Smart Bracelet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432884 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Smart Bracelet Market Size

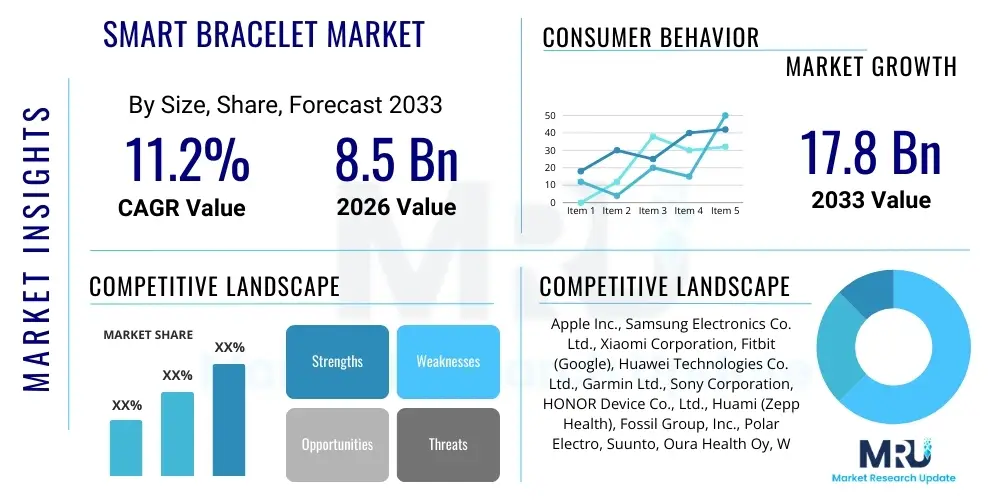

The Smart Bracelet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.2% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Smart Bracelet Market introduction

The Smart Bracelet Market encompasses the global sale and consumption of wearable devices designed to be worn on the wrist, primarily focused on tracking, monitoring, and analyzing biometric data, activity levels, and providing smartphone notifications. These devices, often referred to as fitness trackers or smart bands, have evolved significantly from basic pedometers to sophisticated health monitoring instruments capable of measuring heart rate, sleep quality, blood oxygen saturation (SpO2), and even rudimentary electrocardiogram (ECG) data. The core product offering centers on seamless integration with mobile operating systems, providing users with actionable insights into their physical condition and overall wellness metrics.

Major applications of smart bracelets span across personal fitness and wellness management, clinical and remote patient monitoring, corporate wellness programs, and lifestyle enhancement. Fitness tracking remains the most dominant application, driven by a global surge in health consciousness and the adoption of personalized exercise regimens. However, the integration of medically relevant sensors is rapidly expanding their utility into the healthcare sector, facilitating chronic disease management and proactive health intervention. The continuous, non-invasive data collection capabilities position smart bracelets as essential tools for preventative medicine and remote diagnostics, offering significant value to both consumers and healthcare providers.

The market is primarily driven by the increasing incidence of lifestyle diseases such as diabetes and cardiovascular disorders, which necessitates constant monitoring of vital signs. Furthermore, technological advancements leading to enhanced sensor accuracy, improved battery life, and miniaturized components have boosted consumer adoption. The benefits derived from using smart bracelets include increased accountability regarding personal health goals, timely alerts for critical health events, and convenient access to smartphone features, all packaged in a lightweight and aesthetically pleasing form factor. These factors collectively propel sustained market growth and innovation throughout the forecast period.

Smart Bracelet Market Executive Summary

The Smart Bracelet Market exhibits robust growth, fueled by convergent trends in health tech integration, consumer digitization, and the expansion of the Internet of Medical Things (IoMT). Key business trends highlight a shift towards specialized, clinical-grade wearables, moving beyond standard fitness metrics to offer sophisticated diagnostic capabilities. Strategic partnerships between technology manufacturers and healthcare institutions are becoming crucial, establishing strong validation mechanisms for collected data. Furthermore, enhanced data privacy protocols and the development of proprietary chipsets optimized for low power consumption and high processing speed represent major competitive differentiators among leading market players. The market is also seeing increased segmentation based on price point, catering to both premium, feature-rich segments and budget-conscious mass markets, maintaining high elasticity of demand.

Regionally, the market is spearheaded by Asia Pacific (APAC) due to its vast consumer base, rapid urbanization, and establishment as a major manufacturing hub for smart devices. However, North America and Europe continue to hold significant market share, driven by high healthcare expenditure, sophisticated technological infrastructure, and greater consumer disposable income allocated towards wellness products. Regional trends also show a divergence in regulatory oversight; while the European Union enforces stringent data protection laws (GDPR), influencing device design and data handling, the U.S. market focuses on achieving FDA clearance for medical-grade functions, accelerating innovation in sensor reliability and clinical efficacy. Emerging markets in Latin America and MEA are experiencing exponential growth, primarily driven by increasing smartphone penetration and the adoption of entry-level smart bracelets.

Segment trends underscore the dominance of multi-functional devices equipped with advanced health monitoring features, particularly focusing on heart health and sleep tracking. The application segment sees a rapid rise in adoption within enterprise wellness programs as companies seek to mitigate healthcare costs and improve employee well-being. Furthermore, distribution channels are consolidating, with online retail platforms capturing an increasing share due to their convenience and extensive product range, though traditional brick-and-mortar stores remain vital for consumer education and hands-on product experience. The software and services segment, focusing on data analytics and personalized coaching subscriptions, is emerging as a high-margin revenue stream complementing hardware sales, pushing manufacturers towards holistic ecosystem development.

AI Impact Analysis on Smart Bracelet Market

Common user questions regarding the integration of Artificial Intelligence (AI) in smart bracelets frequently revolve around the accuracy of predictive health alerts, the practical utility of personalized coaching, the impact of continuous processing on battery longevity, and ensuring data security when advanced algorithms analyze sensitive biometric information. Users are concerned about whether AI-driven insights are truly reliable and personalized enough to justify the investment over basic trackers. Furthermore, there is significant interest in how AI can move beyond simple pattern recognition to identify subtle, pre-symptomatic physiological changes indicative of serious health conditions, ensuring proactive care rather than reactive notification. The prevailing expectation is that AI should transform raw sensor data into highly contextualized, actionable medical or fitness advice, all while operating efficiently on the constrained hardware of a wearable device.

The core theme summarizing user expectations is the demand for ‘Smart’ functionality that transcends simple data aggregation. Consumers anticipate that AI will facilitate highly personalized health profiles, adjusting wellness goals dynamically based on fatigue levels, stress metrics, and recovery needs, effectively acting as an omnipresent virtual health assistant. This means AI must be robust enough to filter noise from data streams, interpret complex physiological interactions (e.g., the relationship between sleep quality, stress, and heart rate variability), and deliver these complex findings through intuitive user interfaces. The implementation of edge AI—processing data locally on the bracelet—is a critical area of interest, balancing performance with crucial data privacy requirements, directly addressing user concerns about transmitting highly sensitive personal data over the cloud.

AI's influence is fundamentally reshaping the market by enhancing the intelligence and utility of smart bracelets, transitioning them from simple data loggers to powerful diagnostic and predictive tools. AI algorithms enable sophisticated anomaly detection, alerting users to potential health risks long before symptoms manifest. Moreover, machine learning models optimize energy consumption by intelligently managing sensor usage based on activity context, directly addressing user concerns about limited battery life. This technological leap provides a compelling differentiator for manufacturers, offering advanced feature sets that justify premium pricing and sustain consumer engagement through continuously evolving, personalized experiences.

- AI algorithms enhance data accuracy and reduce false positives in health monitoring.

- Predictive analytics enables early detection of potential health issues, such as atrial fibrillation or stress overload.

- Personalized coaching and dynamic goal setting are optimized using machine learning models trained on vast user data.

- Edge AI processing improves data security and reduces latency by minimizing reliance on cloud computing.

- AI optimizes power management by contextually adapting sensor usage, extending device battery life.

- Natural Language Processing (NLP) is increasingly used to analyze user input and provide highly contextualized feedback.

DRO & Impact Forces Of Smart Bracelet Market

The Smart Bracelet Market is subjected to a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively define its impact forces and trajectory. Key drivers include the escalating global health and fitness awareness, compelling consumers to adopt continuous self-monitoring tools. The technological maturation of micro-sensor technology and the integration of highly reliable biometric sensors, such as Photoplethysmography (PPG) and advanced accelerometers, further fuel adoption by improving data integrity and clinical relevance. Additionally, strong institutional support from insurance companies and government bodies promoting preventative health measures acts as a significant catalyst, encouraging widespread usage across diverse demographic groups, including the elderly population who benefit significantly from fall detection and remote monitoring features.

Conversely, the market faces notable restraints that temper its explosive growth potential. Primary among these is consumer skepticism regarding data privacy and security, particularly concerning the collection and storage of highly sensitive health data. Limited battery life remains a perpetual engineering challenge, as consumers demand more sophisticated features (e.g., continuous GPS, high-resolution screens) without compromising operational autonomy. Furthermore, the lack of universal regulatory standardization across different geographies for classifying smart bracelets—some as consumer electronics, others as medical devices—creates market entry hurdles and increased compliance costs for manufacturers seeking medical-grade validation. The high cost associated with premium, medically certified devices also restricts adoption in price-sensitive markets.

Opportunities for market expansion are vast, primarily centered around strategic integration within the broader digital health ecosystem, including telemedicine platforms and Electronic Health Records (EHRs). The development of specialized smart bracelets targeting specific chronic conditions (e.g., dedicated glucose monitoring integration) presents lucrative niche markets. Moreover, the evolution of material science allows for increasingly comfortable, durable, and aesthetically versatile designs, appealing to a wider fashion-conscious consumer base. The overall impact forces are characterized by high competitive rivalry driven by continuous innovation in sensor fusion and AI analytics, coupled with the threat of technological substitution from increasingly capable smartwatches, compelling smart bracelet manufacturers to focus heavily on battery life, cost-effectiveness, and specialized function.

Segmentation Analysis

The Smart Bracelet Market is extensively segmented based on Device Type, Application, Technology, and Distribution Channel, reflecting the diverse consumer needs and technological specialization within the industry. Understanding these segments is crucial for manufacturers to tailor product development and marketing strategies effectively. Segmentation by Device Type distinguishes between basic trackers that primarily monitor steps and sleep, and advanced trackers that incorporate sophisticated health sensors like ECG, SpO2, and advanced heart rate variability (HRV) measurement. This differentiation reflects varying price points and target user demographics, ranging from casual fitness users to individuals requiring continuous health surveillance. The rapid blurring of lines between advanced smart bracelets and entry-level smartwatches continually challenges traditional market classification, pushing manufacturers towards feature diversification.

- By Device Type:

- Basic Trackers (Focus on steps, distance, calories)

- Advanced Trackers (Incorporating ECG, SpO2, GPS, NFC)

- By Application:

- Fitness and Wellness (Sports tracking, activity monitoring)

- Healthcare Monitoring (Chronic disease management, vital signs tracking)

- Remote Patient Monitoring (RPA)

- Enterprise Wellness Programs

- By Technology:

- Sensor Technology (PPG, ECG, Accelerometers, Temperature Sensors)

- Connectivity Technology (Bluetooth Low Energy (BLE), Wi-Fi, NFC)

- By Distribution Channel:

- Online Retail (E-commerce platforms, company websites)

- Offline Retail (Specialty stores, consumer electronics stores, Pharmacies)

Value Chain Analysis For Smart Bracelet Market

The value chain for the Smart Bracelet Market begins with the Upstream Analysis, which focuses heavily on the procurement of critical components. This includes securing highly specialized microprocessors and system-on-chips (SoCs), advanced biometric sensors (e.g., optical heart rate sensors, accelerometers, gyroscopes), and specialized battery cells (lithium-ion polymer) known for their energy density and compact form factor. Raw material sourcing also involves acquiring high-grade polymers for casing, flexible printed circuit boards (FPCBs), and advanced display materials (OLED/AMOLED). Given the competitive pressure, efficient sourcing, risk mitigation against supply chain disruptions, and managing intellectual property rights related to proprietary sensor technology are essential steps at this stage. Successful upstream operations rely heavily on strong relationships with specialized semiconductor and sensor component manufacturers, often concentrated in East Asia.

The middle segment encompasses manufacturing, assembly, and quality assurance. This stage involves complex micro-assembly processes, integrating highly sensitive electronic components into compact, waterproof, and durable enclosures. Rigorous testing for accuracy, connectivity reliability, and compliance with specific regional regulatory standards (such as FCC, CE, or FDA requirements) is mandatory. Following manufacturing, the Downstream Analysis centers on logistics, distribution, and sales. Distribution channels are bifurcated into Direct and Indirect models. The Direct channel includes sales through company-owned e-commerce websites, allowing for greater control over branding and customer data collection. The Indirect channel utilizes major online marketplaces, specialized consumer electronics retailers, and mobile carrier stores, maximizing market reach and leveraging established retail infrastructure. The efficiency of the distribution network, particularly the ability to rapidly deploy new products globally, significantly impacts market penetration and revenue capture.

Effective post-sale service, including software updates, customer support, and warranty handling, completes the value chain, fostering long-term customer loyalty. The increasing importance of software and services means that the value chain extends beyond the physical product to include continuous data analysis and subscription services, providing recurring revenue streams. The dominance of indirect distribution through major e-commerce platforms highlights the need for competitive pricing and aggressive digital marketing strategies. The entire chain is heavily optimized for speed and cost-effectiveness, reflecting the fast-moving, high-volume nature of the consumer electronics industry.

Smart Bracelet Market Potential Customers

The Smart Bracelet Market serves a diverse range of End-Users and Buyers, extending far beyond the initial target demographic of dedicated fitness enthusiasts. A major segment comprises the general consumer focused on proactive health and wellness, seeking easy-to-use tools for monitoring daily activity, sleep patterns, and basic vital signs. These users value convenience, affordability, and seamless integration with their existing smartphone ecosystem. This group is often targeted via mass-market campaigns highlighting lifestyle benefits and ease of use. This segment drives the high-volume sales of basic and mid-range trackers, often procured through online retail channels due to ease of price comparison and wide availability.

A second crucial segment includes individuals with chronic health conditions, such as hypertension, diabetes, or cardiovascular issues, and the geriatric population. These buyers, often encouraged by healthcare providers or concerned family members, require devices certified for clinical accuracy, providing reliable continuous monitoring of metrics like heart rate variability (HRV), blood pressure trends, and SpO2 levels. For this segment, the smart bracelet acts as an essential component of a remote patient monitoring (RPM) system, facilitating data sharing with clinicians. Purchase decisions here are often influenced by recommendations from medical professionals and are frequently channeled through specialty healthcare distribution networks or reimbursed through insurance plans, emphasizing reliability and regulatory compliance (e.g., FDA or CE certification).

Furthermore, institutional buyers, including corporate wellness programs, research institutions, and sports organizations, represent a growing market segment. Companies leverage smart bracelets to track employee activity and fitness engagement to reduce insurance premiums and promote a healthier workforce, purchasing devices in bulk. Similarly, professional sports teams use specialized high-end trackers for performance optimization, recovery monitoring, and injury prevention, demanding highly durable devices with advanced physiological metrics and robust data output capabilities. These institutional buyers prioritize robust centralized data management platforms, scalability, and device interoperability, making the software and service package as important as the hardware itself.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 11.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Samsung Electronics Co. Ltd., Xiaomi Corporation, Fitbit (Google), Huawei Technologies Co. Ltd., Garmin Ltd., Sony Corporation, HONOR Device Co., Ltd., Huami (Zepp Health), Fossil Group, Inc., Polar Electro, Suunto, Oura Health Oy, WHOOP, Inc., MOOV Inc., Withings, Inc., Misfit (now Fossil), OPPO, BBK Electronics (OnePlus), GOQii. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Bracelet Market Key Technology Landscape

The technological evolution defining the Smart Bracelet Market is centered on advanced sensor fusion, miniaturization, and sophisticated low-power chipsets. The core functionality relies heavily on biomedical sensors, primarily Photoplethysmography (PPG) sensors for continuous heart rate monitoring and blood oxygen saturation (SpO2) measurements. Recent innovations include the integration of electrical sensors capable of taking single-lead Electrocardiogram (ECG) readings, moving the devices closer to medical-grade precision. Furthermore, high-precision accelerometers and gyroscopes are vital for accurate activity recognition, step counting, and essential fall detection capabilities, particularly important for devices targeting the geriatric demographic. Advances in thermistor technology also enable reliable skin temperature tracking, offering valuable insights into sleep stages and general health trends.

Connectivity is another crucial element, predominantly relying on Bluetooth Low Energy (BLE) standards (specifically BLE 5.0 and beyond) to ensure efficient, long-range wireless communication with paired smartphones while minimizing power drain. Near Field Communication (NFC) capabilities are increasingly embedded, transforming smart bracelets into convenient tools for contactless payments and access control, enhancing their utility beyond health tracking alone. Research and development efforts are currently focused on improving the durability and efficiency of flexible batteries and implementing proprietary, highly efficient micro-controllers (MCUs) that can handle complex data processing tasks locally. This shift towards edge computing allows for faster feedback loops, increased security, and reduced reliance on constant data transmission to the cloud, addressing critical user demands for battery life and data privacy.

Material science and display technology also play a significant role in the technological landscape. The use of robust, hypoallergenic, and flexible materials for bands and casing ensures comfort during prolonged wear and compliance with rigorous ingress protection standards (e.g., high IP ratings for water and dust resistance). The shift towards high-resolution, always-on OLED and AMOLED displays provides superior visibility and aesthetic appeal while optimizing energy consumption through pixel dimming capabilities. The overarching technological trajectory is focused on seamless integration: creating devices that are not just accurate health trackers but also subtle, indispensable parts of the user's daily life, achieved through optimal blending of hardware excellence, advanced algorithm development (AI/ML), and secure data connectivity protocols.

Regional Highlights

The Smart Bracelet Market exhibits significant regional variations in adoption rates, technological maturity, and regulatory frameworks, impacting growth dynamics globally. North America, encompassing the United States and Canada, represents a highly mature market characterized by high consumer awareness, substantial disposable income, and a proactive approach to adopting digital health technologies. The region is a leader in incorporating advanced features, such as FDA-cleared ECG functionality and sophisticated sleep analytics. High healthcare expenditure and a strong presence of key technology giants and specialized medical device firms drive continuous innovation. The demand is heavily skewed towards advanced trackers used in both personal wellness and structured remote patient monitoring programs, leveraging sophisticated telehealth infrastructure already in place across major hospital networks.

Europe stands as a robust growth region, particularly in Western Europe (Germany, UK, France), where the emphasis on holistic wellness and preventative health is culturally strong. Market growth here is supported by stringent consumer data protection regulations (GDPR), which mandate high standards for data security, influencing device design and data handling processes. The European market shows a strong affinity for aesthetically pleasing and functionally reliable devices, driving demand for premium brands that balance performance with design. Furthermore, government initiatives in several EU countries to digitalize healthcare systems are integrating smart bracelets into subsidized patient care pathways, particularly for managing chronic conditions like diabetes and cardiovascular health, creating stable, long-term revenue streams for certified medical wearables.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period, primarily due to its massive population base, rapidly increasing middle-class disposable income, and accelerating smartphone penetration rates. Countries like China, India, and South Korea are not only major consumer markets but also global manufacturing hubs, allowing local brands to capture market share through competitive pricing and rapid product iterations tailored to local consumer preferences. While the market initially thrived on basic, low-cost trackers, there is a clear upward trend towards mid-range and advanced smart bracelets, driven by growing awareness of health issues and the increasing prevalence of lifestyle diseases. The regulatory environment in APAC is diverse, but standardization is slowly emerging, particularly concerning the validation of medical-grade functionalities, which is critical for accessing high-value healthcare applications.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets poised for high growth, albeit from a smaller base. Growth in LATAM is primarily driven by expanding digital connectivity and rising consumer interest in fitness and sports culture, particularly in countries like Brazil and Mexico. The penetration of entry-level smart bracelets is high, appealing to the cost-sensitive consumer base. In MEA, rapid infrastructure development and diversification away from oil economies, especially in the GCC countries, are fueling investment in digital healthcare and advanced consumer electronics. While market challenges include fragmented distribution networks and varying regulatory standards, the strong youth population and growing mobile-first economy provide substantial underlying demand for personal health tracking solutions, positioning these regions for substantial expansion in the latter half of the forecast period.

- North America: High adoption of advanced, medical-grade wearables; strong integration with established telehealth systems; driven by high consumer spending.

- Europe: Strong focus on holistic wellness; strict adherence to GDPR impacting data architecture; significant growth in corporate wellness programs.

- Asia Pacific (APAC): Fastest-growing region; massive consumer base and manufacturing dominance; increasing shift towards mid-to-high-end devices.

- Latin America: Growth spurred by increasing mobile internet access; high demand for basic and mid-range, affordable devices.

- Middle East and Africa (MEA): Driven by urbanization and government investment in digital health infrastructure; strong potential in health monitoring applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Bracelet Market.- Apple Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

- Fitbit (Google)

- Huawei Technologies Co. Ltd.

- Garmin Ltd.

- Sony Corporation

- HONOR Device Co., Ltd.

- Huami (Zepp Health)

- Fossil Group, Inc.

- Polar Electro

- Suunto

- Oura Health Oy

- WHOOP, Inc.

- MOOV Inc.

- Withings, Inc.

- Misfit (now Fossil)

- OPPO

- BBK Electronics (OnePlus)

- GOQii

Frequently Asked Questions

Analyze common user questions about the Smart Bracelet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Smart Bracelet Market?

Market growth is primarily driven by the escalating global health consciousness, the rising prevalence of chronic lifestyle diseases necessitating continuous monitoring, and substantial technological advancements in sensor accuracy and miniaturization, making devices more reliable and feature-rich.

How does AI technology enhance the functionality of modern smart bracelets?

AI enhances functionality by enabling predictive analytics for early health risk detection, optimizing personalized fitness and sleep coaching, and improving device energy efficiency through intelligent management of sensor usage and data processing, offering highly actionable insights to users.

What are the main restraints hindering the widespread adoption of smart bracelets?

Key restraints include pervasive consumer concerns regarding the security and privacy of sensitive biometric data, the inherent limitation of battery life in multi-functional devices, and the regulatory complexities associated with obtaining medical-grade certifications across different regional markets.

Which application segment holds the largest share in the Smart Bracelet Market?

The Fitness and Wellness segment currently holds the largest market share, driven by mass consumer adoption for daily activity tracking, calorie counting, and goal setting. However, the Healthcare Monitoring and Remote Patient Monitoring (RPM) segment is projected to exhibit the highest growth rate.

Is the Smart Bracelet Market expected to merge entirely with the Smartwatch Market?

While the markets are converging, smart bracelets maintain a distinct position by prioritizing long battery life, specialized focus on core health metrics, and a more compact, often screen-less design, catering specifically to consumers who prioritize function and convenience over complex app ecosystems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager