Sling repairing service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435284 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Sling repairing service Market Size

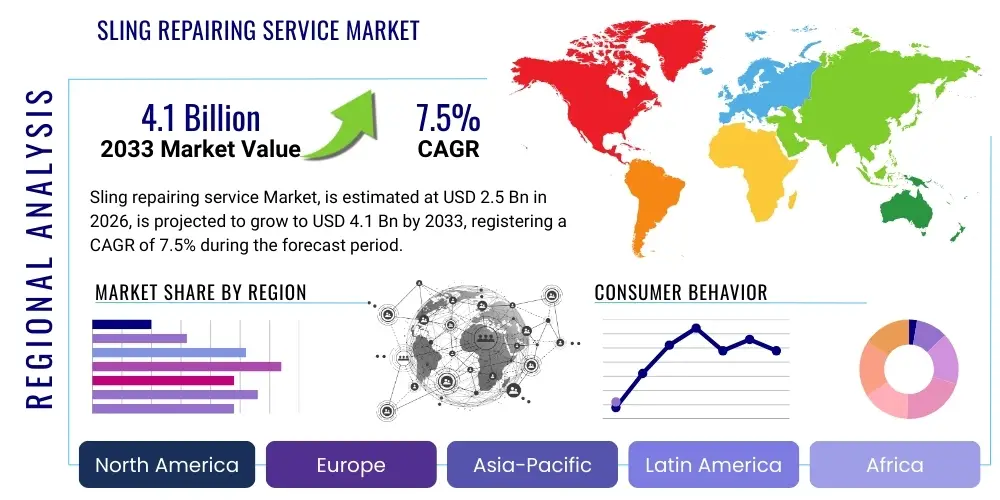

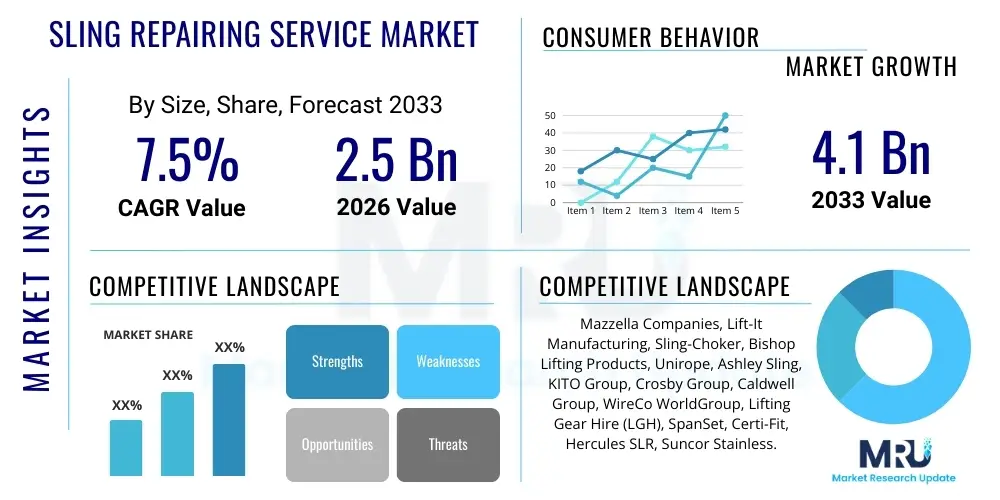

The Sling repairing service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

The consistent expansion of heavy industries, coupled with stringent regulatory frameworks concerning industrial safety and lifting operations, underpins this robust growth projection. Industrial slings, essential components in material handling across sectors like construction, logistics, and manufacturing, are subjected to immense wear and tear. Instead of outright replacement, many businesses are prioritizing specialized repair and certification services to extend asset lifespan and ensure compliance, contributing significantly to market valuation.

Furthermore, regional variations in infrastructural spending and the maturity of industrial safety standards heavily influence market size distribution. Regions characterized by high capital investment in infrastructure and energy production, such as North America and Asia Pacific, exhibit the highest demand for specialized sling repair, inspection, and recertification services. This demand is further amplified by the inherent risks associated with sling failure, pushing end-users toward certified service providers who guarantee adherence to international safety guidelines, thereby increasing the overall expenditure within this service segment.

Sling repairing service Market introduction

The Sling repairing service Market encompasses specialized maintenance, repair, inspection, testing, and certification activities related to various types of industrial lifting slings, including wire rope, chain, synthetic web, and round slings. These services are crucial for maintaining operational safety and compliance in demanding industrial environments such as construction sites, ports, manufacturing facilities, and oil rigs. The core offering of this market is the restoration of damaged slings to original strength specifications and the required regulatory compliance standards, thus providing a cost-effective alternative to immediate replacement.

Major applications for sling repairing services span across all sectors involved in heavy lifting and material transport. Key industries include construction (cranes and rigging), logistics and warehousing (loading dock operations), energy (maintenance of drilling equipment and pipelines), and marine operations (ship loading and offshore installations). The longevity of capital equipment, such as overhead cranes and hoists, is directly tied to the reliability of their lifting accessories, making repair and preventative maintenance indispensable for seamless operations and minimizing downtime across these critical sectors.

The primary benefits driving the adoption of sling repairing services include substantial cost savings compared to purchasing new equipment, reduced environmental impact through material reuse, and enhanced operational safety through mandatory inspection and recertification. Driving factors sustaining market growth include the increasing regulatory emphasis on workplace safety (OSHA, ANSI, LOLER standards), the growing global inventory of industrial lifting equipment, and the macroeconomic trend favoring asset optimization and life extension strategies over capital expenditure on new assets. These factors collectively solidify the necessity of specialized repair services.

The market is experiencing a shift towards advanced non-destructive testing (NDT) methodologies and digital documentation, improving the accuracy of damage assessment and repair quality assurance. This technological integration, combined with the stringent legal requirements imposed on high-risk lifting operations, positions the sling repairing service sector as an indispensable support pillar for global industrial infrastructure. Continued focus on preventative maintenance contracts and rapid turnaround times for repairs are also significant drivers enhancing market attractiveness.

Sling repairing service Market Executive Summary

The Sling repairing service Market is currently characterized by significant business trends centered on consolidation among regional service providers and an increased focus on specialized, rapid-response mobile repair units. Business models are shifting towards integrated service offerings that combine predictive maintenance scheduling, advanced inspection technologies, and complete digital documentation platforms, appealing to large industrial clients seeking comprehensive safety management solutions. Furthermore, supply chain disruptions affecting raw materials for new sling manufacturing have indirectly boosted the demand for repair and refurbishment services, offering an economic incentive for asset life extension.

Regional trends indicate that the Asia Pacific (APAC) region is poised for the fastest expansion, driven by massive investments in infrastructure development, rapid urbanization, and the corresponding growth of manufacturing bases, particularly in India and Southeast Asian nations. North America and Europe, characterized by highly mature industrial safety regulations, maintain high market share primarily due to mandatory periodic inspection and certification cycles, ensuring a steady, recurrent revenue stream for service providers. The Middle East and Africa (MEA) market growth is closely tied to the fluctuating fortunes of the oil and gas and maritime sectors, requiring specialized, heavy-duty repair capabilities.

Segmentation trends highlight the increasing demand for Synthetic Web Sling repair and inspection services due to their growing popularity in logistics and controlled environments requiring non-marring lifting solutions. Simultaneously, the Wire Rope Slings and Chain Slings segment remains dominant in terms of revenue, driven by heavy-duty applications in construction and mining. Within service types, Certification and Testing are becoming mandatory, often integrated into repair contracts, ensuring compliance and maximizing the legal liability mitigation for end-users, thereby increasing the transactional value of service contracts.

Overall, the market trajectory is highly dependent on continuous technological innovation in inspection techniques, regulatory compliance enforcement, and efficient material handling practices. The shift toward sustainable industrial practices also subtly encourages repair over replacement. The sector is fundamentally stable, protected by regulatory barriers to entry and the specialized technical expertise required for certified repairs, ensuring sustained profitability and growth across the forecast period.

AI Impact Analysis on Sling repairing service Market

User inquiries regarding the impact of AI on the Sling repairing service Market often center on its potential to revolutionize inspection processes, enhance predictive maintenance accuracy, and automate administrative compliance tasks. Common concerns revolve around whether AI-driven vision systems can reliably detect minute structural damage, such as internal wire breaks or microscopic fiber degradation, that human inspectors might miss. Users also frequently ask about the integration of machine learning models with regulatory databases to automatically generate and verify certification reports, speeding up the compliance timeline and reducing human error in complex documentation. Expectations are high for AI to minimize human risk exposure during difficult-to-access inspections, particularly in large-scale or offshore environments.

AI is expected to significantly augment the inspection phase of sling repair services. Machine learning algorithms, when applied to visual and ultrasonic inspection data, can analyze patterns indicative of fatigue, corrosion, or material stress far more rapidly and consistently than traditional methods. This capability transforms the inspection from a periodic, time-intensive process into a continuous, data-driven assessment. This transition allows service providers to offer truly predictive maintenance contracts, alerting clients to potential failures before they manifest, thereby mitigating catastrophic risks and optimizing client operational scheduling.

Furthermore, generative AI and natural language processing (NLP) are poised to streamline the heavily regulated aspects of the market. AI systems can rapidly process international and local safety standards (e.g., ASME B30.9, EN 13414), automatically cross-referencing repair procedures and material certifications to ensure absolute compliance. This automation dramatically reduces the overhead associated with mandatory record-keeping, audit preparation, and the generation of legally compliant certification documents, thereby enhancing the overall efficiency and trustworthiness of certified repair services.

- AI-powered vision systems enable automated, high-resolution damage detection in synthetic and wire slings.

- Machine learning models optimize scheduling by predicting remaining useful life (RUL) based on usage data.

- NLP streamlines regulatory documentation, ensuring rapid and accurate compliance reporting.

- AI integration facilitates remote monitoring and inspection in hazardous or inaccessible locations.

- Data synthesis allows for enhanced quality control post-repair, verifying material integrity proactively.

DRO & Impact Forces Of Sling repairing service Market

The dynamics of the Sling repairing service Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the critical Impact Forces shaping market trajectory. Key drivers include the ever-increasing global inventory of lifting equipment requiring mandatory maintenance, the necessity for cost optimization by end-users favoring repair over expensive replacement, and rigorous safety regulations imposed by governmental and industrial bodies globally. These factors establish a non-discretionary demand floor for inspection and repair services, ensuring market stability even during economic downturns, as compliance remains paramount.

Restraints primarily revolve around the inherent risks and liability associated with repair failures. A poorly executed repair can lead to catastrophic accidents, making clients hesitant to use uncertified services. Furthermore, the specialized nature of repair, requiring highly skilled technicians and expensive calibration equipment, creates labor shortages and high operating costs for service providers. Additionally, the proliferation of low-quality, non-certified repair shops undercuts certified market participants, although strict regulations are mitigating this factor by mandating certified documentation for most industrial applications.

Opportunities for growth are concentrated in adopting advanced technology, specifically Non-Destructive Testing (NDT) techniques like Magnetic Particle Inspection (MPI) and phased array ultrasonics, enhancing the accuracy and speed of damage assessment. The global trend towards preventative maintenance contracts, supported by digital asset tracking and IoT integration, presents significant recurring revenue opportunities. Furthermore, expansion into emerging markets, particularly within developing infrastructure sectors, offers substantial untapped potential for establishing market dominance through early entry and standardization of repair protocols.

The primary impact forces driving the market include regulatory pressure (forcing continuous service cycles), economic constraints (making repair cost-effective), and technological innovation (improving service quality and efficiency). These forces generate a self-sustaining cycle where regulatory compliance mandates high-quality repairs, and economic viability drives demand, while technology ensures the quality meets the stringent standards required. This constant pressure ensures that certified, high-quality repair services maintain a central and indispensable role in the industrial lifting ecosystem.

Segmentation Analysis

The Sling repairing service Market is comprehensively segmented based on the type of sling material, the end-use industry utilizing the service, the specific type of service rendered, and the geographical location of operation. Understanding these segmentations provides critical insight into demand patterns, specialized technical requirements, and regional spending priorities. The complexity of material handling across diverse sectors dictates the need for highly specialized repair expertise tailored to specific sling types, from high-strength alloy chains used in hot environments to sophisticated synthetic fibers used in delicate lifting operations.

Analyzing these segments allows market participants to tailor their investment strategies, focusing on high-growth areas such as synthetic sling repair driven by the growth of cleanroom and high-tech manufacturing, or specializing in robust wire rope and chain repair services essential for the sustained expansion of global maritime and construction industries. The dominance of certain service types, particularly mandated inspection and certification, underscores the market’s defensive characteristics, as these services are required regardless of macroeconomic cycles, ensuring market resilience and predictable revenue streams for specialized repair firms.

- By Sling Type:

- Wire Rope Slings (Dominant in heavy construction and mining)

- Chain Slings (High durability, used in high-temperature environments)

- Synthetic Web Slings (Growing demand in logistics and aerospace)

- Round Slings (Flexible lifting applications)

- Specialty Slings (e.g., High-performance fiber slings)

- By End-Use Industry:

- Construction and Infrastructure

- Manufacturing and Heavy Industry

- Logistics, Shipping, and Warehousing

- Oil and Gas (Upstream, Midstream, Downstream)

- Marine and Offshore

- Mining and Excavation

- Energy and Utilities

- By Service Type:

- Inspection and Non-Destructive Testing (NDT)

- Repair and Refurbishment

- Certification and Documentation

- Sling Management Consulting

- By Repair Method:

- Splicing (Wire Rope)

- Swaging (Wire Rope)

- Sewing/Stitching (Synthetic Slings)

- Heat Treatment and Welding (Chain Slings)

Value Chain Analysis For Sling repairing service Market

The value chain for the Sling repairing service Market begins with upstream suppliers providing critical consumables necessary for the repair process, such as high-grade steel wire, synthetic fibers, specialized lubricants, welding electrodes, and essential testing apparatus. These suppliers, often specialized manufacturers themselves, must adhere to stringent material quality standards, as the performance of the repaired sling is directly dependent on the integrity of the replacement components. Maintaining robust relationships with certified material providers is critical for repair service companies to guarantee compliance with international safety specifications and quality assurance protocols, forming the foundation of the service’s value proposition.

The core of the value chain is the service provider (the repair company) which performs inspection, repair, testing, and certification. This stage involves significant technical expertise, requiring certified technicians proficient in various repair methodologies—from precise synthetic stitching to intricate wire rope splicing and specialized chain heat treatment processes. Efficiency and turnaround time are key performance indicators at this stage, as minimizing client downtime is a crucial competitive advantage. Service delivery relies heavily on robust quality management systems (QMS) and comprehensive documentation practices to ensure legal compliance and mitigate client liability.

Downstream activities involve the distribution channel, which is typically direct to the end-user (industrial companies, construction firms, maritime operators). However, indirect channels exist through equipment rental companies or large industrial distributors who subcontract repair services. The final stage of the value chain is the end-user integrating the repaired and certified sling back into their operational workflow. The ultimate value delivery is the guaranteed safety, compliance, and prolonged asset life, which translates directly into reduced operational risk and lower capital expenditure for the buyers. The feedback loop from downstream users regarding performance and durability is crucial for continuous process improvement in the repair segment.

Sling repairing service Market Potential Customers

The primary target audience and potential customers for the Sling repairing service Market are large-scale industrial operators who rely heavily on lifting apparatus for routine operations. These entities prioritize operational continuity, mandatory safety compliance, and financial prudence, making repair and recertification services an attractive necessity. Key decision-makers within these organizations are typically safety managers, procurement directors, and maintenance supervisors who are responsible for asset integrity and adherence to regulatory standards like OSHA in the U.S. or similar regulatory bodies internationally. These customers require verifiable service quality and detailed audit trails, often engaging in long-term service contracts.

Construction and infrastructure development companies represent a critical customer segment, given their extensive use of wire rope and chain slings in demanding, high-wear environments. Due to project-based timelines and the high cost of lifting equipment downtime, these companies seek rapid, on-site inspection and repair services to maintain tight schedules. The maritime and offshore sectors (including oil and gas exploration and port logistics) constitute another highly valuable segment, characterized by extremely high safety requirements and severe operating conditions that necessitate frequent, specialized Non-Destructive Testing (NDT) and corrosion-resistant repairs.

Furthermore, manufacturers in the automotive, aerospace, and general heavy machinery sectors are significant consumers of these services. While their operating environments might be cleaner, their loads are often precise and highly valuable, demanding flawless synthetic sling repairs and stringent certification standards. Ultimately, any organization whose operations involve regulatory oversight concerning material handling and lifting activities is a potential customer, driving the demand for certified repair services as a core component of their risk management and operational maintenance strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mazzella Companies, Lift-It Manufacturing, Sling-Choker, Bishop Lifting Products, Unirope, Ashley Sling, KITO Group, Crosby Group, Caldwell Group, WireCo WorldGroup, Lifting Gear Hire (LGH), SpanSet, Certi-Fit, Hercules SLR, Suncor Stainless. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sling repairing service Market Key Technology Landscape

The technological landscape within the Sling repairing service Market is rapidly evolving, driven primarily by the need for enhanced accuracy in defect detection and comprehensive digital record-keeping. The primary technological advancement involves the widespread adoption of advanced Non-Destructive Testing (NDT) techniques. These include Magnetic Rope Testing (MRT) for wire ropes, ultrasonic testing for internal inspection of synthetic materials, and advanced eddy current inspection. These technologies allow service providers to assess the internal integrity of slings without causing further damage, significantly improving the reliability of repair decisions and the quality assurance process. The integration of high-resolution digital imaging and specialized software further aids in documenting visual evidence of wear and tear, providing auditable proof for certification.

Digitalization and the application of IoT (Internet of Things) are transforming the service delivery model. Many modern slings are now equipped with RFID tags or QR codes, enabling seamless integration with asset management platforms. These platforms allow for real-time tracking of usage cycles, environmental exposure, and historical inspection data. This technological integration supports the transition from reactive repair to proactive, condition-based maintenance. Service providers leverage these digital records to optimize repair scheduling, manage inventory of replacement parts efficiently, and automate the generation of compliance reports, dramatically reducing administrative overhead and accelerating service delivery.

Furthermore, advancements in repair materials and methodology are key technological drivers. For synthetic slings, this involves specialized computerized sewing machines capable of handling high-strength fibers like Dyneema or aramid, ensuring the repaired section maintains the required load capacity and safety factor. For chain slings, advanced metallurgy and controlled heat treatment processes are essential to restore material hardness and elasticity lost due to fatigue or overload. Continuous research in these areas ensures that repair quality matches or even exceeds the original manufacturer's specifications, which is vital for maintaining the market’s integrity and customer confidence in the refurbished equipment.

Regional Highlights

Regional dynamics significantly shape the Sling repairing service Market, reflecting varying levels of industrial maturity, infrastructure investment, and regulatory enforcement. North America currently holds a substantial market share, driven by stringent OSHA regulations and the widespread adoption of certified lifting procedures across the construction, energy, and manufacturing sectors. The market here is highly mature, characterized by established, large-scale service providers offering sophisticated NDT capabilities and comprehensive digital asset management programs. Demand in the U.S. and Canada is consistently high due to mandatory annual or semi-annual inspection cycles for critical lifting gear, creating a highly reliable and lucrative service environment.

Europe mirrors North America in its regulatory maturity, governed by EU directives and specific national standards like LOLER in the UK, which mandate frequent thorough examinations of lifting equipment. The focus in European countries is often on highly specialized, technical repairs, particularly for the offshore wind energy sector and advanced manufacturing industries. Service providers often compete on turnaround speed and technical specialization, leading to high levels of technological investment in automated testing rigs and mobile service units, particularly across industrial hubs in Germany, the UK, and Scandinavia.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate during the projection period. This expansion is fueled by massive infrastructure projects, rapid growth in manufacturing output (especially in China, India, and Southeast Asia), and increasing awareness and gradual enforcement of industrial safety standards. While regulatory enforcement historically lagged behind Western markets, the increasing presence of multinational corporations demanding global safety standards is accelerating the adoption of certified repair services. This region presents substantial opportunities for market entry and scaling, particularly for services related to high-volume construction and maritime logistics.

Latin America and the Middle East & Africa (MEA) represent emerging markets for sling repair services. In Latin America, growth is tied to mining activities and infrastructure spending, demanding robust wire rope and chain sling repair. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits demand primarily concentrated in the oil and gas, petrochemicals, and maritime logistics sectors. These markets require specialized, often mobile, service capabilities to support remote industrial sites. Economic diversification initiatives in the Middle East are also bolstering the construction sector, creating a secondary source of sustained demand for certified maintenance services.

- North America: Market dominance due to strict OSHA and ANSI regulations; high adoption of advanced NDT and digital documentation.

- Europe: Driven by LOLER and EU directives; specialized demand from offshore energy and advanced manufacturing sectors.

- Asia Pacific (APAC): Highest growth potential fueled by massive infrastructure and manufacturing expansion; increasing regulatory compliance.

- Middle East & Africa (MEA): Demand tied heavily to the oil & gas and maritime logistics sectors; emphasis on mobile, rapid-response repair services.

- Latin America: Growth concentrated in mining, construction, and heavy industry sectors, requiring resilient repair solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sling repairing service Market.- Mazzella Companies

- Lift-It Manufacturing Co., Inc.

- Sling-Choker Manufacturing Ltd.

- Bishop Lifting Products, Inc. (A Group of SBP Holdings)

- Unirope Ltd.

- Ashley Sling, Inc.

- KITO Group

- The Crosby Group Inc.

- Caldwell Group

- WireCo WorldGroup

- Lifting Gear Hire (LGH)

- SpanSet Group

- Certi-Fit (A division of various regional service providers)

- Hercules SLR Inc.

- Suncor Stainless, Inc.

- Pewag International GmbH

- Certex UK (Subsidiary of Axel Johnson International)

- Grip-Rite Sling & Rigging

- Safetylift Rigging Services

- Continental Western Corporation

Frequently Asked Questions

Analyze common user questions about the Sling repairing service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulations mandate the use of certified sling repair and inspection services?

Regulations governing sling repair and inspection are primarily dictated by industrial safety authorities globally, including the Occupational Safety and Health Administration (OSHA) in the US, the Provision and Use of Work Equipment Regulations (PUWER) and Lifting Operations and Lifting Equipment Regulations (LOLER) in Europe, and standards set by organizations like the American Society of Mechanical Engineers (ASME B30.9). These regulations mandate periodic, certified inspections to ensure the safety factor and operational integrity of lifting slings.

Is repairing an industrial sling more cost-effective than replacement?

In most industrial applications, certified repair is significantly more cost-effective than outright replacement, particularly for high-value assets like large wire ropes or alloy chain slings. Repair services extend the asset's lifespan, reduce capital expenditure, and minimize environmental waste. The cost-benefit ratio is optimized when preventative maintenance is implemented, catching damage early before it requires extensive refurbishment.

What advanced technologies are used to ensure the quality of sling repairs?

Advanced repair services utilize Non-Destructive Testing (NDT) methods, including Magnetic Rope Testing (MRT), ultrasonic testing, and advanced phased array inspections to accurately assess internal structural integrity. Digital twin technology and centralized asset management systems are also employed to track repair history and usage data, ensuring verifiable quality assurance and compliance documentation post-repair.

How does the end-use industry affect the type of repair service required?

The end-use industry dictates the required material and complexity of the repair. For instance, the maritime and offshore sectors require specialized corrosion-resistant treatments and heavy-duty wire rope splicing, while the aerospace industry demands high-precision synthetic sling sewing and stringent cleanliness standards to avoid contamination. Services must be customized to meet the unique stress factors of each environment.

What is the typical turnaround time for certified sling repair and recertification?

Turnaround time varies based on the sling type, extent of damage, and regional service capacity, typically ranging from 24 hours for simple inspections and minor repairs to several weeks for complex, major refurbishment of specialized slings. Service providers often offer rapid, mobile emergency repair services to minimize critical client downtime, which is a major factor in customer satisfaction and contract retention.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager