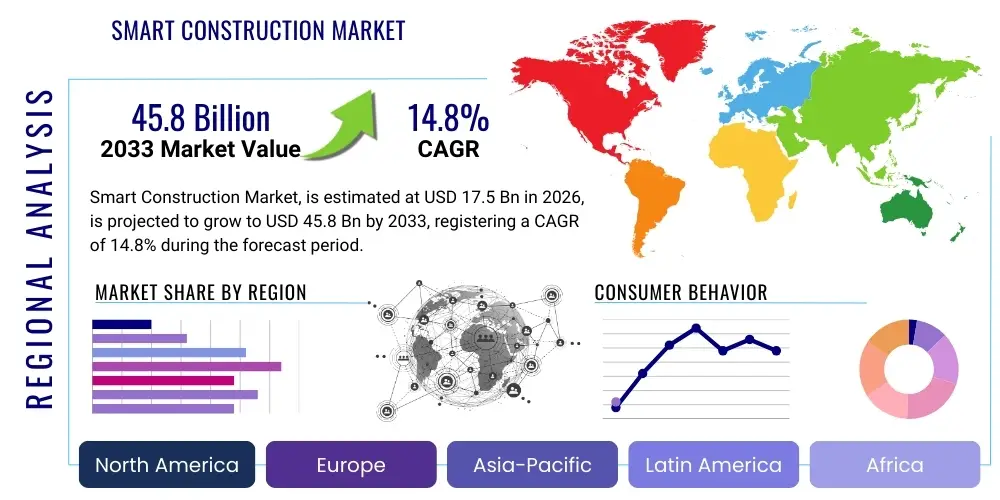

Smart Construction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438189 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Smart Construction Market Size

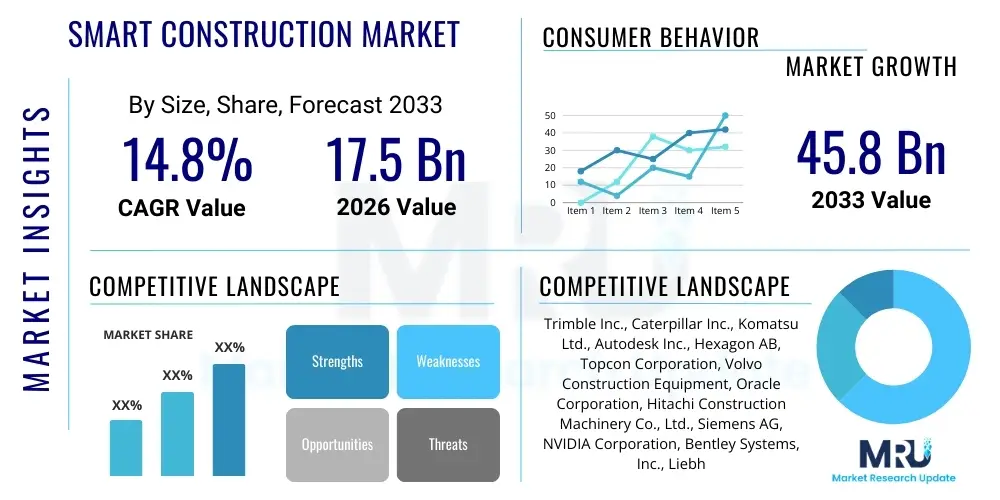

The Smart Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 45.8 Billion by the end of the forecast period in 2033.

Smart Construction Market introduction

The Smart Construction Market encompasses the integration of advanced technologies, such as Building Information Modeling (BIM), IoT, Artificial Intelligence (AI), robotics, drones, and connected devices, into traditional construction processes to enhance efficiency, safety, and productivity. This technological paradigm shift moves the industry away from manual, paper-based, and reactive methods toward data-driven, highly predictive, and automated workflows. The core objective of smart construction is to optimize resource utilization, minimize material waste, significantly shorten project timelines, and deliver superior quality infrastructure and buildings that are optimized for long-term operational performance. Key operational components include integrated smart equipment management systems, real-time site performance monitoring, advanced predictive maintenance protocols for machinery, and sophisticated project management platforms that leverage high-speed cloud computing for seamless and instantaneous data sharing across diverse stakeholder groups, from architects and engineers to contractors and suppliers.

Major applications of smart construction technology span the entire project lifecycle, starting from initial conceptual design and detailed planning, extending through rigorous execution and real-time monitoring, and culminating in facility management and asset operation. In the crucial design and pre-construction phases, advanced tools like BIM and AI-driven generative design platforms allow for precise virtual modeling, extensive simulation, and automated clash detection, substantially reducing the likelihood of costly errors and design changes once physical work commences. During the execution phase, the deployment of IoT sensors tracks material logistics, monitors environmental conditions, and manages worker safety metrics, while increasingly sophisticated robotic systems are deployed to perform repetitive, high-precision, or inherently dangerous tasks, such as automated bricklaying, specialized welding, and structural assembly. Post-construction, integrated smart systems support intelligent asset management, energy consumption optimization, and ensure proactive maintenance planning based on operational data feedback.

The primary benefits driving the widespread adoption of smart construction solutions across global markets include substantial and measurable reductions in overall operational costs achieved through optimized material procurement and labor management, significantly improved safety records derived from automated monitoring and immediate hazard identification systems, and dramatically faster time-to-market for complex projects. Driving factors are highly dependent on the necessity for increased construction productivity amidst accelerating global urbanization trends and pervasive, persistent skilled labor shortages worldwide. Furthermore, increasingly stringent environmental and regulatory pressures are pushing the industry toward fundamentally sustainable practices; smart technologies play an essential role in achieving zero-waste targets, optimizing energy consumption during both construction and the subsequent operational life of the asset, and enabling certification compliance. Large-scale government initiatives promoting digital transformation in infrastructure development and mandating technological compliance further accelerate the overall market growth trajectory.

Smart Construction Market Executive Summary

The global Smart Construction Market is undergoing a phase of robust and sustained acceleration, primarily fueled by the urgent industry requirement for enhanced operational efficiency, superior quality control, and long-term environmental sustainability within the traditionally slow-to-adopt construction sector. Business trends fundamentally indicate a strong strategic move towards fully integrated technology ecosystems, where fragmented point solutions are progressively being replaced by holistic, enterprise-level digital platforms capable of seamlessly connecting design workflows, complex supply chain logistics, and real-time site operations. Significant injections of capital investment are targeting automation and construction robotics, reflecting a pronounced strategic shift among leading construction firms globally to mitigate reliance on dwindling manual labor pools and enhance competitive advantage through the delivery of superior speed, accuracy, and predictability. Strategic mergers and acquisitions are frequently observed, focused on consolidating specialized software capabilities, particularly in areas like advanced BIM and sophisticated predictive analytics, which is actively reshaping the competitive landscape and positioning agile, innovative technology firms as critical enablers of industry transformation.

Regional trends delineate distinct market growth patterns that are critically influenced by varying governmental regulatory support, differential technology adoption rates, and regional economic stability. North America and Europe currently maintain market dominance, largely attributable to highly mature technological infrastructure, mandated early adoption of BIM methodologies (especially in public works), and substantial private and public investment in comprehensive smart city and interconnected infrastructure initiatives. Conversely, the Asia Pacific (APAC) region, encompassing high-growth economies such as China, India, and rapidly digitizing Southeast Asian nations, is projected to register the highest Compound Annual Growth Rate (CAGR). This anticipated explosive growth is fundamentally attributed to accelerated urbanization, monumental government expenditure on national infrastructure development (e.g., regional trade corridors and high-speed rail networks), and an increasing strategic emphasis on deploying sophisticated modular and prefabricated construction techniques, which are intrinsically optimized by smart digital technology and automation. Regulatory standardization and the pace of digital literacy diffusion remain key performance differentiators between the leading and emerging regional markets.

Segmentation analysis consistently reveals that the software and services components, particularly offerings related to advanced project management, real-time data analytics platforms, and comprehensive Building Information Modeling (BIM) solutions, constitute the largest and most stable share of the overall market value. These segments provide the essential digital framework and intelligence layer required for successful, scalable digital transformation across diverse project types. The equipment and machinery segment, which includes smart dozers, autonomous construction vehicles, robotic arm systems, and sophisticated IoT sensors, represents the most dynamically growing component, driven by rapid advancements in robotics integration, high-precision GPS, and embedded AI capabilities on the job site. By application, large-scale commercial, complex industrial, and public infrastructure projects retain the highest demand profile for comprehensive smart solutions due to their inherent complexity, massive scale, and strict requirements for precise coordination and real-time progress monitoring to ensure timely and budget-compliant delivery. Furthermore, applications centered on sustainability goals, such as advanced material tracking and lifecycle energy efficiency modeling (6D BIM), are rapidly emerging as critical future growth areas driven by climate policy mandates.

AI Impact Analysis on Smart Construction Market

Common user inquiries regarding the profound influence of Artificial Intelligence (AI) in the Smart Construction Market typically center on issues of workforce automation and potential displacement, the quantification of efficiency gains in the execution of complex project management, the verifiable accuracy and reliability of predictive analytics models, and the immediate necessity of upskilling the current industry workforce to manage these sophisticated tools. Users demonstrate a keen and specific interest in understanding how AI can drastically optimize highly variable project scheduling (thereby critically reducing delays), enhance sophisticated risk assessment (through the identification of potential structural weaknesses, material failures, or logistical bottlenecks), and facilitate the safe and effective operation of autonomous heavy equipment. Key concerns frequently articulated focus on critical issues such as construction data privacy and security, the substantial cost of initial implementation and integration with legacy systems, and the imperative of ensuring that AI algorithms are trained on sufficiently large, diverse, and reliable global construction datasets to rigorously avoid systemic bias or generate inaccurate, costly predictions. The overarching strategic expectation remains that AI will serve as the indispensable foundational technology enabling true digital twin integration, hyper-efficient project execution, and the ultimate realization of personalized, predictive construction delivery models.

AI’s integration is fundamentally and irreversibly changing how project risk is assessed, quantified, and managed, and how operational efficiency is tracked throughout the entire construction lifecycle. Advanced machine learning algorithms are now capable of analyzing and synthesizing vast, multi-modal datasets—including historical project performance metrics, complex geological surveys, real-time weather patterns, dynamic material pricing fluctuations, and continuous video feeds from site monitoring—to predict potential bottlenecks, budget overruns, or critical safety hazards with unprecedented levels of accuracy and lead time. This enhanced predictive capability radically shifts project management methodologies from a traditional reactive troubleshooting posture to a highly proactive optimization strategy, ensuring that critical labor and material resources are deployed precisely when and where their maximum impact is needed, thereby minimizing downtime and maximizing throughput. Furthermore, sophisticated AI-powered computer vision systems are widely deployed for automated, continuous quality control inspections, instantly flagging any observed deviations from the meticulously defined design specifications, which drastically reduces the reliance on inherently subjective manual inspection processes and subsequent, often crippling, rework costs.

Beyond applications focused on prediction and quality control, Artificial Intelligence is increasingly recognized as the essential enabling technology driving the next generation of highly advanced generative design workflows and entirely autonomous construction practices. Generative design tools, expertly guided by powerful AI engines, can rapidly and concurrently explore thousands of design permutations based on stringent specified constraints (such as target cost ceilings, required material properties, precise structural requirements, and demanding sustainability targets), leading directly to optimally efficient, materially sound, and highly buildable structural outcomes. Concurrently, AI algorithms provide the operational intelligence necessary for the safe, precise, and highly efficient autonomous operation of heavy construction machinery, enabling precise movement, task execution, and coordination across vast construction sites twenty-four hours a day. This convergence of sophisticated design intelligence and hyper-precise physical automation is acknowledged as the single most critical factor currently accelerating measurable productivity gains and improving the fundamental reliability within the entire smart construction market ecosystem, directly mitigating the pervasive risks associated with human error and fatigue.

- AI-driven predictive analytics for proactive risk management, safety assessment, and precise budget adherence forecasting.

- Optimization of complex project scheduling using sophisticated machine learning models to minimize costly delays and resource conflicts.

- Deployment of computer vision and deep learning systems for automated, continuous site monitoring, quality control checks, and progress tracking.

- Utilization of generative design capabilities to rapidly optimize structural efficiency, material selection, and overall resource utilization based on multiple parameters.

- Enabling highly precise, fully autonomous operation and coordinated control of heavy machinery, construction robotics, and specialized drones.

- Significant enhancement of worker safety protocols through real-time identification, prediction, and immediate alerting of hazardous conditions or non-compliance issues.

- Intelligent allocation and dynamic routing of construction resources and optimized supply chain management based on accurate demand forecasting and logistical simulations.

DRO & Impact Forces Of Smart Construction Market

The Smart Construction Market’s expansion is fundamentally propelled by powerful drivers, most notably the universal imperative across the construction sector to radically improve operational efficiency, coupled with the critical need to address the chronic global shortage of skilled construction labor, which automation is uniquely positioned to alleviate. Crucially, increased governmental investment in developing smart city infrastructure, alongside regulatory mandates promoting advanced digital delivery methodologies, such as the mandatory adoption of Building Information Modeling (BIM) for large-scale public infrastructure tenders, further solidifies and propels market growth worldwide. However, this growth faces significant, entrenched restraints, including the substantial initial capital expenditure required for acquiring and implementing highly advanced technology solutions, the inherent, systemic resistance to adopting significant change within traditionally conservative construction cultures, and persistent issues related to data interoperability and seamless platform integration across the often fragmented construction supply chain. Strategic opportunities are abundant, particularly in the rapidly expanding application sphere of modular and prefabricated construction techniques, which are inherently dependent on high-precision technology, alongside the increasing sophistication and deployment of comprehensive digital twin technology for long-term asset performance management and maintenance. The overall impact force resulting from these interacting factors is overwhelmingly positive, driven by long-term strategic goals centered on economic competitiveness, resilience, and environmental sustainability.

A primary and powerful driving force is the relentless global urbanization trend, which demands the rapid, high-volume deployment of critical residential, commercial, and complex transport infrastructure in highly condensed timeframes. Traditional, manual construction methods are structurally unable to maintain the necessary pace and efficiency required by this demand, making the comprehensive adoption of smart technology a necessary operational imperative for large-scale developers seeking sustained competitive differentiation through superior speed, quality, and predictability. Furthermore, strong regulatory drivers, particularly those originating in advanced economies (e.g., EU Green Deal regulations), increasingly emphasize environmental accountability and carbon footprint reduction, compelling construction firms towards solutions that drastically minimize material waste and optimize the energy performance throughout the built asset’s entire operational life. The integration of advanced Internet of Things (IoT) sensors and robust cloud platforms facilitates instantaneous, seamless data flow, effectively transforming fragmented and siloed supply chains into cohesive, transparent, and highly responsive operational systems. This real-time data insight capability is pivotal for superior, predictive decision-making, which substantially reduces overall project risks and dramatically enhances financial confidence among investors and stakeholders.

Despite the presence of these powerful market drivers, structural technological complexity and the prerequisite for significant, costly workforce upskilling and digital literacy training continue to act as measurable restraints on market diffusion. Small and medium-sized enterprises (SMEs), which constitute a significant portion of the global construction volume, often struggle with the financial capacity and internal technical expertise required to successfully implement comprehensive, integrated smart solutions, resulting in market fragmentation and demonstrably slower overall adoption rates across specific geographical and sectoral segments. Furthermore, the persistent lack of universal, standardized data protocols and Application Programming Interfaces (APIs) across numerous hardware and software vendors creates critical interoperability challenges, severely hindering the seamless, unified integration required to build truly cohesive smart construction ecosystems. However, the anticipated rollout and pervasive commercial availability of advanced 5G network infrastructure, coupled with increasingly sophisticated edge computing capabilities, presents a major counter-opportunity. These advancements enable massive, real-time data processing capabilities directly at the construction site level, eliminating latency and connectivity issues, which ultimately unlocks the full operational potential of complex autonomous vehicles, sophisticated robotics, and high-fidelity digital twins, dramatically improving both safety metrics and accelerating project timelines beyond the capabilities achievable with current technologies.

Segmentation Analysis

The Smart Construction Market segmentation provides a detailed and granular view of technology adoption patterns and consumption behavior across various dimensions, including product components, underlying technologies, specific applications, and distinct end-user categories. The market structure is fundamentally segmented into three interactive elements: Hardware, Software, and Services, reflecting the integrated, synergistic nature of comprehensive smart solutions delivery. Hardware components encompass specialized equipment such as embedded IoT sensors, high-precision GPS receivers, advanced telematics devices, RFID tags for asset tracking, sophisticated construction robotics, and dedicated surveying drones. Software—the essential intelligence layer—includes advanced BIM tools, enterprise resource planning (ERP) systems customized for construction, specialized project management platforms, and high-performance data analytics suites. The Services segment, which accounts for a substantial and growing portion of recurring revenue, covers mission-critical functions like specialized consulting, complex system integration, continuous professional training, and essential ongoing maintenance and managed services, all crucial for the successful long-term implementation and scalable utilization of these advanced technologies.

- By Component:

- Hardware (IoT Sensors, High-Precision GPS/GNSS, Telematics Units, RFID Systems, Construction Robotics, Drones/UAVs)

- Software (Building Information Modeling (BIM), Enterprise Resource Planning (ERP), Advanced Project Management Software, Data Analytics Platforms, Digital Twin Software)

- Services (Consulting and Advisory, System Integration, Training and Support, Maintenance and Managed Services)

- By Technology:

- Building Information Modeling (BIM 4D/5D/6D)

- Telematics and Fleet Management Systems

- Geospatial Solutions (LiDAR, Photogrammetry, High-Definition GPS)

- Internet of Things (IoT) (Sensors, Wearables, Edge Computing)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Robotics and Automation

- Cloud Computing and Big Data Analytics

- By Application:

- Heavy Equipment Fleet Management and Optimization

- Asset Management and Predictive Maintenance

- Integrated Project Management and Scheduling

- Worker Safety and Security Monitoring (Proximity Sensors, Biometrics)

- Real-time Site Monitoring and Remote Control

- Material and Inventory Tracking and Logistics

- Quality Control and Inspection Automation

- By End-User:

- Residential Construction (Single-family, Multi-family, Modular)

- Commercial Construction (Office Towers, Retail Centers, Hospitality Venues)

- Industrial Construction (Manufacturing Plants, Power Generation, Utilities)

- Infrastructure Development (Roads, Bridges, Tunnels, Rail Systems, Ports)

Value Chain Analysis For Smart Construction Market

The Smart Construction value chain is highly integrated and digitally interconnected, commencing with critical upstream activities that are dominated by specialized technology providers responsible for fundamental hardware manufacturing (e.g., advanced sensor production, robotics components) and the foundational development of core construction software (e.g., BIM authoring tools, CAD platforms, GIS). These upstream providers are essential, as they establish the initial digital infrastructure and intelligent components necessary for all subsequent smart operations. In the midstream, dedicated system integrators, technology consultants, and specialized construction technology firms assume a crucial role by adapting, customizing, and deploying these technologies into highly specific construction environments. Their function is to ensure seamless data flow and complex interoperability between disparate systems utilized across the fragmented supply chain. Effective distribution channels are multifaceted, utilizing direct sales models for large, strategic enterprise clients needing highly customized integration, alongside strategic partnerships with regional resellers and construction equipment dealers who offer essential localized support, training, and maintenance services, which are crucial for achieving deeper market penetration, particularly in developing economies.

Downstream activities predominantly involve the primary technology consumers and ultimate end-users—large general contractors, highly specialized trade contractors, and professional engineering firms—who are responsible for the physical execution and application of the smart technologies on site. The realized efficiency gains and precision delivered by these smart construction methods directly and measurably impact the final quality, compliance, and timely delivery of the constructed asset. Critically, the value chain extends far beyond physical completion into the facility management and operations phase, often referred to as 7D BIM or Digital Twin integration. Here, continuous, autonomous monitoring via networked IoT devices and the high-fidelity Digital Twin ensures long-term asset performance tracking, predictive maintenance scheduling, and energy optimization, establishing a closed-loop flow of operational data back to the upstream design and engineering phases, thereby enabling continuous process and product improvement and lifecycle value generation.

Indirect distribution mechanisms rely heavily on cloud-based third-party software marketplaces (e.g., Autodesk Exchange Apps, cloud service provider ecosystems) and established heavy equipment dealers who strategically bundle integrated smart solutions (such as telematics systems or automated grading software) with their core machinery offerings. This indirect route is vital for facilitating broader market access, especially targeting smaller construction enterprises and subcontractors who require simpler, pre-packaged solutions. The entire modern value chain is characterized by an accelerating shift towards digitalization, prioritizing the seamless flow and secure exchange of highly structured data over traditional, slow physical movement and documentation. Intense collaboration, standardization, and transparent data sharing between upstream technology developers and downstream construction end-users are recognized as critical success factors, driving an immediate need for robust, secure, and vendor-neutral cloud-based platforms that enable all stakeholders—from architects and equipment lessors to site supervisors and material suppliers—to operate efficiently from a unified, single source of digital truth (the project’s Digital Twin).

Smart Construction Market Potential Customers

Potential customers for comprehensive smart construction solutions are highly diverse but are primarily concentrated within organizations managing substantial capital expenditure (CapEx) projects, seeking to gain decisive competitive advantages through superior operational efficiency, enhanced worker safety records, and stringent regulatory compliance. Large general contractors, specialized Engineering, Procurement, and Construction (EPC) firms, and major property developers constitute the core buying segment, investing aggressively in advanced BIM software, integrated telematics, robotics, and site automation systems to optimize highly complex, multi-phase projects and effectively manage geographically distributed asset portfolios. These enterprises prioritize solutions that promise immediate, verifiable Return on Investment (ROI) via significant cost savings in labor, materials, and reduced insurance premiums, coupled with minimized project execution risk.

Government agencies, public works departments, and state-owned infrastructure bodies represent an equally critical customer base, particularly those charged with implementing large-scale national smart city initiatives, maintaining extensive public infrastructure networks (such as regional roads, national rail, complex utility grids), and enforcing modern, stringent building codes. These organizations prioritize technologies that guarantee long-term asset durability, minimize environmental externalities (e.g., carbon emissions), and ensure maximum transparency and accountability in project delivery against public funds. Their adoption is frequently driven by legislative mandates for the compulsory use of BIM or digital project submission in public sector procurement tenders, which sets an important technology precedent for the broader private market to follow.

Furthermore, highly specialized trade contractors (e.g., mechanical, electrical, and plumbing (MEP) firms; specialized foundation contractors) are rapidly increasing their adoption of localized, task-specific smart tools. Examples include the use of mobile IoT sensors for precise utility routing and installation verification, or deployment of semi-autonomous robotic layout systems to enhance execution accuracy. Real estate investors, property managers, and facility management companies form key downstream customer segments, heavily utilizing smart solutions for operational efficiency post-construction. They rely extensively on the continuous data feedback from digital twins and embedded sensors to optimize energy consumption, schedule sophisticated predictive maintenance, and maximize the long-term economic life and value of their managed assets through intelligent operation and minimal disruption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 45.8 Billion |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trimble Inc., Caterpillar Inc., Komatsu Ltd., Autodesk Inc., Hexagon AB, Topcon Corporation, Volvo Construction Equipment, Oracle Corporation, Hitachi Construction Machinery Co., Ltd., Siemens AG, NVIDIA Corporation, Bentley Systems, Inc., Liebherr Group, Daqri LLC, Hilti Corporation, Bosch Rexroth AG, Doka GmbH, SICK AG, KUKA AG, DJI |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Construction Market Key Technology Landscape

The technological landscape underpinning the Smart Construction Market is defined by the synergistic confluence of multiple advanced technologies specifically engineered to enhance connectivity, automation, predictive analysis, and precision throughout the entire asset lifecycle. Building Information Modeling (BIM) remains the undisputed foundational technology, acting as the central, intelligent digital repository for all project data and documentation, thereby enabling stakeholders across disciplines to visualize, design, simulate, and manage the project within a highly collaborative, integrated 3D environment. The continuous evolution of BIM is currently transitioning rapidly towards higher dimensions—4D (schedule integration), 5D (cost integration), 6D (sustainability/energy performance), and increasingly 7D (facility management/operations)—embedding deeper, verifiable intelligence directly into the digital model. Complementing this, sophisticated geospatial technologies, including High-Definition Global Navigation Satellite Systems (GNSS/GPS) and advanced 3D laser scanning (LiDAR), provide the essential centimeter-level precision required for accurate site mapping, automated quantity surveying, and rigorous verification that the physical construction execution aligns perfectly with the approved digital design specifications, minimizing rework loops.

The Internet of Things (IoT) is critical for driving operational intelligence at the project site, utilizing an extensive network of highly specialized sensors, communication beacons, advanced telematics units embedded in heavy equipment, RFID tags for material tracking, and smart wearables integrated into Personal Protective Equipment (PPE). These diverse devices continuously generate massive streams of real-time operational data covering parameters such as machine utilization, localized environmental conditions, precise material location on site, and worker physiological biometrics. This high-volume data stream is aggregated and analyzed by robust, scalable cloud-based platforms and edge computing systems. This constant influx of data is crucial for feeding highly accurate predictive maintenance models, which drastically optimize equipment uptime and extend asset longevity. Furthermore, it dramatically improves job site safety by enabling sophisticated analytics to immediately alert supervisors and workers to critical safety deviations, hazardous zone intrusion, or potential equipment malfunctions, thereby minimizing incident rates and associated liabilities.

The ambitious shift towards autonomous and highly robotic construction methods is intrinsically powered by robotics and Artificial Intelligence (AI). Construction robotics—which spans from robotic total stations performing automated layout tasks to large, semi-autonomous haul trucks and specialized automated welding and assembly systems—are actively assuming repetitive, ergonomically demanding, and high-risk tasks, substantially enhancing both the speed of execution and the consistency of quality delivered. Drones (UAVs) equipped with high-resolution cameras, thermal imaging, and LiDAR sensors execute rapid, comprehensive site surveys, real-time progress monitoring, volumetric calculations, and asset inspection, effectively replacing slower, more hazardous manual surveying methods. AI algorithms serve as the project’s central nervous system, processing the immense volumes of multi-format data collected by IoT and drones, transforming raw information into highly actionable, predictive insights for project managers. This enables the prediction of potential supply chain disruptions, the optimization of complex logistics routes, and the generative creation of sophisticated, optimized construction schedules, effectively integrating the physical world and the digital planning realm into a fully functioning cyber-physical system for optimal control.

Blockchain technology, while still in relatively early stages of maturity within the construction sector, offers immense potential for enhancing supply chain transparency, ensuring the provenance of building materials, and automating robust contract management via smart contracts. By establishing an immutable, auditable, and decentralized ledger of all material transactions, subcontractor payments, quality certifications, and regulatory compliance steps, blockchain can drastically mitigate contractual disputes, substantially increase accountability across the value chain, and verify the authenticity and sustainability claims of critical building components. Furthermore, the development and rigorous implementation of high-fidelity Digital Twins—highly accurate, dynamically updating virtual replicas of the physical constructed asset—allows asset owners and facility operators to simulate operational changes, continuously monitor real-time performance metrics, and conduct proactive, predictive maintenance throughout the entire asset’s lifespan, maximizing efficiency and minimizing unforeseen operational costs. These collective technologies are engineered to function as a cohesive ecosystem, focused strategically on delivering projects that are consistently faster, more cost-efficient, statistically safer, and fundamentally more sustainable than those achieved through outdated, traditional construction methodologies.

The foundational reliance on scalable, robust cloud computing platforms (such as hyperscale offerings from AWS, Microsoft Azure, and Google Cloud) is an absolute necessity for achieving scale in smart construction operations. These platforms provide the necessary computational elasticity, massive data storage capacity, and high-speed networking capabilities required to securely manage the terabytes of continuous data generated daily by fleets of IoT sensors, detailed BIM models, and complex AI simulation algorithms. Crucially, cloud environments facilitate truly seamless and global collaboration among often geographically dispersed project teams—including specialized architects, structural engineers, subcontractors, external vendors, and asset owners—ensuring that every stakeholder operates from the absolute most current and verified version of the project documentation and digital model. Efforts toward industry-wide data standardization, spearheaded by international organizations promoting open BIM standards (like buildingSMART International), are vital for maximizing the operational effectiveness of these cloud ecosystems, guaranteeing that data exchange between disparate construction technology applications is reliable, efficient, and machine-readable, thereby further accelerating the widespread adoption of comprehensive Integrated Project Delivery (IPD) models.

The penetration of Extended Reality (XR) technology, encompassing both Virtual Reality (VR) for immersive simulation and Augmented Reality (AR) for on-site guidance, is rapidly migrating from the centralized design office directly to the construction site floor. AR applications strategically overlay critical digital models, precise assembly instructions, and real-time clash detection alerts directly onto the physical environment via specialized ruggedized headsets or mobile tablets, actively assisting on-site workers with highly precise installation guidance for complex tasks, thereby significantly reducing installation errors and markedly improving the efficacy of hands-on training for complex systems. Conversely, VR is extensively utilized during the pre-construction and planning phase for comprehensive, immersive design reviews, safety planning walk-throughs, and detailed maintenance simulations, allowing all stakeholders to virtually experience and audit the site before physical ground is broken, identifying potential bottlenecks, workflow inefficiencies, and safety hazards that are often missed in traditional 2D schematics. This advanced visual technology significantly reduces design ambiguity and dramatically enhances cross-disciplinary communication, especially crucial in massive, complex infrastructure projects where spatial visualization is paramount.

Advanced material science and technology, when integrated closely with smart construction methodologies, represent another fundamental pillar of innovation. The engineered use of novel materials such as self-healing concrete, dynamic smart glass, and customized, high-performance 3D-printed building components requires absolute precision in their digital design and highly automated placement, directly linking breakthroughs in material science to technological deployment strategies. Additive Manufacturing (3D printing) is rapidly gaining commercial traction for fast prototyping and the customized production of complex, geometrically challenging building elements, demanding sophisticated AI and algorithmic control to optimize material deposition, structural integrity verification, and quality assurance. This combined approach enables true on-demand manufacturing of specialized components directly near the site, significantly reducing reliance on complex global supply chains, minimizing material warehousing, and dramatically cutting material wastage, aligning perfectly with the overarching environmental sustainability objectives driving the modern Smart Construction Market.

Finally, robust security infrastructure and proactive cybersecurity measures are increasingly recognized as indispensable components of the technology landscape. As construction sites transform into highly interconnected digital data hubs, the protection of sensitive intellectual property (proprietary BIM models, generative design output), confidential project financial information, and critical operational data generated by AI and telematics from sophisticated cyber threats, data breaches, and industrial espionage is absolutely critical. Smart construction necessitates the deployment of stringent security protocols, multi-factor identity and access management systems, and end-to-end encrypted communication channels to rigorously ensure data integrity, confidentiality, and regulatory compliance. Furthermore, the strategic deployment of decentralized edge computing architectures helps to actively mitigate security risks by processing time-sensitive and critical operational data locally on site, minimizing reliance on continuous external cloud connectivity and significantly enhancing the overall resilience and operational robustness of the on-site digital systems against connectivity loss or malicious network attacks. Addressing these complex security and trust concerns is paramount for securing widespread enterprise-level adoption and continued investment in highly interconnected smart construction solutions.

Regional Highlights

- North America: This region maintains its dominance in the Smart Construction Market, characterized by the early adoption and often mandatory implementation of advanced BIM standards across public sector projects, high levels of private sector investment in specialized R&D, and the robust presence of leading global technology developers. The market benefits from substantial private sector investment, particularly in high-value commercial and complex infrastructure projects, necessitating the rapid deployment of advanced technologies like AI, robotics, and sophisticated telematics systems to effectively counter high prevailing labor costs and meet stringent efficiency targets.

- Europe: The European market is strongly defined by powerful regulatory support for digitalization, with major economies including the UK, Germany, and the Nordic nations having implemented mandatory BIM requirements for most publicly funded construction contracts. The regional focus is heavily directed towards long-term sustainability (Green Building certifications, net-zero targets) and the scaling of highly automated prefabrication and modular construction techniques, positioning Europe as a leading consumer of IoT-enabled solutions for optimized energy efficiency, precise site logistics management, and circular economy enablement.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) globally, driven by unprecedented rates of urbanization and massive, sustained government expenditure on national infrastructure development projects (e.g., high-speed rail, metropolitan transit systems). Technology adoption is spurred by the essential need to deliver high volumes of construction rapidly, safely, and efficiently. Key growth technology areas include the mass deployment of drones for rapid, accurate site surveying and progress monitoring, and the use of integrated telematics systems for highly efficient fleet management across vast, distributed project sites.

- Latin America (LATAM): Market growth in LATAM is currently moderate but shows consistent stability, primarily concentrated around major capital cities and critical resource extraction industries (such as large-scale mining, oil, and gas infrastructure). Technology adoption often favors low-cost, high-impact smart solutions such as basic telematics, sophisticated GPS asset tracking, and enhanced digital security systems. The driving forces here are predominantly asset protection, minimizing theft risks, and achieving measurable productivity improvements rather than complex, large-scale automation efforts.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated within the economically robust Gulf Cooperation Council (GCC) states (particularly the UAE and Saudi Arabia), driven by ambitious national transformation programs (like Saudi Vision 2030) and the strategic development of entirely new, purpose-built smart cities (e.g., NEOM, Lusail). These flagship projects involve massive, strategic investment in the very latest cutting-edge smart construction technologies, including large-scale digital twins and advanced construction robotics, often implemented from a clean slate to achieve global benchmarks in rapid delivery, extreme efficiency, and long-term sustainability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Construction Market.- Trimble Inc.

- Caterpillar Inc.

- Komatsu Ltd.

- Autodesk Inc.

- Hexagon AB

- Topcon Corporation

- Volvo Construction Equipment

- Oracle Corporation

- Hitachi Construction Machinery Co., Ltd.

- Siemens AG

- NVIDIA Corporation

- Bentley Systems, Inc.

- Liebherr Group

- Daqri LLC

- Hilti Corporation

- Bosch Rexroth AG

- Doka GmbH

- SICK AG

- KUKA AG

- DJI

Frequently Asked Questions

Analyze common user questions about the Smart Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate for the Smart Construction Market?

The Smart Construction Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 14.8% during the forecast period from 2026 to 2033, driven significantly by the urgent necessity for technology integration and enhanced operational efficiency demands across the global construction sector.

How does Building Information Modeling (BIM) fit into Smart Construction?

BIM is recognized as the foundational software platform, functioning as the central digital hub for all project data (encompassing 4D scheduling, 5D cost, and 6D sustainability). It enables advanced collaboration, automated clash detection, and securely feeds structured data directly to AI and robotics systems, optimizing the entire construction and long-term asset lifecycle management.

What are the primary drivers restraining market growth?

The key factors constraining market growth include the substantial initial capital investment and operational training costs required for integrating high-tech equipment and software, coupled with deep-seated organizational resistance to adopting complex new digital workflows, and persistent technological interoperability challenges between competing software vendors.

Which geographical region leads the Smart Construction market?

North America currently commands the largest market share due to its high technology readiness, mature digital infrastructure, and early government mandates for digital delivery methods. However, the Asia Pacific region is accurately forecasted to experience the highest growth rate due to accelerated urbanization and massive infrastructure investment.

What role does AI play in improving construction site safety?

AI drastically enhances safety through sophisticated computer vision systems that continuously monitor job sites in real-time, proactively detecting workers not wearing required PPE, identifying unauthorized zone access, predicting potential fall hazards, and flagging equipment malfunctions immediately, thereby minimizing risks before incidents occur.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager