SLS, SLES and LAS Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437443 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

SLS, SLES and LAS Market Size

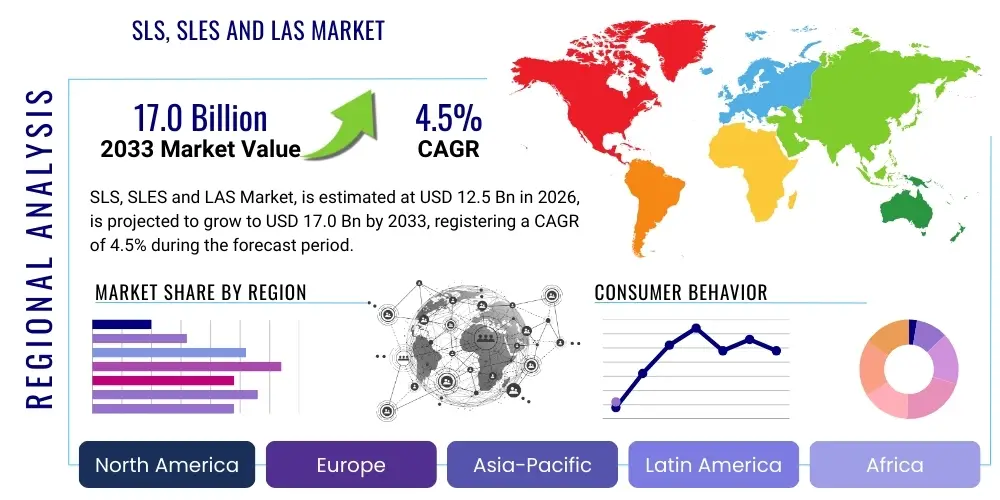

The SLS, SLES and LAS Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $17.0 Billion by the end of the forecast period in 2033.

SLS, SLES and LAS Market introduction

The global market for Sodium Lauryl Sulfate (SLS), Sodium Laureth Sulfate (SLES), and Linear Alkylbenzene Sulfonate (LAS) encompasses a diverse range of surfactants critical for the formulation of cleaning agents, personal care products, and industrial applications. These compounds function primarily as anionic surfactants, known for their excellent foaming, emulsifying, and detergency properties. SLS and SLES are widely utilized in shampoos, body washes, and toothpaste due to their strong cleansing capabilities and cost-effectiveness. LAS, historically a staple in laundry detergents, remains one of the largest volume synthetic surfactants globally, prized for its high performance in hard water and its biodegradability profile compared to older surfactant generations. The foundational strength of this market lies in the indispensable role these materials play across the consumer goods sector.

The major applications for these surfactants are broadly segmented into household cleaning, industrial cleaning, and personal care. In household cleaning, LAS dominates the laundry detergent landscape, while SLES is increasingly favored in dishwashing liquids and surface cleaners for its milder nature compared to SLS. The personal care segment, particularly in emerging economies with growing middle-class populations, drives significant demand for SLES, which offers effective cleansing with reduced irritation compared to SLS. Furthermore, SLS finds specialized uses in pharmaceutical preparations and in certain fire-fighting foams, demonstrating the technical versatility of this class of chemical compounds. Market growth is inherently linked to global population expansion, urbanization, and improvements in sanitation standards, particularly in Asia Pacific.

Driving factors for the stable growth of the SLS, SLES, and LAS market include the consistent demand for cleaning and hygiene products, which saw an accelerated increase following the global health crisis. The continuous innovation in detergent formulations, aiming for concentrated and sustainable products, also necessitates high-performance surfactants. However, the market faces headwinds from regulatory pressures concerning the use of sulfates (particularly in sensitive personal care segments) and the push toward bio-based or "green" surfactants. Despite these challenges, the established efficacy and relatively low cost of LAS and SLES ensure their continued dominance in volume consumption globally, particularly where cost-efficiency is paramount for mass-market products.

SLS, SLES and LAS Market Executive Summary

The SLS, SLES, and LAS market exhibits robust business trends driven by stable demand from the fast-moving consumer goods (FMCG) sector and shifting preferences towards liquid and concentrated cleaning formats. Key business imperatives for manufacturers include securing stable feedstock supply (petrochemicals for LAS, and palm/coconut oil derivatives for SLS/SLES), optimizing sulfonation processes, and navigating increasing scrutiny regarding chemical safety and environmental impact. Strategic initiatives focus on operational efficiency and vertical integration to maintain competitive pricing, especially in commodity segments. Innovation is centered on improving the environmental profile of the products, such as developing milder SLES alternatives or enhanced LAS formulations that perform better at lower wash temperatures, catering to consumer demand for energy efficiency.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market due to rapid urbanization, increasing disposable incomes, and the corresponding spike in demand for packaged personal and household cleaning products, especially in China and India. North America and Europe, characterized by market maturity, exhibit growth primarily driven by product premiumization, replacement of traditional cleaning agents with specialized formulations, and strict adherence to sustainability mandates, which favors bio-degradable LAS over certain older alternatives. Manufacturers are increasingly shifting production capacity to cost-effective locations within APAC, while high-value R&D and specialized product development remain concentrated in Western markets to serve niche demand for high-end personal care ingredients.

Segmentation trends indicate that the Application segment—specifically Household Detergents and Personal Care—retains the largest share. Within the Type segmentation, SLES is experiencing higher growth compared to SLS due to its superior mildness profile, making it the preferred choice for skin-contact applications. The growth of LAS remains steady, underpinned by the massive scale of the global laundry market, though challenges related to the supply chain volatility of crude oil derivatives can influence pricing. End-use segmentation highlights a strong reliance on the residential consumer sector, emphasizing the market's resilience to short-term industrial fluctuations but sensitivity to global economic shifts affecting consumer purchasing power.

AI Impact Analysis on SLS, SLES and LAS Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the SLS, SLES, and LAS market predominantly revolve around optimizing manufacturing efficiency, enhancing R&D for sustainable formulations, and improving supply chain resilience against feedstock price volatility. Users frequently ask how machine learning algorithms can predict optimal sulfonation reaction parameters to maximize yield and purity, minimizing waste generation during the production of SLES and LAS. Another major theme is the application of AI in chemical informatics to rapidly screen and design novel, environmentally friendly surfactant molecules that can potentially replace or complement traditional sulfates, addressing ongoing regulatory and consumer pressures regarding eco-toxicity and biodegradability. Furthermore, there is significant interest in using predictive analytics to forecast demand fluctuations across diverse geographical markets, allowing manufacturers to adjust inventory and distribution strategies dynamically, ensuring timely supply to the major FMCG clients.

AI's primary influence is seen across three core areas: process optimization, predictive maintenance, and novel formulation development. In sulfonation plants, AI-driven process control systems monitor variables like temperature, flow rate, and reagent concentration in real-time, drastically reducing energy consumption and ensuring consistent product quality (purity). This precision reduces batch variation, which is crucial for high-volume commodity chemicals like LAS. Predictive maintenance models analyze sensor data from pumps, reactors, and storage tanks to schedule maintenance preemptively, thereby minimizing unplanned downtime, which is extremely costly in continuous chemical processing operations. This sophisticated level of operational control enhances overall capacity utilization and capital efficiency across the manufacturing footprint.

For R&D and supply chain management, AI offers transformative potential. Machine learning models analyze vast datasets of chemical structures, efficacy testing results, and toxicological profiles to accelerate the discovery of high-performing surfactant blends suitable for specific applications (e.g., cold-water laundry detergents). In the complex supply chain involving petrochemical derivatives and oleochemical feedstocks (palm kernel oil), AI provides enhanced visibility. Algorithms integrate geopolitical data, weather patterns, commodity market indices, and transportation logistics to create highly accurate price and availability forecasts for critical raw materials, allowing procurement teams to hedge risks and optimize purchasing schedules, thereby stabilizing production costs for downstream users.

- Process Optimization: AI models regulate exothermic sulfonation reactions for optimal yield and reduced energy usage.

- Predictive Maintenance: Sensor data analysis minimizes production downtime in continuous flow reactors.

- Formulation Innovation: Machine learning accelerates the design and screening of new mild and bio-based surfactant alternatives.

- Supply Chain Resilience: Predictive analytics forecast feedstock price volatility and optimize global inventory allocation.

- Quality Control: Automated visual inspection systems ensure the consistent physical characteristics of finished sulfate and sulfonate products.

DRO & Impact Forces Of SLS, SLES and LAS Market

The dynamics of the SLS, SLES, and LAS market are shaped by a complex interplay of robust demand drivers rooted in consumer needs and stringent regulatory constraints pushing for sustainable alternatives. The primary driver remains the continuous, high-volume requirement from the global FMCG sector, bolstered by population growth and rising sanitation awareness, particularly across Asia Pacific and Latin America. However, the market is significantly restrained by increasing scrutiny from environmental agencies and consumer groups concerning the potential irritation profile of SLS and the petrochemical origin of certain LAS components, leading to a strong push towards natural, milder, and readily biodegradable alternatives. Opportunities lie in leveraging technological advancements to improve the sustainability profile of existing surfactants and expanding application scope in industrial processes like enhanced oil recovery and specialty construction chemicals. These forces dictate the competitive landscape, compelling major manufacturers to invest heavily in process improvements and green chemistry initiatives to secure long-term viability.

Drivers: Persistent growth in the global population and disposable income, particularly in emerging markets, directly translates to increased consumption of personal care and household cleaning products. SLES, in particular, benefits from the shift towards liquid detergents and premium shampoos where high foaming and mildness are desired attributes. Furthermore, the effectiveness and low cost of LAS continue to make it the staple ingredient in powder and liquid laundry detergents globally, ensuring stable demand. The rebound in industrial manufacturing also contributes, as these surfactants are essential emulsifiers and wetting agents in textile, leather, and mining industries. Manufacturers focus on maximizing economies of scale to maintain the affordability necessary for mass-market penetration, securing their position against higher-priced natural alternatives.

Restraints: The market faces considerable restraints primarily centered on environmental and health concerns. Regulatory bodies in Europe and North America impose limits on certain chemical residues, prompting manufacturers to seek alternatives to conventional SLS/SLES/LAS. Consumer preference for "sulfate-free" personal care products, driven by perceptions of skin and scalp irritation, forces product substitution or reformulation in high-value segments. Moreover, the dependence of LAS and some SLS/SLES feedstock on petrochemicals subjects the market to significant price volatility associated with crude oil, impacting manufacturing margins and cost predictability. The high energy consumption required for the sulfonation process also poses a sustainability and cost restraint.

Opportunities: Opportunities arise from the necessity to innovate. Developing bio-based or "green" LAS alternatives derived from non-petroleum sources offers a pathway to future regulatory compliance and market differentiation. There is a burgeoning market for concentrated and ultra-concentrated formulations, which requires specialized, highly efficient surfactants like advanced SLES grades that perform optimally in minimal liquid volumes. Geographic expansion into underdeveloped regions in Africa and Southeast Asia, coupled with establishing localized production facilities to minimize logistical costs and comply with regional trade agreements, presents substantial growth avenues. Furthermore, the application of these surfactants in sustainable agricultural formulations, acting as adjuvants or wetting agents, represents an underexplored niche market with high potential.

- Drivers:

- Consistent growth in global personal hygiene and household cleaning product demand.

- High effectiveness and cost-efficiency compared to non-ionic and cationic surfactants.

- Rapid urbanization and increasing disposable incomes in Asia Pacific.

- Shift towards concentrated liquid detergent formats requiring high-performance surfactants.

- Restraints:

- Stringent environmental regulations concerning biodegradability and chemical residues.

- Consumer-driven demand for "sulfate-free" products in the premium personal care segment.

- Volatile pricing and supply risks associated with petrochemical and oleochemical feedstocks.

- Perceived skin and eye irritation associated with high concentrations of SLS.

- Opportunities:

- Development and commercialization of bio-based and milder surfactant alternatives.

- Expansion of application scope into industrial processes like enhanced oil recovery (EOR).

- Technological advancements in sulfonation processes to improve purity and reduce energy footprint.

- Market penetration in untapped emerging economies in Africa and parts of Latin America.

- Impact Forces:

- High Threat of Substitutes (Moderate-High): Driven by the growth of milder, specialty, and naturally derived surfactants.

- Bargaining Power of Buyers (High): Large FMCG corporations dominate procurement, demanding competitive pricing and consistent quality.

- Bargaining Power of Suppliers (Moderate-High): Determined by volatility in crude oil and oleochemical markets (feedstock suppliers).

- Intensity of Competitive Rivalry (High): Market is characterized by major global chemical producers competing aggressively on price and scale.

Segmentation Analysis

The SLS, SLES, and LAS market segmentation provides a granular view of consumption patterns, driven primarily by product functionality and end-use application. The market is broadly categorized by Type (SLS, SLES, LAS) and Application (Household Detergents, Personal Care, Industrial Cleaners, Others). LAS generally dominates in volume due to its pervasive use in large-scale laundry detergent manufacturing globally, while SLES leads in value growth due to its expanding role in higher-margin personal care formulations. Understanding these segment dynamics is crucial for manufacturers in strategically allocating production capacity and targeting high-growth areas. The shifting emphasis toward sustainability dictates that specialty SLES grades with higher purity and optimized environmental profiles command a premium, influencing the value distribution across the segments.

Within the Application segment, Household Detergents, encompassing laundry and dishwashing products, is the largest consumer of LAS and SLES, reflecting basic global consumer needs. The Personal Care segment is the primary growth engine for SLES, driven by the expanding middle class, especially in urbanized centers, demanding a variety of shampoos, body washes, and facial cleansers. Segmentation based on geography highlights Asia Pacific’s quantitative dominance, while North America and Europe lead in terms of regulatory complexity and demand for specialized, milder product variants. The industrial and institutional (I&I) cleaning segment, though smaller, offers stable demand for concentrated LAS and SLS formulations necessary for heavy-duty degreasing and cleaning operations across manufacturing and hospitality sectors.

Further analysis of the Type segmentation reveals distinct utility and consumer perception profiles. SLS, while highly effective and inexpensive, is increasingly substituted by SLES due to consumer sensitivity. SLES production, involving ethoxylation, yields a milder compound essential for high-frequency contact products. LAS remains unchallenged in high-volume, cost-sensitive laundry detergent production where performance and environmental fate are balanced. These differentiators mandate distinct R&D strategies; for instance, LAS innovation focuses on improving cold-water performance and enzyme compatibility, while SLES research targets achieving maximal mildness and bio-based sourcing to meet consumer trends in personal care. The segmentation confirms the market's maturity but also its dynamism, requiring constant adaptation to evolving consumer trends and regulatory mandates.

- By Type:

- Sodium Lauryl Sulfate (SLS)

- Sodium Laureth Sulfate (SLES)

- Linear Alkylbenzene Sulfonate (LAS)

- By Application:

- Household Detergents (Laundry, Dishwashing)

- Personal Care (Shampoo, Body Wash, Toothpaste)

- Industrial & Institutional (I&I) Cleaners

- Other Applications (Agriculture, Construction, Textiles)

- By Form:

- Liquid (Concentrated Solutions)

- Powder/Granules

- Paste

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For SLS, SLES and LAS Market

The value chain for SLS, SLES, and LAS is characterized by several complex chemical processing stages, beginning with the sourcing of key feedstocks. Upstream analysis focuses heavily on the procurement of petroleum derivatives for Linear Alkylbenzene (LAB)—the precursor for LAS—and the sourcing of fatty alcohols, typically derived from palm kernel or coconut oil, which are essential for manufacturing SLS and SLES. Volatility in global commodity markets, particularly crude oil and palm oil, exerts significant pressure on raw material costs, defining the initial cost structure. Major chemical manufacturers often strive for vertical integration, either by producing the intermediate LAB or by securing long-term contracts for fatty alcohols, thereby mitigating price fluctuation risks and ensuring stability in supply required for continuous operation.

Midstream activities involve sophisticated chemical conversion processes, specifically sulfonation and, for SLES, ethoxylation. Sulfonation, a capital-intensive and highly technical process, converts LAB into LAS or fatty alcohols into SLS, followed by neutralization. SLES requires an additional ethoxylation step, which is more specialized and often requires proprietary technology. Efficiency at this stage, managed increasingly through advanced automation and AI controls, determines the final purity, consistency, and yield of the surfactants. Major players with advanced manufacturing capabilities and large production scales realize substantial cost advantages through economies of scale, making entry barriers high for new competitors in the core manufacturing segment.

Downstream analysis involves distribution and end-use application. The final surfactant products are sold primarily as concentrated liquids or powders through a mix of direct sales to large Fast-Moving Consumer Goods (FMCG) multinational corporations (MNCs) and through indirect distribution channels involving specialized chemical distributors for smaller or regional manufacturers. Direct sales, common for high-volume transactions, emphasize strong long-term relationships and technical support, whereas indirect channels serve geographically fragmented markets and smaller industrial users. The final step involves formulation by the FMCG companies into finished consumer products (e.g., detergents, shampoos), where the performance of the surfactant directly influences the final product's market success. Logistics efficiency, given the volume and sometimes hazardous nature of the concentrated chemicals, is a critical component of the distribution channel.

SLS, SLES and LAS Market Potential Customers

The primary consumers and end-users of SLS, SLES, and LAS are multinational and regional companies operating within the Fast-Moving Consumer Goods (FMCG) sector. These companies rely heavily on these surfactants as core ingredients for their mass-market product lines, particularly laundry detergents, dishwashing liquids, and a broad range of personal care items. Key potential customers are procurement departments that manage high-volume chemical sourcing, demanding rigorous quality control, guaranteed supply continuity, and highly competitive pricing. Given the commodity nature of these surfactants, purchasing decisions are highly sensitive to cost-performance ratios, making supplier relationships critical for maintaining consistent profit margins on their finished products.

Beyond the consumer goods giants, significant market potential resides in the Industrial & Institutional (I&I) cleaning sector, comprising entities such as commercial laundries, hospitality chains, healthcare facilities, and manufacturing plants. These customers require specialized, highly concentrated cleaning solutions for heavy-duty applications where superior degreasing and wetting capabilities are paramount. Additionally, specialty end-users include the oil and gas industry (for enhanced oil recovery formulations), agricultural chemical manufacturers (where surfactants act as emulsifiers and adjuvants), and the construction sector (for concrete admixtures). These specialized segments often require customized grades of SLS or LAS and represent higher-value, lower-volume opportunities for specialized chemical producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $17.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Stepan Company, Dow Chemical Company, Clariant AG, Solvay SA, Evonik Industries AG, Kao Corporation, Galaxy Surfactants Ltd., Croda International PLC, India Glycols Limited, Pilot Chemical Company, Sasol Limited, Huntsman Corporation, Lion Specialty Chemicals Co., Ltd., Godrej Industries, Sinopec Jinling Petrochemical, Akzo Nobel N.V., P&G Chemicals, Enaspol a.s., Oxiteno S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

SLS, SLES and LAS Market Key Technology Landscape

The core technology underpinning the SLS, SLES, and LAS market is sulfonation, a chemical reaction that attaches a sulfate or sulfonate group to a fatty alcohol or linear alkylbenzene, respectively. Modern production relies heavily on continuous film reactors (like falling film sulfonators) which offer high conversion efficiency, better heat dissipation, and superior control over reaction parameters compared to older batch processes. Advanced sulfonation technology minimizes the formation of undesirable by-products, ensuring high purity levels required by the stringent personal care segment, particularly for SLES. Manufacturers continually invest in optimizing these reactors and incorporating highly efficient cooling systems to manage the exothermic nature of the reaction, enhancing safety and reducing utility costs, which is paramount in volume commodity production.

A crucial technological development, especially for SLES, is the ethoxylation process, which occurs prior to sulfation. Ethoxylation involves reacting fatty alcohols with ethylene oxide to increase the surfactant’s hydrophilic nature and reduce its irritancy profile. Technological advancements here focus on improved catalyst systems, such as alkaline earth metal catalysts, which allow for better control over the degree of ethoxylation (mole ratios). Controlling the mole ratio is essential for tailoring SLES variants (e.g., SLES-1EO, SLES-2EO) to specific applications, offering milder properties for high-end shampoos. Furthermore, the integration of computational fluid dynamics (CFD) modeling helps in designing more efficient reactor geometries, improving mass transfer and mixing within the complex multi-phase systems used for these reactions.

Beyond core synthesis, the key technology landscape is increasingly shaped by environmental and sustainability-focused innovations. This includes the development of proprietary methods for producing bio-based fatty alcohols from renewable resources, reducing dependence on petroleum. Advances in downstream processing, such as highly efficient drying technologies (e.g., spray drying for powdered LAS) and improved neutralization techniques, focus on reducing salt content, which is a key impurity affecting formulation stability and consumer acceptance. Furthermore, the adoption of continuous monitoring systems utilizing spectroscopy and process analytical technology (PAT) ensures real-time quality control, crucial for minimizing waste and maximizing resource utilization in a high-volume, cost-competitive environment.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and most dynamic market globally for SLS, SLES, and LAS, propelled by demographic expansion and rapid industrialization. Countries like China and India represent massive consumer bases where the affordability and effectiveness of LAS and SLES drive high-volume consumption in both laundry and basic personal care items. Investment in local manufacturing capacity is robust, aiming to satisfy regional demand and benefit from lower operational costs. Regulatory environments are evolving but generally less restrictive than in Western markets regarding sulfate usage, supporting strong growth projections.

- North America: The market is characterized by maturity and high consumer purchasing power, leading to demand for premium, specialized products. Growth is driven by innovation focused on high-performance concentrates and specialized industrial applications. The "sulfate-free" movement exerts significant pressure on SLS and standard SLES grades in the personal care sector, promoting the use of milder alternatives, though SLES remains crucial in household cleaning due to its performance.

- Europe: Europe is defined by stringent environmental regulations (e.g., REACH) emphasizing biodegradability and chemical safety, favoring highly pure SLES and highly biodegradable LAS grades. Sustainability is a major regional driver, pushing manufacturers towards bio-based feedstocks and energy-efficient production processes. The mature market relies on incremental innovation and product differentiation to maintain growth, focusing heavily on ecological labeling and compliance.

- Latin America (LATAM): This region offers substantial growth potential, driven by improving economic conditions and increased focus on hygiene standards. Brazil and Mexico are key consumer markets utilizing significant volumes of LAS and SLES in basic cleaning products. Market dynamics often mirror APAC in terms of high-volume, cost-sensitive demand, though infrastructure challenges can affect distribution efficiency.

- Middle East and Africa (MEA): Growth in MEA is highly correlated with infrastructure development and access to clean water, boosting demand for basic hygiene products. The region serves as a growing export market, with local production primarily concentrated in the Gulf Cooperation Council (GCC) countries due to access to petrochemical feedstocks (LAB production).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the SLS, SLES and LAS Market.- BASF SE

- Stepan Company

- Dow Chemical Company

- Clariant AG

- Solvay SA

- Evonik Industries AG

- Kao Corporation

- Galaxy Surfactants Ltd.

- Croda International PLC

- India Glycols Limited

- Pilot Chemical Company

- Sasol Limited

- Huntsman Corporation

- Lion Specialty Chemicals Co., Ltd.

- Godrej Industries

- Sinopec Jinling Petrochemical

- Akzo Nobel N.V.

- P&G Chemicals

- Enaspol a.s.

- Oxiteno S.A.

Frequently Asked Questions

Analyze common user questions about the SLS, SLES and LAS market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between SLS, SLES, and LAS?

SLS (Sodium Lauryl Sulfate) is a strong anionic surfactant used primarily in high-foaming products, known for being potentially more irritating. SLES (Sodium Laureth Sulfate) is the ethoxylated version of SLS, offering milder properties, making it preferred for most personal care applications. LAS (Linear Alkylbenzene Sulfonate) is a petrochemical-derived surfactant dominating the high-volume laundry and dishwashing detergent market due to its excellent cost-performance ratio and biodegradability.

Why are consumers increasingly seeking "sulfate-free" personal care products?

The "sulfate-free" trend stems from consumer perception that SLS and, to a lesser extent, SLES can cause skin irritation, dryness, or strip natural oils, particularly in individuals with sensitive skin or scalp conditions. While SLES is milder, many consumers opt for entirely sulfate-free alternatives, driving innovation towards non-ionic or amphoteric surfactants in premium segments.

Which geographic region dominates the consumption of these surfactants?

Asia Pacific (APAC), particularly China and India, dominates the global SLS, SLES, and LAS market in terms of volume consumption. This dominance is driven by high population density, rapid urbanization, growing consumer awareness of hygiene, and the necessity for cost-effective mass-market cleaning products across the region.

What role does sustainability play in the future growth of the LAS market?

Sustainability is critical. Future growth for LAS requires continuous technological improvement focused on enhancing its ultimate biodegradability and reducing the environmental footprint associated with its petrochemical feedstock sourcing. Research focuses on highly linear LAS variants and process improvements to meet increasingly strict environmental regulations, especially in Europe.

How does the price of crude oil impact the SLS, SLES, and LAS industry?

The price of crude oil significantly impacts the cost structure of LAS, as its primary precursor, Linear Alkylbenzene (LAB), is a petrochemical derivative. Fluctuations in crude oil prices directly translate into raw material cost volatility for LAS manufacturers. While SLES feedstocks are often oleochemical (plant-derived), their pricing can also be indirectly affected by energy costs and supply chain dynamics linked to petrochemicals.

The market analysis concludes that while the SLS, SLES, and LAS segments face challenges related to feedstock volatility and the consumer-driven push for milder alternatives, their foundational role in global sanitation and hygiene ensures sustained demand. Strategic success for market participants hinges on leveraging operational efficiencies, focusing on geographical expansion in emerging economies, and accelerating R&D efforts to produce high-purity, environmentally compliant grades of SLES and LAS, maintaining a competitive edge through optimized production scale and regulatory adherence.

Future market trends indicate a divergence where SLES continues to gain market share in the premium personal care sector due to its favorable mildness profile, whereas LAS maintains its indispensable position in high-volume, cost-sensitive household cleaning. SLS demand, while stable in industrial uses, is likely to diminish further in mainstream consumer products due to substitution efforts. This bifurcation highlights the need for manufacturers to maintain diversified product portfolios and technical expertise across the sulfonation value chain to cater to both the mature, regulatory-heavy Western markets and the rapidly expanding, cost-conscious Asian markets.

The imperative for manufacturers includes achieving higher levels of vertical integration to secure stable access to both oleochemical and petrochemical precursors and incorporating advanced manufacturing technologies, such as AI-driven process control, to maximize resource efficiency. The competitive environment remains intense, characterized by capacity expansion announcements by major Asian and global chemical players seeking to solidify their positions through scale and geographic reach. Successfully navigating the sustainability transition, potentially through investment in large-scale bio-based surfactant production capabilities, will be the determining factor for long-term market leadership in the coming decade, shaping the fundamental chemical composition of future cleaning and personal care products worldwide.

Market stakeholders must continuously monitor shifts in consumer perceptions, particularly concerning product transparency and ingredient sourcing, which are increasingly influential factors in purchasing decisions globally. Regulatory evolution, particularly in relation to wastewater treatment standards and limitations on residual 1,4-dioxane (a potential SLES byproduct), will necessitate continuous investment in compliance and quality assurance protocols. The overall resilience of the SLS, SLES, and LAS market is strongly tied to global economic health, urbanization rates, and public health initiatives, ensuring its continued relevance as a core component of the global chemical industry infrastructure.

The technical differentiation between SLES grades (varying ethoxylation levels) and the constant improvement in LAS linearity and purity are central to maintaining market relevance against competition from specialty non-ionic and alkyl polyglucoside (APG) surfactants. Investment in proprietary sulfonation catalysts and reactor technology will likely define the margins for major producers, allowing them to extract maximum value from volatile feedstocks while satisfying the stringent quality requirements of tier-one FMCG buyers. The convergence of digital technology and chemical manufacturing, as highlighted by the AI impact analysis, promises further gains in efficiency and responsiveness to dynamic market conditions.

The global distribution network, which is vital for delivering these high-volume chemicals, requires strategic optimization, focusing on bulk transportation and localized storage hubs, particularly within high-growth regions like Southeast Asia. Manufacturers that can minimize logistical costs and reduce environmental transportation impact will gain a significant competitive advantage. This focus on logistics and distribution scalability is essential for supporting the relentless growth of the major FMCG customers who operate on global scales and require immediate, reliable supply chains for continuous manufacturing operations. Ultimately, the market trajectory is upward, constrained only by regulatory compliance and the sustained ability of producers to manage raw material volatility effectively while meeting evolving demands for milder and greener formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager