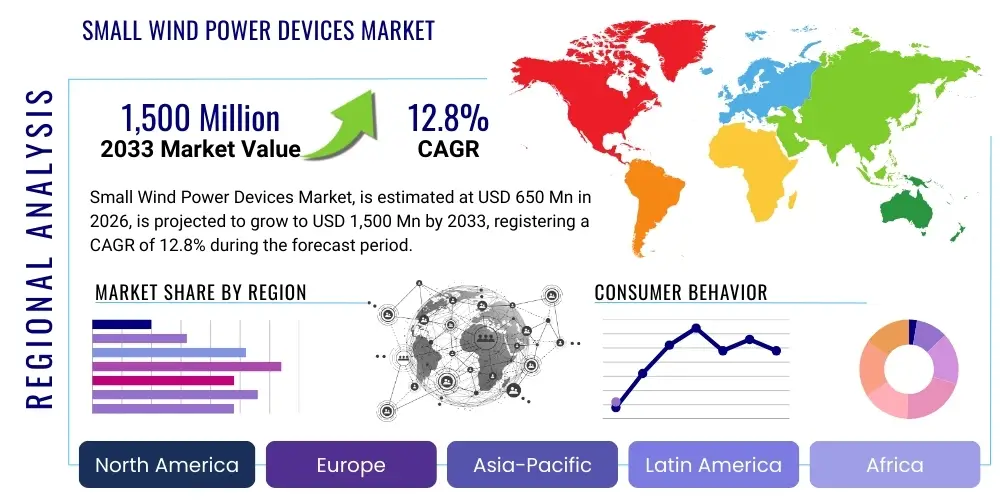

Small Wind Power Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438234 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Small Wind Power Devices Market Size

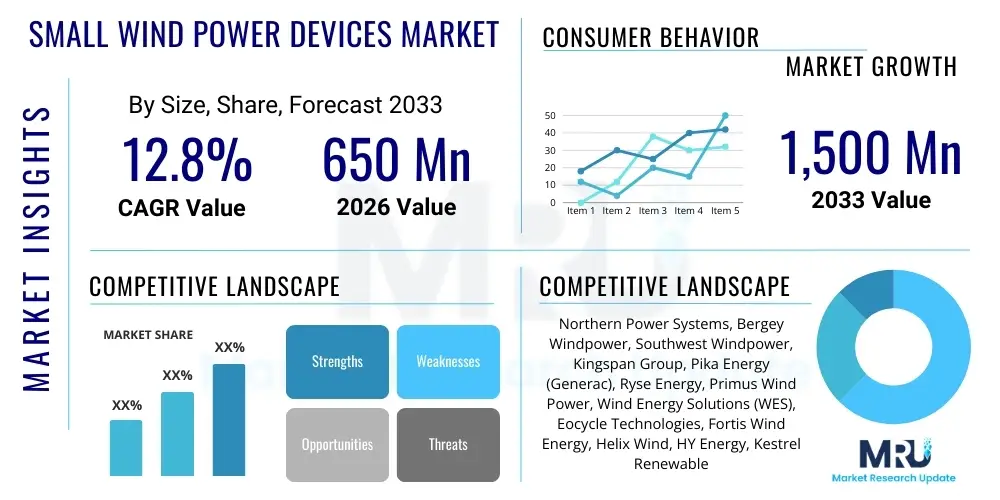

The Small Wind Power Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,500 Million by the end of the forecast period in 2033. This robust growth trajectory is underpinned by increasing global emphasis on decentralized power generation, particularly in remote or off-grid locations where connecting to the central electrical grid is technically challenging or economically prohibitive. Furthermore, regulatory support through favorable incentives, such as feed-in tariffs and tax credits across various developed and developing economies, is accelerating the adoption rate of small wind turbine systems for residential, agricultural, and small commercial applications.

The small wind power devices segment, typically encompassing turbines with a capacity less than 100 kW, is characterized by its versatility and ease of installation compared to large utility-scale wind farms. Market expansion is also significantly influenced by advancements in turbine design, including the shift towards more efficient vertical-axis wind turbines (VAWTs) and optimized horizontal-axis wind turbines (HAWTs) that operate effectively in lower wind speed environments. These technological improvements enhance the overall energy capture and reliability, making small wind solutions increasingly viable for supplementing solar photovoltaic installations in hybrid renewable energy systems. The declining cost of components, coupled with standardized manufacturing processes, is further improving the return on investment for end-users.

Geographically, regions such as Asia Pacific and North America are expected to be the primary growth engines. Asia Pacific, driven by rapid electrification efforts in rural areas of countries like India and China, presents immense potential for off-grid small wind applications. In North America and Europe, the focus shifts towards grid-connected systems for homeowners seeking to reduce their carbon footprint and achieve energy independence. However, market acceptance still faces challenges related to public perception, stringent zoning restrictions in urban settings, and the intermittency associated with wind resources, which necessitates robust energy storage solutions for continuous power supply. Despite these hurdles, the fundamental drive toward sustainable and reliable localized energy generation ensures continued market momentum throughout the forecast period.

Small Wind Power Devices Market introduction

Small Wind Power Devices, often defined as turbines generating electricity with capacities ranging from less than 1 kW up to 100 kW, represent a critical element in the distributed renewable energy landscape. These devices capture kinetic energy from the wind and convert it into usable electricity, primarily catering to localized energy needs. Key products include horizontal-axis wind turbines (HAWTs) and vertical-axis wind turbines (VAWTs), each offering distinct advantages regarding noise levels, efficiency at varying wind speeds, and aesthetic integration. Major applications span residential power generation, agricultural settings (such as powering irrigation pumps or remote monitoring systems), small commercial enterprises, telecom towers, and marine vessels. These systems are particularly valuable in off-grid applications where they provide reliable, clean energy independence, drastically reducing reliance on costly and environmentally harmful diesel generators. The core benefits include reduced electricity bills, decreased carbon emissions, enhanced energy security, and providing power access to remote areas.

The driving factors for market growth are multifaceted. Globally, supportive government policies promoting renewable energy integration, coupled with rising electricity costs and increasing consumer awareness regarding climate change, propel demand. Technological advancements focusing on lightweight materials, improved blade aerodynamics, and integrated smart control systems enhance the performance and longevity of these devices. Moreover, the synergy between small wind turbines and battery storage systems (BESS) is overcoming the historical challenge of power intermittency, making small wind a highly attractive component of hybrid power installations. The global trend towards decentralization and microgrid development strongly favors the adoption of these scalable and flexible power generation solutions.

The Small Wind Power Devices Market is fundamentally shifting from niche hobbyist adoption to a serious commercial option for localized energy resilience. As manufacturing scales up and components become standardized, the capital costs continue to decline, improving economic viability. This market segment is characterized by fierce competition among manufacturers focusing on optimizing efficiency in turbulent wind environments typically encountered in residential or suburban settings. The primary goal remains delivering a highly reliable, low-maintenance, and aesthetically acceptable device that can seamlessly integrate into existing infrastructure while maximizing energy harvest, ultimately contributing significantly to global decarbonization efforts.

Small Wind Power Devices Market Executive Summary

The Small Wind Power Devices Market is entering a rapid growth phase, driven fundamentally by the transition towards decentralized energy systems and critical demand for off-grid electrification solutions, particularly across emerging economies. Current business trends indicate a strong focus on product innovation, emphasizing the development of quieter, more efficient vertical-axis wind turbines (VAWTs) and hybrid systems integrating solar PV and advanced battery storage technology to ensure power continuity. Strategic collaborations between turbine manufacturers and component suppliers, particularly in power electronics and smart grid connectivity, are becoming prevalent to enhance system integration and remote monitoring capabilities. Furthermore, market competition is intensifying, leading to improved economies of scale and consequently lowering the average installed cost per kilowatt, thereby making these systems accessible to a broader consumer base, particularly in agricultural and residential segments.

Regionally, Asia Pacific is anticipated to lead market expansion, fueled by extensive government initiatives aimed at rural electrification and energy security, alongside substantial investments in microgrid infrastructure. North America and Europe, characterized by mature regulatory frameworks and high consumer purchasing power, continue to show robust demand, focusing primarily on grid-tied installations and achieving net-zero energy targets for residential and commercial buildings. Latin America, the Middle East, and Africa are gradually increasing their market share, driven by favorable wind resources and the pressing need to replace expensive, unreliable diesel generators for remote telecommunications and industrial operations. Regulatory stability and tailored incentive programs remain key differentiators influencing regional growth dynamics, particularly the provision of predictable and attractive power purchase agreements or feed-in tariffs for small-scale generation.

Segment trends reveal that the <1 kW capacity segment is dominating residential applications due to its minimal footprint and suitability for low power requirements, while the 1 kW–10 kW segment sees increasing use in agricultural and light commercial sectors requiring moderate power output. The grid-connected application segment maintains the largest market share in developed economies, benefiting from established infrastructure for energy export, although the off-grid segment is growing at the fastest CAGR globally, owing to widespread deployment in developing regions. Technological advancements in blade materials, such as carbon fiber composites, are critical for improving performance across all segments. The ongoing trend towards digitalization, incorporating IoT sensors and AI-driven predictive maintenance, is defining the future operational efficiency and reliability of small wind devices, ensuring long-term sustainability and reducing maintenance downtime significantly.

AI Impact Analysis on Small Wind Power Devices Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Small Wind Power Devices Market predominantly center on optimizing energy capture, enhancing system reliability, and facilitating seamless grid integration. Common questions focus on how machine learning can predict local wind patterns with greater accuracy than traditional models, the application of AI in identifying and mitigating structural faults before they lead to catastrophic failure, and the role of intelligent algorithms in managing hybrid power flows (wind, solar, battery) to maximize efficiency and minimize storage system degradation. Users are keenly interested in predictive maintenance models that reduce operational expenditure (OPEX) and the potential for AI-driven controllers to adapt turbine pitch or yaw in real-time to turbulent or rapidly changing wind conditions, thereby increasing the Annual Energy Production (AEP). The consensus highlights the expectation that AI will transform small wind devices from simple mechanical converters into highly responsive, adaptive, and integral components of the smart energy ecosystem.

AI's integration provides significant advancements in the operational lifecycle of small wind devices, moving beyond basic monitoring to sophisticated decision-making capabilities. By processing vast streams of operational data—including vibration levels, temperature fluctuations, and power output—AI algorithms can establish highly precise baseline performance metrics and identify subtle deviations indicative of potential mechanical or electrical failure. This capability shifts maintenance strategies from time-based scheduling to condition-based intervention, which dramatically improves asset utilization and extends the lifespan of critical components like gearboxes and generators. Furthermore, in environments where wind conditions are highly variable (e.g., residential areas with complex terrain), AI enables advanced control systems to dynamically adjust turbine settings to maximize energy yield, even when operating close to turbulence limits.

The influence of AI extends substantially to the feasibility and installation stages of small wind projects. Using geospatial data combined with localized weather patterns, AI tools can assess site suitability and predict potential AEP with far greater accuracy than manual methods, reducing investment risk for both manufacturers and end-users. For grid-connected systems, AI algorithms optimize power dispatch and ramping rates, ensuring that the intermittent power output from small wind installations does not destabilize the local grid. In off-grid hybrid setups, intelligent controllers use predictive load forecasting and renewable generation forecasts to manage battery charging cycles efficiently, maximizing battery life and ensuring continuous power availability, thereby solidifying the economic case for small-scale distributed generation.

- AI-driven Predictive Maintenance: Reduces downtime by forecasting component failure based on vibrational and thermal signatures, minimizing OPEX.

- Optimized Power Curve Management: Real-time adjustment of blade pitch and yaw angle using machine learning to maximize energy capture in turbulent conditions.

- Enhanced Wind Resource Assessment: Utilization of AI to analyze complex topographical and meteorological data, resulting in higher accuracy for site selection and AEP projections.

- Hybrid System Optimization: Intelligent control algorithms managing the simultaneous output of wind, solar, and battery storage for optimal efficiency and load matching.

- Smart Grid Integration: AI facilitating seamless and stable connection to the grid by predicting and managing power intermittency and ensuring voltage regulation compliance.

DRO & Impact Forces Of Small Wind Power Devices Market

The Small Wind Power Devices Market is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and influential impact forces. Key drivers include supportive governmental policies, especially tax credits and feed-in tariffs promoting distributed generation, coupled with the critical global necessity for rural electrification and energy access in off-grid locations where small wind systems offer a robust alternative to conventional power sources. Furthermore, advancements in hybrid system technology, integrating small wind with solar PV and battery storage, enhance reliability and performance, thereby attracting a broader range of end-users. Conversely, the market faces notable restraints, including the inherent intermittency of wind resources, which necessitates expensive storage solutions, strict local zoning regulations and permitting complexities, particularly in densely populated areas, and the lingering challenge of high initial capital expenditure compared to established utility grid connections.

Opportunities for market growth are abundant, centering on the rapid development of microgrids and smart city infrastructure, where small wind turbines can play a vital supplementary role in localized power generation. The burgeoning market for remote applications, such as powering Internet of Things (IoT) sensors, telecom base stations, and remote monitoring equipment, offers specialized, high-value niches. Moreover, technological breakthroughs focusing on developing high-efficiency, low-noise vertical axis turbines (VAWTs) suitable for urban environments are expected to unlock significant untapped potential. Strategic partnerships focused on integrated manufacturing and simplified installation processes are also creating new pathways for market penetration, particularly in developing economies seeking scalable renewable solutions.

The impact forces influencing the market dynamics are primarily technological and regulatory. The continuous decline in the levelized cost of energy (LCOE) for renewable sources globally exerts pressure on small wind manufacturers to improve efficiency and reduce manufacturing costs continually. Shifting political landscapes and evolving climate commitments at the national level directly influence the longevity and generosity of renewable energy incentives, dictating investment decisions. Furthermore, consumer preference for aesthetically pleasing, low-profile designs is compelling manufacturers to innovate in design and materials, moving away from traditional bulky structures. The global push for energy resilience, particularly following grid vulnerabilities exposed by extreme weather events, strongly reinforces the market position of decentralized small wind systems as a critical component of energy security strategies for homes and critical infrastructure.

Segmentation Analysis

The Small Wind Power Devices Market is comprehensively segmented based on its technical specifications, application area, connectivity to the grid, and geographical distribution, providing granular insights into varying demand patterns across end-user groups. Understanding these segments is crucial for manufacturers to tailor their product offerings, sales strategies, and distribution channels to maximize market reach and address specific power generation requirements. The primary segmentation criteria involve the output capacity of the device, typically categorized into <1 kW, 1 kW–10 kW, 10 kW–50 kW, and 50 kW–100 kW, reflecting the scale of electricity generation and the target user—from residential hobbyists to large farms or small industrial sites. The type of axis used, whether Horizontal Axis Wind Turbines (HAWT) or Vertical Axis Wind Turbines (VAWT), also dictates suitability for different operational environments, particularly concerning wind turbulence and noise sensitivity.

Application-wise, the market is broadly divided into residential, commercial, industrial, and agricultural sectors. Residential use often focuses on smaller, quieter devices for supplementary power or net metering, while agricultural and industrial applications typically demand robust, medium-capacity systems for dedicated loads like pumping or cooling. Connectivity defines whether the system is installed for off-grid (standalone) use, common in remote locations and telecommunications, or grid-connected (grid-tied), prevalent in developed regions seeking to sell excess power back to the utility. The increasing sophistication of power electronics and smart controls is blurring the lines between these segments, enabling hybrid systems that can seamlessly switch between grid-tied and off-grid modes for enhanced resilience.

Geographical segmentation remains pivotal, with North America and Europe leading in terms of revenue from grid-connected systems, driven by high environmental awareness and favorable regulatory environments. Conversely, Asia Pacific and Africa are characterized by high volume growth in the off-grid segment, fueled by immense rural electrification deficits. Successful market penetration necessitates regionally customized solutions addressing local wind conditions, regulatory standards, and economic constraints. The analysis of these segments highlights the dynamic interplay between technological development (e.g., efficiency and noise reduction) and policy implementation (e.g., incentives and zoning laws) in shaping the market landscape for small wind power devices globally.

- By Capacity:

- Below 1 kW

- 1 kW–10 kW

- 10 kW–50 kW

- 50 kW–100 kW

- By Application:

- Residential

- Commercial

- Industrial

- Agricultural

- Telecom Towers

- By Connectivity:

- Grid-Connected

- Off-Grid

- By Type:

- Horizontal Axis Wind Turbines (HAWT)

- Vertical Axis Wind Turbines (VAWT)

Value Chain Analysis For Small Wind Power Devices Market

The value chain for the Small Wind Power Devices Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized alloys for towers and components, composites for rotor blades, and high-performance power electronics for inverters and controllers. Manufacturers engage in design, engineering, and assembly, focusing intensely on aerodynamic efficiency, structural integrity, and the integration of smart monitoring technologies. This phase demands significant investment in R&D to optimize turbine performance for low wind speeds and ensure durability under various climatic conditions. The procurement strategy is critical here, ensuring access to high-quality, lightweight composite materials (like fiberglass and carbon fiber) necessary for high-performance blades, while simultaneously managing the complexity of sourcing specialized components such as permanent magnet generators and integrated battery management systems, which are vital for system reliability.

Midstream activities encompass the core manufacturing and system assembly, followed by rigorous quality assurance and certification processes mandated by international standards (e.g., IEC 61400-2). Downstream activities focus on logistics, distribution, and installation, which are particularly complex for small wind due to the need for site-specific assessment and specialized installation expertise, often requiring heavy lifting equipment for tower erection. Direct distribution models are often used for large commercial or industrial projects, involving the manufacturer's specialized installation teams to ensure performance guarantees. Conversely, indirect distribution relies heavily on regional distributors, certified renewable energy installers, and specialized contractors who manage the entire customer journey, including permitting, site preparation, and ongoing maintenance services, particularly crucial for residential and agricultural customers.

The distribution channel landscape is fragmented; however, specialized renewable energy installers and distributors, often working closely with local permitting authorities, form the backbone of the market, particularly for grid-tied systems. Online retail channels and specialized e-commerce platforms are increasingly serving the smaller, sub-1 kW, off-grid segments and DIY markets. The high touch requirement for installation and post-sales service, which includes performance monitoring and scheduled maintenance (preventive and corrective), emphasizes the enduring importance of a reliable and well-trained network of service providers. Effective management of the downstream portion of the value chain, ensuring swift response times and expert technical support, is a key determinant of competitive advantage and customer satisfaction in this decentralized energy market.

Small Wind Power Devices Market Potential Customers

The potential customer base for Small Wind Power Devices is highly diversified, encompassing residential users seeking energy independence, agricultural businesses requiring power for remote operations, commercial entities aiming for reduced operating costs, and government or non-profit organizations focused on remote infrastructure development. Residential end-users, particularly those in rural or suburban areas with moderate wind resources, represent a significant segment, driven by motivations such as reducing utility bills through net metering or achieving complete off-grid autonomy. These customers typically favor turbines in the <1 kW to 5 kW range that are aesthetically pleasing, low-noise, and require minimal maintenance, often integrating them into hybrid systems with solar panels to ensure consistent power supply throughout the year.

The agricultural sector forms a robust demand segment, utilizing small wind turbines to power critical infrastructure such as water pumping, irrigation systems, grain drying, and remote monitoring of livestock or crop health. Farms often deploy turbines in the 5 kW to 20 kW range to handle substantial dedicated loads, leveraging the large, open spaces often available for optimal wind capture. These buyers prioritize ruggedness, durability, and resistance to harsh weather conditions, requiring reliable systems that operate unattended for extended periods. The economic viability of these installations is high, as they often replace expensive diesel or propane power sources, leading to a quick return on investment.

Furthermore, telecommunication companies and infrastructure developers represent a rapidly growing clientele, utilizing small wind devices to provide reliable power to remote cellular towers, monitoring stations, and meteorological equipment where grid extension is prohibitively costly. For these high-reliability applications, off-grid systems with robust battery backup and remote monitoring capabilities (often integrating IoT and AI) are essential. Governmental entities, especially defense departments and disaster relief agencies, also constitute potential customers, utilizing portable or easily deployable small wind solutions for temporary or emergency power generation in mission-critical scenarios, valuing mobility and rapid deployment capability over long-term aesthetic integration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,500 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northern Power Systems, Bergey Windpower, Southwest Windpower, Kingspan Group, Pika Energy (Generac), Ryse Energy, Primus Wind Power, Wind Energy Solutions (WES), Eocycle Technologies, Fortis Wind Energy, Helix Wind, HY Energy, Kestrel Renewable Energy, XZERES Wind, Aeolos Wind, Hi-VAWT Technology, Tumo-Int., Urban Green Energy, Enair, C&F Green Energy |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Small Wind Power Devices Market Key Technology Landscape

The technology landscape of the Small Wind Power Devices Market is rapidly evolving, driven primarily by the need to enhance efficiency in low and turbulent wind conditions and to minimize visual and acoustic impact, making the devices suitable for urban and residential installation. Key advancements include the optimization of blade aerodynamics, particularly through the use of sophisticated computational fluid dynamics (CFD) modeling, leading to improved power curves even at lower cut-in wind speeds. The material science focus is on lightweight, high-strength composite materials (like carbon fiber and advanced fiberglass laminates) for blades and towers, which reduce the overall weight, decrease structural stress, and improve energy capture ratios. This continuous refinement in mechanical design is coupled with the integration of direct-drive generators, replacing traditional gearboxes to reduce maintenance requirements, noise emissions, and mechanical losses, thus significantly boosting the device's reliability and longevity.

The most transformative technological shift is occurring in power electronics and control systems. Modern small wind turbines increasingly incorporate advanced Maximum Power Point Tracking (MPPT) algorithms, which continuously adjust the generator load to extract maximum power from the wind, regardless of fluctuations in wind speed. Furthermore, the convergence of small wind with battery energy storage systems (BESS) necessitates intelligent inverters and integrated charge controllers capable of managing bidirectional power flow seamlessly. These smart electronics are crucial for the stable operation of off-grid systems and for ensuring compliance with complex grid connection standards (anti-islanding protection and reactive power control) in grid-tied applications, contributing directly to the system’s utility and resilience, especially when combined with solar PV in hybrid setups.

Another crucial area of innovation is in monitoring and communication technologies. The adoption of IoT platforms allows for real-time remote surveillance of turbine performance, health status, and environmental parameters (wind speed, temperature). This data is often fed into AI-driven predictive maintenance systems, allowing operators or users to anticipate mechanical failures before they occur, drastically reducing maintenance costs and unexpected downtime. Furthermore, the growing popularity of Vertical Axis Wind Turbines (VAWTs), which inherently perform better in turbulent wind and are generally quieter and visually less intrusive than HAWTs, marks a strategic technological path for urban and highly sensitive environments. VAWT designs, although historically less efficient, are benefiting from advanced blade shapes (like Darrieus or Savonius types) and magnetic levitation bearings to overcome efficiency hurdles and reduce friction losses, making them increasingly competitive in localized power generation.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate, primarily driven by large-scale government initiatives in China and India aimed at rural electrification and energy access improvement. The region sees immense demand for off-grid small wind systems, often deployed in conjunction with solar panels to power remote villages, agricultural activities, and telecom infrastructure. Favorable policies, coupled with the need to alleviate dependence on centralized coal-fired power plants, are fueling investments. Key technological adoption is focused on robust, low-maintenance systems that can withstand varied and challenging environmental conditions typical of rapidly industrializing nations.

- North America: North America represents a mature market segment, characterized by high adoption rates of grid-connected systems, particularly in the US and Canada. The primary driver here is consumer desire for energy independence, reduction of utility costs through net metering, and strong state-level incentives (such as renewable energy credits). Demand is concentrated in residential and agricultural sectors (e.g., Texas, Midwest states) where wind resources are abundant. The market is highly sensitive to technological reliability and compliance with strict interconnection standards enforced by regional grid operators.

- Europe: Europe maintains a strong presence, spearheaded by countries like Germany, the UK, and Denmark, which possess well-established renewable energy policy frameworks and high public acceptance of distributed generation. The European market emphasizes innovation in urban wind devices (VAWTs) due to population density and strict aesthetic requirements. Policy certainty through mechanisms like feed-in tariffs ensures predictable returns on investment, making small wind an attractive option for homeowners and small businesses committed to carbon neutrality and supplementing building-integrated renewable energy targets.

- Latin America (LATAM): LATAM is an emerging market with significant long-term potential, especially in areas with limited grid coverage, such as parts of Brazil, Argentina, and Chile. The market expansion is currently focused on off-grid applications for mining, remote community power, and telecommunications. Economic instability and fluctuating regulatory environments pose challenges, but the abundant wind resources in coastal and high-altitude regions offer a strong foundational opportunity for future market acceleration, provided financing mechanisms become more accessible.

- Middle East and Africa (MEA): The MEA region is crucial for off-grid deployments, particularly in Africa where energy poverty remains a major challenge. Small wind power devices are vital for providing essential power to healthcare facilities, schools, and remote communities, often replacing expensive diesel generators. In the Middle East, while hydrocarbon dependency is high, select remote industrial and military applications are exploring small wind solutions for specialized power needs. The growth is heavily reliant on international aid, NGO projects, and government-led infrastructure development initiatives focusing on sustainable energy access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Small Wind Power Devices Market.- Northern Power Systems

- Bergey Windpower

- Southwest Windpower

- Kingspan Group

- Pika Energy (Generac)

- Ryse Energy

- Primus Wind Power

- Wind Energy Solutions (WES)

- Eocycle Technologies

- Fortis Wind Energy

- Helix Wind

- HY Energy

- Kestrel Renewable Energy

- XZERES Wind

- Aeolos Wind

- Hi-VAWT Technology

- Tumo-Int.

- Urban Green Energy

- Enair

- C&F Green Energy

- Ghurman Wind Turbine

- Shanghai Ghrepower Green Energy

- Small Wind Systems Inc.

- Windel Green Energy

Frequently Asked Questions

Analyze common user questions about the Small Wind Power Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and maintenance cost of a small wind power device?

Small wind turbines typically have an operational lifespan ranging from 20 to 25 years. Maintenance costs are generally low, focusing mainly on annual inspections, lubrication, and potential replacement of minor components like bearings or blades every 5–10 years. Modern direct-drive turbines significantly reduce these maintenance requirements.

Are small wind turbines suitable for residential use in urban environments?

Yes, newer Vertical Axis Wind Turbines (VAWTs) are increasingly suitable for urban and suburban environments. VAWTs operate better in turbulent wind, are generally quieter, and have a smaller visual footprint, overcoming many of the zoning and noise constraints associated with traditional horizontal axis designs.

How do small wind power devices integrate with solar energy systems?

Small wind devices are often integrated with solar PV to create highly reliable hybrid systems. This combination leverages the complementary nature of wind (stronger often in winter or at night) and solar (stronger during the day), maximizing energy production and minimizing reliance on battery storage capacity for continuous power.

What is the minimum wind speed required for a small wind turbine to generate power?

The minimum operational wind speed, known as the "cut-in speed," typically ranges between 2.5 and 4.0 meters per second (m/s). Highly efficient modern turbines are designed to maximize output even at these lower speeds, although optimal power generation occurs at much higher sustained wind velocities.

What regulatory barriers affect the adoption of small wind power devices?

Key regulatory barriers include complex local zoning ordinances, height restrictions, stringent permitting requirements, and challenges related to obtaining grid interconnection approvals (anti-islanding requirements) from local utilities, which vary significantly by jurisdiction and can prolong the installation process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager