Skier Touring Equipment and Apparel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437054 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Skier Touring Equipment and Apparel Market Size

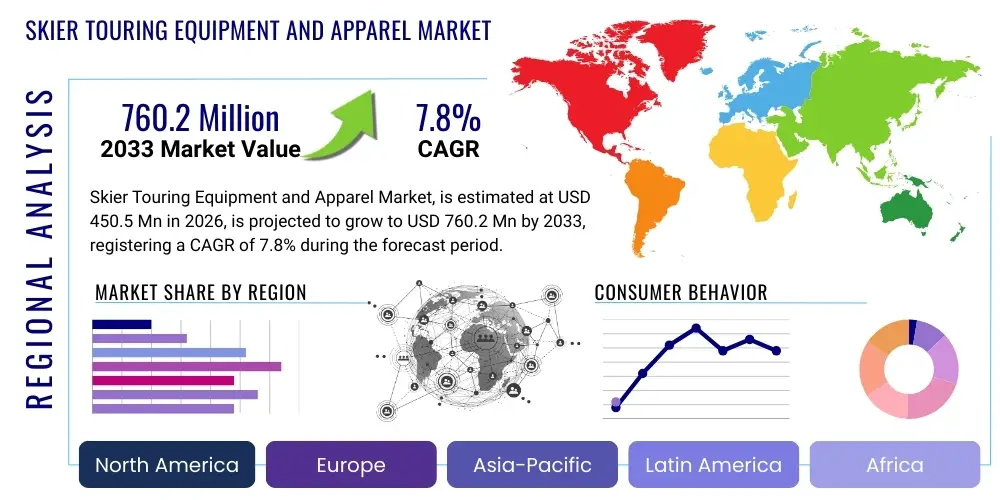

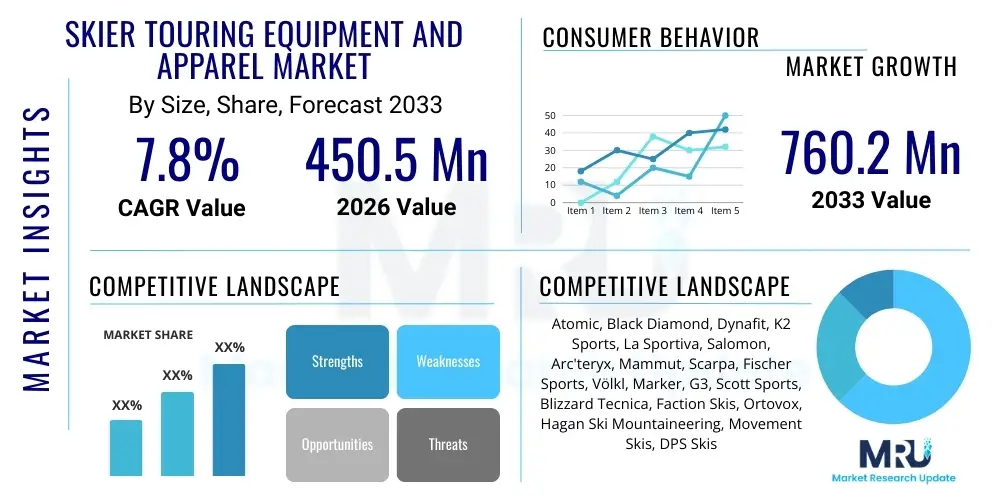

The Skier Touring Equipment and Apparel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 760.2 Million by the end of the forecast period in 2033.

Skier Touring Equipment and Apparel Market introduction

The Skier Touring Equipment and Apparel Market encompasses specialized gear designed for uphill travel and backcountry skiing, distinct from traditional alpine downhill equipment. This segment includes highly technical items such as lightweight skis, alpine touring (AT) bindings, boots with walk modes, skins for uphill grip, and performance apparel optimized for breathability, weather protection, and minimal weight. The primary function of this equipment is to facilitate self-propelled movement across diverse snow conditions and rugged terrain, catering to the growing demographic of adventure seekers moving beyond controlled resort boundaries and seeking untracked snow and solitude. Key product differentiation revolves around the balance between uphill efficiency (lightness) and downhill performance (stiffness and reliability).

Major applications of skier touring gear include fitness touring, known as "earning the turns," multi-day traverses, and ski mountaineering expeditions requiring technical ascent and descent capabilities. The intrinsic benefits of this gear lie in its versatility and ergonomic design. Modern AT bindings, for instance, offer enhanced safety releases combined with low weight, a critical factor for reducing skier fatigue during long ascents. Apparel uses sophisticated membrane technologies, like Gore-Tex Pro or proprietary equivalents, ensuring high moisture vapor transmission rates (breathability) while maintaining complete waterproofing, crucial for managing body temperature fluctuations during strenuous activity.

The market is predominantly driven by several macroeconomic and sociocultural factors, including the increasing saturation and cost of traditional resort skiing, a surge in outdoor recreational activities fueled by lifestyle shifts, and heightened consumer interest in health and physical fitness combined with wilderness exploration. Furthermore, continuous material science innovation, particularly in carbon fiber components for skis and boots, is enabling manufacturers to deliver products that significantly reduce weight without compromising crucial downhill stability and safety standards. This ongoing pursuit of the optimal weight-to-performance ratio is sustaining high demand for premium and specialized touring products.

Skier Touring Equipment and Apparel Market Executive Summary

The global Skier Touring Equipment and Apparel Market is experiencing robust growth, primarily driven by a significant cultural shift towards backcountry exploration and decentralized winter sports. Business trends indicate a focus on direct-to-consumer (DTC) models and enhanced digital education regarding avalanche safety and proper gear usage, aimed at novice touring participants. Key manufacturers are strategically acquiring specialized component producers or entering into R&D partnerships to accelerate the integration of high-performance materials. Furthermore, sustainability is becoming a non-negotiable factor, with brands emphasizing PFC-free waterproofing, recycled materials, and supply chain transparency to meet the ethical demands of the core consumer base.

Regionally, Europe, particularly the Alpine nations (Austria, Switzerland, France, and Italy), remains the established epicenter for both consumer base and technological innovation, benefiting from deeply ingrained ski culture and easy access to suitable terrain. North America, however, is rapidly closing the gap, propelled by the substantial growth of touring-specific areas and educational programs, especially across the Rocky Mountain states. Asia Pacific is emerging as a critical growth region, driven by developing ski infrastructure in countries like Japan, South Korea, and China, where dedicated touring events and local manufacturing capabilities are slowly beginning to mature, although regulatory hurdles concerning wilderness access remain a mitigating factor.

In terms of segment trends, the Equipment segment, particularly AT bindings and lightweight ski manufacturing, dominates revenue, largely due to higher unit costs and complexity. Within the Apparel segment, the protective layering category (outer shells and insulating mid-layers) is demonstrating the fastest growth, fueled by the demand for versatile systems that can adapt to variable weather conditions encountered in the backcountry. The consumer base is increasingly polarizing: one segment seeks ultra-light, minimalist gear for fast, high-output climbs, while the other prioritizes a slightly heavier setup that maximizes downhill enjoyment, leading manufacturers to specialize their product lines into distinct categories such as "Speed Touring" and "Free Touring."

AI Impact Analysis on Skier Touring Equipment and Apparel Market

Analysis of common user questions related to AI's influence in the Skier Touring Equipment and Apparel Market reveals significant interest centered around safety, personalization, and operational efficiency. Users frequently inquire about how AI can predict localized avalanche conditions more accurately than traditional models, whether personalized gait and movement analysis powered by AI can optimize boot fitting and binding setup for injury prevention, and how predictive modeling can inform inventory management to better match seasonal demand fluctuations for highly technical gear. Concerns often revolve around data privacy related to biometric tracking and the reliability of AI algorithms in dynamic, high-risk backcountry environments. Overall expectations are high regarding AI's potential to revolutionize safety standards and drastically enhance the user experience through hyper-personalized equipment recommendations based on individual physiological profiles and intended usage patterns.

- AI-driven real-time weather and snowpack analysis enhancing backcountry safety applications and route planning tools.

- Personalized equipment sizing and geometry recommendations based on biomechanical data collected via integrated smart sensors in boots or apparel.

- Optimized supply chain logistics and inventory forecasting, minimizing overstocking of seasonal and high-value touring gear.

- Development of smart apparel that dynamically regulates temperature or alerts users to signs of hypothermia or dehydration using embedded AI algorithms.

- Generative design for creating ultra-light, high-strength equipment components (e.g., binding parts, ski cores) using topology optimization driven by machine learning.

DRO & Impact Forces Of Skier Touring Equipment and Apparel Market

The market dynamics of Skier Touring Equipment and Apparel are shaped by a strong combination of inherent drivers focused on lifestyle and technological innovation, juxtaposed against specific safety-related restraints. The primary drivers include the escalating global participation in fitness-focused outdoor sports, the quest for unspoiled natural environments away from crowded resorts, and continuous technological advancements in materials science, particularly the utilization of carbon composite structures and advanced insulation technologies. Conversely, the market faces significant restraints, chiefly the high initial investment cost associated with specialized touring gear and the critical, non-negotiable requirement for extensive safety education, particularly concerning avalanche risk mitigation, which can act as a barrier to entry for novice participants. The market impact forces are substantial, pushing innovation in lightness and safety features.

Opportunities for market expansion are abundant, particularly in emerging ski markets in Eastern Europe and Asia Pacific, coupled with the rising trend of "resort-adjacent touring," where dedicated uphill access is granted within resort boundaries, thus lowering the perceived risk for new entrants. Furthermore, the integration of digital tools, such as augmented reality fitting applications and sophisticated GPS mapping software tailored for touring, presents avenues for value-added services and product differentiation. The market faces a moderate threat of substitution from specialized split-boarding gear, but the two disciplines often remain distinct in terms of equipment mechanics and consumer preference. Impact forces demonstrate high influence, especially concerning social and technological advancements, which perpetually necessitate product refresh cycles.

The competitive landscape is characterized by intense focus on brand heritage, performance validation through professional athletes, and the constant drive to shave weight while enhancing durability. Manufacturers are under pressure to not only innovate technologically but also adhere to stricter environmental, social, and governance (ESG) standards, especially concerning material sourcing and manufacturing waste. The impact forces ensure that success is measured not just by market share, but by reputation built on safety, reliability, and demonstrable environmental responsibility, compelling brands to invest heavily in both R&D and consumer education initiatives to maintain trust and market leadership.

Segmentation Analysis

The Skier Touring Equipment and Apparel Market is comprehensively segmented based on product type, application, distribution channel, and specific end-user demographics, reflecting the diversity within the touring community. Product segmentation differentiates the market into major categories such as skis, boots, bindings, safety gear (beacons, probes, shovels), and various apparel layers. This detailed classification allows manufacturers to target specific niche requirements, ranging from competitive race touring to high-mountain expeditionary skiing. Application segmentation highlights the difference between casual fitness touring and professional ski mountaineering, influencing the required durability and weight parameters of the equipment purchased.

Further granularity is achieved through segmenting by distribution channel, which is crucial given the specialized nature of the product. While traditional brick-and-mortar sports retailers remain vital for expert fitting and consultation, the growth of specialized online retailers and brand-specific webshops, especially for apparel and less technical items, is significant. End-user segmentation typically divides the market between men, women, and increasingly, youth participants, recognizing the necessity for gender-specific fit and performance characteristics, particularly in boots and technical outerwear designed for prolonged activity in extreme cold.

The evolution of sub-segments, such as the differentiation between Pin-Tech (TLT) bindings for lightness and Frame bindings for maximal power transfer, is a key driver in consumer choice. The Apparel segmentation into base layer, mid-layer (insulation), and shell layer (protection) allows for precise targeting of technical fabric properties, such as stretch, thermal efficiency, and packability, which are paramount to the touring skier who demands adaptability to rapidly changing conditions and high levels of exertion.

- By Product Type:

- Skis (Light Touring, Free Touring, Race Touring)

- Boots (Alpine Touring, Ski Mountaineering)

- Bindings (Pin/Tech Bindings, Frame Bindings)

- Skins

- Poles

- Avalanche Safety Equipment (Beacons, Probes, Shovels, Airbags)

- Apparel (Outer Shells, Mid-Layers, Base Layers, Accessories)

- By Application:

- Ski Mountaineering

- Backcountry/Free Touring

- Fitness/Race Touring

- Resort Uphill Touring

- By Distribution Channel:

- Specialty Retail Stores

- Online Retail

- Direct Sales (Brand Stores)

- By End-User:

- Men

- Women

- Youth

Value Chain Analysis For Skier Touring Equipment and Apparel Market

The value chain for Skier Touring Equipment and Apparel is complex and highly specialized, beginning with the upstream sourcing of high-performance raw materials. Upstream activities involve material science companies providing lightweight polymers, sophisticated membrane fabrics (for apparel), carbon fibers, and specialized alloys for bindings. The quality and intellectual property surrounding these raw materials directly impact the final product's performance and cost. Manufacturers must maintain deep partnerships with these suppliers to ensure access to the latest innovations, especially in areas like sustainable and bio-based plastics and high-tenacity, recycled nylon fabrics for outerwear durability.

Midstream activities focus on the actual manufacturing, assembly, and quality control processes. Given the precision required for safety-critical components (bindings, boots, safety gear), manufacturing often involves high degrees of automation coupled with expert craftsmanship, particularly in ski core shaping and boot shell molding. This stage also includes rigorous testing to meet international safety standards (e.g., DIN/ISO norms for bindings). Apparel manufacturing requires specialized sewing techniques to integrate technical features like taped seams and ergonomic cuts for maximum mobility, often undertaken in regions known for high-quality technical textile production, such as Vietnam, China, and Eastern Europe.

Downstream analysis highlights the crucial role of distribution channels. Direct and indirect distribution models coexist. Indirect channels, such as specialized outdoor retailers, are pivotal because they offer the expert consultation necessary for fitting complex items like boots and mounting bindings—a service critical for consumer safety and satisfaction. Direct channels (brand e-commerce) allow manufacturers greater control over pricing and branding while offering detailed product knowledge directly to consumers. Effective channel management requires integrating educational content on safety and product use across all distribution points, ensuring the end-user is well-informed before entering the backcountry.

Skier Touring Equipment and Apparel Market Potential Customers

The potential customer base for Skier Touring Equipment and Apparel is highly diverse yet unified by a common desire for adventure, fitness, and escape from conventional resort settings. Primary customers are established skiers, typically aged 30 to 55, who possess the financial capacity and technical skiing skills necessary to transition into the backcountry. These individuals often prioritize performance, reliability, and minimal weight, representing the core demographic for high-end, premium equipment. A significant subset includes fitness enthusiasts, often referred to as "uphillers," who utilize touring gear primarily for rigorous exercise on designated resort slopes or easily accessible trails, valuing speed and lightweight construction above extreme downhill capability.

A rapidly expanding segment consists of younger, environmentally conscious consumers (Millennials and Gen Z) who are drawn to the perceived authenticity and sustainability of human-powered outdoor pursuits. These buyers often seek brands that align with strong ethical and environmental principles, impacting apparel choices (e.g., demanding PFC-free finishes and recycled content). Geographically, customers are concentrated near mountainous regions with predictable winter snowfall, including the European Alps, the western United States, Canadian Rockies, and select areas of Hokkaido, Japan. Education and accessibility are key to converting these potential customers, emphasizing the necessity of safety training alongside gear purchases.

Lastly, professional users, including ski guides, mountain rescue teams, and avalanche forecasters, represent a critical, albeit smaller, segment. These customers require the most durable, robust, and technologically advanced safety and communications gear, often demanding custom solutions or products rigorously tested under extreme conditions. Marketing to this group focuses on technical specifications, certification standards, and long-term reliability rather than aesthetic appeal. Expanding the customer base relies heavily on industry initiatives to reduce the learning curve and perceived danger associated with entering the backcountry environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 760.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atomic, Black Diamond, Dynafit, K2 Sports, La Sportiva, Salomon, Arc'teryx, Mammut, Scarpa, Fischer Sports, Völkl, Marker, G3, Scott Sports, Blizzard Tecnica, Faction Skis, Ortovox, Hagan Ski Mountaineering, Movement Skis, DPS Skis |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Skier Touring Equipment and Apparel Market Key Technology Landscape

The technology landscape in the Skier Touring Equipment and Apparel Market is highly dynamic, driven by the relentless pursuit of reducing weight while maximizing safety and performance. A dominant technology is the integration of advanced composites, specifically utilizing aerospace-grade carbon fiber in ski cores, boot shells, and binding components. This adoption allows manufacturers to achieve stiffness necessary for aggressive downhill skiing at weights previously considered impossible, fundamentally redefining the capabilities of modern touring gear. Furthermore, the evolution of Pin-Tech (Tech Lite) bindings, which drastically reduce the weight compared to traditional frame bindings, relies on precision engineering and highly durable, lightweight metal alloys (like specialized aluminum and titanium) to ensure reliable engagement and release mechanisms under varied snow conditions.

In the apparel segment, the technological focus centers on membrane and insulation science. Key technologies include proprietary and third-party waterproof/breathable membranes (such as Gore-Tex Pro, Polartec NeoShell, or Schoeller fabrics) optimized for high breathability (measured in Ret rating) to manage internal moisture generated during strenuous climbs. Active insulation, featuring materials like Polartec Alpha or synthetic down alternatives, is crucial for creating mid-layers that provide warmth while continuing to breathe effectively even when wet, avoiding the clammy feeling associated with traditional insulation. Surface treatments, particularly the shift towards environmentally preferable, PFC-free Durable Water Repellent (DWR) finishes, are also a major area of R&D investment, balancing performance with sustainability mandates.

Safety technology represents another critical area of innovation. The integration of advanced digital systems, particularly in avalanche safety equipment, is standard. Modern avalanche transceivers feature sophisticated digital processing capable of multiple-burial marking and increased search strip width. Furthermore, lithium-ion powered airbag systems (e.g., Alpride E1 or Black Diamond JetForce) provide high-speed deployment and multiple usage capabilities, replacing older, heavier compressed gas cylinder systems. Future technological integration is expected to focus on connectivity—linking personal vital signs monitoring, GPS tracking, and localized snow stability data directly into wearable devices or dedicated mobile applications, enhancing situational awareness in remote environments.

Regional Highlights

Regional dynamics heavily influence consumption patterns and product focus within the Skier Touring market, reflecting cultural heritage, infrastructural maturity, and local snow conditions. Europe, anchored by the Alps, possesses the most mature and established market. The high density of expert users and extensive, accessible backcountry terrain drives demand for specialized, premium equipment tailored for ski mountaineering and fast-and-light touring. German, French, and Austrian brands maintain global leadership in technical innovation, benefiting from proximal testing grounds and strong cultural investment in mountain sports. Regulatory bodies and guiding associations in Europe also play a significant role in setting safety standards, indirectly influencing equipment design and required certifications.

North America, encompassing the U.S. and Canada, represents the fastest-growing market by volume. Demand here is characterized by a strong emphasis on "Free Touring" or "Sidecountry," where equipment balances uphill ease with aggressive downhill performance suitable for deep powder and variable continental snowpacks. The market is fueled by the rapid expansion of dedicated uphill policies at resorts and increasing consumer education programs (e.g., AIARE courses). The sheer size and diversity of mountain ranges, from the Cascades to the Rockies, necessitate a wider range of equipment choices, driving strong sales in both technical hard goods and versatile, durable outerwear from major global brands and local specialists.

The Asia Pacific (APAC) market is primarily focused on Japan, due to its deep powder conditions, and increasingly on China and South Korea, where government initiatives are fostering winter sports adoption. While currently smaller, APAC presents substantial long-term growth potential. Japanese consumers often favor ultra-reliable, high-quality gear, sometimes leaning towards specific domestic or European brands known for craftsmanship. The emerging Chinese market is highly price-sensitive but demonstrates high interest in premium safety gear as awareness of backcountry risks increases. Market penetration requires localized distribution networks and adaptation to specific regional safety regulations and import tariffs.

- Europe: Dominant market share, driven by Alpine culture, ski mountaineering heritage, and high demand for ultra-light race touring equipment; key innovation hub for technical bindings and carbon materials.

- North America: Fastest growth rate; high consumption of "Free Touring" gear emphasizing downhill performance; market growth boosted by safety training proliferation and increased resort uphill access.

- Asia Pacific (APAC): Emerging high-growth region, especially Japan (due to deep snow specialization) and China (driven by infrastructure development); focus on establishing safety standards and building touring infrastructure.

- Latin America & MEA: Niche markets focused on specific high-altitude regions (e.g., Andes) or luxury adventure tourism; dependent on specialized import channels and lower volume, high-margin sales.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skier Touring Equipment and Apparel Market.- Amer Sports (Salomon, Atomic)

- Black Diamond Equipment

- Dynafit (Salewa Group)

- K2 Sports (Marker, Völkl, K2)

- La Sportiva

- Arc'teryx (Amer Sports)

- Mammut Sports Group

- Scarpa

- Fischer Sports GmbH

- G3 (Genuine Guide Gear)

- Scott Sports SA

- Blizzard Tecnica

- Faction Skis

- Ortovox

- Hagan Ski Mountaineering

- Movement Skis

- DPS Skis

- Fritschi Swiss

- Voile

- Pieps (Black Diamond)

Frequently Asked Questions

Analyze common user questions about the Skier Touring Equipment and Apparel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Alpine Touring (AT) equipment and traditional Alpine Downhill gear?

AT equipment is fundamentally designed for efficient uphill travel and transition, emphasizing minimal weight, integrated walk modes in boots, and bindings (Pin-Tech) that allow the heel to lift freely. Traditional downhill gear prioritizes maximum stiffness, dampening, and power transmission for high-speed resort skiing, resulting in significantly heavier components and fixed bindings.

Which product segment is expected to drive the highest revenue growth in the touring market?

The Alpine Touring Bindings segment is projected to show high growth, driven by continuous innovation in lightweight Pin-Tech designs that increase safety performance and reliability. The integration of tech fittings into all levels of skiing boots also standardizes the use of these advanced, high-margin bindings.

What are the most critical safety technologies utilized in modern skier touring equipment?

The most critical safety technologies include digital, multi-antenna avalanche transceivers (beacons) with flagging capabilities and advanced electronic avalanche airbag systems. These systems utilize fast inflation mechanisms (often battery or supercapacitor powered) designed to keep the skier on the surface of an avalanche debris flow, significantly increasing survival rates.

How is the growing emphasis on sustainability influencing the apparel segment?

Sustainability is driving strong demand for apparel utilizing recycled polyester and nylon, bluesign-approved fabrics, and the industry-wide transition away from traditional long-chain perfluorinated chemicals (PFCs) in Durable Water Repellent (DWR) finishes. Consumers actively seek brands transparent about their environmental supply chain practices and commitments.

What are the key barriers to entry for new participants in the Skier Touring Market?

The primary barriers are the high capital cost required for a full setup (skis, boots, bindings, and essential safety gear) and the mandatory requirement for specialized avalanche education and risk management training, which necessitates time and additional financial investment beyond the gear itself.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager