Small Molecule CXO Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433528 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Small Molecule CXO Market Size

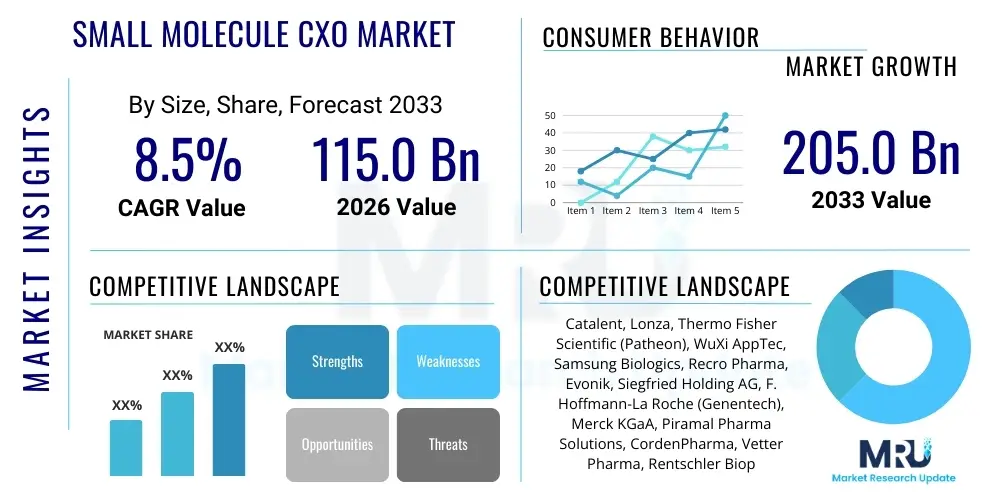

The Small Molecule CXO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 115.0 Billion in 2026 and is projected to reach USD 205.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the pharmaceutical industry’s persistent shift towards outsourcing core functions, especially in complex areas such as API development and clinical trial material production. The cost efficiencies realized through specialized Contract development and manufacturing organizations (CDMOs) and Contract research organizations (CROs) allow innovator companies to focus their internal resources on novel target identification and late-stage commercialization, thereby fueling sustained demand across the value chain.

Small Molecule CXO Market introduction

The Small Molecule CXO Market encompasses the comprehensive spectrum of outsourced services related to the discovery, development, and manufacturing of small molecule active pharmaceutical ingredients (APIs) and finished drug products. This includes activities traditionally handled internally by pharmaceutical and biotechnology companies, such as synthetic route scouting, process optimization, formulation development, clinical supply management, and commercial-scale production. The market is characterized by intense specialization, with providers offering niche expertise in complex chemistries, including highly potent APIs (HPAPIs), chiral synthesis, and flow chemistry, catering to the increasingly sophisticated pipelines of emerging biotechs and large pharmaceutical enterprises seeking speed-to-market and operational flexibility.

The core offerings in this market span early-stage research support (Contract Research Organizations or CROs), encompassing target validation and hit-to-lead optimization, through to late-stage commercial supply (Contract Manufacturing Organizations or CMOs/CDMOs). The integration of these services under the "CXO" umbrella signifies the trend toward integrated service offerings, where clients prefer a single, end-to-end partner capable of managing the entire small molecule lifecycle. Key applications include the development of therapeutics for chronic diseases, oncology, infectious diseases, and central nervous system disorders. The rising prevalence of outsourcing is directly correlated with the escalating complexity and cost of bringing a new drug to market, making external expertise and infrastructure indispensable for maintaining competitive advantage and adhering to stringent global regulatory standards set by bodies like the FDA and EMA.

Major driving factors sustaining the robust growth of the Small Molecule CXO market include the surge in patent expirations leading to increased generic API manufacturing demand, significant funding injection into biotech startups focusing exclusively on innovative small molecule drugs, and the necessity for advanced manufacturing technologies that smaller players cannot afford to maintain in-house. Furthermore, the global trend of pharmaceutical companies divesting non-core manufacturing assets and focusing on virtual research models substantially increases the addressable market for CXO service providers. The benefits realized by utilizing CXOs include accelerated development timelines, access to cutting-edge technologies (such as continuous manufacturing), risk mitigation associated with capacity constraints, and optimization of capital expenditures, solidifying the outsourced model as a permanent fixture in the pharmaceutical landscape.

Small Molecule CXO Market Executive Summary

The Small Molecule CXO market exhibits robust growth underpinned by significant secular business trends, particularly the increasing globalization of pharmaceutical R&D and the persistent financial pressures driving outsourcing adoption across both large and emerging biopharma sectors. Key segment trends indicate a pronounced shift towards integrated CDMO models offering seamless transition from early development to commercialization, with manufacturing services, specifically complex API and HPAPI production, representing the largest and fastest-growing segment due to the rising complexity of new chemical entities. Regionally, while North America and Europe remain the primary revenue generators due to high R&D spending and established regulatory frameworks, the Asia Pacific (APAC) region is demonstrating superior growth dynamics, fueled by lower operational costs, favorable government policies promoting life sciences investment, and the emergence of highly competitive, technically adept local CXOs, positioning it as the future manufacturing powerhouse and a crucial hub for clinical trials, thereby demanding continuous strategic re-evaluation by multinational market participants.

AI Impact Analysis on Small Molecule CXO Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming traditional drug discovery processes handled by CXOs, specifically focusing on improved efficiency in synthesis planning, predictive toxicology, and optimal clinical trial design. The common themes center on AI's potential to significantly reduce the discovery timeline, optimize reaction conditions for cost-effective manufacturing, and enhance regulatory compliance through advanced data analysis. Key concerns revolve around data security, intellectual property rights when large datasets are shared with AI tools managed by CXOs, and the necessary integration of specialized bioinformatics and data science expertise within the operational framework of traditional chemistry and manufacturing service providers. Expectations are high regarding AI-driven lead optimization and predictive capacity planning, which promise to deliver substantial competitive advantages to CXOs that effectively integrate these digital capabilities into their service portfolios, fundamentally altering client engagement models and operational expenditure management.

- AI significantly accelerates hit-to-lead identification and optimization by screening vast chemical libraries computationally.

- Machine learning algorithms predict synthetic feasibility and optimize reaction parameters, improving yield and reducing waste in manufacturing.

- Predictive toxicology and ADMET modeling enhance preclinical candidate selection, reducing the failure rate in subsequent clinical phases.

- AI-driven supply chain management optimizes capacity planning, inventory tracking, and demand forecasting for commercial production.

- Advanced analytics supports smarter clinical trial design, patient selection, and monitoring, leading to faster data generation and regulatory submission readiness.

- Integration of AI tools creates new service segments focused on computational chemistry and in-silico drug design within the CXO offering.

DRO & Impact Forces Of Small Molecule CXO Market

The Small Molecule CXO market is primarily propelled by the fundamental structural shift in the pharmaceutical industry towards asset-light models, requiring extensive external expertise for complex R&D and manufacturing. A significant driver is the rapidly increasing complexity of small molecule drugs, particularly those requiring advanced synthesis capabilities like high-potency API handling and complex conjugation technologies, which demand specialized infrastructure and intellectual capital often found only within leading CXOs. Conversely, the market faces constraints primarily related to stringent and evolving global regulatory scrutiny, particularly concerning data integrity and supply chain compliance, alongside the persistent challenge of talent acquisition and retention in highly specialized chemistry and engineering roles. Opportunities abound in the realm of personalized medicine and niche therapeutic areas, which require flexible, smaller-batch manufacturing runs, complemented by the adoption of sophisticated continuous manufacturing technologies that offer significant efficiency gains and present a key competitive differentiation for forward-thinking CXO providers, creating potent impact forces across the strategic decision-making landscape of the industry.

The primary impact forces shaping the competitive landscape include technological disruptions, regulatory dynamics, and macroeconomic volatility. Technological forces mandate continuous investment in advanced equipment and digital transformation, such as the adoption of Industry 4.0 principles, to maintain operational superiority and meet demands for high quality and rapid turnaround. Regulatory harmonization efforts, or the lack thereof, between key markets influence investment strategies, particularly regarding facility location and validation procedures. Furthermore, geopolitical risks and supply chain resilience have emerged as critical impact forces post-2020, compelling clients to diversify their CXO partners and prioritize regional or dual-sourcing strategies, particularly for critical APIs. The confluence of these drivers, restraints, and opportunities dictates that CXOs must adopt agile operational strategies, focusing on vertical integration and technological innovation to mitigate risks and capitalize on long-term growth trajectories.

A key restraint is the issue of capacity bottlenecks, particularly in specialized areas such as sterile fill-finish and HPAPI handling, where high demand often outstrips available high-quality supply, leading to inflated pricing and prolonged lead times for new projects. This scenario creates an environment where smaller or emerging biotechs may struggle to secure timely access to necessary services. However, this restraint concurrently fuels an immense opportunity for strategic mergers and acquisitions, allowing major CXOs to rapidly expand their geographic footprint and specialized capacity. Ultimately, the market trajectory is heavily influenced by the global pipeline of small molecule drugs entering late-stage development; a healthy pipeline ensures sustained growth (driver), while an unexpected decrease in clinical success rates across the industry could severely limit future manufacturing demand (restraint), highlighting the intrinsically interconnected nature of R&D risk and CXO market performance.

Segmentation Analysis

The Small Molecule CXO market is rigorously segmented based on the type of service provided, the therapeutic area being targeted, the developmental stage of the compound, and the specific end-user category accessing these specialized services. This comprehensive segmentation allows for a granular understanding of demand dynamics, enabling CXO providers to tailor their capabilities, investment strategies, and regional focus areas effectively. The Service Type segmentation, which includes Discovery, Development, and Manufacturing, provides the clearest picture of market expenditure, revealing manufacturing services, specifically Active Pharmaceutical Ingredient (API) production, as the dominant revenue segment due to its capital intensity and continuous commercial demand. Conversely, the Development segment, driven by clinical trial acceleration, often exhibits the highest growth trajectory, reflecting the urgent need to transition promising drug candidates efficiently through regulatory hurdles.

Segmentation by Therapeutic Area illustrates the market’s responsiveness to current pharmaceutical innovation trends, with Oncology consistently holding the largest share, reflecting the high volume and complexity of cancer therapies in development. This segment demands specialized capabilities, such as HPAPI handling. Furthermore, segmentation by Developmental Stage—ranging from Preclinical to Commercial—highlights the varying resource requirements at different phases; early-stage projects heavily utilize CRO services, whereas late-stage and commercial projects are dominated by specialized CDMOs focusing on process validation and scale-up. Analyzing these segments helps in identifying unmet needs, such as the increasing demand for expedited manufacturing services for orphan drugs, which often necessitates flexible capacity arrangements and regulatory expertise in accelerated approval pathways.

The analysis of the End User segment—comprising Pharmaceutical, Biotechnology, and Academic/Research entities—is critical for understanding buying behaviors and strategic partnerships. Biotechnology companies, particularly virtual biotechs with minimal internal infrastructure, represent the fastest-growing client base, relying almost entirely on CXOs for their operations, thereby driving the demand for fully integrated, end-to-end service offerings. Conversely, large pharmaceutical companies utilize CXOs strategically, often seeking specialized technology platforms or external capacity to manage peak production volumes or mitigate supply chain risks. The convergence of these segmentation analyses is vital for market participants seeking to optimize their service portfolio and resource allocation to align with the most lucrative and future-proof market niches, thereby ensuring long-term profitability and strategic resilience in a competitive outsourcing environment.

- By Service Type:

- Discovery Services (Target Validation, Hit Identification, Lead Optimization)

- Development Services (Preclinical Development, Process Development, Formulation)

- Manufacturing Services (API Manufacturing, Drug Product Manufacturing)

- By Therapeutic Area:

- Oncology

- Central Nervous System (CNS) Disorders

- Cardiovascular Diseases

- Infectious Diseases

- Metabolic Disorders

- Other Therapeutic Areas

- By Stage of Development:

- Preclinical Stage

- Clinical Stage (Phase I, Phase II, Phase III)

- Commercial Stage

- By End User:

- Pharmaceutical Companies

- Biotechnology Companies

- Academic and Research Institutes

Value Chain Analysis For Small Molecule CXO Market

The value chain of the Small Molecule CXO market is highly integrated and spans multiple complex stages, beginning with upstream activities focused on raw material procurement, specialized chemical synthesis, and technological platform development. Upstream analysis involves assessing the sourcing reliability and quality of niche chemical building blocks and ensuring compliance with Good Manufacturing Practices (GMP) from the supplier base, which is crucial as the quality of the final drug product is fundamentally dependent on the purity of starting materials. Strategic long-term relationships with key suppliers for high-volume, standard chemicals, and flexible, specialized sourcing networks for complex, proprietary intermediates are vital. The integration of advanced computational chemistry and process engineering platforms at this stage provides the technological foundation for efficient and scalable development, constituting a key competitive differentiator for CXOs.

The core of the value chain involves the execution of Contract Research (Discovery and Preclinical) and Contract Development and Manufacturing services (Clinical and Commercial). Downstream analysis focuses primarily on logistics, packaging, and distribution channel management, ensuring the final drug product reaches global markets efficiently and under strict temperature and regulatory controls. Distribution channels are typically segmented into direct supply (from the CXO facility directly to the client's commercial distribution centers or clinical sites) and indirect channels utilizing third-party logistics (3PL) providers specialized in pharmaceutical supply chain management. The shift towards globalized trials and commercial launches necessitates robust cold chain logistics and sophisticated serialization and traceability systems to combat counterfeiting and meet regulatory requirements in diverse international jurisdictions.

Effective value chain management necessitates a blend of direct client engagement and reliance on specialized external partners. Direct engagement is paramount during the development and manufacturing phases to ensure seamless technology transfer and process alignment, often facilitated through dedicated client relationship managers and joint steering committees. Indirect distribution methods, leveraging global 3PL networks, enhance scalability and regional penetration, particularly in complex emerging markets where established local expertise is essential. The efficiency of the entire value chain is optimized through the adoption of Enterprise Resource Planning (ERP) systems and digital tools that provide real-time visibility into inventory, production scheduling, and regulatory documentation, thereby minimizing lead times and maximizing asset utilization across the complex network of services offered by Small Molecule CXOs.

Small Molecule CXO Market Potential Customers

The primary customers in the Small Molecule CXO market are entities engaged in the research, development, and commercialization of therapeutic drugs, seeking external expertise to manage capital-intensive or specialized activities. These potential customers predominantly include large established pharmaceutical corporations, which leverage CXOs to manage peak capacity, optimize complex manufacturing processes, or access specialized capabilities (like HPAPI handling or continuous flow synthesis) without significant internal capital investment. Pharmaceutical giants often form multi-year, strategic partnerships with top-tier CDMOs, viewing them as extensions of their internal supply chain and R&D functions, focusing on risk mitigation and operational flexibility, particularly when scaling up for global commercial supply chains.

The fastest-growing segment of buyers comprises small-to-mid-sized biotechnology and emerging biopharma companies. These organizations typically operate on a virtual or semi-virtual model, possessing strong intellectual property but limited infrastructure. For these emerging players, CXOs are essential, providing comprehensive, end-to-end services from initial discovery chemistry through to clinical supply manufacturing, essentially serving as their entire R&D and manufacturing arm. The success of these biotechs is critically dependent on the CXO’s ability to navigate regulatory pathways efficiently and provide flexible, high-quality service packages that align with venture capital funding cycles and aggressive development timelines, making reliability and speed paramount purchasing criteria.

Furthermore, academic institutions and major research organizations, particularly those involved in translational science and drug repurposing initiatives, constitute another important customer base. These entities frequently require specialized CRO services for preclinical studies, complex analytical testing, and small-scale cGMP manufacturing of clinical materials for investigator-initiated trials. Their purchasing decisions are often driven by access to highly specialized equipment, cutting-edge analytical capabilities, and competitive pricing, typically engaging CXOs on a project-by-project basis. Therefore, CXO providers must develop segmented service models—offering large-scale, cost-efficient manufacturing for Big Pharma, integrated flexibility for Biotech, and specialized technical consultation for the Academic sector—to effectively capture demand across the entire spectrum of potential customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.0 Billion |

| Market Forecast in 2033 | USD 205.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Catalent, Lonza, Thermo Fisher Scientific (Patheon), WuXi AppTec, Samsung Biologics, Recro Pharma, Evonik, Siegfried Holding AG, F. Hoffmann-La Roche (Genentech), Merck KGaA, Piramal Pharma Solutions, CordenPharma, Vetter Pharma, Rentschler Biopharma, Albany Molecular Research Inc. (AMRI), AbbVie (Allergan), Aenova Group, DPx Holdings (Alcami), Binex Co., Ltd., Syngene International Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Molecule CXO Market Key Technology Landscape

The technological landscape of the Small Molecule CXO market is rapidly evolving, driven by the need for increased efficiency, precision, and the ability to handle increasingly complex chemical structures, particularly those relevant to precision medicine. A critical area of technological focus is continuous manufacturing (CM), which moves away from traditional batch processing to a streamlined, automated, and continuous flow of materials. CM offers significant advantages including reduced footprint, lower operational costs, and superior control over reaction parameters, leading to higher product quality and reduced timelines. Leading CXOs are making substantial investments in modular CM platforms, enabling them to offer clients faster scale-up from clinical trials to commercial production, a key differentiator in a time-sensitive market. Furthermore, advanced analytical techniques such as Process Analytical Technology (PAT) are integrated into these CM systems to monitor critical quality attributes in real-time, ensuring stringent regulatory compliance and robust process validation.

Another pivotal technology involves handling High Potency Active Pharmaceutical Ingredients (HPAPIs), which are increasingly common in oncology and targeted therapies. CXOs must utilize specialized containment facilities, including isolators, glove boxes, and highly sophisticated HVAC systems, to ensure operator safety and prevent cross-contamination while maintaining GMP standards. The technical expertise in developing scalable synthetic routes for complex, multi-chiral molecules is also crucial, often leveraging cutting-edge synthetic methodologies such as biocatalysis and flow chemistry. Biocatalysis, utilizing enzymes to facilitate highly selective and environmentally friendly reactions, allows for the production of complex intermediates with high purity and fewer synthetic steps, significantly reducing cost and waste, thereby aligning with sustainability mandates increasingly valued by large pharmaceutical clients.

Beyond chemistry and manufacturing, digital transformation technologies are reshaping the CXO operational model. Cloud-based data management systems, laboratory information management systems (LIMS), and secure client portals facilitate seamless data sharing and regulatory documentation, enhancing transparency and project oversight for clients globally. The application of Artificial Intelligence and Machine Learning (as detailed in the AI Impact Analysis) is becoming standard practice in predicting molecular properties, optimizing synthesis routes, and managing complex clinical trial logistics. The strategic adoption of these integrated digital and physical technologies—from continuous reactors and specialized containment to advanced data analytics—defines the competitive edge and dictates the capacity of a CXO to service the next generation of small molecule therapies, positioning technological mastery as a core component of market leadership.

Regional Highlights

The global Small Molecule CXO market exhibits distinct regional dynamics, influenced by R&D intensity, regulatory environment maturity, and cost competitiveness. North America, particularly the United States, remains the largest revenue contributor due to the presence of the world's leading pharmaceutical and biotechnology companies, exceptionally high R&D spending, and a robust venture capital ecosystem funding novel small molecule development. The region drives demand for high-end, specialized services, particularly early-stage discovery and development (CRO services), and complex manufacturing services (HPAPI, sterile formulation). The stringent but clear regulatory pathway established by the FDA encourages high investment in quality assurance and specialized technologies within the regional CXO infrastructure, leading to premium service pricing but guaranteed compliance and speed to market for innovative drugs.

Europe, driven primarily by Germany, Switzerland, Ireland, and the UK, constitutes the second major market hub. The European market is characterized by a mature pharmaceutical base and strong manufacturing heritage, resulting in a dense presence of specialized CDMOs focusing heavily on complex API production and large-scale commercial supply for both regional and global markets. European CXOs are often leaders in adopting advanced manufacturing technologies like continuous processing and green chemistry initiatives, driven partly by stringent environmental regulations and a focus on sustainability. Furthermore, regulatory alignment through the European Medicines Agency (EMA) facilitates pan-European commercialization, making the region a critical location for manufacturing and supply chain management for global pharmaceutical companies.

The Asia Pacific (APAC) region, encompassing China, India, and South Korea, is projected to record the highest growth rates over the forecast period. This accelerated expansion is primarily attributed to highly competitive operational costs, substantial government support for local life sciences ecosystems, and a rapidly expanding pool of skilled scientific talent. China and India are major hubs for generic API manufacturing and large-scale clinical trials, attracting global attention for their capacity and efficiency. While challenges related to intellectual property protection and regulatory harmonization persist, the scale of manufacturing capability, particularly in India (often referred to as the 'Pharmacy of the World'), and the rising technological sophistication of South Korean CDMOs, positions APAC as the unavoidable future hub for large volume, cost-effective small molecule production, forcing North American and European players to establish strategic partnerships or direct operations in the region.

- North America: Dominant market due to extensive biotech funding, high R&D intensity, and demand for specialized early-stage CRO services; focus on complex synthesis and stringent quality standards.

- Europe: Mature market characterized by strong API manufacturing expertise, high adoption of advanced technologies (e.g., continuous manufacturing), and strategic partnerships with global pharma; centers in Germany, Switzerland, and Ireland.

- Asia Pacific (APAC): Fastest-growing region driven by competitive operating costs, massive production capacity (especially in India and China), and increasing technological maturity, serving as a global center for generic API and clinical trial services.

- Latin America (LATAM): Emerging potential market, primarily focused on serving local pharmaceutical markets and expanding clinical trial capabilities, though regulatory complexity remains a barrier to large-scale international commercial manufacturing.

- Middle East and Africa (MEA): Small but developing market, primarily reliant on imports and local formulation activities; growing interest in establishing regional manufacturing hubs to enhance drug security, offering niche opportunities for specialized CXOs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Molecule CXO Market.- Catalent, Inc.

- Lonza Group AG

- Thermo Fisher Scientific Inc. (Patheon)

- WuXi AppTec Co., Ltd.

- Samsung Biologics Co., Ltd.

- Recro Pharma, Inc.

- Evonik Industries AG

- Siegfried Holding AG

- F. Hoffmann-La Roche Ltd (Genentech)

- Merck KGaA

- Piramal Pharma Solutions

- CordenPharma International

- Vetter Pharma-Fertigung GmbH & Co. KG

- Rentschler Biopharma SE

- Albany Molecular Research Inc. (AMRI, now Curia Global, Inc.)

- AbbVie Inc. (Allergan)

- Aenova Group

- DPx Holdings B.V. (Alcami)

- Binex Co., Ltd.

- Syngene International Ltd.

Frequently Asked Questions

Analyze common user questions about the Small Molecule CXO market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Small Molecule CXO market?

The core driver is the increasing tendency of large pharmaceutical companies and emerging biotechs to adopt asset-light business models, leading to extensive outsourcing of complex, capital-intensive activities, particularly specialized API manufacturing and advanced process development, ensuring greater capital efficiency and access to niche technologies.

How is High Potency Active Pharmaceutical Ingredient (HPAPI) handling impacting CXO service demand?

The rising prevalence of highly targeted small molecule therapies, especially in oncology, necessitates specialized facilities and expertise for HPAPI handling. CXOs equipped with advanced containment infrastructure and safety protocols are experiencing significant demand growth, as most clients lack the internal capacity to manage these potent compounds safely and compliantly at scale.

What role does Continuous Manufacturing (CM) play in the competitiveness of Small Molecule CDMOs?

Continuous Manufacturing is a critical technological differentiator, allowing CDMOs to offer faster time-to-market, enhanced product quality control via Process Analytical Technology (PAT), and reduced operating costs compared to traditional batch processes. Adoption of CM positions a CDMO favorably for strategic, long-term partnerships requiring efficient, high-volume production.

Which region is expected to demonstrate the highest growth rate in the Small Molecule CXO market and why?

The Asia Pacific (APAC) region is projected to register the highest CAGR, primarily driven by substantial cost advantages in large-scale manufacturing, increased government support for the life sciences sector in countries like China and India, and the rising technological sophistication of local CDMOs attracting global outsourcing demand for both generics and novel compounds.

What are the major supply chain challenges facing the Small Molecule CXO industry?

Major challenges include geopolitical instability leading to critical raw material supply risks, capacity bottlenecks in highly specialized areas (like sterile fill-finish), and the necessity for robust serialization and traceability systems to ensure compliance with diverse global regulatory requirements, requiring strategic dual-sourcing and resilience planning.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager