Smart Cooling Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433004 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Smart Cooling Systems Market Size

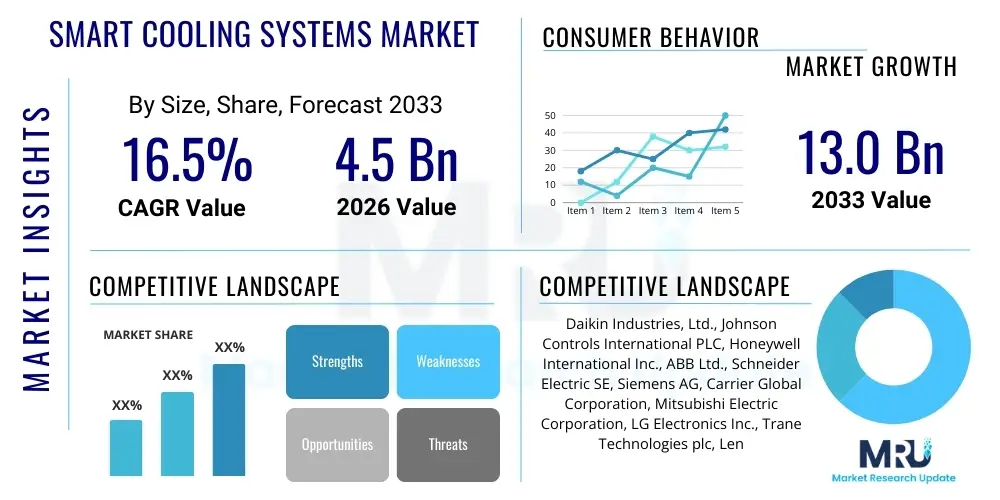

The Smart Cooling Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 13.0 Billion by the end of the forecast period in 2033.

Smart Cooling Systems Market introduction

The Smart Cooling Systems Market encompasses the integration of advanced technologies, such as the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and sophisticated sensor networks, into traditional cooling infrastructure like HVAC systems, refrigerators, and specialized industrial chillers. These systems move beyond simple temperature regulation by offering predictive maintenance capabilities, remote diagnostics, and dynamic optimization of energy consumption based on real-time environmental factors and usage patterns. The fundamental shift is toward creating autonomous cooling environments that minimize operational expenses while maximizing comfort and equipment longevity, particularly crucial in data centers, commercial buildings, and smart homes.

The primary applications of smart cooling solutions span various sectors, including residential buildings seeking enhanced energy management, commercial spaces aiming for reduced utility costs and regulatory compliance, and mission-critical environments like data centers, where stable temperature control is paramount for hardware performance and preventing costly downtime. These systems provide measurable benefits, such as significant reductions in energy consumption—often ranging from 20% to 40% compared to traditional systems—improved air quality through integrated filtration and monitoring, and the ability to proactively address potential mechanical failures before they escalate into system outages. This focus on efficiency and reliability positions smart cooling as an essential component of modern sustainable infrastructure.

The robust market growth is fundamentally driven by the escalating global demand for energy efficiency, spurred by rising electricity costs and stringent environmental regulations aimed at reducing carbon footprints associated with building operations. Furthermore, the rapid proliferation of IoT devices and widespread adoption of smart home and smart city initiatives provide the necessary technological backbone for seamless integration and centralized control of complex cooling networks. The increasing number of hyperscale and edge data centers worldwide, which require highly efficient and reliable cooling solutions to handle massive heat loads, serves as a major accelerator for the deployment of advanced smart cooling technologies.

Smart Cooling Systems Market Executive Summary

The Smart Cooling Systems Market is poised for exceptional expansion, driven by critical business trends emphasizing sustainability, operational efficiency, and digitalization across infrastructure sectors. Key business trends indicate a significant pivot towards subscription-based cooling as a service (CaaS) models, offering predictive maintenance and optimization as integrated solutions rather than simply selling hardware. This trend, coupled with the increasing strategic importance of edge computing, mandates decentralized, highly efficient cooling technologies capable of operating reliably in varied environmental conditions, fueling innovation in liquid cooling and modular data center cooling solutions. The competitive landscape is characterized by strategic partnerships between traditional HVAC manufacturers and pure-play software/IoT providers to deliver comprehensive end-to-end smart solutions.

Regionally, North America and Europe currently dominate the market due to robust regulatory frameworks promoting energy efficiency in commercial buildings and high rates of smart home technology adoption. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid urbanization, significant investment in new data center construction, particularly in developing economies like India and Southeast Asia, and increasing government focus on smart city infrastructure development. The Middle East and Africa (MEA) are also emerging as key markets, primarily driven by large-scale infrastructure projects and intense heat conditions necessitating advanced, energy-saving cooling solutions.

Segment trends reveal that the data center application segment remains the largest revenue generator, driven by the ceaseless growth of cloud computing and AI workloads. Technologically, IoT-enabled sensors and control systems are fundamental, but the fastest growing segment is software and services, particularly concerning cloud-based analytics platforms and predictive fault detection services, which maximize the value derived from installed hardware. Furthermore, the residential segment is showing strong growth, motivated by consumer interest in seamless integration with wider home automation ecosystems and the tangible reduction in household energy bills resulting from optimized usage.

AI Impact Analysis on Smart Cooling Systems Market

User inquiries regarding AI's influence in the Smart Cooling Systems Market primarily revolve around practical outcomes: how AI can drastically lower energy costs, the feasibility of truly autonomous cooling operations, the reliability of predictive maintenance algorithms, and the security implications of managing critical infrastructure via machine learning systems. Users are seeking quantifiable proof points on energy savings (e.g., optimization success rates), clarity on how AI handles variable loads and external weather fluctuations, and information on the transition costs involved in upgrading traditional systems to AI-enabled platforms. The key themes summarized are the expectation of maximum efficiency, minimizing human intervention, and maintaining system security against sophisticated cyber threats targeting operational technology (OT) infrastructure.

AI's primary transformative impact is enabling unparalleled energy optimization through dynamic load management. Traditional cooling systems rely on static setpoints, whereas AI algorithms continuously process massive datasets—including occupancy levels, external weather forecasts, utility tariff structures, and equipment performance metrics—to anticipate thermal loads and adjust cooling output precisely. This predictive capability allows systems to learn the thermal characteristics of a building or data center, pre-cool during off-peak hours, and modulate compressor speeds to operate at maximum efficiency, minimizing wasted energy and reacting instantly to unpredictable shifts in demand, which is crucial for stability and cost reduction.

Furthermore, AI significantly enhances maintenance strategies by shifting them from reactive or time-based schedules to predictive protocols. Machine learning models analyze vibration data, current draw, temperature deltas, and pressure readings to detect subtle anomalies indicative of impending component failure (e.g., refrigerant leaks, bearing degradation) long before human operators or standard alarms would trigger. This proactive approach drastically reduces unplanned downtime, extends the operational lifespan of expensive cooling assets, and optimizes the scheduling of maintenance tasks, ensuring resources are deployed only when and where they are truly needed, thus minimizing operational expenditure (OPEX).

- AI enables real-time dynamic energy optimization (D-EO) based on occupancy and weather patterns.

- Predictive maintenance minimizes unplanned downtime by forecasting equipment failure with high accuracy.

- Machine Learning (ML) algorithms improve system resilience by autonomously adjusting to fluctuations in cooling load.

- AI facilitates the integration of diverse sensor data, creating a centralized, holistic view of thermal performance.

- Enhanced cybersecurity models are deployed to protect networked smart cooling infrastructure from external breaches.

- Optimized refrigerant management and leakage detection, contributing directly to environmental sustainability goals.

DRO & Impact Forces Of Smart Cooling Systems Market

The dynamics of the Smart Cooling Systems Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. The primary drivers include global energy conservation mandates, the exponential expansion of data center infrastructure demanding ultra-efficient thermal management, and rapid advancements in IoT and sensor technologies that make intelligent control cost-effective and scalable. These drivers collectively push enterprises and consumers toward replacing outdated, energy-intensive cooling apparatus with intelligent, network-enabled alternatives that offer long-term operational savings and improved environmental compliance.

Restraints, however, pose certain challenges to widespread adoption. High initial capital expenditure (CAPEX) associated with installing advanced smart cooling systems, especially when retrofitting existing infrastructure, often discourages immediate investment, particularly for small and medium enterprises (SMEs). Furthermore, the critical shortage of skilled technicians capable of installing, maintaining, and troubleshooting complex integrated cooling networks presents a significant barrier. Data privacy concerns and vulnerability to cyberattacks, given that these systems are interconnected via the cloud, also necessitate robust security protocols and often slow down enterprise adoption due to perceived risk.

Opportunities for market stakeholders are substantial, centered on the increasing adoption of Liquid Cooling solutions for high-density computing environments, the expansion into underserved residential smart home markets, and the development of Cooling-as-a-Service (CaaS) models that mitigate upfront costs and ensure continuous performance optimization via subscription. Key impact forces include regulatory shifts (e.g., stricter F-gas regulations targeting refrigerants), rapid urbanization increasing demand for dense, energy-efficient building infrastructure, and technological convergence, where integration with renewable energy sources and smart grid technology further amplifies the benefits of intelligent cooling management.

Segmentation Analysis

The Smart Cooling Systems Market is comprehensively segmented based on technology, component, application, and end-user, reflecting the diverse requirements across different deployment environments, ranging from precise temperature control in industrial settings to aesthetic integration in residential spaces. Understanding these segmentations is critical for market participants to tailor their offerings, focusing on either hardware innovation, software intelligence, or specialized service delivery. The component segmentation, particularly the rise of advanced control systems and sophisticated sensor arrays, demonstrates the increasing emphasis on data acquisition and algorithmic decision-making rather than simple mechanical output.

The application segmentation clearly highlights the dominance of the data center industry, driven by the continuous demand for increased compute capacity and thermal density, necessitating advanced techniques like immersion cooling and containment systems. Conversely, the commercial segment, including offices, hospitals, and retail, focuses more on balancing occupant comfort with significant utility cost reductions, often utilizing integrated building management systems (BMS). The technology segmentation, covering traditional compression methods integrated with intelligence versus newer, non-traditional methods like evaporative cooling or thermoelectric cooling, outlines the maturity and future growth trajectory of different solution types.

End-user segmentation differentiates between those who prioritize massive scale and efficiency (like hyperscale data center operators and large industrial complexes) and those who prioritize convenience, ease of use, and aesthetic integration (like residential customers and small commercial offices). This differentiation affects pricing strategies, distribution channels, and the required level of system complexity. The robust growth in the residential segment is largely fueled by the affordability and integration capabilities of IoT devices, turning basic air conditioning units into smart, self-optimizing cooling appliances accessible via mobile platforms.

- By Component:

- Hardware (Compressors, Chillers, Cooling Towers, Heat Exchangers, Pumps)

- Control Systems (Thermostats, Controllers, Variable Frequency Drives)

- Sensors and Monitoring Devices (Temperature, Humidity, Pressure, Air Quality)

- By Technology:

- Air Conditioning (Centralized, Ductless, VRF)

- Evaporative Cooling

- Free Cooling

- Liquid Cooling (Immersion Cooling, Direct-to-Chip)

- By Application:

- Data Centers and IT Infrastructure

- Commercial Buildings (Offices, Retail, Healthcare)

- Industrial Facilities (Manufacturing, Power Generation)

- Residential Buildings

- By End-User:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Value Chain Analysis For Smart Cooling Systems Market

The Value Chain for the Smart Cooling Systems Market begins with upstream activities focused heavily on raw material procurement, component manufacturing (e.g., high-efficiency compressors, advanced heat exchangers, microprocessors, and sophisticated sensor components), and the development of proprietary IoT platforms and AI optimization software. Key upstream players include specialized semiconductor manufacturers, industrial material suppliers, and software developers who create the foundational algorithms necessary for predictive maintenance and energy management. Strategic alliances in the upstream segment are crucial for ensuring the supply of specialized, high-performance, and miniaturized electronic components required for integrated smart systems.

Midstream activities involve the assembly, integration, and standardization of these components into deployable cooling units and control systems. This stage is dominated by large HVAC manufacturers and specialized cooling solution providers (especially for data center cooling). Value is added through rigorous testing, quality assurance, software integration, and the certification of systems for specific regional energy standards. Effective inventory management and lean manufacturing processes are essential here to maintain competitive pricing against traditional cooling solutions, a primary barrier to market entry.

Downstream activities encompass distribution, installation, maintenance, and post-sales service, forming the crucial connection with end-users. Distribution channels are typically bifurcated: Direct channels are preferred for large enterprise clients, hyperscale data centers, and complex industrial projects, enabling customized engineering and direct service contracts. Indirect channels utilize networks of specialized contractors, system integrators, and retail distributors, particularly for the residential and small commercial sectors. The long-term value in the downstream segment is increasingly tied to recurring revenue generated through software updates, remote monitoring, and proactive maintenance services, necessitating a strong, technically proficient service network.

Smart Cooling Systems Market Potential Customers

Potential customers for Smart Cooling Systems represent a wide spectrum of organizations and individuals prioritizing energy efficiency, uptime reliability, and operational cost reduction. The most prominent end-users are hyperscale cloud providers and enterprise data center managers, who require cooling solutions capable of handling massive thermal loads generated by AI, machine learning, and high-performance computing (HPC) workloads while maintaining continuous operation. For these buyers, the total cost of ownership (TCO) is heavily influenced by cooling efficiency (Power Usage Effectiveness or PUE), making smart systems a necessity rather than a luxury.

Another significant customer segment is the commercial real estate sector, including large office complexes, hotel chains, educational institutions, and healthcare facilities. These organizations purchase smart cooling systems primarily to comply with green building standards (e.g., LEED certification), achieve substantial utility cost savings, and provide optimal environmental conditions that enhance occupant productivity and comfort. They often require systems that integrate seamlessly with existing Building Management Systems (BMS) and provide granular zone control based on real-time occupancy data.

Furthermore, industrial facilities, such as manufacturing plants, chemical processing units, and power generation stations, constitute critical buyers for specialized smart cooling solutions, particularly those that require process cooling stability to maintain product quality or safe equipment operation. Finally, the affluent residential segment and early adopters of smart home technology represent a growing customer base, seeking integrated, aesthetically pleasing, and highly automated cooling solutions controllable via voice commands or mobile applications, primarily motivated by convenience and personalized energy savings reports.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 13.0 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daikin Industries, Ltd., Johnson Controls International PLC, Honeywell International Inc., ABB Ltd., Schneider Electric SE, Siemens AG, Carrier Global Corporation, Mitsubishi Electric Corporation, LG Electronics Inc., Trane Technologies plc, Lennox International Inc., Nortek Air Management, Vertiv Group Corp., Rittal GmbH & Co. KG, Stulz GmbH, Munters Group, Airedale International Air Conditioning, Emerson Electric Co., Danfoss A/S, Belimo Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Cooling Systems Market Key Technology Landscape

The technological landscape of the Smart Cooling Systems Market is rapidly evolving, driven by the convergence of operational technology (OT) and information technology (IT). Key advancements center around the deployment of robust Internet of Things (IoT) ecosystems, utilizing highly accurate and networked sensors to gather environmental, operational, and energy consumption data in real time. These sensors, often integrated with edge computing capabilities, preprocess data locally before transmission, reducing latency and ensuring immediate control adjustments. The integration of Variable Refrigerant Flow (VRF) and Variable Air Volume (VAV) systems with smart control platforms allows for granular, multi-zone temperature and airflow management, significantly improving partial load efficiency—a common scenario in commercial buildings.

Artificial intelligence (AI) and Machine Learning (ML) constitute the critical intelligence layer atop the IoT infrastructure. These technologies enable predictive optimization, moving beyond pre-programmed schedules to truly self-learning and self-correcting systems. AI algorithms are responsible for complex tasks such as forecasting thermal loads days in advance based on forecasted weather and scheduled building events, optimizing utility rate arbitrage by strategically shifting cooling loads, and detecting subtle performance degradation through pattern recognition in operational data. The adoption of cloud-based centralized management platforms ensures that these complex algorithms are continually updated and refined without requiring physical system intervention.

Furthermore, innovative approaches to cooling high-density computing are reshaping the technology landscape, particularly in the data center application segment. Liquid cooling, including both direct-to-chip methods (using cold plates) and full immersion cooling, is gaining traction as traditional air cooling reaches its practical limits for thermal management of advanced CPUs and GPUs. These liquid solutions offer superior heat transfer efficiency, significantly reducing the PUE of facilities. Simultaneously, advancements in magnetic bearing compressors and oil-free chiller technologies are improving mechanical reliability and energy efficiency, further cementing the market's trajectory towards sustainable and intelligent operations.

Regional Highlights

- North America: This region holds a dominant market share, primarily due to the high concentration of hyperscale data centers, stringent energy efficiency mandates imposed by state and federal regulators, and a mature infrastructure capable of supporting complex IoT and cloud-based solutions. Strong consumer demand for smart home technology further accelerates the residential segment. The U.S. and Canada are key early adopters of advanced liquid cooling and Cooling-as-a-Service (CaaS) business models.

- Europe: Characterized by ambitious sustainability targets (e.g., the European Green Deal) and high energy prices, Europe is a leader in adopting highly efficient and environmentally compliant smart cooling solutions. Germany, the UK, and the Nordic countries, in particular, invest heavily in free cooling and utilize waste heat recovery from data centers for district heating schemes. Regulatory drivers, especially related to F-gas phase-downs, compel rapid replacement of legacy systems with smart, low Global Warming Potential (GWP) refrigerant alternatives.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, driven by rapid urbanization, massive investment in new construction, and the booming digitalization across countries like China, India, Japan, and Australia. The sheer scale of new data center construction and the rising middle-class disposable income fueling residential smart tech adoption provide vast market opportunities, though implementation often faces challenges related to infrastructure inconsistency and varying regulatory standards.

- Latin America (LATAM): Growth in LATAM is concentrated in key economies such as Brazil and Mexico, spurred by foreign investment in IT infrastructure and telecommunications. The market is developing, focusing primarily on commercial and light industrial applications, with demand influenced by the need for robust, cost-effective solutions capable of withstanding high ambient temperatures while managing escalating electricity costs.

- Middle East and Africa (MEA): This region exhibits strong demand, driven by extreme climatic conditions that make cooling a critical, energy-intensive necessity. Large infrastructure projects (e.g., Saudi Arabia's Vision 2030, UAE smart city initiatives) and growing data center hubs are necessitating the adoption of industrial-grade, highly efficient smart cooling systems, often focusing on solar power integration and localized energy generation to offset peak grid demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Cooling Systems Market.- Daikin Industries, Ltd.

- Johnson Controls International PLC

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric SE

- Siemens AG

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- LG Electronics Inc.

- Trane Technologies plc

- Lennox International Inc.

- Nortek Air Management

- Vertiv Group Corp.

- Rittal GmbH & Co. KG

- Stulz GmbH

- Munters Group

- Airedale International Air Conditioning

- Emerson Electric Co.

- Danfoss A/S

- Belimo Holding AG

- Ingersoll Rand Inc.

- Eaton Corporation plc

- Fuji Electric Co., Ltd.

- Hitachi, Ltd.

Frequently Asked Questions

Analyze common user questions about the Smart Cooling Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of deploying smart cooling systems over traditional HVAC?

The primary benefit is significant energy cost reduction and optimized operational efficiency, achieved through AI-driven predictive control, real-time data analysis, and dynamic load adjustments based on occupancy and external conditions. This proactive approach leads to lower utility bills and reduced carbon footprint.

How does smart cooling enhance reliability and reduce downtime in data centers?

Smart cooling systems use embedded IoT sensors and machine learning algorithms to perform predictive maintenance, identifying subtle anomalies (like component wear or leaks) before they cause catastrophic failure. This capability ensures maximum uptime by enabling scheduled repairs rather than emergency interventions.

What is Cooling-as-a-Service (CaaS) and why is it gaining popularity?

CaaS is a business model where a provider installs, maintains, and optimizes the smart cooling infrastructure for a customer, typically charging a subscription fee based on usage or guaranteed efficiency savings. It minimizes the customer's upfront capital expenditure (CAPEX) and transfers the technical risk and operational responsibility to the service provider.

Which technology segment is driving the fastest growth in the smart cooling market?

The Liquid Cooling technology segment, particularly immersion cooling and direct-to-chip solutions, is experiencing the fastest growth. This acceleration is driven by the necessity to efficiently manage the extreme heat loads generated by advanced AI chips and high-performance computing in modern data centers.

Are smart cooling systems compatible with existing building automation infrastructure?

Most modern smart cooling systems are designed for interoperability and are compatible with existing Building Management Systems (BMS) through standard communication protocols such such as BACnet, Modbus, and LonWorks. This ensures seamless integration and centralized control within a wider smart building ecosystem.

The comprehensive analysis provided herein underscores the transition of the cooling sector from purely mechanical functionality to intelligent, interconnected infrastructure, highly optimized by digital technologies. The market trajectory is irrevocably linked to global digitalization efforts and the urgent mandate for energy conservation across all industry verticals, ensuring robust, sustained growth throughout the forecast period. The strategic adoption of advanced predictive analytics and AI remains the crucial differentiator for industry leaders seeking to capture market share and deliver superior Total Cost of Ownership (TCO) benefits to their diverse customer base. Continuous technological investment in materials science, sensor accuracy, and algorithmic sophistication will define competitive advantage in this rapidly evolving landscape.

Furthermore, the focus on sustainable practices, particularly the development of systems utilizing natural refrigerants or highly efficient liquid cooling methods, is becoming a non-negotiable factor, especially in regulatory-heavy regions like Europe. Manufacturers are increasingly prioritizing modularity and scalability in their product designs to cater effectively to the needs of both hyperscale enterprises and distributed edge computing environments. This adaptability ensures that smart cooling remains relevant across the varied spectrum of IT and infrastructure deployment models, solidifying its position as a foundational element of the modern digital economy. The fusion of hardware excellence with sophisticated software intelligence defines the contemporary market standard.

Looking ahead, the market is expected to witness greater consolidation among key players as they seek to acquire specialized software firms and sensor technology developers to strengthen their end-to-end service portfolios. Vertical integration, from component manufacturing through to CaaS delivery, will be a key strategy to control costs and enhance service quality. The educational aspect, addressing the shortage of skilled installation and maintenance personnel, will also be critical for realizing the full potential of these complex systems. Investment in technical training and certification programs will be necessary to ensure widespread, successful deployment and operational longevity of high-performance smart cooling infrastructure worldwide.

This detailed report provides foundational intelligence for stakeholders, investors, and strategic planners navigating the complexities and opportunities within the global Smart Cooling Systems Market, emphasizing data-driven decisions and long-term sustainability goals.

The growing integration of photovoltaic systems and battery storage technologies into commercial and industrial infrastructure offers a significant synergistic opportunity for smart cooling systems. By leveraging stored energy and dynamically adjusting cooling demand based on renewable energy generation curves, smart systems can contribute substantially to grid stability and energy independence. This capability transforms cooling assets from mere energy consumers into active participants in smart grid management, maximizing the utilization of clean energy sources, thereby enhancing the overall business case for smart infrastructure upgrades.

Addressing the stringent requirements of pharmaceutical and food and beverage industries represents another crucial growth area. These sectors demand extremely precise, stable, and auditable temperature control for critical processes and storage. Smart cooling systems equipped with advanced data logging, validation features, and highly resilient backup mechanisms are indispensable. The use of IoT and AI to monitor compliance in real-time minimizes regulatory risk and ensures product integrity throughout complex cold chains, creating a high-value market segment distinct from general commercial HVAC applications.

The standardization of communication protocols and API development is vital for unlocking the next phase of market expansion. Open standards facilitate easier integration between hardware from different vendors and diverse smart building applications, reducing proprietary lock-in and encouraging faster innovation. As regulatory bodies begin to mandate open data sharing and interoperability, particularly in public sector infrastructure, the market will benefit from increased competition and reduced integration complexity, further accelerating the adoption rate across diverse organizational sizes and technical maturity levels.

The influence of government procurement and public infrastructure projects cannot be overstated. When government entities adopt smart cooling for schools, hospitals, and administrative buildings, it provides both market validation and scale, driving down manufacturing costs through economies of scale. These large-scale deployments serve as reference points, showcasing tangible efficiency gains and encouraging private sector investment. Policy instruments, such as tax credits for energy-efficient retrofits and performance-based rebates, play a crucial role in tilting the economic balance in favor of smart, high-efficiency solutions over lower-cost, conventional options.

Furthermore, the development of robust edge computing capabilities is becoming integral to smart cooling architecture. While cloud analytics offer powerful long-term optimization, critical control decisions—such as emergency shutdown or rapid temperature adjustment in a high-density zone—require instantaneous action. Edge devices embedded within the cooling infrastructure process data locally, ensuring ultra-low latency control loops, enhancing system autonomy, and maintaining operational security even during network outages. This hybrid cloud-edge architecture provides the ideal balance between global optimization and local operational resilience, a necessity for mission-critical applications.

The market also faces ongoing challenges related to the global supply chain, particularly regarding microchip shortages and volatility in commodity pricing (e.g., copper and specialized steel). Manufacturers must implement highly resilient supply chain strategies, including diversification of sourcing and increased localization of production, to mitigate risks and maintain competitive pricing. Successful navigation of these logistical hurdles will be key to sustaining aggressive market growth targets projected through 2033, ensuring timely delivery and installation of complex smart cooling infrastructure components across all geographies.

Investor sentiment remains overwhelmingly positive toward companies innovating in sustainable and energy-efficient technologies. Firms specializing in non-traditional cooling methods, such as geothermal and magnetic refrigeration, or those offering cutting-edge AI software platforms, are attracting significant venture capital and private equity interest. This financial backing validates the long-term strategic importance of intelligent thermal management in the global effort to decarbonize the building and IT sectors. The market is thus characterized by both incremental improvements in existing technology and radical breakthroughs in thermal science and AI application.

In conclusion, the Smart Cooling Systems Market is transitioning from a niche technological pursuit to a mainstream necessity, driven by interlocking pressures from economics, regulation, and climate change. The future market leaders will be those who successfully master the integration of hardware reliability, software intelligence, and flexible, service-oriented business models like CaaS, providing holistic solutions that address the complex operational demands of the 21st-century digital infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager