Smart Cards Automated Fare Collection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432342 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Smart Cards Automated Fare Collection System Market Size

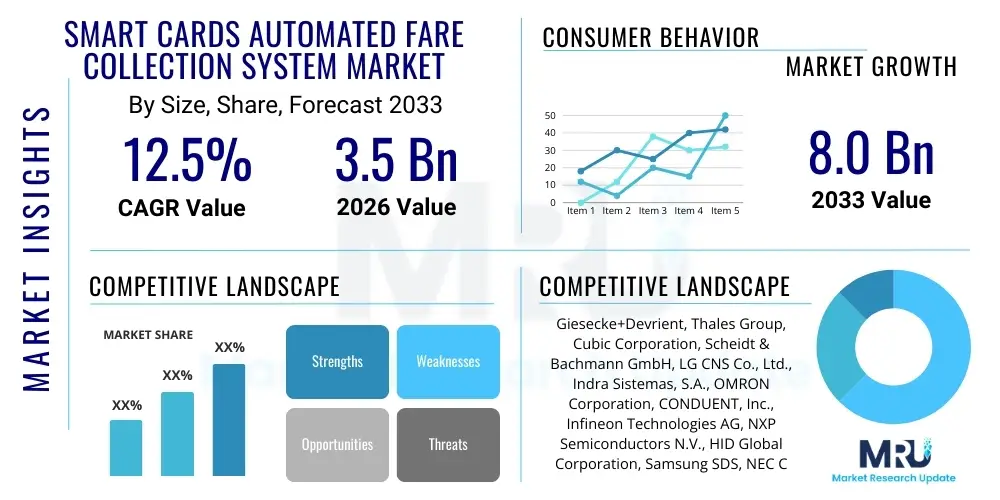

The Smart Cards Automated Fare Collection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by rapid urbanization, increasing investments in smart city infrastructure globally, and the paramount need for efficient, secure, and seamless public transportation experiences across metropolitan areas. The widespread adoption of contactless payment technologies, driven by both consumer preference and governmental mandates for efficient transit operations, is a central accelerator for this valuation increase.

Smart Cards Automated Fare Collection System Market introduction

The Smart Cards Automated Fare Collection (AFC) System Market encompasses the deployment of smart card technology, primarily utilizing standards such as ISO/IEC 14443 (MIFARE, Calypso), within public transit networks to manage ticketing, revenue collection, and access control automatically. These systems replace traditional paper tickets and coin-based payments, offering significant operational efficiencies for transit authorities and enhanced convenience for commuters. Key components include validators, central management systems, secure ticketing media (smart cards), and backend software for transaction processing and data analytics. Major applications span urban buses, metro rail networks, suburban commuter trains, high-speed rail, and increasingly, integrated multimodal transport systems where a single card facilitates travel across various modes.

The core benefits derived from implementing Smart Cards AFC systems include reduced operational costs associated with manual fare handling, minimization of revenue leakage through fraud prevention, and the generation of valuable ridership data that aids in optimized route planning and scheduling. Furthermore, these systems dramatically improve passenger throughput at entry points, particularly during peak hours, contributing to better overall service quality and customer satisfaction. The driving factors propelling market expansion are the global emphasis on smart city development, government initiatives promoting cashless transactions, and the seamless integration capabilities of smart cards with other payment methods, such as mobile wallets and Near Field Communication (NFC) devices, ensuring future-proofing of transit infrastructure.

Smart Cards Automated Fare Collection System Market Executive Summary

The Smart Cards Automated Fare Collection System market is currently defined by significant technological convergence, moving beyond proprietary systems toward open-loop payment standards that accept standard bank cards (EMV). Business trends indicate a strong shift from solely hardware procurement toward integrated Service-as-a-Software (SaaS) and platform solutions, where long-term maintenance contracts and data analytics services represent critical revenue streams for vendors. Geographically, while Asia Pacific remains the largest market due to intensive investment in new rail and metro infrastructure in countries like China and India, North America and Europe are driving innovation in system upgrades and the transition to account-based ticketing (ABT) architecture, which fundamentally relies on secure smart card technology as the primary token of identity.

Segment trends demonstrate that the Contactless Smart Cards sub-segment is dominating the market, largely replacing older contact-based systems due to superior processing speed and durability, which are crucial for high-volume transit environments. Furthermore, the Rail application segment, including metro and light rail, commands the largest market share, driven by the high initial investment required for turnstile and gate installations compared to bus systems. However, the Services component (including system integration, consulting, and managed services) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the complexity of modern AFC deployments and the outsourcing trend among Public Transit Authorities (PTAs). These PTAs prioritize seamless implementation and consistent system uptime over in-house management, recognizing the mission-critical nature of fare collection.

AI Impact Analysis on Smart Cards Automated Fare Collection System Market

User queries regarding the impact of Artificial Intelligence (AI) on Smart Cards AFC systems frequently center on how AI can enhance fraud detection, optimize dynamic pricing models, and improve predictive maintenance of hardware. Key themes emerging from these concerns include the requirement for real-time anomaly detection to combat sophisticated fare evasion schemes, the necessity for machine learning algorithms to personalize fare products and adjust prices based on real-time demand and historical patterns, and the desire to leverage AI for predicting failure points in validators and gates before they impact service quality. Users expect AI to transform AFC from a simple transaction system into an intelligent, adaptive revenue management and operational efficiency platform, ensuring the longevity and security of smart card infrastructure.

The integration of AI fundamentally changes the back-office operations of AFC systems. AI-driven analytics can process massive datasets generated by smart card taps, identifying subtle patterns indicative of irregular usage or collusion, which traditional rule-based systems often miss. This enhancement significantly boosts revenue assurance. Moreover, AI contributes directly to passenger experience by enabling sophisticated, personalized incentives and ensuring smooth integration with multimodal services, calculating the best fare instantly across different modes of transport without user intervention. This level of sophistication transforms the smart card from a static token into a dynamic element within a responsive urban mobility ecosystem, thereby increasing the intrinsic value and required computing power of the overall AFC solution.

- AI-driven fraud detection enhances revenue protection by identifying anomalous transaction patterns in real-time.

- Predictive maintenance utilizes machine learning to forecast hardware failures (e.g., card readers, gates), minimizing system downtime.

- Dynamic pricing algorithms, powered by AI, enable transit operators to optimize utilization and revenue based on demand elasticity.

- Improved customer segmentation and personalized fare recommendation systems enhance rider satisfaction and loyalty.

- AI-based operational optimization streamlines data reconciliation and reduces manual intervention in complex clearing and settlement processes.

DRO & Impact Forces Of Smart Cards Automated Fare Collection System Market

The Smart Cards Automated Fare Collection System market is primarily driven by the imperative of enhancing efficiency and reducing operational costs within public transportation networks globally. Government mandates supporting smart city development and sustainable urban mobility schemes act as powerful catalysts, necessitating the integration of advanced ticketing solutions. Restraints include the high initial capital expenditure required for system overhaul and implementation, alongside interoperability challenges arising from integrating disparate legacy systems with modern open-loop standards. Opportunities abound in the expansion into secondary and tertiary cities in developing economies, the convergence with Mobile-as-a-Service (MaaS) platforms, and the increasing adoption of Account-Based Ticketing (ABT) systems that leverage smart cards purely as tokens rather than repositories of value. These forces collectively shape the competitive landscape and technological roadmap for the industry.

The primary impact force remains the rapid pace of technological obsolescence, specifically the pressure to migrate from proprietary closed-loop systems, which traditionally relied solely on smart cards, toward open-loop standards that incorporate EMV bank cards and mobile devices. While smart cards remain the backbone for reliability and high throughput, system architects must now design platforms capable of handling multiple payment tokens seamlessly. This requirement significantly increases complexity but also drives innovation in backend processing and security protocols. Secondly, increasing regulatory focus on data privacy and security (such as GDPR in Europe) compels AFC solution providers to invest heavily in secure element technology and tokenization processes to protect sensitive personal and financial transaction data captured through smart card usage.

Segmentation Analysis

The Smart Cards Automated Fare Collection System market segmentation provides a granular view of component consumption, technological maturity, and application-specific adoption rates across global transit networks. The market is fundamentally segmented by the type of components involved—hardware, software, and services—reflecting the transition from capital expenditure on physical devices to operational expenditure on robust, cloud-based management platforms. Technology segmentation distinguishes between Contact and Contactless smart cards, highlighting the clear market preference for rapid, secure, and durable contactless solutions (like MIFARE DESFire) necessary for high-volume urban transit. Furthermore, application analysis details utilization across Bus, Rail, Parking, and Miscellaneous transit modes, providing insights into investment priorities across different public transportation types.

- By Component:

- Hardware (Turnstiles, Validators, Gates, Vending Machines)

- Software (Central Management Systems, Data Analytics, Revenue Reporting)

- Services (System Integration, Consulting, Maintenance, Managed Services)

- By Technology:

- Contact Smart Cards (Declining usage)

- Contactless Smart Cards (Dominant segment, ISO/IEC 14443 compliant)

- Near Field Communication (NFC) Enabled Devices (Mobile integration)

- By Application:

- Bus Transport Systems

- Rail Transport Systems (Metro, Subway, Light Rail, Commuter Rail)

- Parking and Toll Systems

- Others (Ferries, Taxis, Bike Share Programs)

Value Chain Analysis For Smart Cards Automated Fare Collection System Market

The value chain for the Smart Cards AFC System market initiates with upstream suppliers, primarily semiconductor manufacturers (e.g., NXP, Infineon) who provide the secure chips and microcontrollers essential for the smart cards and the reader hardware. This is followed by specialized smart card manufacturers and hardware integrators who embed the secure elements into the physical cards and produce the ruggedized validators and gates required for harsh public transport environments. Key differentiators at this stage are security accreditation (e.g., Common Criteria, EMVCo) and card durability.

Midstream activities involve the core System Integrators (SIs) and software platform providers (e.g., Cubic, Thales) who develop and customize the Automated Fare Collection software, linking the frontline hardware with the central management and financial clearing systems. The complexity of modern transit requires advanced software capable of handling massive volumes of real-time transactions and integrating various payment methods. Downstream activities involve the Public Transit Authorities (PTAs) who are the ultimate buyers and operators. Distribution channels are predominantly direct, involving long-term public procurement contracts between the large SIs and the PTAs, often including substantial maintenance and operational support contracts (managed services) for durations exceeding ten years, reflecting the criticality and longevity of these municipal infrastructures. Indirect channels, involving smaller local distributors or resellers, are rare and usually limited to specific hardware components or software modules.

Smart Cards Automated Fare Collection System Market Potential Customers

The primary customers and buyers in the Smart Cards Automated Fare Collection System market are large-scale governmental or quasi-governmental entities responsible for the planning, operation, and maintenance of urban and regional public transport networks. These entities typically include Municipal Transit Authorities, Metropolitan Transportation Operators (MTOs), and Ministries of Transportation seeking integrated mobility solutions. The procurement process is highly formalized, usually involving competitive bidding through Requests for Proposal (RFPs) due to the significant public investment required and the long operational lifespan of the systems.

Secondary but rapidly growing customer segments include organizations managing private transport fleets (e.g., large corporate shuttles, airport transit systems) and specialized infrastructure operators such as bridge and tunnel tolling authorities, and large-scale parking management firms. These customers prioritize seamless integration, high security, and demonstrable Return on Investment (ROI) through reduced fraud and enhanced data visibility. The decision-making unit often comprises financial controllers, IT directors, and operational heads within the transit agency, emphasizing the need for robust security features, compliance with global standards, and comprehensive maintenance service contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Giesecke+Devrient, Thales Group, Cubic Corporation, Scheidt & Bachmann GmbH, LG CNS Co., Ltd., Indra Sistemas, S.A., OMRON Corporation, CONDUENT, Inc., Infineon Technologies AG, NXP Semiconductors N.V., HID Global Corporation, Samsung SDS, NEC Corporation, Vix Technology, Genfare, Parkeon (Flowbird), STMicroelectronics, Shenzhen Sunray Technology Co., Ltd., Advanced Card Systems Ltd., Lookheed Martin |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Cards Automated Fare Collection System Market Key Technology Landscape

The technological core of the Smart Cards AFC market revolves around secure microcontrollers embedded in contactless cards, adhering primarily to ISO/IEC 14443 standards. The transition from older proprietary technologies like MIFARE Classic to more secure and complex protocols such as MIFARE DESFire EV2/EV3 or Calypso is critical for ensuring data integrity and preventing cloning. Crucially, the move toward Account-Based Ticketing (ABT) architecture represents the most profound technological shift. In an ABT system, the smart card merely acts as a secure identity token, and all fare calculations, rules, and stored value reside centrally on the backend server. This separation allows for greater flexibility in fare structure updates and integration of various media types, significantly reducing the security requirements placed solely on the physical card.

Furthermore, the incorporation of advanced hardware components, such as multi-protocol validators capable of reading both closed-loop smart cards and open-loop EMV (Europay, Mastercard, Visa) contactless bank cards, defines modern system deployments. These validators are increasingly equipped with embedded encryption modules and capabilities for over-the-air (OTA) software updates, minimizing physical intervention and improving operational resilience. Backend software, critical for managing the complex interplay of transactions, clearing, and settlement across multiple operators, relies heavily on cloud-native architectures (e.g., AWS, Azure) to handle massive scale, ensure low latency, and facilitate real-time data analysis. The security infrastructure, particularly cryptographic key management and Payment Card Industry Data Security Standard (PCI DSS) compliance, remains a non-negotiable requirement for all AFC solutions.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, characterized by extensive investment in new metro and high-speed rail networks, especially in emerging economies. Countries like China, India, and Southeast Asian nations are rapidly deploying robust smart card systems to manage increasing urbanization and population density. The region prioritizes high throughput and large-scale proprietary closed-loop deployments, although movement toward open-loop systems is accelerating in major hubs like Singapore and Hong Kong. The scale of required infrastructure investment ensures continuous high growth.

- Europe: Europe is characterized by technological maturity and a high focus on standardization and interoperability, exemplified by initiatives like the Calypso standard. The region is leading the transition to open-loop payments, integrating smart card systems with EMV bank card acceptance and leveraging sophisticated Account-Based Ticketing (ABT) architectures. Key markets such as the UK (Transport for London’s success with Oyster/EMV) and France are driving innovation in seamless cross-border and multimodal fare management, demanding highly secure and scalable software platforms.

- North America: North America demonstrates significant market potential driven by the necessity to upgrade aging transit infrastructure in major metropolitan areas such as New York, Los Angeles, and Toronto. The region is rapidly adopting ABT and mobile ticketing solutions, positioning smart cards as one component of a broader, integrated mobility portfolio. Security compliance and the integration of transit solutions with broader city services (smart parking, bike-share) are primary strategic focus areas for procurement.

- Latin America (LATAM): The LATAM market exhibits strong growth fueled by government commitments to modernizing bus rapid transit (BRT) systems and nascent metro expansion projects. Brazil and Mexico are key growth drivers. The challenge remains managing high levels of informal economy activity and achieving reliable network connectivity, often leading to a preference for reliable, high-security, closed-loop smart card systems initially, followed by eventual migration to open standards.

- Middle East and Africa (MEA): Growth in MEA is primarily concentrated in the Gulf Cooperation Council (GCC) countries, driven by massive infrastructure projects and smart city developments in nations like the UAE and Saudi Arabia. These markets often jump directly to the latest technology, favoring integrated multimodal smart card systems that are robust and scalable. Africa presents vast untapped potential, particularly in metropolitan centers, where smart card solutions address efficiency challenges in rapidly expanding bus networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Cards Automated Fare Collection System Market.- Giesecke+Devrient

- Thales Group

- Cubic Corporation

- Scheidt & Bachmann GmbH

- LG CNS Co., Ltd.

- Indra Sistemas, S.A.

- OMRON Corporation

- CONDUENT, Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- HID Global Corporation

- Samsung SDS

- NEC Corporation

- Vix Technology

- Genfare

- Parkeon (Flowbird)

- STMicroelectronics

- Shenzhen Sunray Technology Co., Ltd.

- Advanced Card Systems Ltd.

- Lookheed Martin

Frequently Asked Questions

Analyze common user questions about the Smart Cards Automated Fare Collection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Account-Based Ticketing (ABT) and Card-Based Ticketing (CBT) systems?

CBT stores value and ride entitlement directly on the smart card, making the card the primary source of truth. ABT uses the smart card only as a token of identity, storing all value and transaction history securely on a centralized backend server. ABT offers greater flexibility, real-time fare updates, and better support for multimodal journeys.

How are open-loop payment systems integrated with existing closed-loop smart card infrastructure?

Integration relies on upgrading validators and backend software to accept both proprietary transit smart cards (closed loop) and standard contactless EMV bank cards (open loop). This requires robust central systems capable of tokenizing EMV transactions and reconciling them alongside proprietary closed-loop transaction data for accurate revenue reporting.

What security standards are essential for modern Smart Cards AFC systems?

Key security standards include ISO/IEC 14443 for contactless communication, specialized transit security protocols (e.g., Calypso, MIFARE DESFire), and financial industry standards such as EMVCo certification for open-loop acceptance and PCI DSS compliance for secure payment processing and data handling.

Which regions are leading the growth and technological innovation in the AFC market?

Asia Pacific leads in market size and deployment volume due to massive infrastructure expansion. However, Europe and North America lead in technological innovation, specifically in the adoption of Account-Based Ticketing, sophisticated multimodal integration, and the seamless convergence of closed-loop smart cards with open-loop payment options.

What is the expected long-term impact of mobile ticketing solutions on the smart card market?

Mobile ticketing (using NFC/HCE) is viewed as complementary, not fully replacement. Mobile devices essentially emulate the smart card or function as an ABT token. While mobile usage is rising, physical smart cards remain crucial for reliability, high-speed validation in high-volume environments, and serving users without smartphones or bank access.

The imperative for urban centers globally to manage increasing population densities and optimize public transport operations is the fundamental driver sustaining the growth of the Smart Cards Automated Fare Collection (AFC) System market. These systems are moving away from being mere transaction collection tools toward sophisticated data platforms essential for smart city governance and mobility planning. The technological evolution is swift, requiring vendors to constantly upgrade their offerings to integrate cloud computing, advanced data analytics, and robust cybersecurity measures, ensuring that the smart card remains a reliable and highly secure component within the broader multimodal transit ecosystem. The focus has decisively shifted from hardware longevity to software agility and the ability to seamlessly handle multiple payment tokens, including mobile wallets and standardized bank cards, all unified under a robust Account-Based Ticketing framework.

The complexity of securing these large-scale municipal systems cannot be overstated. With millions of transactions occurring daily, system integrity is paramount, leading to high barriers to entry for new vendors and consolidating market power among established global players like Cubic, Thales, and Giesecke+Devrient. These leaders invest heavily in proprietary security elements and advanced cryptography to protect against fraud, which, when successfully deployed, translates directly into enhanced revenue assurance for transit operators. Regional market dynamics play a critical role; while mature markets in Europe prioritize interoperability and consumer convenience through open standards, rapidly expanding infrastructure markets in Asia Pacific demand high-volume scalability and cost-efficiency in hardware deployment. This dual demand profile ensures that both high-security physical cards and sophisticated backend platforms will continue to see strong demand throughout the forecast period, solidifying the market’s projected CAGR of 12.5% through 2033.

A key structural trend influencing procurement decisions is the increasing reliance on the Services segment, particularly long-term maintenance, system integration, and consulting. Transit authorities recognize that managing and evolving a complex AFC system is often beyond their core competencies, leading to the outsourcing of operations to expert vendors. This shift from pure CAPEX (Capital Expenditure) to OPEX (Operational Expenditure) models provides vendors with stable, recurring revenue streams and positions them as long-term strategic partners in urban mobility planning, rather than just equipment suppliers. The ability of a vendor to provide integrated solutions spanning the entire value chain—from secure silicon manufacturing to cloud-based data management—is increasingly the metric by which market leadership is defined, emphasizing the need for robust partnerships and comprehensive service portfolios across the globe.

The continued proliferation of contactless technology, spurred by health concerns and convenience preferences following global public health crises, has significantly accelerated the adoption curve for smart cards and related systems. The reliability of contactless smart cards in environments where cellular connectivity might be unreliable or high transaction speed is necessary (such as subway turnstiles during rush hour) ensures their foundational role. While mobile payment options offer convenience, smart cards offer unmatched transaction speed and physical resilience, guaranteeing operational continuity. This resilience, combined with the security features inherent in modern high-security smart chips, ensures that the market for dedicated transit media will remain robust, even as payment modality evolves. Furthermore, smart cards often serve as the crucial payment medium for demographics who may lack access to conventional banking or smartphone technology, reinforcing their necessity for achieving truly inclusive public transport services.

The regulatory landscape is becoming increasingly stringent, particularly concerning the handling of transit usage data and financial information, reinforcing the demand for highly certified and secure hardware and software. The adoption of specific industry standards, such as those set by EMVCo for transaction acceptance and Common Criteria for chip security, is mandatory for participation in major global tenders. This regulatory pressure acts as a barrier to entry for smaller or less established firms but drives continuous improvement and standardization among market leaders. The development of robust tokenization schemes to protect passenger identity and transaction data is a primary area of technological focus, ensuring compliance while maximizing the utility of ridership data for planning and revenue management purposes. The necessity for integrated solutions that seamlessly manage both data compliance and operational efficiency highlights the sophisticated nature of the contemporary AFC market.

Examining the application segments in detail reveals divergent investment patterns. The Rail segment consistently demands the highest sophistication due to the high costs associated with physical access control (gates, turnstiles) and the imperative for zero revenue leakage. Conversely, the Bus segment, particularly in rapidly expanding urban areas, focuses on lower-cost, high-volume validators that are often mounted on vehicle dashboards and require robust communication capabilities (3G/4G/5G) for real-time data transmission. The growth in the ‘Others’ segment, encompassing systems for bike sharing, ferries, and micro-mobility solutions, signals the expanding scope of AFC systems beyond traditional public transit, positioning the smart card infrastructure as a core component of a holistic city mobility platform. This expansion requires system architects to design highly flexible, modular platforms capable of accommodating diverse fare rules and business models.

The competitive strategy among the top key players centers heavily on mergers and acquisitions (M&A) to consolidate market share, acquire niche technology expertise (especially in cloud and AI analytics), and expand geographic presence. Long-term public contracts, which can span over two decades including maintenance, provide a significant competitive moat. Companies must not only demonstrate superior technology but also financial stability and a proven track record of successful deployment and operational management under public scrutiny. The ability to offer a complete end-to-end solution—from card personalization and issuance to backend clearing and settlement—is often a prerequisite for securing high-value municipal contracts, emphasizing vertical integration within the value chain.

Looking at the component segmentation, while Hardware remains essential for the physical interface (validators, gates), the long-term growth is disproportionately centered in the Software and Services components. Software development for central clearing, risk management, and predictive analytics represents the high-margin segment, allowing for continuous iteration and customization based on specific transit authority needs. The shift to subscription-based and managed service models ensures sustained revenue generation for vendors long after the initial system installation. This financial model transition reflects the understanding that the value derived from an AFC system increasingly resides in the intelligence and flexibility of the data platform rather than solely the physical security of the card itself, driving deeper partnerships between technology providers and transit agencies worldwide.

Finally, the long-term strategic direction of the market is inevitably linked to the broader smart city concept. Smart card AFC systems generate critical, high-frequency mobility data that informs urban planning, traffic management, and sustainability initiatives. The secure integration of this data with other municipal data layers (e.g., traffic control, utilities management) is a future differentiator. Vendors who can leverage AI and machine learning to translate raw smart card transaction data into actionable mobility insights will capture premium market share. The smart card, therefore, serves not only as a fare collection token but also as an indispensable sensor for understanding urban flow, positioning the entire AFC industry at the intersection of finance, transportation, and civic technology innovation.

The technical demands placed upon smart card security chips are increasing exponentially. They must handle higher cryptographic complexity to support advanced security features required by modern transit systems, resisting both physical and side-channel attacks. The shift to utilizing modern cryptographic suites, often leveraging hardware-based secure elements in mobile devices and dedicated cards, is mandatory. Manufacturers of silicon components, such as Infineon and NXP, play a foundational role, driving innovations that enhance card lifespan, transaction speed, and tamper resistance. The performance characteristics of these underlying secure elements dictate the efficiency and reliability of the entire system, especially during peak transaction loads where validation must occur in milliseconds to prevent passenger queues.

Another crucial technological aspect is system connectivity and resilience. Modern AFC systems must maintain full operational capability even during network outages. This necessitates robust offline processing capabilities within the validator hardware and sophisticated data synchronization mechanisms to ensure that transactions processed offline are accurately reconciled when connectivity is restored. This requirement for fail-safe operation is especially critical in large underground metro systems or geographically dispersed bus networks. The architecture must support seamless transition between online and offline modes without compromising security or transaction integrity, highlighting the importance of distributed data management systems and edge computing capabilities within the validators themselves, ensuring continuous, reliable service for commuters.

The trend towards multi-application smart cards represents a significant opportunity. Transit smart cards are increasingly being used for secondary functions, such as access control to public libraries, payment in municipal parking facilities, and even limited retail purchases. This convergence maximizes the utility of the issued card and strengthens the institutional linkage between the transit system and the broader civic infrastructure. For vendors, this requires systems that adhere to broader open standards (not just transit-specific protocols) and offer modular software architecture that can easily integrate diverse services, transforming the transit card into a foundational electronic identity token for urban life, thereby deepening the market penetration and enhancing the stickiness of the deployed solution.

In summary, the Smart Cards AFC market is maturing rapidly, moving beyond basic transaction management to embrace sophisticated data science, cloud architecture, and open financial standards. The convergence of physical smart card technology with digital payment tokens necessitates continuous research and development into security protocols and system integration capabilities. The market growth is firmly underpinned by the global commitment to smart, efficient, and inclusive public transportation, ensuring that smart card systems remain a cornerstone of urban infrastructure development for the foreseeable future, despite the increasing adoption of mobile-centric payment alternatives, which often utilize the same backend AFC framework for core functions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager