Small Molecule Drug CDMO Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439369 | Date : Jan, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Small Molecule Drug CDMO Services Market Size

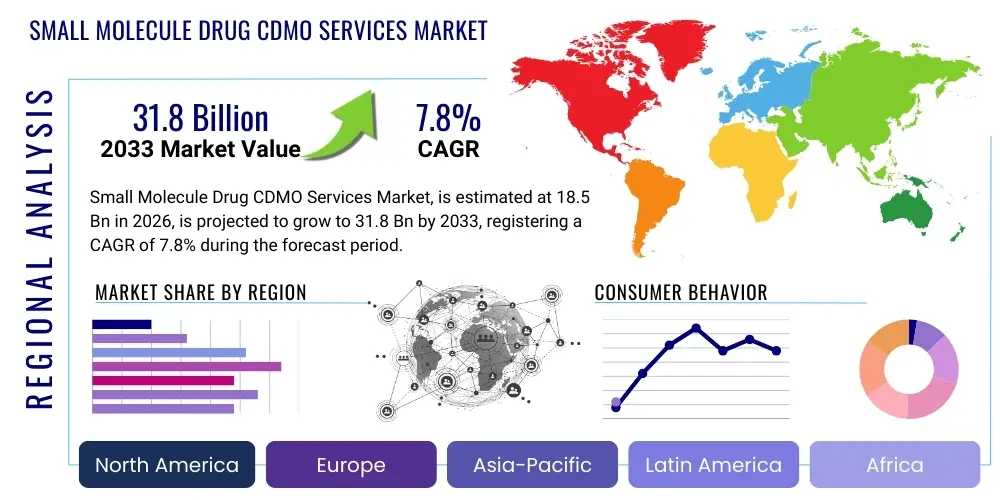

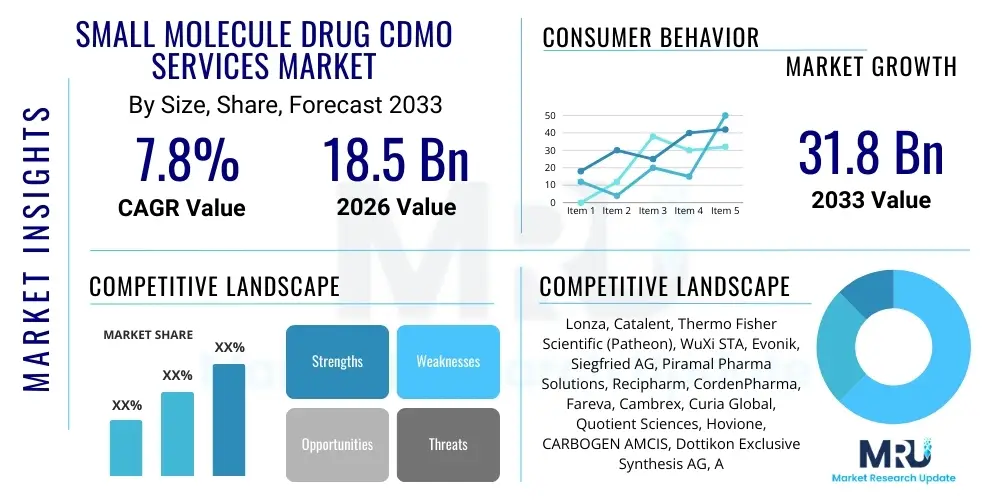

The Small Molecule Drug CDMO Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

Small Molecule Drug CDMO Services Market introduction

The Small Molecule Drug Contract Development and Manufacturing Organization (CDMO) Services market encompasses a comprehensive range of outsourced activities critical to the pharmaceutical industry, from early-stage drug discovery and development to commercial manufacturing and packaging of small molecule active pharmaceutical ingredients (APIs) and finished drug products. These services are vital for pharmaceutical and biotechnology companies looking to streamline their operations, leverage specialized expertise, and accelerate their drugs' journey from concept to market. CDMOs offer an integrated approach, providing services such as process development, formulation development, analytical testing, stability studies, clinical trial material manufacturing, and commercial-scale production, often under stringent regulatory guidelines.

The primary applications for small molecule CDMO services span a vast array of therapeutic areas, including but not limited to oncology, cardiovascular diseases, central nervous system disorders, infectious diseases, and metabolic disorders. The benefits of engaging CDMOs are numerous, offering pharmaceutical companies cost efficiencies by avoiding significant capital expenditures on infrastructure and personnel, access to advanced technologies and specialized scientific talent, and enhanced flexibility to scale production up or down based on demand. This strategic outsourcing allows pharmaceutical innovators to focus on their core competencies, such as drug discovery and clinical development, while mitigating risks associated with manufacturing complexities and regulatory compliance.

Key driving factors for the robust growth of this market include the increasing global pharmaceutical R&D expenditure, the rising complexity of small molecule drug candidates demanding specialized manufacturing capabilities, and the growing trend among pharmaceutical companies to outsource non-core activities to gain competitive advantages. Additionally, the expiration of patents for blockbuster drugs is fueling the demand for generic drug development and manufacturing, often supported by CDMOs. The constant need for faster time-to-market, coupled with evolving regulatory landscapes and the necessity for robust supply chain management, further solidifies the essential role of small molecule CDMO services in the modern pharmaceutical ecosystem.

Small Molecule Drug CDMO Services Market Executive Summary

The Small Molecule Drug CDMO Services market is experiencing dynamic business trends characterized by a strong emphasis on consolidation, technological innovation, and an increasing demand for end-to-end integrated services. Pharmaceutical companies are increasingly seeking partners capable of handling multiple stages of the drug development and manufacturing process, from pre-clinical to commercialization, to simplify supply chains and ensure consistency. This has led to strategic mergers and acquisitions within the CDMO sector, enabling larger entities to expand their service portfolios, geographical reach, and specialized capabilities, particularly in areas like highly potent APIs (HPAPIs), sterile manufacturing, and continuous processing. Digitalization and automation are also playing a pivotal role in optimizing operational efficiency, quality control, and data management across CDMO facilities.

Regionally, North America and Europe continue to dominate the market due to the presence of a well-established pharmaceutical industry, significant R&D investments, and stringent regulatory frameworks that favor experienced CDMOs. However, the Asia Pacific region is rapidly emerging as a high-growth market, driven by lower manufacturing costs, increasing government support for the life sciences sector, and a growing number of local pharmaceutical and biotechnology companies. Countries like China and India are becoming key manufacturing hubs for APIs and intermediates, attracting substantial investments and collaborations. Latin America and the Middle East & Africa regions are also showing promising growth, albeit from a smaller base, fueled by improving healthcare infrastructure and expanding access to medicines.

Segment-wise, the market is seeing significant growth in both API manufacturing and drug product manufacturing, with a particular demand for specialized capabilities. Within API manufacturing, the need for HPAPI handling, chiral synthesis, and complex chemistry solutions is escalating due to the nature of modern drug candidates. For drug product manufacturing, sterile injectables, modified-release formulations, and pediatric formulations are key growth areas. The increasing pipeline of new chemical entities (NCEs) and complex generics further contributes to the demand across all stages of development, from clinical trial materials to commercial-scale production. The trend towards personalized medicine and orphan drugs also creates opportunities for CDMOs capable of handling smaller batch sizes and highly specialized manufacturing processes.

AI Impact Analysis on Small Molecule Drug CDMO Services Market

User questions regarding the impact of AI on the Small Molecule Drug CDMO Services market frequently revolve around its potential to revolutionize drug discovery and development, enhance manufacturing efficiency, and reduce costs. Common inquiries explore how AI can accelerate lead compound identification, optimize synthetic routes, improve process parameters, and ensure quality control throughout the manufacturing lifecycle. There is considerable interest in AI's role in predictive analytics for supply chain management, demand forecasting, and risk assessment, alongside its capacity to streamline regulatory processes and facilitate data-driven decision-making. Users are keenly interested in whether AI can shorten the drug development timeline, making manufacturing more agile and personalized, while also considering potential challenges such as data privacy, algorithmic bias, and the need for significant initial investment and skilled talent to implement these advanced technologies.

The integration of Artificial Intelligence (AI) is poised to fundamentally transform the Small Molecule Drug CDMO Services market by injecting unprecedented levels of efficiency, precision, and innovation into various operational facets. In the early stages of drug development, AI algorithms can rapidly analyze vast datasets of chemical compounds, predict their properties, and identify potential drug candidates with higher accuracy and speed than traditional methods. This significantly shortens the lead optimization phase and improves the chances of success. Furthermore, AI-driven computational chemistry can design more efficient synthetic routes for APIs, reducing material consumption, waste, and overall production costs while simultaneously improving yields and purity.

Within manufacturing, AI tools are enhancing process development and optimization. Machine learning models can monitor real-time production data from bioreactors and synthesis vessels, identifying subtle deviations and predicting potential failures before they occur. This proactive approach minimizes downtime, ensures batch consistency, and significantly improves overall product quality. AI-powered analytical systems can perform faster and more accurate quality control, reducing the need for extensive manual testing. Beyond the lab and factory floor, AI contributes to robust supply chain management by predicting demand fluctuations, optimizing inventory levels, and identifying potential supply chain disruptions, thereby ensuring a more resilient and responsive CDMO service offering. This holistic application of AI across the value chain positions CDMOs to deliver more innovative, cost-effective, and high-quality services to their clients.

- AI accelerates drug discovery by predicting compound efficacy and toxicity.

- Optimizes synthetic routes for APIs, reducing development time and costs.

- Enhances process development and manufacturing efficiency through real-time monitoring and predictive maintenance.

- Improves quality control and assurance with advanced data analytics and anomaly detection.

- Facilitates supply chain optimization and demand forecasting, leading to better resource allocation.

- Supports personalized medicine by enabling flexible and precise small-batch manufacturing.

- Streamlines regulatory documentation and compliance through automated data compilation and analysis.

- Mitigates risks associated with process deviations and ensures higher batch consistency.

- Drives innovation in formulation development through computational modeling.

- Aids in identifying and characterizing impurities more efficiently.

DRO & Impact Forces Of Small Molecule Drug CDMO Services Market

The Small Molecule Drug CDMO Services Market is significantly shaped by a confluence of driving factors, restraints, opportunities, and broader impact forces. Key drivers include the escalating global pharmaceutical R&D expenditure, which fuels the pipeline of new small molecule drug candidates requiring expert development and manufacturing. The increasing trend of pharmaceutical and biotechnology companies outsourcing non-core activities to focus on innovation further propels CDMO demand, leveraging specialized expertise, advanced technologies, and cost efficiencies offered by these partners. The growing complexity of small molecules, including highly potent APIs (HPAPIs) and chiral compounds, necessitates specialized handling and manufacturing capabilities that CDMOs are uniquely positioned to provide. Additionally, the rising demand for generic drugs and biosimilars, driven by patent expirations and healthcare cost containment efforts, generates substantial opportunities for CDMOs in formulation and commercial manufacturing.

Despite robust growth drivers, the market faces several restraints. Stringent regulatory environments globally, particularly from bodies like the FDA and EMA, impose significant compliance burdens and necessitate substantial investments in quality systems and infrastructure, which can be challenging for smaller CDMOs. High capital investment required for advanced manufacturing technologies and facility expansion can also act as a barrier to entry or growth. Concerns related to intellectual property (IP) protection, especially when outsourcing sensitive drug development and manufacturing processes, remain a critical consideration for clients. Furthermore, challenges in maintaining consistent quality control across diverse manufacturing sites and navigating complex global supply chains present operational hurdles. Geopolitical instabilities and trade disputes can also disrupt raw material sourcing and product distribution, impacting the overall market stability and growth.

Opportunities for growth are abundant, particularly in emerging markets such as Asia Pacific, Latin America, and the Middle East, where healthcare infrastructure is expanding and pharmaceutical spending is increasing. The demand for advanced therapy medicinal products (ATMPs) and personalized medicine, though often associated with biologics, also creates specialized small molecule opportunities, especially for linkers and payloads in antibody-drug conjugates (ADCs) or other complex small molecule components. Technological advancements such as continuous manufacturing, flow chemistry, and digitalization (e.g., AI, IoT, big data analytics) offer avenues for CDMOs to enhance efficiency, reduce costs, and improve quality, thereby gaining a competitive edge. Strategic partnerships, mergers, and acquisitions remain a vital strategy for CDMOs to expand their service offerings, geographical presence, and technological capabilities, catering to a broader client base and capturing greater market share. The ongoing need for robust and resilient supply chains post-pandemic further underscores the value of diversified and geographically dispersed CDMO networks.

Segmentation Analysis

The Small Molecule Drug CDMO Services market is comprehensively segmented across various dimensions, providing a granular view of its structure and growth dynamics. These segmentations are crucial for understanding market demand, competitive landscapes, and strategic opportunities. The primary axes of segmentation typically include the type of service offered, the specific application or therapeutic area, the end-user leveraging these services, and the stage of development for the drug candidate. Each segment exhibits unique characteristics, growth drivers, and competitive nuances, reflecting the diverse needs of the pharmaceutical and biotechnology industries.

- By Service Type:

- API Manufacturing

- Drug Product Manufacturing (Formulation, Fill-Finish)

- Process Development

- Analytical Services

- Packaging & Labeling

- Regulatory Consulting & Support

- Clinical Research & Development (CR&D)

- Stability Studies

- Custom Synthesis

- By Application/Therapeutic Area:

- Oncology

- Cardiovascular Diseases

- Central Nervous System (CNS) Disorders

- Infectious Diseases

- Metabolic Disorders

- Respiratory Diseases

- Immunology

- Gastroenterology

- Dermatology

- Other Therapeutic Areas

- By End-User:

- Pharmaceutical Companies (Big Pharma)

- Biotechnology Companies

- Specialty Pharmaceutical Companies

- Generic Drug Manufacturers

- Academic & Research Institutions

- By Stage of Development:

- Pre-clinical

- Clinical (Phase I, Phase II, Phase III)

- Commercial Manufacturing

- By Molecule Type (within Small Molecules):

- Highly Potent APIs (HPAPIs)

- Chiral Molecules

- Complex Generics

- New Chemical Entities (NCEs)

- Steroids & Hormones

Value Chain Analysis For Small Molecule Drug CDMO Services Market

The value chain for the Small Molecule Drug CDMO Services market is intricate, involving a series of interconnected stages from raw material procurement to the final distribution of drug products. At the upstream end, the chain begins with suppliers of raw materials, key intermediates, excipients, and specialized equipment providers. These suppliers are critical for providing the foundational components necessary for synthesis and formulation. CDMOs meticulously select and qualify their upstream partners to ensure the quality, purity, and consistent supply of materials, which directly impacts the quality and regulatory compliance of the final drug substance or product. Robust supplier management and quality agreements are essential at this stage to mitigate risks and ensure adherence to Good Manufacturing Practices (GMP).

The core of the value chain is the CDMOs themselves, which undertake the complex processes of drug development and manufacturing. This includes process optimization, analytical method development, API synthesis, formulation development, clinical manufacturing, and large-scale commercial production. CDMOs invest heavily in scientific expertise, advanced technologies, and quality infrastructure to provide these specialized services. Their role involves transforming raw materials into drug substances and then into finished dosage forms, often managing multiple projects for various clients simultaneously. This stage also involves extensive regulatory documentation and compliance efforts, ensuring that all processes meet international standards set by regulatory bodies like the FDA, EMA, and other national health authorities.

Downstream, the manufactured APIs and drug products are delivered to pharmaceutical companies, biotechnology firms, and sometimes academic research institutions, which represent the direct customers. These clients then manage further distribution to hospitals, pharmacies, and ultimately, patients. Distribution channels can be direct, where CDMOs ship products directly to their clients' distribution centers, or indirect, through specialized third-party logistics (3PL) providers who handle warehousing, transportation, and cold chain management. The effectiveness of the distribution channel is crucial for ensuring product integrity and timely delivery to the end-user market. The entire value chain is characterized by a high degree of collaboration, stringent quality control at every step, and a continuous focus on innovation and efficiency to bring life-saving small molecule drugs to patients worldwide.

Small Molecule Drug CDMO Services Market Potential Customers

The primary potential customers for Small Molecule Drug CDMO Services are diverse entities within the pharmaceutical and biotechnology ecosystems, all seeking specialized expertise and capacity for drug development and manufacturing. Large pharmaceutical companies, often referred to as "Big Pharma," represent a significant customer segment. Despite their extensive in-house capabilities, these companies increasingly outsource complex or niche projects, early-stage development, or supplementary commercial manufacturing to CDMOs to manage capacity fluctuations, access specialized technologies like HPAPI handling or sterile fill-finish, or accelerate time-to-market for their vast pipelines. Outsourcing allows them to focus internal resources on core drug discovery and clinical research activities, while leveraging the CDMO's efficiency and cost-effectiveness.

Biotechnology companies, particularly smaller and mid-sized firms, constitute another crucial customer base. These companies often possess innovative drug candidates but lack the necessary infrastructure, manufacturing expertise, and capital to develop and produce their molecules in-house. CDMOs provide them with a full suite of services, from process development and clinical trial material supply to commercial manufacturing, enabling them to bring their novel therapies to patients without prohibitive upfront investments. Virtual pharma companies, which operate with minimal internal infrastructure and outsource nearly all development and manufacturing activities, are also increasingly reliant on comprehensive CDMO partnerships to manage their entire product lifecycle.

Additionally, specialty pharmaceutical companies focusing on specific therapeutic areas or niche markets, generic drug manufacturers seeking cost-effective and efficient production of off-patent drugs, and even academic and research institutions requiring custom synthesis or small-batch manufacturing for research purposes, are significant potential customers. The need for flexible manufacturing solutions, regulatory expertise, and advanced analytical capabilities across all these customer segments underscores the foundational role of small molecule CDMOs in facilitating drug innovation and ensuring global drug supply. The growing complexity of small molecules and the pressures of accelerating drug development timelines further solidify the symbiotic relationship between CDMOs and their diverse client base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza, Catalent, Thermo Fisher Scientific (Patheon), WuXi STA, Evonik, Siegfried AG, Piramal Pharma Solutions, Recipharm, CordenPharma, Fareva, Cambrex, Curia Global, Quotient Sciences, Hovione, CARBOGEN AMCIS, Dottikon Exclusive Synthesis AG, Almac Group, Merck KGaA (MilliporeSigma CDMO Services), PCAS, Delpharm |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Molecule Drug CDMO Services Market Key Technology Landscape

The Small Molecule Drug CDMO Services market is characterized by a rapidly evolving technological landscape, driven by the need for greater efficiency, higher quality, and the ability to handle increasingly complex molecules. A significant trend is the adoption of continuous manufacturing processes, which offer substantial advantages over traditional batch processing. Continuous manufacturing allows for smaller equipment footprints, reduced energy consumption, higher yields, and more consistent product quality by maintaining steady-state operations. This technology is particularly appealing for high-volume products and those requiring strict control over reaction parameters, leading to more robust and scalable production methods for APIs and drug products alike.

Another critical area of technological advancement is flow chemistry, which involves performing chemical reactions in continuously flowing streams rather than in batch reactors. Flow chemistry enhances reaction control, improves safety, enables the synthesis of highly potent compounds more effectively, and often leads to higher purity and yield. This technology is becoming indispensable for the synthesis of complex intermediates and APIs, especially those involving hazardous reagents or highly exothermic reactions. Furthermore, the handling of highly potent active pharmaceutical ingredients (HPAPIs) requires specialized containment technologies, such as isolators and restricted access barrier systems (RABS), ensuring operator safety and preventing cross-contamination, a capability increasingly sought after by pharmaceutical clients.

Digitalization and automation are also transforming the CDMO space. The integration of advanced analytics, artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) is enabling real-time monitoring of manufacturing processes, predictive maintenance, and data-driven decision-making. These technologies facilitate the implementation of Quality by Design (QbD) principles, allowing CDMOs to understand and control critical process parameters more effectively, thereby enhancing product quality and reducing regulatory risks. Other key technologies include advanced particle engineering techniques (e.g., micronization, nano-milling), sophisticated analytical instrumentation for comprehensive characterization, and specialized formulation capabilities like amorphous solid dispersions, hot-melt extrusion, and sterile fill-finish operations, all aimed at improving drug solubility, bioavailability, and patient compliance.

Regional Highlights

- North America: Dominant market share due to a mature pharmaceutical industry, significant R&D investments, presence of numerous large pharmaceutical and biotechnology companies, and robust regulatory framework. The United States is the primary contributor, focusing on novel drug development and advanced manufacturing technologies.

- Europe: A key player driven by strong pharmaceutical innovation, established CDMO infrastructure, and a focus on specialized services like HPAPI manufacturing and sterile injectables. Countries like Germany, Switzerland, the UK, and France are leaders in R&D and manufacturing excellence.

- Asia Pacific (APAC): Fastest-growing region, fueled by lower manufacturing costs, increasing pharmaceutical production, expanding healthcare expenditure, and a growing number of local pharmaceutical and biotechnology companies. China, India, and Japan are significant markets, offering both cost-effective large-scale manufacturing and specialized capabilities.

- Latin America: Emerging market with increasing investments in healthcare infrastructure and pharmaceutical manufacturing. Countries like Brazil and Mexico are showing potential for growth, driven by local demand and efforts to reduce reliance on imports.

- Middle East and Africa (MEA): A nascent but developing market, characterized by increasing healthcare investments and a push towards local pharmaceutical production to improve drug accessibility and reduce healthcare costs. Opportunities exist for specialized CDMO services as local capabilities expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Molecule Drug CDMO Services Market.- Lonza

- Catalent

- Thermo Fisher Scientific (Patheon)

- WuXi STA

- Evonik

- Siegfried AG

- Piramal Pharma Solutions

- Recipharm

- CordenPharma

- Fareva

- Cambrex

- Curia Global

- Quotient Sciences

- Hovione

- CARBOGEN AMCIS

- Dottikon Exclusive Synthesis AG

- Almac Group

- Merck KGaA (MilliporeSigma CDMO Services)

- PCAS

- Delpharm

Frequently Asked Questions

What are Small Molecule Drug CDMO Services?

Small Molecule Drug CDMO Services encompass outsourced activities for developing and manufacturing active pharmaceutical ingredients (APIs) and finished drug products based on small molecules, covering everything from process development, formulation, and analytical testing to clinical trial material and commercial production.

Why do pharmaceutical companies use Small Molecule CDMOs?

Pharmaceutical companies engage CDMOs to access specialized expertise, advanced technologies, reduce capital expenditure, achieve cost efficiencies, accelerate time-to-market, manage capacity fluctuations, and comply with stringent regulatory requirements, allowing them to focus on core drug discovery.

What are the key growth drivers for the Small Molecule Drug CDMO Services Market?

Key drivers include increasing R&D spending, the growing trend of outsourcing in pharma, rising complexity of small molecules requiring specialized handling, patent expirations fueling generics, and the demand for faster drug development timelines.

How does AI impact Small Molecule Drug CDMO Services?

AI significantly impacts CDMO services by accelerating drug discovery, optimizing synthetic routes, enhancing manufacturing process efficiency and quality control through real-time monitoring and predictive analytics, and improving supply chain management for greater agility.

Which regions are leading the Small Molecule Drug CDMO Services Market?

North America and Europe currently lead the market due to strong pharmaceutical industries and R&D investments, while the Asia Pacific region is rapidly growing, driven by cost advantages and expanding manufacturing capabilities in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager