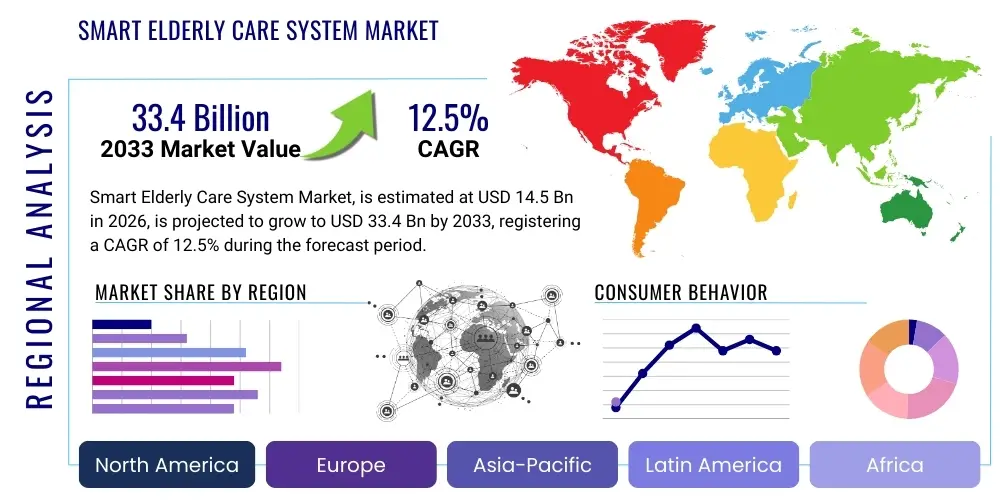

Smart Elderly Care System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437223 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Smart Elderly Care System Market Size

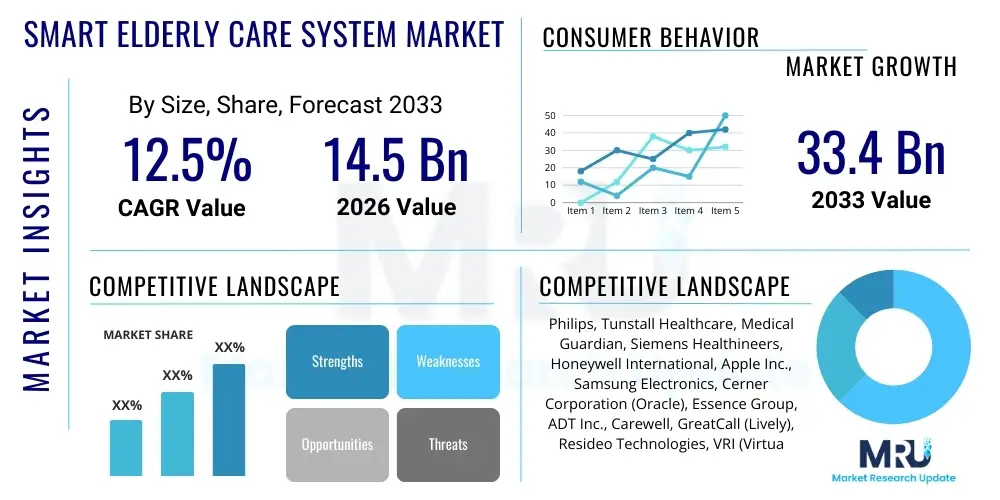

The Smart Elderly Care System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 33.4 Billion by the end of the forecast period in 2033.

Smart Elderly Care System Market introduction

The Smart Elderly Care System Market focuses on integrating advanced technology, including IoT devices, artificial intelligence (AI), robotics, and telecommunication platforms, to provide continuous monitoring, assistance, and improved quality of life for the aging population. These systems move beyond traditional institutional care by enabling seniors to live independently, securely, and comfortably within their own homes or assisted living facilities. Key products include sophisticated remote patient monitoring (RPM) solutions, emergency response systems (PERS), smart home sensors for environmental awareness and fall detection, and personalized health management platforms that analyze real-time biometric data. The evolution of 5G infrastructure and miniaturization of sensors are critical enablers driving the widespread adoption of these solutions across developed and rapidly aging economies.

Major applications of Smart Elderly Care Systems span various facets of geriatric health management, including chronic disease management, proactive safety monitoring, medication adherence tracking, and social engagement facilitation. The primary benefits derived from these integrated systems are substantial: they significantly reduce the economic burden on national healthcare services by minimizing hospital readmissions, enhancing early detection of health crises, and optimizing caregiver resource allocation. Furthermore, they provide peace of mind to family members and caregivers through reliable, always-on monitoring capabilities. The personalized data collection and analysis inherent in these systems allow healthcare providers to transition from reactive treatment models to predictive and preventative care strategies tailored specifically to the needs of each elderly individual.

The market is predominantly driven by profound demographic shifts globally, particularly the accelerated increase in the percentage of the population aged 65 and over. This demographic trend places immense pressure on conventional care models, making scalable and cost-effective smart solutions essential. Other significant driving factors include increasing digital literacy among the elderly and their families, rising disposable incomes in developed nations leading to greater investment in senior well-being technologies, and supportive government initiatives promoting independent living and telemedicine adoption. Technological convergence, marrying medical technology with consumer electronics, ensures continuous product innovation, further fueling market expansion and penetration into diverse residential and clinical environments.

Smart Elderly Care System Market Executive Summary

The Smart Elderly Care System Market is characterized by robust growth, fueled primarily by structural demographic changes and accelerated technological innovation. Current business trends indicate a strong move toward platform-based, interoperable ecosystems rather than standalone devices, facilitating comprehensive data integration for personalized care delivery. Key market players are heavily investing in AI and machine learning capabilities to enhance predictive analytics for fall prevention and early onset detection of cognitive decline. Furthermore, there is a pronounced shift towards subscription-based service models (SaaS and HaaS – Hardware as a Service), ensuring continuous revenue streams and enabling regular software updates and feature improvements, which is highly appealing to institutional caregivers and proactive family consumers.

Regional trends highlight North America and Europe as dominant markets due to high healthcare expenditure, established technological infrastructure, and substantial aging populations demanding sophisticated care solutions. However, the Asia Pacific region is emerging as the fastest-growing market segment. This rapid expansion is driven by huge populations in countries like China and Japan facing critical demographic crises and increasingly adopting government-backed initiatives to deploy smart city and smart home technologies designed specifically for senior welfare. Investment in localized hardware manufacturing and culturally relevant care algorithms is crucial for success in APAC, emphasizing affordable and scalable solutions suitable for dense urban and developing rural environments.

Segment trends reveal that the Monitoring & Safety Systems segment, particularly centered around remote patient monitoring (RPM) and personal emergency response systems (PERS), currently holds the largest market share. However, the Robotics and Assistive Technology segment, including companion robots and automated mobility aids, is projected to exhibit the highest growth CAGR over the forecast period, reflecting advancements in mechanical engineering and AI-human interaction design. Within the end-user segmentation, the home care setting dominates the market due to the overwhelming preference among seniors for aging in place, although assisted living facilities and hospitals remain significant institutional adopters, leveraging these systems for enhanced operational efficiency and compliance monitoring.

AI Impact Analysis on Smart Elderly Care System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Smart Elderly Care System Market primarily center on issues of data privacy, predictive accuracy, and the extent to which automation might dehumanize caregiving. Common questions analyze the potential of AI to accurately predict health emergencies (like strokes or heart attacks) days before symptoms manifest, assess the reliability of AI-driven fall detection systems in complex environments, and address the ethical considerations of using AI for cognitive assessments and behavior monitoring. Furthermore, users frequently question the integration challenges of different AI models (e.g., computer vision vs. natural language processing) and the necessary regulatory framework required to ensure secure and trustworthy deployment of these advanced systems in sensitive healthcare settings, seeking assurance that AI enhances, rather than replaces, essential human interaction and empathy in elder care.

- AI enables highly accurate predictive analytics for proactive health intervention, minimizing emergency room visits.

- Machine learning algorithms personalize care plans based on real-time biometric and behavioral data inputs.

- Natural Language Processing (NLP) facilitates sophisticated voice command interfaces and companion chatbot interactions, addressing social isolation.

- Computer vision and deep learning enhance fall detection accuracy by differentiating critical events from normal movements, reducing false alarms.

- AI optimizes logistical management in assisted living facilities, improving resource allocation and staff efficiency.

- Ethical AI frameworks are critical for maintaining data privacy, ensuring transparency, and addressing algorithmic bias in senior care recommendations.

- Automated medication management systems utilize AI for adherence tracking and issuing timely dosage reminders.

- AI-driven anomaly detection identifies subtle changes in vital signs or mobility patterns indicative of underlying health deterioration.

DRO & Impact Forces Of Smart Elderly Care System Market

The Smart Elderly Care System Market is powerfully shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the Impact Forces influencing market direction and velocity. The primary driver is the accelerating global demographic aging trend coupled with government mandates promoting digital health infrastructure and home-based care models. These factors generate consistent demand for scalable, technologically advanced solutions that can handle the volume and complexity of geriatric care efficiently. Conversely, the market faces significant restraints, notably the high initial cost of deploying integrated smart systems, persistent user concerns regarding data security and privacy compliance (especially concerning HIPAA and GDPR), and a prevalent resistance to technology adoption among certain segments of the elderly population who lack digital proficiency or perceive these systems as invasive.

Opportunities for exponential growth reside in expanding geographical reach into untapped developing economies experiencing rapid urbanization and aging, and developing hyper-personalized, preventative care models powered by advanced sensor technology and AI. The integration of 5G networks presents a massive opportunity to facilitate real-time, high-fidelity data transmission necessary for complex remote surgical guidance and advanced telemedicine applications. Furthermore, market players can capitalize on strategic partnerships between technology firms and traditional healthcare providers to streamline adoption and ensure clinical validation of new smart elderly care products. Focusing on creating intuitive, user-friendly interfaces that minimize the learning curve for seniors and caregivers will be pivotal to unlocking broader market acceptance.

The impact forces exerted by these factors ensure a high degree of market volatility and rapid innovation. The aging population driver consistently applies upward pressure on demand, while the restraint of stringent regulatory environments, particularly concerning medical device certification and patient data handling, acts as a brake on speed-to-market for new entrants. The overall resultant impact is a market trending strongly upward, but one that rewards companies focusing on security, interoperability, and demonstrated clinical efficacy. Success relies on balancing advanced technological complexity with accessible, affordable, and trustworthy product design that addresses the core need for safety, independence, and improved quality of life for the elderly, thereby mitigating psychological resistance to technological integration in personal spaces.

Segmentation Analysis

The Smart Elderly Care System market is extensively segmented based on the component type, technology, application, and end-user, reflecting the diversity of needs within the geriatric care spectrum. Component segmentation differentiates between hardware (sensors, wearables, monitoring devices), software (data analytics platforms, mobile applications), and services (installation, maintenance, and cloud services). This segmentation is crucial for understanding the value proposition of system integrators versus hardware manufacturers. The high growth rate projected for the software and services segment underscores the market's transition towards subscription-based, continuous care models centered on data utilization and predictive maintenance.

Application segmentation reveals key investment areas, spanning chronic disease management, independent living solutions (like home automation for seniors), cognitive health monitoring, and emergency response. End-user analysis distinctly separates demand generated by individuals aging in place (home care settings), which currently dominates the market, from institutional demand originating from assisted living facilities (ALFs) and hospitals. Understanding these segments allows providers to tailor marketing strategies, focusing either on consumer-facing products for home use or enterprise solutions requiring stringent compliance and large-scale deployment capabilities for institutional clients.

The convergence of diverse technological elements is particularly defining. Key technological segments include IoT and sensor technology (the foundation for data collection), telehealth and remote communication systems, and advanced robotics for assistance and companionship. The trend indicates that future market leadership will belong to companies that successfully integrate AI/ML into all these technological layers, transforming raw data collected by IoT sensors into actionable, real-time insights accessible via seamless telehealth platforms, ensuring holistic and responsive care delivery across all defined market segments.

- By Component:

- Hardware (Sensors, Wearable Devices, Communication Modules)

- Software (Data Analytics Platforms, Mobile Applications, Cloud Computing Solutions)

- Services (Consulting, Implementation, Maintenance, Managed Services)

- By Technology:

- Wired Communication

- Wireless Communication (Wi-Fi, Bluetooth, Zigbee, NFC, 5G)

- Internet of Things (IoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Robotics and Automation

- By Application:

- Safety and Security Monitoring (Fall Detection, Intruder Alarms)

- Remote Health Monitoring and Diagnosis (Telehealth)

- Medication Management and Adherence

- Cognitive and Behavior Monitoring

- Social Interaction and Engagement

- By End-User:

- Home Care Setting (Aging in Place)

- Assisted Living Facilities and Nursing Homes

- Hospitals and Clinics

Value Chain Analysis For Smart Elderly Care System Market

The value chain for the Smart Elderly Care System Market begins with upstream activities focused on the procurement and manufacturing of sophisticated electronic components, including highly sensitive biosensors, low-power microprocessors, and secure communication chips. Key activities in this stage involve research and development for miniaturization and battery life optimization, ensuring devices are comfortable, discreet, and reliable for continuous wear or environmental integration. Component suppliers often face challenges related to regulatory compliance (FDA/CE approval) for medical-grade hardware, making robust quality control a vital upstream activity. Innovation in material science and wireless protocol security is critical here to establish a strong foundational technology base for downstream integration.

Midstream activities encompass the integration and platform development phase, where core value is added by combining disparate hardware components into a cohesive smart system and developing the proprietary software platform necessary for data aggregation and analysis. This phase involves creating secure cloud infrastructure, developing intuitive user interfaces for caregivers and seniors, and applying AI/ML models to raw sensor data to generate actionable health insights. System integrators and dedicated software companies play a dominant role in this midstream section, focusing on interoperability standards (e.g., HL7, FHIR) to ensure seamless communication between various monitoring devices and existing Electronic Health Record (EHR) systems used by healthcare providers. Differentiation at this stage relies heavily on data security architecture and the robustness of analytical capabilities.

Downstream activities center on distribution, sales, installation, and ongoing support services. Products reach end-users through multiple distribution channels: direct sales to large institutional clients (hospitals, ALFs), partnerships with traditional healthcare equipment distributors, and increasingly, direct-to-consumer e-commerce channels targeting families opting for home care solutions. Indirect channels, such as partnerships with insurance providers or governmental social services, are crucial for reaching large user bases and facilitating reimbursement schemes. The final stage involves extensive customer service and technical support, providing maintenance and managing subscription services, which ensures long-term customer retention and sustained revenue. Effective installation and personalized training are paramount to overcoming technological barriers faced by the elderly end-user.

Smart Elderly Care System Market Potential Customers

The primary and largest segment of potential customers for Smart Elderly Care Systems comprises seniors aged 65 and above, particularly those living independently or desiring to age in place, often dealing with one or more chronic conditions such as diabetes, hypertension, or mild cognitive impairment. This consumer group, or more accurately, their immediate family members (the purchasers and decision-makers), seek systems that offer safety, emergency response capabilities, and continuous passive monitoring without infringing on personal autonomy. Products appealing to this segment must emphasize ease of use, non-intrusive design, reliability, and guaranteed emergency connectivity, often sold through direct-to-consumer models or via authorized home healthcare service providers who incorporate the technology into comprehensive care packages.

A significant institutional customer base includes Assisted Living Facilities (ALFs), skilled nursing homes, and major hospital systems. These organizations purchase smart systems not only to improve patient safety and care quality but also to achieve operational efficiencies, reduce staffing costs, and enhance regulatory compliance. For ALFs, integrated systems that monitor resident location, movement, and general well-being are crucial for optimizing staff rounds and quickly responding to incidents. Hospitals utilize these systems, particularly telehealth and RPM solutions, to manage post-discharge care, reduce readmission rates, and extend clinical monitoring capabilities beyond the physical confines of the facility, often procuring solutions via B2B contracts requiring high levels of integration with existing IT infrastructure.

Furthermore, government health agencies, municipal elder services, and private health insurance providers represent influential potential customers, acting as large-scale purchasers or facilitators. Governments often deploy smart systems as part of broader public health initiatives aimed at reducing the overall cost burden of geriatric care on the state, focusing on preventative measures. Private insurance companies increasingly invest in these technologies as a tool for preventative risk management, offering subsidized devices to policyholders to encourage healthier behaviors and reduce costly acute care interventions. These institutional buyers prioritize solutions that demonstrate clear return on investment (ROI), evidence-based clinical efficacy, and proven scalability across diverse populations and environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 33.4 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Philips, Tunstall Healthcare, Medical Guardian, Siemens Healthineers, Honeywell International, Apple Inc., Samsung Electronics, Cerner Corporation (Oracle), Essence Group, ADT Inc., Carewell, GreatCall (Lively), Resideo Technologies, VRI (Virtual Radiologic), Bay Alarm Medical, Life Alert, Sensara, Konica Minolta, E-Care, Get Safe |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Elderly Care System Market Key Technology Landscape

The technological backbone of the Smart Elderly Care System Market is characterized by the convergence of several high-growth domains, fundamentally shifting care delivery from reactive to predictive. Core to this landscape is the ubiquitous deployment of the Internet of Things (IoT) and advanced sensor technologies. These include physiological sensors (monitoring heart rate, blood pressure, glucose levels), environmental sensors (detecting temperature, air quality, gas leaks), and motion sensors (crucial for fall detection and activity tracking). These diverse data points require robust, low-power connectivity protocols like Bluetooth Low Energy (BLE), Zigbee, and increasingly, specialized low-power wide-area networks (LPWAN) like LoRaWAN, which ensure extended battery life and reliable transmission of critical data from home environments to centralized platforms.

Another defining technology is Artificial Intelligence (AI) and Machine Learning (ML). AI algorithms are necessary to process the massive volumes of heterogeneous data generated by IoT devices, transforming raw telemetry into meaningful clinical insights. ML models are deployed to learn individual baseline behaviors, enabling them to flag anomalies indicative of deteriorating health or potential safety hazards much faster and more accurately than human observation alone. Furthermore, AI powers predictive maintenance for the care systems themselves and enhances the utility of virtual assistants and companion robots, facilitating intuitive, voice-activated interactions that improve user engagement and compliance, thereby lowering the friction associated with technology use for the elderly.

Telehealth and robust secure cloud computing infrastructure form the communication and storage layer. Telehealth platforms provide the necessary secure video and audio conferencing tools for remote consultations, allowing clinicians to manage chronic conditions effectively without requiring patient travel. The shift to 5G connectivity is drastically improving the quality and latency of these telehealth interactions, potentially enabling real-time remote diagnostics and robotic assistance. Finally, specialized medical robotics, encompassing both mobile assistive robots for tasks like fetching items and stationary monitoring robots, represent a rapidly maturing segment, utilizing advanced navigation and manipulation algorithms to offer physical assistance and emotional companionship, addressing both mobility limitations and issues of social isolation prevalent among the elderly population.

Regional Highlights

- North America: Dominates the market share due to high consumer awareness, substantial healthcare spending, the presence of major technology and healthcare companies, and favorable reimbursement policies for Remote Patient Monitoring (RPM) and telehealth services. The US market emphasizes advanced AI integration in predictive health analytics and strong regulatory oversight ensuring high data security standards (HIPAA compliance).

- Europe: Characterized by strong government support for digital health initiatives, particularly in Scandinavia and Western Europe (UK, Germany). High adoption rates are driven by the need to manage rising healthcare costs associated with large aging populations. The market focuses heavily on data privacy, influenced by the strict requirements of GDPR, leading to robust security features in system design.

- Asia Pacific (APAC): Fastest-growing region globally, spurred by rapidly aging populations in Japan, South Korea, and China, coupled with increasing government investment in smart city infrastructure focused on elder care. The market demands highly scalable, affordable solutions suitable for dense populations and diverse economic backgrounds, often prioritizing localized languages and cultural adaptations in system interfaces.

- Latin America (LATAM): Exhibits emerging growth driven by increasing internet penetration and rising middle-class disposable income, particularly in Brazil and Mexico. Market adoption is currently focused on essential security and Personal Emergency Response Systems (PERS), with potential for rapid expansion as telemedicine regulations become more formalized and supportive of remote monitoring technologies.

- Middle East and Africa (MEA): Represents a nascent market with significant potential concentrated in the GCC states (UAE, Saudi Arabia) where high wealth enables investment in advanced, often imported, elderly care technologies. Growth is primarily centered around luxury assisted living facilities and specialized high-tech home care services targeting expatriate and affluent local populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Elderly Care System Market.- Philips

- Tunstall Healthcare

- Medical Guardian

- Siemens Healthineers

- Honeywell International

- Apple Inc.

- Samsung Electronics

- Cerner Corporation (Oracle)

- Essence Group

- ADT Inc.

- Carewell

- GreatCall (Lively)

- Resideo Technologies

- VRI (Virtual Radiologic)

- Bay Alarm Medical

- Life Alert

- Sensara

- Konica Minolta

- E-Care

- Get Safe

Frequently Asked Questions

Analyze common user questions about the Smart Elderly Care System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Smart Elderly Care System Market?

The Smart Elderly Care System Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven by global demographic aging and advancements in integrated healthcare technologies.

Which segment holds the largest share in the Smart Elderly Care System Market?

The Home Care Setting segment, under the End-User classification, currently holds the largest market share, reflecting the widespread preference among seniors globally to age in place using advanced remote monitoring and safety systems.

How does AI technology benefit Smart Elderly Care Systems?

AI significantly enhances Smart Elderly Care Systems by providing predictive analytics for health risks, personalizing care protocols, improving the accuracy of fall detection, and facilitating social interaction through sophisticated companion applications and robotics.

What are the key restraints impacting market growth?

Key restraints include the high initial cost of deploying comprehensive smart systems, complexity in ensuring strict data privacy compliance (like HIPAA and GDPR), and overcoming technological resistance and lack of digital literacy among some elderly users.

Which region is expected to demonstrate the fastest market growth?

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market, propelled by rapidly aging populations in major economies like China and Japan and increased governmental funding for smart technology integration in public elder welfare programs.

The comprehensive analysis provided herein underscores the significant opportunity within the Smart Elderly Care System Market, driven by macro-level demographic trends and continuous technological innovation, demanding strategic investments in secure, interoperable, and user-centric care solutions. The market trajectory is firmly positioned towards preventative, AI-enabled, and home-based care models, redefining geriatric support globally.

Further market analysis indicates that the integration of virtual reality (VR) and augmented reality (AR) technologies, while currently nascent, represents a long-term transformative opportunity, particularly for cognitive engagement and rehabilitation services. VR environments can offer safe, controlled spaces for physical therapy and cognitive stimulation, directly addressing mental wellness and mobility challenges faced by the elderly. This shift requires overcoming technical hurdles related to user comfort and ease of interface, but promises a highly immersive and personalized therapeutic experience.

The regulatory landscape remains a persistent variable impacting innovation speed. As smart elderly care systems increasingly move into diagnosing or providing critical health monitoring services, they fall under stricter classifications as medical devices. Navigating the complex regulatory requirements of bodies like the FDA in the US and the EMA in Europe necessitates substantial financial investment and rigorous clinical validation, particularly for software-as-a-medical-device (SaMD) solutions that rely on AI algorithms for diagnostic support. Compliance often requires robust partnerships between traditional med-tech firms and agile software developers to ensure both technological edge and regulatory adherence.

An emerging trend involves the adoption of blockchain technology for enhancing data security and interoperability. While currently in the exploratory phase, blockchain could provide an unchangeable, decentralized ledger for managing longitudinal health records generated by multiple smart devices. This would solve current fragmentation issues, allowing various care providers (from primary physicians to emergency services) to access reliable, verified patient data securely and instantaneously, thereby improving coordination and minimizing medical errors, which are critical concerns in elderly care management.

Investment trends show a clear preference for companies that offer integrated platform solutions rather than single-function devices. Venture capital funding is increasingly flowing towards firms specializing in data harmonization and predictive algorithm development, demonstrating that the future value of smart elderly care lies not just in the hardware, but overwhelmingly in the intelligence derived from the aggregated data. Acquisitions and strategic partnerships are focused on building holistic ecosystems that can handle the full spectrum of elder care needs, from minor daily assistance to emergency medical intervention.

The market in China, specifically, warrants dedicated focus due to its massive scale and unique policy framework. The Chinese government is actively subsidizing smart care technology deployment in both urban and rural settings to cope with rapid aging and the shrinking traditional family caregiver structure. This results in huge opportunities for manufacturers that can produce high-quality, government-certified systems at competitive price points, often necessitating localized manufacturing and sophisticated supply chain management tailored to regional logistics.

The shift towards preventive healthcare necessitates proactive marketing and education campaigns. For smart elderly care systems to achieve mass market penetration, consumers must be convinced of the long-term cost savings and quality-of-life improvements, moving beyond the perception that these devices are only for frail or acutely ill seniors. Marketing efforts are increasingly targeting the "young-old" segment (aged 65-75), who are more digitally savvy and are proactively adopting these technologies to maintain an active lifestyle and preemptively manage health risks, viewing them as tools for wellness rather than solely for crisis response.

Furthermore, workforce training presents a critical challenge and opportunity. The widespread deployment of smart systems requires caregivers and nursing staff to be proficient in utilizing complex digital interfaces and interpreting AI-generated reports. Companies offering comprehensive training and certification programs for healthcare professionals on their specific platforms are gaining a competitive edge, ensuring that the technology is utilized effectively, maximizing patient safety and minimizing operational disruption within institutional settings.

The long-term success of personalized care relies heavily on non-invasive monitoring techniques. Advanced radar-based sensing, which monitors vital signs and movements without physical contact (i.e., through walls or clothes), is a technology gaining traction. These systems address the comfort and privacy concerns associated with wearable devices, offering continuous, passive data collection that is especially valuable for monitoring sleep quality and breathing patterns in high-risk individuals without compromising their comfort or sense of autonomy.

In terms of competitive landscape, market consolidation is expected. Large technology conglomerates (like Apple, Google, Amazon) are entering the peripheral healthcare space, leveraging their vast consumer device ecosystems and cloud infrastructure to integrate elder care features seamlessly into everyday consumer electronics. This introduces intense competitive pressure on specialized care providers, forcing them to focus rigorously on clinical specialization, regulatory compliance, and deeper integration with established medical infrastructure to maintain relevance and market share.

The emphasis on mental and emotional well-being is driving innovation in social robotics and AI companions. These non-medical applications, designed to combat loneliness and stimulate cognitive function, are becoming increasingly sophisticated, utilizing advanced Natural Language Processing (NLP) to engage in meaningful conversation and offer personalized cognitive exercises. While not direct substitutes for human interaction, these solutions offer scalable support for emotional health, particularly vital in communities with limited access to frequent human companionship.

Finally, affordability and accessibility remain pivotal for sustained global growth. Developing cost-effective, modular systems that allow users to scale services based on need and budget is essential for penetrating lower-income brackets and emerging markets. The trend towards leased or subsidized hardware models, often in conjunction with governmental or insurance subsidies, is making advanced smart care accessible to a broader demographic, moving these systems from luxury items to essential health management tools.

Technological refinement is ongoing in energy efficiency. Smart devices require reliable, long-lasting power sources, especially those used in remote or unsupervised settings. Innovations in battery technology, including solid-state batteries and improved energy harvesting techniques, are crucial for ensuring continuous operation and reducing the burden of frequent recharging or battery replacement for elderly users and caregivers, enhancing the reliability of the entire care ecosystem.

The ethical framework surrounding autonomous decision-making in smart systems is gaining legislative attention. As AI moves from simple monitoring to suggesting or executing interventions (e.g., automatically adjusting room temperature or alerting emergency services), clear protocols regarding liability, transparency, and accountability must be established. This governance requirement will influence future product design, mandating built-in human oversight capabilities and comprehensive data logging for auditing purposes.

Furthermore, cross-sector collaboration between automotive technology firms and elderly care system providers is emerging, particularly in safety and mobility applications. Leveraging advanced sensor technologies developed for autonomous vehicles (like LiDAR and high-resolution radar) is enhancing the precision of in-home movement tracking and fall anticipation, offering extremely reliable spatial awareness that transcends the capabilities of traditional motion detectors.

The professional training deficit regarding digital health tools represents a significant bottleneck. Clinical staff often lack the specific skills required to fully leverage the diagnostic and administrative features of integrated smart care platforms. To address this, providers are offering gamified learning modules and continuous professional development credits (CPDs) to ensure widespread, competent adoption of the technology, turning skeptical users into effective advocates for smart systems.

The market for Smart Elderly Care Systems is highly susceptible to macro-economic forces, particularly government budgetary constraints and public healthcare funding allocations. Periods of fiscal austerity can slow institutional adoption, making consumer-driven demand and private insurance coverage increasingly critical revenue streams. Conversely, targeted government stimulus focusing on infrastructure or digital transformation can rapidly accelerate market uptake, particularly in subsidized long-term care settings.

The rising prevalence of chronic conditions among the elderly population directly correlates with the demand for sophisticated monitoring solutions. Smart systems designed specifically for managing complex conditions like multi-morbidity, where patients require simultaneous monitoring of several physiological parameters, are experiencing exceptional growth. These integrated platforms offer clinicians a consolidated view of patient status, significantly improving coordination of care across different specialties and reducing potential drug interactions.

Finally, the standardization of communication protocols is essential for future growth and competition. Lack of universal standards for data exchange between different manufacturers' devices creates silos and hampers the development of truly comprehensive care ecosystems. Industry alliances and regulatory push towards open APIs and common standards (such as Continua Design Guidelines) are necessary steps to foster interoperability, which is vital for consumer acceptance and clinical efficiency in multi-vendor environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager