Slalom Windsurf Sails Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431390 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Slalom Windsurf Sails Market Size

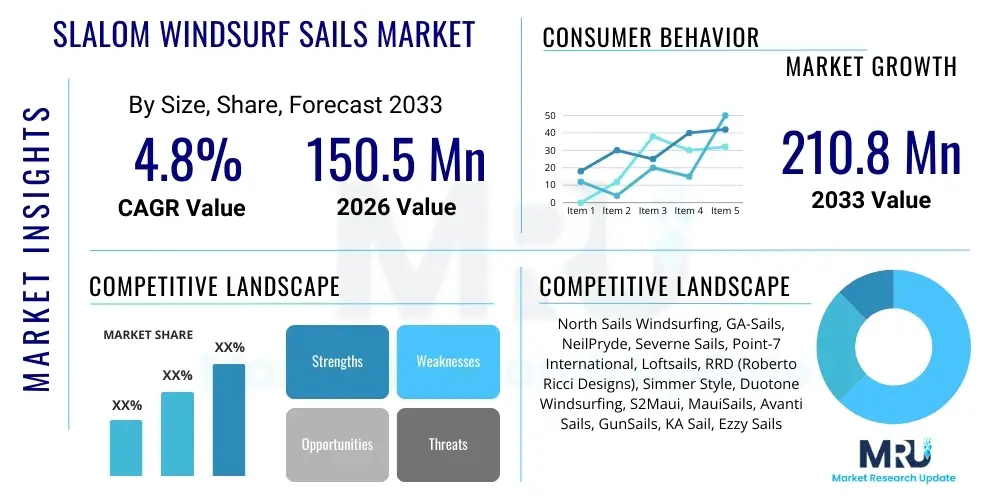

The Slalom Windsurf Sails Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 150.5 Million in 2026 and is projected to reach USD 210.8 Million by the end of the forecast period in 2033.

Slalom Windsurf Sails Market introduction

The Slalom Windsurf Sails Market is an integral and highly specialized segment within the broader water sports equipment industry, primarily focusing on high-performance sailing gear designed for competitive racing and speed sailing. These sails are engineered for maximum speed and stability, characterized by high aspect ratios, deep profiles, multiple camber inducers, and reinforced mast sleeves. The core objective of slalom sail design is to minimize drag while maximizing propulsion, allowing professional and highly skilled recreational windsurfers to achieve exceptional velocities across various water conditions. The stringent technical requirements necessitate the use of advanced materials such as multilayered monofilms, aramid scrims, and lightweight carbon reinforcements, ensuring durability under extreme loads and precise profile maintenance. This focus on aerodynamic efficiency and material innovation drives premium pricing and specialized consumer engagement within the segment.

The product landscape is continuously evolving, driven by advancements in materials science and computational fluid dynamics (CFD) modeling used by leading manufacturers. Major applications of slalom windsurf sails are concentrated in professional windsurfing tours, competitive regattas, and speed record attempts. These high-end products offer distinct benefits, including superior stability at high speeds, instantaneous power delivery for quick planing, and optimized gybing performance required in competition courses. Furthermore, the technology developed in the slalom sector often trickles down to freerace and freeride segments, elevating the overall quality and performance of recreational sails, underscoring the segment's role as a key innovation incubator within the windsurfing community. This technological leadership contributes significantly to brand positioning and market share acquisition for specialized equipment suppliers.

Driving factors for the market include the increasing participation in international windsurfing events, the growing disposable income allowing enthusiasts to invest in premium specialized gear, and continuous material lightweighting that enhances performance without sacrificing longevity. The competitive nature of the sport compels serious enthusiasts to regularly upgrade their quiver of sails to utilize the latest aerodynamic designs and construction methods. Moreover, global trends promoting outdoor and adventure sports, coupled with focused marketing efforts targeting high-net-worth individuals interested in performance sailing, sustain the demand trajectory for these highly technical products. The synthesis of engineering precision and extreme sporting demands positions the Slalom Windsurf Sails Market as a dynamic and technologically sophisticated niche.

Slalom Windsurf Sails Market Executive Summary

The Slalom Windsurf Sails Market is poised for stable expansion, propelled by structural shifts in manufacturing efficiency and heightened consumer focus on sustainable performance materials. Business trends indicate a movement toward vertically integrated supply chains, where leading brands exert greater control over the fabrication of highly specialized composites and monofilms, ensuring quality consistency and rapid incorporation of R&D breakthroughs. Furthermore, digital transformation is influencing the retail side, with e-commerce platforms and sophisticated digital fitting tools becoming crucial for connecting high-performance equipment with a dispersed global consumer base. Market leadership is increasingly defined not just by raw performance, but also by the successful application of data analytics in design optimization, leading to faster product cycles and greater customization options for professional athletes. Consolidations among smaller custom manufacturers and larger equipment conglomerates are restructuring the competitive landscape, prioritizing economies of scale and global distribution networks over regional specialization.

Regional trends highlight Europe, particularly Western European nations such as Germany, France, and Spain, as the dominant consumer and technological hub, benefiting from established windsurfing cultures, extensive coastlines, and hosting numerous international competitions. However, the Asia Pacific region, led by Australia and emerging markets like South Korea and Japan, is exhibiting the highest growth trajectory, driven by infrastructure investments in coastal resorts and rising interest in competitive water sports among affluent demographics. North America maintains a steady demand profile, concentrated in specific coastal and lake regions, emphasizing recreational speed sailing rather than strictly professional circuits. Segment trends underscore the accelerating preference for lightweight, three-cam or two-cam configurations, balancing the pure speed of four-cam race sails with enhanced maneuverability for gybing. The material segment is witnessing a significant shift towards proprietary composite textiles that offer reduced stretch characteristics and improved UV resistance, directly addressing the core performance degradation concerns of high-end users. Additionally, customization services within the premium segment are gaining traction, allowing consumers to tailor sail stiffness and power delivery profiles.

The market's resilience is built upon its dedication to innovation, primarily through continuous refinement of aerodynamic shapes and the integration of highly durable, yet lighter, polymer films. The segmentation based on material (Monofilm vs. Composite Scrim) shows a definitive movement towards sophisticated laminated scrim materials due to superior longevity and reduced environmental impact compared to traditional monofilm construction. From an application perspective, competition-grade sails drive the highest value per unit, whereas advanced recreational sailors constitute the bulk of the volume demand. The core strategy for market players involves maintaining strong professional athlete endorsements, leveraging championship success to validate technological superiority, and strategically pricing replacement components, such as sail battens and cambers, to ensure long-term customer lock-in and high lifetime value. The overall outlook remains positive, underpinned by technological superiority and strong engagement within the niche sporting community.

AI Impact Analysis on Slalom Windsurf Sails Market

Analysis of common user questions regarding AI's influence on the Slalom Windsurf Sails Market reveals core themes centered on design optimization, personalized performance feedback, and supply chain efficiency. Users frequently inquire about whether AI can predict optimal sail shapes for specific weight classes or wind conditions, questioning the extent to which machine learning algorithms can supersede traditional aerodynamic intuition. Concerns often revolve around the cost implications of integrating AI-driven design processes and whether such advanced tools will widen the performance gap between top-tier manufacturers and smaller custom shops. Expectations are high regarding AI's potential to revolutionize material stress testing through predictive failure modeling and to create hyper-personalized training regimes by analyzing real-time sensor data collected during races. These inquiries collectively highlight a belief that AI is set to transition sail design from an empirical art form to a data-driven science, fundamentally altering product development cycles and consumer interaction with high-performance gear.

- AI-driven Computational Fluid Dynamics (CFD): Utilization of machine learning to rapidly iterate and optimize sail profiles, minimizing drag coefficients and maximizing lift generation specific to target wind speed ranges.

- Predictive Material Engineering: AI algorithms analyze stress tolerance, UV degradation, and fiber orientation to select the optimal composite layup, significantly reducing prototyping time and improving sail lifespan.

- Personalized Performance Calibration: Machine learning models process real-time sensor data (mast bending, boom tension, GPS speed) to provide customized feedback on optimal rigging settings and technique adjustments for individual users.

- Enhanced Supply Chain Resilience: AI-powered demand forecasting and inventory management specific to specialized materials (aramid fibers, high-density monofilms) prevent bottlenecks and optimize production scheduling.

- Automated Quality Control: Computer vision systems and AI analyze lamination consistency and panel alignment during manufacturing, ensuring zero-defect rates for critical performance components like camber inducers and batten pockets.

- Virtual Prototyping and Simulation: Development of digital twins for sails, allowing manufacturers to simulate years of usage and extreme environmental conditions before physical construction, accelerating R&D cycles.

DRO & Impact Forces Of Slalom Windsurf Sails Market

The Slalom Windsurf Sails Market is shaped by a complex interplay of internal drivers, external constraints, and emerging opportunities that dictate its growth trajectory and competitive intensity. The primary driver is the relentless pursuit of speed and performance enhancement among competitive athletes and high-level amateurs, which mandates continuous investment in R&D for lighter, stronger, and more aerodynamically efficient materials. Coupled with this is the established structure of professional windsurfing circuits, which provides essential visibility and credibility for new product lines. Restraints mainly stem from the high initial cost of premium slalom equipment, making the entry barrier steep for casual participants, and the niche nature of the sport, which limits the total addressable market size compared to broader water sports categories. Furthermore, the specialized nature of sail construction requires highly technical labor and bespoke machinery, which limits mass production capabilities and maintains elevated manufacturing costs. Addressing these constraints through component standardization and material price stabilization is crucial for sustained long-term growth.

Opportunities for market players are concentrated in material innovation, particularly the integration of sustainable and recyclable high-performance polymers that appeal to environmentally conscious consumers without compromising stiffness or power delivery. Geographic expansion into high-growth potential regions, especially coastal areas in Asia where infrastructure for water sports is rapidly developing, presents a strong avenue for market penetration and diversification away from traditionally saturated European markets. Another significant opportunity lies in harnessing digital platforms to offer sophisticated aftermarket services, such as remote tuning advice and performance diagnostics, enhancing customer loyalty and extending the perceived value of high-end equipment. Capitalizing on the growing interest in foil windsurfing, which utilizes specialized, related sail designs, also offers synergistic market growth potential by broadening the application base for technical fabrications.

The market is significantly influenced by several key impact forces. Competitive rivalry is extremely high, concentrated among a few global brands that aggressively vie for professional athlete endorsements and race domination, driving intense price wars and rapid technological obsolescence. Supplier power is moderate; while the procurement of standard textile materials is competitive, specialized polymer films and carbon fiber components often come from a limited number of technical suppliers, granting them notable leverage over production costs. Buyer power is also moderate to high, as end-users (competitive sailors) are highly informed, technically knowledgeable, and extremely discerning regarding product specifications and proven performance metrics. The threat of substitutes is relatively low, as conventional windsurf sails cannot replicate the specialized performance of slalom sails, and other water sports, while competing for leisure time, do not offer a direct replacement for high-speed windsurfing competition. Finally, the threat of new entrants is low due to the substantial capital required for R&D, establishing specialized manufacturing facilities, and building credibility within the elite windsurfing community.

Segmentation Analysis

The Slalom Windsurf Sails Market is systematically segmented based on construction material, the number of cambers, and end-user application, providing a granular view of market dynamics and consumer preferences within this specialized niche. Material segmentation is perhaps the most critical determinant of price and performance, dividing the market between traditional, lightweight Monofilm sails and more durable, complex Composite Scrim designs. The number of cambers, which dictate the sail's profile stability and power, is a key functional segmentation, separating hyper-stable four-cam race sails from more versatile two or three-cam freerace options. Furthermore, differentiating sales channels—direct-to-consumer versus specialty retail—allows companies to tailor their distribution strategies to match the technical consultation needs of high-performance buyers. Understanding these segments is vital for manufacturers to align product portfolios with specific consumer demands for durability, ease of rigging, and ultimate speed potential in varied wind conditions. The trend suggests a shift towards technical, laminated scrim materials across all camber configurations.

- By Material:

- Monofilm

- Composite Scrim (X-Ply, Dyneema, Aramid Reinforced Laminates)

- By Camber Configuration:

- Four-Camber Sails (Pure Race)

- Three-Camber Sails (High-Performance Slalom/Freerace)

- Two-Camber Sails (Performance Freeride)

- By Sail Size (Area):

- Small (5.0 m² and below)

- Medium (5.1 m² to 7.5 m²)

- Large (7.6 m² and above)

- By End-User:

- Professional Athletes/Competition

- Advanced Recreational Sailors

- By Distribution Channel:

- Online Retail

- Specialty Sports Stores

- Direct Sales (Manufacturer)

Value Chain Analysis For Slalom Windsurf Sails Market

The value chain for the Slalom Windsurf Sails Market is characterized by highly specialized upstream processes and a concentrated distribution network that emphasizes technical expertise at the point of sale. Upstream activities begin with the procurement and refinement of raw materials, primarily specialized high-tensile polymer films (monofilms), technical weaving of composite scrims (e.g., Aramid or Vectran fibers), and sourcing of lightweight carbon or glass fiber for battens and mast sleeves. The unique performance demands of slalom sails require material suppliers to maintain exceptionally high quality and dimensional stability, leading to strong reliance on specialized chemical and textile manufacturers. Following material procurement, the manufacturing stage involves sophisticated cutting (often CNC-controlled), precision panel layout, and multi-layered stitching and lamination, which represent significant value addition due to the labor-intensive nature of creating complex, three-dimensional profiles with accurate camber induction geometry. This stage is a critical cost center, demanding highly skilled technicians and stringent quality control protocols to ensure aerodynamic perfection.

Downstream activities focus heavily on distribution and post-sale support. Given the technical complexity, the dominant distribution channel remains the specialty sports store, which offers personalized advice on sail selection, rigging techniques, and compatibility with specific mast and board combinations. These retailers often serve as localized hubs for the windsurfing community, validating product performance and offering essential maintenance services. However, the indirect channel through online retail is rapidly gaining traction, particularly for replacement parts and standardized sizes, facilitated by high-resolution product imagery, detailed specification sheets, and video tutorials that attempt to replicate the in-store consultation experience. Direct sales, predominantly used by leading manufacturers for professional team equipment and high-profile launches, serve as an important market validation and brand-building tool.

The efficiency of the distribution channel hinges on maintaining product integrity during transit and ensuring quick replenishment of seasonal stock, especially in high-demand summer months. Direct channels allow for greater profit margin capture and immediate customer feedback loops, critical for rapid design refinement, yet they necessitate substantial investment in logistics and dedicated customer service infrastructure. Indirect channels provide broader market reach and leverage the expertise of established local retailers but require careful management of dealer margins and branding consistency. The overall value chain emphasizes intellectual property protection related to sail geometry and material construction, as technical superiority is the primary competitive differentiator in this high-performance market niche.

Slalom Windsurf Sails Market Potential Customers

The primary customer base for the Slalom Windsurf Sails Market consists of highly engaged, affluent individuals who prioritize speed, technical precision, and competitive performance above all other factors. This demographic is segmented into two main categories: professional athletes participating in international windsurfing organizations (PWA, IFCA) and advanced recreational sailors (often termed 'Masters' or 'Grand Masters' in amateur racing circles) who possess significant technical knowledge regarding sail aerodynamics and rigging optimization. Professional competitors require the absolute latest technology, demanding annual or bi-annual replacements of their entire quiver to maintain a competitive edge. Their purchasing decisions are heavily influenced by brand endorsements, proven success in major races, and the availability of immediate technical support and customized components. These customers represent the highest value segment per unit due to their requirement for specialized, often custom-tuned, racing gear.

The secondary, yet volume-driving, customer segment comprises advanced recreational sailors who engage in local or regional speed sailing events and possess high disposable incomes allocated specifically to premium sports equipment. These customers seek sails that offer a blend of near-race performance with slightly enhanced durability and ease of use compared to pure competition models. Their purchasing cycle is typically longer (3–5 years for a complete upgrade), but their loyalty to specific, proven brands is high. They utilize comprehensive online resources, forums, and specialty retailer advice to make informed decisions, focusing heavily on long-term value, ease of rigging, and proven performance metrics like stability and wind range. This group often drives the demand for high-performance freerace sails, which share many aerodynamic features with pure slalom sails but offer greater versatility.

Geographically, potential customers are concentrated in areas with consistently strong wind conditions and established coastal infrastructure suitable for speed sailing, including the Mediterranean Sea coasts, parts of the North Atlantic (e.g., the Canary Islands, Portugal), and specific major lakes and reservoirs worldwide. Targeted marketing efforts must therefore focus on event sponsorship, digital content showcasing extreme performance, and close partnership with established windsurfing travel destinations and training camps to effectively reach and influence these highly specialized buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.5 Million |

| Market Forecast in 2033 | USD 210.8 Million |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | North Sails Windsurfing, GA-Sails, NeilPryde, Severne Sails, Point-7 International, Loftsails, RRD (Roberto Ricci Designs), Simmer Style, Duotone Windsurfing, S2Maui, MauiSails, Avanti Sails, GunSails, KA Sail, Ezzy Sails |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slalom Windsurf Sails Market Key Technology Landscape

The technology landscape of the Slalom Windsurf Sails Market is dominated by advances in composite materials science and precision aerodynamic shaping, focusing intensely on reducing drag and increasing profile stability under immense pressure. A primary technological focus is the development of ultra-lightweight, low-stretch scrim materials, often incorporating high-modulus fibers such as Aramid, Technora, or Dyneema. These proprietary laminates replace traditional heavy monofilms in critical stress zones, offering superior tear resistance and dimensional stability, which is paramount for maintaining the precise foil shape necessary for slalom speed. Manufacturers employ advanced computerized cutting (CAD/CAM) systems to ensure every panel of the sail is cut to within millimeter precision, guaranteeing that the complex curvature and intended draft location are perfectly realized during the assembly process. Furthermore, innovations in batten technology, moving towards stiffer, highly tapered carbon composite battens, are crucial for supporting the deep profile and ensuring rapid rotation during gybing without profile deformation.

Another crucial technological area involves the refinement of camber inducers and mast sleeve construction. Camber inducers are small plastic or composite pieces that force the sail into a predefined, stable aerofoil shape around the mast. Recent innovations focus on minimizing the friction between the camber inducer and the mast, allowing for smoother and faster rotation during transitions, a critical factor in competitive slalom. Mast sleeve material technology is evolving to include proprietary fabrics that resist water absorption and minimize weight gain, while the sleeve’s shaping is increasingly optimized through three-dimensional modeling to accommodate wide mast diameters and ensure the correct aerodynamic flow over the mast itself. This integration of the mast into the overall aerofoil design is a defining feature of modern high-performance slalom sails, distinguishing them from simpler freeride models.

Moreover, the integration of digital modeling, particularly Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA), has become standard R&D practice. CFD is utilized to simulate airflow over various sail shapes, allowing engineers to pinpoint areas of turbulence and optimize luff curve and leech tension digitally before expensive physical prototypes are constructed. FEA helps predict material stress distribution and potential failure points under dynamic load conditions, thereby improving durability and safety factors. These sophisticated simulation tools allow manufacturers to rapidly iterate on designs, leading to significant performance gains in shorter development cycles, pushing the boundaries of what is aerodynamically achievable within the constraints of windsurfing equipment regulations. This commitment to technical engineering excellence ensures the market remains at the cutting edge of lightweight structural design.

Regional Highlights

The global distribution of the Slalom Windsurf Sails Market reveals distinct patterns of consumption, technological development, and competitive activity across key geographical areas. Europe stands as the undisputed market leader, both in terms of consumption volume and technological innovation. This dominance is attributed to a deep-rooted windsurfing culture, high participation rates in competitive circuits (such as the PWA World Tour stops held across the continent), and the presence of numerous specialized equipment manufacturers and world-class sailing spots. Germany, France, and the Netherlands represent primary consumer markets, driven by high disposable incomes and a strong affinity for water sports. The European market dictates global design trends and is the primary testing ground for new high-performance materials and sail geometries, establishing a benchmark for quality and performance worldwide. European manufacturers often invest heavily in athlete sponsorship to maintain regional and global visibility.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment, driven primarily by rising affluence in coastal nations and governmental investment in marine tourism and sports infrastructure. Countries like Australia and New Zealand have long been strongholds for advanced windsurfing, but emerging interest in destinations like South Korea, Thailand, and China, fueled by a burgeoning middle class seeking premium leisure activities, is accelerating demand. While currently lagging behind Europe in sheer volume, the region represents untapped growth potential, particularly as local race circuits and international events start gaining prominence, necessitating the importation or local production of high-performance slalom equipment. The growth in APAC is sensitive to infrastructure development and the establishment of local specialty retail networks capable of providing technical support for complex gear.

North America, encompassing the United States and Canada, maintains a robust but mature market profile. Demand is steady, concentrated around specific coastal areas (e.g., California, Florida, the Great Lakes) where windsurfing communities are well-established. North American consumers typically value durability and ease of handling alongside performance, showing strong demand for the high-end freerace segment that bridges the gap between pure competition and advanced recreation. The Middle East and Africa (MEA), while smaller, show niche potential, particularly in the Gulf nations which are investing heavily in luxury marine sports tourism and infrastructure development, attracting affluent international windsurfers and creating small, high-value demand pockets for premium slalom equipment.

- Europe: Market leader characterized by high competition participation, strong innovation hubs, and mature consumer base (Germany, France, Spain). Dominates in technological development and professional endorsement activity.

- Asia Pacific (APAC): Highest projected growth rate, driven by rising disposable incomes, expansion of marine tourism infrastructure, and emerging local competitive scenes (Australia, Japan, South Korea).

- North America: Stable, mature market with high demand concentrated in specific coastal and inland water areas, prioritizing advanced recreational performance (California, Great Lakes region).

- Latin America: Smaller market share but potential in coastal nations like Brazil and Chile, where windsurfing is popular, though often constrained by import duties and economic volatility impacting equipment accessibility.

- Middle East and Africa (MEA): Niche, high-value demand linked to marine tourism investment in the Gulf countries; requires specialized distribution logistics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slalom Windsurf Sails Market.- North Sails Windsurfing

- GA-Sails

- NeilPryde

- Severne Sails

- Point-7 International

- Loftsails

- RRD (Roberto Ricci Designs)

- Simmer Style

- Duotone Windsurfing

- S2Maui

- MauiSails

- Avanti Sails

- GunSails

- KA Sail

- Ezzy Sails

Frequently Asked Questions

Analyze common user questions about the Slalom Windsurf Sails market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between a Slalom sail and a Freeride sail?

Slalom sails are designed strictly for speed and stability at high velocities, featuring deep, stable profiles maintained by multiple camber inducers (usually 3-4) and stiffer, lower-stretch materials. Freeride sails prioritize ease of rigging, maneuverability, and a wider wind range, often utilizing fewer or no cambers for simplified handling.

Which materials are most commonly used in high-performance Slalom Windsurf Sails?

High-performance slalom sails primarily use advanced composite scrims—such as Aramid, Dyneema, or Technora reinforced laminates—in high-stress areas for low stretch and high durability, often coupled with specialized, UV-resistant monofilms for the main window panels to reduce weight.

How do technological advancements like Computational Fluid Dynamics (CFD) influence sail design?

CFD allows manufacturers to digitally model and simulate airflow and pressure distribution over various sail geometries, enabling precise optimization of the sail's aerodynamic profile, luff curve, and twist characteristics, drastically reducing the time and cost associated with physical prototyping.

What are the primary factors driving the growth of the Slalom Windsurf Sails Market?

Market growth is predominantly driven by the continuous demand for technological upgrades by professional and advanced recreational windsurfers, the expansion of global competitive circuits, and material innovations that deliver lighter weight coupled with superior durability and performance stability.

Is the transition towards foil windsurfing impacting the demand for traditional Slalom sails?

While hydrofoil windsurfing is a growing segment, it often utilizes highly specialized, often shorter and lower-aspect, sails. It complements the traditional slalom market rather than replacing it entirely, though some design elements and material technologies are shared, leading to synergistic growth in related high-performance sailing gear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Slalom Windsurf Sails Market Size Report By Type (7-batten, 6-batten, 8-batten, Others), By Application (For Amateur, For Professionals), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Slalom Windsurf Sails Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (7-batten, 6-batten, 8-batten, Others), By Application (For Beginners, For Professionals), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager