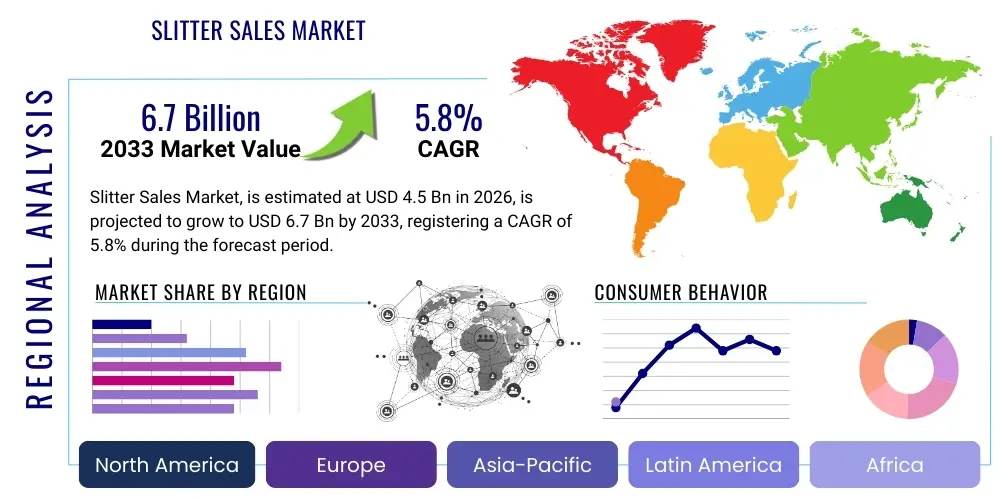

Slitter Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438754 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Slitter Sales Market Size

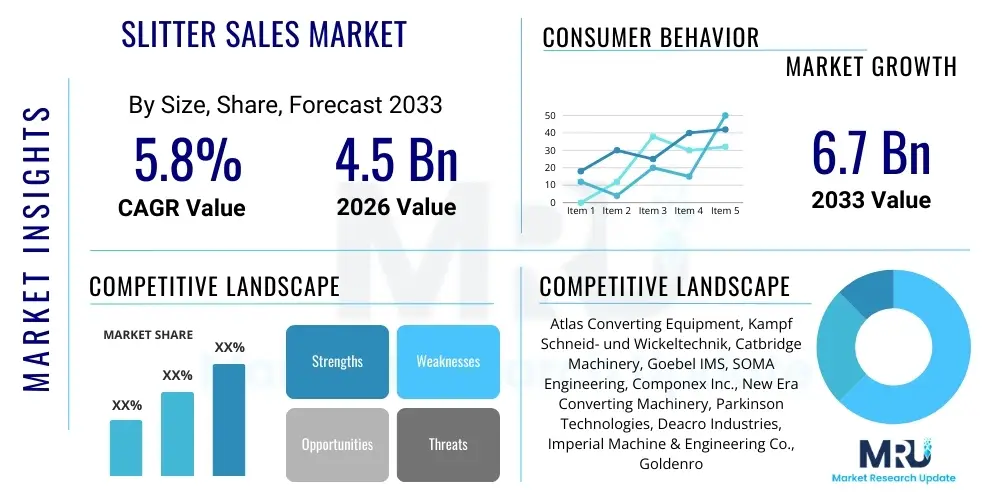

The Slitter Sales Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily attributed to the expanding global packaging industry, increased demand for flexible materials, and continuous technological advancements in automated web handling and precision cutting equipment. Market participants are focusing on developing high-speed, multi-functional slitting machinery capable of processing diverse materials, which significantly contributes to efficiency improvements across various end-use sectors, particularly in Asia Pacific where industrialization is rapid.

Slitter Sales Market introduction

The Slitter Sales Market encompasses the manufacturing, distribution, and utilization of industrial machinery designed to cut wide rolls of material, known as 'webs,' into several narrower rolls. Slitting machines are critical components in the converting industry, processing materials such as paper, film, foil, textiles, nonwovens, and flexible packaging substrates with high precision and speed. The primary functionality of a slitter involves unwinding a large master roll, passing the web through cutting mechanisms (shear, razor, or crush cutting), and then accurately rewinding the material onto multiple smaller cores. This fundamental process ensures materials meet specific dimensional requirements for downstream manufacturing or end-user applications, making slitters indispensable assets in material conversion operations globally.

Major applications driving the demand for slitting machines include flexible packaging production for food and beverages, labeling and printing processes, metal coil processing in construction and automotive sectors, and specialized textile manufacturing. The inherent benefits of modern slitting equipment—such as minimized material waste, enhanced operational throughput, superior edge quality, and adaptability to varying web tensions and thicknesses—are key drivers for market growth. Furthermore, the shift towards sustainable and lightweight packaging materials necessitates sophisticated slitting technologies that can handle delicate and bio-degradable films without compromising integrity or speed, thereby promoting investment in advanced machinery.

Key driving factors accelerating the market expansion include the exponential growth of e-commerce, which fuels demand for protective and flexible packaging solutions, especially in emerging economies. Concurrent growth in the electronics industry, requiring high-precision slitting for functional films and battery components, further bolsters sales. Manufacturers are increasingly integrating features like automatic tension control systems, laser guidance for alignment, and automated core loading/unloading to enhance productivity and reduce reliance on manual labor, positioning high-automation slitters as the preferred choice across mature and developing markets alike.

Slitter Sales Market Executive Summary

The Slitter Sales Market is characterized by robust business trends focusing on digitalization, modular machine design, and energy efficiency. Business trends indicate a strong move toward Industry 4.0 integration, where slitting machines are equipped with IoT sensors for predictive maintenance, real-time diagnostics, and seamless integration into enterprise resource planning (ERP) systems. Manufacturers are prioritizing the development of versatile slitting platforms that can quickly switch between different cutting methods and material types, thus minimizing downtime and maximizing operational flexibility for converters. The competitive landscape is intensely focused on patenting high-precision automation features, particularly concerning rewind tension accuracy and waste minimization techniques, influencing purchasing decisions heavily.

Regional trends highlight Asia Pacific (APAC) as the dominant growth region, propelled by massive investments in new manufacturing infrastructure, particularly in China, India, and Southeast Asian nations where consumer goods consumption and subsequent packaging demand are surging. North America and Europe maintain stable demand, driven by stringent quality requirements, regulatory pushes for sustainable materials, and the necessity to replace aging machinery with faster, more efficient automated systems. The focus in developed regions is on minimizing carbon footprints and adopting advanced servo-driven slitting solutions that offer superior power efficiency compared to conventional hydraulic or pneumatic systems.

Segment trends reveal that the demand for multi-shaft and turret slitter rewinders is accelerating, primarily due to their superior efficiency in high-volume, continuous processing environments, especially within the flexible packaging and adhesive tape industries. Segmentation by material processing shows robust growth in film and foil slitting due to their pervasive use in protective and barrier applications, while the paper and board segment remains foundational but experiences moderate growth. Furthermore, the market for refurbished and used equipment provides a cost-effective alternative, though the shift towards high-speed, new machinery with comprehensive warranties and technical support remains the principal trend among large-scale enterprises seeking operational excellence.

AI Impact Analysis on Slitter Sales Market

Users commonly question how Artificial Intelligence (AI) and Machine Learning (ML) can improve the operational efficiency and predictive maintenance of slitting machinery, focusing on reducing material waste and optimizing throughput. Key concerns revolve around the cost and complexity of integrating AI platforms into existing machine infrastructure and the availability of skilled labor capable of managing these sophisticated systems. Users express expectations that AI will enable true closed-loop control over variables like web tension, knife positioning, and rewind density, transforming reactive maintenance schedules into highly accurate predictive models. The overarching theme is the pursuit of 'lights-out' manufacturing processes where human intervention is minimized, leading to higher product quality and significant long-term operational savings in the highly specialized converting sector.

- AI-powered Predictive Maintenance: Analyzing vibration, temperature, and current draw data from motors and bearings to predict component failure, significantly reducing unscheduled downtime and optimizing maintenance schedules.

- Optimized Slitting Recipes: Machine Learning algorithms analyze historical material properties and environmental conditions to auto-adjust cutting parameters (speed, tension, blade pressure) in real-time for maximum yield and edge quality.

- Waste Reduction through Vision Systems: AI-integrated vision systems detect subtle defects (pinholes, streaks, contaminants) on the running web and automatically map these imperfections, instructing the slitter to adjust cutting paths or initiate quality rejection protocols before the roll is finished.

- Enhanced Production Scheduling: ML optimizes complex production schedules, considering factors such as material availability, machine capacity, changeover times, and specific customer requirements to maximize overall equipment effectiveness (OEE).

- Automated Tension Control: Neural networks fine-tune complex differential winding tensions across multiple slit widths and varying roll diameters, ensuring perfectly wound rolls even with heterogeneous or difficult-to-handle film types.

DRO & Impact Forces Of Slitter Sales Market

The dynamics of the Slitter Sales Market are influenced significantly by robust drivers such as the burgeoning demand from the flexible packaging sector, accelerated by e-commerce expansion and urbanization, compelling converters to invest in faster, high-capacity machinery. However, market growth faces restraints, primarily high capital investment required for advanced, automated slitters and the growing challenge of sourcing highly specialized components and trained technicians globally. Opportunities are plentiful in the development of specialized machinery for emerging materials like bio-plastics and thin films used in advanced electronics (e.g., battery electrodes and display films), offering manufacturers lucrative niche markets. The combined effect of these factors creates a strong pull-impact force driven by technological necessity and a moderate push-impact force due to economic constraints and skilled labor shortages, resulting in a market that rewards innovation and operational efficiency.

Segmentation Analysis

The Slitter Sales Market is comprehensively segmented based on various factors, including the type of machinery utilized, the mechanism of operation, the materials processed, and the specific application sector. This multi-dimensional segmentation allows market stakeholders to precisely target their product development and sales strategies towards high-growth areas. The primary classifications delineate between single-shaft and multi-shaft rewinders, catering to low and high-volume operations, respectively. Furthermore, the distinction between surface, center, and differential winding mechanisms is crucial, as each is optimized for specific material properties and final roll quality requirements. The market is increasingly fragmented by application, with the flexible packaging and specialty film sectors demanding the highest degree of technological sophistication and customization.

- By Product Type:

- Single-shaft Slitters

- Twin-shaft Slitters (Duplex Slitters)

- Surface Slitters

- Center Wind Slitters

- Differential Wind Slitters

- Turret Slitter Rewinders

- By Cutting Mechanism:

- Razor Slitting

- Shear Slitting (Rotary Knives)

- Crush/Score Slitting

- By Material Processed:

- Plastic Films (BOPP, PET, PE, PVC)

- Paper and Board

- Metal Foils (Aluminum, Copper)

- Laminates and Flexible Packaging Materials

- Nonwovens and Textiles

- Adhesive Tapes and Labels

- By Application:

- Flexible Packaging Industry

- Printing and Labeling

- Paper & Pulp Converting

- Metals and Foil Processing

- Specialty Film Manufacturing (e.g., Electronics, Medical)

Value Chain Analysis For Slitter Sales Market

The value chain for the Slitter Sales Market begins with upstream activities, predominantly involving the procurement of high-precision components such as servo motors, drives, programmable logic controllers (PLCs), high-grade steel alloys for cutting elements, and sophisticated sensor technology. Key upstream suppliers include global automation giants and specialized component manufacturers whose quality dictates the performance and longevity of the final slitter machine. Efficiency at this stage is crucial, as the fluctuating costs and geopolitical security of raw materials directly impact the final machine price and lead times. Manufacturers must maintain robust supplier relationships and strict quality control over all incoming components to ensure the reliability required for continuous industrial operation.

The core segment of the value chain is the manufacturing and assembly phase, where slitter producers integrate the procured components, perform complex machining of frames and rollers, and implement proprietary software for web handling and tension control. Direct distribution channels are often favored, especially for large, custom-engineered slitting lines, involving direct sales teams, technical consultations, installation, and extensive post-sale support and training. Indirect channels, typically utilized for standard models or replacement parts, include regional distributors and specialized machinery agents who possess deep local market knowledge and can manage inventory and expedited delivery requirements effectively.

Downstream analysis focuses on the end-users, primarily the converting industry, which utilizes these machines to produce sellable goods like packaged foods, industrial films, and printed media. The performance of the slitter directly influences the quality and efficiency of the end product, creating a strong feedback loop demanding continuous technological upgrades from the slitter manufacturers. Aftermarket services, including spare parts supply, maintenance contracts, and periodic retrofitting or upgrade services, represent a significant and profitable portion of the overall market value chain, extending the product lifecycle and reinforcing the relationship between the supplier and the customer.

Slitter Sales Market Potential Customers

Potential customers for slitting machinery are broadly defined as any organization involved in processing large rolls of flexible materials to specific widths and diameters. The primary buying segment includes large-scale flexible packaging converters and printing houses that operate high-speed, 24/7 production lines requiring automated, durable, and highly precise slitter rewinders. These end-users prioritize machines offering high throughput rates, minimal changeover times, and sophisticated waste management features to optimize profitability in a high-volume, low-margin environment. Decision-making units within these organizations typically involve plant managers, maintenance engineers, and procurement specialists focused on total cost of ownership (TCO) rather than just initial purchase price.

Another significant customer base comprises specialty material manufacturers, such as producers of advanced battery separators, optical films for displays, and medical-grade materials. These buyers demand ultra-high precision slitters capable of handling extremely thin or sensitive substrates without generating contaminants or microscopic edge flaws. The requirements here lean heavily towards technical specifications, cleanroom compatibility, and verifiable precision, often necessitating highly customized machine builds. Furthermore, the paper and corrugated board industry remains a foundational customer segment, although their demand trends lean towards robust, high-torque slitting systems designed for heavier materials and high-speed core cutting operations.

The burgeoning market of e-commerce packaging solution providers is emerging as a rapidly expanding customer group, requiring versatile slitters to handle complex laminated structures, protective films, and adhesive materials used in shipping and logistics. This segment often seeks modular and scalable solutions that can adapt quickly to changing packaging trends and material specifications. Ultimately, the potential customers span the entire gamut of material converting—from massive multinational corporations replacing aging assets to smaller, specialized niche players investing in their first high-end precision machinery to gain a competitive edge.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Converting Equipment, Kampf Schneid- und Wickeltechnik, Catbridge Machinery, Goebel IMS, SOMA Engineering, Componex Inc., New Era Converting Machinery, Parkinson Technologies, Deacro Industries, Imperial Machine & Engineering Co., Goldenrod Corp., Pasquato S.R.L., Jennerjahn Machine, Accuweb Inc., Bimec S.r.l., Nishimura Manufacturing Co. Ltd., A.Celli Group, Schiavi Macchine, FAE S.r.l., Elite Cameron. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slitter Sales Market Key Technology Landscape

The Slitter Sales Market is characterized by intense technological evolution, shifting towards fully automated, high-precision winding and cutting systems. A primary technological focus involves advanced web tension control systems, moving beyond basic pneumatic brakes to highly sophisticated, closed-loop servo-driven systems. These systems utilize load cells and proprietary algorithms to maintain precise and consistent tension throughout the slitting run, which is essential for processing sensitive or stretch-prone materials like thin films and specialty composites. Furthermore, the adoption of laser-guided core positioning systems and automatic knife setting modules has drastically reduced machine setup times, which previously constituted a major bottleneck in productivity, thus increasing the practical throughput of modern machines.

Another crucial element of the current technology landscape is the integration of differential winding technology, particularly within duplex turret slitters. Differential winding allows the machine to precisely control the tension on each individual rewind reel, even when the thickness or density of the material being slit varies across the web width. This capability is vital for converters dealing with metallized films, delicate laminates, and adhesive materials, where minor variations can lead to telescoped or otherwise unusable final rolls. Manufacturers are heavily investing in proprietary software interfaces that offer intuitive touch-screen controls, remote diagnostics capabilities, and compatibility with factory-wide network protocols (e.g., OPC UA) to facilitate data exchange and operational transparency, aligning with smart factory initiatives.

The cutting technology itself is also evolving, with increasing demand for robust shear slitting systems that offer superior longevity and edge quality compared to razor or crush cutting, particularly for heavier materials and high-speed operations. Moreover, safety standards are being enhanced through integrated machine guarding, light curtains, and emergency stop protocols that are compliant with global standards (e.g., CE, OSHA), ensuring operator safety without hindering machine accessibility for maintenance. The combination of precision mechanical engineering with state-of-the-art electronics and software defines the competitive edge in the contemporary slitter sales market, emphasizing reliability, speed, and versatility across a broad range of converting applications.

Regional Highlights

The global Slitter Sales Market exhibits heterogeneous growth patterns influenced by industrial maturity, regulatory frameworks, and consumer demand dynamics across key geographical regions. Asia Pacific (APAC) currently holds the largest market share and is projected to demonstrate the fastest growth rate during the forecast period. This dominance is underpinned by massive population growth, escalating disposable incomes driving consumer packaged goods (CPG) consumption, and extensive government initiatives promoting domestic manufacturing and infrastructure development. Countries such as China, India, and Vietnam are the epicenters of this growth, fueling immense demand for affordable, high-volume slitting machinery in the flexible packaging and nonwovens sectors.

North America and Europe represent mature markets characterized by replacement demand and the shift towards high-automation, highly efficient equipment. Demand in these regions is less driven by capacity expansion and more by the need for operational excellence, stringent quality control, and compliance with increasingly demanding environmental regulations, particularly concerning sustainable and bio-degradable packaging materials. European manufacturers are leaders in high-precision, specialized slitting lines tailored for medical, aerospace, and advanced material applications, often commanding premium prices for their sophisticated technology and engineering standards. The emphasis is heavily placed on Industry 4.0 integration and energy conservation features.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions that show promising growth, albeit from a smaller base. Growth in LATAM is tied to stabilizing economies and foreign investments in local manufacturing facilities, particularly in Brazil and Mexico. The MEA region, notably the UAE and Saudi Arabia, is experiencing demand fueled by large-scale infrastructure projects and diversification efforts away from hydrocarbon dependence, leading to increased activity in the construction and industrial packaging sectors. However, procurement decisions in these regions are often sensitive to fluctuating currency exchange rates and require flexible financing solutions from slitter suppliers.

- North America: Focus on high-speed, fully automated slitting lines; strong replacement cycle; demand driven by specialty films, adhesive tapes, and rigorous quality standards in food packaging.

- Europe: Market maturity necessitates continuous innovation; emphasis on precision machinery for demanding applications (medical, automotive components); leading adoption of energy-efficient servo technology and sustainable material handling capabilities.

- Asia Pacific (APAC): Dominant region driven by capacity expansion, new factory setups, and rapid growth in flexible packaging; strong demand for affordable, high-volume turret slitters in emerging economies; major hub for electronics film slitting.

- Latin America (LATAM): Moderate growth supported by stabilization in key economies (Mexico, Brazil); increasing localized converting operations necessitate investment in mid-range and high-performance slitting equipment.

- Middle East and Africa (MEA): Growth linked to industrialization and infrastructure development projects; focus on durable machines for industrial packaging, nonwovens, and local food packaging needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slitter Sales Market.- Atlas Converting Equipment Ltd.

- Kampf Schneid- und Wickeltechnik GmbH & Co. KG

- Goebel IMS (part of the IMS Technologies Group)

- Catbridge Machinery

- SOMA Engineering s.r.o.

- New Era Converting Machinery, Inc.

- Parkinson Technologies Inc. (Marshall and Williams, Dusenbery)

- Deacro Industries Ltd.

- Bimec S.r.l.

- Nishimura Manufacturing Co. Ltd.

- A.Celli Group S.p.A.

- Pasquato S.R.L.

- Jennerjahn Machine, Inc.

- Componex Inc.

- Goldenrod Corp.

- Dienes Corporation

- Tidland Corporation (Maxcess International)

- Schiavi Macchine S.p.A.

- Elite Cameron

- Universal Converting Equipment Ltd.

- Gap Engineering Ltd.

- Mario Cotta S.p.A.

- ASHE Converting Equipment

- Winderosa (Division of Accuweb)

- Accuweb, Inc.

Frequently Asked Questions

Analyze common user questions about the Slitter Sales market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the current demand for high-speed slitting machinery?

The primary driver is the exponential expansion of the flexible packaging sector, fueled by global e-commerce growth and the need for fast, high-volume production of food wraps, labels, and industrial films. Additionally, the replacement cycle for older, less efficient machinery in developed markets necessitates investment in modern, automated, high-speed slitters that minimize waste and maximize throughput.

How does the choice between shear, razor, and crush slitting mechanisms impact the end product quality?

The cutting mechanism is crucial for quality. Shear slitting (rotary knives) provides the most precise, dust-free edge for thicker materials like paperboard and heavy films, essential for high-quality rewind rolls. Razor slitting is favored for thin plastic films and delicate materials but can generate dust. Crush (score) slitting is generally used for non-critical, heavier paper and provides a lower-cost solution, but often results in less precise edges and compressed material.

Which regional market is experiencing the highest growth rate for slitter sales, and why?

The Asia Pacific (APAC) region is experiencing the highest growth rate, primarily driven by rapid industrialization, burgeoning domestic consumer markets in China and India, and significant capital investments in new manufacturing plants. This expansion directly translates into a massive demand for new slitting and converting equipment to support localized production of consumer goods and packaging materials.

What role does Industry 4.0 play in the evolution of modern slitter rewinders?

Industry 4.0 integration enables smart slitting operations through connectivity, data analysis, and automation. Modern slitters incorporate IoT sensors for real-time monitoring, AI-driven predictive maintenance, and seamless data exchange with factory management systems (MES/ERP). This integration optimizes machine performance, reduces unplanned downtime, and allows for remote diagnostics and software-driven process adjustments.

What are the key technological advancements expected in slitting machinery over the next five years?

Key advancements will focus on superior automation, including fully automated core placement and finished roll handling systems, enhanced differential winding capabilities to handle complex composite materials, and increased use of vision systems coupled with AI for real-time defect detection and quality control. Furthermore, machines designed specifically to process sensitive bio-plastics and ultra-thin technical films will become commonplace.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager