Smart Fabrics and Textiles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437903 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Smart Fabrics and Textiles Market Size

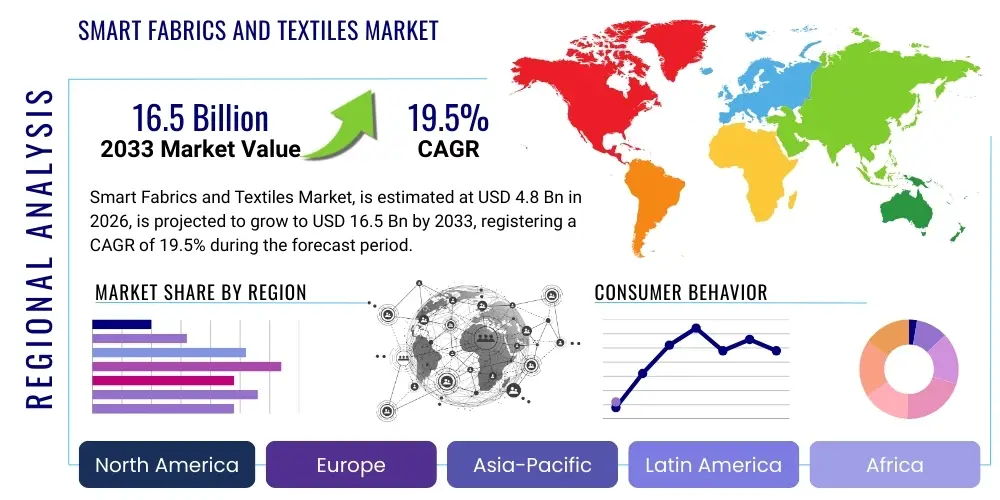

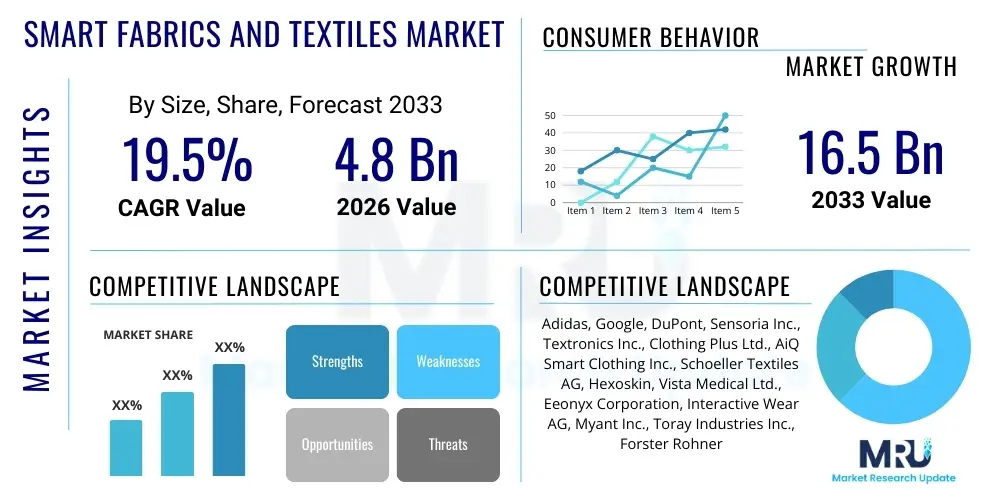

The Smart Fabrics and Textiles Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 16.5 Billion by the end of the forecast period in 2033.

This aggressive growth trajectory is primarily fueled by the burgeoning integration of electronic components, sensors, and connectivity features into traditional textile manufacturing processes. Consumer demand for enhanced functionality, particularly in sectors such as healthcare, fitness monitoring, and high-performance sports apparel, mandates continuous innovation in material science and miniaturization of embedded electronics. Furthermore, the increasing adoption of smart uniforms in the defense and enterprise sectors, offering features like location tracking and physiological monitoring, significantly contributes to market expansion across various geographic regions. Investment in research and development aimed at improving washability, durability, and energy efficiency of these smart textiles remains a critical factor defining the market’s valuation and long-term potential.

Smart Fabrics and Textiles Market introduction

The Smart Fabrics and Textiles Market encompasses materials that incorporate digital components and electronics, allowing them to sense, communicate, store energy, regulate temperature, and change color or shape. These next-generation textiles transcend passive functions, offering active capabilities vital for complex monitoring and interaction. Products range from sophisticated wearable technology like bio-sensing garments used in medical diagnostics to adaptive military uniforms and innovative applications in automotive and interior design, providing interactive surfaces and environmental control. The core value proposition of smart textiles lies in their ability to seamlessly merge advanced technology with everyday functionality, often improving user safety, health outcomes, and overall performance without sacrificing comfort or aesthetics. This convergence is driving the shift from simple fitness trackers to fully integrated smart apparel ecosystems.

Major applications of smart fabrics are deeply entrenched in performance-driven sectors. In the healthcare domain, they are utilized for continuous patient monitoring, collecting real-time data on heart rate, respiration, and body temperature, thereby enabling proactive health management and remote diagnostics. For the sports and fitness industry, smart apparel optimizes athletic training by tracking metrics like muscle activity, posture, and fatigue levels. The military and defense sectors leverage these materials for situational awareness, ballistic protection, and environmental hazard detection. Key benefits include enhanced data accuracy, superior wearer comfort compared to hard electronics, reduced device visibility, and the ability to operate in highly dynamic and demanding environments. These materials are also intrinsically linked to the Internet of Things (IoT), serving as flexible, pervasive data capture points.

The primary driving factors for market growth include the dramatic rise in chronic diseases necessitating continuous health monitoring, substantial technological advancements leading to flexible and stretchable electronics, and the decreasing cost of sensors and microprocessors. Furthermore, standardization efforts across the electronics and textile industries, coupled with supportive government initiatives focusing on digital healthcare and defense modernization, accelerate adoption. Consumer willingness to invest in premium functional wear, motivated by wellness trends and professional performance requirements, provides a sustained revenue stream, encouraging manufacturers to diversify product offerings and improve product longevity and washing compatibility.

Smart Fabrics and Textiles Market Executive Summary

The Smart Fabrics and Textiles Market is currently characterized by rapid integration and cross-industry partnerships, positioning it as a dynamic segment within the broader technology and materials landscape. Key business trends indicate a strong focus on miniaturization and energy harvesting techniques, moving smart textiles closer to self-sufficiency and extended operational lifetimes. Strategic alliances between semiconductor manufacturers, textile producers, and major apparel brands are crucial for accelerating time-to-market for sophisticated products. Investment is heavily concentrated in developing standardized, reliable, and scalable manufacturing processes to transition smart fabrics from niche, high-cost items to mass-market consumer goods, particularly within the medical and high-end fitness segments. Furthermore, data security and privacy protocols associated with the sensitive biometric data collected by these textiles are becoming pivotal competitive differentiators, driving companies to implement robust encryption and compliance measures.

Regionally, North America and Europe maintain dominance, primarily due to high healthcare expenditure, significant research and development activities in materials science, and the early adoption of advanced wearable technology. However, the Asia Pacific region (APAC) is emerging as the fastest-growing market, driven by its massive manufacturing capabilities, increasing disposable incomes, and the rapid urbanization and adoption of digital health solutions, especially in countries like China, Japan, and South Korea. Latin America and the Middle East and Africa (MEA) are still nascent but show promising potential, particularly in defense applications and industrial safety apparel, as governments prioritize worker monitoring and military modernization programs. Regional growth is intricately linked to local regulatory frameworks concerning wearable medical devices and data privacy standards.

Segmentation trends highlight the dominance of the passive smart fabrics segment, which includes textiles with enhanced conductivity or thermal regulation, due to its maturity and lower manufacturing complexity. However, the active smart fabrics segment, incorporating sophisticated sensors and actuators for real-time interaction (e.g., self-cleaning, energy-generation, biometric monitoring), is projected to exhibit the highest CAGR. In terms of application, the healthcare and wellness segment commands the largest market share, driven by aging populations and the shift toward preventative medicine. Meanwhile, the military and protection sector remains a high-value, albeit smaller, segment due to high technology integration and specialized material requirements, often involving integration with advanced communication systems and physiological stress detection systems for soldiers operating in extreme conditions.

AI Impact Analysis on Smart Fabrics and Textiles Market

User queries regarding the impact of Artificial Intelligence (AI) on the Smart Fabrics and Textiles Market primarily revolve around data processing efficiency, personalized user experiences, and manufacturing automation. Common concerns include how AI can manage the immense volume of biometric and environmental data generated by smart garments, whether AI algorithms can lead to truly personalized clothing that adapts dynamically to the wearer’s needs (e.g., thermal regulation or posture correction), and the integration of machine learning into textile production lines to optimize material quality and detect defects instantly. Key expectations center on AI serving as the intelligence layer, moving smart textiles beyond simple data capture toward predictive analytics and autonomous action. Users anticipate AI will enhance the diagnostic accuracy of medical garments, improve the efficiency of maintenance scheduling for industrial safety wear, and ultimately reduce the computational burden on the garment itself by utilizing cloud-based processing.

- AI-driven Data Interpretation: Processing vast, complex data streams from embedded sensors (ECG, EMG, temperature) to provide accurate, actionable health diagnostics and performance insights without requiring manual analysis.

- Predictive Maintenance and Safety: Utilizing machine learning algorithms to anticipate textile wear and tear or predict physiological failure points in industrial or military personnel based on continuous biometric monitoring.

- Personalized Adaptive Functionality: Enabling smart garments to autonomously adjust parameters such as stiffness, thermal output, or compression levels based on real-time environmental factors or the wearer's current metabolic state.

- Optimized Manufacturing and Quality Control: Implementing computer vision and AI for real-time defect detection in textile production, improving yield rates, and optimizing the integration of electronic components into flexible substrates.

- Enhanced User Interface and Interaction: Integrating natural language processing (NLP) and voice commands into smart clothing ecosystems, making interaction more intuitive and hands-free for professional users like surgeons or field operatives.

DRO & Impact Forces Of Smart Fabrics and Textiles Market

The dynamics of the Smart Fabrics and Textiles Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the Impact Forces shaping its trajectory. The primary driver is the pervasive adoption of IoT devices and the growing trend toward connected health monitoring, which necessitates seamless, comfortable, and data-rich wearable solutions. This is powerfully restrained by significant challenges related to the durability and washability of integrated electronics, which remains a primary consumer pain point and barrier to mass market penetration. Furthermore, the lack of universal standardization across electronic components, data protocols, and washing instructions complicates large-scale manufacturing and consumer trust. However, significant opportunities exist in developing highly specialized applications, such as professional sports recovery optimization and advanced elderly care monitoring, coupled with breakthroughs in materials science focused on self-healing textiles and highly flexible printed circuitry, paving the way for sustainable and fully integrated smart garments.

Impact forces are currently trending toward market maturity but are still constrained by high initial investment costs for manufacturing equipment, which limits the number of entrants. The shift toward incorporating nanotechnology and flexible battery technologies is mitigating the size and weight restraints previously associated with smart apparel, enhancing user acceptance. Regulatory impact forces are increasingly significant, particularly in Europe (with stringent GDPR requirements) and the US (FDA approvals for medical-grade garments), driving companies to prioritize security and clinical validation. Competitive intensity is high, characterized by numerous startups and established tech giants vying for intellectual property in sensor technology and data analytics platforms. The overall impact of these forces suggests a sustained, high-growth environment, provided manufacturers successfully navigate the challenges of cost reduction and long-term product resilience.

Segmentation Analysis

The Smart Fabrics and Textiles Market is extensively segmented based on type, functionality, end-use application, and geography, allowing for a precise understanding of market dynamics and potential investment areas. Functional segmentation is particularly critical, dividing the market into passive, active, and ultra-smart textiles, reflecting the varying levels of technological integration and complexity. Application segmentation, spanning sectors like healthcare, military, sports, and fashion, reveals diverse adoption rates influenced by regulatory requirements and budget allocations. Geographic segmentation highlights the disparity in market maturity and adoption rates between developed economies with high technological infrastructure and emerging markets focused primarily on basic monitoring solutions. The complexity of these materials demands segmentation by textile type, including woven, non-woven, and knitted structures, each offering distinct advantages for housing flexible electronics and sensors.

- Type:

- Passive Smart Fabrics

- Active Smart Fabrics (incorporating sensors and actuators)

- Ultra-Smart Fabrics (capable of learning and adapting)

- Functionality:

- Sensing (Biometric, chemical, physical)

- Energy Harvesting and Storage

- Thermo-regulating

- Luminosity and Aesthetics

- Protection and Safety (Ballistic, electromagnetic shielding)

- Application:

- Healthcare and Wellness (Remote patient monitoring, rehabilitation)

- Sports and Fitness (Performance tracking, injury prevention)

- Military and Defense (Soldier monitoring, camouflage, communication)

- Automotive (Smart interiors, driver fatigue detection)

- Fashion and Entertainment (Interactive clothing, aesthetic displays)

- Industrial and Enterprise (Worker safety, environmental monitoring)

- End-Use Technology:

- E-Textiles (Electronic components integrated)

- Chromic Materials (Color changing)

- Phase Change Materials (Thermal regulation)

Value Chain Analysis For Smart Fabrics and Textiles Market

The value chain for the Smart Fabrics and Textiles Market is highly complex, beginning with upstream raw material suppliers who provide specialized conductive fibers, polymers, and chemical coatings necessary for textile function. This segment also includes semiconductor and sensor manufacturers who develop highly miniaturized, flexible, and washable electronic components essential for data acquisition and processing. Success at this stage relies heavily on collaborative research and development to ensure material compatibility, flexibility, and longevity, often involving nanotechnology specialists to achieve seamless integration. The primary challenge upstream is standardizing interfaces between rigid electronics and flexible textile substrates to prevent connection failures during strenuous use or cleaning cycles. Investment in developing biodegradable and sustainable conductive materials is also a growing strategic imperative at this initial phase.

The midstream involves the core manufacturing and integration processes. This includes textile manufacturers who utilize specialized machinery for weaving, knitting, or embedding electronic traces directly into the fiber structure—a critical step that defines the product's quality and washability. System integrators then combine the smart textile base with software platforms, data analytics tools (often utilizing AI/ML), and communication modules. This stage is marked by high proprietary expertise in circuit integration techniques, such as flexible circuit printing and conductive ink application. Effective thermal management and power source integration (batteries or energy harvesting systems) are key determinants of product reliability and market acceptance, requiring stringent testing procedures to meet both electronic and textile quality standards.

The downstream distribution channel involves a diverse network due to the market's varied applications. Direct sales models are prevalent for high-value, specialized segments such as military and medical devices, ensuring controlled distribution and necessary technical support. Indirect channels, utilizing specialized retailers, large apparel companies, and e-commerce platforms, dominate the fitness, fashion, and consumer wellness segments. Partnerships with major global sports brands and medical device distributors are crucial for market penetration. The final element involves post-sale services, including data platform subscriptions and maintenance agreements, which often represent a recurring revenue stream, particularly for industrial and healthcare applications, ensuring long-term customer engagement and data integrity management.

Smart Fabrics and Textiles Market Potential Customers

The Smart Fabrics and Textiles Market serves a diverse range of end-user segments, spanning professional, institutional, and consumer demographics, each driven by unique needs for performance, safety, and data insights. Primary end-users in the institutional category include hospitals, clinics, and elderly care facilities, which adopt smart garments for continuous, non-invasive vital sign monitoring, enhancing patient safety and reducing the need for constant direct physical supervision. Government agencies, particularly defense and homeland security departments, represent high-value customers, procuring sophisticated textiles for soldier health tracking, performance optimization in extreme environments, and integration into advanced communication and combat systems. The core buyer requirement in these sectors is unwavering reliability, certification compliance, and highly secure data transmission protocols.

The consumer segment forms the largest volume of potential customers, segmented predominantly into high-performance athletes, fitness enthusiasts, and general wellness consumers. High-performance buyers seek garments that provide granular data on muscle fatigue, biomechanics, and recovery status, enabling them to optimize training regimens and prevent injuries. The general wellness consumer is focused on preventative health, utilizing textiles for daily activity tracking, sleep monitoring, and stress level assessment. These buyers prioritize comfort, aesthetics (discretion), and ease of use, often demanding compatibility with existing smartphone operating systems and popular health applications. The fashion industry is also emerging as a significant potential customer base, integrating smart elements for personalized style, interactive displays, and unique aesthetic experiences, transforming clothing into a dynamic form of expression.

Industrial end-users, encompassing manufacturing, construction, mining, and oil and gas companies, represent a rapidly expanding segment driven by rigorous regulatory requirements for worker safety. These companies purchase smart textiles integrated into uniforms and protective gear (PPE) to monitor environmental hazards, track worker location, detect fatigue or physical stress, and ensure compliance with safety protocols. The return on investment for industrial buyers is calculated based on reduced workplace accidents, lower insurance costs, and improved operational efficiency through proactive intervention. Furthermore, the automotive sector uses smart fabrics for car seats and interiors to detect driver fatigue, monitor occupant presence, and provide integrated heating or massage functions, enhancing vehicular safety and luxury.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adidas, Google, DuPont, Sensoria Inc., Textronics Inc., Clothing Plus Ltd., AiQ Smart Clothing Inc., Schoeller Textiles AG, Hexoskin, Vista Medical Ltd., Eeonyx Corporation, Interactive Wear AG, Myant Inc., Toray Industries Inc., Forster Rohner AG, Pireta, ThermoElectric Textiles, MAS Holdings, Ohmatex ApS, BeBop Sensors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Fabrics and Textiles Market Key Technology Landscape

The technological evolution defining the Smart Fabrics and Textiles Market is driven by advancements in three core areas: flexible electronics, material science, and data processing integration. Flexible electronics, including thin-film transistors and stretchable circuits, are critical as they allow sensors and microprocessors to be seamlessly embedded without compromising the textile’s flexibility or comfort. Innovations in conductive polymers, inks, and fibers—such as silver-coated nylon or specialized carbon materials—are enabling the creation of washable, robust electronic pathways directly within the fabric weave. This shift from placing rigid components onto textiles to fully integrating them into the textile structure represents the most significant technological leap, improving durability and minimizing the user’s awareness of the embedded technology. Furthermore, advancements in low-power wide-area network (LPWAN) protocols are crucial for enabling energy-efficient data communication from the garment to external devices or cloud platforms.

Material science innovation centers around developing Phase Change Materials (PCM) and shape-memory polymers, which give textiles active regulatory capabilities. PCM integrated into fabrics can absorb, store, and release latent heat, providing superior thermal comfort regulation, particularly vital for military and protective apparel exposed to extreme temperatures. Simultaneously, the focus on sustainable and biocompatible materials is intensifying, driven by regulatory demands and consumer preference, leading to research into bio-sourced conductive polymers and recyclable electronic components. Another critical area is the development of advanced energy solutions, including textile-based piezoelectric and thermoelectric generators that harness movement or body heat to power the embedded electronics, significantly reducing reliance on conventional batteries and extending the operational life of the smart garment.

The data integration and software platform layer constitutes the intelligence backbone of smart textiles. This involves sophisticated algorithms, increasingly powered by machine learning and edge computing, that can filter noise, process raw biometric data accurately, and deliver actionable insights in real-time. For instance, in medical applications, complex signal processing is required to extract a clear ECG reading despite body movement artifacts. The development of robust, secure operating systems specific to wearable textiles ensures interoperability between different sensors and facilitates compliance with stringent data security regulations like HIPAA and GDPR. Furthermore, augmented reality (AR) integration, particularly in industrial and defense contexts, leverages smart textiles to feed relevant situational data directly to the user’s visual field, representing the cutting edge of human-machine interface development within this domain.

Regional Highlights

- North America: North America holds the dominant market share, characterized by high adoption rates in the healthcare sector, particularly due to significant investment in remote patient monitoring (RPM) technologies and clinical trials involving smart wearables. The region benefits from a robust ecosystem of technology innovation, favorable regulatory support for medical devices (FDA), and a high concentration of key industry players and research institutions focusing on defense and aerospace applications. Consumer adoption of high-end sports and wellness apparel is also exceptionally strong, driven by high disposable incomes and a pervasive culture of fitness and preventative health management.

- Europe: Europe represents a mature market focusing heavily on standardization, sustainability, and industrial safety applications. Strong regulatory frameworks like GDPR mandate high standards for data privacy, compelling manufacturers to build security into their products from inception, thereby fostering consumer trust. Countries such as Germany and the UK are leaders in applying smart textiles in high-value automotive interiors and protective workwear. Furthermore, EU-funded research initiatives often focus on integrating smart textiles into the circular economy, emphasizing material recycling and reduced environmental impact.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by extensive manufacturing capabilities, lower production costs, and rapidly expanding local consumer markets in China, India, and South Korea. Government initiatives promoting digital transformation in healthcare, coupled with massive investments in smart city projects, are driving the large-scale deployment of smart textiles for public health management and infrastructure monitoring. South Korea and Japan are particularly advanced in research concerning OLED displays embedded in textiles and sophisticated biomedical sensing applications.

- Latin America: The market in Latin America is nascent but shows significant growth potential, driven primarily by government spending on military modernization and increasing awareness of industrial worker safety in mining and construction sectors, particularly in Brazil and Mexico. The consumer segment is slowly emerging, often focused on cost-effective fitness tracking solutions. Challenges include economic volatility and less developed technological infrastructure compared to Northern counterparts, but this creates opportunities for focused, low-cost application development.

- Middle East and Africa (MEA): MEA exhibits growth concentrated in two high-value areas: defense and high-end construction safety. Gulf Cooperation Council (GCC) countries are investing heavily in advanced military apparel and protective gear suited to extreme desert climates, necessitating sophisticated thermal regulation and environmental sensing capabilities. Growth in this region is often driven by direct government contracts and large-scale infrastructure projects requiring advanced worker monitoring solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Fabrics and Textiles Market.- Adidas

- DuPont

- Sensoria Inc.

- Textronics Inc.

- Clothing Plus Ltd.

- AiQ Smart Clothing Inc.

- Schoeller Textiles AG

- Hexoskin

- Vista Medical Ltd.

- Eeonyx Corporation

- Interactive Wear AG

- Myant Inc.

- Toray Industries Inc.

- Forster Rohner AG

- Pireta

- ThermoElectric Textiles

- MAS Holdings

- Ohmatex ApS

- BeBop Sensors

- D3O Lab

- Bolt Threads

- Intelligent Textiles Ltd.

- Gore-Tex (W. L. Gore & Associates)

Frequently Asked Questions

Analyze common user questions about the Smart Fabrics and Textiles market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key technological bottleneck hindering the mass adoption of smart fabrics?

The primary technological bottleneck is the lack of long-term durability, specifically the inability of embedded electronic components and conductive pathways to withstand repeated industrial washing cycles, which severely limits the lifespan and reliability required for true mass market acceptance and regulatory compliance.

How are smart fabrics currently powered, and what are the major innovations in energy solutions?

Smart fabrics are currently powered primarily by small, rechargeable batteries integrated into the garment interface. Major innovations focus on energy harvesting technologies, including textile-integrated solar cells, piezoelectric materials that convert kinetic energy (movement) into electrical power, and thermoelectric generators that utilize body heat differential for continuous, sustainable charging.

Which application segment currently drives the highest revenue in the Smart Fabrics and Textiles Market?

The Healthcare and Wellness application segment currently drives the highest revenue due to the critical demand for continuous, non-invasive physiological monitoring, particularly for managing chronic conditions, remote diagnostics, and supporting the rapidly growing elderly care sector globally.

What role does Artificial Intelligence play in enhancing the functionality of smart textiles?

AI serves as the crucial analytical layer, interpreting vast amounts of sensor data collected by smart textiles to provide predictive insights, optimize personalization (e.g., adaptive temperature control), and significantly improve the accuracy of health diagnoses by filtering noise and identifying subtle patterns in biometric information.

What is the difference between Passive Smart Fabrics and Active Smart Fabrics?

Passive Smart Fabrics offer baseline functionalities such as UV protection or static thermal insulation without external intervention. Active Smart Fabrics, conversely, incorporate integrated, powered electronic components like sensors and actuators that actively sense, respond, and adapt to external stimuli or internal physiological changes in real time.

Are there regulatory standards governing the medical use of smart textiles, and how do they impact market entry?

Yes, medical-grade smart textiles that monitor or diagnose health conditions are subject to stringent regulations globally, such as FDA approval in the US and CE marking in Europe. These regulations require extensive clinical validation and data security compliance (like HIPAA/GDPR), significantly raising the barriers to entry and necessitating high investment in testing and certification.

What is the primary factor driving the high growth rate projected for the Asia Pacific smart textiles market?

The rapid growth in APAC is driven by the region’s dominant manufacturing capabilities, which allow for scalable and cost-effective production, coupled with increasing governmental focus on digital health initiatives and the rising disposable income leading to greater consumer acceptance of high-tech fitness and wellness wearables.

How is the industrial safety sector utilizing smart fabrics for worker protection?

Industrial safety leverages smart fabrics to create intelligent Personal Protective Equipment (PPE) that continuously monitors workers for dangerous environmental conditions (gas leaks, extreme heat), tracks vital signs to detect fatigue or stress, and provides real-time location data for emergency response, thereby reducing workplace accidents.

Which material science breakthroughs are essential for achieving self-cleaning functionality in smart fabrics?

Self-cleaning functionality relies on integrating photocatalytic nanomaterials, such as titanium dioxide (TiO2) nanoparticles, which, when exposed to light, break down organic contaminants and microbial pathogens, significantly reducing the need for traditional washing and improving hygiene.

How does the integration of smart textiles impact the sustainability profile of the apparel industry?

Smart textile manufacturing currently poses challenges due to the use of non-recyclable electronic waste. However, ongoing R&D focuses on developing sustainable conductive inks, biodegradable substrates, and easily detachable electronic modules to facilitate end-of-life recycling and improve the overall environmental footprint of the smart apparel lifecycle.

What is the primary challenge related to data security when deploying medical smart garments?

The primary challenge is ensuring the security and privacy of highly sensitive biometric and health data collected continuously by the garments, necessitating robust encryption protocols, secure data storage solutions compliant with global privacy laws, and verifiable mechanisms for user consent and data access control.

In the military application segment, what is the most sought-after capability of smart fabrics?

The most sought-after capability is advanced physiological status monitoring (PSM), which tracks soldier vitals, stress levels, and fatigue in high-stress operational environments, allowing commanders to make data-driven decisions regarding troop deployment and minimizing risks of heat injury or combat exhaustion.

What are E-Textiles, and how do they differ from traditional conductive fabrics?

E-Textiles are fabrics with electronically integrated functionalities, where circuits and electronic components are directly woven, knitted, or embroidered into the textile structure. They differ from traditional conductive fabrics, which only transmit electricity, by actively computing, sensing, and communicating data.

How does miniaturization of sensors influence the consumer acceptance of smart apparel?

Miniaturization is critical for consumer acceptance as it ensures that the smart components are virtually invisible and imperceptible to the wearer, maintaining the comfort, aesthetic appeal, and natural feel of traditional clothing, thereby overcoming the resistance associated with bulky wearable devices.

Which sectors are leading the development of phase change materials (PCM) in smart fabrics?

The Defense and High-Performance Sports sectors are leading the development of PCM, utilizing these materials to create garments that proactively manage heat transfer, offering superior thermo-regulation to protect users from rapid temperature fluctuations and optimize athletic performance or soldier endurance.

What are the key barriers to entry for new startups in the Smart Fabrics and Textiles Market?

Key barriers include the significant capital expenditure required for specialized textile and electronic manufacturing integration equipment, the necessity for robust intellectual property protection surrounding proprietary sensor and circuit printing techniques, and the lengthy, costly process of obtaining medical or safety certifications.

How is the automotive industry incorporating smart fabrics into vehicle design?

The automotive industry uses smart fabrics for sophisticated seat covers and interiors to detect driver drowsiness or fatigue through pressure and movement sensors, monitor occupant vital signs, control dynamic lighting, and integrate haptic feedback systems for navigation or safety alerts.

What role does the fashion industry play in expanding the smart fabrics consumer base?

The fashion industry acts as a crucial driver for consumer adoption by focusing on aesthetics, style, and novel interactive features (like color-changing or illuminated textiles), translating complex technology into desirable, high-value consumer goods beyond purely functional applications.

What is the most promising opportunity within the Ultra-Smart Fabrics segment?

The most promising opportunity lies in the development of closed-loop adaptive systems, such as fabrics that can autonomously deliver localized drug treatments (drug-eluting textiles) or adjust compression levels based on real-time physiological feedback, essentially turning clothing into an active, responsive treatment device.

What specific challenges are faced when integrating flexible batteries into smart textile designs?

Integrating flexible batteries requires overcoming challenges related to safety (preventing overheating or leakage), maintaining charging efficiency and capacity over the garment's lifespan, and ensuring the battery remains robustly protected against mechanical stress and moisture during use and washing, often necessitating specialized encapsulation techniques.

How do smart fabrics contribute to preventative medicine?

Smart fabrics facilitate preventative medicine by enabling continuous, passive monitoring of key health indicators (heart rate variability, sleep patterns, movement efficiency) in daily life, providing early warnings of potential health deteriorations or chronic condition flares, allowing for timely intervention before acute episodes occur.

Which type of smart fabric construction—woven, non-woven, or knitted—is preferred for complex sensor integration?

Knitted and woven constructions are often preferred for complex sensor integration because their structural regularity allows for precise mapping and embedding of conductive yarns and flexible circuitry, ensuring connectivity and minimizing signal interference during movement, while also offering superior stretch and conformity to the body.

What is the current trend regarding collaboration between traditional textile companies and tech firms?

The current trend is a necessity-driven, deep integration, where traditional textile companies provide material expertise and manufacturing scalability, while tech firms supply the proprietary sensor technology, data analytics platforms, and software development needed to create a fully functional, market-ready smart garment ecosystem.

What are chromic materials, and where are they primarily used in smart textiles?

Chromic materials are smart textiles that change color in response to external stimuli such as temperature (thermochromic), light (photochromic), or chemical presence (chemochromic). They are primarily used in high-end fashion, military camouflage, and industrial sensing applications (e.g., detecting temperature overloads).

How does the Internet of Things (IoT) influence the strategic development of smart textiles?

IoT fundamentally positions smart textiles as end-point data collectors within a massive connected network. Strategic development focuses on ensuring secure, standardized communication protocols (like Bluetooth Low Energy or proprietary mesh networks) to reliably transmit data from the garment to the cloud for analysis and system integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Passive And Active Smart Fabrics and Textiles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smart Fabrics And Textiles Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Ultra-Smart Fabrics and Textiles, Active Smart Fabrics and Textiles, Passive Smart Fabrics and Textiles), By Application (Healthcare Uses, Civil Uses, Military Uses), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager