Small Home Appliances Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432029 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Small Home Appliances Market Size

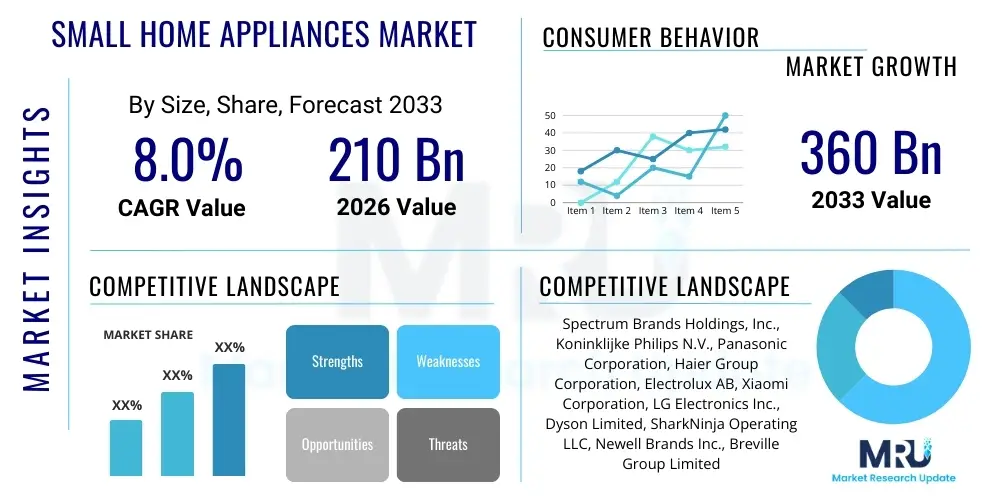

The Small Home Appliances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.0% between 2026 and 2033. The market is estimated at USD 210 Billion in 2026 and is projected to reach USD 360 Billion by the end of the forecast period in 2033.

Small Home Appliances Market introduction

The Small Home Appliances Market encompasses a wide and diverse portfolio of portable, often electronically driven, household devices designed specifically to perform daily tasks with enhanced efficiency and convenience. This category is distinct from major appliances (white goods) due to their size, mobility, and typically lower energy consumption profile. Key products span critical domestic functions, including cooking and food preparation (e.g., blenders, air fryers, specialized coffee makers), domestic maintenance (e.g., vacuum cleaners, garment steamers), and personal wellness (e.g., hair styling tools, electric toothbrushes). The market's structural evolution is fundamentally tied to global technological progress, particularly the convergence of Internet of Things (IoT) connectivity and advanced material science, transforming simple mechanical devices into smart, integrated components of the modern residential ecosystem. Manufacturers are increasingly focused on introducing specialized appliances that cater to niche consumer demands, such as devices tailored for specific dietary needs or those offering professional-grade performance in a home setting, thereby expanding the total addressable market and driving higher average selling prices (ASPs).

The primary benefit derived from the adoption of these appliances is the significant improvement in domestic operational efficiency, leading to substantial time savings for consumers navigating demanding modern lifestyles. Furthermore, technological innovation has placed a strong emphasis on energy efficiency, with newer models often adhering to stringent international standards (such as Energy Star ratings), appealing to environmentally conscious consumers and offering long-term operational cost reductions. The integration of high-definition sensors, advanced motor technology (like BLDC motors), and sophisticated software algorithms enables these appliances to deliver highly optimized and personalized results, ranging from precision temperature control in cooking to autonomous navigation in robotic cleaning devices. This focus on performance and customization justifies the replacement cycles in mature markets and drives first-time purchases in developing economies where rapid urbanization is creating new households seeking modern conveniences.

Driving factors for the sustained market growth are multifaceted and powerful. Socio-economic trends, including the global rise in disposable income, particularly across the Asia Pacific region, make premium and feature-rich appliances accessible to a wider demographic. Concurrent shifts towards smaller household units and denser urban living environments necessitate compact, multi-functional appliances that maximize utility within limited spaces. Moreover, the pervasive marketing focus on home aesthetics and lifestyle integration compels consumers to upgrade older, less visually appealing models for sleek, designer appliances that complement modern interior design trends. The confluence of these factors—high-tech innovation, robust economic backing, and evolving consumer lifestyle expectations—positions the Small Home Appliances Market as a consistently dynamic sector characterized by fierce competition, rapid product launches, and continuous segmentation to capture specific consumer pain points and desires across global markets.

Small Home Appliances Market Executive Summary

The Small Home Appliances Market is defined by a significant structural shift towards digitalization and sustainability, compelling major players to realign their business models around service-oriented offerings and interconnected product ecosystems. Key business trends include aggressive vertical integration by manufacturers to control critical component supply chains, particularly semiconductors and specialized motors, thereby mitigating external supply chain volatility which has historically challenged the sector. There is an increasing frequency of strategic mergers, acquisitions, and partnerships, especially those aimed at acquiring expertise in AI, IoT platforms, and specialized product categories like robotic cleaning and sophisticated air quality management. The rise of direct-to-consumer (D2C) channels, leveraging sophisticated data analytics and targeted digital marketing, allows brands greater margin control and direct feedback loops, accelerating product development cycles in response to real-time consumer demand signals, fundamentally optimizing inventory management and product positioning strategies globally.

Regionally, the market presents a dichotomy: high volume growth is anchored in the Asia Pacific, driven by accelerating first-time household formation and rising middle-class consumerism in economies like India, Vietnam, and Indonesia. In contrast, the market dynamism in North America and Europe is concentrated on value-added features, technological obsolescence, and the replacement of older non-smart devices with premium, connected alternatives. European market expansion is uniquely influenced by stringent environmental regulations (e.g., Waste Electrical and Electronic Equipment directive and energy labeling requirements), which actively shape consumer purchasing decisions towards durable, repairable, and energy-efficient appliances. Manufacturers operating in these mature regions must continuously innovate on design, performance metrics, and post-purchase service excellence to maintain market share against agile, digitally native competitors who prioritize seamless user experience and ecosystem integration.

Analysis of segmentation trends confirms the accelerating demand for small kitchen appliances, specifically those facilitating health-focused cooking (e.g., air fryers, high-speed blenders for smoothies), driven by global wellness trends and a renewed interest in home culinary skills. Furthermore, the floor care segment, particularly premium cordless vacuum systems and highly automated robotic platforms, continues to outperform, reflecting consumer willingness to invest significantly in devices that reduce manual labor and improve home hygiene standards. A crucial segmented trend involves the growing market for specialized personal care devices, such as high-performance hair tools and advanced oral care systems, which are increasingly marketed as wellness investments rather than mere functional tools. Successful market leaders are those who manage to bridge technological complexity with intuitive user interfaces, ensuring that smart features translate into tangible, reliable convenience, while simultaneously meeting the demanding criteria for durability and energy stewardship set by contemporary consumers and regulatory bodies worldwide.

AI Impact Analysis on Small Home Appliances Market

Common user questions regarding AI integration in small home appliances frequently center on the tangible return on investment (ROI) derived from increased purchase price—specifically, how AI moves functionality beyond simple programming to genuine, proactive automation. Users inquire about the fidelity of personalized appliance settings, such as whether a smart oven can accurately adapt cooking cycles based on the specific weight and composition of food placed inside, or if a smart refrigerator can truly manage inventory and suggest recipes based on learned family preferences and nutritional goals. A significant portion of consumer concern also revolves around the ethical implications of data collection; users are acutely sensitive to which data points (usage frequency, energy consumption, specific habits) are collected, how they are stored, and who ultimately accesses them, demanding transparent privacy policies and robust encryption mechanisms to secure their domestic digital environment against breaches or unauthorized commercial exploitation of behavioral data.

The implementation of Artificial Intelligence transforms small home appliances by enabling sophisticated contextual awareness and self-optimization capabilities, making them highly integrated ecosystem components rather than isolated devices. AI algorithms are deployed to analyze massive datasets related to energy consumption patterns, environmental factors (like external weather or indoor air quality), and individual usage history, allowing devices to preemptively adjust operations. For instance, AI in HVAC control or smart fans can predict temperature fluctuations and adjust output before the user feels discomfort, maintaining an optimal indoor climate with minimal energy waste. Similarly, AI-powered food preparation devices can compensate for minor human errors in ingredient measurement or timing, ensuring consistent, high-quality outcomes, thereby lowering the barrier for complex home cooking and enhancing overall user satisfaction across diverse usage scenarios, significantly differentiating high-end models.

From a manufacturing and service perspective, AI integration drives operational efficiencies and unlocks novel business opportunities. Machine learning models embedded within appliance firmware facilitate continuous self-diagnosis and failure prediction, drastically shortening the time needed for remote troubleshooting and reducing the necessity for costly in-person service calls. This shift towards predictive maintenance extends product life cycles, aligning with consumer demand for sustainability and reducing overall waste, while simultaneously improving manufacturer reputation for reliability. Furthermore, the data generated by AI-enabled appliances offers unparalleled market intelligence, providing manufacturers with granular insights into product utilization, feature popularity, and potential pain points. This intelligence is crucial for guiding future R&D investment towards features consumers genuinely value, accelerating the development of highly customized, next-generation appliances that address previously unmet needs through advanced automation and proactive assistance.

- Enhanced personalization through learned user habits (e.g., customized coffee brewing profiles, automated cleaning routines).

- Predictive maintenance and fault detection via real-time monitoring of component performance, minimizing downtime.

- Optimized energy consumption schedules based on AI analysis of historical usage and external grid factors.

- Natural Language Processing (NLP) integration for advanced voice control and intuitive, seamless interaction.

- Advanced sensor fusion leading to superior performance (e.g., robotic vision systems for improved navigation and object recognition).

- Continuous Over-The-Air (OTA) updates enhancing functionality, adding new features, and addressing security vulnerabilities post-purchase.

- Integration with external smart home platforms and standards (e.g., Matter/Thread) for improved interoperability.

- Behavioral pattern recognition enabling proactive task automation and reminder functions.

DRO & Impact Forces Of Small Home Appliances Market

The sustained growth of the Small Home Appliances Market is fundamentally driven by a triad of factors: technological convergence, demographic shifts, and rising consumer focus on wellness. The convergence of IoT, AI, and affordable sensor technology is creating entirely new product categories (e.g., specialized sous vide machines, advanced UV sanitizers) and enhancing the core functionality of existing ones, compelling consumers to upgrade to smart, connected versions that offer superior control and data feedback. Demographic drivers include the global expansion of the working middle class, leading to time-starved consumers prioritizing convenience and automation, thus favoring devices that save effort and time. Furthermore, heightened global awareness concerning public health and environmental quality directly translates into increased demand for comfort appliances like sophisticated air purifiers and humidifiers, moving these devices from luxury items to perceived necessities for modern, healthy living environments. These powerful drivers create a cyclical demand mechanism, ensuring continuous market momentum.

Despite strong drivers, the market faces significant structural and operational restraints. A primary restraint is the severe price sensitivity among a large segment of global consumers, particularly in emerging markets, making high-end smart appliances difficult to penetrate without substantial pricing concessions. Furthermore, the market is characterized by a short product lifecycle, which necessitates perpetual R&D investment and constant competitive discounting, pressuring profit margins for established brands. Operationally, the deep reliance on complex global supply chains for specialized electronic components, exacerbated by ongoing chip shortages and trade tensions, creates vulnerability to delays, cost inflation, and production bottlenecks, demanding massive capital investment in logistics and component sourcing security. Consumer hesitation regarding data privacy and the complexity of managing multiple proprietary smart home ecosystems also act as soft restraints, slowing mass market adoption of fully interconnected domestic setups.

Significant opportunities are emerging through the adoption of circular economy principles and sustainable product design. Brands that successfully incorporate recycled materials, minimize packaging waste, and offer verified pathways for product repair and end-of-life recycling are positioned to capture the growing segment of environmentally conscious consumers, offering a compelling competitive differentiation beyond mere feature lists. The expansion of high-speed internet infrastructure in previously underserved regions unlocks vast new potential for smart appliance sales and remote diagnostic services. Impact forces, which are exogenous factors, include stringent governmental energy efficiency mandates (which dictate design and component choices), volatile raw material pricing (especially for plastics and non-ferrous metals), and unpredictable macroeconomic fluctuations impacting consumer credit availability. Navigating these constraints and capitalizing on technological opportunities requires strategic foresight, emphasizing product durability, transparent corporate environmental governance, and continuous innovation focused on simplifying complex smart technologies for everyday household utility.

Segmentation Analysis

The Small Home Appliances Market is critically segmented across multiple dimensions—product type, application, and distribution channel—providing a structured framework for analyzing competitive intensity and identifying high-growth pockets. The Product Type segmentation is the most granular, highlighting the bifurcation between high-frequency, essential kitchen appliances (like kettles and toasters) and complex, high-value specialty items (like robotic vacuums and espresso machines). This segmentation allows manufacturers to allocate resources effectively, targeting high-volume production for staple items and focusing R&D on high-margin, innovation-led specialty categories. The inherent cyclicality and average replacement rates within each product segment also heavily influence long-term financial forecasting and inventory planning, necessitating distinct strategies for durable goods versus frequently replaced items.

Analysis by Application or End-User reveals the overwhelming dominance of the residential sector, which drives demand based on household formation, demographic changes, and rising consumer discretionary spending allocated to home comfort and convenience. However, the commercial application segment—encompassing small businesses, institutional settings, and the hospitality sector—requires products with higher durability, duty cycle capacity, and professional-grade certification, often commanding premium pricing due to stricter performance demands and heavier usage profiles. Tracking the growth divergence between residential smart home adoption (focused on integration and ease of use) and commercial requirements (focused on resilience and maintenance simplicity) is essential for companies aiming for broad market coverage and specialized product portfolio management across the consumer-professional spectrum.

The distribution channel analysis underscores the revolutionary impact of e-commerce, which has become the preferred purchasing route for highly researched, feature-rich small appliances, owing to the ability to compare specifications, read extensive reviews, and access competitive pricing. This shift demands significant investment in digital logistics, fulfillment efficiency, and sophisticated digital marketing campaigns focused on lifestyle visualization. While traditional brick-and-mortar retail (hypermarkets and specialty stores) maintains relevance, primarily for immediate purchases and product demonstration requiring tactile interaction (e.g., trying a new vacuum cleaner), the strategic imperative for market players is to achieve seamless omni-channel integration. This unified approach ensures price parity, consistent branding, and personalized customer support across both physical and digital touchpoints, maximizing consumer accessibility and reinforcing brand loyalty across disparate purchase environments.

- By Product Type:

- Kitchen Appliances

- Cooking Appliances (Ovens, Microwaves, Air Fryers, Toasters, Grills, Specialty Cookers)

- Food Preparation Appliances (Blenders, Mixers, Food Processors, Juicers, Choppers)

- Beverage Preparation Appliances (Coffee Makers, Espresso Machines, Kettles, Water Dispensers)

- Cleaning & Floor Care Appliances

- Vacuum Cleaners (Corded Canister, Cordless Stick, Handheld Models)

- Robotic Vacuum Cleaners and Mops (Autonomous Navigation Systems)

- Steam Mops and Advanced Surface Cleaners

- Personal Care Appliances

- Hair Care Appliances (Dryers, Straighteners, Curlers, Styling Tools)

- Grooming Appliances (Electric Shavers, Trimmers, Body Groomers)

- Oral Care Appliances (Electric Toothbrushes, Water Flossers)

- Comfort and Other Appliances

- Air Purifiers, Dehumidifiers, and Humidifiers (Advanced Filtration Systems)

- Fans and Heaters (Smart Climate Control Devices)

- Irons and Garment Steamers (Advanced Fabric Care)

- By Distribution Channel:

- Offline Retail (Supermarkets and Hypermarkets, Specialty Appliance Stores, Departmental Stores)

- Online Retail (Major E-commerce Platforms, Brand-Owned Websites, Direct-to-Consumer Channels)

- By End-User:

- Residential (Individual Households, Multi-Family Units)

- Commercial (Hotels, Offices, Small Restaurants, Institutional Settings)

Value Chain Analysis For Small Home Appliances Market

The Small Home Appliances value chain initiates with the sophisticated upstream sourcing of specialized components and raw materials, where cost effectiveness and quality control are paramount. This involves procuring specific grades of plastics and metals, highly reliable Brushless DC (BLDC) motors for high-performance devices, and crucially, complex microprocessors and sensors that enable smart functionality. Upstream manufacturers, predominantly located in East Asia, hold significant negotiating power due to their specialized capabilities in high-volume, precision electronics manufacturing. Market participants must manage supplier concentration risk and adhere to strict international environmental and labor standards (e.g., conflict mineral regulations, ethical sourcing policies). Strategic procurement focuses on long-term contracts and dual sourcing strategies to ensure supply continuity for high-demand, high-tech components, minimizing the disruptive impact of global shortages or geopolitical trade tariffs that often impact the pricing of critical inputs.

Midstream activities encompass design, manufacturing, and assembly, requiring significant capital expenditure in automated production lines to achieve economies of scale. Design innovation is crucial at this stage, focusing on ergonomic factors, aesthetic appeal, and modularity to facilitate repair and reduce material waste, aligning with emerging circular economy mandates. Quality control processes are exceptionally rigorous, particularly for appliances dealing with heat (e.g., cooking devices) or water (e.g., steam cleaners), requiring certification against numerous safety standards (UL, CE, etc.) before market introduction. High-value manufacturers invest heavily in software development and testing to ensure seamless IoT connectivity and reliable AI-driven performance, transitioning their focus from purely hardware-centric assembly to integrated hardware-software platform development, thereby securing intellectual property and enhancing brand differentiation in a highly competitive market environment.

The downstream segment covers logistics, distribution, marketing, and post-sales service, directly influencing consumer perception and brand loyalty. Distribution channels are optimized for high-volume, rapid transit, utilizing complex warehousing and inventory management systems to balance stock across numerous regional distribution centers to meet both peak seasonal demand and ongoing replacement cycles. Direct and indirect sales routes coexist; indirect channels (e-commerce platforms and mass retailers) provide reach and visibility, while direct channels (company stores and proprietary websites) facilitate higher margin capture and deep consumer relationship building. Post-purchase support, including efficient warranty processing, spare parts availability, and responsive technical helpdesks, constitutes a critical competitive lever. Excellence in downstream operations—characterized by speed, accuracy, and customer-centric service—is essential for converting transactional sales into long-term brand advocacy and ensuring a positive brand reputation, especially crucial for high-value smart appliances.

Small Home Appliances Market Potential Customers

The primary customer base for the Small Home Appliances Market resides within the global residential sector, demonstrating a complex tapestry of needs segmented by income, location, and technological savviness. Key purchasing demographics include young urban dwellers, who prioritize compact, aesthetically pleasing, and multi-functional devices (like combination grill/air fryers or foldable steamers) that fit limited apartment spaces and support fast-paced lifestyles. Established middle-income families form the high-volume replacement market, purchasing durable mid-range appliances driven by failure or the need to upgrade for better energy efficiency and safety features, typically buying through large hypermarkets and online general retailers, valuing reliability and competitive pricing above all else. Market strategies must address the fundamental trade-off these consumers face between upfront cost and long-term operating efficiency, emphasizing life-cycle value in marketing narratives.

A rapidly expanding and highly profitable segment consists of affluent and high-net-worth individuals, who act as early adopters for cutting-edge technologies like advanced AI-powered robotic systems and professional-grade kitchen appliances (e.g., highly specialized espresso machines and precision induction cooktops). These customers are motivated by luxury, status, and the desire for seamless smart home integration, often purchasing through specialty retailers or direct brand channels that offer premium consultation, installation, and dedicated white-glove support services. Their purchasing decisions are less price-sensitive and more focused on brand prestige, technical superiority, and exclusive aesthetic design, demanding high-quality materials and unparalleled product performance guarantees, reinforcing the premiumization trend across multiple product categories, particularly in comfort and culinary preparation segments.

Beyond the core residential segment, the commercial sector represents an essential, albeit smaller, group of potential customers requiring robust, industrial-strength small appliances. This includes small and medium-sized enterprises (SMEs) such as independent cafes, small hotel chains, healthcare clinics, and corporate offices, which rely on small appliances for daily operations (e.g., heavy-duty coffee brewers, commercial garment steamers for laundry). These buyers prioritize longevity, ease of cleaning, high operational capacity (duty cycle), and rapid servicing agreements over purely smart features or consumer aesthetics. Manufacturers must differentiate their commercial offerings with reinforced internal components, extended warranty periods, and certifications tailored to commercial use, catering to the distinct business need for minimized operational downtime and guaranteed reliability under demanding, continuous usage conditions, moving the sales focus from discretionary purchase to essential operational equipment procurement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 210 Billion |

| Market Forecast in 2033 | USD 360 Billion |

| Growth Rate | CAGR 8.0% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spectrum Brands Holdings, Inc., Koninklijke Philips N.V., Panasonic Corporation, Haier Group Corporation, Electrolux AB, Xiaomi Corporation, LG Electronics Inc., Dyson Limited, SharkNinja Operating LLC, Newell Brands Inc., Breville Group Limited, Hitachi, Ltd., Midea Group Co., Ltd., Whirlpool Corporation, Samsung Electronics Co., Ltd., Hamilton Beach Brands Holding Company, Instant Brands (Corelle Brands), iRobot Corporation, SEB S.A., Melitta Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Home Appliances Market Key Technology Landscape

The Small Home Appliances market’s technological foundation is rapidly advancing, fundamentally driven by the convergence of miniaturization and sophisticated wireless communication protocols. The widespread adoption of low-power Wi-Fi and Bluetooth mesh technologies allows for robust, low-latency connectivity, forming the backbone of the smart home ecosystem and enabling seamless integration of devices, irrespective of manufacturer, especially through emerging universal standards like Matter. Crucially, the advancement of embedded sensor technology—ranging from high-precision thermal sensors for induction cooking to complex LiDAR and optical sensors for robotic mapping and navigation—is the enabling factor for autonomous operation and precision control. This sensor fusion allows devices to gather, analyze, and react to environmental data in real-time, such as air purifiers dynamically adjusting filtration based on volatile organic compound (VOC) detection or smart irons automatically identifying fabric type to prevent damage, moving device operation beyond simple timers to genuinely intelligent, responsive systems.

A major technical shift is the increasing use of advanced materials science to improve both performance and durability. This includes the development of self-cleaning and scratch-resistant ceramic coatings for cooking surfaces, high-grade lightweight composites for vacuum cleaner bodies, and specialized acoustic dampening materials to minimize operational noise, particularly critical for appliances used frequently in confined living spaces. Furthermore, the exponential improvement in battery technology, specifically high-density, fast-charging Lithium-Ion cells combined with smart battery management systems (BMS), has significantly enhanced the run time and overall power output of cordless appliances, effectively making them competitive with, and often superior to, their corded predecessors. The integration of high-efficiency, permanent magnet Brushless DC (BLDC) motors across all high-performance categories (from blenders to hair dryers) ensures superior longevity, reduced energy consumption, and quieter operation compared to traditional universal motors, supporting the premiumization trend by offering verifiable improvements in core mechanical function.

The future technology trajectory is heavily focused on refining Artificial Intelligence (AI) and edge computing capabilities. Next-generation appliances will feature more powerful, dedicated AI chips capable of processing complex data locally (at the "edge"), reducing dependence on cloud latency and ensuring greater data privacy and operational speed. This facilitates sophisticated machine learning models that not only predict maintenance needs but also continuously self-calibrate and optimize energy use based on learned user profiles and micro-environmental fluctuations, maximizing efficiency over the entire product lifespan. Additionally, security technology is paramount; manufacturers are incorporating hardware-based encryption and implementing strong authentication protocols to protect the sensitive user data collected by connected home devices against external threats, solidifying consumer trust as connectivity becomes standard. This convergence of robust hardware, energy-efficient mechanics, and sophisticated, secure software platforms defines the modern competitive edge in the small home appliance technology landscape.

Regional Highlights

The Small Home Appliances Market demonstrates highly diversified regional performance profiles, with growth and maturity varying significantly across continents. Asia Pacific (APAC) continues its momentum as the undisputed leader in volume growth, primarily fueled by the economic ascendancy of countries like China, India, and Southeast Asian nations. Rapid urbanization and the concomitant rise in nuclear family structures are increasing the need for convenient, modern household tools. Consumers in APAC are characterized by high digital adoption rates and a strong preference for multi-functional, value-driven appliances that often integrate smart features developed specifically for localized needs, such as high-temperature cooking methods or specialized rice cookers. The regional market is also home to the world’s largest manufacturing base, leading to highly competitive pricing and rapid product introduction cycles, maintaining its status as the global epicenter for both production and consumption.

North America and Europe, representing mature and highly penetrated markets, anchor the global value segment. Growth in these regions is strategically driven by premiumization—consumers willingly pay a premium for technologically superior, design-forward, and sustainable products. In Europe, strict energy efficiency and e-waste regulations strongly influence purchasing behavior, leading to high demand for products with verified low energy consumption and extended warranties, favoring brands that emphasize repairability and long product life cycles. The North American market is a dominant adopter of smart home technology; consumers prioritize devices that seamlessly integrate into existing platforms (like voice assistants) and offer maximum automation, driving intense competition in high-value categories like robotic floor care and professional-grade culinary preparation systems that simplify complex tasks for time-constrained households.

The Latin American and Middle East & Africa (MEA) regions offer future high-potential growth trajectories. Latin America’s growth is strongly tied to macroeconomic stability and the expansion of organized retail infrastructure, enabling broader access to mid-range essential appliances (e.g., blenders, irons, standard vacuums). Consumer purchasing is often driven by affordability and financing options, with brands focused on establishing robust localized distribution and after-sales service networks to build market trust. Conversely, the MEA region is bifurcated: the Gulf Cooperation Council (GCC) nations show strong demand for sophisticated, often luxury imported appliances, particularly advanced air treatment and comfort systems due to climatic conditions. In sub-Saharan Africa, the focus remains on essential, robust, and highly durable appliances designed to cope with power grid volatility and resource constraints, emphasizing resilience and fundamental utility over complex smart features, requiring localized product adaptations and strategic pricing to achieve mass market penetration.

- Asia Pacific (APAC): Highest volume and value growth; driven by urbanization, middle-class expansion, and high adoption of digital and multi-functional appliances. Manufacturing hub for the global market.

- North America: Market maturity driven by premiumization, smart technology adoption (IoT/AI), and high replacement rates for cutting-edge floor care and beverage systems. Focus on seamless smart ecosystem integration.

- Europe: Growth influenced by stringent environmental mandates; high demand for energy-efficient, durable, and repairable products. Strong market for high-quality kitchen and comfort appliances.

- Latin America: Emerging growth market supported by improving economic conditions; demand concentrated on essential and mid-range functional appliances, prioritizing price and reliability.

- Middle East and Africa (MEA): Highly segmented market; high-end smart and comfort appliances dominate GCC, while affordable, durable basics are key in developing African economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Home Appliances Market.- Spectrum Brands Holdings, Inc.

- Koninklijke Philips N.V.

- Panasonic Corporation

- Haier Group Corporation

- Electrolux AB

- Xiaomi Corporation

- LG Electronics Inc.

- Dyson Limited

- SharkNinja Operating LLC

- Newell Brands Inc.

- Breville Group Limited

- Hitachi, Ltd.

- Midea Group Co., Ltd.

- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- Hamilton Beach Brands Holding Company

- Instant Brands (Corelle Brands)

- iRobot Corporation

- SEB S.A.

- Melitta Group

- Vitamix Corporation

- Conair Corporation

- Tineco Intelligent Technology Co., Ltd.

- Vorwerk Group (Thermomix)

Frequently Asked Questions

Analyze common user questions about the Small Home Appliances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current market trend regarding cordless versus corded small appliances?

The market trend heavily favors high-performance cordless appliances, particularly in the cleaning and floor care segment. Advancements in Lithium-Ion battery technology and Brushless DC (BLDC) motors provide extended run times and superior power, making cordless devices highly competitive and preferred for convenience over traditional corded models.

How do energy efficiency regulations impact purchasing behavior in the Small Home Appliances Market?

Energy efficiency regulations, particularly in Europe and North America, significantly influence consumer choice. High energy ratings (e.g., A++ or Energy Star certification) are a strong purchasing determinant, as consumers seek to reduce long-term utility costs and align with environmental sustainability goals, compelling manufacturers to invest in power-optimized designs.

Which product segment is witnessing the most significant adoption of IoT technology?

The kitchen appliances segment, specifically beverage preparation (smart coffee makers) and cooking devices (smart ovens, air fryers), along with robotic vacuum cleaners in the floor care segment, are experiencing the highest rates of IoT adoption, driven by consumer demand for remote control, scheduled operation, and seamless integration with voice assistant technologies.

What role does e-commerce play in the distribution of small home appliances?

E-commerce platforms play a dominant and accelerating role, offering wide selection, competitive pricing, and extensive product information, making it the primary channel for smart and specialized appliance sales. This shift necessitates robust digital logistics and high-quality online customer support from market players.

What are the primary factors contributing to the high growth projection in the APAC market?

The high growth in APAC is attributed to rapidly increasing disposable incomes, accelerated urbanization leading to new household formation, and a high technological acceptance rate among a large, aspirational middle class seeking time-saving, modern conveniences for their homes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager