Skis & Snowboards Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438992 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Skis & Snowboards Market Size

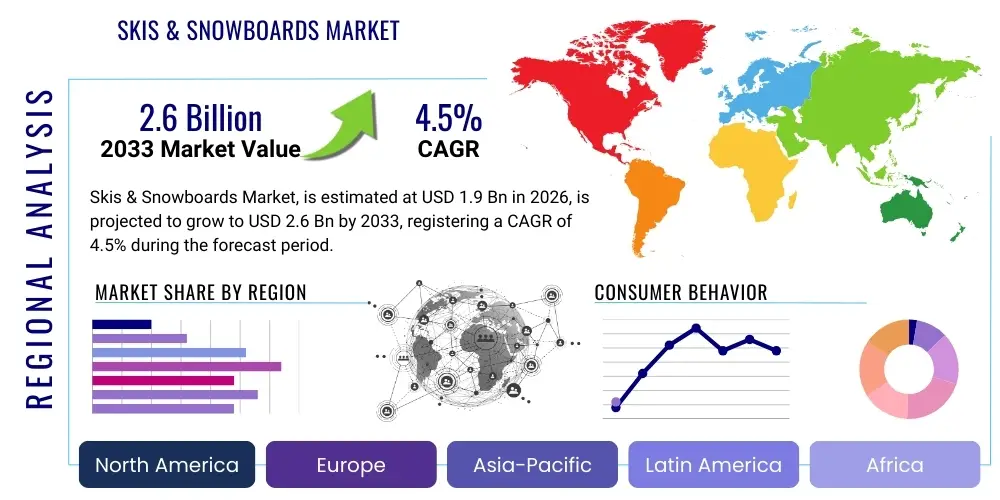

The Skis & Snowboards Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.9 Billion in 2026 and is projected to reach USD 2.6 Billion by the end of the forecast period in 2033.

Skis & Snowboards Market introduction

The Skis & Snowboards Market encompasses the manufacturing, distribution, and sale of equipment used in alpine skiing, cross-country skiing, and snowboarding. This market caters to recreational enthusiasts, professional athletes, and rental businesses operating globally in winter sports destinations. Key products include various types of skis (such as all-mountain, powder, carving, and twin-tip) and snowboards (freestyle, freeride, and all-mountain), along with related accessories like bindings, boots, and poles. Technological advancements in materials science, focusing on weight reduction, durability, and performance enhancement—such as incorporating carbon fiber, advanced wood cores, and specialized composite laminates—are central to product differentiation and market growth.

Major applications of skis and snowboards span recreational use, competitive sports, and institutional purposes (like ski patrol and military training). The recreational segment, driven by increasing participation in winter tourism and improved accessibility to ski resorts worldwide, constitutes the largest demand base. Benefits derived from market products include physical fitness, outdoor recreation, and community engagement. Furthermore, modern equipment significantly enhances safety and user experience through improved edge grip, dampening capabilities, and customized fit systems, making winter sports more accessible to beginners and enjoyable for experts.

Driving factors propelling market expansion include rising disposable incomes in developing economies, increased consumer spending on leisure and outdoor activities, and continuous product innovation focused on sustainability and performance. The professionalization of winter sports, highlighted by major international events like the Winter Olympics and various world championships, also catalyzes demand for high-performance, specialized gear. Additionally, the proliferation of indoor ski slopes and dry slopes in non-traditional winter regions is expanding the geographical reach of the market and introducing the sports to new consumer demographics.

Skis & Snowboards Market Executive Summary

The Skis & Snowboards Market is characterized by robust growth, primarily fueled by consumer desire for advanced, high-performance, and sustainable equipment. Business trends indicate a strong move toward direct-to-consumer (DTC) sales models, enabling brands to better control branding, pricing, and customer engagement, particularly for high-end, customized products. Furthermore, strategic mergers and acquisitions among major equipment manufacturers and apparel providers are common, aimed at consolidating market share and achieving supply chain efficiencies. Sustainability initiatives, including the use of recycled materials and bio-based resins in production, are becoming critical differentiators, responding to the environmentally conscious demands of the core consumer base.

Regional trends reveal that Europe and North America remain the dominant revenue generators, possessing established infrastructure and a deeply rooted culture of winter sports participation. However, the Asia Pacific region, specifically China and South Korea, is emerging as the fastest-growing market segment, largely stimulated by government investments in winter sports facilities and mass participation campaigns following major international sporting events hosted in the region. Climate change presents a significant challenge, particularly in low-altitude resorts, leading to increased investment in snowmaking technology, which in turn influences the design requirements for equipment built to perform optimally on man-made snow conditions.

Segment trends demonstrate continuous innovation in the product landscape. All-mountain skis and snowboards remain the most popular segment due to their versatility across varied terrain and conditions, appealing broadly to recreational users. In terms of distribution, specialized sports stores maintain importance for professional advice and fitting services, crucial for safety and performance, while e-commerce platforms are rapidly gaining ground for standard gear and accessories, driven by convenience and competitive pricing. The rental segment is also seeing substantial investment in digital management systems and higher-quality, durable equipment tailored for commercial use.

AI Impact Analysis on Skis & Snowboards Market

User queries regarding AI's influence in the Skis & Snowboards Market commonly revolve around personalized equipment selection, advanced training tools, and optimization of manufacturing processes. Key themes identified include the expectation of AI-driven fitting systems that surpass traditional measurements by analyzing biomechanics and real-time performance data, and the deployment of machine learning algorithms to predict material failure and optimize material usage in production, thereby enhancing sustainability and reducing waste. Concerns often focus on data privacy related to smart equipment and the potential high cost of integrating such advanced technologies, which could widen the accessibility gap for entry-level users. Users are highly interested in how AI can translate data collected from wearable sensors and smart bindings into actionable feedback for skill improvement, seeking a personalized coaching experience directly integrated into their gear.

AI's impact is already transforming product development and consumer experience. In manufacturing, AI algorithms analyze complex material interactions and structural stress points, accelerating the design cycle for lighter yet stronger equipment, such as optimizing the flex patterns in ski cores or the torsion stiffness of snowboard laminates. For the end-user, AI-driven recommendation engines leverage purchase history, performance metrics, and stated preferences to suggest the ideal equipment configuration—from specific ski models to precise binding setups—ensuring optimal performance and injury prevention tailored to the individual skier or rider. This level of personalization is driving higher customer satisfaction and reducing return rates related to poorly matched equipment.

Furthermore, the retail sector is utilizing AI for inventory management and demand forecasting, allowing manufacturers and retailers to efficiently manage seasonal peaks and minimize overstocking high-cost inventory items. On the slope, AI is integrated into smart equipment via embedded sensors that track metrics like speed, jump height, G-forces, and technique efficiency. These systems process the data instantaneously, providing riders with immediate feedback through accompanying mobile applications. This move toward 'smart sports gear' is fundamentally changing how athletes train, offering objective, quantifiable data that traditional coaching methods could not achieve, thereby boosting performance optimization for both recreational users and professional competitors.

- AI impacts in concise points

- AI-Powered Biometric Fitting Systems: Utilizing machine learning to analyze user weight distribution, stance, and turning dynamics for hyper-personalized equipment selection and binding setup, minimizing injury risk.

- Manufacturing Optimization: AI algorithms predicting optimal material layup (carbon, fiberglass, wood core) to maximize strength-to-weight ratio while reducing material waste in the molding and pressing stages.

- Real-time Performance Coaching: Integrated sensors and AI processing offering instantaneous feedback on technique, balance, and energy expenditure through smart bindings and boots.

- Supply Chain and Demand Forecasting: Predictive analytics optimizing inventory levels for seasonal demand, improving retail efficiency and reducing warehousing costs.

- Enhanced Design Simulation: Utilizing neural networks to simulate product performance under extreme conditions (e.g., high-speed vibrations, varied snow textures) before physical prototyping, shortening the R&D cycle.

DRO & Impact Forces Of Skis & Snowboards Market

The Skis & Snowboards Market is primarily driven by expanding winter tourism globally, sustained technological innovation in lightweight and high-performance materials, and increasing governmental and private investment in ski resort infrastructure, particularly in Asia. Restraints include the unpredictable impact of global climate change, leading to shorter ski seasons and reliance on costly artificial snowmaking, alongside the high initial investment cost required for premium quality equipment, which can deter new participants. Opportunities lie in expanding into untapped emerging markets, capitalizing on the shift toward eco-friendly and customizable products, and leveraging the growing popularity of rental services which lower the barrier to entry for casual users. The market is subject to significant impact forces, including intense brand competition, rapid shifts in consumer preference toward specialized gear (e.g., backcountry touring equipment), and stringent safety regulations influencing design and materials.

Drivers include the continuous efforts by manufacturers to introduce advanced equipment featuring improved safety mechanisms, enhanced torsional stiffness, and reduced weight, making the sports more appealing and less physically taxing. The growth in experiential tourism, where consumers prioritize leisure activities and outdoor adventures, directly fuels the demand for high-quality ski and snowboard gear. Furthermore, the robust marketing efforts and sponsorship of high-profile athletes and events by key industry players maintain visibility and desirability for the latest product generations, encouraging frequent upgrades among committed users. The rising participation of women and children in winter sports necessitates the development of specifically tailored equipment, driving specialized segment growth.

Conversely, the high seasonality and dependence on favorable weather conditions pose substantial restraints. Manufacturers must manage complex production schedules to meet peak winter demand while navigating the risks associated with unpredictable snowfall patterns. The market faces a constant trade-off between delivering innovative, high-performance products and maintaining an accessible price point. The complexity and maintenance requirements of specialized gear also act as a soft restraint, requiring specialized knowledge and fitting services, which can be limited outside major winter sports regions. However, the adoption of digital distribution channels and improved educational content online mitigates some of these geographical limitations, creating a balanced landscape of growth potential countered by environmental and economic constraints.

Segmentation Analysis

The Skis & Snowboards Market is strategically segmented based on product type, catering to specific user needs and terrain, application (differentiating between recreational and professional use), and distribution channel, which reflects modern purchasing behaviors. Analyzing these segments provides crucial insights into targeted product development and regional marketing strategies. The core segmentation by product type is vital, as alpine skis, cross-country skis, and various snowboard styles exhibit distinct manufacturing complexities and price points. The recreational user segment consistently dominates the market volume, driving demand for all-mountain and versatile equipment, while the smaller but higher-value professional segment dictates the pace of technological innovation, demanding ultra-light, customized, and rigid racing or freestyle apparatus. Understanding the distribution channel split—online versus physical retail—is key for optimizing supply chain logistics and customer service delivery.

- List all key segments in bullet format

- Product Type

- Skis (Alpine Skis, Cross-Country Skis, Telemark Skis, Touring/Backcountry Skis)

- Snowboards (All-Mountain, Freestyle, Freeride, Powder, Splitboards)

- Accessories (Bindings, Boots, Poles, Helmets, Goggles)

- Application

- Recreational Use

- Professional/Competitive Use

- Rental and Institutional Use

- Distribution Channel

- Specialty Stores (Sports and Winter Gear Stores)

- Online Retail (E-commerce Websites, Company Websites)

- Department Stores and Hypermarkets

- Rental Shops (On-site Resort Rental)

Value Chain Analysis For Skis & Snowboards Market

The value chain of the Skis & Snowboards Market begins with the upstream processes involving raw material procurement, encompassing specialized wood cores, advanced plastics (polyethylene, ABS), composite fibers (carbon fiber, fiberglass), and various metallic components for edges and bindings. Upstream suppliers are critical, as the quality and sustainability of these materials directly dictate the performance and environmental footprint of the final product. Manufacturers often engage in long-term contracts with specialized chemical and wood suppliers to ensure consistency and meet certifications like FSC (Forest Stewardship Council) for wood cores or specific performance standards for high-density plastics used in the base layer. Efficiency in upstream sourcing is vital due to fluctuating commodity prices and the need for precision engineering materials.

The core manufacturing stage involves complex processes like CNC machining, pressing, lamination, and molding, where technological prowess significantly differentiates market leaders. Manufacturers focus on maximizing production throughput while maintaining high quality control over parameters such as camber profile, flex index, and edge tuning. Following manufacturing, the distribution channel plays a pivotal role. Direct channels (company-owned stores, dedicated e-commerce) allow for premium pricing and direct customer engagement, critical for collecting feedback. Indirect channels involve wholesalers, specialized sports retailers, and large-scale rental operations, offering broad market reach and essential physical fitting services that are difficult to replicate online, especially for boots and binding mounting.

Downstream analysis focuses on the final customer interface, primarily comprising retail sales and the crucial after-sales service (warranty, repairs, tuning, and maintenance). Specialized retailers serve as experts, providing necessary knowledge and customization services, which significantly enhance the consumer experience and justify premium prices. Rental shops at resorts, while operating with durable, mid-range equipment, form a key downstream component, acting as a crucial entry point for new participants and generating significant revenue through seasonal cycles. The effectiveness of the value chain is increasingly measured by its sustainability metrics and responsiveness to fast-changing seasonal inventory demands, making supply chain agility a competitive advantage.

Skis & Snowboards Market Potential Customers

The potential customer base for the Skis & Snowboards Market is segmented into three primary groups: recreational enthusiasts, professional athletes/trainers, and institutional buyers, which include rental fleets and adventure tourism operators. Recreational users constitute the largest demographic, spanning novices, intermediate skiers, and advanced hobbyists who typically purchase versatile, all-mountain equipment through specialty retail or online channels, motivated by leisure, exercise, and social interaction. This group is highly sensitive to trends, performance enhancements, and increasingly, sustainability features, driving demand for annual model updates and accessory purchases like specialized outerwear and safety gear.

Professional athletes and dedicated competitive teams represent a smaller, high-value segment demanding highly customized, top-tier, specialized equipment (e.g., World Cup racing skis, competition-level park boards). These buyers prioritize minute performance gains, precision engineering, and often collaborate directly with manufacturers for bespoke tuning and prototype testing. Their purchasing decisions are heavily influenced by brand sponsorships and the perceived performance advantage offered by the latest materials technology. This segment, while small in volume, drives brand prestige and serves as a vital proving ground for new innovations before they trickle down to the mass market.

Institutional customers, primarily ski resorts and independent rental shops, require durable, easy-to-maintain equipment that can withstand heavy commercial usage and cater to a wide range of skill levels. Their purchasing cycle is driven by fleet replacement schedules and the need for standardized, safety-compliant gear. Additionally, educational institutions, government agencies (military/patrol units), and specialized training camps represent niche institutional buyers requiring highly specific, robust, and reliable equipment for specialized operational needs or instruction programs. Manufacturers targeting this segment emphasize durability, longevity, and bulk purchasing incentives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 2.6 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amer Sports (Salomon, Atomic), Head N.V., K2 Sports, Burton Snowboards, Rossignol Group, Elan d.o.o., Nordica (Tecnica Group), Blizzard Sport GmbH, Völkl (Marker Völkl International GmbH), Skis Dynastar, Faction Skis, Capita Snowboarding, Never Summer Industries, Arbor Snowboards, Lib Tech, Gnu Snowboards, DPS Skis, Line Skis, Black Crows. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Skis & Snowboards Market Key Technology Landscape

The technology landscape of the Skis & Snowboards Market is continuously evolving, focusing predominantly on material innovation, geometry optimization, and digital integration. Material science advancements are crucial, with a sustained shift toward proprietary composite blends, high-modulus carbon fiber, and lightweight wood species (like Paulownia) engineered to maximize energy return and minimize swing weight, enhancing maneuverability and reducing fatigue for the user. Advanced dampening technologies, such as elastomer inserts or specialized polymer layers embedded within the ski or snowboard core, are being utilized to absorb high-frequency vibrations, ensuring stability at high speeds and improving edge hold on firm snow conditions. Furthermore, sustainable material engineering, employing bio-resins and recycled bases, is gaining traction, driven by consumer demand for eco-conscious products and manufacturers’ commitments to reduced environmental impact across the product lifecycle.

Geometry optimization involves sophisticated computer-aided design (CAD) and simulation to refine the sidecut, camber profile, and rocker shape of the equipment. Modern designs often incorporate variable flex patterns—stiffer underfoot for power transmission and softer at the tips and tails for floatation and forgiveness—tailored specifically for different types of terrain, such as deep powder or icy park conditions. Snowboard design has seen significant breakthroughs with asymmetrical sidecuts and specialized edge technology (like Magna-Traction) developed to improve carving performance and grip. Binding technology is also critical, moving toward lighter weight, tool-less adjustability, and improved safety releases that function reliably under varied stress loads, integrating seamlessly with boots designed for maximum power transfer.

Digital technology integration represents a growing segment, involving the embedment of micro-sensors (accelerometers, gyroscopes) within bindings and boots, creating 'smart gear.' These technologies collect real-time data on user performance, snow conditions, and impact forces, transmitting the information to mobile applications for post-session analysis and personalized feedback. This data-driven approach is transforming training methods and contributing to further product refinement. Furthermore, the use of sophisticated 3D scanning and printing technologies is enhancing customization capabilities, particularly for boot liners and intricate binding components, offering tailored fit and performance optimization previously unattainable through mass production methods. The confluence of lightweight materials, precise geometry, and digital feedback loops defines the cutting-edge of the current market technology landscape.

Regional Highlights

Regional dynamics heavily influence the Skis & Snowboards Market, driven by climate, infrastructure, and cultural affinity for winter sports. Europe, encompassing major ski nations like Austria, France, Switzerland, and Italy, represents the largest and most mature market, characterized by high adoption rates, a strong rental culture, and a demand for high-performance alpine and touring equipment. The market here is highly competitive, with established local brands maintaining strong loyalty. Recent trends show a surge in demand for lightweight touring and backcountry equipment, reflecting a shift away from crowded resort slopes toward more adventurous, self-guided mountain experiences.

North America (primarily the US and Canada) is the second-largest market, marked by robust consumer spending and significant influence from freestyle and freeride snowboarding culture. The US market, in particular, drives demand for innovation in all-mountain versatility and integrated technological features. The market structure favors large retail chains and e-commerce platforms, though specialized boot fitters remain essential. There is growing regional emphasis on sustainable manufacturing practices and locally sourced materials, particularly within smaller, boutique ski and snowboard manufacturers catering to niche markets.

The Asia Pacific (APAC) region, led by emerging giants China, Japan, and South Korea, is the key growth engine for the forecast period. China's efforts to promote mass participation in winter sports, catalyzed by hosting the Winter Olympics, have created unprecedented demand for entry-level and mid-range equipment and the corresponding development of resort infrastructure. While Japan and South Korea have mature, culturally rich ski markets, the influx of new Chinese skiers and snowboarders is rapidly shifting the regional demand profile. This region offers immense potential for international brands focusing on accessibility and the rapid scaling of rental and retail services.

Latin America and the Middle East & Africa (MEA) represent smaller but developing markets. Latin America, specifically the Andes mountain region (Chile, Argentina), supports a niche, highly seasonal market focused on high-altitude alpine skiing. The MEA region is developing small, exclusive indoor ski facilities, driving low-volume but high-value demand for specialized rental equipment and luxury gear, relying heavily on imports. Growth in these regions is highly dependent on climate stability, tourism investment, and the successful establishment of reliable winter sports infrastructure.

- Highlight key countries or regions and their market relevance

- Europe: Largest and most mature market, driving demand for alpine, cross-country, and rapidly growing backcountry touring equipment; strong presence of established brands (Rossignol, Head, Atomic).

- North America (USA & Canada): High consumer purchasing power, significant influence in freestyle/freeride segments, leading innovation in integrated digital technology and sustainability initiatives.

- Asia Pacific (China, Japan, South Korea): Fastest-growing region, driven by massive government investment in China's winter sports participation programs and established, high-quality resort markets in Japan and South Korea.

- Rest of World (Latin America, MEA): Niche markets supported by natural alpine ranges (Andes) or high-end artificial indoor facilities, highly reliant on imported goods and tourism fluctuations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Skis & Snowboards Market.- Amer Sports (Salomon, Atomic)

- Head N.V.

- K2 Sports

- Burton Snowboards

- Rossignol Group (Dynastar, Lange)

- Elan d.o.o.

- Nordica (Tecnica Group)

- Blizzard Sport GmbH

- Marker Völkl International GmbH

- Skis Dynastar

- Faction Skis

- Capita Snowboarding

- Never Summer Industries

- Arbor Snowboards

- Lib Tech (Mervin Manufacturing)

- Gnu Snowboards

- DPS Skis

- Line Skis

- Black Crows

- Scott Sports SA

Frequently Asked Questions

Analyze common user questions about the Skis & Snowboards market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth in the Skis & Snowboards Market?

Market growth is primarily driven by the expansion of global winter tourism, rising consumer disposable income spent on leisure activities, continuous technological innovation in equipment materials (focusing on lightweight and performance), and significant infrastructure development in emerging Asia Pacific markets.

How is climate change impacting the sales of skis and snowboards?

Climate change acts as a restraint by leading to shorter natural snow seasons and increased operational costs for resorts (relying on artificial snowmaking), which can reduce participation rates. This pressure, however, drives demand for equipment optimized for varied conditions, including durable, all-mountain gear suitable for hard-packed or man-made snow.

Which product segment holds the largest market share?

The All-Mountain Skis and Snowboards segment currently holds the largest market share. This dominance is due to their versatility, appealing to the vast majority of recreational users who ski or ride diverse terrain and conditions, offering the best balance of performance and forgiveness.

What role does e-commerce play in the distribution of winter sports equipment?

E-commerce is a rapidly expanding distribution channel, particularly for standardized products like accessories, apparel, and certain equipment models. It provides convenience and competitive pricing. However, specialty stores remain crucial for complex, personalized services like professional boot fitting and binding mounting, which require physical presence.

What are the key technological advancements shaping future equipment design?

Future design is centered on integrating Artificial Intelligence (AI) for hyper-personalized fitting and real-time performance coaching via embedded sensors. Material science focuses on lighter, sustainable composites (bio-resins, recycled materials), and optimized geometry to enhance torsional stiffness and dampening for superior high-speed stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager