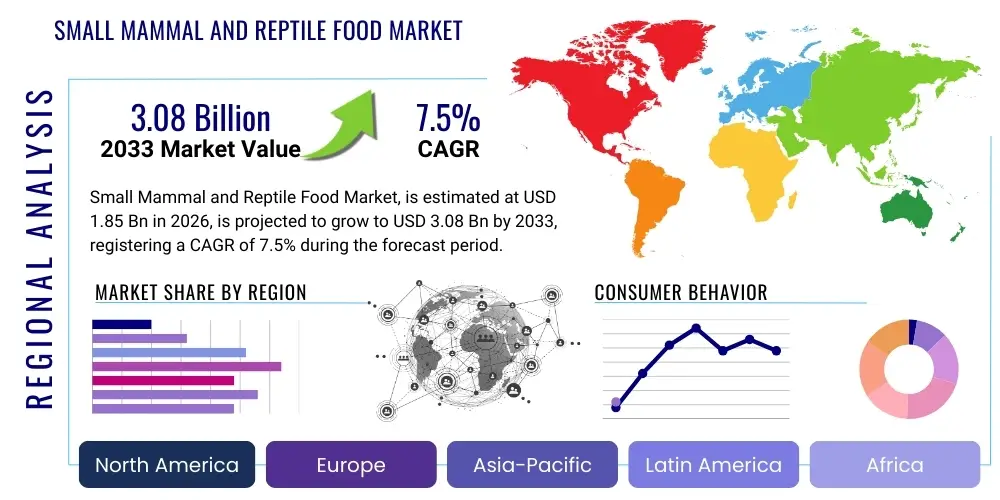

Small Mammal and Reptile Food Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434989 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Small Mammal and Reptile Food Market Size

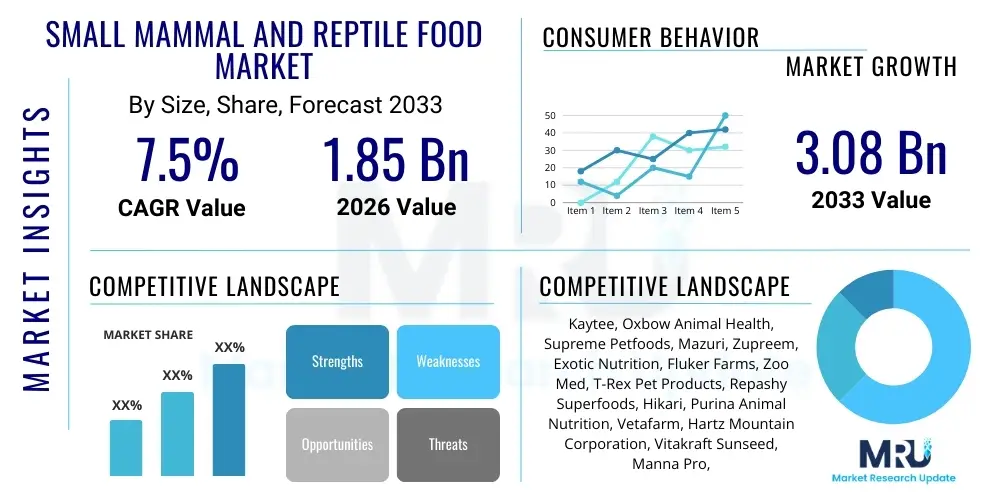

The Small Mammal and Reptile Food Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.08 Billion by the end of the forecast period in 2033.

Small Mammal and Reptile Food Market introduction

The Small Mammal and Reptile Food Market encompasses specialized nutritional products designed to meet the dietary requirements of companion animals such as rabbits, guinea pigs, hamsters, snakes, turtles, and various lizard species. These products range from fortified pellets and hay to live and frozen feeder insects, reflecting the highly diverse physiological needs across these exotic pet categories. The market is fundamentally driven by the increasing global trend of pet humanization, where owners prioritize high-quality, scientifically formulated nutrition that enhances the longevity and well-being of their non-traditional pets. A shift towards specialized, life-stage specific, and ailment-specific diets is notable, moving consumers away from generic or low-quality feed options.

Products within this market are meticulously developed to replicate the natural diets of these species in the wild, which often requires complex formulations, especially for herbivores (like rabbits needing high fiber hay) and carnivores (like reptiles needing specific protein sources). Major applications include daily feeding, dietary supplementation, and specialized veterinary care nutrition. Key benefits derived from premium small mammal and reptile food include improved digestive health, enhanced immune function, vibrant coloration in reptiles, and prevention of common deficiency diseases such as metabolic bone disease (MBD) in reptiles and dental issues in small mammals. The industry emphasizes ingredient sourcing transparency and sustainable practices to appeal to environmentally conscious pet owners.

Driving factors propelling market expansion include rising disposable incomes in emerging economies, increased acceptance and popularity of exotic pets, particularly among Generation Z and millennials, and continuous innovation in feed technology. Furthermore, the robust growth of the e-commerce sector has significantly improved the accessibility of niche and premium food products globally. Veterinary recommendations also play a critical role, as specialized exotic pet vets increasingly advocate for balanced, commercially prepared diets over home-prepared meals, solidifying the market's long-term growth trajectory and focus on nutritional efficacy.

Small Mammal and Reptile Food Market Executive Summary

The Small Mammal and Reptile Food Market is exhibiting robust growth, predominantly steered by significant business trends focusing on premiumization, personalization, and sustainability. Manufacturers are heavily investing in research and development to create species-specific and life-stage-specific formulations, moving beyond generic feed to highly customized products addressing specific health concerns like obesity, aging, and digestive sensitivities. Business strategies emphasize direct-to-consumer (D2C) channels and strategic partnerships with exotic veterinarians to build brand trust and leverage professional recommendations. Ingredient trends show a shift towards natural, non-GMO, and organic components, particularly in the small mammal segment, while the reptile sector is seeing increased demand for laboratory-raised, ethically sourced live and frozen feeder insects, ensuring consistent nutritional profiles.

Regionally, North America and Europe remain the dominant markets, characterized by high rates of pet ownership, stringent animal welfare standards, and high consumer spending power on premium pet care. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by rapid urbanization, increasing middle-class income levels, and the growing popularity of small, low-maintenance pets suitable for apartment living. Key regional trends involve the proliferation of specialized pet food retail chains and the rapid adoption of online subscription models for recurring feed purchases, particularly in developed APAC countries like Japan and South Korea. Regulatory landscapes concerning ingredient safety and labeling are becoming more harmonized across major markets, demanding greater compliance from international manufacturers.

Segment-wise, the Reptile Food segment, specifically the Live/Frozen Feeder Insects category, is experiencing accelerated demand, fueled by heightened awareness of the necessity of bio-appropriate diets for carnivorous and omnivorous reptiles. Concurrently, within the Small Mammal segment, high-fiber hay and forage products are witnessing significant uptake, reinforcing the established veterinary consensus regarding their importance for lagomorph and rodent dental health. The Online Retail distribution channel continues to outperform traditional brick-and-mortar stores, offering extensive product diversity and competitive pricing, thereby facilitating easier access to highly specialized, often temperature-sensitive, reptile food items and bulky small mammal substrates and hay bales.

AI Impact Analysis on Small Mammal and Reptile Food Market

User inquiries regarding AI's influence in the Small Mammal and Reptile Food Market frequently center on three main themes: precision nutrition formulation, optimized supply chain logistics for perishable goods (like live insects), and personalized pet owner advisory tools. Common questions include: "How can AI customize diets based on a pet's genetic markers or health data?", "Will AI-driven farming techniques make feeder insect production cheaper and more standardized?", and "How will AI assist in predicting demand to minimize waste in specialty food distribution?" These concerns highlight a strong expectation that AI will move the market toward hyper-personalization and significant operational efficiencies, particularly addressing the challenge of maintaining the quality and viability of live or refrigerated food components. The primary concerns relate to data privacy regarding pet health records and the potential displacement of human expertise in specialized formulation, though overall sentiment anticipates substantial technological benefits leading to superior nutritional outcomes and reduced environmental footprint.

Artificial Intelligence is set to revolutionize the research and manufacturing phases of specialized pet diets. Utilizing machine learning algorithms, manufacturers can process vast datasets related to species-specific nutritional requirements, ingredient bioavailability, disease prevalence, and genomic markers. This capability allows for the development of bespoke feed formulations that precisely balance macronutrients, vitamins, and minerals, optimizing outcomes for specialized needs like breeding success, specific growth stages, or recovery from illness. Furthermore, AI enhances predictive quality control, analyzing sensor data during production to identify and correct deviations in ingredient mixing, pellet density, or heat treatment, ensuring batch consistency and maximum nutrient retention, which is crucial for sensitive exotic pets.

In the supply chain, AI implementation is particularly impactful for the logistics of live and frozen reptile foods, which have demanding requirements for temperature, humidity, and transit time. AI-powered route optimization and demand forecasting significantly reduce spoilage and improve the welfare of live feeder colonies, lowering costs and ensuring fresher products reach the customer. For the consumer, AI-driven platforms, such as sophisticated chatbots or embedded diagnostics tools in smart feeders, offer immediate, personalized dietary advice based on observed consumption patterns, weight changes, or common symptoms reported by the owner. This instant, evidence-based guidance elevates the standard of care for these niche pets, increasing owner confidence in the commercially available food solutions.

- AI-Powered Precision Formulation: Development of species-specific diets optimized using genomic and clinical data, ensuring ideal nutrient ratios for individual health profiles.

- Optimized Insect Farming: Use of machine learning to control environmental conditions (temperature, feed inputs) in large-scale insect rearing facilities, increasing yield and nutritional consistency.

- Predictive Demand Forecasting: Utilizing AI to anticipate seasonal and regional sales fluctuations for highly perishable products (live food, fresh hay), minimizing inventory waste and spoilage.

- Automated Quality Control: Application of computer vision and sensors in manufacturing lines to ensure uniformity, density, and safety standards in pellet and kibble production.

- Personalized Pet Care Apps: Deployment of AI chatbots and diagnostic tools to provide real-time feeding recommendations and symptom analysis for exotic pet owners.

- Supply Chain Efficiency: Algorithmically optimized cold chain logistics for frozen reptile foods, reducing transit times and preserving product integrity across complex distribution networks.

DRO & Impact Forces Of Small Mammal and Reptile Food Market

The Small Mammal and Reptile Food Market is shaped by a strong interplay of compelling drivers and persistent restraints, creating a dynamic environment where opportunities abound, often leveraged through strategic responses to internal and external impact forces. A primary driver is the widespread pet humanization trend, elevating exotic pets from mere novelties to valued family members, prompting owners to willingly spend significantly more on premium, high-welfare nutritional products. This driver is intrinsically linked to the growing influence of veterinary professionals and specialized pet societies who endorse high-quality, commercially prepared diets, further validating consumer investment. Simultaneously, the restraint of limited public knowledge regarding specialized care for exotic pets often leads to improper feeding practices, although this restraint is slowly being mitigated by digital educational resources provided by manufacturers and retailers.

Opportunities in this market are significant, particularly in expanding product lines to address specific life stages (juvenile, adult, senior) and niche dietary requirements, such as low-calcium diets for certain tortoises or high-protein recovery diets for sick ferrets. Furthermore, the development of sustainable and ethically sourced protein alternatives, like black soldier fly larvae (BSFL) for reptiles, presents a lucrative avenue for innovation that aligns with global sustainability mandates. However, the market faces strong impact forces, notably the high cost and complexity associated with sourcing specialized ingredients (e.g., specific hays, wild-caught insects, or ethically raised live prey), which can elevate production costs and consequently retail prices, potentially limiting market penetration in price-sensitive regions.

The overall impact force structure indicates that while the market is susceptible to regulatory changes concerning exotic animal trade and food safety, the technological advances in feed manufacturing and the unwavering commitment to pet welfare will continue to act as powerful positive multipliers. The primary challenge remains managing the biological variability and sensitivity inherent in live food distribution and ensuring shelf stability for specialized, nutrient-dense products. Success hinges on manufacturers’ ability to integrate supply chain innovations that address perishability, coupled with robust educational campaigns that reinforce the value proposition of specialized nutrition over conventional feed options.

Segmentation Analysis

The Small Mammal and Reptile Food Market is comprehensively segmented based on the type of pet, the specific product formulation, and the corresponding distribution channels utilized to reach diverse consumer bases. Segmentation by Pet Type is crucial, as the nutritional needs between a strictly herbivorous rabbit and a carnivorous lizard are fundamentally different, necessitating distinct product portfolios. The segmentation highlights the relative market size of major pet categories, with rabbits, guinea pigs, and bearded dragons typically representing high-volume segments due to their popularity, while niche pets like chinchillas or monitor lizards require highly specialized, lower-volume feeds.

Product Type segmentation dissects the market based on the physical form and purpose of the feed, distinguishing between staple diets (pellets, hay) and specialized items (live feeders, calcium supplements, treats). The growth trajectory varies significantly here; while pellets offer nutritional completeness and convenience, the hay/forage segment is driven by veterinary consensus on fiber necessity, and the live/frozen segment is highly dependent on effective cold-chain logistics. Understanding these segments allows companies to tailor their manufacturing capabilities and inventory management to address both mass-market staples and high-margin, specialized supplements required for optimal pet health across the board.

Finally, Distribution Channel segmentation emphasizes the increasing shift towards e-commerce, which allows consumers easy access to a wider variety of specialized, hard-to-find products typically not stocked by mass retailers. Specialty Pet Stores remain vital for immediate expert advice and customer service, while Veterinary Clinics serve as a high-trust channel for prescription and therapeutic diets. This multidimensional segmentation framework provides stakeholders with a precise map of consumer behavior, competitive landscape, and growth potential within each niche area of the small mammal and reptile food ecosystem.

- By Pet Type:

- Small Mammals (Rabbits, Guinea Pigs, Hamsters/Gerbils, Ferrets, Chinchillas, Others)

- Reptiles (Snakes, Turtles/Tortoises, Lizards/Geckos, Crocodilians, Others)

- By Product Type:

- Dry Food (Pellets, Kibble, Grains)

- Hay and Forage (Timothy Hay, Alfalfa, Orchard Grass)

- Live and Frozen Feeder Food (Crickets, Mealworms, Rodents, Black Soldier Fly Larvae)

- Supplements and Treats (Calcium Dust, Vitamins, Fruit/Vegetable Mixes)

- By Distribution Channel:

- Specialty Pet Stores

- Veterinary Clinics and Pharmacies

- Online Retail (E-commerce Platforms and D2C Websites)

- Mass Merchandisers and Supermarkets

Value Chain Analysis For Small Mammal and Reptile Food Market

The value chain for the Small Mammal and Reptile Food Market is intricate, characterized by specialized upstream activities essential for sourcing highly specific and often biologically sensitive ingredients. Upstream analysis involves the procurement of high-quality agricultural products (specific hays and grains) for small mammals and the highly controlled, captive breeding of live feeder insects or rodents for reptiles. Maintaining consistency and nutritional integrity at this stage is paramount, requiring strict quality control, especially concerning pesticide residues in hay or pathogen screening in live food. Manufacturers often forge long-term contracts with specialized farms and insectaries to ensure a reliable supply that meets the stringent safety and nutritional standards required for these sensitive exotic animals, forming the foundation of product quality and efficacy.

The manufacturing and processing stage involves advanced formulation techniques, including extrusion, pelletizing, and vacuum coating, aimed at improving palatability, shelf life, and nutrient absorption. Crucially, this stage also includes the packaging of live or frozen feeder food, requiring specialized temperature-controlled facilities and complex logistical planning. Downstream analysis focuses on distribution, which is bifurcated into direct and indirect channels. Direct distribution (D2C websites) allows manufacturers greater control over branding and customer data, fostering personalized marketing. Indirect distribution relies heavily on Specialty Pet Stores for their knowledgeable staff who can advise customers on complex dietary needs, and on online mega-retailers for wide reach and efficient handling of bulk or refrigerated items.

Distribution channel effectiveness is highly dependent on product type; veterinary clinics are the primary conduit for specialized therapeutic diets, leveraging the high trust factor associated with professional recommendation. Conversely, mass merchandisers focus mainly on standardized, high-volume pellet feeds for common pets like hamsters or basic turtle sticks. The overall efficiency of the value chain is increasingly being optimized through technology, particularly in inventory management and cold-chain monitoring, ensuring that sensitive products, especially live insects and frozen rodents, maintain their biological viability and nutritional value until they reach the end consumer, thereby safeguarding both product quality and animal welfare.

Small Mammal and Reptile Food Market Potential Customers

Potential customers for the Small Mammal and Reptile Food Market encompass a diverse group of pet owners, professional keepers, and institutional users who prioritize species-appropriate and high-quality nutrition for their exotic companions. The largest demographic comprises general household pet owners, specifically millennials and Gen Z individuals residing in urban environments who seek smaller, quieter pets like rabbits, guinea pigs, or bearded dragons that are suitable for smaller living spaces. This group is characterized by a strong emotional bond with their pets and a willingness to spend premium amounts on products marketed as natural, organic, or veterinarian-approved, viewing quality food as an investment in their pet’s longevity and health.

A secondary, highly valuable customer segment consists of hobbyist keepers and specialized breeders. These individuals maintain large collections of exotic species, such as rare snakes, chameleons, or specialized tortoise breeds, demanding high-volume, extremely consistent, and precise nutritional inputs. Breeders often require specific diets to maximize reproductive success and ensure the health of neonates, making them critical buyers of specialized supplements and ethically sourced live foods. For manufacturers, targeting this group requires highly technical product information and reliability in bulk supply, often facilitated through direct sales or specialized wholesale distributors.

Institutional buyers represent the third key segment, including zoological institutions, educational research facilities, and specialized rehabilitation centers. These organizations require foods that meet rigorous scientific standards and often contract with manufacturers for customized, bulk formulations. Furthermore, the growing network of exotic animal veterinarians serves as a critical indirect customer; while not purchasing the food themselves for ongoing use, their strong influence in prescribing therapeutic and maintenance diets drives significant volume through specialty clinics and pharmacies. Effective marketing strategies must therefore address both the emotional drivers of the household owner and the technical requirements of the professional keeper and veterinarian.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.08 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaytee, Oxbow Animal Health, Supreme Petfoods, Mazuri, Zupreem, Exotic Nutrition, Fluker Farms, Zoo Med, T-Rex Pet Products, Repashy Superfoods, Hikari, Purina Animal Nutrition, Vetafarm, Hartz Mountain Corporation, Vitakraft Sunseed, Manna Pro, Small Pet Select, Rodent Pro, Arcadia Reptile, Nutro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Mammal and Reptile Food Market Key Technology Landscape

The technological landscape within the Small Mammal and Reptile Food Market is rapidly evolving, driven by the need for enhanced nutritional accuracy, prolonged shelf life, and the ethical production of complex food sources. A critical area of development involves advanced extrusion and pelletizing technologies, which utilize specialized machinery to process raw ingredients under controlled heat and pressure. This technique not only ensures ingredient sterilization and digestibility but also allows manufacturers to uniformly integrate specific micronutrients, such as stabilized Vitamin C for guinea pigs or specialized calcium ratios for reptiles, into a highly palatable and structurally consistent pellet form, thereby preventing selective feeding and nutrient imbalance.

Another pivotal technological advancement focuses on the controlled environment agriculture (CEA) necessary for producing high-quality live and frozen feeder insects, a cornerstone of the reptile diet segment. Modern insectaries leverage sophisticated IoT sensors, automated feeding systems, and climate control technologies to optimize conditions for mass rearing species like crickets, mealworms, and black soldier fly larvae (BSFL). This technological approach ensures a consistent, high-protein nutritional profile free from external contaminants or wild-caught parasites, meeting the increasing demand for ethically sourced and nutritionally guaranteed prey items. Furthermore, cryogenic freezing and flash-freezing technologies are essential for preserving the biological integrity of frozen reptile prey, maintaining freshness and minimizing nutrient degradation during storage and transit.

Beyond manufacturing, the use of advanced testing and traceability technologies is becoming standard. Near-Infrared (NIR) spectroscopy is employed for rapid, non-destructive analysis of raw hay and grain ingredients, instantly verifying moisture content, protein levels, and fiber composition before processing. For consumers, the implementation of blockchain technology is starting to appear in niche segments, offering unparalleled traceability from the source (e.g., the specific farm where the hay was grown or the insectary that bred the feeder) directly to the final package. This transparency builds consumer trust, a vital component in the market for specialized and often expensive pet health products, reinforcing the value proposition of premium scientifically formulated diets.

Regional Highlights

- North America: This region holds the largest market share, characterized by high levels of discretionary spending on pets and a mature retail infrastructure that supports both specialized stores and extensive online sales. The US market, in particular, showcases strong demand for premium, organic, and hay-based products for small mammals (rabbits and guinea pigs), driven by high consumer awareness of veterinary recommendations regarding fiber intake. Canada also exhibits robust growth, mirroring US trends with a strong emphasis on locally sourced and sustainable feed options. The region is a leader in product innovation, particularly concerning advanced pellet formulations and therapeutic diets, solidifying its dominant position.

- Europe: Europe represents the second-largest market, driven by stringent animal welfare regulations and a cultural emphasis on high-quality pet care, especially in the UK, Germany, and France. Germany, with its high density of exotic pet owners, is a significant consumer of specialized reptile foods, including live feeder insects and high-grade supplements. The European market sees strong competition among established domestic brands and international players, with a clear segmentation favoring sustainable sourcing, non-GMO ingredients, and environmentally friendly packaging, heavily influenced by EU regulatory standards.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by rising disposable incomes, rapid urbanization, and a shift towards owning smaller, apartment-friendly pets like hamsters, small rodents, and small reptiles. Countries such as China, India, and Southeast Asian nations present immense untapped potential. While the market historically relied on generalized feed, there is a swift movement towards importing or locally manufacturing Western-standard specialized food, particularly premium pellets and high-quality hay. E-commerce platforms are the primary channel for penetration, overcoming fragmented traditional retail landscapes.

- Latin America (LATAM): The LATAM market, while smaller, is experiencing steady growth, particularly in countries like Brazil and Mexico, where exotic pet ownership is culturally established. The market remains sensitive to pricing, favoring mid-range products, but the premiumization trend is emerging, driven by increasing awareness disseminated through social media and local veterinary associations. Challenges include complex import tariffs and establishing reliable cold chain logistics necessary for sensitive reptile foods.

- Middle East and Africa (MEA): This region is characterized by fragmented demand, focused primarily on institutional customers (zoos) and high-net-worth individuals who maintain exotic collections. Growth is concentrated in the UAE and Saudi Arabia, where high-end specialty stores cater to premium products, often imported from Europe and North America. The market is low-volume but high-value, with a strong preference for high-quality, traceable reptile prey items and specialized vitamin supplements for desert-dwelling species.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Mammal and Reptile Food Market.- Kaytee (Central Garden & Pet Company)

- Oxbow Animal Health

- Supreme Petfoods

- Mazuri (Purina Animal Nutrition)

- Zupreem

- Exotic Nutrition

- Fluker Farms

- Zoo Med Laboratories, Inc.

- T-Rex Pet Products

- Repashy Superfoods

- Hikari Sales USA, Inc.

- Vetafarm

- Hartz Mountain Corporation

- Vitakraft Sunseed

- Manna Pro Products, LLC

- Small Pet Select

- Rodent Pro

- Arcadia Reptile

- Nutro (Mars Petcare)

- Ecotrition

Frequently Asked Questions

Analyze common user questions about the Small Mammal and Reptile Food market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Small Mammal and Reptile Food Market?

The primary drivers include the global trend of pet humanization, leading owners to prioritize premium nutrition; the increasing popularity and adoption rates of exotic pets suitable for urban living; and strong endorsements from exotic animal veterinarians advocating for species-appropriate, commercially prepared diets.

How does the segmentation of the market by Product Type affect purchasing decisions?

Product type segmentation is critical, distinguishing between core staple diets (pellets, hay for small mammals) and specialized biological feeds (live/frozen insects for reptiles). Consumer purchasing is highly influenced by the pet's specific dietary needs, with premium purchases concentrated in the high-fiber hay and nutritionally guaranteed live feeder segments.

Which distribution channel is expected to dominate market sales in the forecast period?

Online Retail, encompassing major e-commerce platforms and direct-to-consumer (D2C) websites, is projected to dominate sales. This channel offers extensive product variety, competitive pricing, and efficient logistics for specialized items, including cold chain management necessary for frozen reptile foods, making niche products easily accessible globally.

What are the key technological advancements impacting the reptile food segment?

Key technological impacts include the application of Controlled Environment Agriculture (CEA) and IoT systems for high-volume, standardized breeding of feeder insects (like Black Soldier Fly Larvae), and advanced cryogenics for maintaining the nutritional integrity and freshness of frozen prey items throughout the supply chain.

What major regulatory challenges face manufacturers in this specialized food market?

Manufacturers face significant regulatory challenges related to food safety standards for exotic species, managing biosecurity and pathogen risk in live food production, and navigating complex international trade regulations for importing/exporting specialized ingredients and live animals across diverse jurisdictions like the EU and North America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager