Smart advisors Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439794 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Smart advisors Market Size

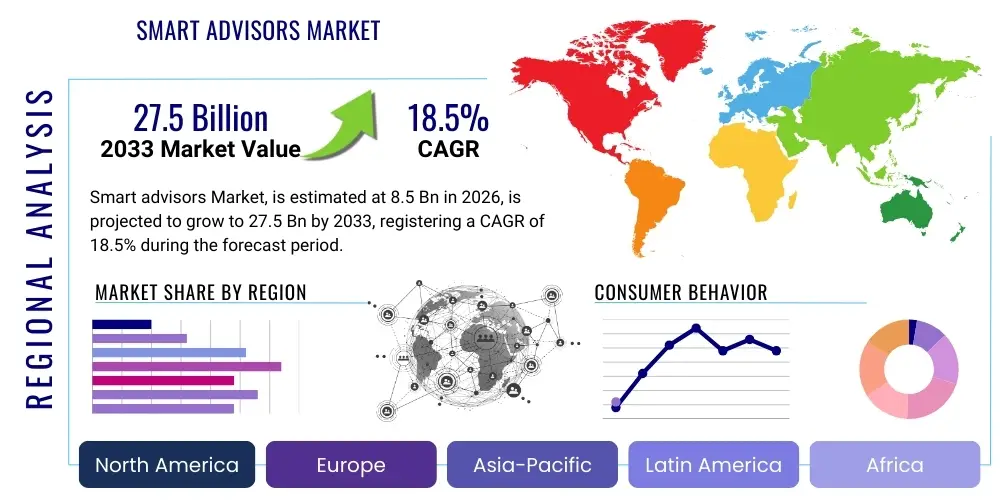

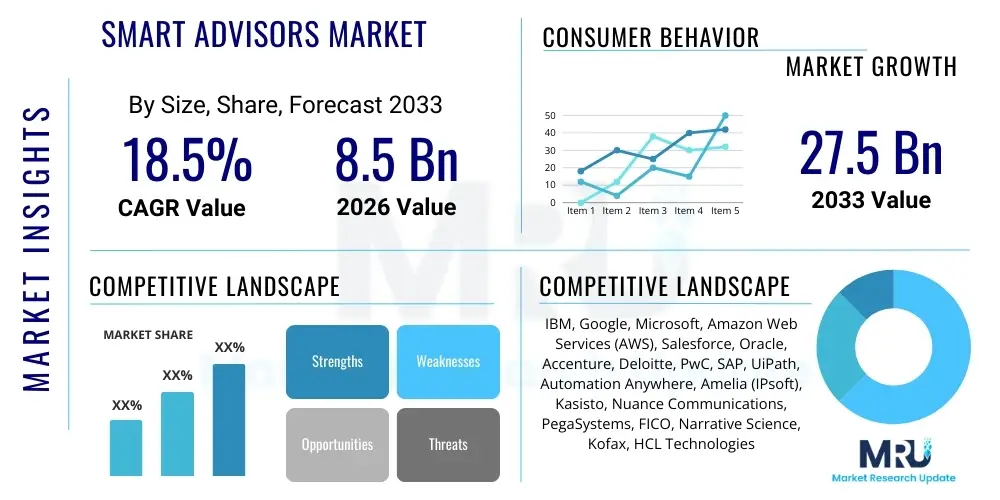

The Smart advisors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 27.5 Billion by the end of the forecast period in 2033.

Smart advisors Market introduction

The Smart advisors Market encompasses intelligent, AI-driven platforms and services designed to provide personalized, data-backed insights and recommendations across various domains. These digital entities leverage advanced machine learning algorithms, natural language processing, and big data analytics to process vast amounts of information, understand complex patterns, and offer proactive, context-aware advice to individuals and enterprises. From financial planning and investment management to health and wellness coaching, smart advisors are transforming decision-making processes by making expert guidance more accessible, efficient, and tailored to specific user needs. Their core function is to automate and enhance advisory roles, enabling users to make informed choices with greater confidence and less manual effort.

The primary applications of smart advisors are remarkably diverse, spanning critical sectors. In finance, they offer robo-advisory services, portfolio optimization, and personalized budget management, democratizing access to sophisticated financial advice. Within healthcare, smart advisors assist with preventative care recommendations, chronic disease management support, and personalized fitness regimens, acting as intelligent health companions. Education benefits from smart advisors through adaptive learning paths, career counseling, and personalized tutoring, enhancing student engagement and outcomes. Furthermore, their utility extends to retail for personalized shopping experiences, smart home management for energy optimization, and enterprise resource planning for operational efficiency. The widespread applicability across these sectors highlights the transformative potential of smart advisors in improving quality of life and business productivity.

The growth of the Smart advisors Market is fundamentally driven by several powerful forces. Foremost among these is the exponential advancement in artificial intelligence and machine learning technologies, which provide the computational backbone for sophisticated analytical capabilities and predictive accuracy. Coupled with this is the ever-increasing volume of digital data, which smart advisors harness to generate highly personalized and relevant advice. A growing demand for personalized services across all aspects of life, from financial guidance to health management, further fuels market expansion. Additionally, the ongoing digital transformation initiatives across industries, alongside a desire for greater operational efficiency and cost reduction, compel businesses to adopt smart advisory solutions. These factors collectively create a fertile ground for sustained innovation and market penetration for smart advisors globally.

Smart advisors Market Executive Summary

The Smart advisors Market is experiencing robust growth, driven by pervasive technological advancements and an escalating demand for personalized digital assistance across consumer and enterprise landscapes. Key business trends include a significant shift towards AI-as-a-Service (AIaaS) models, fostering easier integration of smart advisory capabilities for businesses of all sizes. There is also a notable rise in hybrid models that combine the strengths of AI-driven advice with human oversight, particularly in sensitive sectors like finance and healthcare, addressing concerns around trust and empathy. Strategic partnerships between technology providers and traditional service industries are accelerating market penetration, while continuous innovation in natural language understanding and predictive analytics remains a core competitive differentiator.

Regionally, North America continues to dominate the Smart advisors Market, attributed to early technology adoption, substantial investment in AI research and development, and a mature digital infrastructure. Europe is also a significant market, characterized by stringent data privacy regulations that shape the development and deployment of smart advisory solutions, emphasizing ethical AI and robust data protection. The Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid digitalization, a vast digitally native population, and increasing government initiatives supporting AI adoption across diverse industries. Latin America and the Middle East & Africa (MEA) are showing promising potential, with growing internet penetration and increasing awareness of smart technology benefits, albeit from a lower base.

Segmentation trends within the Smart advisors Market reveal dynamic shifts in demand and adoption patterns. Financial smart advisors, particularly robo-advisors, are experiencing sustained growth due to their cost-effectiveness and accessibility, appealing to a broad demographic of investors. The healthcare segment is rapidly expanding, with AI-powered platforms offering personalized wellness plans, virtual health assistants, and diagnostics support, addressing the rising need for preventative and personalized medicine. Furthermore, enterprise-focused smart advisors, designed to optimize business operations, customer service, and decision-making processes, are gaining traction as organizations seek to enhance efficiency and competitive advantage through intelligent automation. The emphasis on cloud-based deployment models is also prevalent across all segments, offering scalability and flexibility to users.

AI Impact Analysis on Smart advisors Market

Common user questions regarding AI's impact on the Smart advisors Market frequently revolve around the degree of personalization, the potential for job displacement, ethical considerations, and the accuracy of AI-driven advice. Users are particularly keen to understand how AI enables hyper-personalization beyond human capabilities, questioning the depth of analysis and the relevance of recommendations provided by these intelligent systems. Concerns about data privacy and the security of sensitive information shared with AI advisors are paramount, alongside inquiries into the transparency of AI decision-making processes. Furthermore, there's a strong interest in the symbiotic relationship between human experts and AI, exploring whether AI will augment or completely replace traditional advisory roles, particularly in areas requiring nuanced judgment and emotional intelligence. The reliability and continuous learning capabilities of AI in dynamic environments also form a significant part of user curiosity, reflecting an overarching desire for trustworthy and adaptable smart advisory solutions.

- Enhanced predictive analytics for more accurate forecasting and recommendations.

- Hyper-personalization of advice based on individual user data and behavior.

- Automated decision-making capabilities, streamlining complex processes.

- Natural Language Processing (NLP) advancements for intuitive user interaction.

- Continuous learning and adaptation of advisory models in real-time.

- Improved efficiency and scalability of advisory services.

- Development of autonomous advisory agents reducing human intervention.

- Increased accessibility to expert advice for a broader demographic.

- Ethical AI frameworks for bias mitigation and transparent operations.

- Integration with IoT devices for context-aware and proactive guidance.

DRO & Impact Forces Of Smart advisors Market

The Smart advisors Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute its Impact Forces. Key drivers include the rapid advancements in Artificial Intelligence and Machine Learning technologies, making sophisticated analytical tools more accessible and effective. The proliferation of big data, coupled with a growing demand for personalized services across finance, healthcare, and education, further propels market expansion. Moreover, the increasing adoption of digital transformation strategies by enterprises seeking enhanced operational efficiency and cost reduction fuels the demand for intelligent advisory solutions. These factors create a powerful impetus, pushing the market towards pervasive adoption of smart advisors.

Despite the robust growth drivers, the Smart advisors Market faces several significant restraints. Foremost among these are growing concerns regarding data privacy and security, as these systems handle vast amounts of sensitive personal and financial information. Ethical dilemmas surrounding AI bias, transparency in decision-making, and accountability for AI-generated advice also pose considerable challenges. High initial deployment costs, particularly for bespoke enterprise solutions, can deter adoption for smaller businesses. Furthermore, a lack of trust in fully autonomous systems, coupled with the inherent complexity of integrating these advanced technologies into existing infrastructures, can slow down market penetration. Regulatory uncertainties in various jurisdictions also create hurdles for global expansion and standardization.

However, the market is rife with significant opportunities that promise future growth and innovation. The expansion into untapped emerging markets, particularly in developing economies with rapidly digitalizing populations, presents substantial growth avenues. The development of specialized niche smart advisors, tailored for specific industries or highly regulated sectors, offers new revenue streams. Opportunities also lie in the integration of smart advisors with other cutting-edge technologies like the Internet of Things (IoT) for more contextual and proactive advice, and blockchain for enhanced data security and transparency. The evolution of hybrid advisory models, combining AI efficiency with human empathy, is another promising area, addressing the limitations of fully automated systems and broadening appeal to a wider user base. Continuous innovation in AI capabilities, coupled with user education and the development of robust regulatory frameworks, will be crucial in leveraging these opportunities and mitigating restraints, ultimately shaping the market's trajectory.

Segmentation Analysis

The Smart advisors Market is intricately segmented based on various factors including type, application, deployment, and end-user, reflecting the diverse functionalities and target markets for these intelligent solutions. Each segment exhibits unique growth patterns and adoption drivers, providing granular insights into market dynamics. This detailed segmentation helps businesses identify core areas of innovation, target specific customer needs, and develop tailored strategies for market penetration and expansion. Understanding these divisions is crucial for stakeholders aiming to capitalize on the evolving landscape of AI-powered advisory services.

- By Type

- AI-powered Smart Advisors

- Machine Learning-driven Smart Advisors

- Rule-based Smart Advisors

- Hybrid Smart Advisors (AI+Human)

- By Application

- Financial Advisory (Robo-advisors, Wealth Management)

- Healthcare & Wellness Advisory (Health Bots, Fitness Coaches)

- Educational & Career Advisory (Adaptive Learning, Job Matching)

- Enterprise Resource Planning (ERP) Advisory

- Customer Service & Sales Advisory

- Retail & E-commerce Advisory

- Personal Development & Life Coaching

- Smart Home & IoT Management

- By Deployment Model

- Cloud-based

- On-premise

- By End-User

- Individuals (Mass Affluent, High Net-Worth Individuals)

- Small & Medium-sized Enterprises (SMEs)

- Large Enterprises (BFSI, Healthcare Providers, Educational Institutions)

- Government & Public Sector

- By Technology

- Natural Language Processing (NLP)

- Predictive Analytics

- Machine Learning (ML) & Deep Learning

- Big Data Analytics

- Robotic Process Automation (RPA)

- Computer Vision

Value Chain Analysis For Smart advisors Market

The value chain for the Smart advisors Market is a complex ecosystem, beginning with foundational technology development and extending to the ultimate delivery and utilization by end-users. The upstream segment primarily involves core technology providers, including developers of advanced AI and Machine Learning platforms, natural language processing (NLP) toolkits, big data analytics engines, and cloud computing infrastructure. These foundational components are critical for building the intelligence and processing capabilities of smart advisors. Data providers, supplying vast, structured, and unstructured datasets for training AI models, also play a crucial upstream role, ensuring the accuracy and relevance of the advice generated. Research institutions and academic bodies contribute significantly to the innovation pipeline, pushing the boundaries of AI capabilities that eventually integrate into smart advisory solutions.

Moving downstream, the value chain involves a diverse set of actors responsible for integrating, customizing, and distributing smart advisory solutions. This includes specialized software developers and AI solution integrators who build industry-specific smart advisor applications, tailoring generic AI platforms to meet unique sector requirements in finance, healthcare, or education. Service providers, such as financial institutions, healthcare organizations, and educational platforms, then embed these smart advisors into their existing offerings or launch them as standalone products. Marketing and sales channels are vital for reaching end-users, encompassing direct sales teams for enterprise clients, online marketplaces, and digital marketing campaigns for individual consumers. Post-deployment, ongoing support, maintenance, and continuous learning services ensure the smart advisors remain effective and up-to-date.

The distribution channels for smart advisors are multifaceted, involving both direct and indirect approaches. Direct channels typically involve technology vendors selling their proprietary smart advisor platforms or customized solutions directly to large enterprises. This often includes long-term contracts, implementation support, and ongoing service agreements. Indirect channels are more varied and include partnerships with system integrators, consulting firms, and value-added resellers (VARs) who bundle smart advisors with their broader service offerings. Online marketplaces, app stores, and subscription-based platforms serve as significant indirect channels for reaching individual consumers and small to medium-sized businesses (SMEs) with ready-to-use smart advisory applications. The choice of distribution channel often depends on the target market, complexity of the solution, and desired level of customization, with a growing trend towards ecosystem partnerships to expand reach and accelerate adoption.

Smart advisors Market Potential Customers

The Smart advisors Market caters to a broad spectrum of potential customers, segmented by their varying needs, technological readiness, and scale of operations. On the individual consumer front, potential customers include mass affluent individuals seeking accessible and cost-effective financial planning and investment advice, as well as high-net-worth individuals looking for augmented insights alongside traditional wealth management services. Beyond finance, individuals concerned with personal wellness, career development, or even optimizing their smart homes represent a growing user base for specialized smart advisors. These end-users are typically seeking convenience, personalization, and data-driven insights to improve their daily decision-making and overall quality of life.

For enterprises, potential customers span across industries and organizational sizes. Small and Medium-sized Enterprises (SMEs) are increasingly adopting smart advisors to streamline operations, enhance customer service, and gain competitive advantages without the need for extensive in-house AI expertise. Large enterprises across sectors such as Banking, Financial Services, and Insurance (BFSI), healthcare, retail, education, and manufacturing are major end-users, leveraging smart advisors for complex tasks like risk assessment, personalized patient care, supply chain optimization, and sophisticated customer engagement. These organizations seek scalable, efficient, and data-driven solutions to automate routine tasks, improve decision accuracy, and free up human capital for more strategic initiatives.

Government and public sector entities also represent a significant and expanding customer segment for smart advisors. They can utilize these intelligent systems for public service delivery optimization, policy analysis, resource allocation, and even smart city management. Educational institutions are adopting smart advisors for adaptive learning platforms, student support, and administrative efficiency. The diverse array of applications means that virtually any organization or individual looking to leverage data and AI for enhanced decision-making, personalization, and operational efficiency can be considered a potential customer for the Smart advisors Market, signifying a vast and continuously evolving demand landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 27.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Google, Microsoft, Amazon Web Services (AWS), Salesforce, Oracle, Accenture, Deloitte, PwC, SAP, UiPath, Automation Anywhere, Amelia (IPsoft), Kasisto, Nuance Communications, PegaSystems, FICO, Narrative Science, Kofax, HCL Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart advisors Market Key Technology Landscape

The Smart advisors Market is fundamentally driven and defined by a sophisticated array of cutting-edge technologies that empower these systems to deliver intelligent and personalized advice. At its core, Artificial Intelligence (AI) serves as the primary engine, encompassing various sub-fields such as Machine Learning (ML) and Deep Learning (DL). ML algorithms, including supervised, unsupervised, and reinforcement learning, enable smart advisors to learn from vast datasets, identify complex patterns, and make predictions or recommendations. Deep learning, a subset of ML, further enhances capabilities, particularly in processing unstructured data like natural language and images, leading to more nuanced understanding and advanced predictive models.

Natural Language Processing (NLP) is another critical technology, allowing smart advisors to understand, interpret, and generate human language. This enables seamless conversational interfaces, whether through chatbots, voice assistants, or text-based interactions, making the advisory experience intuitive and user-friendly. Paired with NLP, speech recognition technologies facilitate voice-activated smart advisors, expanding accessibility. Furthermore, Big Data analytics plays an indispensable role, providing the framework for collecting, storing, processing, and analyzing the enormous volumes of data—from user behavior to market trends—that smart advisors rely upon to generate accurate and context-rich insights. The ability to quickly process and derive intelligence from diverse data sources is paramount to their effectiveness.

Beyond these foundational AI components, other key technologies contribute significantly to the smart advisors ecosystem. Cloud computing platforms provide the scalable infrastructure necessary to host and run these computationally intensive applications, ensuring high availability and flexibility for users globally. Predictive analytics, building on ML models, forecasts future outcomes and trends, enabling smart advisors to offer proactive advice rather than merely reactive responses. Robotic Process Automation (RPA) can be integrated to automate routine tasks based on advisor recommendations, streamlining execution. Technologies like blockchain are also emerging for enhancing data security, transparency, and trust in the advice process, particularly in sensitive domains like finance. The continuous evolution and convergence of these technologies are pivotal in shaping the capabilities, reliability, and market potential of smart advisors.

Regional Highlights

- North America: Leading market in terms of innovation and adoption, driven by significant R&D investments in AI, a mature digital infrastructure, and a high concentration of tech companies and early adopters. Strong presence in financial robo-advisory and enterprise AI solutions.

- Europe: Characterized by stringent data privacy regulations (e.g., GDPR), which influence the development of ethical and secure smart advisory platforms. Growing adoption in healthcare and government sectors, with a focus on trust and transparency.

- Asia Pacific (APAC): Fastest-growing market due to rapid digitalization, a large internet-savvy population, and increasing government support for AI initiatives. Significant adoption in financial services, e-commerce, and smart city applications, particularly in China, India, and Japan.

- Latin America: Emerging market with increasing internet penetration and smartphone adoption. Growing awareness of smart technology benefits, driving initial adoption in basic financial advisory and customer service applications.

- Middle East and Africa (MEA): Developing market with expanding digital infrastructure and smart city projects. Government initiatives to diversify economies are fostering AI adoption, especially in sectors like finance, government services, and smart living.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart advisors Market.- IBM

- Microsoft

- Amazon Web Services (AWS)

- Salesforce

- Oracle

- Accenture

- Deloitte

- PwC

- SAP

- UiPath

- Automation Anywhere

- Amelia (IPsoft)

- Kasisto

- Nuance Communications

- PegaSystems

- FICO

- Narrative Science

- Kofax

- HCL Technologies

Frequently Asked Questions

Analyze common user questions about the Smart advisors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What exactly are smart advisors and how do they work?

Smart advisors are AI-powered digital platforms that provide personalized advice and recommendations using machine learning, natural language processing, and big data analytics. They analyze vast amounts of information, learn from user interactions, and offer insights tailored to individual needs in domains like finance, health, and education, automating or augmenting traditional advisory roles.

How do smart advisors ensure data privacy and security?

Smart advisors implement robust data privacy and security measures through encryption, anonymization, and adherence to regulations like GDPR. They often use secure cloud infrastructure, employ advanced threat detection, and develop clear privacy policies to protect sensitive user information, prioritizing ethical data handling and transparent practices.

Can smart advisors replace human expertise in complex scenarios?

While smart advisors excel in data analysis and routine advice, they generally augment rather than fully replace human expertise in highly complex or emotionally nuanced scenarios. Hybrid models, combining AI efficiency with human judgment, are increasingly prevalent, especially where empathy, creative problem-solving, and intricate ethical considerations are paramount.

What are the primary benefits of using smart advisors for businesses?

Businesses leverage smart advisors for numerous benefits, including enhanced operational efficiency through automation, improved customer engagement via personalized services, significant cost reduction, better data-driven decision-making, and scalability of advisory services. They enable businesses to offer consistent, high-quality advice around the clock.

What future trends are expected in the smart advisors market?

Future trends include greater integration with IoT for context-aware advice, a stronger emphasis on ethical AI and bias mitigation, the proliferation of hybrid human-AI advisory models, expanded applications in specialized niche markets, and continuous advancements in emotional AI and natural language understanding for more human-like interactions. Blockchain for enhanced security will also become more prominent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager