Slag Wool Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437785 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Slag Wool Market Size

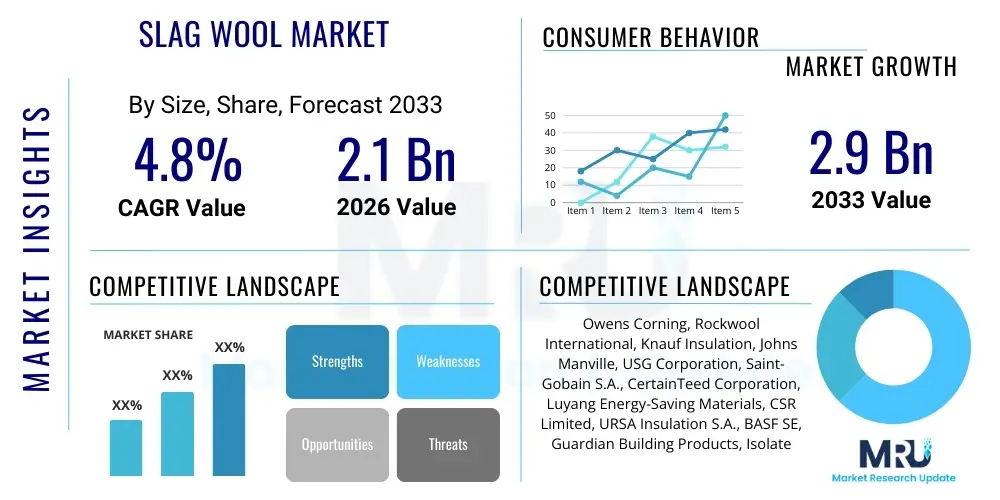

The Slag Wool Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Slag Wool Market introduction

Slag wool, often categorized under the broader mineral wool segment, is an engineered insulating material derived primarily from molten blast furnace slag, a byproduct of the iron and steel manufacturing industry. This material is produced by spinning the molten slag into fine, interlocking fibers, resulting in a product highly valued for its exceptional thermal insulation, fire resistance, and acoustic absorption properties. Its environmentally advantageous sourcing, utilizing industrial waste, positions it favorably within the sustainable construction movement, minimizing landfill usage and promoting circular economy principles.

The primary applications of slag wool span across the building and construction sector, utilized extensively in residential, commercial, and industrial facilities for wall, roof, and pipe insulation. Beyond thermal management, its inherent non-combustibility makes it critical for fire stopping and protective insulation systems, meeting stringent building codes globally. Furthermore, the material is increasingly deployed in specialized industrial environments, such as high-temperature furnaces and process piping, where extreme heat mitigation is necessary, highlighting its versatility and robust performance characteristics.

Key market drivers fueling demand include accelerating global urbanization, which necessitates vast amounts of new construction and retrofitting activities, particularly in energy-efficient buildings. Government mandates supporting reduced carbon emissions and stringent energy efficiency standards, especially in North America and Europe, compel the adoption of superior insulation materials like slag wool. The material’s cost-effectiveness compared to virgin fiber-based alternatives and its contribution to green building certifications further solidify its competitive position in the global insulation market.

Slag Wool Market Executive Summary

The Slag Wool Market exhibits robust growth driven by escalating demand for fire-resistant and high-performance thermal insulation solutions across mature and emerging economies. Business trends indicate a strong focus on strategic partnerships between slag wool manufacturers and major steel producers to secure consistent, high-quality raw material supply (slag), thereby optimizing production costs and increasing market competitiveness. Innovation is centered on enhancing fiber density, binder chemistry (often moving towards bio-based alternatives), and developing pre-fabricated insulation systems that reduce installation time and waste on construction sites, catering specifically to the modular and offsite construction segments.

Regionally, the Asia Pacific (APAC) region is poised to maintain the highest growth trajectory, fueled by rapid industrial expansion, infrastructure development, and the implementation of initial energy efficiency mandates in densely populated nations like China and India. Conversely, North America and Europe, mature markets, focus heavily on insulation retrofitting initiatives and high-specification industrial applications, particularly within the petrochemical and power generation sectors, demanding products with superior thermal stability at elevated temperatures. Regulatory harmonization regarding fire safety standards across the European Union further standardizes demand for non-combustible insulation products.

Segment trends reveal that the Insulation application segment, particularly structural insulation, remains the market's largest revenue contributor, although the filtration segment, driven by environmental regulations mandating cleaner industrial exhaust and air purification systems, is exhibiting above-average growth rates. Furthermore, within the Type segment, granulated slag wool is experiencing increased uptake due to its ease of handling and application in loose-fill cavity insulation and as a component in specialized horticultural applications, showcasing diversification away from traditional batt and board formats.

AI Impact Analysis on Slag Wool Market

Common user questions regarding AI's impact on the Slag Wool Market often revolve around optimizing the complex manufacturing process, predicting raw material variability, and improving supply chain efficiency. Users are keenly interested in how machine learning algorithms can manage the inherent inconsistency of blast furnace slag composition to maintain product quality and fiber characteristics (diameter, length, shot content). Key concerns include integrating AI into legacy manufacturing plants and leveraging predictive maintenance to minimize costly downtimes associated with high-temperature fiberizing equipment. Ultimately, the expectation is that AI will drive down manufacturing costs, leading to more competitively priced, standardized slag wool products for the mass market.

AI implementation is expected to fundamentally revolutionize quality control and process automation within slag wool production. Sophisticated sensors and computer vision systems, managed by AI, can continuously monitor the molten stream temperature, flow rates, and the subsequent fiber formation process, making real-time adjustments that human operators cannot achieve. This precision is vital because the quality of the final insulating product is directly correlated with the consistency of the fiberization process. Furthermore, AI analytics can sift through complex energy consumption data across large manufacturing facilities, identifying patterns and opportunities for energy savings, crucial for reducing the overall embodied carbon footprint of the product.

Beyond manufacturing, AI significantly influences market strategy and supply chain dynamics. Predictive modeling can forecast demand fluctuations based on construction permits, regional economic indicators, and seasonal weather patterns, allowing manufacturers to optimize inventory levels and distribution networks. This predictive capability reduces warehousing costs and ensures just-in-time delivery to large construction projects. In the realm of R&D, machine learning accelerates the development of new, high-performance binders and coatings for slag wool insulation, simulating material interactions and testing performance characteristics much faster than traditional laboratory methods.

- AI optimizes raw material sourcing by predicting variability in slag composition and adjusting processing parameters instantly.

- Machine learning algorithms enhance manufacturing efficiency through real-time monitoring and control of the fiberization process, improving fiber quality consistency.

- Predictive maintenance schedules for high-wear manufacturing equipment are generated by AI, drastically reducing unscheduled downtime and operational costs.

- AI-driven demand forecasting improves supply chain resilience and inventory management, linking production directly to regional construction pipeline data.

- Generative design tools assist in formulating novel, bio-based binders for slag wool, enhancing sustainability and product performance.

DRO & Impact Forces Of Slag Wool Market

The Slag Wool market's trajectory is primarily defined by strong regulatory tailwinds (Drivers) pushing for energy efficiency and fire safety, counterbalanced by Restraints such as fluctuating raw material availability and competition from alternative insulation materials like fiberglass and foam boards. Significant opportunities lie in tapping into the burgeoning retrofitting market and developing specialized high-temperature industrial applications, particularly in emerging Asian economies. These factors combine to create substantial Impact Forces, necessitating continuous product innovation and robust supply chain management to maintain market share and capitalize on global sustainability commitments.

Key drivers include stringent governmental regulations globally, such as the EU's Energy Performance of Buildings Directive (EPBD) and similar mandates in North America, which mandate high R-values and non-combustible materials for construction projects. The escalating cost of energy globally further enhances the economic attractiveness of high-performance insulation, directly boosting demand for slag wool. Another crucial driver is the increasing recognition of slag wool as an environmentally sound product, owing to its recycled content (minimizing industrial waste) and its ability to significantly reduce building operational energy consumption, aligning with corporate sustainability goals.

However, the market faces notable restraints, including the inherent variability of blast furnace slag quality, which can complicate the consistency of the manufacturing process and requires additional quality control measures. Moreover, the perception that mineral wool products can be challenging to handle and install compared to rigid foam insulation boards sometimes limits its adoption in smaller, less specialized construction segments. Finally, intense price competition from substitute products, particularly lower-cost fiberglass alternatives in less demanding residential applications, exerts continuous pressure on profit margins for slag wool manufacturers, forcing cost optimization strategies.

- Drivers:

- Increasing global emphasis on green building standards and high fire resistance requirements in commercial construction.

- Stringent governmental energy efficiency mandates and carbon emission reduction targets.

- Growing construction and infrastructure spending, particularly in Asia Pacific and the Middle East.

- Utilizing industrial waste (blast furnace slag), aligning with circular economy principles.

- Restraints:

- Fluctuations in the supply and quality consistency of raw material (steel and iron slag).

- Price competition from conventional insulation materials such as fiberglass and EPS foam.

- Logistical challenges associated with the low density and high volume of finished insulation products.

- Opportunities:

- Expansion into niche applications like specialized agricultural growing mediums (hydroponics/rockwool derivatives).

- Significant potential in the energy efficiency retrofitting market for existing buildings in mature economies.

- Development of high-density slag wool products tailored for acoustic dampening in industrial noise control.

- Impact Forces:

- Regulatory pressure forcing mandatory non-combustible materials adoption (high impact).

- Macroeconomic trends affecting commodity prices and construction activity (moderate impact).

- Technological advancements reducing energy consumption during the fiberization process (moderate to high impact).

Segmentation Analysis

The Slag Wool Market is meticulously segmented based on product type, application, and end-use, allowing for precise market targeting and strategic resource allocation. Understanding these segment dynamics is crucial for manufacturers looking to capitalize on specialized needs, such as high-temperature tolerance in industrial settings or enhanced acoustic performance in commercial buildings. The dominance of the insulation application segment reflects the foundational role of slag wool in global energy conservation efforts, while the growth in specialized types, such as pelletized formats, indicates evolving construction methodologies that favor ease of transport and application in automated processes.

By Type, the market is broadly divided into Granulated Slag Wool, Pelletized Slag Wool, and Slag Wool Boards/Batts. Granulated slag wool is often used as a loose fill, particularly suitable for filling cavities, acoustic voids, and for integration into cementitious mixtures. Pelletized slag wool represents a highly processed, low-dust format favored in automated blowing applications and in horticultural systems due to its structure. Conversely, boards and batts constitute the largest volume segment, serving standard residential and commercial wall and roof insulation, where dimensional stability and ease of mechanical fastening are paramount.

Application segmentation reveals a strong reliance on Thermal Insulation, followed by Acoustic Insulation, and specialized segments such as Filtration and Fire Protection. End-use analysis shows that the Industrial sector (power plants, refineries, chemical processing units) demands the highest performance specifications due to operating temperatures and safety requirements, while the Residential and Commercial sectors drive volume demand, especially for fire-safe partition walls and facade systems, consistently adhering to stricter fire rating requirements than non-mineral based insulants.

- By Type:

- Granulated Slag Wool

- Pelletized Slag Wool

- Slag Wool Boards and Batts

- Slag Wool Blankets and Felts

- By Application:

- Thermal Insulation (Building Envelope, HVAC, Pipe Insulation)

- Acoustic Insulation (Soundproofing, Noise Dampening)

- Fire Protection (Firestops, Fire-rated Barriers)

- Filtration (Industrial Gas Cleaning, Air Filters)

- Horticulture (Growing Media)

- By End-Use Industry:

- Residential Construction

- Commercial Construction (Offices, Retail, Hospitals)

- Industrial (Oil and Gas, Power Generation, Manufacturing)

- Marine and Offshore

Value Chain Analysis For Slag Wool Market

The Slag Wool value chain commences with the upstream supply of raw materials, primarily encompassing molten blast furnace slag procured directly from steel mills, supplemented by smaller quantities of basalt, dolomite, and coke utilized for melting and process optimization. The critical dependence on steel production cycles introduces a significant variability factor, necessitating long-term procurement contracts and logistical planning to ensure a steady, high-quality input stream. Efficiency gains at this stage are crucial, focusing on minimizing transportation costs of bulk raw materials and maximizing the quality of the molten feed for the subsequent fiberization process, which is the most energy-intensive part of the chain.

Midstream activities involve the energy-intensive manufacturing process, including the melting of supplementary materials, fiberization via spinning machines, curing (applying binders and water repellents), and finally, cutting and packaging into various formats like batts, boards, or granulated loose fill. Distribution channels, forming the downstream segment, are characterized by a mix of direct sales to large industrial customers (e.g., power plant contractors) and indirect sales through extensive networks of building material distributors, wholesalers, and specialized insulation installation contractors who manage smaller, project-specific requirements. The effectiveness of the indirect channel heavily relies on maintaining inventory levels and providing technical support regarding installation standards.

Direct distribution often includes large volume contracts for major commercial or infrastructure projects where bespoke dimensions and rapid delivery schedules are required, minimizing reliance on intermediaries. Indirect channels, conversely, cater to the fragmented residential repair and renovation market, providing crucial market penetration and accessibility to smaller buyers. Optimizing the value chain, particularly integrating digital tools for tracking inventory and coordinating logistics, is essential for reducing the total delivered cost, which is crucial given the product's high volume-to-weight ratio and associated transportation expenses across the lengthy supply chain.

Slag Wool Market Potential Customers

Potential customers for slag wool products are heavily concentrated within the construction ecosystem, ranging from large-scale general contractors specializing in commercial development to individual homeowners engaging in home renovation projects. The primary decision-makers, however, are often found within the professional segments, specifically architectural firms and specification engineers who mandate the use of slag wool based on project requirements for fire rating, acoustic performance, and thermal efficiency. Industrial end-users, such as operators of petrochemical refineries and thermal power plants, constitute a specialized customer base focused solely on the material’s high-temperature insulation capabilities and long-term durability in corrosive environments.

The Residential segment, driven by new construction and renovation, prioritizes energy savings and ease of installation, favoring standard batt and loose-fill formats. Customer acquisition in this segment is strongly influenced by government incentive programs and the materials specified by home builders committed to energy-star ratings. Conversely, the Commercial sector, encompassing high-rise offices, educational institutions, and healthcare facilities, places a premium on meeting stringent fire safety codes (Type I and II construction) and superior acoustic comfort, making high-density slag wool boards an essential requirement for partition walls and floor assemblies.

A rapidly growing customer niche includes specialized agricultural producers, particularly those utilizing hydroponics and controlled-environment agriculture (CEA). These buyers utilize slag wool derivatives (often processed as rock wool growing media) for its inert properties, excellent water retention, and structural stability, providing a sterile environment for plant roots. This specialized application demands high purity and specific structural characteristics, separating it distinctly from the traditional construction customer base but offering substantial long-term growth potential due to increasing global demand for resilient and high-yield food production systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Owens Corning, Rockwool International, Knauf Insulation, Johns Manville, USG Corporation, Saint-Gobain S.A., CertainTeed Corporation, Luyang Energy-Saving Materials, CSR Limited, URSA Insulation S.A., BASF SE, Guardian Building Products, Isolatek International, Kingspan Group plc, Polyglass USA, Roxul Inc., TechnoNICOL, Tenmat Ltd., Superglass Insulation, Hebei Huamei Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slag Wool Market Key Technology Landscape

The technology landscape in the Slag Wool market is dominated by the centrifugal spinning process, often referred to as the rotor process, which involves high-speed wheels or rotors that atomize the molten slag stream into fine fibers. Continuous technological refinement focuses on optimizing rotor speed, temperature control of the melt, and minimizing the "shot content" (unfiberized material), which directly impacts the product's thermal performance and density consistency. Advancements in sensor technology and process automation are crucial for maintaining these parameters, ensuring high-quality fiber yield and energy efficiency during the intense melting and fiberization stages, which are central to competitive manufacturing.

Beyond the core manufacturing process, significant technological advancements are occurring in binder chemistry. Traditionally utilizing phenol-formaldehyde resins, the industry is rapidly transitioning toward bio-based, low-formaldehyde, or entirely formaldehyde-free binders to meet increasingly stringent indoor air quality regulations and consumer demand for sustainable materials. These next-generation binders enhance product longevity, water resistance, and reduce the environmental footprint of the final insulation product. Furthermore, product innovation includes developing hybrid slag wool systems, such as composite boards incorporating facers (like foil or fiberglass scrim) to provide vapor barriers and enhanced fire protection characteristics for specialized applications.

Installation technology also represents a key area of technological development. The shift towards mechanized and automated application methods, especially for loose-fill and granulated slag wool, requires materials designed for consistent pneumatic delivery and minimal settling over time. This involves precise fiber and pellet sizing to ensure optimal flow characteristics and density uniformity within wall cavities and attics. Research also targets improving the material’s hydrophobic properties, enhancing its resistance to moisture absorption without compromising its inherent fire performance or breathability, crucial for facade insulation systems in humid climates.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth: APAC, particularly China, India, and Southeast Asia, represents the fastest-growing market for slag wool due to massive infrastructure projects, rapid urbanization, and industrial expansion. The region's increasing adoption of stringent fire safety standards, often following international guidelines, pushes demand for non-combustible insulation in high-density residential and commercial towers. China's focus on sustainable manufacturing and utilizing industrial byproducts provides a strong domestic supply of blast furnace slag, supporting local production and reducing dependence on imports. While penetration rates for insulation are historically lower than in the West, government initiatives promoting energy conservation in new building codes are rapidly accelerating market maturity and product demand.

- North America (NA) Retrofit and Industrial Focus: North America is a mature, high-value market characterized by robust demand in both the residential retrofitting segment and heavy industrial applications, especially in the US and Canada. Regulations promoting energy efficiency, such as tax credits for weatherization, drive homeowners and commercial property owners to upgrade existing insulation. The industrial sector, including petrochemical processing, oil and gas, and high-temperature manufacturing, relies heavily on slag wool for pipe and equipment insulation due to its superior thermal stability and durability in corrosive environments. The market here demands premium products with advanced facings and specialized fire ratings.

- Europe's Sustainability and Regulatory Leadership: Europe stands as a leader in setting high standards for both energy efficiency (EPBD) and indoor air quality (IAQ), directly benefiting the slag wool market. Strict regulations mandating fire classification A1 (non-combustible) materials in commercial and public buildings ensure sustained high demand. Scandinavian countries and Germany, with strong environmental policies, drive innovation in developing sustainable, formaldehyde-free binders and maximizing the recycled content of insulation products. The retrofit market is exceptionally strong, supported by various EU-funded renovation waves aimed at decarbonizing the existing building stock.

- Middle East and Africa (MEA) Infrastructure Development: The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits significant potential driven by rapid investment in mega-projects and commercial real estate. While thermal insulation is critical due to extreme heat, the primary driver for slag wool adoption is fire safety. The high risk associated with large-scale projects and high-rise construction mandates non-combustible materials, positioning slag wool favorably against flammable foam alternatives. Market growth is heavily contingent on the pacing of large, government-backed infrastructure and industrial projects.

- Latin America (LATAM) Emerging Growth and Cost Sensitivity: The Latin American market is highly cost-sensitive, often favoring economically viable insulation solutions. Slag wool sees increasing adoption, particularly in large industrial zones and in commercial construction in nations like Brazil and Mexico, driven by industrialization and the need to control energy costs. However, regulatory enforcement regarding insulation performance is often inconsistent, leading to regional variations in product demand and quality specification. The market potential is high but requires infrastructure improvements and stricter building code implementation to reach maturity levels comparable to Europe or North America.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slag Wool Market.- Owens Corning

- Rockwool International A/S

- Knauf Insulation, Inc.

- Johns Manville Corporation

- USG Corporation

- Saint-Gobain S.A.

- CertainTeed Corporation (a subsidiary of Saint-Gobain)

- Luyang Energy-Saving Materials Co., Ltd.

- CSR Limited

- URSA Insulation S.A.

- BASF SE

- Guardian Building Products (a subsidiary of Guardian Industries)

- Isolatek International

- Kingspan Group plc

- Polyglass USA, Inc.

- Roxul Inc. (now branded as ROCKWOOL)

- TechnoNICOL Corporation

- Tenmat Ltd.

- Superglass Insulation Ltd.

- Hebei Huamei Group

Frequently Asked Questions

Analyze common user questions about the Slag Wool market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between slag wool and traditional fiberglass insulation?

Slag wool is primarily derived from industrial waste (blast furnace slag), making it a high-recycled content material, while fiberglass uses sand and recycled glass. Slag wool is inherently denser, offering superior fire resistance (non-combustible) and higher acoustic performance compared to standard fiberglass, making it preferred for high-specification commercial and industrial fire-rated assemblies.

Is slag wool considered a sustainable or green building material?

Yes, slag wool is highly regarded as a sustainable material because its production utilizes industrial waste that would otherwise be landfilled, conserving natural resources. Furthermore, its excellent thermal properties contribute significantly to reducing the operational energy consumption and carbon footprint of buildings throughout their lifespans, aligning with global green building standards.

How do global steel production rates impact the supply and pricing of slag wool?

Global steel production directly dictates the availability of blast furnace slag, the primary raw material for slag wool. Fluctuations in steel output, driven by economic cycles, directly affect the slag wool supply chain, potentially leading to price volatility and requiring manufacturers to secure diversified and consistent supply agreements to maintain stable production volumes.

Which application segment drives the largest demand for slag wool globally?

The Thermal Insulation application segment, particularly structural insulation for walls, roofs, and HVAC systems in residential and commercial construction, drives the largest volume and revenue demand for slag wool. This is primarily fueled by mandatory energy efficiency codes and the need for non-combustible building materials in densely populated urban centers.

What is the future outlook for bio-based binders in the slag wool market?

The future outlook for bio-based and formaldehyde-free binders is extremely positive. Driven by stringent indoor air quality regulations and consumer health concerns, the industry is rapidly adopting these sustainable chemistries to enhance product safety and market appeal, positioning them as the standard for premium, high-performance mineral wool insulation products globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager