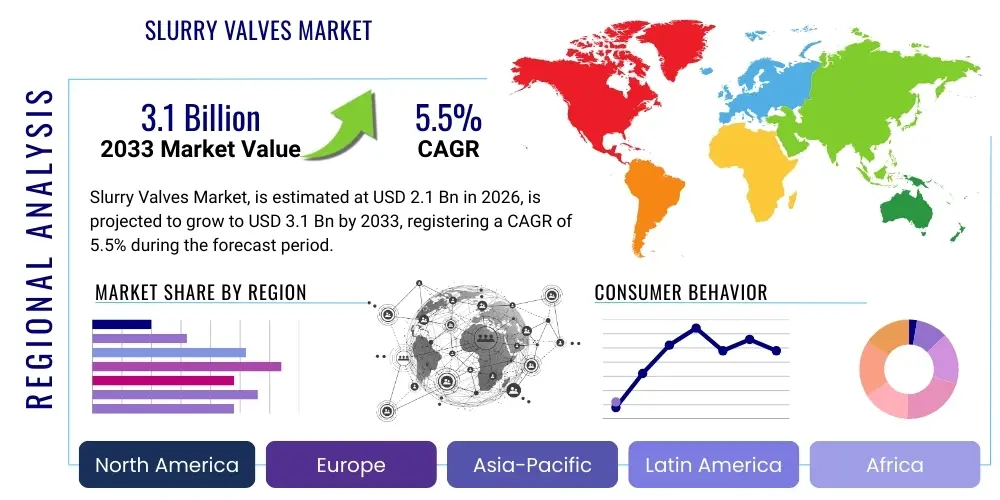

Slurry Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439095 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Slurry Valves Market Size

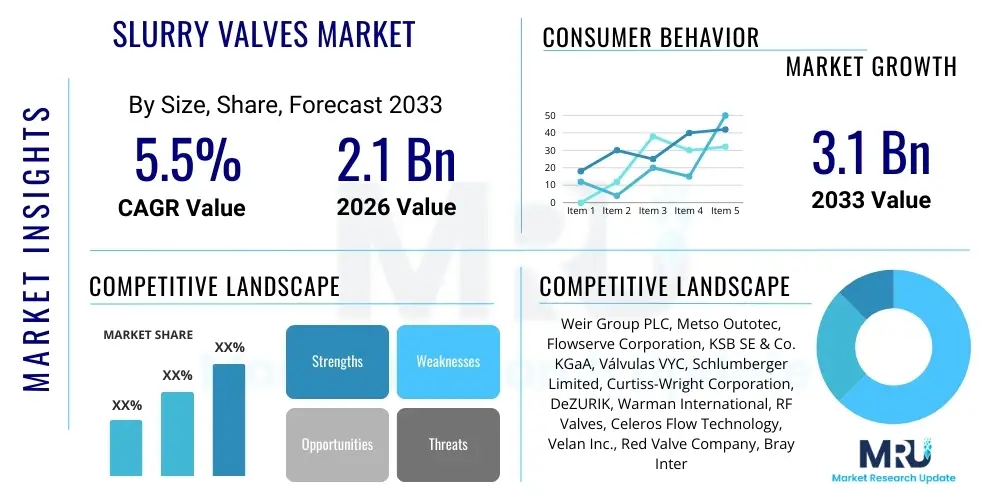

The Slurry Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 2.1 billion in 2026 and is projected to reach USD 3.1 billion by the end of the forecast period in 2033. This growth is fundamentally driven by the escalating demand for raw materials across developing economies and the sustained investment in infrastructure projects globally that rely heavily on the efficient transport and processing of abrasive and corrosive fluids.

Slurry Valves Market introduction

The Slurry Valves Market encompasses a highly specialized segment of industrial flow control equipment designed specifically to manage fluids containing high concentrations of suspended solids, known as slurries. These valves are critical components in industries such as mining, mineral processing, oil sands, power generation (ash handling), and wastewater treatment, where standard valves would quickly fail due to abrasive wear, erosion, or clogging. Key product types include knife gate valves, pinch valves, ball valves, and diaphragm valves, each engineered with robust materials like specialized alloys, ceramics, or elastomers to withstand severe operational environments.

Slurry valves serve the primary function of regulating, isolating, or diverting the flow of highly viscous, abrasive, or corrosive media, ensuring operational integrity and minimizing costly downtime associated with valve maintenance and replacement. Their performance is paramount to the economic viability of large-scale industrial operations, particularly in sectors dealing with commodities such as copper, gold, iron ore, and heavy crude derivatives. The design focus is typically on full port geometry, replaceable liners, and external sealing mechanisms to prevent contact between the slurry and the valve’s critical components, thereby maximizing service life.

Major applications driving market expansion involve tailings management in mining, the hydraulic transportation of ash in coal-fired power plants, and chemical processing where crystallization and particulate buildup are routine challenges. The inherent benefits of specialized slurry valves, including extended operational lifespan, enhanced process safety, and reduced total cost of ownership (TCO) compared to generic valves, cement their necessity. Key driving factors include increasing global mining activities stimulated by the energy transition (e.g., battery metals) and stringent regulatory requirements compelling industries to adopt leak-proof and environmentally sound flow control solutions.

- Product Description: Specialized flow control devices engineered for abrasive and corrosive fluids containing suspended solids.

- Major Applications: Mineral processing, mining (tailings and concentrate), oil sands extraction, power generation (fly ash), and heavy chemical manufacturing.

- Benefits: Enhanced resistance to abrasion and corrosion, prolonged service life, reduced maintenance frequency, and improved process reliability.

- Driving Factors: Expansion of global mining projects, increasing investment in industrial infrastructure, and the necessity for highly durable components in severe service environments.

Slurry Valves Market Executive Summary

The Slurry Valves Market is experiencing robust growth fueled by cyclical upswings in global commodity prices and significant modernization efforts in mature industrial sectors, particularly in North America and Europe. Business trends indicate a strong shift toward valves incorporating smart technologies, such as integrated sensors and predictive maintenance capabilities, moving beyond simple mechanical function to offer crucial operational data. Manufacturers are focusing on modular designs that allow for easy replacement of liners and wear parts, thereby minimizing labor time and increasing overall plant efficiency. Furthermore, strategic mergers and acquisitions among leading global players are concentrating expertise in specialized material science and digital integration, aiming to capture the high-margin aftermarket service sector.

Regionally, the Asia Pacific (APAC) market maintains its dominance due to extensive mining operations, rapid industrialization, and massive investment in infrastructure and metallurgical processing facilities, particularly in China, India, and Australia. While APAC leads in volume, North America and Europe demonstrate leadership in technological adoption, driving demand for premium, highly automated slurry valves capable of operating under extreme pressure and temperature conditions, often driven by stringent environmental regulations mandating zero-leakage performance. The Middle East and Africa (MEA) region is emerging as a critical growth center, supported by large-scale phosphate, copper, and bauxite extraction projects, necessitating high-specification slurry handling equipment.

Segment trends highlight the increasing prominence of pinch valves due to their exceptional sealing capabilities and complete isolation from media contact, making them ideal for highly abrasive applications. Material segmentation shows a growing preference for engineered ceramic and specialized rubber linings, which offer superior wear resistance compared to traditional metals, justifying a higher upfront investment through significantly reduced lifecycle costs. The application segment remains heavily dominated by the mining and mineral processing industry, but wastewater treatment, specifically in highly urbanized areas, is rapidly expanding its share, driven by the need to efficiently manage sludge and biosolids.

AI Impact Analysis on Slurry Valves Market

Common user inquiries regarding AI’s impact on the Slurry Valves Market typically center on themes of predictive failure, maintenance scheduling optimization, and achieving autonomous flow control in harsh environments. Users are primarily concerned with how AI-driven analytics can transition maintenance strategies from time-based or reactive to condition-based and predictive, thereby significantly reducing unexpected downtime and maximizing valve lifespan. There is high interest in the integration of edge computing capabilities with slurry valve sensors to instantaneously process vibration, pressure, and temperature data, allowing for immediate corrective actions before catastrophic failure occurs. Furthermore, users question the ability of AI algorithms to compensate for the erratic and non-linear wear patterns inherent to slurry service, which historically challenges traditional mechanical monitoring systems.

The direct integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is poised to fundamentally transform the operational efficiency and reliability of slurry valve systems. By analyzing historical performance data, real-time sensor inputs (such as acoustic emissions, pressure differentials, and actuator load data), and environmental conditions, AI systems can accurately model the unique erosion profile of a specific valve installation. This capability allows operators to predict the precise point of liner or component failure with high accuracy, enabling Just-in-Time maintenance interventions. Such precision minimizes the cost of premature component replacement while entirely avoiding the extremely expensive downtime associated with sudden operational halts in high-throughput facilities.

Beyond predictive maintenance, AI is enabling the development of smarter, autonomous slurry handling systems. ML models are being deployed to optimize valve position and throttling behavior in real-time, compensating for variations in slurry density, velocity, and concentration without human intervention. This optimization ensures continuous pipeline integrity, prevents ‘water hammer’ effects, and reduces energy consumption by maintaining optimal flow dynamics. This shift transforms slurry valves from passive isolation devices into integrated, intelligent components essential for the overall efficiency and digitalization of modern industrial processes, fulfilling a core requirement of Industry 4.0 adoption.

- Enhanced Predictive Maintenance (PdM) through ML analysis of vibration and acoustic signatures.

- Optimization of valve throttling and position control based on real-time slurry rheology data.

- Development of Digital Twin models for simulating abrasive wear and stress tests under virtual conditions.

- Reduction in unplanned operational downtime and associated maintenance costs.

- Improved safety and environmental compliance by preemptively addressing potential leakage points.

DRO & Impact Forces Of Slurry Valves Market

The Slurry Valves Market dynamics are governed by a complex interplay of growth drivers (D), inherent restraints (R), strategic opportunities (O), and powerful external impact forces. Key drivers include the revitalization of global mining activities, particularly focused on strategic metals necessary for the renewable energy transition (lithium, cobalt, copper), which inherently require extensive slurry transport systems. Another significant driver is the aging industrial infrastructure in developed nations, necessitating replacement and upgrades with high-performance, modern valve technology. Opportunities lie primarily in the customization of materials—leveraging specialized polymers and ceramics for hyper-abrasive applications—and the expansion into emerging markets such as specialized agricultural processing and deep-sea mining exploration.

Restraints on market growth largely revolve around the high initial capital expenditure (CAPEX) associated with high-quality, corrosion-resistant slurry valves, which can deter smaller operators. Furthermore, the volatility of commodity prices directly impacts investment decisions in new mining and processing plants, creating cyclical demand fluctuations for industrial components. Complex regulatory landscapes concerning environmental discharge and safety standards, while acting as a long-term driver for high-specification equipment, can restrain immediate deployment due to lengthy approval processes and high compliance costs. These factors compel manufacturers to continuously innovate both material science and digital integration.

Impact forces significantly shaping the market include the global trend toward digitalization (Industry 4.0), which accelerates the adoption of smart valves with remote diagnostic capabilities. The increasing focus on sustainability and tailings dam management exerts pressure on the market to deliver highly reliable, zero-leakage valves to prevent environmental contamination, driving demand for diaphragm and pinch valves. Geopolitical instability and trade wars affect supply chains for critical raw materials (e.g., specialized steel alloys and elastomers), impacting production costs and lead times. Successfully navigating these forces requires manufacturers to establish robust, regionally diversified supply chains and invest heavily in proprietary material research.

Segmentation Analysis

The Slurry Valves Market segmentation provides a granular view of demand patterns based on valve type, material, operation method, and end-use application, enabling manufacturers and suppliers to accurately target specialized industrial requirements. The type segmentation, which includes Knife Gate, Pinch, Ball, and Diaphragm valves, reflects varying requirements for isolation, throttling, and resistance to specific media characteristics. Knife gate valves, being cost-effective and suitable for high solid content, currently hold a significant market share, while pinch valves are rapidly gaining traction due to their superior resistance to abrasion and ability to provide a complete, leak-tight seal, isolating the fluid entirely from the mechanical components.

Segmentation by material is crucial, as the longevity of a slurry valve is determined by its ability to withstand erosion and chemical attack. Materials are typically categorized into Elastomers (various rubbers, polyurethane), Metals (stainless steel, specialized alloys), and Ceramics (alumina, silicon carbide). The choice is heavily dependent on the pH, temperature, pressure, and particle size distribution of the slurry. Advances in engineering ceramics are opening new opportunities, particularly in high-velocity and highly corrosive applications where traditional metal components experience rapid degradation, offering unparalleled service life despite a higher initial cost.

Application segmentation confirms the dominance of the mining and mineral processing sector, covering diverse processes such as heap leaching, flotation, thickening, and tailings disposal. However, sectors like power generation (handling ash and gypsum slurries), chemical processing (managing crystallized products), and municipal wastewater treatment are providing stable growth trajectories. Understanding these specific application needs is vital for developing specialized valve liners and actuation systems that meet the rigorous operational demands unique to each industry segment, driving focused product development and customized solution provisioning.

- By Type: Knife Gate Valves, Pinch Valves, Ball Valves, Diaphragm Valves, Globe Valves, Check Valves, Custom-Engineered Valves.

- By Material: Elastomer Lined (Natural Rubber, Neoprene, EPDM), Metal Alloy (Stainless Steel, Duplex Steel, Nickel Alloys), Ceramic Lined, Polyurethane.

- By Operation: Manual Operated, Pneumatic Actuated, Electric Actuated, Hydraulic Actuated.

- By End-Use Industry: Mining and Mineral Processing, Power Generation, Chemical Processing, Oil and Gas (Oil Sands, Heavy Oil), Wastewater Treatment, Metallurgy.

Value Chain Analysis For Slurry Valves Market

The value chain for the Slurry Valves Market begins with the upstream sourcing of specialized raw materials, a phase characterized by the high dependence on global suppliers for high-grade metals (e.g., abrasion-resistant alloys, titanium) and specific engineered polymers and elastomers. Manufacturers must maintain robust relationships with suppliers capable of providing certified materials that meet rigorous specifications for pressure resistance, temperature tolerance, and chemical inertness. The manufacturing stage itself is highly capital-intensive, involving specialized casting, machining, and, crucially, proprietary lining processes (such as vulcanization or ceramic bonding) to ensure the internal components offer maximum protection against abrasive media. Quality control and testing protocols are exceptionally stringent at this stage, focusing on leak integrity and material adhesion.

The middle segment of the value chain involves sophisticated distribution channels, which are essential for connecting highly specialized product offerings to niche industrial end-users. Due to the severe service nature of slurry applications, distribution is often indirect, relying heavily on specialized industrial distributors, technical sales representatives, and system integrators who possess deep application knowledge specific to mining, power, or chemical sectors. These intermediary partners provide pre-sales technical consultation, ensuring the correct valve type and material are specified for the intended service. Direct sales channels are typically reserved for large-scale, custom-engineered projects or strategic accounts requiring proprietary manufacturing insights and direct engineering support, fostering stronger manufacturer-client relationships.

The downstream analysis focuses on the aftermarket service, which represents a significant and high-margin component of the market value. Slurry valves, by their nature, require frequent inspection, repair, and replacement of wear parts (liners, sleeves, seals). Therefore, the value chain extends into providing comprehensive maintenance services, spare parts inventory management, and specialized field service support. Companies that successfully offer long-term service agreements (LTSAs) and readily available spare parts—often leveraging digital platforms for expedited ordering and technical support—capture substantial value downstream, ensuring product longevity and maximizing customer satisfaction throughout the product lifecycle.

Slurry Valves Market Potential Customers

Potential customers for slurry valves are defined by their engagement in processes that involve the hydraulic transportation and processing of abrasive, viscous, or high-solid content fluids, primarily centering on the extraction and initial refinement of raw materials. The largest consumer base resides within the mining and mineral processing sector, including major global mining conglomerates, mid-tier exploration companies, and contract operators involved in the extraction of base metals (copper, nickel), precious metals (gold, silver), and industrial minerals (phosphate, iron ore). These operations rely on slurry valves for critical applications like tailings disposal, ore concentration circuits (flotation and filtration), and pipeline transport systems, making them highly sensitive to valve reliability and wear characteristics.

Beyond mining, the energy sector, particularly companies operating coal-fired power plants and oil sands extraction facilities, represents a substantial customer base. Power generation requires highly durable valves for handling fly ash, bottom ash, and gypsum slurries generated during emission control and combustion processes, where high temperatures and variable pH levels add complexity. Oil sands customers use slurry valves extensively in hydrotransport pipelines and froth treatment facilities to move highly abrasive oil-sand mixtures and tailings, demanding specialized valves capable of operating under high pressure and temperature variations inherent in bitumen extraction processes.

Furthermore, municipal and industrial wastewater treatment plants (WWTPs) are increasing their consumption of slurry valves for managing sludge, biosolids, and grit removal processes, particularly in large urban centers where operational continuity and environmental compliance are paramount. Chemical processing companies that deal with crystallization, filtration, and highly corrosive chemical slurries—such as those producing fertilizers or petrochemical intermediates—also constitute a crucial market segment. The purchasing decision across these customer groups is typically driven less by upfront cost and more by Total Cost of Ownership (TCO), focusing on reliability, maintenance frequency, and the manufacturer’s ability to provide technical support and rapid access to specialized wear parts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weir Group PLC, Metso Outotec, Flowserve Corporation, KSB SE & Co. KGaA, Válvulas VYC, Schlumberger Limited, Curtiss-Wright Corporation, DeZURIK, Warman International, RF Valves, Celeros Flow Technology, Velan Inc., Red Valve Company, Bray International, Richards Industrials, Clarkson Valve, Orbinox, Dixon Valve & Coupling, ITT Inc., Trelleborg AB |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slurry Valves Market Key Technology Landscape

The technological landscape of the Slurry Valves Market is rapidly evolving, driven by the dual needs for enhanced resistance against severe abrasion and the digitalization of flow control systems. Traditional slurry valves relied heavily on bulky, purely mechanical designs, but modern technological advancements focus intensely on advanced material science. Specifically, the adoption of engineered ceramics, such as high-density alumina and silicon carbide, for internal linings is a major technological shift. These materials offer wear resistance several orders of magnitude greater than traditional steel or even specialized alloys, dramatically extending the mean time between failure (MTBF) in the harshest applications, such as high-pressure hydro-transport and highly acidic leaching circuits. This requires manufacturers to invest in precision manufacturing techniques like advanced sintering and bonding processes to integrate these brittle, yet ultra-hard, components successfully into metallic valve bodies.

Another crucial technological development is the integration of Industrial Internet of Things (IIoT) sensors and smart actuation systems. Modern slurry valves are increasingly equipped with non-intrusive monitoring sensors that track parameters critical to valve health, including acoustic emissions (to detect internal erosion), actuator torque profiles, vibration analysis, and stem position feedback. These smart components transmit data wirelessly to centralized control systems or cloud-based platforms, enabling sophisticated condition monitoring. The use of electro-hydraulic and high-precision electric actuators further allows for highly granular control over flow rates, which is essential for managing non-Newtonian, high-viscosity slurries and preventing pipeline blockages or surge pressures often encountered in slurry pipelines.

Furthermore, technology is enhancing the serviceability of slurry valves. Manufacturers are moving towards highly modular and field-replaceable component designs, particularly for liners and sleeves in pinch and knife gate valves. Innovations in material compounding are yielding new generations of proprietary elastomers and polyurethanes with enhanced chemical resistance and elasticity, tailored specifically for applications dealing with fine particles and corrosive agents simultaneously. This technological pivot towards modularity and data-driven maintenance significantly reduces the required complexity and duration of field repairs, maximizing plant uptime and offering substantial operational savings to end-users.

Regional Highlights

Regional dynamics heavily dictate the demand and technological specifications for slurry valves. Asia Pacific (APAC) currently holds the dominant market share, primarily driven by massive, ongoing investment in mining and mineral processing in Australia, China, and Indonesia, which are major global sources of iron ore, coal, and base metals. The region’s rapid urbanization also fuels extensive infrastructure projects, requiring robust water and wastewater treatment facilities. While the APAC market is highly price-sensitive, there is a growing demand for high-performance valves due to increasing regulatory pressure and the shift towards complex ore bodies requiring more aggressive chemical processing.

North America and Europe represent mature markets characterized by stringent environmental regulations and a focus on technological sophistication and lifecycle cost optimization. In these regions, the demand is concentrated on highly automated, smart valves integrating IIoT technology for predictive maintenance and compliance monitoring. North America's growth is particularly stimulated by the oil sands industry and the modernization of aging municipal water infrastructure. European demand is bolstered by sophisticated chemical manufacturing and metallurgy industries requiring precision control in high-pressure, severe-service environments, often favoring materials like specialized ceramics and high-nickel alloys.

Latin America (LATAM) and the Middle East and Africa (MEA) are projected to exhibit high growth rates over the forecast period. LATAM, underpinned by significant copper, gold, and iron mining operations in Chile, Peru, and Brazil, is a crucial market, with demand driven by new project startups and expansions. The MEA region is seeing investment in mineral processing (e.g., phosphates in North Africa and copper in Sub-Saharan Africa) and massive desalination and wastewater treatment initiatives in the Gulf countries. These regions often face challenging logistical environments, making the reliability and durability of the valves, alongside strong local technical support, paramount buying considerations.

- Asia Pacific (APAC): Market dominance due to extensive mining (iron ore, coal) and infrastructure development; high volume demand.

- North America: Focus on technological adoption, IIoT integration, and high-specification valves for oil sands and mature mining sectors.

- Europe: Driven by stringent environmental regulations, advanced chemical processing, and demand for precision flow control systems.

- Latin America (LATAM): High growth potential fueled by large-scale copper and iron mining expansions in Chile and Brazil.

- Middle East and Africa (MEA): Emerging market growth tied to phosphate mining, water infrastructure development, and increased mineral exploration activity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slurry Valves Market.- Weir Group PLC

- Metso Outotec

- Flowserve Corporation

- KSB SE & Co. KGaA

- Válvulas VYC

- Schlumberger Limited

- Curtiss-Wright Corporation

- DeZURIK

- Warman International

- RF Valves

- Celeros Flow Technology

- Velan Inc.

- Red Valve Company

- Bray International

- Richards Industrials

- Clarkson Valve

- Orbinox

- Dixon Valve & Coupling

- ITT Inc.

- Trelleborg AB

Frequently Asked Questions

What are the primary differences between pinch valves and knife gate valves in slurry service?

Pinch valves provide complete isolation by collapsing an internal rubber sleeve, ensuring the moving parts never contact the media, making them superior for highly abrasive service. Knife gate valves use a sharp metal gate to cut through solids for isolation and are generally more cost-effective for applications where particle size is large but abrasion levels are moderate.

How does the choice of liner material impact the lifecycle cost of a slurry valve?

Liner material selection is critical as it dictates the wear life. While initial investment in advanced ceramic or high-grade polyurethane linings is higher than standard rubber or metal, their significantly extended resistance to erosion and chemical attack drastically reduces maintenance frequency and unexpected downtime, leading to a lower Total Cost of Ownership (TCO) over the valve's lifespan.

Which end-use industry drives the highest demand for specialized slurry valve solutions?

The mining and mineral processing industry consistently accounts for the largest share of demand, requiring slurry valves for high-volume, continuous operation in highly abrasive and often chemically corrosive environments associated with ore concentration, tailings management, and long-distance hydraulic transport.

What role does IIoT technology play in enhancing slurry valve performance?

IIoT sensors integrated into smart slurry valves enable continuous monitoring of operational parameters like vibration, acoustic emissions, and actuator performance. This data is fed into predictive maintenance algorithms, allowing operators to anticipate component failure due to erosion or wear, thereby scheduling maintenance precisely when needed and preventing costly unplanned shutdowns.

What are the key drivers for the adoption of ceramic-lined slurry valves?

The main drivers for ceramic linings are the need to handle slurries containing fine, hard particles (like silica or alumina) and the requirement for operation in high-velocity or high-temperature circuits where elastomer linings would fail rapidly. Ceramics offer unmatched resistance to sliding and impact wear, providing exceptional durability in severe service applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager