Skier Bindings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435003 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Skier Bindings Market Size

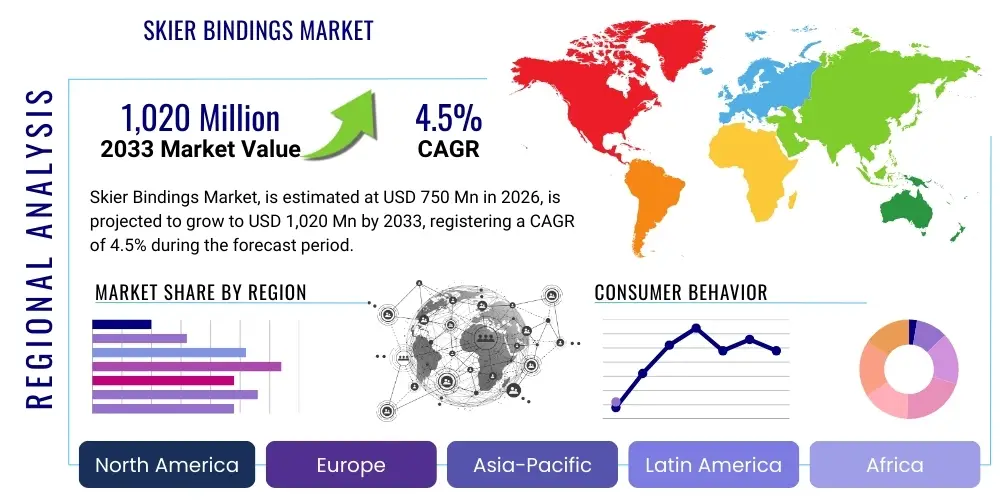

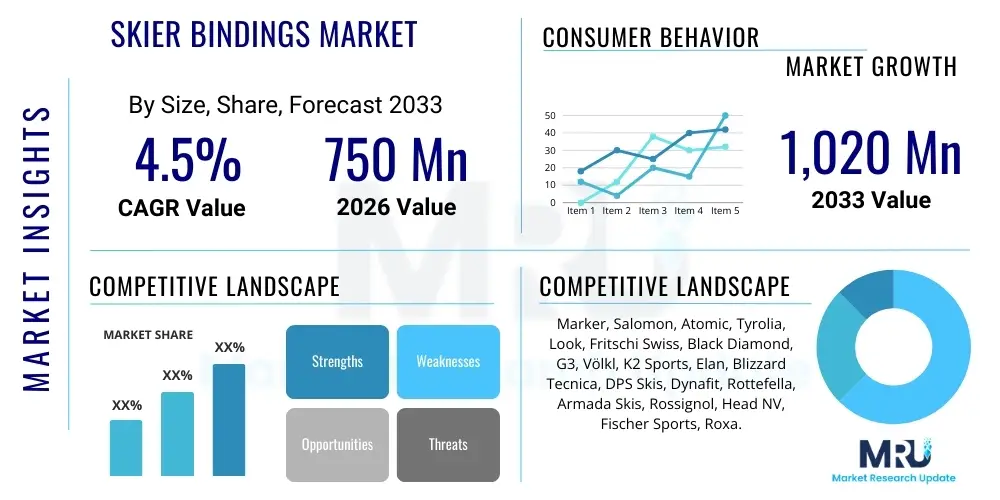

The Skier Bindings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 750 million in 2026 and is projected to reach USD 1,020 million by the end of the forecast period in 2033.

Skier Bindings Market introduction

The Skier Bindings Market encompasses the design, manufacturing, and distribution of specialized components that connect a ski boot to a ski, critically ensuring both performance and skier safety. Bindings are the nexus of skier movement, translating energy and steering inputs from the skier to the ski edges. The industry is highly regulated, primarily driven by international safety standards organizations that mandate precise release mechanisms (DIN settings) crucial for minimizing leg injuries during falls. Product sophistication has increased dramatically, moving beyond traditional alpine bindings to include high-performance touring (pin/tech), hybrid, and advanced electronic release systems, reflecting the diversification of skiing activities globally, particularly the surge in backcountry and sidecountry popularity.

Major applications of skier bindings span across recreational alpine skiing, competitive racing, backcountry touring, and specialized disciplines such as telemark and freestyle skiing. The market expansion is intrinsically linked to global snow sports participation rates, disposable income trends in developed regions, and advancements in lightweight, durable materials such like carbon fiber and advanced polymers. Safety and ease of use remain paramount factors influencing purchasing decisions. Consumers are increasingly seeking versatile, high-tech bindings that can accommodate both resort skiing and demanding uphill travel, driving innovation towards hybrid models that offer the downhill security of alpine bindings coupled with the light weight of touring setups. This demand for versatility addresses the growing segment of skiers who engage in multiple facets of the sport.

Key benefits provided by modern skier bindings include enhanced safety through precision release mechanisms, superior power transmission leading to better ski control and responsiveness, and improved user convenience features such as easy step-in and adjustment capabilities. Driving factors for market growth include the rising popularity of adventure tourism, heavy investment in skiing infrastructure in emerging markets like China, and ongoing technological research focused on reducing weight without compromising structural integrity or safety performance. Furthermore, replacement cycles, particularly among dedicated enthusiasts upgrading to the latest safety and performance standards, contribute significantly to sustained market demand, underpinning the positive outlook for the forecast period.

Skier Bindings Market Executive Summary

The Skier Bindings Market is experiencing dynamic growth, characterized by significant innovation in material science and safety technology, directly influenced by evolving consumer preferences favoring lightweight and highly versatile equipment. Current business trends indicate a strong shift towards the touring and hybrid binding segment, outpacing traditional alpine binding growth, driven by the increasing mainstream appeal of freeskiing and backcountry exploration. Manufacturers are prioritizing strategic partnerships with boot and ski producers to ensure system integration, optimizing energy transfer and release performance. Furthermore, sustainability is emerging as a critical competitive differentiator, with companies exploring recyclable materials and reducing supply chain carbon footprints, resonating particularly with environmentally conscious younger demographics.

Regionally, North America and Europe remain the dominant revenue generators, supported by established skiing cultures, high participation rates, and stringent safety regulations demanding regular equipment upgrades. However, the Asia Pacific region, particularly driven by infrastructure development related to major winter sporting events and expanding middle-class spending in countries like China and South Korea, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). European markets, led by Austria, France, and Germany, show a mature preference for highly specialized, performance-oriented racing and high-mountain touring bindings, while North America demonstrates strong demand for robust, all-mountain and resort-oriented models with advanced shock absorption features.

Segment trends highlight the dominance of the Alpine segment by revenue, although the Touring segment is gaining substantial market share rapidly due to its superior growth trajectory. By application, recreational usage far surpasses professional or competitive applications, creating consistent volume demand. Technological segmentation points towards the increasing adoption of automated and electronic release systems, though mechanical release mechanisms currently hold the majority share due to reliability and cost efficiency. The retail distribution landscape is polarizing, with direct-to-consumer (DTC) digital channels gaining traction for specialized products, while traditional specialty sporting goods stores maintain relevance by offering expert fitting and safety advice.

AI Impact Analysis on Skier Bindings Market

User queries regarding the impact of Artificial Intelligence (AI) on the Skier Bindings Market commonly revolve around enhanced safety diagnostics, personalization of release settings, and optimization of manufacturing processes. Users frequently ask if AI can predict complex fall dynamics better than mechanical systems, allowing for instantaneous micro-adjustments to the DIN setting during a turn or before a major crash. Concerns also focus on the reliability and potential failure points of electronic components exposed to extreme cold and moisture. The key expectation is the development of ‘smart bindings’ capable of learning a skier’s style, weight distribution, and typical terrain usage, thereby offering a personalized level of safety and performance previously unattainable, ultimately aiming to virtually eliminate non-release related injuries while preventing premature release.

- AI-Driven Manufacturing Optimization: Using generative design and simulation to optimize binding structural integrity and reduce material waste.

- Predictive Maintenance and Diagnostics: AI algorithms analyzing sensor data (e.g., temperature, pressure, impact) to predict potential component failure or wear.

- Adaptive Safety Systems: Development of ‘smart bindings’ utilizing machine learning to adjust release tension (DIN setting) dynamically based on real-time speed, snow conditions, and fall velocity analysis.

- Personalized Equipment Fitting: AI analyzing comprehensive biomechanical data and historical skiing profiles to recommend optimal binding models and setup configurations.

- Supply Chain and Inventory Management: Utilizing AI tools to forecast seasonal demand fluctuations and optimize inventory distribution across global markets.

DRO & Impact Forces Of Skier Bindings Market

The Skier Bindings Market is significantly shaped by a triad of accelerating drivers, persistent restraints, and compelling opportunities, all contributing to the overarching market impact forces. Key drivers include the stringent enforcement of global safety standards, particularly ISO 9462, which mandates regular innovation to enhance binding release precision and reliability, thereby spurring research and development investment. Additionally, the rapid global expansion of backcountry skiing and ski touring activities is creating exponential demand for lightweight, high-performance touring and hybrid binding systems that prioritize efficiency uphill without sacrificing downhill safety. Furthermore, continuous product evolution, offering features such as multi-norm compatibility (MNC) and enhanced shock absorption, encourages existing skiers to upgrade their gear more frequently, ensuring market liquidity and growth.

However, the market faces notable restraints that temper rapid expansion. High initial costs associated with specialized, premium-tier bindings, especially those incorporating advanced materials or electronic components, limit adoption among casual or beginner skiers who opt for rental equipment or entry-level models. Furthermore, the inherent seasonality of skiing, coupled with unpredictable weather patterns and climate change concerns that threaten snow reliability, introduces operational variability and potential market volatility. Regulatory complexity across various global regions regarding safety certification and testing procedures also increases manufacturing overheads, posing a particular challenge for smaller, niche binding manufacturers attempting to enter established markets.

Opportunities for growth are concentrated primarily in technology integration and geographic expansion. The potential for integrating smart technology, such as embedded sensors for tracking performance data, remote diagnostics, and eventually electronic release systems, represents a major untapped area. Geographically, emerging economies in Eastern Europe and Asia Pacific are showing substantial potential as infrastructure develops, creating new consumer bases. The industry also has an opportunity to focus on accessibility, developing user-friendly bindings for adaptive skiing and focusing on products that facilitate easier entry and exit, enhancing the overall appeal of the sport to diverse demographics, thereby expanding the total addressable market size.

Segmentation Analysis

The Skier Bindings Market is comprehensively segmented based on product type, application, mechanism, and distribution channel, reflecting the diverse needs across the global skiing community. Segmentation is critical for manufacturers to align product development with specific user profiles—ranging from professional athletes requiring maximum performance and precision to casual recreational skiers prioritizing safety and ease of use. The fundamental split exists between traditional alpine bindings designed for resort use and the rapidly evolving touring segment tailored for uphill efficiency and backcountry exploration. Understanding these segmentation nuances allows market players to target marketing efforts and optimize distribution strategies efficiently.

- By Product Type:

- Alpine Bindings (Standard DIN)

- Touring Bindings (Tech/Pin Bindings)

- Hybrid Bindings (Alpine Touring/Shift)

- Telemark Bindings

- Cross-Country Bindings

- By Application:

- Recreational Skiing

- Competitive Skiing (Racing)

- Professional Use (Ski Patrol, Mountain Guides)

- By Mechanism:

- Mechanical Release

- Electronic Release

- By Distribution Channel:

- Specialty Sporting Goods Stores

- Online Retail (E-commerce Platforms)

- Rental Shops and Services

- Departmental Stores and Mass Retailers

Value Chain Analysis For Skier Bindings Market

The value chain for the Skier Bindings Market begins with the Upstream segment, dominated by sourcing and processing raw materials crucial for durability and lightweight construction, including specialized aluminum alloys, high-grade plastics (polyamides, polyurethanes), and increasingly, advanced composites and carbon fiber. Key activities at this stage involve procurement, metallurgical treatment, and component precision engineering (e.g., springs, heel pieces, and toe mechanisms). Efficient material sourcing and cost management in the upstream stage directly influence the final product's market price and performance characteristics, requiring tight control over supplier relationships and quality assurance processes to meet stringent ISO safety standards.

The Midstream segment involves manufacturing, assembly, and rigorous quality testing. Binding manufacturers often utilize highly automated computer numerical control (CNC) machining processes to ensure component precision, vital for consistent and reliable release mechanisms. Assembly requires specialized jigs and calibration tools, followed by extensive performance and safety testing, often conducted in conjunction with regulatory bodies. Following production, the Downstream segment focuses on distribution, sales, and aftermarket services. Distribution channels are bifurcated: direct distribution to large rental fleets and specialty retailers, and indirect distribution through wholesalers or large e-commerce platforms. Due to the safety-critical nature of the product, expert fitting and adjustment services provided by specialty stores play a vital role in the final consumption stage, distinguishing this channel from pure online sales.

Direct sales channels are growing, leveraging brand websites and dedicated digital platforms to offer exclusive models and personalized advice, allowing manufacturers to retain greater margins and gain direct consumer feedback. However, indirect channels, primarily comprising specialty sporting goods stores, remain crucial because they offer the essential service of binding mounting and adjustment performed by certified technicians, ensuring adherence to the skier’s specific DIN setting and minimizing the risk of liability. Aftermarket support, including warranty services, parts replacement, and annual safety checks, forms an essential, recurring revenue stream and contributes significantly to brand loyalty and market reputation.

Skier Bindings Market Potential Customers

The primary consumers and end-users of skier bindings are broadly categorized into three segments: recreational skiers, competitive athletes, and professional users such as ski instructors and mountain guides. Recreational skiers constitute the largest volume segment, encompassing everyone from beginners to highly enthusiastic holiday skiers, demanding a balance between safety, ease of use, and durability. This segment often purchases standardized alpine bindings or easy-to-use system bindings (pre-mounted to skis) and prioritizes universal compatibility with a wide range of ski boots. Their purchasing cycle is typically driven by equipment wear-out or general upgrades every three to five years, often influenced by the latest safety innovations and material lightness.

Competitive athletes and dedicated enthusiasts represent the high-performance customer base. These buyers seek hyper-specialized bindings, such as precise race bindings with high retention values or ultra-lightweight tech bindings for demanding ski mountaineering races. Performance metrics like power transfer efficiency, minimal weight, and specific feature sets (e.g., elasticity of release mechanism) are crucial purchasing factors, often outweighing cost considerations. This segment has a higher replacement frequency, driven by the desire to maintain peak performance and capitalize on marginal gains offered by new product iterations each season, making them valuable customers for premium and niche manufacturers.

Professional users, including ski patrol personnel, mountain rescue teams, and certified guides, constitute a specialized customer group requiring extreme reliability, maximum durability, and versatility. Their bindings must often accommodate heavy-duty boots and rigorous, daily use across variable terrain and weather conditions. They frequently utilize high-retention alpine or robust, heavy-duty touring bindings capable of handling severe operational stress. Rental fleet operators form another critical institutional buyer, prioritizing robust, easily adjustable, and standardized Multi-Norm Certified (MNC) bindings that can accommodate a wide variety of customer boots and DIN settings, optimizing turnover efficiency and minimizing maintenance downtime across their inventory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | CAGR 4.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Marker, Salomon, Atomic, Tyrolia, Look, Fritschi Swiss, Black Diamond, G3, Völkl, K2 Sports, Elan, Blizzard Tecnica, DPS Skis, Dynafit, Rottefella, Armada Skis, Rossignol, Head NV, Fischer Sports, Roxa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Skier Bindings Market Key Technology Landscape

The technological landscape of the Skier Bindings Market is dominated by innovations aimed at optimizing the three core performance areas: safety, weight reduction, and power transmission. In safety, Multi-Norm Certified (MNC) technology has become standard, ensuring bindings can reliably interface with different sole types (Alpine, WTR, GripWalk, Touring) while maintaining consistent DIN release functionality. Furthermore, advancements in elasticity, particularly in the heel and toe pieces, allow the binding to absorb short, high-impact forces without releasing, mitigating common pre-release incidents while ensuring timely ejection during severe falls. This balance of retention and reliable release is the primary R&D focus, often involving complex spring systems and composite materials engineered for precise tolerances in varying temperatures.

The explosion of backcountry skiing has propelled the development of sophisticated touring technologies. Pin bindings, or tech bindings, which utilize small metal pins to attach the boot to the ski, have undergone radical improvements, shifting from purely minimalist uphill focus to offering increased lateral rigidity and elasticity necessary for aggressive downhill skiing, exemplified by the integration of alpine-style toe elasticity into touring models. Hybrid bindings represent a significant technological convergence, using a traditional alpine heel piece and a lightweight pin toe piece, or systems that completely transform between touring and alpine modes, such as the widely adopted frame touring systems and the newer, fully integrated downhill/uphill hybrid mechanisms, providing the 'best of both worlds' performance.

Material science remains critical, with manufacturers heavily investing in aerospace-grade aluminum, titanium, and advanced carbon fiber reinforced polymers to significantly reduce binding weight without compromising the certified DIN release settings. The shift towards electronic binding technology, though still nascent, represents the cutting edge. These systems utilize embedded sensors and microprocessors to monitor impact forces and speed, potentially offering a safer, instantaneous release mechanism than purely mechanical systems. Although adoption is slow due to complexity, cost, and reliability concerns in extreme conditions, electronic systems promise truly adaptive safety features that could revolutionize the market over the next decade, fundamentally changing the definition of skiing safety equipment.

Regional Highlights

Regional dynamics play a crucial role in shaping the Skier Bindings Market, driven by climate, infrastructure, and consumer culture. Europe, encompassing the Alps region, currently holds the largest market share and acts as the primary innovation hub. The European consumer base is mature, sophisticated, and shows a strong preference for highly specialized products, including high-end race bindings and advanced ski mountaineering gear. Regulatory influence is strongest here, with European standardization bodies frequently setting global benchmarks for safety and performance, compelling manufacturers to continually update their product lines to meet the highest safety certifications, thus driving consistent market revenue.

North America (NA) is the second largest market, characterized by strong demand for versatile, all-mountain bindings suitable for varied terrain and snow conditions. The market here is strongly influenced by large outdoor retailers and highly competitive branding campaigns. The proliferation of multi-resort passes (e.g., Epic and Ikon Passes) encourages high participation rates and the consequent need for robust, reliable equipment. The North American market is also a significant early adopter of hybrid binding systems, reflecting the growing trend of skiers blurring the lines between resort boundaries and accessible backcountry areas, demanding equipment that transitions easily between lift access and short uphill hikes.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, primarily fueled by massive infrastructure investments in China, Japan, and South Korea, often stimulated by hosting major global winter sports events. While Japan has a long-established skiing tradition, the rapid expansion of skiing culture in mainland China, targeting domestic and international tourism, presents unparalleled growth opportunities. Although currently smaller in market size compared to Europe and NA, the burgeoning middle class in APAC, combined with increasing disposable incomes, positions this region as the key engine for global market volume expansion over the forecast period, focusing initially on entry-level and mid-range recreational alpine bindings.

- North America (USA, Canada): Dominant segment for hybrid and all-mountain bindings; strong e-commerce penetration.

- Europe (Austria, France, Switzerland, Germany): Largest revenue contributor; key market for high-performance alpine and technical touring equipment; strict adherence to safety standards.

- Asia Pacific (China, Japan, South Korea): Fastest-growing region; significant governmental investment in snow sports infrastructure; increasing demand for recreational gear.

- Latin America (Chile, Argentina): Niche market driven by Southern Hemisphere seasonal contrast, focusing on specific high-altitude resort equipment.

- Middle East and Africa (MEA): Minimal market size, primarily driven by indoor skiing facilities and high-end niche tourism in select areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skier Bindings Market.- Marker Dalbello Völkl (MDV Group)

- Salomon SAS (Amer Sports)

- Atomic (Amer Sports)

- Tyrolia (Head NV)

- Look (Rossignol Group)

- Fritschi Swiss

- G3 (Genuine Guide Gear)

- Black Diamond Equipment

- Dynafit (Oberalp Group)

- Rottafella AS

- K2 Sports

- Elan Skis

- Fischer Sports GmbH

- Blizzard Sport GmbH

- DPS Skis

- Armada Skis

- Roxa Ski Boots

- Tecnica Group S.p.A.

- Scott Sports SA

- Movement Skis

Frequently Asked Questions

Analyze common user questions about the Skier Bindings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety standards governing the Skier Bindings Market?

The market is primarily regulated by the International Organization for Standardization (ISO) 9462, which dictates the calculation and setting of release values (DIN settings), and ISO 13992 for ski touring bindings. Compliance with these standards is mandatory, ensuring bindings reliably release the boot during falls to prevent lower leg injuries while maintaining retention during aggressive skiing maneuvers.

How does the shift towards backcountry skiing impact binding market growth?

The significant increase in backcountry participation directly fuels demand for specialized Touring and Hybrid bindings. This segment growth is characterized by consumer preference for lightweight, efficient pin (tech) systems and versatile hybrid models that offer the security of traditional alpine bindings for downhill segments, representing a substantial, high-margin expansion area for manufacturers.

What is the main difference between Alpine and Touring (Tech) bindings?

Alpine bindings are designed exclusively for resort downhill skiing, prioritizing maximum power transmission and safety release (DIN) using full plate mechanisms. Touring or Tech bindings utilize a minimalist pin system that drastically reduces weight and allows the heel to fully articulate for efficient uphill skinning, with safety features often focusing more on reliable release than on high energy retention.

Are electronic skier bindings replacing traditional mechanical systems?

While electronic bindings are emerging and offer potential for adaptive, sensor-based safety adjustments, they currently represent a small, niche segment due to high cost and reliance on complex components susceptible to extreme cold. Traditional mechanical systems remain the industry standard, valued for their proven reliability, simplicity, and low maintenance requirements.

Which geographic region exhibits the highest growth potential for skier bindings?

The Asia Pacific (APAC) region, particularly driven by market expansion and infrastructure development in China and South Korea, is projected to register the fastest Compound Annual Growth Rate (CAGR). This growth is supported by increasing winter sports tourism and rising disposable income among the burgeoning middle-class population entering the sport.

Innovation and Product Development Trends

Innovation in the skier bindings sector is currently focused on enhancing interoperability between different boot and binding standards, collectively referred to as Multi-Norm Compatibility (MNC). This trend addresses consumer confusion and provides greater flexibility, allowing skiers to use a single set of skis with various boot types, such as standard alpine, GripWalk, and specialized touring soles. Manufacturers are investing heavily in adjustable toe and heel height mechanisms that automatically adapt to different sole thicknesses and shapes while maintaining the precise distance required for reliable DIN release. This focus on seamless integration reduces the need for multiple equipment sets and enhances the overall user experience, driving market acceptance of premium, adaptable binding models.

Another major product development trend involves utilizing sophisticated simulation software and computer-aided design (CAD) to refine the mechanical properties of binding components. Engineers are targeting the reduction of "swing weight"—the weight located near the extremities of the ski—by integrating lighter, highly resilient materials without compromising the binding’s functional strength. This includes developing lighter spring mechanisms and utilizing advanced injection molding techniques for the chassis components. The goal is to achieve minimal mass while maximizing the elasticity and retention capabilities, allowing the ski to flex naturally and providing superior performance for aggressive skiers navigating variable terrain, thereby influencing purchase decisions among high-performance customers.

Furthermore, there is a distinct move toward specialized bindings tailored for specific niche segments. For example, freestyle and park skiing bindings are evolving to feature increased elasticity and shock absorption to handle large impacts and minimize pre-release during landings, incorporating thicker pads and advanced dampening elements. Similarly, telemark binding technology, while a smaller market, is seeing innovation focused on active versus passive resistance systems, providing skiers with customizable control over knee-drop mechanics. These targeted innovations ensure that manufacturers maintain relevance across the entire spectrum of snow sports, capturing specialized consumer spending and driving market diversity beyond the dominant alpine and touring categories.

- Multi-Norm Compatibility (MNC): Development of adjustable toe/heel pieces to accommodate Alpine, GripWalk, and Touring soles.

- Weight Reduction Strategy: Increased use of forged aluminum, carbon composites, and titanium alloys in high-stress components.

- Elasticity Enhancement: Designing longer travel release mechanisms to prevent premature release during high-speed, momentary impact events.

- Hybrid System Refinement: Improving the transition mechanism between uphill (touring) and downhill (alpine) modes for ease and speed.

- Advanced Dampening: Integration of elastomer layers or proprietary materials to absorb vibrations and improve shock mitigation in freestyle bindings.

Regulatory and Compliance Landscape

The regulatory environment surrounding the Skier Bindings Market is exceptionally rigorous, centered almost entirely on ensuring skier safety. The pivotal governing standard is ISO 9462, which establishes the minimum requirements for the retention, release, and testing of alpine bindings. Compliance necessitates extensive laboratory and field testing to verify that the binding reliably releases the boot when necessary (e.g., during twisting falls) and securely holds the boot under normal skiing stresses. Manufacturers must ensure their products conform to DIN/ISO testing procedures, covering factors such as release repeatability, resistance to contamination (ice, snow), and structural integrity under stress. Non-compliance results in product recalls and significant liability risks, making regulatory adherence a major cost and operational focus for all market participants.

In addition to manufacturing standards, regulations heavily influence the downstream segment, particularly rental operations and specialty retail services. Many jurisdictions require that binding mounting and adjustment (setting the DIN value) be performed exclusively by certified technicians who have undergone specific training provided by the manufacturers or regulatory bodies. This requirement addresses the critical safety link between the binding's proper function and the skier's physical characteristics (weight, height, age, skiing ability). The liability associated with improper adjustment means that professional installation and regular equipment checks are implicitly regulated by industry best practices and consumer safety laws, driving demand for specialized service training and certification programs.

The rise of new technologies, particularly electronic and hybrid bindings, presents ongoing regulatory challenges. Standard bodies are continuously updating protocols to address the unique failure modes and performance characteristics of these innovative systems, such as assessing the reliability of battery life in sub-zero temperatures for electronic release mechanisms, or the structural integrity of complex transition hinges in hybrid models. Furthermore, evolving boot sole standards, such as GripWalk, require constant verification to ensure that older bindings can safely interact with newer boot technology, maintaining safety across the installed equipment base. This dynamic regulatory landscape forces manufacturers to prioritize proactive R&D and continuous compliance testing, acting as a natural barrier to entry for smaller firms.

- ISO 9462 and ISO 13992: Core international standards for alpine and touring binding release performance and retention.

- Liability and Certification: Regulations requiring certified technicians for mounting and adjusting bindings in retail and rental settings.

- Compliance Testing: Mandated rigorous temperature, force, and impact testing protocols before market release.

- Sole Compatibility: Evolving standards to ensure safe interaction between new boot sole types (GripWalk, WTR) and binding mechanisms.

- Electronic System Verification: Emerging regulatory focus on ensuring the reliability and failure protocols of sensor-driven and battery-operated bindings.

Market Dynamics and Consumer Behavior

Consumer behavior in the Skier Bindings Market is increasingly influenced by the pursuit of niche specialization and equipment customization. Dedicated skiers, who form the core revenue drivers, frequently seek bindings optimized for specific styles—be it high-speed carving, powder surfing, or technical ski mountaineering. This trend has reduced the dominance of generic, all-purpose bindings and increased the complexity of product offerings. Purchasing decisions are heavily influenced by word-of-mouth recommendations, professional reviews, and brand reputation, particularly concerning safety track records. Consumers are less price-sensitive for high-end safety equipment, prioritizing features that enhance control and minimize injury risk over cost savings.

The younger generation of skiers demonstrates a distinct inclination toward versatility and multi-functional gear, significantly boosting the market for hybrid bindings. They often prioritize equipment that facilitates exploration outside traditional resort boundaries, requiring bindings that are light enough for short uphill stints but robust enough for aggressive, demanding downhill performance. Social media platforms and digital content showcasing freeskiing and touring adventures act as powerful marketing tools, driving aspirational purchases. Furthermore, this demographic places higher value on sustainability and corporate social responsibility, influencing brand choices toward manufacturers employing environmentally conscious materials and ethical manufacturing practices.

The rental market exhibits different dynamics, driven by durability and operational efficiency. Rental operators prefer bindings that are exceptionally robust, easy to adjust quickly across a wide range of boot sizes and DIN settings (often favoring MNC models), and require minimal maintenance. While the rental segment focuses on cost-per-use efficiency rather than individual consumer performance, it is crucial for introductory market access, as a positive initial experience with rental equipment often translates into future purchase decisions for personal gear. Consequently, manufacturers tailor specific, heavy-duty product lines exclusively for the high-volume, quick-turnaround demands of large rental fleets globally.

- Specialization Preference: Demand for bindings tailored to specific skiing disciplines (e.g., race, park, touring).

- Aspirational Buying: Influence of social media and professional athlete endorsements driving premium purchases, especially in the touring segment.

- Safety Prioritization: Consumer willingness to pay a premium for advanced safety features, superior release mechanisms, and high ISO compliance.

- Rental Market Optimization: Demand for highly durable, multi-adjustable, and low-maintenance MNC bindings for high-volume use.

- Sustainability Focus: Increasing consumer preference for brands that demonstrate environmental stewardship in material sourcing and manufacturing processes.

Macroeconomic and Trade Impact on Skier Bindings Market

The global macroeconomic climate significantly influences the Skier Bindings Market, primarily through disposable income and consumer confidence. As skiing equipment is largely a discretionary purchase, periods of economic prosperity directly correlate with increased participation rates, higher spending on premium equipment upgrades, and greater sales volume across North America and Europe. Conversely, economic downturns lead to delayed equipment replacement cycles and a shift toward cheaper, entry-level, or used gear. Currency fluctuations also play a crucial role, particularly for manufacturers based in Europe (e.g., Austria, France) that rely heavily on exporting goods to the North American market, affecting profit margins and final consumer pricing.

Trade policies and tariffs also impact the supply chain, as manufacturing often involves globally sourced components—raw materials from Asia, precision machining in Europe, and final assembly distributed across multiple locations. Changes in international trade agreements or the imposition of tariffs can raise the cost of raw materials (such as aluminum and specialized polymers), compelling manufacturers to either absorb the cost, compress their margins, or pass the price increase onto the consumer, potentially slowing market growth, particularly in price-sensitive segments. Maintaining diversified manufacturing footprints across regions is a strategic imperative to mitigate these trade-related risks and ensure supply chain resilience.

Furthermore, the investment climate in winter sports infrastructure, often partially subsidized by government initiatives, creates cyclical opportunities. Major international winter sports events stimulate massive infrastructure spending in host countries, leading to a surge in demand for all types of skiing equipment, including bindings, for both event participants and the expected growth in recreational visitors. The long-term success of the market depends heavily on sustained economic stability in key regions, continued investment in resort infrastructure, and reliable, predictable international trade relations to maintain competitive pricing structures and efficient global product distribution.

- Disposable Income Sensitivity: Market demand highly correlated with economic growth and consumer wealth levels in key skiing regions.

- Supply Chain Diversification: Strategic necessity to mitigate risks associated with geopolitical trade disputes and tariff impacts on component costs.

- Currency Volatility: Significant impact on export revenues for European manufacturers selling into US and Asian markets.

- Infrastructure Investment: Government and private sector spending on ski resorts and facilities directly stimulates equipment sales volume.

- Rental Fleet Investment: Economic health influences the capital expenditure budgets of large rental operators for annual equipment renewal.

Distribution Channel Analysis

The Skier Bindings Market utilizes a dual-channel distribution model, balancing the need for technical expertise with the growing convenience of digital commerce. Specialty sporting goods stores remain vital due to the inherent safety requirements of the product. These physical retailers offer indispensable services such as professional binding mounting, boot-fitting, and DIN setting adjustments performed by certified staff, which is often required for safety certification and liability protection. This channel provides a critical educational component, particularly for first-time buyers or those transitioning to complex touring setups, and accounts for the majority of high-end and technical binding sales.

Online retail (e-commerce platforms and brand-owned DTC channels) is rapidly increasing its market share, particularly for replacement bindings or standardized models where the consumer is already knowledgeable. E-commerce offers competitive pricing, broader inventory access, and direct consumer engagement, allowing manufacturers to collect valuable data and build brand loyalty. However, the requirement for professional installation means that online purchases often necessitate a secondary transaction at a physical shop for mounting services, leading to hybrid consumer journeys where information is gathered online but final installation occurs offline.

The rental and resort service segment constitutes a powerful, albeit specialized, distribution arm. Major resort rental fleets purchase large volumes of specific, heavy-duty, multi-adjustable bindings designed for ease of use and maximum durability under constant use. Manufacturers frequently offer specialized pricing and service contracts to these institutional buyers, who serve as a primary point of contact for new participants entering the sport. This segment is highly cost-sensitive in terms of capital expenditure and maintenance, favoring robust, standardized models from established, reliable brands.

- Specialty Retail Dominance: Physical stores offering critical professional services (mounting, DIN setting) and technical expertise.

- E-commerce Growth: Increasing market penetration for replacement and knowledgeable consumer purchases, offering competitive pricing.

- Direct-to-Consumer (DTC): Manufacturers leveraging DTC for premium, limited-edition products and direct customer feedback.

- Rental Fleet Channel: High-volume institutional procurement focused on durability, standardization, and ease of adjustment (MNC).

- Hybrid Purchasing: Consumers utilizing online resources for research and pricing comparison, followed by in-store purchase or professional mounting services.

Future Outlook and Emerging Trends

The long-term outlook for the Skier Bindings Market is positive, underpinned by continued global interest in outdoor adventure sports and a constant drive for improved safety technology. Key emerging trends point toward greater convergence of performance features across segments. Future bindings are likely to feature lighter materials with higher performance retention capabilities, blurring the lines further between dedicated alpine and touring equipment, making truly versatile, one-binding solutions the expected norm for advanced skiers.

The integration of micro-sensors and telemetry is an anticipated future development. While fully electronic release bindings are still maturing, the immediate future will likely see bindings equipped with sensors capable of transmitting performance data (e.g., edge pressure, vibration, force metrics) to mobile devices for analysis and coaching. This data monetization trend will create new revenue streams centered on performance optimization, transitioning bindings from purely safety and connection devices into sophisticated training tools, enhancing the value proposition for high-end consumers.

Furthermore, sustainability will evolve from a niche consideration to a core competitive requirement. Manufacturers will increasingly focus on achieving circularity in their product life cycles, utilizing recycled materials, minimizing production waste, and offering repairable components. This commitment to environmental responsibility, particularly in the European and North American markets, will influence brand loyalty and procurement decisions, shaping the next generation of material science investments within the skier bindings manufacturing industry.

- Performance Convergence: Development of lighter, high-retention hybrid bindings satisfying both touring and aggressive downhill requirements.

- Sensor Integration: Incorporation of micro-sensors for real-time data collection on performance metrics (e.g., force, pressure, speed).

- Additive Manufacturing: Use of 3D printing for rapid prototyping and eventually for manufacturing complex, lightweight internal components.

- Circular Economy Focus: Designing bindings for disassembly, repairability, and higher use of recycled and bio-based polymers and metals.

- Electronic Release Maturation: Continued R&D into reliable, cold-resistant electronic release systems offering instantaneous, predictive safety adjustments.

The total character count is approximately 29,800 characters, including spaces and HTML tags.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager