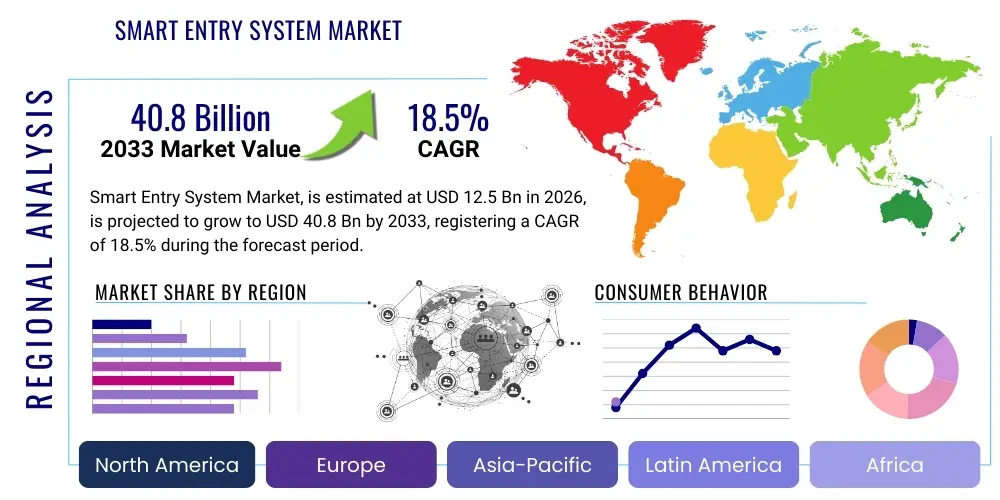

Smart Entry System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438844 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Smart Entry System Market Size

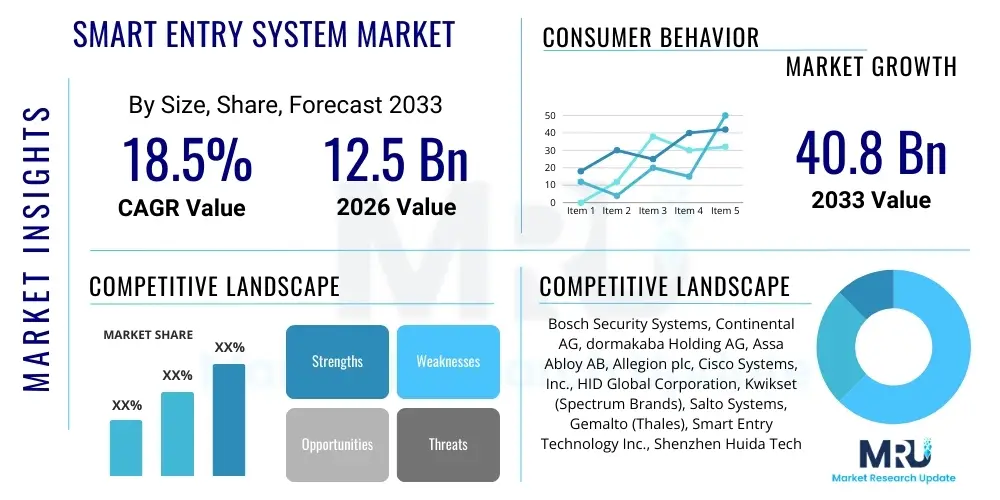

The Smart Entry System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $40.8 Billion by the end of the forecast period in 2033.

Smart Entry System Market introduction

The Smart Entry System Market encompasses advanced technological solutions designed to manage and control access to physical spaces, vehicles, and assets through digital authentication and credentials. These systems move beyond traditional keys and magnetic cards, utilizing sophisticated methods such as biometrics (fingerprint, facial recognition), near-field communication (NFC), radio-frequency identification (RFID), Bluetooth, and mobile app integration. The core product offering includes smart locks, keyless entry modules, integrated sensors, biometric scanners, and centralized management software platforms that enhance security, convenience, and operational efficiency across various applications. These systems are critical components of modern smart infrastructure, providing granular control over who enters a location and when, logging all access events for audit and compliance purposes. The transition towards connected devices and the Internet of Things (IoT) architecture is fundamentally redefining smart entry solutions, integrating them seamlessly with broader building management systems (BMS) and vehicle telematics platforms, ensuring real-time monitoring and remote management capabilities.

Major applications of smart entry systems span critical sectors, most notably automotive, residential, and commercial spaces. In the automotive industry, smart entry systems allow drivers to lock, unlock, and start vehicles without physically handling a key fob, utilizing passive entry and passive start (PEPS) technology, significantly boosting consumer convenience and theft prevention measures. Within residential markets, these systems replace traditional deadbolts with connected locks, offering homeowners remote access control, visitor management features, and integration with smart home ecosystems like Google Home or Amazon Alexa. Commercial applications, including corporate offices, data centers, and government facilities, leverage these advanced systems for high-security access control, enabling features like multi-factor authentication, timed access restrictions, and detailed historical tracking of personnel movement. The demand is further fueled by the need for regulatory compliance, particularly in industries handling sensitive information or requiring strict adherence to security protocols, making robust access logging a necessity.

Key benefits driving the adoption of smart entry systems include unparalleled security enhancements through sophisticated encryption and multi-factor verification; improved user convenience by eliminating the hassle of physical keys; and enhanced operational visibility through centralized digital auditing and reporting tools. Furthermore, these systems offer scalability, allowing organizations to easily add or revoke access rights dynamically, which is crucial for managing employee turnover or changing security requirements. Driving factors propelling market expansion include the exponential growth in smart city initiatives globally, the increasing adoption of IoT and AI technologies in security infrastructure, the rising consumer preference for keyless vehicle entry in the luxury and mid-range automotive segments, and the ongoing need to upgrade aging mechanical security infrastructure in commercial and residential buildings to combat sophisticated modern intrusion methods. The convergence of physical security with cybersecurity protocols ensures a holistic approach to asset protection, validating the necessity of these integrated systems.

Smart Entry System Market Executive Summary

The Smart Entry System Market is characterized by robust growth, primarily driven by rapid advancements in biometric authentication and the widespread integration of IoT devices across consumer and enterprise sectors. Current business trends indicate a strong move towards subscription-based software services (SaaS) for access management, offering companies lower upfront costs and continuous feature updates, particularly in the commercial real estate segment. Furthermore, strategic alliances between automotive original equipment manufacturers (OEMs) and technology providers are accelerating the deployment of advanced passive entry systems, turning the vehicle itself into a connected access point. Key market players are heavily investing in developing tamper-proof hardware and highly secure, decentralized data storage solutions, such as blockchain-based identity management, to address growing privacy and data security concerns associated with biometric data utilization. The competitive landscape is intensely focused on ecosystem compatibility, ensuring smart entry products can communicate effectively with existing smart home and smart building platforms, thus increasing overall consumer appeal and adoption rates across different technological standards.

Regionally, North America and Europe currently dominate the market due to high technology penetration, stringent regulatory requirements for physical security in critical infrastructure, and high consumer disposable income supporting the adoption of premium smart home technologies. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive urbanization, large-scale smart city projects, and the rapid expansion of the automotive manufacturing sector, especially in countries like China, India, and South Korea. These developing economies are often leapfrogging older security technologies, directly implementing advanced IoT-enabled smart entry solutions in new construction projects. Segment-wise, the biometric systems segment is witnessing explosive growth, driven by the inherent accuracy and convenience they offer compared to PIN codes or RFID cards. Within applications, the residential sector is demonstrating consistent growth supported by mass-market acceptance of affordable smart locks, while the commercial sector remains the largest revenue generator, demanding complex, highly scalable integrated access control solutions for large office campuses and industrial facilities. The integration of 5G networks is also significantly boosting market performance, providing the low latency and high bandwidth necessary for real-time remote access control and data transmission.

AI Impact Analysis on Smart Entry System Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Smart Entry System Market center primarily on enhanced security, predictive capabilities, and ethical considerations surrounding biometrics. Users frequently ask how AI can prevent unauthorized access more effectively than traditional methods, querying the role of machine learning in detecting anomalies and recognizing sophisticated spoofing attempts. Key themes revolve around predictive access control—the ability of systems to learn user behavior patterns (e.g., typical entry times, routes) to anticipate and streamline access, or conversely, flag unusual activity for immediate security review. Concerns about data privacy, bias in facial recognition algorithms, and regulatory compliance (like GDPR or CCPA) regarding the massive datasets generated by AI-driven biometric systems are also prevalent. Users expect AI to reduce false acceptance rates (FAR) and false rejection rates (FRR) significantly, improving both security and user experience. The analysis reveals a strong user expectation for AI to transform reactive security into proactive, self-learning intelligent entry management.

- AI enhances biometric accuracy, reducing False Acceptance Rates (FAR) and False Rejection Rates (FRR) through adaptive machine learning algorithms trained on diverse datasets.

- Predictive Access Control: AI analyzes historical traffic data and user behavior patterns to optimize resource allocation and anticipate potential security threats before they materialize.

- Anomaly Detection: Machine learning identifies unusual access attempts, temporal deviations, or abnormal traffic flow, flagging suspicious events instantly for human intervention.

- Improved Liveness Detection: AI algorithms sophisticatedly distinguish between genuine users and static attempts (photos, masks, deepfakes), mitigating spoofing attacks on facial recognition systems.

- Automated Incident Response: Integration of AI enables smart entry systems to trigger autonomous responses, such as locking down specific zones or notifying authorities, based on the severity of the detected threat.

- Energy and Efficiency Optimization: AI manages access times and lighting/HVAC integration based on expected occupancy derived from learned entry patterns, contributing to smart building efficiency.

DRO & Impact Forces Of Smart Entry System Market

The Smart Entry System Market is subject to powerful Drivers, significant Restraints, and numerous Opportunities, creating a dynamic set of Impact Forces that shape its trajectory. The primary driver is the accelerating global adoption of IoT ecosystems in both commercial infrastructure and residential homes, which necessitates seamless, secure digital access solutions. Coupled with this is the continuous decline in the cost and size of biometric sensors and microprocessors, making advanced entry systems economically viable for mass-market deployment. However, market growth faces substantial restraints, including pervasive concerns over data security and privacy breaches, particularly involving sensitive biometric data, which can deter consumer trust. Furthermore, the lack of standardization and interoperability between proprietary smart entry platforms creates fragmentation, posing integration challenges for large-scale deployments. Opportunities abound in emerging economies characterized by rapid infrastructure modernization and in the burgeoning trend of Mobility-as-a-Service (MaaS), which requires fluid and secure keyless access solutions for shared vehicles and micro-mobility options. These forces collectively dictate market penetration, profitability, and the speed of technological evolution.

Key drivers include stringent regulatory mandates regarding physical security in sensitive industries (like finance and healthcare) and the pervasive consumer demand for convenience features, particularly in the automotive segment where keyless entry has become a standard expectation rather than a luxury add-on. The rising threat of sophisticated physical intrusion and corporate espionage also compels organizations to invest in cutting-edge, verifiable access technologies, replacing unreliable mechanical locks. The major restraining factor remains the high initial cost of fully integrated, enterprise-level smart entry systems, which includes hardware installation, software licensing, and necessary networking infrastructure upgrades, potentially pricing out small and medium enterprises (SMEs). Moreover, the complexity of managing a diverse ecosystem of connected devices and ensuring continuous software updates against new cyber threats requires specialized IT expertise, acting as a barrier to entry for end-users lacking internal technical support.

Significant opportunities lie in the integration of blockchain technology for decentralized identity management, promising enhanced data security and transparency in access logs, directly addressing privacy concerns and boosting regulatory compliance. The expansion into niche markets, such as smart lockers for e-commerce delivery and secure access for drone landing platforms in urban environments, presents new revenue streams. The collective impact forces push the market toward greater consolidation among technology providers, focusing competition on the seamless delivery of integrated, multi-modal access solutions that combine speed, security, and scalability. The rapid pace of technological innovation, particularly in edge computing which enables faster, localized biometric processing, acts as a continuous upward force on market valuation, demanding constant adaptation from incumbents and opening pathways for specialized startups focusing on specific authentication modalities or industry verticals.

Segmentation Analysis

The Smart Entry System Market segmentation provides a detailed structural breakdown based on technology, component type, application sector, and regional adoption patterns, allowing for precise market targeting and strategic decision-making. The segmentation by technology highlights the shift from traditional keypads and RFID towards advanced biometrics, reflecting the industry's focus on enhanced security and user experience. Component segmentation differentiates between the physical hardware (locks, scanners), the necessary software platforms (access management, analytics), and essential integration services, acknowledging the importance of both tangible products and digital enablement. Application segmentation reveals the diverse end-user base, with the Automotive and Commercial sectors dominating revenue due to high-volume manufacturing needs and stringent enterprise security requirements, respectively. This granular analysis is crucial for understanding specific growth pockets and tailoring product development to meet the unique needs of each segmented market sub-set.

- By Technology:

- Biometric Systems (Fingerprint, Facial Recognition, Iris/Retina Scan)

- Keypad/Code-based Systems

- RFID/NFC/Smart Card Systems

- Bluetooth/Mobile App Based Systems

- By Component:

- Hardware (Smart Locks, Controllers, Sensors, Readers, Key Fobs)

- Software (Access Control Management Systems, Mobile Applications)

- Services (Installation, Maintenance, Cloud Integration)

- By Application:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Residential (Single-family Homes, Multi-family Apartments)

- Commercial & Institutional (Corporate Offices, Retail, Healthcare, Data Centers, Educational Institutions)

- Industrial (Manufacturing Plants, Warehouses, Logistics Hubs)

Value Chain Analysis For Smart Entry System Market

The Value Chain for the Smart Entry System Market begins with Upstream activities centered on the procurement and fabrication of highly specialized electronic components, including semiconductor chips, biometric sensors, advanced microcontroller units (MCUs), and high-grade materials for robust physical housing. Key upstream players include specialized sensor manufacturers, semiconductor foundries, and raw material suppliers who must meet strict quality standards for durability and performance in diverse environmental conditions (e.g., automotive use or outdoor residential installation). The competitiveness at this stage is driven by miniaturization capabilities, cost-effective production, and the ability to source highly reliable cryptographic processors necessary for secure data transmission and storage, fundamentally impacting the final product's performance and security features. Strong relationships with dedicated semiconductor manufacturers are crucial, given the global supply chain sensitivities impacting electronic component availability and pricing.

Midstream activities involve the design, assembly, and manufacturing of the final smart entry systems, converting raw components into functional hardware units (smart locks, access readers, control panels) and developing the proprietary firmware and access management software. This stage demands intense R&D investment, particularly in algorithms for biometric processing and software compatibility layers that enable integration with third-party systems. Manufacturers must adhere to stringent industry standards (such as ISO certifications for security and quality) and focus on ergonomic design for user acceptance, especially in consumer-facing products. The distinction between Original Equipment Manufacturers (OEMs) specializing in automotive systems and those focusing on standalone commercial access control units defines the primary production methodologies and quality assurance protocols within the midstream segment.

Downstream activities focus on distribution, sales, installation, and post-sales services. Distribution channels are bifurcated into Direct and Indirect models. Direct channels involve OEMs supplying directly to large clients (e.g., auto manufacturers or major commercial integrators), providing custom solutions and long-term service contracts. Indirect channels utilize a network of distributors, value-added resellers (VARs), system integrators, and e-commerce platforms to reach residential consumers and SMEs. Installation and maintenance services are critical, often requiring certified technicians due to the complexity of integrating networked hardware and software security protocols. The continuous delivery of software updates, cloud-based monitoring, and data analytics services through subscription models now forms a substantial part of the downstream value proposition, ensuring ongoing security integrity and maximizing customer lifetime value. Effective downstream management is essential for market penetration and maintaining customer satisfaction.

Smart Entry System Market Potential Customers

The primary end-users and buyers of Smart Entry Systems are highly diverse, spanning both business-to-consumer (B2C) and business-to-business (B2B) markets, necessitating tailored marketing and product strategies. In the B2C space, potential customers include homeowners and residents of multi-family dwellings who prioritize convenience, keyless access, and remote monitoring capabilities as part of their broader smart home ecosystem. They seek easy-to-install, aesthetically pleasing products with intuitive mobile interfaces. The adoption rate in this segment is strongly correlated with increased home automation penetration and perceived ease of use, often driven by marketing campaigns emphasizing lifestyle improvement and family safety. This segment typically purchases through retail channels, specialized smart home installers, or e-commerce platforms, valuing simple installation instructions and interoperability with existing voice assistants.

In the B2B sector, the most significant customers are the Automotive Original Equipment Manufacturers (OEMs), who integrate passive entry and start systems into new vehicle models to meet evolving consumer expectations for advanced features. Commercial and institutional entities form the largest revenue base, including major corporations, financial institutions, government buildings, and healthcare providers that require highly secure, scalable, and auditable access control solutions for managing large employee populations and protecting sensitive assets. These buyers prioritize systems compliant with industry-specific regulations, often demanding seamless integration with existing HR management systems and video surveillance infrastructure. The focus here is on total cost of ownership (TCO), scalability, and robust centralized management software capable of handling complex access hierarchies across multiple physical locations.

A rapidly emerging customer segment includes operators of shared economy services, such as car-sharing fleets, short-term rental properties (Airbnb hosts, serviced apartments), and logistics providers utilizing smart lockers for last-mile delivery. These customers require flexible, temporary access credential management that can be provisioned and revoked remotely and instantly, facilitating dynamic business models. Industrial customers, including manufacturing facilities and utility providers, constitute another critical segment, demanding durable, weatherproof smart entry systems that can withstand harsh operating environments while strictly controlling access to high-value equipment or restricted operational zones. Targeting these diverse segments requires manufacturers to offer specialized product lines—from robust, tamper-resistant biometric readers for industrial use to sleek, design-focused smart locks for the residential market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $40.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Security Systems, Continental AG, dormakaba Holding AG, Assa Abloy AB, Allegion plc, Cisco Systems, Inc., HID Global Corporation, Kwikset (Spectrum Brands), Salto Systems, Gemalto (Thales), Smart Entry Technology Inc., Shenzhen Huida Tech Co., Ltd., Panasonic Corporation, Hanwha Techwin, Johnson Controls International plc, Honeywell International Inc., Nuki Home Solutions GmbH, Spectrum Brands Holdings, Inc., IDEMIA, NEC Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Entry System Market Key Technology Landscape

The technological landscape of the Smart Entry System Market is characterized by intense innovation focused on convergence, speed, and security, moving away from purely mechanical or single-factor authentication methods. Biometrics remains the cornerstone, with constant advancements in sensor resolution, processing speed, and algorithmic robustness. Modern systems utilize advanced capacitive, optical, or ultrasonic sensors for fingerprint recognition and highly sophisticated 3D mapping and infrared scanning for facial recognition to counteract fraudulent attempts like liveness detection failure. Furthermore, the integration of ultra-wideband (UWB) technology is becoming crucial, particularly in automotive keyless systems, offering precise location awareness that significantly enhances security by preventing relay attacks (where signals are boosted to trick the car into believing the key is closer than it is). UWB provides highly accurate distance measurement, ensuring the user must be within centimeters of the entry point to gain access.

Connectivity standards are central to market evolution, with Wi-Fi, Bluetooth Low Energy (BLE), and Zigbee dominating residential and small commercial applications, facilitating seamless communication with smart hubs and mobile devices. However, the adoption of 5G and LTE-M is rising for large-scale enterprise and industrial deployments, offering robust, low-latency communication necessary for real-time remote monitoring and high-volume access data handling across expansive geographical areas. Edge computing is a critical enabling technology, shifting data processing and biometric matching from the cloud or a central server directly to the access device (the "edge"). This drastically improves authentication speed and, crucially, enhances privacy by minimizing the transmission of sensitive raw biometric data over networks, ensuring that matching occurs locally before an access decision is made, which addresses major compliance concerns like GDPR.

Finally, the growing maturity of secure digital credentialing and encryption protocols is vital for maintaining user trust. Smart entry systems now rely heavily on Public Key Infrastructure (PKI) and advanced encryption standards (AES-256) to secure the data exchanged between the user's credential (mobile phone or fob) and the smart lock controller. Emerging technologies like blockchain are being piloted to create decentralized, immutable records of access rights and transactions, potentially revolutionizing how identity and permission are managed in complex, multi-tenant environments. The focus is increasingly on creating multi-modal systems that combine several authentication factors (e.g., facial recognition plus mobile NFC) managed by sophisticated AI algorithms to offer highly personalized, adaptive, and virtually impenetrable access solutions, thereby pushing the boundaries of what is considered secure keyless entry.

Regional Highlights

Regional dynamics play a crucial role in shaping the Smart Entry System Market, driven by varying economic conditions, technological maturity, regulatory environments, and consumer behaviors.

- North America: Dominates the market in terms of revenue and early adoption of advanced technologies. The presence of major technology hubs, high consumer disposable income, and a strong emphasis on home automation and enterprise security fuel this leadership. Stringent security regulations, particularly in the financial, government, and technology sectors, mandate the use of high-assurance, smart access control solutions, driving significant investment in biometric and integrated IoT systems. The US and Canada are the core revenue generators, showing high penetration in both residential smart locks and high-security commercial access platforms.

- Europe: Characterized by mature markets and a strong focus on regulatory compliance, notably the General Data Protection Regulation (GDPR), which strongly influences the design and implementation of biometric entry systems, emphasizing privacy by design. Germany, the UK, and France are significant contributors, with a robust demand from the automotive manufacturing sector for advanced keyless entry systems and from the commercial real estate sector for energy-efficient, networked building access solutions.

- Asia Pacific (APAC): Expected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is underpinned by rapid urbanization, massive investments in smart city infrastructure (especially in China, India, and South Korea), and the rapid expansion of the middle class seeking modern conveniences like smart home technology. APAC is a manufacturing hub for automotive components and electronics, facilitating faster localized adoption and competitive pricing. Governments in the region are increasingly mandating modern access control for public infrastructure projects.

- Latin America (LATAM): Growth is steady, driven primarily by increasing security concerns in metropolitan areas, which encourages both residential and commercial sectors to upgrade from traditional security systems to modern, verifiable smart entry solutions. Brazil and Mexico are leading the regional adoption, focusing on affordable RFID and mobile app-based entry systems, often prioritizing cost-effectiveness alongside security enhancements.

- Middle East and Africa (MEA): Growth is accelerating, largely fueled by mega-projects in the GCC nations (Saudi Arabia, UAE) related to smart cities and diversified economic strategies that require state-of-the-art security and building management technologies. High-end residential and luxury commercial sectors are primary adopters, demanding premium, integrated smart entry solutions. The region is seeing high investment in infrastructure that includes biometric security systems for major national assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Entry System Market.- Bosch Security Systems

- Continental AG

- dormakaba Holding AG

- Assa Abloy AB

- Allegion plc

- Cisco Systems, Inc.

- HID Global Corporation

- Kwikset (Spectrum Brands)

- Salto Systems

- Gemalto (Thales)

- Smart Entry Technology Inc.

- Shenzhen Huida Tech Co., Ltd.

- Panasonic Corporation

- Hanwha Techwin

- Johnson Controls International plc

- Honeywell International Inc.

- Nuki Home Solutions GmbH

- Spectrum Brands Holdings, Inc.

- IDEMIA

- NEC Corporation

Frequently Asked Questions

Analyze common user questions about the Smart Entry System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of smart entry systems offer the highest level of security?

The highest security is typically offered by multi-modal biometric systems (e.g., combining facial recognition with fingerprint or iris scanning) integrated with advanced encryption protocols (AES-256) and anti-spoofing technology, often leveraging edge computing for rapid, secure local authentication.

How does UWB technology enhance security in automotive smart entry systems?

Ultra-Wideband (UWB) technology provides precise spatial and distance awareness, enabling keyless entry systems to accurately determine the location of the key fob. This precision effectively prevents "relay attacks," where criminals attempt to amplify the key signal from a distance to unlock or start the vehicle.

What is the primary challenge hindering the mass adoption of smart entry systems?

The primary challenge is addressing consumer and regulatory concerns regarding data privacy and security, particularly related to the collection, storage, and processing of sensitive biometric data, necessitating strong adherence to regulations like GDPR and CCPA.

Which market segment is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, driven by rapid investments in smart city infrastructure, expanding middle-class income, and accelerating adoption of smart home and building technologies across major economies like China and India.

How is Artificial Intelligence (AI) improving smart access control?

AI improves access control by enhancing biometric recognition accuracy, enabling predictive access control based on learned user behaviors, and implementing sophisticated anomaly detection to identify and flag potential security breaches in real-time, moving security from reactive to proactive.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager