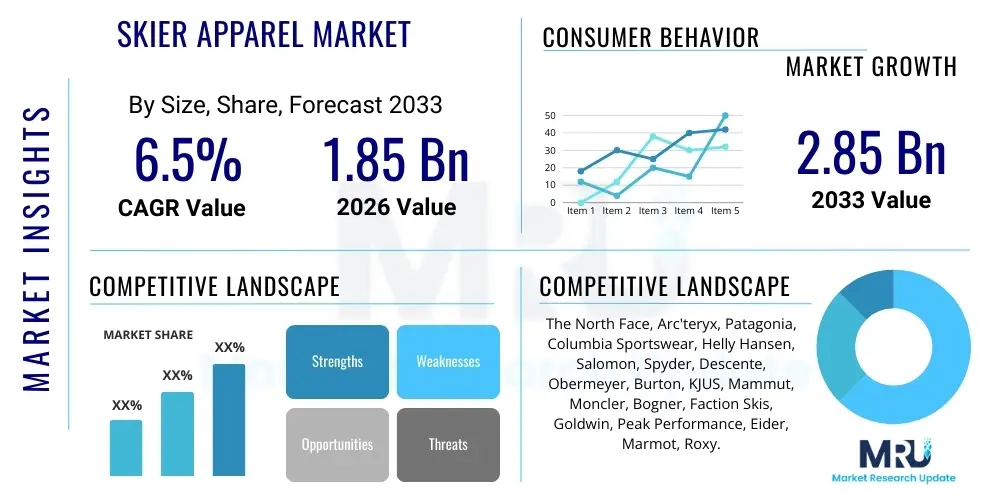

The Skier Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.85 Billion USD in 2026 and is projected to reach $2.85 Billion USD by the end of the forecast period in 2033.

Skier Apparel Market introduction

The Skier Apparel Market encompasses specialized clothing and gear designed to protect skiers from extreme cold, wind, and moisture while maximizing performance and comfort on the slopes. This market segment includes various products such as ski jackets, ski pants, base layers, mid-layers, gloves, headwear, and specialized accessories, utilizing high-performance materials like Gore-Tex, proprietary waterproof breathable membranes, and advanced synthetic insulation. The primary objective of these products is thermal regulation, moisture management, and ensuring freedom of movement, crucial for both recreational and professional skiing. The demand is driven fundamentally by the increasing global participation in winter sports, rising disposable incomes in key regional economies, and continuous innovation in textile technology that enhances the functionality and sustainability of apparel.

Product descriptions within this market emphasize technical specifications, focusing on water column ratings, breathability scores (MVTR), insulation type (down or synthetic), and fit (e.g., tailored, relaxed, or ergonomic). Major applications extend beyond alpine skiing to include snowboarding, cross-country skiing, and general winter outdoor activities, though specialized ski apparel often features elements like specific pocket configurations for lift passes, helmet-compatible hoods, and reinforced patches against edge cuts. The intrinsic benefits of modern skier apparel include enhanced safety due to integrated reflective elements or Recco reflectors, superior comfort across varying conditions, and longevity of the product, justifying the typically premium pricing structure observed across leading brands.

Driving factors propelling the market growth are multifaceted, involving the resurgence of destination skiing tourism post-pandemic, infrastructure development in emerging ski regions (particularly in Asia), and strong marketing focus by leading brands on sustainable and fashionable winter wear. Furthermore, the generational shift towards experiential travel and outdoor recreation, combined with continuous advancements in material science offering lighter yet warmer solutions, ensures sustained consumer interest and willingness to invest in high-quality technical apparel. The integration of smart textile technologies, such as embedded heating elements or fitness trackers, also presents a significant trajectory for future market expansion and product differentiation, catering to high-end, tech-savvy consumers seeking optimal performance data and comfort in challenging environments.

Skier Apparel Market Executive Summary

The Skier Apparel Market is characterized by robust business trends centered on sustainability, digitization of retail channels, and premiumization of technical features. Leading companies are heavily investing in circular economy models, utilizing recycled polyesters, and minimizing PFC (perfluorinated compound) usage in Durable Water Repellent (DWR) finishes, responding directly to heightened consumer environmental consciousness. The shift towards Direct-to-Consumer (DTC) models and enhanced e-commerce experiences, leveraging virtual try-ons and personalized recommendations, is reshaping the distribution landscape, allowing brands greater control over pricing and customer data. Furthermore, strategic mergers and acquisitions targeting niche technical apparel providers or sustainable material manufacturers indicate a consolidation trend aimed at capturing specialized market segments and integrating innovative supply chain practices.

Regional trends demonstrate North America and Europe retaining dominance due to established ski cultures, high per capita spending on sports equipment, and extensive ski resort infrastructure. However, the Asia Pacific (APAC) region, driven primarily by China and South Korea, exhibits the highest growth trajectory, fueled by government initiatives promoting winter sports participation, increased infrastructure investment (e.g., following major winter sporting events), and a rapidly expanding middle class adopting Western recreational activities. Within Europe, the Alps region remains the core consumption hub, emphasizing highly technical and fashion-forward designs, while North American consumers prioritize durability and extreme weather protection, reflecting diverse regional climates and skiing styles.

Segmentation trends highlight the technical apparel segment (jackets and pants) as the largest revenue generator, although the base layers and mid-layers segment is experiencing accelerated growth driven by the popularity of layering systems for optimal thermal performance. In terms of end-users, the adult segment holds the majority share, yet the children's apparel segment shows consistent growth owing to greater family participation in winter sports and the need for durable, easily adjustable, and high-visibility gear. Distribution analysis underscores the continuing importance of specialty sports stores for expert advice and fitting, juxtaposed against the overwhelming speed of growth observed in online retail, particularly for replenishment items like gloves and technical socks. Material innovation remains a key segment trend, with synthetic insulation gaining ground over traditional down due to performance consistency in damp conditions and ethical sourcing concerns.

AI Impact Analysis on Skier Apparel Market

User inquiries regarding AI's influence in the Skier Apparel Market frequently revolve around personalization of fit and style, predictive demand forecasting, and sustainable production optimization. Consumers are particularly concerned about how AI can enhance the online shopping experience, questioning the feasibility of perfect virtual sizing recommendations to minimize returns. Businesses, conversely, focus on AI’s capability to analyze real-time weather and consumer feedback to rapidly adjust production volumes and designs, aiming to reduce overstocking and material waste. The integration of AI into design processes, such as generating novel material patterns or optimizing apparel ventilation zones based on biometric data inputs, represents a major theme, highlighting expectations for more performance-driven and less wasteful product cycles in the near future.

- Personalized Sizing and Fit: AI-driven algorithms analyze consumer body scans and preference data, reducing high return rates associated with online purchases of specialized, technical outerwear.

- Predictive Demand Forecasting: AI models integrate complex data sets (weather patterns, resort visitor numbers, historical sales) to optimize inventory levels and inform production cycles, minimizing obsolescence.

- Supply Chain Optimization: Machine learning identifies bottlenecks, streamlines logistics, and improves traceability of raw materials, particularly important for ethically sourced insulation and sustainable fibers.

- Smart Apparel Integration: AI processes data collected from integrated sensors (e.g., temperature, heart rate) within base layers, offering real-time performance feedback and personalized adjustment recommendations to the user.

- Automated Quality Control: AI vision systems inspect finished garments for stitching integrity, waterproofing defects, and material consistency faster and more accurately than manual processes.

- Accelerated Material R&D: AI simulations predict the performance characteristics (e.g., water resistance, breathability) of novel textile compositions before costly physical prototyping, speeding up innovation.

DRO & Impact Forces Of Skier Apparel Market

The dynamics of the Skier Apparel Market are shaped by a complex interplay of internal and external forces categorized as Drivers, Restraints, and Opportunities (DRO). The primary driver remains the robust and growing global interest in leisure and extreme winter sports, fueled by better access to indoor and outdoor snow facilities and the expanding influence of social media marketing showcasing high-performance gear. Coupled with this is the continuous technological advancement in textiles, offering consumers lighter, warmer, and more sustainably produced garments, which justifies regular upgrades and premium purchases. Furthermore, rising disposable income, particularly across Asian markets, allows a broader consumer base to invest in specialized and high-cost recreational equipment, supporting the overall market expansion trajectory significantly.

Conversely, significant restraints hinder growth and operational efficiency. The market faces high seasonality, leading to inherent inventory and logistics challenges, necessitating robust forecasting and warehousing strategies. Another critical restraint is the high cost of raw materials, especially specialized membranes and ethical down, which directly impacts the final product pricing, potentially limiting mass-market penetration. Climate change poses a severe long-term restraint; decreasing reliable snowfall patterns and shorter winter seasons in traditional ski regions force consumers to re-evaluate the utility and necessity of specialized apparel, although this also drives demand for flexible, multi-climate technical wear. Counterfeiting and the saturation of lower-end market segments with generic products also pressure the profit margins of premium brands that rely heavily on intellectual property and brand prestige.

Opportunities for market players are abundant, predominantly surrounding sustainable innovation and digital engagement. The shift towards circular fashion models—renting, repairing, and recycling ski apparel—presents a fresh revenue stream and appeals strongly to environmentally conscious Millennials and Gen Z consumers. Geographically, emerging markets in Eastern Europe, China, and the Himalayan regions offer untapped potential for infrastructure development and market penetration. Furthermore, capitalizing on personalization through customized design tools and integrating advanced features like biometric monitoring and heating elements represents a high-margin opportunity within the luxury and professional skier segment, allowing brands to differentiate themselves substantially beyond basic weather protection features.

Segmentation Analysis

The Skier Apparel Market segmentation provides a granular understanding of consumer behavior, product preferences, and distribution channel effectiveness, crucial for strategic planning. The market is primarily segmented based on Product Type (Outerwear, Base Layers, Accessories), End-User (Men, Women, Children), Distribution Channel (Online Retail, Specialty Stores, Department Stores), and Material (Natural, Synthetic, Blends). Analyzing these segments reveals shifting consumer preferences, such as the increasing demand for versatile, multi-functional apparel that transitions seamlessly from the slope to après-ski environments, pushing brands to balance technical performance with aesthetic appeal. Specialized segmentation by insulation type, focusing on the debate between natural down and proprietary synthetic alternatives, also dictates product positioning and price points within competitive landscapes, particularly concerning wet weather performance and ethical sourcing claims, thereby influencing overall market share distribution among key players.

- By Product Type:

- Ski Jackets (Hardshell, Softshell, Insulated)

- Ski Pants/Bibs

- Base Layers (Merino Wool, Synthetic, Blends)

- Mid-Layers (Fleece, Lightweight Insulation)

- Accessories (Gloves/Mittens, Headwear, Socks, Goggles)

- By End-User:

- Men

- Women

- Children

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Sports Stores, Department Stores, Discount Stores)

- By Material Type:

- Natural Fibers (e.g., Down, Merino Wool)

- Synthetic Fibers (e.g., Polyester, Nylon, Gore-Tex, Primaloft)

- Blends and Hybrids

- By Price Range:

- Economy/Budget

- Mid-Range

- Premium/Luxury

Value Chain Analysis For Skier Apparel Market

The value chain for Skier Apparel commences with the Upstream Analysis, which focuses on the sourcing and processing of specialized raw materials. This includes procuring technical fabrics (e.g., waterproof membranes, ripstop nylon), high-performance insulation (natural down or synthetic fills like Primaloft), and necessary hardware (YKK zippers, specialized closures). Key upstream activities involve complex chemical treatments for water repellency (DWR) and breathability enhancements, alongside ensuring ethical sourcing and material certifications, particularly for natural fibers. Relationships with specialized textile manufacturers who possess the proprietary technology to produce Gore-Tex or similar membranes are critical, as the quality and performance attributes established at this stage directly dictate the final product's market positioning and price potential, requiring substantial investment in quality control and sustainability audits throughout the material supply network.

Midstream activities primarily involve design, manufacturing, and assembly. Design studios translate performance requirements into ergonomic patterns suitable for skiing movement, focusing heavily on seam sealing, ventilation placement, and pocket functionality. Manufacturing often takes place in specialized facilities in Southeast Asia or Eastern Europe, requiring high levels of technical expertise for garment construction, particularly the precise application of tapes to waterproof seams and the controlled filling of down chambers. Rigorous quality assurance testing for water resistance and durability is paramount at this stage to meet industry standards. The efficient management of cutting, stitching, and assembly processes determines the production cost and turnaround time, forming a core competitive advantage for companies that integrate vertical manufacturing or maintain strong partnerships with dedicated contract manufacturers capable of handling highly complex, multi-layered technical garments, ensuring consistency across high-volume orders.

Downstream analysis centers on distribution and market access. The distribution channel is bifurcated into direct and indirect methods. Direct channels involve brand-owned retail stores and specialized e-commerce platforms, offering greater control over brand messaging and pricing, and facilitating direct customer feedback. Indirect channels rely on third-party retailers, including specialty winter sports retailers, major department stores, and large online marketplaces (e.g., Amazon, Zalando). Specialty sports stores remain crucial as they provide expert advice, professional fitting services, and opportunities for customers to physically examine the technical features of high-cost items. Effective distribution requires sophisticated logistics for handling seasonal inventory fluctuations and ensuring timely stock delivery to ski resort locations globally, utilizing omnichannel strategies to harmonize the customer experience across all points of sale for maximum market penetration and efficient inventory turnover, particularly during peak winter months.

Skier Apparel Market Potential Customers

Potential customers for the Skier Apparel Market are diverse, ranging from recreational enthusiasts to professional athletes, segmented primarily by skill level, frequency of activity, and budget. The largest segment comprises Recreational Skiers and Snowboarders (often families or holidaymakers) who seek durable, moderately priced, and aesthetically pleasing gear suitable for typical resort conditions. These buyers prioritize waterproof ratings, warmth, and style, often making purchases once every few seasons. The purchasing decision for this group is heavily influenced by resort proximity, travel trends, and seasonal discounts, positioning them as high-volume consumers that drive sales for mid-range and popular brand offerings that balance performance and cost effectively for several days of annual use.

The second major group is the Expert and Professional Athletes segment, including ski instructors, competitive racers, and extreme sports enthusiasts. These customers demand the highest possible technical specifications, prioritizing lightweight construction, maximum breathability, specialized ergonomic fits for aggressive movement, and proprietary materials designed for multi-day, high-intensity use in variable conditions. This segment is less price-sensitive and frequently updates their gear, driving innovation and demand for high-end, premium, and custom-fitted apparel. Purchases within this segment are often driven by performance endorsements, sponsorship agreements, and direct product feedback to manufacturers, forming a critical segment that dictates emerging material and design trends across the entire market.

A rapidly growing customer base includes Urban and Outdoor Enthusiasts who use specialized ski apparel for general winter wear, winter hiking, and cold-weather commuting, valuing the jacket’s durability, warmth, and stylish design cues. This segment prefers multi-functional apparel that can transition off the slopes, broadening the purchasing window beyond the traditional ski season. Furthermore, the rising awareness of technical apparel in emerging markets, especially China and South Korea, is expanding the potential customer base geographically. These new skiers, often characterized by high brand loyalty and willingness to invest in reputable foreign brands, represent the future growth engine for the market, necessitating tailored marketing and distribution strategies focused on luxury presentation and digital engagement within the target regions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion USD |

| Market Forecast in 2033 | $2.85 Billion USD |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The North Face, Arc'teryx, Patagonia, Columbia Sportswear, Helly Hansen, Salomon, Spyder, Descente, Obermeyer, Burton, KJUS, Mammut, Moncler, Bogner, Faction Skis, Goldwin, Peak Performance, Eider, Marmot, Roxy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Skier Apparel Market Key Technology Landscape

The Skier Apparel Market is highly dependent on continuous innovation in textile engineering to deliver products that meet stringent demands for lightness, warmth, waterproofing, and breathability simultaneously. Core technologies revolve around proprietary membrane development, such as Gore-Tex, eVent, and various in-house branded materials, which utilize microscopic pores or electrochemical barriers to allow water vapor (sweat) to escape while preventing liquid water (rain/snow) penetration. The shift towards PFC-free Durable Water Repellent (DWR) treatments is a major technological trend, driven by environmental regulations and consumer preferences, forcing manufacturers to invest heavily in bio-based and non-fluorinated chemical alternatives that maintain high performance without ecological compromise. Insulation technology is another focal point, where advances in synthetic microfibers (like Primaloft or Thinsulate) offer superior performance to traditional down when wet, while also addressing ethical sourcing concerns, pushing the development of hybrid insulation mapping—placing different insulation types strategically across the garment for optimized thermal regulation across the body.

Beyond material science, smart apparel technologies are emerging as a high-growth area, albeit still niche. This includes the integration of flexible heating elements powered by small batteries, allowing users to actively adjust warmth levels in extreme cold environments. Furthermore, embedded sensor technology, often within base layers, monitors biometric data such as body temperature, heart rate, and movement, providing crucial data for both performance analysis and safety (e.g., monitoring hypothermia onset). These smart garments rely on durable, washable electronics that maintain functionality through repeated cycles of intense use and cleaning. The development of Recco technology—reflectors integrated into the garment that assist search and rescue operations—has become an industry standard for safety, indicating a broader trend towards embedded safety features that leverage passive or active electronic components without compromising the garment's technical performance or comfort.

Manufacturing technology also plays a crucial role in enabling technical performance. Laser cutting ensures precise fabric pieces for complex garment assembly, minimizing waste and improving consistency. Advanced seam sealing techniques, utilizing specialized heat-activated tapes and ultrasonic welding, are essential for maintaining the waterproof integrity of the apparel, particularly critical in areas subject to high stress. Furthermore, the implementation of 3D body scanning and computer-aided design (CAD) software allows for the creation of highly ergonomic and anatomically tailored fits, optimizing mobility and reducing bulk, addressing the professional skier segment's need for unencumbered movement and layering capability. The digital integration of the design-to-manufacture pipeline, often leveraging AI for pattern optimization, is enhancing efficiency and accelerating the speed-to-market for complex seasonal collections, ensuring that brands can rapidly respond to fast-changing trends and material innovations without extensive manual prototyping loops.

Regional Highlights

The Skier Apparel Market exhibits significant geographical variations in consumption patterns, product preferences, and market maturity, with distinct leaders across continents. Europe, particularly the Alpine nations (Austria, Switzerland, France, Italy), represents the most mature and dominant market. This region boasts a deep-rooted skiing culture, high consumer expectations for technical performance combined with European fashion aesthetics, and proximity to high-end resorts, driving demand for premium and luxury brands like Moncler, Bogner, and KJUS. The focus here is often on sustainable luxury and multi-functional high-performance textiles.

North America (primarily the US and Canada) is characterized by a strong market for durable, high-visibility, and robust apparel designed to withstand varied and often severe continental climates. Brands like Patagonia, Columbia, and The North Face hold strong market positions, appealing to a consumer base that values longevity, warranty, and environmental activism. The large consumer base and expansive retail distribution networks, including substantial online penetration, make North America a key region for innovation launch and large-volume sales, focused on the intersection of utility and mainstream outdoor lifestyle appeal.

Asia Pacific (APAC) is the fastest-growing region, with explosive growth centered in China, South Korea, and Japan. Government promotion of winter sports, expanding middle-class wealth, and major international events have significantly boosted participation rates. While Japan has a mature, quality-conscious market, the influx of new skiers in China drives demand for both entry-level equipment and aspirational luxury brands, particularly those associated with Western heritage and performance, positioning APAC as the critical future growth driver for the global market, requiring tailored sizing and distribution strategies to handle rapid demand scale-up.

- North America: Dominated by the US and Canada; high demand for durable, multi-layer technical gear and established brand loyalty; strong e-commerce presence and focus on sustainable practices.

- Europe: Core market centered in the Alps (Austria, Switzerland); preference for high-end, fashion-forward, and highly technical specialized apparel; strict regulatory environment promoting PFC-free materials.

- Asia Pacific (APAC): Highest CAGR, driven by China and South Korea; rapid infrastructure development in ski resorts; emerging consumer base with high interest in premium foreign brands and technical novelty.

- Latin America: Niche market focused on specific winter resort areas in the Andes (Chile, Argentina); relies heavily on imported premium gear; sales highly seasonal and tied to localized tourism trends.

- Middle East and Africa (MEA): Smallest regional share, primarily driven by luxury consumption in the UAE (indoor skiing facilities) and high-end tourism; demand concentrated on luxury, globally recognized designer brands and high-end technical wear for travel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skier Apparel Market.- The North Face (VF Corporation)

- Arc'teryx (Amer Sports)

- Patagonia, Inc.

- Columbia Sportswear Company

- Helly Hansen AS

- Salomon Group (Amer Sports)

- Spyder Active Sports

- Descente Ltd.

- Obermeyer Apparel

- Burton Snowboards

- KJUS North America, Inc.

- Mammut Sports Group AG

- Moncler S.p.A.

- Bogner Fire + Ice

- Faction Skis (CoreUPT)

- Goldwin Inc.

- Peak Performance (Amer Sports)

- Eider

- Marmot Mountain LLC

- Roxy (Boardriders, Inc.)

Frequently Asked Questions

What is the primary factor driving demand in the Skier Apparel Market?

The increasing global participation in winter sports and the continuous innovation in technical textiles, specifically waterproof and breathable membranes, are the primary drivers. Consumers are consistently upgrading to gear that offers better performance, lighter weight, and improved thermal efficiency for diverse mountain conditions, supported by rising leisure spending.

How is the trend of sustainability influencing product development in ski apparel?

Sustainability is forcing manufacturers to transition towards eco-friendly materials such as recycled polyester, organic cotton, ethically sourced and traceable down, and non-PFC DWR finishes. Brands are also implementing repair programs and circular business models, responding to consumer demand for environmentally responsible, long-lasting technical products, reducing reliance on virgin synthetic materials.

Which distribution channel is expected to show the fastest growth rate?

Online retail (e-commerce platforms and direct-to-consumer websites) is projected to exhibit the fastest growth. This channel offers extensive product information, easy price comparison, and the convenience of home delivery, which is increasingly appealing for both technical replenishment items and high-end, digitally-marketed seasonal collections.

What technological feature is becoming mandatory in high-performance ski jackets?

The integration of advanced safety features, particularly the passive Recco reflector technology, is becoming standard in high-performance and premium ski jackets. Furthermore, high-level waterproofing (20k+ ratings) and superior breathability scores (MVTR) enabled by proprietary membrane systems are essential benchmarks for technical outerwear in the premium segment.

What is the expected impact of climate change on the Skier Apparel Market outlook?

Climate change poses a long-term restraint by shortening natural ski seasons, potentially reducing overall participation. However, it also creates an opportunity for specialized apparel designed for variable, warmer, or mixed-weather conditions, driving demand for multi-functional, highly versatile layering systems and specialized three-in-one jacket designs that cater to rapid temperature shifts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager