Smart-Connected Wallets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434884 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Smart-Connected Wallets Market Size

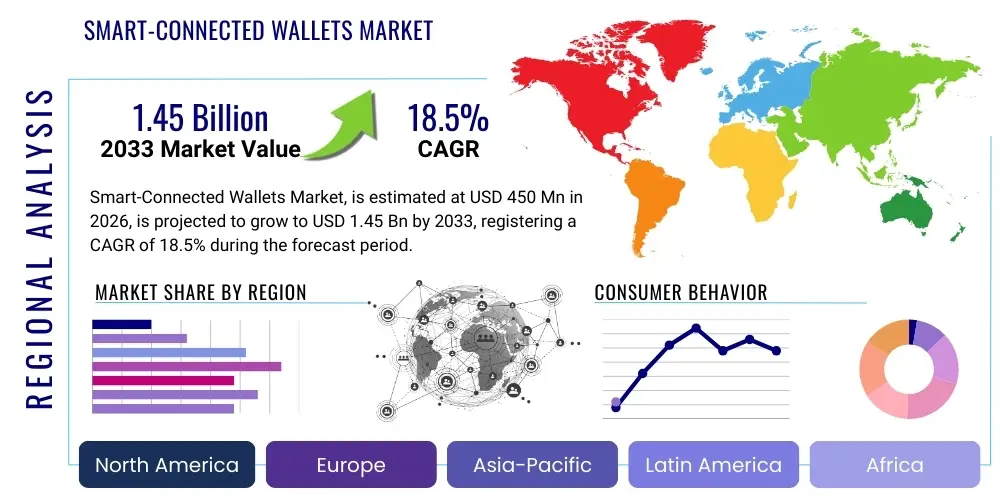

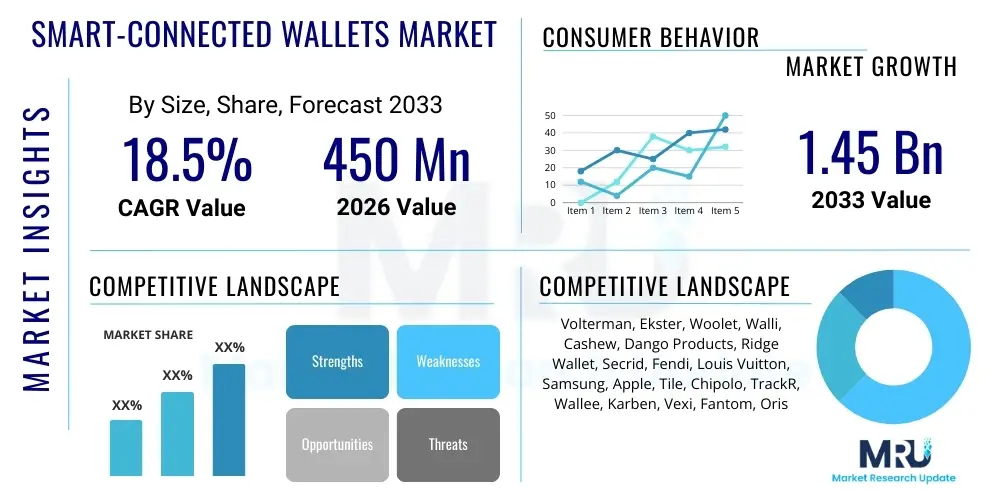

The Smart-Connected Wallets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 450 million in 2026 and is projected to reach USD 1.45 billion by the end of the forecast period in 2033.

Smart-Connected Wallets Market introduction

The Smart-Connected Wallets Market encompasses the development, manufacturing, and distribution of personal accessories integrated with advanced technological features designed to enhance security, trackability, and convenience. These devices move beyond traditional storage function by incorporating sensors, connectivity modules (like Bluetooth or GPS), and often biometric scanners or RFID blocking capabilities. The primary product description centers around a consumer electronic device that maintains the aesthetic and utility of a standard wallet while adding "smart" features such as anti-loss alarms, remote tracking via smartphone apps, and security alerts for unauthorized access. This convergence of fashion, security, and technology addresses a significant consumer pain point: the high risk and financial disruption associated with losing cash, credit cards, and vital identification documents.

Major applications of smart wallets span across individual personal use, particularly among frequent travelers, technology enthusiasts, and urban professionals who prioritize security and efficiency. The wallets are increasingly adopted in corporate settings as high-value, tech-enabled gifts, and within the travel and hospitality sectors where quick access and enhanced security for digital and physical assets are paramount. Furthermore, the integration with digital payment platforms positions smart wallets as a critical bridge between physical identification and mobile payment ecosystems. The market is characterized by ongoing innovation, focusing on thinner designs, longer battery life, and seamless integration with broader IoT ecosystems, driving continuous product iterations and consumer interest.

The primary benefits driving market expansion include unparalleled security through anti-theft mechanisms and biometric locks, enhanced convenience due to automated tracking and charging capabilities, and loss prevention enabled by connectivity features that alert users when they leave their wallet behind. Key driving factors fueling the market growth are the increasing global digitization of transactions, a rising consumer preference for sophisticated security solutions against identity theft and fraud, and the pervasive penetration of smartphones which serve as the hub for managing and interacting with these connected devices. Additionally, improvements in miniaturization technology and battery efficiency are making smart wallets more practical and aesthetically appealing, overcoming earlier limitations related to bulkiness and charging frequency.

Smart-Connected Wallets Market Executive Summary

The Smart-Connected Wallets Market is poised for robust expansion driven by converging trends in consumer electronics, personal security, and mobile technology. Key business trends indicate a significant shift towards premiumization, with consumers willing to invest in wallets offering advanced biometric security (fingerprint scanning) and seamless global tracking capabilities (integrated GPS). Strategic collaborations between technology firms and traditional luxury accessory brands are becoming crucial for market penetration, allowing smart wallets to transition from niche gadgets to mainstream fashion-tech accessories. Furthermore, companies are prioritizing modular design and sustainability, utilizing eco-friendly materials and offering feature scalability to appeal to a broader, environmentally conscious consumer base, ensuring competitive differentiation and sustained growth throughout the forecast period.

Regional trends highlight North America and Europe as the leading revenue generators, characterized by high disposable incomes, early technology adoption rates, and a mature infrastructure for supporting IoT and location-based services. However, the Asia Pacific region is expected to register the highest growth rate (CAGR), fueled by increasing urbanization, rapid digitization of payment systems (especially in countries like India and China), and a growing middle class adopting smart lifestyle products. Governments' focus on digital identity and secure transactions further encourages the use of connected accessories in APAC. Investment in regional manufacturing and localized marketing strategies targeting device compatibility and specific regional security concerns are critical for companies aiming to capitalize on this dynamic growth potential.

In terms of segment trends, the Biometric Wallets segment is accelerating its market share capture due to unmatched security credentials, addressing the severe risk of card-present fraud and identity theft. Within the connectivity landscape, Bluetooth Low Energy (BLE) remains dominant due to its energy efficiency, but hybrid connectivity solutions integrating both BLE and cellular-based GPS are gaining traction for enhanced distance tracking. The application segment sees robust growth in personal use, though corporate bulk orders and personalized luxury gifting are emerging as high-value, albeit smaller, segments. Continuous innovation in materials science, focusing on combining durability, slimness, and high-tech integration, dictates success across all segmented product offerings.

AI Impact Analysis on Smart-Connected Wallets Market

Common user questions regarding AI's influence center around how artificial intelligence can move the smart wallet beyond simple location tracking to truly intelligent security and financial management assistance. Users frequently ask about AI's role in proactive fraud detection, personalized spending habit analysis, and enhanced biometric authentication processes. Key themes include the expectation that AI should enable predictive maintenance for the device (e.g., anticipating battery failure), improve the accuracy of anti-loss alerts by learning user routines and environments, and provide intelligent organization suggestions for physical and digital contents. Concerns often revolve around data privacy—specifically, how the AI engine processes sensitive financial and location data—and the trade-off between sophisticated intelligence and device complexity or cost, pushing manufacturers to ensure AI features are intuitive and provide clear, demonstrable value without compromising security protocols.

AI integration is transforming the operational capabilities of smart wallets, moving them from reactive tracking tools to proactive security and lifestyle assistants. Predictive security is a major application; AI algorithms can analyze movement patterns, transaction history, and typical usage context. If the wallet detects an abnormal movement (e.g., leaving a frequented location at an unusual time without the associated smartphone), the AI can trigger enhanced alerts or security lockdowns, significantly reducing the window for potential theft or loss exploitation. This contextual awareness minimizes false alarms, a common frustration with non-AI smart devices, thereby enhancing user satisfaction and maintaining the device's utility as a reliable asset management tool.

Furthermore, AI plays a pivotal role in optimizing power consumption and managing digital assets stored or linked via the wallet. By learning peak usage times and charging schedules, AI can intelligently manage power distribution to different components (GPS, Bluetooth, biometric sensor), extending the effective battery life between charges. In terms of financial management, integrated AI could analyze linked card usage and suggest the optimal card for a specific transaction based on rewards programs, location, or currency exchange rates, moving the device towards a holistic financial hub rather than just a secure container. This level of smart assistance elevates the value proposition of connected wallets substantially.

- AI-Powered Contextual Awareness: Minimizing false anti-loss alarms by learning user routines and location contexts.

- Predictive Security Analysis: Identifying and flagging unusual transaction or movement patterns suggestive of fraud or unauthorized access.

- Enhanced Biometric Authentication: Utilizing advanced machine learning algorithms for faster and more accurate biometric (e.g., fingerprint, facial recognition) unlocking mechanisms.

- Intelligent Power Management: Optimizing battery consumption by dynamically managing sensor and connectivity usage based on predicted user behavior.

- Personalized Financial Guidance: Providing automated insights on spending habits and optimizing card usage based on real-time data analysis.

- Fraud Scoring and Alerting: Calculating a real-time risk score for the physical location and status of the wallet and alerting the user of high-risk scenarios.

DRO & Impact Forces Of Smart-Connected Wallets Market

The Smart-Connected Wallets Market is governed by a dynamic interplay of growth drivers (D), constraining factors (R), and latent opportunities (O), which collectively define the impact forces shaping its trajectory. Key drivers include the escalating global concerns over identity theft and financial fraud, pushing consumers towards secure biometric and RFID-protected storage solutions. The constraint primarily revolves around the high manufacturing cost associated with integrating complex electronics (sensors, batteries, connectivity modules) into a slim, aesthetically pleasing form factor, often resulting in high retail prices that deter price-sensitive consumers. Opportunities lie in expanding functionalities beyond security, integrating health monitoring features, or partnering with global payment networks to offer exclusive benefits. These three elements—security demand, cost sensitivity, and functional diversification—act as the core impact forces determining market velocity and competitive strategies within this technology-driven accessory segment.

The primary driver sustaining high market growth is the rapid advancement in IoT technology, allowing for enhanced miniaturization and improved battery performance, directly addressing earlier consumer concerns about device bulkiness. This technological maturation makes smart wallets more appealing for daily use. Furthermore, the robust proliferation of smartphones, which are necessary interfaces for managing smart wallet functions, provides a pre-existing massive user base ready for connected accessories. Restraints are significant, particularly consumer hesitation related to device durability and reliability; concerns about electronics failing under daily wear and tear, or complex charging requirements, hinder widespread adoption. Regulatory complexity related to cross-border data privacy and GPS tracking also poses a challenge for global product deployment and data management, forcing companies to adapt features based on regional laws, increasing complexity and compliance costs.

Opportunities are vast, centering on integration and ecosystem development. Establishing seamless connectivity with automotive security systems (e.g., alerting users if their wallet is left in the car) or smart home platforms creates stickiness and increases perceived value. The most compelling opportunity lies in tapping into the high-end luxury market, where consumers seek technology integrated discreetly into premium materials, commanding higher margins. The impact forces indicate a market trending towards high-value, security-focused offerings. The need to overcome the high initial cost (Restraint) through superior, diversified functionality (Opportunity) driven by increasing security demand (Driver) is the central tension defining market success. Companies that successfully balance technological sophistication, aesthetic appeal, and competitive pricing will exert the strongest positive impact force on overall market growth and consumer adoption rates, cementing the smart wallet as an essential personal security device.

Segmentation Analysis

The Smart-Connected Wallets Market is analyzed across critical dimensions including product type, connectivity technology, and end-user application, providing a granular view of demand dynamics and high-growth areas. Product type segmentation distinguishes between basic tracking capabilities and advanced biometric security, reflecting varied consumer needs ranging from simple loss prevention to sophisticated identity protection. Connectivity segmentation highlights the technological infrastructure supporting the device's intelligence, essential for determining range, power consumption, and integration complexity. Application segmentation differentiates between individual consumer use and commercial or corporate requirements, influencing design, volume requirements, and pricing strategies. This detailed segmentation enables manufacturers to tailor their R&D investments and marketing efforts towards the most lucrative and rapidly evolving sub-markets.

- By Type

- Basic Smart Wallets (Bluetooth Tracking Only)

- GPS Enabled Wallets (Long-Distance Tracking)

- Biometric Wallets (Fingerprint or Face Recognition)

- RFID Blocking Wallets (Standard and Enhanced)

- By Connectivity Technology

- Bluetooth Low Energy (BLE)

- Wi-Fi Assisted Tracking

- NFC/RFID

- Hybrid (BLE + GPS/Cellular)

- By Application/End-User

- Personal Use (Individual Consumers)

- Commercial Use (Corporate Gifting)

- Travel & Hospitality

- Government and Enterprise Security Applications

- By Material

- Leather and Synthetic Leather

- Carbon Fiber and Aluminum

- Polycarbonate and Other Plastics

Value Chain Analysis For Smart-Connected Wallets Market

The value chain for the Smart-Connected Wallets Market begins with upstream activities focused on securing high-quality materials and core technological components. This includes sourcing specialized sensors (GPS, biometric scanners), miniaturized batteries (often lithium polymer), and connectivity modules (BLE chips). Upstream analysis also involves acquiring premium materials such as aerospace-grade aluminum, high-grade carbon fiber, or ethically sourced leather, ensuring durability and aesthetic appeal crucial for consumer acceptance. Efficiency and cost optimization at this stage are paramount, as the integration of multiple complex electronic components into a confined space is inherently expensive. Strategic partnerships with specialized component suppliers, particularly in the semiconductor and micro-electromechanical systems (MEMS) sector, are key determinants of overall product performance and unit cost.

Downstream analysis focuses heavily on manufacturing, assembly, quality assurance, and distribution. The assembly process is complex due to the delicate integration of electronics into a flexible or rigid casing, requiring high precision and specialized tooling. After manufacturing, the distribution channel is bifurcated into direct and indirect routes. The direct channel leverages proprietary e-commerce platforms and flagship retail stores, allowing companies maximum control over branding, customer experience, and data collection. This channel is crucial for establishing premium positioning and managing firmware updates and customer service related to the technology components. Direct sales often yield higher margins and allow for quicker feedback loops regarding product enhancements.

The indirect distribution channel utilizes traditional retail partnerships, electronics stores, department stores, and large e-commerce marketplaces (like Amazon or specialized tech retailers). This approach ensures broader geographic reach and accessibility, particularly critical for mass-market adoption. Due to the product's technological nature, distributors must possess expertise in handling consumer electronics and be capable of providing initial technical support. Channel partners often require comprehensive training to effectively articulate the advanced security and connectivity features to end consumers. Effective coordination between manufacturing and a robust omnichannel distribution strategy is essential for maximizing market penetration and maintaining competitive pricing against traditional wallet manufacturers and competing tech accessories.

Smart-Connected Wallets Market Potential Customers

The primary customer base for Smart-Connected Wallets consists of tech-savvy urban professionals and affluent millennials who prioritize security, convenience, and early adoption of innovative gadgets. These end-users, typically aged 25 to 45, frequently use mobile payments, possess multiple credit cards, and travel regularly, making them highly vulnerable to loss and identity theft. Their high engagement with smartphone applications means they readily integrate the necessary companion apps required to manage the wallet’s smart functions. This segment values the assurance provided by biometric locks and GPS tracking, viewing the smart wallet as a proactive investment against financial and personal disruption caused by loss. Manufacturers tailor features like slim design and seamless integration with existing smart ecosystems directly to this demographic’s lifestyle requirements.

A secondary, yet rapidly growing, customer segment includes corporate clients and institutions purchasing these wallets for high-end gifting or employee security initiatives. Companies in finance, legal, or high-tech sectors may utilize smart wallets as a professional accessory emphasizing security consciousness. In this context, features like RFID blocking and durable construction are highly valued. Furthermore, the travel and hospitality industries represent significant potential buyers, using these devices in specialized forms for staff or guests to ensure secure handling of identification and access credentials. The ability to track high-value physical assets, even if the primary use case is for personal items, appeals to operational security needs in these commercial environments.

The tertiary consumer group comprises older adults and individuals with accessibility needs who benefit from the simplicity of remote tracking and the peace of mind offered by anti-loss features. As technology becomes more intuitive, this demographic is increasingly adopting smart devices. The market potential is further broadened by targeting users who regularly lose items, regardless of socioeconomic status, positioning the smart wallet as a functional solution to common organizational failures. Successful market penetration hinges on demonstrating a clear return on investment in terms of stress reduction and financial protection, justifying the higher purchase price compared to conventional wallets for all these diverse end-user segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 1.45 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Volterman, Ekster, Woolet, Walli, Cashew, Dango Products, Ridge Wallet, Secrid, Fendi, Louis Vuitton, Samsung, Apple, Tile, Chipolo, TrackR, Wallee, Karben, Vexi, Fantom, Oris |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart-Connected Wallets Market Key Technology Landscape

The technological core of the Smart-Connected Wallets Market is defined by the convergence of four primary areas: connectivity, power management, sensing, and material science. Connectivity technology relies heavily on Bluetooth Low Energy (BLE) protocols (specifically Bluetooth 5.0 and newer versions) to ensure continuous, low-power communication with smartphones for tracking, alerts, and management. While BLE is standard for proximity tracking, advanced models incorporate cellular-based GPS modules, requiring minimal SIM or e-SIM integration, enabling global location tracking without proximity to the paired phone. Power management is critical, employing highly efficient, flexible lithium-polymer batteries and sophisticated charging mechanisms, often leveraging wireless Qi charging to avoid cumbersome ports and maintain waterproof ratings. The miniaturization of these components, particularly the antenna and battery cell, is essential for maintaining the sleek form factor demanded by consumers.

Sensing technology forms the security bedrock of these devices, prominently featuring high-resolution capacitive fingerprint sensors or optical sensors for biometric authentication, moving beyond simple PIN codes. Many wallets also utilize accelerometers and gyroscopes to detect unauthorized movement or drops, triggering security protocols. RFID and NFC blocking technology is standard, implemented through specialized metallic or carbon fiber weaves embedded within the material structure, ensuring digital theft prevention. This layered security approach, combining physical blocking with electronic authentication, addresses the dual threat of card skimming and unauthorized physical access to the contents, defining the wallet’s premium value proposition in the security accessory market.

Furthermore, the integration of advanced firmware and software ecosystems is indispensable. The companion mobile application serves as the user interface, managing tracking data, battery status, and triggering security features such as the remote "ringing" function or "last known location" features. These applications are increasingly relying on cloud infrastructure for storing anonymized location data and running basic AI models for pattern recognition. Material science contributes significantly to market maturation, moving beyond traditional leather to durable, lightweight materials like carbon fiber and aerospace-grade aluminum. These materials are chosen not only for their robustness and modern aesthetic but also for their ability to protect integrated electronics and facilitate effective radio transmission for connectivity components, ensuring functionality without compromising design integrity.

Regional Highlights

The global Smart-Connected Wallets Market exhibits distinct regional consumption patterns and growth dynamics influenced by economic maturity, technology adoption rates, and regional security concerns. North America currently dominates the market in terms of revenue share. This dominance is attributed to high consumer spending on advanced consumer electronics, a strong prevalence of digital payment methods, and an acute awareness and concern regarding identity theft and financial security. The region benefits from a robust infrastructure supporting location-based services and high mobile connectivity penetration. Manufacturers often launch premium, feature-rich products with comprehensive GPS capabilities first in the United States and Canada, positioning North America as a primary testing ground for innovative smart wallet features, particularly those involving biometric authentication and complex software integrations.

Europe represents the second-largest market, characterized by sophisticated consumer demand for high-quality design, durability, and secure data handling, particularly under strict regulations like the General Data Protection Regulation (GDPR). European consumers show a strong preference for smart wallets that merge seamless technology with traditional, high-quality materials, often favoring brands that offer sustainable and modular designs. Western European countries, including Germany, the UK, and France, are major contributors, driven by high e-commerce activity and frequent international travel, where loss prevention features are highly valued. Market strategies here often emphasize aesthetics, brand heritage, and compliance with privacy standards to build consumer trust.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market throughout the projection period. This explosive growth is underpinned by accelerating urbanization, rapidly expanding middle-class populations, and massive governmental initiatives promoting digital identity and cashless transactions (e.g., India's UPI or various Chinese mobile payment systems). While price sensitivity is higher in some APAC countries, rising disposable income and the high propensity for mobile technology adoption are offsetting factors. Localized competition is intensifying, with regional players focusing on integrating device capabilities that align with local payment ecosystems and infrastructure constraints. The dense, urban environments common in APAC make proximity and anti-loss features highly relevant, creating a substantial opportunity for both basic and advanced smart wallet variants.

- North America: Market leader in revenue; driven by high identity theft concerns, early adoption of biometric technology, and high disposable income.

- Europe: Strong demand for aesthetically premium, GDPR-compliant smart wallets; high adoption due to frequent travel and focus on secure physical item storage.

- Asia Pacific (APAC): Highest CAGR; fueled by rapid digitization, rising middle class, urbanization, and increasing acceptance of mobile and connected lifestyle products.

- Latin America (LATAM): Emerging market focused on affordability and basic tracking functions; growth limited by fluctuating currency exchange rates and slower technology adoption outside major urban centers.

- Middle East and Africa (MEA): Growth driven by luxury segment demand and increasing security consciousness in business hubs; focus on high-end, secure materials and discreet technology integration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart-Connected Wallets Market.- Volterman

- Ekster

- Woolet

- Walli

- Cashew

- Dango Products

- Ridge Wallet

- Secrid

- Fendi

- Louis Vuitton

- Samsung

- Apple

- Tile (Strategic Partner/Component Supplier)

- Chipolo (Strategic Partner/Component Supplier)

- TrackR

- Wallee

- Karben

- Vexi

- Fantom

- Oris

Frequently Asked Questions

Analyze common user questions about the Smart-Connected Wallets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Smart-Connected Wallet and how does it prevent loss?

A Smart-Connected Wallet is an accessory integrated with electronic features like Bluetooth, GPS, and sensors. It prevents loss primarily through proximity alerts, utilizing Bluetooth Low Energy to notify the user's smartphone when the wallet moves beyond a set range. Advanced models feature GPS for long-distance tracking and remote signaling.

Are Biometric Smart Wallets more secure than traditional wallets?

Yes, Biometric Smart Wallets offer superior security by incorporating fingerprint or facial recognition sensors to restrict access to cards and cash, preventing unauthorized use even if the wallet is stolen. They also typically include robust RFID/NFC blocking capabilities to safeguard digital information from skimming.

How long does the battery last in a Smart Wallet and how is it charged?

Battery life varies significantly based on the connectivity features, typically ranging from a few weeks to several months per charge, especially for models relying on BLE. Most modern smart wallets are conveniently recharged using wireless charging (Qi standard) or via a discreet USB cable, avoiding complex battery replacement.

What is the primary difference between Bluetooth and GPS tracking in these devices?

Bluetooth tracking is proximity-based, providing an alert only when the wallet is near the connected smartphone, primarily for anti-forgetting purposes. GPS tracking utilizes cellular triangulation to provide the wallet’s location globally, making it essential for tracking a lost or stolen device over long distances.

Does using a Smart Wallet compromise my financial data privacy?

Reputable Smart Wallet manufacturers design their products to enhance security, not compromise privacy. They store only necessary tracking and operational data, often encrypted. Financial card data is usually not stored on the wallet itself but managed through secured connections, with privacy controls often governed by strong regulations like GDPR.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager