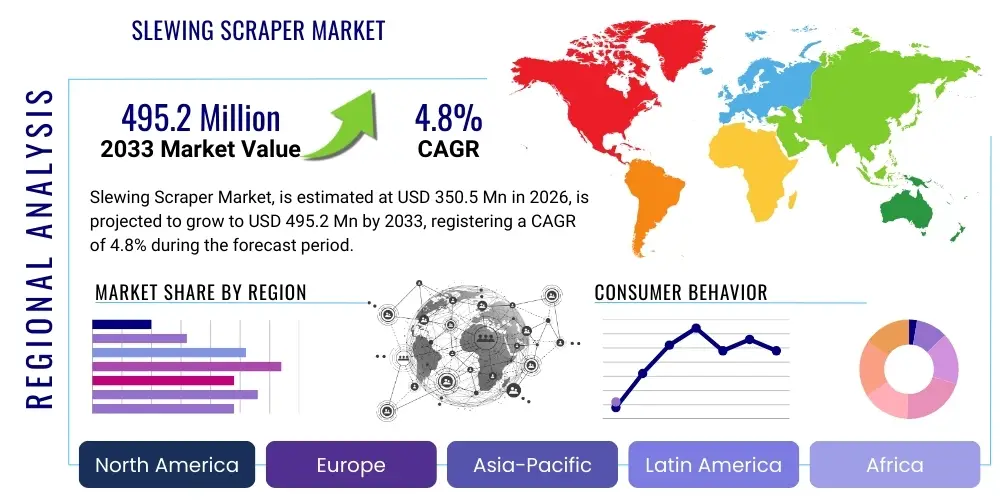

Slewing Scraper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437883 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Slewing Scraper Market Size

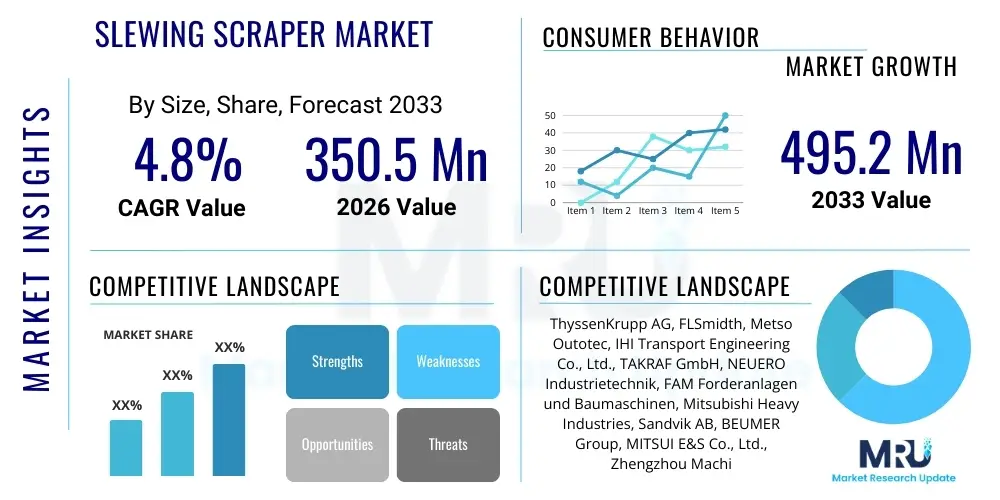

The Slewing Scraper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 495.2 Million by the end of the forecast period in 2033.

Slewing Scraper Market introduction

The Slewing Scraper Market encompasses specialized heavy machinery utilized primarily in bulk material handling, storage yards, and stockpile management, particularly within the mining, cement, power generation, and port logistics sectors. Slewing scrapers are designed to efficiently reclaim materials, such as coal, iron ore, limestone, and other bulk commodities, from large, linear stockpiles. The core product provides enhanced operational efficiency by maximizing material recovery rates and ensuring consistent feed into processing facilities or loading docks, thereby minimizing production bottlenecks associated with manual or less efficient reclaiming methods. These systems are integral to automated stockyard operations, often working in conjunction with stackers to create sophisticated storage and handling ecosystems.

The major applications of slewing scrapers revolve around thermal power plants, where consistent coal supply is critical; large-scale ports and terminals handling massive volumes of imported or exported minerals; and cement and steel manufacturing facilities requiring reliable intake of raw materials. Key product benefits include high capacity reclaiming (often exceeding 5,000 tons per hour), reduced operational footprint compared to bridge-type scrapers, and the capability to handle various bulk densities and moisture levels. Furthermore, modern slewing scraper designs often incorporate features for dust suppression and improved safety, appealing to environmentally conscious and regulatory-compliant industries. The ability of the scraper to slew (rotate) allows it to cover a wide arc of the stockpile efficiently.

Market growth is predominantly driven by the robust expansion of global trade and the accompanying infrastructural development, particularly in Asia Pacific and other emerging economies, necessitating high-throughput bulk handling systems. Increased demand for energy and construction materials fuels mining and raw material processing activities, directly increasing the need for efficient material reclaiming technology. Additionally, the industry trend toward fully automated stockyards to minimize labor costs, improve accuracy, and enhance worker safety acts as a significant catalyst for the adoption of technologically advanced slewing scraper systems, replacing older, less efficient equipment models.

Slewing Scraper Market Executive Summary

The Slewing Scraper Market is characterized by moderate but stable growth, primarily anchored by persistent global demand for energy resources and infrastructure commodities. Key business trends indicate a shift towards customization, with end-users demanding scrapers designed specifically for challenging materials (e.g., highly abrasive or sticky ores) and integrating sophisticated monitoring and control systems (SCADA, PLC). Consolidation among equipment manufacturers is observed, leading to larger entities offering comprehensive material handling solutions, often bundling slewing scrapers with stackers and conveyor systems. The competitive landscape is driven by product durability, maintenance ease, and adherence to stringent environmental and safety standards, particularly concerning dust and noise pollution. Manufacturers focusing on modular designs capable of quick deployment and minimal downtime are gaining a competitive edge in mature markets.

Regionally, Asia Pacific maintains its dominance, spurred by massive infrastructural spending in China, India, and Southeast Asian nations, where port expansion and new power plant construction are prevalent. This region requires high-capacity, robust machinery to cope with immense material volumes. Europe and North America, while mature, exhibit demand primarily through replacement cycles and modernization projects, focusing heavily on integrating automation, predictive maintenance, and energy-efficient drive technologies to comply with stricter regional emission and operational efficiency mandates. The Middle East and Africa (MEA) and Latin America represent growing opportunities, driven by mineral extraction projects and the development of new bulk handling terminals, especially for fertilizer components and metal ores, although these markets are more sensitive to capital investment costs and long-term financing availability.

Segment trends reveal that the 'High Capacity' segment (over 3,000 tons per hour) is witnessing the fastest adoption rate, particularly in large international ports and mega-mining operations, reflecting the global focus on throughput maximization. Furthermore, the ‘Fully Automated’ control segment is rapidly displacing semi-automated models, aligning with the industry's digital transformation agenda. For application segments, the Power Generation sector remains the largest consumer due to the continuous reliance on coal stockpiles worldwide, followed closely by the Metals and Mining industry, where reclaim reliability is essential for continuous processing plant operation. Custom-engineered solutions, utilizing advanced structural materials for longevity, are commanding premium pricing and driving value-based segment growth.

AI Impact Analysis on Slewing Scraper Market

User inquiries regarding AI's influence on the Slewing Scraper Market frequently center on predictive maintenance capabilities, autonomous operation feasibility, optimization of reclaiming routes, and the integration of machine vision for stockpile management. Users are concerned about the implementation costs, the required network infrastructure for data transmission, and the reliability of AI algorithms in harsh, dusty operating environments. Expectations are high regarding significant reductions in unexpected downtime, labor costs, and fuel/energy consumption through smart optimization. The consensus theme is that AI will transform scrapers from purely mechanical devices into intelligent, self-optimizing material handling assets, pushing the market towards 'Equipment-as-a-Service' models where uptime guarantees become standard contractual features.

- AI-driven Predictive Maintenance: Utilizing sensor data (vibration, temperature, current draw) to forecast equipment failure, dramatically reducing unscheduled downtime and optimizing maintenance scheduling, extending component lifespan.

- Autonomous Operation & Fleet Management: Enabling fully unsupervised reclaiming cycles, automatic route planning based on real-time inventory data, and coordination between multiple scrapers and stackers (fleet optimization).

- Stockpile Inventory Optimization: Employing machine learning and 3D laser scanning/LIDAR data to accurately measure stockpile volume, density, and degradation in real time, ensuring optimal material blending and minimizing dead zones.

- Energy Consumption Minimization: AI algorithms optimize motor speeds, slew rates, and travel patterns based on load and desired throughput, reducing overall energy usage during the reclamation process.

- Enhanced Safety Protocols: Integrating AI-powered anomaly detection to identify unsafe operating conditions, unauthorized personnel entry into the working area, or collision risks, leading to automatic shutdown or speed reduction.

- Process Control Integration: Seamless integration with plant-wide SCADA systems, allowing the scraper to adjust its output based on the immediate needs of the downstream processing facility (demand-responsive reclaiming).

DRO & Impact Forces Of Slewing Scraper Market

The Slewing Scraper Market is influenced by a dynamic interplay of driving forces, inherent limitations, and emergent opportunities, creating distinct market pressures. Key drivers include global industrialization, specifically the rise in sea-borne bulk trade and the expansion of integrated steel and cement plants, which necessitate higher capacity material flow. These macro trends create consistent demand for robust and reliable reclaiming machinery. Conversely, the high initial capital investment required for these large, complex systems, coupled with extended project timelines for new installations, acts as a primary restraint, particularly affecting adoption in smaller economies or by companies with constrained capital expenditure budgets. Opportunities lie in integrating advanced technologies like digitalization and remote diagnostics, offering manufacturers avenues for value-added services and operational improvements that justify the initial investment cost.

Impact forces currently shaping the market are heavily focused on environmental and regulatory compliance. Stricter global regulations pertaining to dust emission control and noise levels in industrial settings compel manufacturers to incorporate sophisticated dust suppression systems (e.g., fog cannons, water sprays) and acoustic dampening materials into new slewing scraper designs. This compliance pressure is a critical factor influencing purchasing decisions in Europe and North America. Economic volatility, particularly fluctuations in commodity prices (coal, iron ore), also significantly impacts market momentum; periods of low commodity prices lead to delayed investment in new heavy machinery, while sustained high prices spur capital spending on modernization and capacity expansion.

The competitive rivalry within the slewing scraper sector is intense, dominated by a few established global giants known for their engineering prowess and reliability. Differentiation is achieved not just through mechanical performance but increasingly through sophisticated control systems and aftermarket support capabilities, including spare parts availability and rapid technical servicing. Buyer power is substantial, as end-users often procure these systems as part of massive, multi-million-dollar handling projects and demand highly tailored specifications and performance guarantees. The threat of substitutes, primarily bridge-type scrapers, bucket wheel excavators, or even mobile equipment for smaller yards, remains present, compelling slewing scraper manufacturers to continuously innovate in terms of efficiency and footprint utilization to maintain their market advantage in high-throughput applications.

Segmentation Analysis

The Slewing Scraper Market is comprehensively segmented based on its capacity, level of automation, power source, and critical end-user applications, allowing for precise market sizing and strategic targeting. The segmentation by capacity—low, medium, and high—reflects the scale of operations, with high-capacity units dominating large ports and major utilities. Automation levels range from semi-automatic operation requiring constant operator intervention to fully automated systems integrated seamlessly into plant-wide logistics networks. Analysis across these dimensions reveals differing growth trajectories: high-capacity and fully automated segments are anticipated to exhibit faster growth due to the overwhelming global trend toward labor reduction and maximized throughput efficiency across industries like bulk material handling and metallurgy.

- By Capacity

- Low Capacity (Up to 1,500 tons/hour)

- Medium Capacity (1,501 – 3,000 tons/hour)

- High Capacity (Above 3,000 tons/hour)

- By Automation Level

- Semi-Automatic

- Fully Automatic (Integrated Control Systems)

- By Drive Type

- Electric Drive

- Hydraulic Drive (Less common in modern, large units)

- By Application

- Power Generation (Coal Handling)

- Metals and Mining (Iron Ore, Bauxite, Concentrates)

- Cement and Construction Materials

- Ports and Terminals

- Chemical and Fertilizer Plants

Value Chain Analysis For Slewing Scraper Market

The value chain for the Slewing Scraper Market begins with the upstream segment, involving the sourcing and processing of core raw materials such as high-grade structural steel, complex mechanical components (gearboxes, bearings), high-powered electrical motors, and advanced PLC/sensor systems. The quality and availability of these inputs directly impact the final product's performance and delivery timeline. Suppliers of specialized steel alloys and precision-engineered power transmission components hold significant leverage in the upstream segment. Key challenges here include managing supply chain volatility, ensuring material traceability, and optimizing procurement strategies for custom-built, large-scale components required for the scraper's structure and drive system.

The manufacturing and assembly stage, situated in the middle of the value chain, is characterized by high levels of engineering expertise, heavy fabrication capabilities, and rigorous quality control processes. Leading manufacturers maintain strong control over intellectual property related to reclaiming geometry, slew mechanism design, and control system architecture. Post-manufacturing, the distribution channel is primarily direct, especially for large, custom-engineered projects. Manufacturers work directly with end-users (e.g., port authorities, utility companies) or through EPC (Engineering, Procurement, and Construction) contractors. Indirect channels, involving local agents or distributors, are more common for smaller service parts or standard replacement units in geographically dispersed or less accessible markets.

Downstream activities involve complex logistics, site erection, commissioning, and, most critically, long-term aftermarket support. Given the substantial investment and critical role of slewing scrapers in continuous operations, post-sales services—including maintenance contracts, spare parts management, modernization kits, and remote diagnostics—are crucial sources of revenue and customer retention for market participants. The efficiency of the scraper relies heavily on its integration with the entire stockyard and plant control system, making post-installation optimization a vital component of the service value proposition. Value creation shifts increasingly towards digitalization and software-based enhancements that improve machine uptime and operational intelligence throughout the asset lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 495.2 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ThyssenKrupp AG, FLSmidth, Metso Outotec, IHI Transport Engineering Co., Ltd., TAKRAF GmbH, NEUERO Industrietechnik, FAM Forderanlagen und Baumaschinen, Mitsubishi Heavy Industries, Sandvik AB, BEUMER Group, MITSUI E&S Co., Ltd., Zhengzhou Machinery, Tenova S.p.A., HLT (Heavy Load Technology), PWH Anlagen + Systeme |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slewing Scraper Market Key Technology Landscape

The technology landscape of the Slewing Scraper Market is defined by continuous evolution towards higher energy efficiency, enhanced structural integrity, and deep digitalization. Core technology includes robust drive systems, predominantly using sophisticated electric motors coupled with Variable Frequency Drives (VFDs) to manage acceleration and deceleration smoothly, thus reducing mechanical stress and optimizing power consumption based on immediate load requirements. The integration of advanced metallurgy and finite element analysis (FEA) in structural design ensures that the boom and slew mechanisms can handle extreme loads and corrosive environments typical of bulk material handling operations, guaranteeing a longer service life and minimizing component fatigue. Safety is augmented by sophisticated laser scanning and collision avoidance systems, which dynamically monitor the scraper's environment.

Modern slewing scrapers heavily rely on smart automation technologies. Programmable Logic Controllers (PLCs) form the backbone of the control architecture, managing all operational sequences, interlocks, and safety functions. These PLCs are increasingly integrated with higher-level Supervisory Control and Data Acquisition (SCADA) systems, allowing plant operators to monitor performance parameters remotely and adjust throughput targets. A major technological trend is the adoption of sensorization across critical components—bearings, gearboxes, and motors—feeding data into Condition Monitoring Systems (CMS). This facilitates predictive maintenance, moving away from time-based servicing to condition-based interventions, which significantly boosts operational uptime and reduces lifecycle maintenance costs by identifying issues before catastrophic failure.

Furthermore, technology development is focused on improving environmental performance and footprint utilization. Dust suppression systems, utilizing precise misting or specialized enclosures, are becoming standard features, driven by regulatory demands. In terms of digital twin technology, manufacturers are creating virtual models of the slewing scraper to simulate operational stresses, optimize reclaiming paths, and train operators, leading to faster commissioning and superior long-term performance optimization. The convergence of IoT (Internet of Things), cloud computing for data storage and analysis, and edge computing for instantaneous on-board decision-making marks the future direction of slewing scraper technology, paving the way for full autonomy and seamless integration into smart logistical supply chains.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of demand, driven by massive infrastructure investments, rapid industrialization, and sustained growth in thermal power generation (particularly in India, Indonesia, and Southeast Asia). China remains the largest single market, although growth is moderating. The region demands high-capacity, cost-effective solutions for port expansion and large-scale mining projects, leading to competitive local manufacturing and high adoption rates of new installations.

- Europe: This market is mature, characterized by stringent environmental regulations and a focus on modernization and replacement. Demand is primarily centered on technologically advanced scrapers featuring high energy efficiency, integrated predictive maintenance, and superior dust and noise control capabilities. Western European ports and utilities prioritize reliability and automation over pure cost minimization.

- North America: Similar to Europe, North America is a replacement market focusing on digitalization and automation. The demand is strong from high-throughput coal terminals and bulk ports, emphasizing safety standards and seamless integration with existing advanced inventory management systems. Implementation of autonomous features is higher here than in other regions due to labor cost sensitivity.

- Middle East and Africa (MEA): This region is an emerging growth hub, fueled by significant investments in mining, particularly phosphate, iron ore, and bauxite extraction, alongside the expansion of new international logistics hubs. The market is highly price-sensitive but offers substantial long-term growth potential tied to large-scale greenfield projects requiring new installations.

- Latin America: Growth is driven by the robust mining sector in countries like Brazil, Chile, and Peru, focusing on commodities such as iron ore and copper concentrates. Investment cycles are highly correlated with global commodity prices. The region favors robust, durable equipment capable of operating reliably in often remote and challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slewing Scraper Market.- ThyssenKrupp AG

- FLSmidth

- Metso Outotec

- IHI Transport Engineering Co., Ltd.

- TAKRAF GmbH (Tenova Group)

- NEUERO Industrietechnik

- FAM Forderanlagen und Baumaschinen

- Mitsubishi Heavy Industries

- Sandvik AB

- BEUMER Group

- MITSUI E&S Co., Ltd.

- Zhengzhou Machinery

- Tenova S.p.A.

- HLT (Heavy Load Technology)

- PWH Anlagen + Systeme

- Anhui Heli Co., Ltd.

- CIMC Group

- Jiangsu Huaxia Heavy Industry Co., Ltd.

- Konecranes

- Sany Group

Frequently Asked Questions

Analyze common user questions about the Slewing Scraper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a slewing scraper in bulk handling?

The primary function of a slewing scraper is to reclaim bulk materials (such as coal, iron ore, or limestone) from stockpiles and feed them continuously and uniformly onto a conveyor system for further processing or shipment, optimizing material flow and storage yard efficiency.

How does the adoption of AI influence the maintenance of slewing scrapers?

AI significantly enhances maintenance by enabling predictive maintenance strategies. Algorithms analyze real-time sensor data (vibration, temperature) to forecast potential component failure, minimizing unplanned downtime and reducing overall lifecycle maintenance costs through condition-based monitoring.

Which application segment holds the largest market share for slewing scrapers?

The Power Generation sector, particularly coal handling for thermal power plants, holds the largest market share, driven by the requirement for extremely high-capacity and reliable reclaiming systems to ensure continuous fuel supply.

What are the key differences between a slewing scraper and a bridge-type scraper?

Slewing scrapers typically cover a semicircular area and are favored for linear stockpiles due to their smaller footprint and dynamic maneuverability. Bridge-type scrapers cover the entire width of the stockpile, are highly precise for blending, but require a larger structural setup.

Which geographical region is expected to show the fastest growth in the Slewing Scraper Market?

Asia Pacific (APAC) is projected to exhibit the fastest growth, fueled by substantial government and private investment in expanding port infrastructure, new power generation capacity, and large-scale mining projects across emerging economies like India and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager