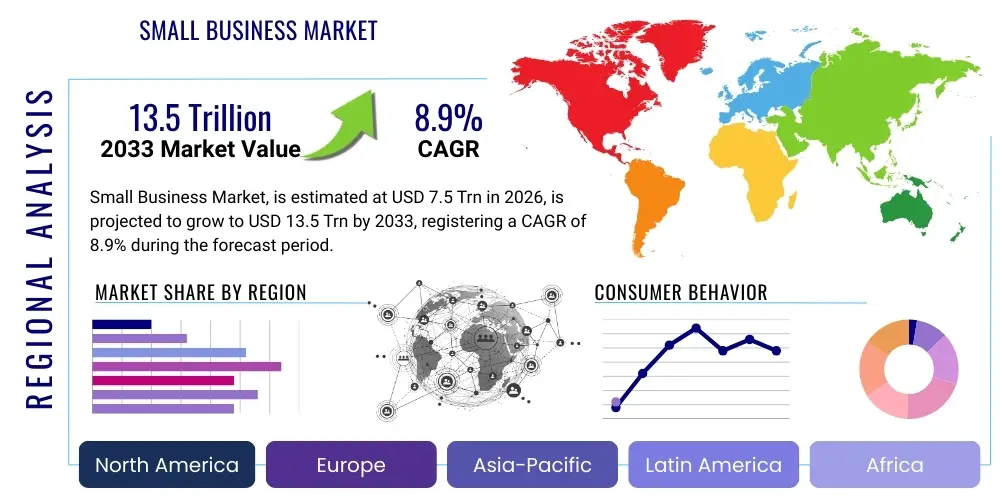

Small Business Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436566 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Small Business Market Size

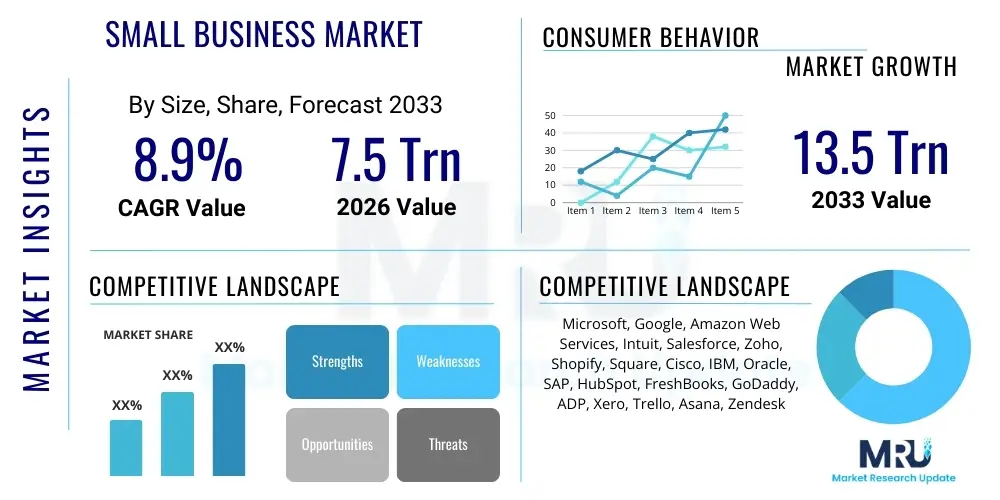

The Small Business Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $7.5 Trillion in 2026 and is projected to reach $13.5 Trillion by the end of the forecast period in 2033.

Small Business Market introduction

The Small Business Market encompasses the vast ecosystem of products, services, and technologies specifically designed to facilitate the operation, growth, and efficiency of enterprises typically employing fewer than 500 individuals. This market segment is characterized by a high degree of technological adoption, particularly in cloud-based solutions, integrated financial technology (FinTech), and advanced customer relationship management (CRM) tools. The primary objective driving growth in this sector is the necessity for small businesses to achieve economies of scale and operational sophistication comparable to larger enterprises, despite resource limitations. Products range from essential accounting software and human resources platforms to complex, industry-specific automation tools, addressing crucial operational bottlenecks such as inventory management, digital marketing execution, and regulatory compliance adherence.

Major applications of Small Business solutions span crucial operational areas including financial management (invoicing, payroll, taxation), customer engagement (omnichannel marketing and sales tracking), and supply chain optimization. The inherent benefits derived from these integrated solutions include enhanced productivity, reduced operational overheads through automation, and improved decision-making capabilities driven by real-time data analytics. Furthermore, the adoption of modern, scalable solutions significantly improves the competitive positioning of small entities in increasingly digitalized global markets, allowing them to serve geographically diverse customer bases and manage cross-border transactions efficiently. This accessibility to sophisticated tools, historically reserved for large corporations, is democratizing business processes and fueling entrepreneurial activity worldwide.

The market is predominantly driven by the accelerating pace of global digital transformation, spurred by the post-pandemic shift toward remote work and e-commerce dominance. Governments and financial institutions are increasingly supporting small and medium-sized enterprises (SMEs) through favorable lending policies and digitization grants, recognizing their critical role in economic stability and job creation. The driving factors also include the proliferation of highly flexible and subscription-based Software-as-a-Service (SaaS) models, which lower the barrier to entry for advanced technology adoption, coupled with heightened consumer expectations for seamless digital interactions, compelling small businesses to upgrade their technological infrastructure rapidly.

Small Business Market Executive Summary

The Small Business Market is undergoing profound transformations driven by rapid technological advancements and shifting economic structures. Current business trends indicate a strong move toward consolidated, all-in-one business management platforms that integrate financial, CRM, and operational functions into a single interface, reducing system complexity and vendor management overhead for owners. There is a notable surge in demand for embedded finance solutions and tailored vertical Software-as-a-Service (SaaS) offerings that address highly specific industry needs, moving away from generic, one-size-fits-all software. Furthermore, cybersecurity resilience and data privacy compliance have emerged as top priorities, driving increased investment in advanced security solutions accessible to resource-constrained small enterprises, reflecting a maturation of digital risk awareness across the segment.

Regionally, the market exhibits varied growth trajectories, with the Asia Pacific (APAC) region expected to register the fastest growth rate, fueled by massive government-led digitization initiatives in developing economies like India and Southeast Asian nations, alongside a rapidly expanding base of internet users and mobile-first entrepreneurs. North America and Europe, while already mature, continue to lead in the adoption of cutting-edge technologies, especially Artificial Intelligence (AI) and Machine Learning (ML) solutions for hyper-personalization and workflow automation. Latin America and the Middle East and Africa (MEA) are witnessing accelerating adoption due to improved internet penetration and the introduction of localized financial technology solutions tailored to specific regional payment infrastructures and regulatory environments, indicating global harmonization of technological standards.

Segmentation trends reveal that the deployment model is rapidly shifting toward cloud-native architectures, primarily driven by scalability, cost-effectiveness, and the need for remote access, making on-premise solutions increasingly niche. The services segment, particularly consulting and managed IT services focused on migration and integration support, is experiencing exponential growth, reflecting the skill gap many small businesses face when adopting complex digital tools. Among industry verticals, the Retail and E-commerce segment remains the largest consumer, driven by the intense competition requiring advanced point-of-sale (POS) systems, inventory optimization, and robust digital storefront capabilities. Simultaneously, specialized sectors like professional services and healthcare are demonstrating rapid uptake of compliant, purpose-built administrative and patient management systems.

AI Impact Analysis on Small Business Market

User inquiries regarding AI's impact on the Small Business Market primarily center around accessibility, affordability, and practical application. Common concerns revolve around whether AI tools are too expensive or complex for a small operation, focusing on the return on investment (ROI) in areas like customer service automation (chatbots), personalized marketing campaign generation, and predictive analytics for inventory and cash flow. Users are keenly interested in understanding how AI can democratize data insights, previously the domain of large enterprises, and whether job displacement will occur, especially in administrative and entry-level roles. The overarching theme is the expectation that AI should serve as an affordable, plug-and-play digital employee, handling routine tasks and providing strategic foresight without requiring significant internal technical expertise or substantial capital outlay, thereby leveling the competitive landscape.

The integration of artificial intelligence is fundamentally restructuring how small businesses operate, transforming customer interaction, internal efficiency, and market strategy. AI-powered tools are now commonly embedded within standard SaaS platforms, offering functionalities such as automated bookkeeping reconciliation, intelligent data entry, and advanced fraud detection, which drastically reduce the time spent on manual administrative tasks. This automation allows small business owners and their limited staff to reallocate resources toward core strategic activities like product development and high-touch customer relationships. The immediate impact is tangible in improved operational accuracy and faster response times, enhancing customer satisfaction and boosting overall productivity within highly constrained work environments.

Furthermore, AI significantly enhances the marketing and sales capabilities of small businesses. Predictive analytics, driven by machine learning algorithms, allows for granular customer segmentation and highly personalized communication, which dramatically increases the efficacy of marketing spend compared to traditional mass-market approaches. AI tools analyze purchasing patterns and behavioral data to forecast demand, helping small businesses avoid costly overstocking or stockouts, which is critical for maintaining healthy cash flow. This transformative technology is moving beyond simple automation to become a strategic asset, providing small businesses with data-driven insights necessary to compete effectively against industry giants, fostering an environment where agility and intelligent decision-making are paramount for survival and growth.

- AI streamlines administrative tasks, including invoicing, automated payroll processing, and regulatory compliance checks.

- Predictive analytics enables sophisticated demand forecasting, optimizing inventory levels and reducing waste.

- AI-powered chatbots and virtual assistants provide 24/7 basic customer support, enhancing service quality without significant staffing increases.

- Machine learning algorithms personalize marketing messages and product recommendations, increasing conversion rates and customer loyalty.

- Embedded AI enhances cybersecurity protocols, providing robust, scalable protection against modern digital threats and mitigating financial risk.

- Automated lead scoring and sales pipeline management improve the efficiency of small sales teams, focusing efforts on high-potential opportunities.

DRO & Impact Forces Of Small Business Market

The Small Business Market is shaped by a powerful interplay of Driving forces, Restraints, and Opportunities (DRO), collectively forming the critical Impact Forces that dictate market direction and growth velocity. Key drivers include the global mandate for digital transformation and the increasing affordability of cloud computing infrastructure, enabling small firms worldwide to adopt sophisticated tools previously inaccessible due to cost barriers. However, significant restraints persist, notably the chronic challenge of accessing adequate capital and managing complex, evolving regulatory frameworks across multiple jurisdictions. These forces create a dynamic environment where the opportunity lies primarily in exploiting niche technological capabilities, such as advanced data analytics and integration of AI, to achieve competitive differentiation and scale efficiently.

The primary drivers are fundamentally rooted in the democratization of technology. The prevalence of high-speed internet, coupled with the shift to flexible, subscription-based Software-as-a-Service (SaaS) models, drastically reduces the upfront investment required for adopting enterprise-grade applications. Additionally, the proliferation of specialized vertical SaaS solutions caters precisely to unique small business needs, eliminating the necessity for extensive customization. These drivers are bolstered by strong governmental support, including tax incentives and funding programs aimed at encouraging SME digitization, recognizing their vital role in post-recession economic recovery. The ease of setting up e-commerce operations further accelerates this adoption curve, pushing small businesses to embrace digital tools for global reach.

Conversely, significant restraints limit market potential, especially for micro-enterprises. These include the persistent challenge of capital availability, often resulting in delayed or insufficient technology investments. Moreover, the shortage of tech-savvy talent within small organizations forces reliance on external consultants or delays the full utilization of sophisticated systems. Regulatory complexity, particularly concerning cross-border data privacy (like GDPR), imposes substantial compliance burdens that disproportionately affect smaller entities lacking dedicated legal departments. Despite these hurdles, substantial opportunities exist in the underserved areas of industry-specific automation, the integration of FinTech services directly into operational platforms, and the utilization of low-code/no-code platforms that empower business users to develop their own applications without specialized programming skills, mitigating the internal skill gap restraint and driving bespoke innovation.

Segmentation Analysis

The Small Business Market is highly fragmented and segmented across multiple dimensions, including the type of Solution offered, the deployment model utilized, the industry vertical served, and the size of the enterprise (Micro, Small, or Medium). Analyzing these segments is crucial as the needs of a micro-business relying solely on mobile solutions differ significantly from those of a medium-sized manufacturing firm requiring complex, integrated Enterprise Resource Planning (ERP) systems. The shift toward cloud-based solutions represents the most transformative segment trend, driven by the demand for accessibility, operational efficiency, and minimized infrastructural costs. Furthermore, the market is increasingly defined by vertical specialization, where solutions are tailored precisely to the compliance and workflow requirements of sectors such as healthcare, finance, and specialized retail.

The solution segment is dominated by Software-as-a-Service (SaaS), encompassing critical applications like Customer Relationship Management (CRM), Financial Management Software (FMS), and Human Capital Management (HCM). Services, including implementation support, managed IT services, and ongoing training, represent the fastest-growing sub-segment, essential for overcoming the internal technical knowledge deficit common among small businesses. Hardware components, while stable, are evolving toward smart, integrated devices such as advanced Point-of-Sale (POS) systems and mobile computing devices optimized for business operations, often bundled with cloud software subscriptions. Understanding the interplay between software functionality and professional service requirements is key to grasping market consumption patterns.

Geographically, while mature markets like North America and Europe hold the largest market share due to early digital adoption and high technology spending, emerging economies in APAC and MEA are presenting unparalleled growth opportunities. This is due to a rapid leapfrogging of older technologies directly to cloud and mobile-native platforms, bypassing traditional infrastructure limitations. The competitive dynamics within each segment necessitate vendors offering flexible pricing structures and modular product designs that can scale seamlessly as a small business transitions through its growth stages, from startup to mid-market enterprise, ensuring solutions remain relevant and cost-effective across the entire business lifecycle.

- By Solution

- Software (SaaS, PaaS, IaaS)

- Services (Consulting, Integration, Managed Services, Training)

- Hardware (POS Systems, Networking Equipment, Mobile Devices)

- By Deployment Model

- Cloud-Based (Public Cloud, Private Cloud, Hybrid Cloud)

- On-Premise

- By Enterprise Size

- Micro Enterprises (1–9 employees)

- Small Enterprises (10–49 employees)

- Medium Enterprises (50–499 employees)

- By Industry Vertical

- Retail and E-commerce

- Healthcare and Life Sciences

- Financial Services and Insurance (BFSI)

- Manufacturing and Industrial

- Professional Services (Legal, Accounting, Consulting)

- Hospitality and Travel

- Construction and Real Estate

- By Application

- Customer Relationship Management (CRM)

- Financial Management and Accounting

- Enterprise Resource Planning (ERP)

- Human Capital Management (HCM)

- Supply Chain Management (SCM)

- Business Intelligence and Analytics

Value Chain Analysis For Small Business Market

The Value Chain for the Small Business Market is fundamentally composed of upstream technology providers, solution developers and integrators, and downstream distribution channels leading directly to the end-users. Upstream activities involve foundational technology development, including cloud infrastructure providers (IaaS), operating system developers, and specialized component manufacturers. These entities dictate the cost structure and technological capabilities available for integration. Downstream is heavily focused on ensuring last-mile delivery and localized support, often leveraging a network of resellers, certified partners, and value-added distributors (VADs) who specialize in tailoring complex solutions to meet the specific requirements and limited budgets of small businesses. Effective collaboration across this chain is essential for rapid innovation and competitive pricing.

Upstream analysis reveals a high degree of dependence on major hyperscale cloud providers, who offer the infrastructural backbone necessary for the rapid scaling and accessibility of SaaS products consumed by small businesses. Key vendors focus on developing modular, API-driven solutions that facilitate easy integration across different platforms, crucial for small businesses that often use multiple specialized applications rather than a single monolithic system. The manufacturing and software development phases emphasize cost efficiency and user experience (UX) design, as solutions must be intuitive and require minimal training to maximize adoption rates within non-technical small business environments. Strategic partnerships at this level, such as between accounting software providers and leading payment processors, create seamless ecosystem experiences.

Distribution channels in this market are predominantly indirect, relying heavily on digital marketplaces, app stores, and partner ecosystems. Direct sales often occur for large enterprise solutions but are less common for the mass small business market, which prefers self-service adoption models. Indirect channels, including Managed Service Providers (MSPs) and System Integrators (SIs), play a pivotal role in acting as trusted advisors, assisting small businesses with initial setup, data migration, and ongoing technical support, ensuring high adoption and retention rates. The rise of integrated digital platforms that offer trial periods and highly modular pricing structures (per user, per month) has significantly streamlined the purchasing process, directly impacting the velocity of downstream consumption and customer acquisition.

Small Business Market Potential Customers

The potential customers for the Small Business Market are defined by the immense global population of Small and Medium-sized Enterprises (SMEs) across nearly all industry verticals, seeking technology to enhance efficiency, comply with regulations, and drive profitable growth. Primary buyers include business owners, financial controllers, and operational managers who prioritize solutions that offer immediate ROI, ease of use, and integration capabilities with existing systems. The customer base is highly diverse, ranging from sole proprietorships needing simple financial tracking tools to medium-sized firms requiring sophisticated logistics and manufacturing resource planning (MRP) software. A critical characteristic of this customer segment is the high sensitivity to pricing and the need for personalized support due to limited internal IT expertise, making affordable, scalable, and reliable cloud solutions particularly attractive to them.

The end-users are segmented not just by industry, but also by their level of digital maturity. Digital-native startups, for instance, are immediate adopters of cloud and mobile solutions, integrating new technologies from day one. In contrast, traditional businesses in sectors like manufacturing or construction often require more extensive consultative services to facilitate the transition from legacy, on-premise systems to modern, digital platforms. The decision-making process within small businesses is typically centralized, often residing with the owner or a single high-level manager, meaning vendors must clearly articulate tangible benefits—such as time savings, compliance assurance, or direct revenue growth—to justify the investment expenditure. Furthermore, the increasing complexity of regulatory environments mandates that potential customers prioritize solutions that inherently ensure data security and compliance, especially in sectors like healthcare and finance.

Targeting potential customers effectively requires a deep understanding of vertical-specific pain points. For retail buyers, the focus is on unified commerce solutions that blend physical and online sales channels seamlessly. For professional services firms, the key requirement is project management, time tracking, and robust client communication tools. Therefore, vendors are increasingly focusing their marketing and product development efforts on creating industry-specific value propositions, rather than generic administrative tools. The vast majority of potential customers are seeking simplification; they want complex technology delivered in an easily digestible, affordable package that addresses their most pressing operational challenges while simultaneously providing a pathway for scalable growth without requiring a dedicated IT department.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Trillion |

| Market Forecast in 2033 | $13.5 Trillion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft, Google, Amazon Web Services, Intuit, Salesforce, Zoho, Shopify, Square, Cisco, IBM, Oracle, SAP, HubSpot, FreshBooks, GoDaddy, ADP, Xero, Trello, Asana, Zendesk |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Business Market Key Technology Landscape

The technology landscape for the Small Business Market is heavily concentrated on cloud-native solutions that emphasize connectivity, scalability, and ease of use. Key technologies involve the continued maturation of Software-as-a-Service (SaaS) platforms, which deliver essential business functions via subscription, eliminating the need for internal maintenance and dedicated servers. The integration of Application Programming Interfaces (APIs) is paramount, creating cohesive ecosystems where specialized applications for CRM, accounting, and marketing can communicate and exchange data seamlessly, addressing the small business need for centralization and data synchronization. Furthermore, advanced mobile technology and optimized applications are crucial, supporting the modern demand for business operations to be managed remotely and in real-time by owners and staff who are frequently away from a traditional office environment.

A significant trend is the rise of embedded FinTech, where financial services—such as lending, payment processing, and banking—are integrated directly into operational business software, transforming platforms like POS systems and accounting software into full financial hubs. This simplifies cash flow management and provides immediate access to capital based on real-time business performance data. Coupled with this is the increasing utilization of low-code and no-code development platforms. These tools allow non-technical business users to rapidly prototype and deploy custom applications and automated workflows tailored to unique business requirements, effectively bridging the talent gap and accelerating internal digitization without relying on expensive external developers or complex IT infrastructure management.

Moreover, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) is moving beyond initial experimentation into practical, high-impact applications. AI is used extensively for advanced business intelligence, providing small businesses with predictive insights into customer behavior, inventory fluctuations, and optimal staffing levels. Cybersecurity solutions are also evolving, offering small businesses enterprise-grade protection through managed security services and cloud-delivered security frameworks that are easy to deploy and manage without specialized knowledge. The technology landscape is moving towards convergence, offering holistic, secure, and intelligent platforms that reduce complexity and provide strategic advantages to resource-constrained small enterprises, ensuring technological parity with larger market competitors.

Regional Highlights

The global Small Business Market presents a highly differentiated regional landscape, with North America and Europe leading in terms of absolute market value and technological sophistication, while Asia Pacific demonstrates the most dynamic growth potential. North America maintains market dominance due to high cloud penetration rates, robust investment in digital infrastructure, and a competitive environment that mandates continuous technological upgrades across all business sizes. The region benefits from a dense ecosystem of innovative tech providers specializing in SaaS, FinTech, and vertical-specific applications, driven by a mature venture capital environment that continuously funds new solutions tailored for SMEs. High regulatory compliance standards also push small businesses to adopt automated software solutions quickly, particularly in areas like accounting and data privacy.

Europe represents a large and fragmented market, where regulatory harmonization (such as GDPR) drives regional consistency in technology adoption, particularly in cybersecurity and data management solutions. Western European countries exhibit high maturity, focusing on integrating AI for operational efficiency and embracing environmentally sustainable business practices often supported by specialized software. Central and Eastern Europe are characterized by rapid catch-up growth, benefiting from lower labor costs and increasing foreign direct investment, spurring quick adoption of flexible cloud platforms. However, the presence of diverse languages and varying tax systems across the continent necessitates localized software customization, presenting both a challenge and an opportunity for specialized regional vendors.

Asia Pacific (APAC) is projected to be the fastest-growing region, powered by the immense market size of emerging economies like India, China, and Southeast Asian nations, where millions of new small businesses are entering the digital economy annually, often directly via mobile platforms. Governments across APAC are actively promoting digital literacy and providing financial subsidies for technology adoption, accelerating the shift from cash-based to digital transactions. The Middle East and Africa (MEA) are also experiencing significant transformation, driven by massive infrastructure projects, increased mobile internet penetration, and strategic economic diversification plans that emphasize SME growth, particularly in FinTech and e-commerce solutions tailored to local banking and logistics infrastructure.

- North America: Market leader driven by high cloud adoption, mature startup ecosystem, and strong regulatory pressure promoting automated compliance software. Focus on advanced AI and integrated financial services.

- Europe: Characterized by high compliance needs (GDPR), strong vertical software specialization, and a rising focus on sustainable technology solutions (Green IT). Germany and the UK lead in enterprise solution adoption.

- Asia Pacific (APAC): Highest projected CAGR due to governmental digitization mandates, vast expansion of mobile-first enterprises, and rapid industrialization in developing markets. China and India are the primary growth engines.

- Latin America (LATAM): Growth fueled by increasing internet penetration, necessity for localized payment and banking integrations, and strong demand for supply chain optimization tools.

- Middle East and Africa (MEA): Emerging market driven by governmental economic diversification, heavy investment in digital infrastructure, and a necessity for affordable, scalable cloud solutions catering to new businesses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Business Market.- Microsoft

- Amazon Web Services (AWS)

- Intuit

- Salesforce

- Zoho Corporation

- Shopify

- Square (Block Inc.)

- Cisco Systems

- IBM

- Oracle Corporation

- SAP SE

- HubSpot

- FreshBooks

- GoDaddy

- ADP (Automatic Data Processing)

- Xero

- Trello (Atlassian)

- Asana

- Zendesk

Frequently Asked Questions

Analyze common user questions about the Small Business market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary barriers to technology adoption for small businesses?

The main barriers include high initial capital investment costs, the complexity of integrating new systems with existing legacy infrastructure, and a critical internal shortage of skilled technical talent required to fully utilize advanced software, leading many to prefer simplified, managed service models.

How is cloud computing specifically benefiting the small business sector?

Cloud computing provides unparalleled scalability, allowing small businesses to access enterprise-grade applications without significant upfront infrastructure investment. It supports operational flexibility, enabling remote work capabilities, faster disaster recovery, and ensures automatic software updates, reducing IT management overhead.

Which technology segment is experiencing the fastest growth in the Small Business Market?

The Services segment, particularly Managed IT Services and specialized consulting for migration and integration, is growing the fastest. This growth is driven by the necessity for external expertise to successfully deploy and maintain complex cloud, AI, and security solutions that small businesses cannot manage internally.

What role does Artificial Intelligence play in differentiating small businesses competitively?

AI enables small businesses to automate routine tasks, personalize customer interactions at scale, and gain sophisticated predictive analytics capabilities previously exclusive to large corporations. This allows them to achieve higher operational efficiency and more targeted marketing strategies, significantly boosting competitive parity.

Which geographical region holds the highest future growth potential for Small Business solutions?

The Asia Pacific (APAC) region, particularly emerging economies like India and Southeast Asia, holds the highest future growth potential. This is driven by massive governmental digitization initiatives, a burgeoning entrepreneurial class, and widespread adoption of mobile-first, cloud-native business models.

What is the most crucial consideration for small businesses when selecting new software?

Integration capability is arguably the most crucial factor. Small businesses require new software to seamlessly connect with their existing tools (like accounting or payment systems) to ensure data flow consistency and avoid operational silos, thereby maximizing efficiency and data accuracy.

How do cybersecurity needs differ for small businesses compared to large corporations?

While the threats are similar, small businesses typically need affordable, automated, and easy-to-manage cybersecurity solutions delivered via the cloud (Security-as-a-Service), as they lack the resources and specialized staff to implement and manage complex, on-premise security architectures used by large corporations.

What impact does embedded finance have on small business operational models?

Embedded finance integrates banking, lending, and payment capabilities directly within core business software (like POS or accounting systems). This speeds up access to capital based on real-time data, simplifies transaction management, and provides superior cash flow visibility, revolutionizing daily financial operations.

Why are vertical SaaS solutions gaining prominence in the small business segment?

Vertical SaaS (Software-as-a-Service) solutions are highly tailored to the specific regulatory and workflow demands of a single industry (e.g., dental clinics or specialized construction). This specificity provides immediate, high-value utility and compliance assurance that generic, horizontal solutions often lack, driving rapid adoption.

What is the role of digital marketplaces in the distribution channel for small business software?

Digital marketplaces and app stores (like those offered by major cloud providers) serve as a critical indirect distribution channel, offering small businesses standardized, easily comparable, and review-driven platforms for discovering, trialing, and adopting new software solutions quickly and cost-effectively.

How is the move toward subscription-based pricing models affecting market accessibility?

Subscription-based (SaaS) pricing eliminates prohibitive upfront software licensing costs, significantly lowering the financial barrier to entry for small businesses. This pay-as-you-go model allows firms to scale their technology usage commensurate with their growth, making advanced tools accessible to even the smallest enterprises.

What are the key drivers boosting e-commerce solution adoption among small businesses?

The primary drivers are changing consumer purchasing habits toward online channels, the necessity for global market reach, and the availability of integrated platforms (like Shopify or Square) that simplify digital storefront setup, inventory sync, and omnichannel management capabilities for resource-limited teams.

In which small business application area is Artificial Intelligence most immediately impactful?

AI is most immediately impactful in Customer Relationship Management (CRM) and customer service through the deployment of intelligent chatbots, automated ticket routing, and predictive lead scoring, dramatically improving response times and sales team efficiency without increasing staffing levels.

What is the significance of low-code/no-code platforms in the current small business technology landscape?

Low-code/no-code platforms empower non-technical users within small businesses to create custom applications and automate specialized workflows quickly. This mitigates dependence on expensive external developers and allows firms to rapidly tailor their IT environment to unique operational requirements.

How does governmental support influence the Small Business Market dynamics?

Governmental support, including tax credits, grants for digital adoption, and favorable lending schemes for technology investment, plays a crucial role. This support stimulates demand for new solutions and helps small businesses overcome the initial capital constraints associated with necessary digital transformation initiatives.

What factors are driving the demand for specialized Human Capital Management (HCM) software?

The demand is driven by increasing complexity in labor regulations (e.g., minimum wage laws, leave tracking), the need for efficient remote employee management, and the necessity to automate payroll and benefits administration, which are highly time-consuming tasks for small business administrative staff.

How do micro-enterprises (1-9 employees) differ in their technology purchasing behaviors?

Micro-enterprises are highly price-sensitive, prioritize mobile-first solutions, and seek platforms that consolidate multiple functions (e.g., accounting and invoicing) into one simple app. They prioritize immediate functionality and minimal learning curves over extensive feature sets.

What is the role of data analytics in small business decision-making today?

Data analytics, increasingly powered by embedded AI, transforms raw transaction data into actionable insights regarding customer retention, inventory optimization, and marketing campaign effectiveness. This shift allows small firms to move from reactive management to proactive, data-driven strategic planning.

How are industry consolidation and mergers affecting the vendor landscape for small business solutions?

Industry consolidation leads to larger vendors offering integrated, bundled solutions that combine CRM, accounting, and communication tools, simplifying vendor management for small businesses. While this offers convenience, it can also limit specialized choices and increase dependence on major platform providers.

Why is mobile optimization critical for small business software providers?

Mobile optimization is critical because many small business owners and staff manage operations, sales, and customer interactions while away from a desk. Fully functional mobile applications ensure continuity of business processes and facilitate real-time decision-making, which is essential for agile operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Insurance Brokers Tools Market Statistics 2025 Analysis By Application (Small Business (1-10 users), Medium-sized Business (11-50 users), Large Business (50+ users), By Type (Cloud-Based, On-Premise), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Small Business Accounting Platform Market Statistics 2025 Analysis By Application (Food, Retail, Freelancers), By Type (Browser-based, Application-based), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Corporate Card Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Open-Loop, Closed Loop Cards), By Application (Small Business Credit Cards, Corporate Credit Cards), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Specialized Scanners Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Small business card scanners, Drum scanners, Duplex scanners, Photo scanners, Other), By Application (Commercial use, Home use, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Enterprise Time and Attendance Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On Premise Enterprise Time and Attendance Software, Cloud-based Enterprise Time and Attendance Software), By Application (Small Business (SSB), Small and Midsize Business (SMB), Large Enterprise), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager