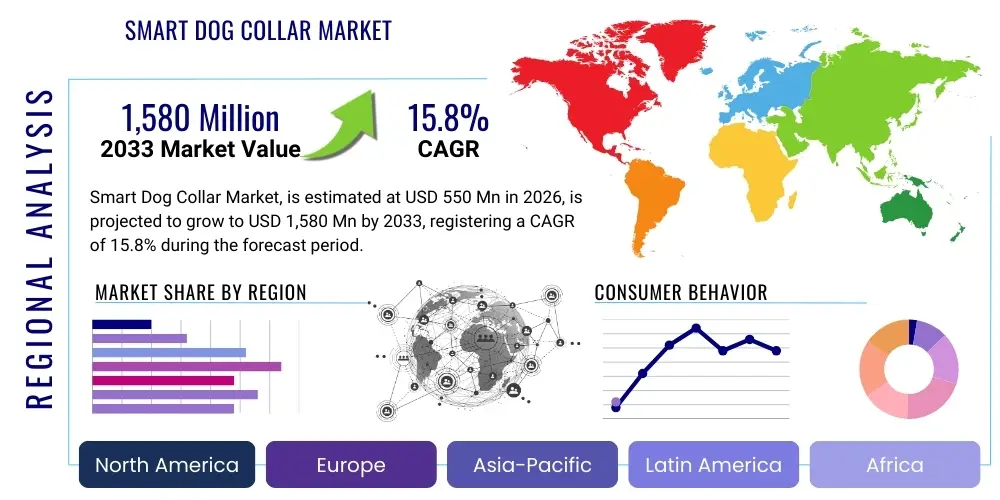

Smart Dog Collar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436142 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Smart Dog Collar Market Size

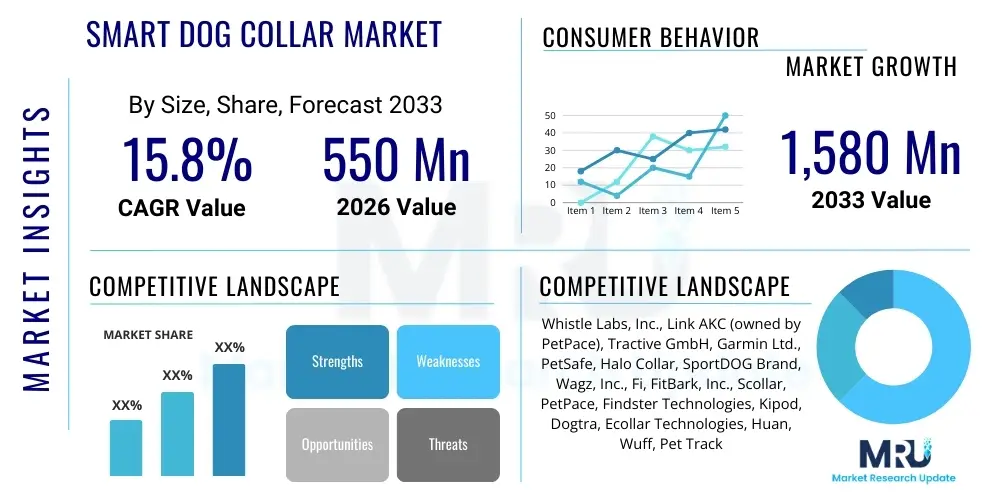

The Smart Dog Collar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 1,580 Million by the end of the forecast period in 2033. This significant expansion is primarily driven by the increasing integration of Internet of Things (IoT) technology into pet care, coupled with rising consumer spending on premium pet health and safety products. The market trajectory reflects a strong trend toward preventative healthcare and enhanced remote monitoring capabilities for companion animals globally.

Smart Dog Collar Market introduction

The Smart Dog Collar Market encompasses sophisticated wearable technology designed for canine companions, offering functionalities far beyond traditional identification tags. These devices, which leverage advanced sensing technologies, GPS, cellular connectivity, and Bluetooth, provide real-time data on a dog's location, activity levels, vital signs, and behavioral patterns. The primary purpose of smart collars is to enhance pet safety, optimize health management, and facilitate effective training protocols, transforming the relationship between owners and their pets through data-driven insights. The core product category includes devices focused on GPS tracking for containment and recovery, fitness monitoring for managing weight and activity, and specialized health monitors capable of tracking heart rate and respiration.

Major applications of smart dog collars span consumer safety, veterinary telemedicine, and professional dog training. Consumers utilize these devices primarily for geofencing capabilities, ensuring pets remain within designated safe zones, and for monitoring daily exercise routines crucial for breed-specific health needs. In the veterinary sector, the longitudinal data collected by these collars proves invaluable for early disease detection and post-operative monitoring, enabling proactive medical intervention. Furthermore, the rising incidence of pet obesity and chronic conditions, such as arthritis and heart disease, mandates continuous data collection, thereby increasing the reliance on these smart solutions across developed economies.

Key benefits driving market adoption include enhanced peace of mind for pet owners through constant location tracking, improved ability to maintain optimal canine health through detailed activity logs, and the potential for early intervention based on anomaly detection in behavior or vital signs. Driving factors include the overall increase in pet ownership rates, particularly during and after recent global events, the significant technological advancements leading to smaller, lighter, and longer-lasting batteries, and the increasing convergence of pet tech with broader home automation and smart living ecosystems. These factors collectively solidify the smart collar as an essential component of modern pet care infrastructure.

Smart Dog Collar Market Executive Summary

The global Smart Dog Collar Market is experiencing robust business trends characterized by intense competition focused on feature stacking and subscription models. Companies are increasingly moving beyond basic GPS tracking to offer comprehensive health platforms that integrate AI-driven behavioral analysis and direct data sharing capabilities with veterinarians. A major business trend involves strategic partnerships between hardware manufacturers and pet insurance providers, offering bundled services that incentivize the use of monitoring technology to reduce risk. Furthermore, the shift towards modular designs allowing owners to customize sensor packages based on specific needs (e.g., medical monitoring vs. high-intensity training) represents a critical evolution in product strategy, emphasizing user flexibility and scalable pricing.

Regional trends indicate North America currently dominates the market due to high discretionary income allocated to pets, a strong culture of pet safety consciousness, and the early adoption of IoT devices. Europe follows closely, driven by stringent animal welfare regulations and a high penetration of localized tracking services adapted to varied terrain. Asia Pacific (APAC) is projected to exhibit the fastest growth, primarily fueled by rapid urbanization in countries like China and India, leading to increased pet adoption in apartment settings where localized tracking and remote monitoring become essential for owner peace of mind. Investment in cellular infrastructure expansion across APAC further supports the penetration of connected collar technologies.

Segment trends highlight the significant growth of the Health Monitoring segment, poised to overtake basic GPS tracking in terms of revenue share over the forecast period. Consumers are recognizing the long-term value of preventative health data over simple location awareness. Technology-wise, the adoption of low-power wide-area networks (LPWAN) like NB-IoT and LTE-M is a major trend, addressing historic challenges related to battery life and connectivity range, making smart collars viable for extended use in rural and suburban environments. The premium price point associated with vital sign monitoring collars indicates a strong willingness among affluent consumers to invest heavily in veterinary-grade data collection wearables for their pets.

AI Impact Analysis on Smart Dog Collar Market

Common user questions regarding AI's impact on smart dog collars center on practical utility, data security, and accuracy: "Can AI truly diagnose my dog's illness before symptoms appear?", "How does AI analyze abnormal barking or restlessness?", and "Will AI integration make these collars too expensive or complicated?". Users are keenly interested in the transition from raw data collection (steps, heart rate) to actionable, predictive insights. The analysis reveals a strong user expectation that AI should facilitate early warnings for medical conditions, differentiate normal behavior from distress, and personalize training recommendations, ultimately simplifying pet ownership by filtering vast amounts of data into simple, actionable alerts. Concerns often revolve around algorithmic transparency and the reliability of non-medical devices providing health alerts, urging manufacturers to validate AI models rigorously against veterinary standards.

AI is fundamentally transforming the smart dog collar market by shifting the value proposition from merely monitoring to actively predicting and interpreting canine behavior and health status. Machine learning algorithms analyze vast datasets collected from individual dogs—including sleep patterns, activity variations, and temperature fluctuations—to establish personalized baselines. Deviations from these baselines, often too subtle for human owners to notice, trigger sophisticated alerts. For instance, AI can detect subtle shifts in gait suggestive of early arthritis or changes in respiratory rate indicating potential cardiac issues, allowing owners to seek veterinary consultation before acute symptoms manifest.

Furthermore, AI significantly enhances the efficacy of training and behavioral adjustment collars. By analyzing the context, intensity, and frequency of behaviors like barking, scratching, or separation anxiety-related movements, AI models can categorize the behavior and suggest appropriate interventions or training schedules via the companion app. This level of personalized, contextual interpretation not only improves pet well-being but also justifies the premium pricing of next-generation smart collars, positioning them as essential tools for proactive pet management rather than luxury gadgets. Generative AI is also being used to create personalized daily goal settings and educational content tailored to specific breeds and activity profiles.

- Predictive Health Diagnostics: Utilizing deep learning to identify subtle physiological and behavioral anomalies indicative of early-stage illnesses (e.g., diabetes, arthritis, cardiac issues) before overt symptoms appear.

- Behavioral Contextualization: AI algorithms analyze movement, acoustics, and location data to accurately classify behaviors (e.g., playful barking vs. distress barking) and provide context-specific guidance to owners.

- Personalized Training Protocols: Generating customized training schedules and feedback loops based on a dog's learning rate, breed characteristics, and activity history.

- Data Simplification and Actionability: Filtering continuous raw sensor data into clear, prioritized alerts and actionable recommendations for owners, optimizing the user experience.

- Enhanced Geofencing Accuracy: Employing AI to learn environmental factors (e.g., signal interference near large buildings) to improve the reliability and reduce false alarms in virtual fence systems.

- Optimized Power Management: Using machine learning to predict usage patterns and dynamically adjust communication frequencies (e.g., GPS ping rate) to maximize battery life without compromising critical monitoring functions.

DRO & Impact Forces Of Smart Dog Collar Market

The Smart Dog Collar Market is characterized by dynamic interplay between technological drivers and market adoption challenges. Key drivers include the massive global growth in pet humanization, where pets are increasingly viewed as family members, leading to higher spending on their well-being. Coupled with this is the rapid advancement in micro-sensor technology, making devices lighter, more accurate, and capable of measuring complex biological parameters previously limited to clinical settings. Opportunities lie predominantly in integrating ecosystem services, such as direct health data submission to telemedicine platforms and insurance providers, creating recurring revenue streams and enhancing customer lock-in.

However, the market faces significant restraints. The primary impediment to mass adoption remains the high initial cost of premium smart collars, often coupled with necessary monthly or annual subscription fees for cellular connectivity and data analysis services. Furthermore, limitations related to battery longevity and the need for frequent recharging diminish the appeal, particularly for owners seeking continuous, uninterrupted monitoring. Data privacy concerns, especially regarding the sensitive location and health data being collected and stored by third-party apps, also pose a psychological barrier to adoption among privacy-conscious consumers, necessitating robust security frameworks and transparent data usage policies from manufacturers.

Impact forces in this sector are primarily technological and competitive. Technological advancements in low-power communication standards (5G, LPWAN) are rapidly addressing the core restraint of battery life and connectivity range, potentially lowering operational costs. The competitive impact force is high, with new startups consistently entering the space, driving down hardware costs and forcing established players to innovate faster, particularly in the realm of AI and health diagnostics. Regulatory impact is emerging, especially in areas concerning veterinary oversight of data and the acceptable use of static/vibrational training features, which could shape future product design and marketing claims, particularly in regions like Europe.

Segmentation Analysis

The Smart Dog Collar Market is rigorously segmented based on product type, underlying technology, distribution channel, and end-user application, reflecting the diverse needs of the global pet ownership base. Segmentation analysis is critical for understanding market niches, targeting specific consumer demographics, and developing tailored product offerings. The segmentation highlights the market's evolution from basic GPS tracking devices to highly complex, multi-functional health and training systems. This diversification allows manufacturers to capture different value points, ranging from budget-conscious consumers seeking simple location alerts to high-end users demanding continuous vital sign monitoring and predictive health analysis.

The Type segmentation (GPS vs. Health Monitoring) defines the core functionality and corresponding price tiers. GPS-only collars appeal to safety-focused owners of active dogs, whereas Health Monitoring collars target owners of aging pets or those managing chronic illnesses, representing the highest Average Selling Price (ASP) segment. Technology segmentation (Bluetooth, Wi-Fi, Cellular) dictates the geographical range and real-time capability of the device, with Cellular (LTE/NB-IoT) emerging as the standard for wide-area tracking. Distribution channel analysis reveals a strong trend towards online retail and specialized pet stores, allowing manufacturers to leverage direct-to-consumer models that emphasize educational content and personalized support necessary for complex tech products. Understanding these segments is paramount for strategic market entry and portfolio management.

- By Product Type:

- GPS Tracking Collars

- Activity/Fitness Monitoring Collars

- Health Monitoring Collars (Vital Signs, Temperature)

- Behavioral Training Collars (Stimulation, Vibration, Tone)

- Hybrid and Multi-Function Collars

- By Technology:

- Bluetooth Low Energy (BLE)

- Wi-Fi Connectivity

- Cellular Connectivity (2G, 3G, LTE-M, NB-IoT)

- Radio Frequency (RF)

- Hybrid Communication Systems

- By End-User:

- Household/Pet Owners

- Commercial (Professional Trainers, Breeders, Shelters, Veterinary Clinics)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Pet Specialty Stores, General Retailers, Veterinary Clinics)

Value Chain Analysis For Smart Dog Collar Market

The value chain for the Smart Dog Collar Market begins with Upstream Analysis, which focuses heavily on the procurement and development of highly specialized components. This includes securing contracts for miniaturized, high-precision MEMS sensors (accelerometers, gyroscopes, temperature sensors), efficient GNSS (Global Navigation Satellite System) modules, and long-life, high-density batteries. A critical upstream component is the sourcing and design of custom low-power integrated circuits (SoCs) essential for data processing and energy management, often requiring highly skilled partnerships with semiconductor manufacturers. Pricing power in the upstream segment is generally held by major chip and sensor suppliers, compelling smart collar manufacturers to negotiate scale or specialize in unique component integration.

The midstream involves device manufacturing, assembly, software development, and quality assurance. Unlike generic electronics, smart collar manufacturing requires robust waterproofing, shock resistance, and material science expertise to ensure comfort and durability on a moving animal. Software development, encompassing proprietary firmware and the associated cloud platforms and mobile applications, is the key differentiator. This stage includes sophisticated data science teams developing algorithms for AI-driven health and behavior analysis, representing the highest intellectual property value in the chain. Rigorous testing is necessary to validate accuracy and reliability under varied environmental and usage conditions.

Downstream analysis covers distribution channels and post-sales services. Distribution occurs through Direct and Indirect channels. Direct channels involve company websites and proprietary apps, allowing manufacturers control over branding, pricing, and access to crucial first-party customer data, often linked to subscription services. Indirect channels, including major e-commerce platforms (Amazon, Chewy) and brick-and-mortar pet retailers, provide essential market reach. Post-sales services, including technical support, warranty fulfillment, and continuous software updates (firmware-over-the-air), are crucial for customer satisfaction and retention, particularly given the reliance on continuous connectivity and complex technology. The efficiency of customer support significantly impacts brand loyalty in this technology-driven pet care segment.

Smart Dog Collar Market Potential Customers

The primary End-Users and Buyers of smart dog collars are segmented into two major categories: individual Household Owners and Commercial Entities. Household Owners, the largest segment, are further segmented by motivation. The affluent pet owner, often referred to as a ‘pet parent,’ is heavily invested in premium products, prioritizing proactive health monitoring, particularly for breeds prone to specific conditions or aging pets. This group is highly receptive to subscription-based services that offer predictive analytics and veterinary integration. A second key household segment includes owners of highly active or escape-prone dogs, whose primary driver is GPS safety and real-time location tracking, often opting for robust, rugged designs with strong geofencing capabilities.

The Commercial segment comprises professional entities that leverage smart collars for efficiency and specialized data needs. Professional Dog Trainers and Behaviorists use the collars for consistent application of stimuli (in training variants) and objective data collection on a dog’s responsiveness and stress levels during sessions. Veterinary Clinics and Research Institutions are increasingly becoming buyers, utilizing the collars in clinical trials or for continuous, non-invasive patient monitoring post-discharge, leveraging the high-fidelity sensor data for comprehensive patient management outside the clinic environment. Furthermore, Animal Shelters and Rescue Organizations use simpler versions for inventory management, health tracking, and preparing animals for adoption, adding a layer of transparency and verifiable health history.

The expansion of the market into commercial applications underscores the shift in smart collars from consumer gadgets to professional-grade monitoring instruments. Commercial buyers prioritize data reliability, ease of integration with existing management systems, and centralized data management features, often necessitating enterprise-level software licenses. The key characteristic of all potential customers, however, is a fundamental desire for actionable data that translates directly into better health outcomes, enhanced safety, or improved training efficiency for the canine population they manage or own. Marketing strategies must be tailored to address these divergent needs—emotional peace of mind for consumers versus efficiency and clinical accuracy for commercial users.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 1,580 Million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Whistle Labs, Inc., Link AKC (owned by PetPace), Tractive GmbH, Garmin Ltd., PetSafe, Halo Collar, SportDOG Brand, Wagz, Inc., Fi, FitBark, Inc., Scollar, PetPace, Findster Technologies, Kipod, Dogtra, Ecollar Technologies, Huan, Wuff, Pet Tracker, HoneyGuard |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Dog Collar Market Key Technology Landscape

The technological landscape of the Smart Dog Collar Market is defined by the convergence of several high-growth IT sectors, primarily centered around connectivity, sensor integration, and data processing. A core enabling technology is the Global Navigation Satellite System (GNSS), which includes GPS, GLONASS, and Galileo capabilities, essential for providing precise, real-time location data, which is foundational to most smart collars. However, the true advancement lies in shifting connectivity standards from legacy 2G/3G to energy-efficient Low-Power Wide-Area Networks (LPWAN) such as LTE-M and NB-IoT. These cellular technologies offer superior coverage and significantly reduced power consumption compared to traditional mobile data, directly addressing the critical market restraint of battery life and making continuous tracking feasible for weeks, rather than days.

Sensor technology constitutes the intelligence layer of the collars. Accelerometers and gyroscopes provide detailed motion analysis for activity tracking, sleep monitoring, and calorie expenditure calculation. The current technological frontier is the non-invasive measurement of physiological vital signs. This includes specialized bio-impedance sensors or photoplethysmography (PPG) sensors adapted for canine use to reliably track heart rate, heart rate variability (HRV), and respiratory rates through the dog's skin and fur, a complex engineering challenge due to movement artifacts and coat thickness. Temperature sensing, often critical for heatstroke alerts and illness monitoring, is also a standard component, relying on accurate thermal sensors positioned against the pet's body.

Furthermore, cloud computing and proprietary algorithms are indispensable for translating raw sensor output into meaningful insights. The development of sophisticated AI and machine learning models is crucial for interpreting behavioral data (e.g., differentiating playful energy from anxiety) and performing predictive analytics on health trends. The entire technology stack must be seamlessly integrated via robust mobile applications that offer intuitive user interfaces, data visualization, and alert customization. Integration capabilities, such as APIs to connect with veterinary practice management software or wearable ecosystems, further define the competitive technology edge, moving the collar beyond a standalone device into a connected health system.

Regional Highlights

- North America: This region holds the largest market share, driven by high pet ownership rates, substantial disposable income allocated to pet expenditure, and a consumer culture that readily adopts advanced technology. The US and Canada are home to several key innovators and are characterized by a high penetration of geofencing and sophisticated health monitoring systems. Robust cellular network coverage supports reliable, widespread usage of LTE-enabled smart collars. Market growth is sustained by continuous product refinement and strong partnership networks involving veterinary clinics and pet insurance providers.

- Europe: Europe represents the second-largest market, exhibiting steady growth propelled by stringent animal welfare regulations and a cultural emphasis on pet health. Western European countries, particularly the UK, Germany, and France, show high adoption, focusing primarily on GPS tracking for outdoor activities and comprehensive health data. Regulatory compliance, especially concerning data protection (GDPR) and the ethical use of electronic training devices, is a significant regional factor influencing product development and feature sets.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region over the forecast period. This rapid expansion is attributed to increasing urbanization, which has led to a surge in apartment-dwelling pet owners who rely on technology for remote monitoring and location safety. Key growth markets include China, Japan, and South Korea, where investment in 5G infrastructure supports advanced IoT devices. The market here is highly price-sensitive but shows increasing demand for integrated smart home solutions that include pet monitoring.

- Latin America (LATAM): The LATAM market is emerging, with moderate growth driven by increasing economic stability and rising discretionary spending on pet products in countries like Brazil and Mexico. The primary driver in this region is basic theft prevention and location tracking, necessitating cost-effective GPS solutions. Connectivity challenges in rural or underdeveloped areas require hybrid technology solutions utilizing multiple communication protocols to ensure service reliability.

- Middle East and Africa (MEA): This region currently represents the smallest market share but presents specialized growth opportunities, particularly in high-income Gulf Cooperation Council (GCC) countries where luxury pet services are in high demand. Adoption is primarily focused on premium, feature-rich collars. Challenges include varying regulatory environments and infrastructure limitations, limiting the widespread deployment of cellular-dependent smart devices outside major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Dog Collar Market.- Whistle Labs, Inc.

- Fi (Smart Collar)

- Link AKC (PetPace Subsidiary)

- Tractive GmbH

- Garmin Ltd.

- PetSafe (Radio Systems Corporation)

- Halo Collar

- SportDOG Brand

- Wagz, Inc.

- FitBark, Inc.

- Scollar

- PetPace

- Findster Technologies

- Kipod

- Dogtra

- Ecollar Technologies

- Huan

- Wuff

- Pet Tracker

- HoneyGuard (Specialized Monitoring)

Frequently Asked Questions

Analyze common user questions about the Smart Dog Collar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a high-end smart dog collar and its key differentiating factor?

The primary function of a high-end smart dog collar is to provide continuous, non-invasive health monitoring, including vital signs (heart rate, respiration) and detailed activity logs. The key differentiating factor is the integration of AI-driven predictive analytics, which alerts owners to potential health issues before physical symptoms become apparent, moving beyond basic location tracking.

How reliable is the GPS tracking feature in smart collars, and what connectivity is required?

GPS tracking reliability is high, particularly with modern collars that utilize multiple satellite systems (GNSS) and cellular technologies (LTE-M or NB-IoT) for broad coverage. Continuous connectivity requires an active cellular subscription, typically managed through a monthly or annual service fee paid to the collar manufacturer, ensuring real-time data transmission regardless of distance from the owner’s phone.

Are smart dog collars suitable for all breeds and sizes, and what are the limitations regarding battery life?

Most manufacturers offer size variations suitable for dogs weighing 10 pounds and up, though smaller breeds may face limitations due to device weight and bulk. Battery life remains a key constraint, typically ranging from 3 to 14 days, heavily dependent on the tracking frequency set by the user and the signal strength in the usage area; continuous, high-frequency GPS pings drain the battery much faster.

What is the role of subscription services in the smart dog collar market?

Subscription services are fundamental to the market business model. They cover the operational costs of cellular data transmission, cloud storage for collected health and location data, and access to proprietary software features, including AI-powered health reports, specialized behavior analysis, and advanced geofencing functionalities. Without the subscription, most advanced features are disabled.

How do smart collars contribute to preventative veterinary care and pet insurance claims?

Smart collars contribute by collecting objective, longitudinal health data (e.g., changes in sleep, mobility, and vital signs) that aid veterinarians in preventative diagnostics and early intervention planning. Some pet insurance companies are beginning to offer premium discounts or wellness credits for owners who use approved smart monitoring devices, viewing the data as a risk mitigation tool.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager