Slate Tableware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436581 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Slate Tableware Market Size

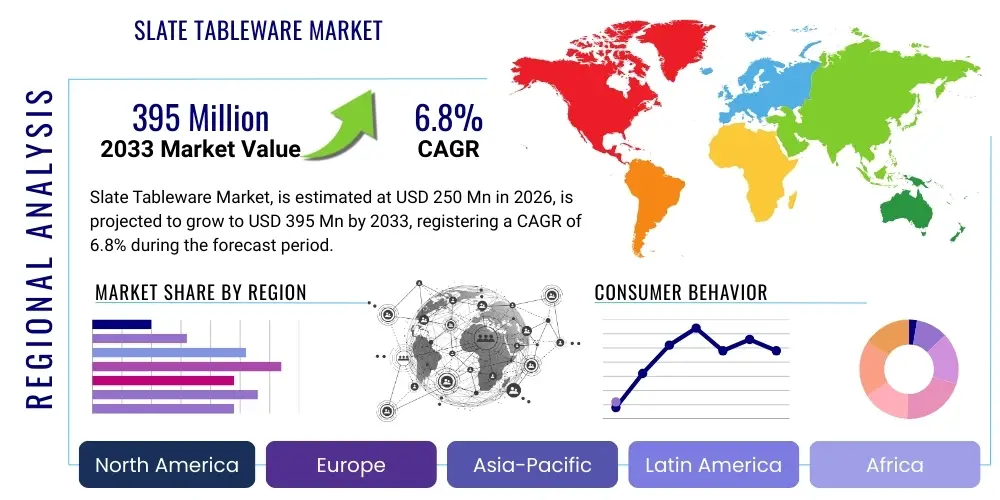

The Slate Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $395 Million by the end of the forecast period in 2033.

Slate Tableware Market introduction

The Slate Tableware Market encompasses the production, distribution, and sale of dining and serving products crafted primarily from natural slate stone. These products include, but are not limited to, serving boards, charger plates, coasters, tiered stands, and specialized food presentation items. Slate is highly valued in the culinary and hospitality sectors for its unique aesthetic properties, providing a dark, rustic, and elegant contrast that enhances food presentation. Its inherent characteristics, such as natural heat retention capabilities, resistance to staining, and durability when properly sealed, position it as a premium material choice, particularly within high-end dining and specialized retail environments. The product's appeal lies in its fusion of natural material ruggedness with sophisticated design, appealing strongly to consumer trends favoring organic textures and minimalist design philosophies in home decor and culinary arts.

Major applications of slate tableware span both the commercial and residential segments. Commercially, slate products are indispensable in fine dining restaurants, boutique hotels, and catering services where distinctive food display is paramount to the customer experience. The trend toward experiential dining, where the presentation is as important as the cuisine itself, drives demand from the hospitality sector. Residential applications are expanding rapidly, driven by the increasing popularity of home entertaining, gourmet cooking, and the use of social media platforms, which necessitate visually appealing food settings. Consumers utilize slate pieces for cheese boards, appetizers, sushi platters, and even as minimalist placemats, viewing them as functional art pieces that elevate everyday meals. The versatility of slate, allowing for custom engraving and unique shaping, further broadens its application scope across promotional goods and personalized gifts.

Key driving factors supporting market expansion include the burgeoning global growth of the HoReCa (Hotel, Restaurant, and Catering) industry, coupled with rising disposable incomes in emerging economies which allow for greater spending on luxury and aesthetic kitchenware. The functional benefits of slate, such as its thermal stability and easy cleaning properties, provide a strong value proposition compared to traditional ceramic or glass alternatives. Furthermore, the growing consumer preference for natural, sustainable, and eco-friendly home goods strongly favors slate, which is perceived as a naturally occurring, minimally processed material. Ongoing innovation in surface treatments and protective coatings is also enhancing the durability and longevity of slate products, mitigating concerns about chipping or scratching and ensuring wider market acceptance among discerning professional and residential users.

Slate Tableware Market Executive Summary

The global Slate Tableware Market is characterized by robust growth, primarily fueled by significant expansion in the high-end hospitality sector and increasing consumer focus on aesthetic dining experiences. Current business trends indicate a strong move towards customization and personalization, where manufacturers leverage advanced cutting and laser etching technologies to provide bespoke slate products to commercial clients, reinforcing brand identity and theme consistency within restaurants and hotels. Furthermore, sustainable sourcing and ethical manufacturing practices are becoming non-negotiable prerequisites, leading companies to secure certifications regarding material origin and production labor standards. The emergence of specialized e-commerce platforms focused solely on artisan and niche kitchenware is critically transforming distribution, allowing smaller, high-quality producers to reach a global consumer base, bypassing traditional brick-and-mortar retail monopolies.

Regional trends reveal that North America and Europe currently dominate the market share, driven by a mature high-end dining culture and strong consumer purchasing power dedicated to home décor and premium lifestyle products. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly in metropolitan centers in China, India, and Southeast Asia, where rapid urbanization and the proliferation of international hotel chains are creating massive demand for sophisticated serving ware. This regional shift is compelling global market leaders to establish localized production or distribution partnerships in APAC to mitigate logistical costs and address regional aesthetic preferences. Meanwhile, regulatory scrutiny regarding food safety and material inertness remains a significant factor in Western markets, ensuring that sealed and certified food-grade slate remains the industry standard, thereby influencing production processes globally.

Segment trends underscore the supremacy of the Commercial Application segment, although the Residential segment shows faster, more dynamic growth rates, largely influenced by lifestyle trends on social media platforms. Within product types, serving boards and platters remain the largest revenue generators due to their multi-functional nature and popularity in entertaining. The Distribution Channel analysis highlights the accelerating importance of the Online segment, which offers greater product variety, price transparency, and direct-to-consumer relationships, especially for specialty items. In contrast, the Offline segment, comprising hypermarkets and specialty home goods stores, continues to be vital for instantaneous purchasing and tactile assessment of the product, particularly concerning texture and weight, which are crucial attributes for premium slate pieces.

AI Impact Analysis on Slate Tableware Market

Common user questions regarding the impact of AI on the Slate Tableware Market often revolve around operational efficiency, design innovation, and supply chain optimization. Users frequently inquire if AI can streamline the complex natural stone sourcing process, predict shifts in dining presentation trends to inform product development, or automate quality control checks for material defects (such as micro-fissures or uneven thickness) during manufacturing. There is also significant curiosity about how AI-driven predictive analytics might influence inventory management for seasonal demands in the hospitality sector, ensuring manufacturers avoid costly overstocking or stockouts of bespoke items. Key concerns center on whether AI-generated designs might compromise the authentic, artisanal aesthetic valued in slate products, or if the technology will disproportionately benefit large-scale producers, potentially marginalizing smaller, craft-focused businesses.

Based on this analysis, the key themes summarize that users view AI primarily as a tool for enhancing back-end operations and precision, rather than a direct replacement for human craftsmanship. Expectations are high concerning AI's ability to improve material yield optimization during the cutting phase, reducing waste—a significant cost driver in natural stone processing. Users also anticipate AI algorithms analyzing global consumer behavior data from social media and hospitality booking patterns to provide nuanced insights into emerging color palettes, textures, and preferred presentation styles for slate, thereby ensuring the products developed remain highly relevant and profitable. The overall sentiment suggests that AI will elevate the industrial processes of slate fabrication, making the production more sustainable and demand-responsive, while the aesthetic creation remains a collaboration between human designers and data intelligence.

- AI optimizes material yield by analyzing stone slab geometries, minimizing waste during cutting.

- Predictive analytics forecasts inventory needs based on hospitality bookings and seasonal dining trends.

- AI-powered visual inspection systems enhance quality control, identifying surface imperfections and ensuring dimensional accuracy faster than manual processes.

- Generative design tools assist in creating optimized shapes and packaging solutions, improving logistics and reducing breakage rates.

- Chatbots and personalized recommendation engines enhance the online buying experience for bespoke slate products in the Direct-to-Consumer (D2C) channel.

DRO & Impact Forces Of Slate Tableware Market

The market dynamics are governed by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive trend of premiumization in the global food service industry, where aesthetic presentation is recognized as a critical differentiator for competitive advantage. This demand is reinforced by the growth in global tourism and experiential dining, which mandates high-quality, distinctive serving ware like slate. Opportunities arise chiefly from technological advancements in processing, such as precision laser cutting and advanced sealing agents, which mitigate slate’s natural vulnerability to chipping and moisture absorption, thereby expanding its functional lifespan and market acceptance. The increasing consumer desire for natural, sustainable materials also provides a substantial tailwind, positioning slate favorably against synthetic alternatives.

Conversely, significant restraints hinder growth potential. The fundamental reliance on natural geological resources makes the supply chain susceptible to geopolitical risks, quarrying regulations, and resource scarcity, leading to volatile raw material costs. Furthermore, slate products are inherently fragile compared to ceramic or durable plastics, resulting in higher logistics costs due to specialized packaging requirements and increased breakage rates during transport and handling. Price sensitivity among mid-tier commercial users remains a restraint, as slate is typically positioned at a higher price point than mass-produced stoneware, limiting its penetration into budget-conscious segments. The intense competition from alternative aesthetic materials, such as bamboo, exotic woods, and specialized recycled materials, also segments the market and limits pricing power for slate producers.

The cumulative impact forces dictate that the market will continue its upward trajectory, predominantly focused on the luxury and niche segments where price inelasticity is higher. The opportunity to develop innovative, highly resistant surface treatments is paramount to overcoming fragility restraints. Furthermore, strategic vertical integration, where producers control both quarrying and processing, will be key to stabilizing raw material supply and cost structure. The most potent impact force driving growth is the integration of slate into home entertaining culture globally, moving the product from purely commercial use to an essential, aspirational home décor item. This diversification lessens dependence solely on the highly cyclical hospitality sector, ensuring broader and more consistent demand across various economic climates.

Segmentation Analysis

The Slate Tableware Market is comprehensively segmented based on product type, application, and distribution channel, providing a multi-dimensional view of market penetration and revenue streams. Product segmentation reflects the diverse forms slate takes, ranging from large, flat serving surfaces to smaller, highly specialized items. Application segmentation distinguishes between the high-volume, professional demands of the commercial sector and the aesthetic-driven, intermittent demands of the residential consumer. Distribution segmentation highlights the ongoing transition from traditional brick-and-mortar sales channels to rapidly expanding digital marketplaces, each catering to different buyer behaviors and geographical reach requirements.

- Product Type

- Plates and Chargers

- Serving Boards and Platters

- Coasters and Trivets

- Specialty Items (e.g., Tiered Stands, Engraved Pieces)

- Application

- Commercial (Hotels, Restaurants, Catering (HoReCa))

- Residential (Household Use and Home Entertaining)

- Distribution Channel

- Online (E-commerce Platforms, Brand Websites)

- Offline (Specialty Stores, Department Stores, Supermarkets, Wholesalers)

Value Chain Analysis For Slate Tableware Market

The value chain for slate tableware commences with the Upstream Analysis, focused primarily on the sourcing of high-quality, dense slate material suitable for food contact. This stage involves quarrying operations, which are capital-intensive and geographically concentrated in specific regions known for premium slate deposits (such as parts of Europe, North America, and specific Asian regions). Key activities at this stage include geological surveying, block extraction, and primary cutting into manageable slabs. Establishing sustainable and ethical sourcing practices is increasingly critical at the upstream level, as consumers and commercial clients demand transparency regarding the environmental impact and labor conditions associated with material extraction. Long-term supply contracts and strategic alliances with certified quarry operators are essential for manufacturers to maintain competitive pricing and consistent material quality, mitigating supply chain volatility.

The Midstream and Processing phase involves the transformation of raw slate slabs into finished tableware products. This stage requires specialized machinery for precision cutting, grinding, and edge finishing. Crucially, the application of food-safe sealing treatments is necessary to make the slate non-porous, resistant to bacterial growth, and durable against oils and acidic foods. Quality control is rigorous here, focusing on surface flatness, uniform thickness, and the absence of structural defects. Manufacturing companies often invest heavily in robotic cutting technology to improve efficiency and reduce material wastage, a significant cost factor. The ability to offer customization, including laser etching or specific shape designs tailored for unique culinary presentations, adds considerable value during the processing stage, distinguishing premium manufacturers from generic producers.

Downstream activities center on Distribution Channel management, encompassing both direct and indirect sales strategies. The Indirect distribution channel relies on large wholesalers, specialized kitchenware distributors, and institutional suppliers that service the vast commercial HoReCa market. This channel focuses on volume and consistent supply logistics. The Direct channel, increasingly dominated by proprietary e-commerce platforms and D2C marketing, allows manufacturers to capture higher margins and directly manage brand narrative and customer feedback in the residential sector. For high-end slate, presentation in physical Specialty Stores remains important, allowing consumers to feel the material quality and weight before purchase. Effective logistics, including specialized packaging designed to withstand transit shocks, is a major differentiator in this segment, directly impacting customer satisfaction and replacement costs.

Slate Tableware Market Potential Customers

The primary target demographic for slate tableware spans a dual market structure: high-volume commercial purchasers and high-value residential consumers. Commercial end-users, constituting the largest segment by transaction volume, include luxury and boutique hotels, fine dining restaurants, exclusive catering companies, and specialized culinary academies. These buyers prioritize product durability, consistency across large orders, compliance with food safety regulations, and the ability to customize items with branding logos or unique dimensions to match their specific interior design or menu requirements. Their purchasing decisions are often centralized, driven by procurement departments seeking materials that offer both aesthetic appeal and a favorable return on investment (ROI) through enhanced customer experience and reduced need for frequent replacement.

Residential buyers represent a rapidly growing market, driven largely by lifestyle and experiential factors. This segment includes affluent millennials and Gen X consumers who are keen on home entertaining, gourmet cooking, and curating aesthetically pleasing homes, often influenced by design trends seen on platforms like Instagram and Pinterest. These consumers seek unique, artisanal, and high-quality serving pieces that elevate everyday dining or special occasions. While they purchase in lower volumes, their willingness to pay a premium for certified, ethically sourced, and aesthetically unique pieces is higher. Marketing efforts directed at this segment often focus on the narrative of the material, its natural origins, and its ability to act as a sophisticated canvas for food presentation.

A third, emerging category of potential customers includes corporate clients and event organizers who utilize customized slate products for corporate gifting, promotional events, or luxury product launches. In these scenarios, the slate serves as a premium substrate for laser engraving corporate logos or personalized messages, capitalizing on the material's perceived value and permanence. Educational institutions focused on culinary arts also represent a steady demand source, requiring durable, professional-grade slate boards for training purposes. Successful market penetration necessitates tailored sales approaches: volume-based contracts and stringent compliance assurance for commercial buyers, and emotionally resonant branding combined with D2C efficiency for residential consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $395 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boska Holland, R.S.V.P. International, Slateware USA, Just Slate Company, T&G Woodware, John Booij, Naturally Slate, Artesà, Pro-Cook, TableCraft Products, Epicurean, LSA International, The Just Slate Company, Slate Plate, Vermont Slate Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slate Tableware Market Key Technology Landscape

The manufacturing landscape for slate tableware relies heavily on precision cutting and advanced surface treatment technologies to ensure product quality and durability. The initial processing involves high-pressure waterjet cutters or Computer Numerical Control (CNC) laser cutters, which are essential for achieving highly precise shapes, uniform thickness, and smooth, refined edges—critical features for food-grade serving ware. Traditional splitting and sawing methods are increasingly being supplemented by these advanced techniques to maximize material yield and minimize material stress fractures. Furthermore, the development of sophisticated quality assurance systems, often involving automated vision systems, utilizes technology to rapidly scan for micro-fissures or variations in slate density that would compromise the product’s integrity, thereby dramatically improving outgoing quality rates and reducing customer returns.

The most crucial technological innovation in this market lies in surface finishing and sealing. Natural slate is inherently porous and requires treatment to prevent the absorption of moisture, bacteria, and oils, which is a regulatory necessity for food contact surfaces. The transition from rudimentary oil treatments to advanced, food-grade polyurethane or mineral oil-based sealants has significantly enhanced the longevity and hygienic characteristics of slate tableware. Research and development efforts are currently focused on nanotechnology-based coatings that offer superior hydrophobic and oleophobic properties, making the slate surface highly resistant to staining and significantly easier to clean without dulling the natural aesthetic. These advanced sealants also provide enhanced scratch resistance, addressing a major restraint associated with material fragility.

Beyond core manufacturing, digital technologies are playing an increasing role in market infrastructure. Sophisticated Enterprise Resource Planning (ERP) systems are integrated across the value chain, from quarry inventory tracking to finished product logistics, enabling real-time supply chain transparency and optimizing production scheduling based on forecast demand. The use of 3D modeling and prototyping technology allows designers to rapidly iterate on new slate forms and test feasibility before committing to full-scale production runs. Furthermore, technology related to sustainable packaging—utilizing recyclable, high-density foam or innovative cushioning materials—is crucial for reducing the high rate of breakage often associated with shipping natural stone products through e-commerce channels, indirectly reducing overall environmental impact and increasing consumer satisfaction.

Regional Highlights

- North America (United States and Canada): This region maintains a substantial market share, driven by a high concentration of sophisticated, high-end dining establishments and a robust culture of gourmet home entertaining. The US market demands certified food-safe products and exhibits a strong preference for large serving boards used for charcuterie and cheese displays. Growth is stabilized by consistent demand from the resilient hospitality industry, particularly luxury hotel chains that use slate as a staple element in their breakfast and room service presentations. Canadian demand follows similar trends but shows a higher inclination toward sustainably sourced and ethically manufactured goods, driving localized sourcing initiatives.

- Europe (Germany, UK, France, Italy, Spain): Europe is both a major consumer and a primary producer of high-quality slate tableware, leveraging historical quarrying expertise, particularly in Spain and Wales. The market here is highly mature and fragmented, characterized by a strong aesthetic tradition and discerning buyers who value craftsmanship and material origin. Germany and the UK are leading consumers, with significant e-commerce penetration driving residential demand. Regulatory compliance, particularly concerning REACH standards for chemical safety in sealants, is stringent and heavily influences manufacturing protocols across the continent, prioritizing inert and non-toxic surface treatments.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC represents the fastest-growing market, propelled by rapid urbanization, the burgeoning middle class, and the aggressive expansion of international hotel brands and luxury retail formats. China's enormous domestic consumption market is rapidly adopting Western dining and presentation styles, driving massive commercial orders. Japan and South Korea, known for their strong emphasis on minimalist aesthetics and precise food presentation, are increasingly integrating slate into contemporary dining concepts. The key growth challenge in this region is the establishment of efficient, breakage-resistant distribution networks across vast distances and varied infrastructural conditions.

- Latin America (Brazil, Mexico, Argentina): The market in Latin America is still nascent but shows promising growth, primarily concentrated in major economic hubs like São Paulo and Mexico City, where upscale dining and tourism sectors are expanding. Economic volatility poses a restraint, making high-cost imports challenging. However, local producers are beginning to capitalize on indigenous stone resources and artisanal craftsmanship to meet domestic demand for unique, rustic tableware that resonates with regional culinary traditions. The focus is currently on the commercial application segment, driven by destination resorts and premium urban eateries.

- Middle East and Africa (MEA) (UAE, Saudi Arabia, South Africa): Demand in the MEA region is strongly skewed toward the high-end commercial sector, fueled by massive investment in luxury hotels, elaborate catering services, and premium retail experiences in the Gulf Cooperation Council (GCC) states. Purchasers prioritize opulence, custom-designed pieces, and products that offer a sense of exclusivity. South Africa serves as a secondary regional hub, where demand is more evenly split between high-end residential use and commercial ventures. Logistics complexity and reliance on imports from European quarries remain a major structural characteristic of this region's supply chain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slate Tableware Market.- The Just Slate Company (UK)

- Slateware USA (USA)

- Boska Holland (Netherlands)

- R.S.V.P. International (USA)

- T&G Woodware (UK)

- John Booij (Netherlands)

- Naturally Slate (USA)

- Artesà (UK)

- Pro-Cook (UK)

- TableCraft Products (USA)

- Epicurean (USA)

- LSA International (UK)

- Slate Plate (Spain)

- Vermont Slate Company (USA)

- Norpro (USA)

- Fiskars Group (Finland)

- Steelite International (UK)

- Nambucca Slate (Australia)

- Crate and Barrel (USA)

- Williams Sonoma (USA)

Frequently Asked Questions

Analyze common user questions about the Slate Tableware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Slate Tableware Market?

The Slate Tableware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033, driven primarily by increasing demand from the global hospitality sector and aesthetic residential consumers.

What are the primary restraints affecting the Slate Tableware Market?

The primary restraints include the inherent material fragility leading to high breakage rates, volatility in the cost and supply of natural slate resources, and significant competition from alternative materials such as ceramics, wood, and glass in budget-sensitive segments.

Which application segment accounts for the highest revenue share in the market?

The Commercial Application segment, encompassing Hotels, Restaurants, and Catering (HoReCa), currently accounts for the highest revenue share due to the high volume and frequent replacement cycles required by professional food service operations focused on premium presentation.

How does AI impact the manufacturing process of slate tableware?

AI significantly impacts manufacturing by optimizing material yield through automated cutting pattern analysis, enhancing quality control using machine vision systems to detect minute defects, and streamlining inventory management via predictive demand forecasting for customized orders.

Which geographical region exhibits the highest future growth potential for slate tableware?

The Asia Pacific (APAC) region, specifically countries like China and India, exhibits the highest growth potential, fueled by rapidly expanding urbanization, the proliferation of international dining concepts, and rising consumer spending on premium home and kitchenware products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager