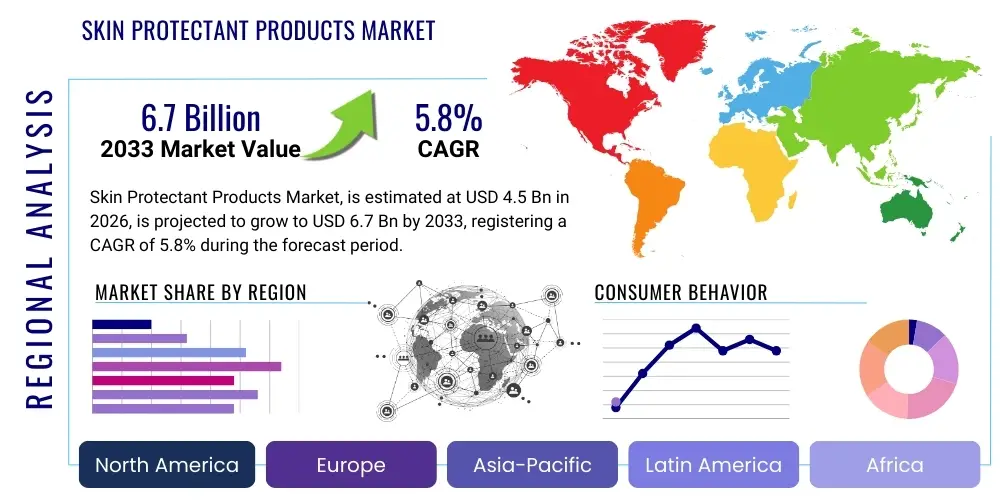

Skin Protectant Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435928 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Skin Protectant Products Market Size

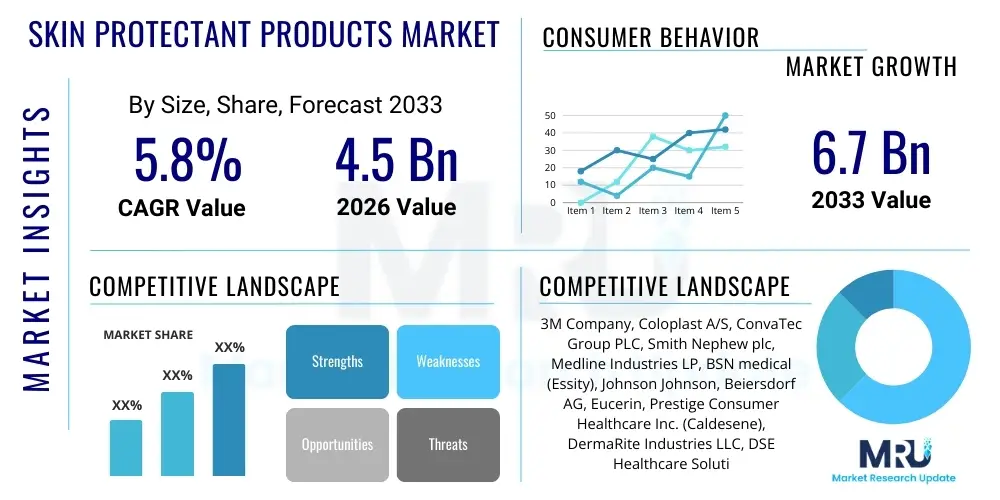

The Skin Protectant Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by increasing awareness regarding skin barrier function, rising prevalence of dermatological conditions such as eczema and dermatitis, and the heightened demand for products offering preventative care, particularly within geriatric and pediatric populations. Market expansion is further supported by innovations in formulation chemistry that enhance product efficacy and consumer compliance across various application settings.

Skin Protectant Products Market introduction

The Skin Protectant Products Market encompasses a wide range of topical formulations specifically designed to create a physical or chemical barrier on the skin, preventing irritation, moisture loss, and damage from external environmental factors or friction. These products are crucial in maintaining skin integrity, accelerating wound healing, and managing common conditions like dryness, chafing, and irritant contact dermatitis. Key product types include creams, ointments (which often provide occlusive barriers), lotions, and specialized sprays, leveraging active ingredients such as dimethicone, petrolatum, zinc oxide, and various botanicals known for their emollient and anti-inflammatory properties. The primary application spans clinical, consumer, and occupational settings, reflecting the universal need for epidermal defense against physical and chemical stressors.

The market benefits significantly from robust driving factors, including demographic shifts towards an aging population more susceptible to skin fragility and breakdown, and the continuous elevation of hygiene standards across institutional and personal care sectors. Furthermore, the increasing awareness campaigns promoting proactive skincare and the availability of over-the-counter (OTC) status for many high-efficacy protectants contribute to broader market penetration. These products serve essential functions in hospitals and long-term care facilities, where they are vital for preventing pressure ulcers and managing incontinence-associated dermatitis, establishing them as non-negotiable components of standard patient care protocols.

Major applications of skin protectants extend beyond clinical use into sports, outdoor activities, and industrial environments where workers are exposed to harsh chemicals or repetitive friction. The key benefits derived from these products include superior moisture retention, reduction of transepidermal water loss (TEWL), creation of a protective film against irritants, and overall soothing of compromised skin. Innovations focusing on non-greasy, fast-absorbing formulations are increasingly driving consumer preference, particularly in the daily personal care segment, allowing for enhanced compliance and consistent application. The confluence of medical necessity and cosmetic appeal solidifies the market's fundamental growth potential.

Skin Protectant Products Market Executive Summary

The Skin Protectant Products Market exhibits dynamic growth propelled by favorable business trends focused on ingredient science, sustainable packaging, and rapid expansion in emerging economies. Key business trends include the shift towards naturally derived and clean-label ingredients (e.g., ceramide-based formulations), and the integration of pharmaceutical-grade components into consumer-facing products. Companies are prioritizing clinical validation and regulatory compliance to differentiate high-efficacy offerings, resulting in increased merger and acquisition activities aimed at consolidating specialized technology and expanding geographic footprints, particularly in the high-growth Asia Pacific region.

Regionally, North America and Europe maintain dominance due to established healthcare infrastructure, high consumer spending on personal care, and stringent regulatory frameworks promoting quality and safety in medical-grade skin protectants. However, the Asia Pacific (APAC) market is projected to demonstrate the fastest CAGR, fueled by rapid urbanization, increasing disposable incomes, burgeoning awareness of dermatological health, and the expansion of domestic manufacturing capabilities. Latin America and MEA are seeing steady adoption, particularly in institutional settings, driven by improving access to standardized healthcare products and targeted marketing efforts focusing on product utility in tropical or arid climates.

Segment trends highlight the leading position of the Ointments and Creams segments due to their superior occlusive properties critical for severe skin conditions and wound care. The Ingredient segment is experiencing rapid innovation, with Dimethicone and Petrolatum retaining market leadership, though bio-actives like hyaluronic acid and proprietary peptide complexes are gaining traction. The Medical/Healthcare application segment remains the largest revenue generator, necessitated by institutional demand for pressure ulcer prevention and barrier protection, while the Cosmetics & Personal Care segment shows robust growth, capitalizing on daily preventive care and anti-pollution claims. Distribution is increasingly shifting towards online channels, offering consumers greater access and price comparison advantages, although retail pharmacies remain critical for physician-recommended and high-trust purchases.

AI Impact Analysis on Skin Protectant Products Market

User queries regarding the impact of Artificial Intelligence (AI) on the Skin Protectant Products Market frequently center on themes of personalized product recommendations, efficiency in clinical diagnosis, and optimization of R&D cycles. Consumers and industry professionals alike are keenly interested in how AI algorithms can leverage genomic or phenotypic data to tailor skin protectant formulations to individual needs (e.g., specific barrier deficiencies or environmental exposures). Concerns often revolve around data privacy when utilizing deep learning for skin analysis and the regulatory pathway for AI-informed cosmetic and medical devices. Expectations are high regarding AI's ability to streamline the identification of novel, highly effective barrier components and to predict ingredient compatibility and stability, thereby drastically reducing development timelines and enhancing product safety profiles.

The primary influence of AI is observed in clinical diagnostics, where machine learning models analyze images (dermoscopy, photography) to rapidly and accurately diagnose conditions requiring skin protection, such as early-stage pressure ulcers or severe dermatitis. This rapid, non-invasive assessment minimizes human error and enables timely intervention with appropriate protectant products. Furthermore, AI-powered predictive analytics are being utilized in manufacturing to optimize batch consistency, monitor supply chain risks associated with raw materials, and forecast demand more accurately, reducing waste and ensuring product availability in critical care settings.

In the consumer sphere, AI algorithms drive advanced e-commerce personalization. By analyzing user-uploaded skin metrics, climate data, lifestyle factors, and existing product usage patterns, generative AI models can recommend the optimal type (cream vs. ointment), ingredient composition (e.g., zinc oxide concentration), and application frequency for maintaining skin health. This personalized approach boosts consumer confidence, improves the efficacy of self-care routines, and strengthens brand loyalty through highly targeted digital engagement, transforming the traditional, one-size-fits-all marketing approach into precision dermatological guidance.

- AI-driven personalization of protectant formulations based on individual skin microbiome and genetic markers.

- Enhanced speed and accuracy in clinical diagnosis of skin barrier disorders (e.g., eczema severity, burn depth) using image recognition algorithms.

- Optimization of R&D processes, including virtual screening of novel emollient and occlusive ingredients.

- Automated quality control and predictive maintenance in manufacturing lines for barrier creams and ointments.

- Improved consumer engagement via virtual skin analysis tools recommending optimal protectant application regimes.

- Supply chain optimization and demand forecasting for essential medical-grade skin protectant inventories in hospitals.

DRO & Impact Forces Of Skin Protectant Products Market

The dynamics of the Skin Protectant Products Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and strategic direction of industry participants. Primary drivers include the global increase in chronic skin conditions such as psoriasis and atopic dermatitis, demanding consistent use of barrier products, coupled with the rapid growth of the geriatric population globally, which requires specialized products to manage age-related skin vulnerability and incontinence. These forces establish a resilient baseline demand, particularly in the medical and institutional segments. Opportunities emerge from advanced material science, focusing on developing highly efficacious, water-resistant, and breathable formulations that meet the dual needs of high protection and user comfort, expanding market potential into new consumer segments like high-performance sports and specialized occupational health.

Restraints primarily revolve around regulatory complexity, especially concerning products marketed for both cosmetic and therapeutic claims, leading to prolonged approval processes and high development costs. Furthermore, the market faces challenges related to consumer misconceptions about the benefits of specialized skin protectants versus standard moisturizers, necessitating significant investment in consumer education and clinical evidence dissemination. Price sensitivity in developing markets and the rise of private-label competitors offering low-cost alternatives further constrain pricing power for premium brands, requiring strategic differentiation based on ingredient quality and proven clinical results. Managing supply chain volatility for key active ingredients like high-purity petrolatum or specific bio-ceramides also poses an operational constraint.

The overall impact forces are strongly positive, driven by the indispensable role skin protectants play in preventing costly and complex secondary infections in clinical settings, thereby proving a favorable cost-benefit ratio for healthcare providers. Technological advancements focusing on sustained-release protectant systems and microencapsulation techniques are continually expanding the product utility, driving market adoption across new demographics and applications. The push for clean-label, environmentally sustainable formulations is also a powerful impact force, aligning corporate strategy with evolving consumer ethics and creating new competitive advantages for companies investing in green chemistry and recyclable packaging solutions. Regulatory bodies, especially in key markets, are increasingly recognizing the therapeutic value of advanced skin protectants, which is expected to facilitate easier market access for clinically validated innovations.

Segmentation Analysis

The Skin Protectant Products Market is meticulously segmented across product type, active ingredient, application area, and distribution channel, providing a granular view of revenue streams and growth pockets. This segmentation allows manufacturers to target specific consumer needs, ranging from daily cosmetic barrier maintenance to critical medical applications. Creams and ointments traditionally dominate the market due to their proven effectiveness in severe dryness and barrier function repair, though newer formats like highly efficacious sprays and wipes are gaining traction for convenience and hygienic application in institutional settings.

Ingredient-based segmentation highlights the foundational role of occlusive agents like Petrolatum and Dimethicone, which form the cornerstone of barrier protection formulations. However, the fastest growth is seen in segments utilizing physiological lipids such as Ceramides and advanced ingredients like Zinc Oxide, specifically formulated for sensitive skin and sun protection claims integrated within the protectant structure. Application analysis reveals the sustained reliance of the Medical/Healthcare sector, followed by the robust and highly competitive Personal Care segment, which is increasingly blending protection with anti-aging and cosmetic benefits, driving premiumization.

The evolving distribution landscape underscores the shift towards digitalization. While conventional channels such as retail and hospital pharmacies maintain critical importance for trusted advice and immediate access, online platforms are increasingly capturing market share by offering diverse product ranges, subscription models, and comprehensive consumer reviews. Successful market penetration necessitates a multichannel strategy that capitalizes on the convenience of e-commerce while maintaining a strong presence in professional and specialized retail settings.

- By Product Type:

- Creams

- Lotions

- Ointments

- Sprays

- Wipes

- By Ingredient:

- Allantoin

- Dimethicone

- Zinc Oxide

- Petrolatum

- Glycerin

- Ceramides and Lipids

- Others (e.g., colloidal oatmeal, hyaluronic acid)

- By Application:

- Medical and Healthcare (Wound Care, Pressure Ulcer Prevention, Incontinence-Associated Dermatitis)

- Cosmetics and Personal Care (Daily Barrier Protection, Anti-Chafing)

- Home Care (Household Cleaning Exposure)

- Industrial and Occupational Health (Chemical Exposure Protection)

- By Distribution Channel:

- Retail Pharmacies

- Online Channels (E-commerce)

- Supermarkets and Hypermarkets

- Hospital Pharmacies and Institutional Supply

Value Chain Analysis For Skin Protectant Products Market

The value chain for the Skin Protectant Products Market begins with the upstream sourcing and refining of key raw materials, including specialized chemical compounds (petrolatum, silicones like dimethicone), pharmaceutical-grade active ingredients (zinc oxide, allantoin), and natural extracts (oils, essential fatty acids). Quality assurance at this stage is paramount, as the purity and stability of these raw inputs directly determine the efficacy and regulatory compliance of the final protectant product. Strong relationships with reliable global chemical and pharmaceutical suppliers are crucial for maintaining cost control and ensuring uninterrupted production, especially given the increased scrutiny on ingredient traceability and sustainability practices throughout the supply chain.

The central manufacturing phase involves complex formulation science, mixing, emulsion, and sterile filling processes, particularly for medical-grade ointments and creams. Companies leverage sophisticated R&D capabilities to develop proprietary technologies that enhance product characteristics, such as sustained adherence to moist skin, breathability, and non-greasy feel. Packaging is an important intermediate step, focusing on barrier protection (to maintain product stability), dose control (e.g., pumps, unit doses), and increasingly, environmental sustainability through recyclable or biodegradable materials. Operational efficiency and adherence to Good Manufacturing Practices (GMP) are critical cost and quality differentiators in this midstream section of the value chain.

The downstream activities involve distribution and sales through a multifaceted channel structure. Direct channels are prevalent for institutional sales (hospitals, long-term care facilities), where large volume contracts are negotiated directly with Group Purchasing Organizations (GPOs). Indirect channels, including wholesalers, retail pharmacies, and burgeoning e-commerce platforms, manage consumer access. E-commerce platforms benefit from sophisticated digital marketing and direct-to-consumer (D2C) models, while traditional retail relies heavily on pharmacist recommendation and brand visibility. Effective value chain management focuses on minimizing stock-outs in critical care settings and maximizing shelf visibility in competitive retail environments, requiring robust logistics and localized inventory management systems.

Skin Protectant Products Market Potential Customers

The Skin Protectant Products Market caters to a diverse array of end-users and buyers, spanning professional institutional purchasers to individual consumers. The primary revenue drivers are institutional buyers, including hospitals, clinics, and long-term care facilities, which procure bulk quantities of medical-grade protectants necessary for routine patient care, particularly the prevention and management of pressure ulcers (bedsores), moisture lesions, and incontinence-associated dermatitis (IAD). These organizations prioritize clinical efficacy, ease of application, cost-effectiveness per use, and adherence to infection control standards when selecting products, often relying on GPO contracts.

The second major category encompasses general consumers who purchase over-the-counter (OTC) skin protectants for personal care, including daily moisturization, relief from minor irritations (e.g., chapping, windburn), and use in specialized activities such as sports (anti-chafing products) or gardening/DIY tasks. This demographic is highly influenced by brand reputation, ingredient transparency (clean beauty trends), positive reviews, and dermatologist recommendations. The increasing awareness among parents regarding pediatric skin sensitivity also drives demand for specialized, mild formulations for infants and children, making family households a critical purchasing segment.

A growing segment of potential customers includes industrial and occupational environments, such as manufacturing plants, chemical handling facilities, and construction sites. Workers in these sectors require specialized barrier creams to protect skin against irritants, solvents, and prolonged exposure to water or harsh working conditions. Purchasing decisions in this segment are often driven by occupational safety standards, regulatory requirements, and the need to reduce employee sick leave related to contact dermatitis, highlighting the need for specialized, heavy-duty protectant formulations provided through industrial safety suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Coloplast A/S, ConvaTec Group PLC, Smith Nephew plc, Medline Industries LP, BSN medical (Essity), Johnson Johnson, Beiersdorf AG, Eucerin, Prestige Consumer Healthcare Inc. (Caldesene), DermaRite Industries LLC, DSE Healthcare Solutions LLC (A DSE Company), Reckitt Benckiser Group PLC, Kimberly-Clark Corporation, The Procter Gamble Company, Sanofi (Chattem), CeraVe (LOréal), Cetaphil (Galderma), Unilever, PDI Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Skin Protectant Products Market Key Technology Landscape

The technological landscape of the Skin Protectant Products Market is rapidly evolving, moving beyond simple occlusive barriers towards sophisticated, multi-functional formulations that interact intelligently with the skin barrier. A key technological focus is on sustained-release technology, where active protective ingredients are encapsulated in micro- or nanoparticles. This ensures a prolonged presence of the protectant on the skin surface, resisting wash-off and friction, which is vital for patients requiring infrequent repositioning or care, thereby minimizing the need for frequent reapplication and improving compliance. Furthermore, advancements in film-forming polymers are enabling the creation of breathable barriers that provide robust protection against external moisture and irritants while allowing the skin to breathe, reducing the risk of maceration commonly associated with older, heavy occlusive products.

Another significant technological advancement involves the integration of biomimetic ingredients, specifically ceramides, cholesterol, and essential fatty acids, designed to structurally mimic the natural lipid matrix of the stratum corneum. These bio-identical protectants work not only as a physical barrier but also actively contribute to repairing and strengthening the compromised skin barrier from within, offering a therapeutic benefit alongside protection. Research and development efforts are heavily invested in optimizing the ratio and type of these lipids to accelerate recovery from dermatitis and severe dryness. This approach represents a paradigm shift from passive protection to active restoration, highly sought after in both medical and high-end cosmetic segments.

Digital technologies and smart packaging are also impacting the delivery and application of skin protectants. Examples include packaging with integrated sensors or indicators that signal when a product should be reapplied based on exposure or remaining product quantity. Furthermore, specialized formulation techniques are addressing challenges such as achieving high water resistance without relying solely on petrochemical derivatives, leading to the development of novel silicone-based elastomers and advanced waxes. The pursuit of highly stable, hypoallergenic, and non-sensitizing formulations that maintain their integrity under various environmental conditions drives continuous technological innovation across the entire product development lifecycle.

Regional Highlights

Regional analysis confirms North America’s leading role in the Skin Protectant Products Market, primarily due to the presence of advanced healthcare systems, substantial spending on dermatological and wound care products, and high consumer awareness regarding preventative skin health. The US market dominates the region, driven by extensive institutional purchasing (hospitals, nursing homes) for managing pressure ulcers and IAD, alongside a mature retail segment that readily adopts premium, clinically validated protective formulations. High regulatory standards in this region ensure quality control and foster a competitive environment pushing for continuous product innovation, particularly in medical-grade formulations.

Europe represents a robust and mature market, characterized by significant R&D investment, especially in countries like Germany, France, and the UK. Strict EU cosmetic and medical device regulations influence product development, favoring natural and clean-label ingredients while maintaining high standards for efficacy. The aging population across Western Europe drives consistent demand for protectants, focusing on geriatric care and maintaining skin integrity. Furthermore, the strong emphasis on occupational health in European industrial sectors ensures steady demand for specialized barrier creams for worker protection against chemical and physical hazards.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This accelerated growth is attributed to massive demographic factors, including rising populations, increasing disposable incomes, and the rapid expansion of healthcare infrastructure across economies like China, India, and Southeast Asian nations. Growing urbanization exposes populations to increased pollution and environmental irritants, boosting demand for daily barrier protectants. Local manufacturers are rapidly developing products tailored to regional skin sensitivities and climate conditions, leveraging both traditional ingredients and modern scientific formulations to capture the vast consumer base.

- North America: Dominant market share due to sophisticated healthcare infrastructure, high geriatric care expenditure, and leadership in medical-grade product innovation.

- Europe: Mature market characterized by stringent regulatory environments, strong focus on natural and sustainable ingredients, and sustained demand from occupational health sectors.

- Asia Pacific (APAC): Highest CAGR, driven by rising health awareness, increasing disposable income, rapid expansion of hospital infrastructure, and high demand for anti-pollution protectants.

- Latin America: Emerging market with increasing penetration due to improving access to standardized healthcare and rising adoption of institutional barrier protection protocols.

- Middle East and Africa (MEA): Growth driven by infrastructure development in healthcare, particularly in the GCC countries, and demand for products mitigating skin damage in arid and harsh climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skin Protectant Products Market.- 3M Company

- Coloplast A/S

- ConvaTec Group PLC

- Smith Nephew plc

- Medline Industries LP

- BSN medical (Essity)

- Johnson Johnson

- Beiersdorf AG

- Eucerin

- Prestige Consumer Healthcare Inc. (Caldesene)

- DermaRite Industries LLC

- DSE Healthcare Solutions LLC (A DSE Company)

- Reckitt Benckiser Group PLC

- Kimberly-Clark Corporation

- The Procter Gamble Company

- Sanofi (Chattem)

- CeraVe (LOréal)

- Cetaphil (Galderma)

- Unilever

- PDI Inc.

Frequently Asked Questions

Analyze common user questions about the Skin Protectant Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Skin Protectant Products Market?

Market growth is primarily driven by the increasing global geriatric population susceptible to skin breakdown, the rising prevalence of chronic skin conditions such as eczema and dermatitis, and heightened institutional demand for products that prevent pressure ulcers and moisture lesions in clinical settings. Additionally, consumer awareness regarding proactive skin barrier maintenance contributes significantly to retail sales expansion.

Which application segment holds the largest share in the Skin Protectant Products Market?

The Medical and Healthcare application segment currently holds the largest market share. This dominance is attributable to the mandatory use of specialized barrier creams and ointments in hospitals, nursing homes, and long-term care facilities for managing incontinence, preventing skin damage from medical adhesives, and reducing the incidence of pressure injuries, which are crucial quality indicators in patient care.

How is technological advancement influencing new product development in this market?

Technological advancement is driving a shift toward sustained-release formulations and biomimetic ingredients (like ceramides and specific lipids) that actively repair the skin barrier, rather than just forming a passive shield. Furthermore, innovations focus on developing breathable, non-occlusive films and water-resistant formulations that offer superior protection while enhancing user comfort and compliance, especially for daily use.

What is the projected growth rate (CAGR) for the Skin Protectant Products Market through 2033?

The Skin Protectant Products Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period spanning 2026 to 2033. This robust growth trajectory is underpinned by favorable demographic trends and continuous advancements in dermatological science that expand the utility and efficacy of these essential products.

Which geographical region is anticipated to experience the fastest market expansion?

The Asia Pacific (APAC) region is anticipated to record the fastest market expansion (highest CAGR). This acceleration is fueled by improving economic conditions, substantial investments in public healthcare infrastructure, rapid urbanization increasing exposure to environmental stressors, and a burgeoning consumer base prioritizing high-quality personal care and preventive health products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager