Smart Fork Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436196 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Smart Fork Market Size

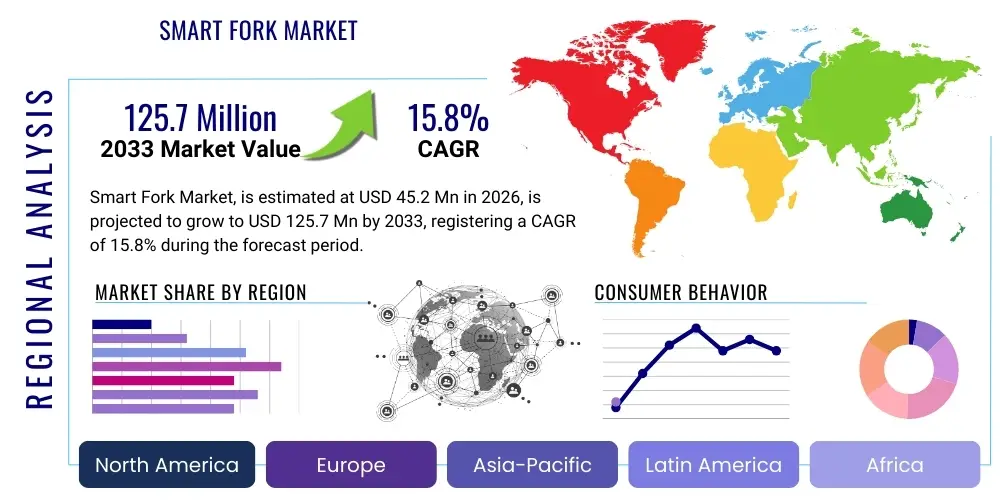

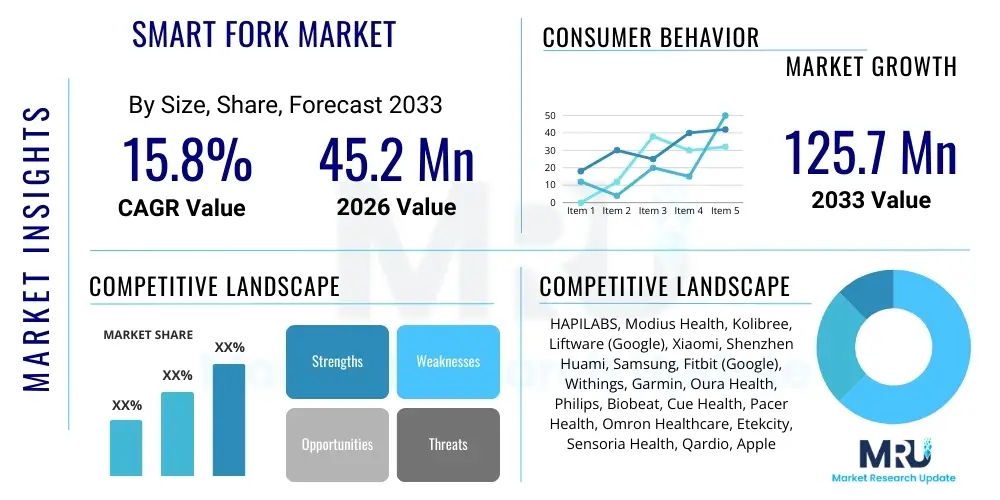

The Smart Fork Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 45.2 Million in 2026 and is projected to reach USD 125.7 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global focus on preventative healthcare, weight management, and the increasing consumer willingness to adopt connected lifestyle devices that offer quantifiable physiological and behavioral data. The convergence of miniaturized sensor technology, advanced data processing capabilities, and user-friendly mobile interfaces has transformed the smart fork from a niche gadget into a viable tool for behavior modification in the wellness and clinical nutrition sectors. The market trajectory indicates a strong shift toward integration with broader digital health ecosystems.

The calculation of market size and growth projections incorporates several critical macroeconomic and industry-specific factors. Key determinants include the pervasiveness of obesity and related chronic conditions, which necessitates innovative solutions for dietary management and consumption monitoring. Furthermore, increasing disposable incomes in emerging economies, coupled with significant advancements in wearable technology and the Internet of Things (IoT), create fertile ground for the adoption of smart eating tools. However, market penetration is currently focused heavily on health-conscious demographics and specific clinical applications, suggesting that future growth hinges on lowering device costs and expanding functionality beyond basic calorie or speed tracking to offer comprehensive nutritional insights derived from behavioral patterns. This projected CAGR underscores a robust confidence in both technological maturity and consumer acceptance of proactive dietary tracking devices within the next decade.

Smart Fork Market introduction

The Smart Fork Market encompasses specialized utensil technology designed to monitor and analyze eating habits, primarily focusing on the speed and duration of meals, bite frequency, and the subsequent data synchronization with mobile applications for user feedback and personalized coaching. Product descriptions highlight embedded sensors, typically employing accelerometers and gyroscopes, capable of detecting the motion patterns associated with lifting food, placing it in the mouth, and subsequent chewing and swallowing actions. These devices are fundamentally digital behavior modification tools, engineered to address problems such as rushed eating, which is statistically linked to poor digestion, weight gain, and increased risk of type 2 diabetes. The core mechanism involves vibrating or lighting up when the user exceeds a pre-set speed threshold, subtly training the individual to slow down their pace, thereby maximizing satiety and aiding in weight control efforts. Initial market entrants focused heavily on this speed metric, but modern smart forks are rapidly incorporating features like food recognition (though often requiring manual input verification), improved calorie estimation based on estimated bite size, and integration with established nutritional tracking platforms.

Major applications for smart forks span several critical areas: proactive preventative healthcare, clinical dietetics, sports nutrition, and general wellness tracking. In preventative healthcare, these devices serve as invaluable non-invasive tools for individuals seeking weight loss or managing conditions sensitive to eating speed, such as chronic acid reflux or post-bariatric surgery recovery. Clinicians utilize the objective, quantifiable data provided by smart forks to better assess patient adherence to dietary instructions and modify behavioral interventions effectively, moving beyond subjective reporting. The benefits of adoption are multifaceted; for the consumer, the primary advantage is achieving mindful eating, which enhances digestive health, improves nutrient absorption, and provides a sustainable method for weight maintenance without rigorous calorie counting alone. Furthermore, the gamification and real-time feedback loop inherent in the associated applications boost user engagement and long-term adherence to healthier habits. The technological refinement continues to address challenges related to washing durability, battery life, and the precision of bite detection in varied dining scenarios, enhancing the overall utility and user experience.

Driving factors for sustained market growth are deeply rooted in global demographic and technological shifts. The surging global prevalence of obesity, recognized by the World Health Organization (WHO) as a major public health crisis, fuels demand for effective behavioral modification technologies. Concurrently, the proliferation of the Internet of Medical Things (IoMT) and personal wellness trackers establishes a broad consumer base already accustomed to utilizing connected devices for physiological data logging. The convergence of nutritional science emphasizing the importance of eating pace—slower eating is linked to hormonal signaling of fullness—and the miniaturization of sensory hardware creates a compelling proposition. Finally, increasing investment in personalized nutrition solutions, driven by venture capital and large consumer electronics companies, ensures continuous innovation and heightened market visibility. These factors collectively position the smart fork market for substantial commercial expansion across diverse geographical regions and socioeconomic strata.

Smart Fork Market Executive Summary

The Smart Fork Market is poised for accelerated expansion, driven primarily by favorable business trends focused on strategic partnerships between medical device manufacturers and established wellness technology platforms. Current business trends indicate a strong move toward subscription-based models for premium coaching and personalized dietary insights, moving away from a purely hardware-centric revenue structure. This trend ensures sustained recurring revenue streams and fosters deeper user engagement, positioning smart fork companies as long-term behavioral health providers rather than just product sellers. Furthermore, there is a visible trend in integration capabilities, where smart fork data is seamlessly fed into comprehensive electronic health records (EHR) systems or popular fitness tracking applications, enhancing data interoperability and value for both consumers and medical practitioners. Mergers and acquisitions are also becoming prevalent, with larger fitness tech giants acquiring smaller, innovative sensor technology firms to quickly integrate eating behavior tracking into their existing health monitoring ecosystems, thereby consolidating market expertise and reducing time-to-market for advanced features.

Regionally, North America and Europe remain the dominant markets due to high health awareness, robust purchasing power, and favorable regulatory environments for digital health devices. North America, particularly the United States, demonstrates high adoption rates driven by high prevalence of lifestyle diseases and sophisticated marketing efforts targeting proactive wellness consumers. Europe follows closely, underpinned by strong public health initiatives that endorse preventative technological solutions. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth in APAC is attributed to rapidly increasing disposable incomes, burgeoning middle-class populations becoming more susceptible to Westernized dietary patterns, and large-scale government investments in digital healthcare infrastructure in countries such as China, India, and Japan. The Middle East and Africa (MEA) and Latin America (LATAM) currently represent smaller market shares but offer significant future opportunities as health tracking and chronic disease management become critical public health priorities, particularly through governmental initiatives to combat rising rates of obesity and diabetes.

Segmentation trends highlight the increasing importance of the clinical and specialized applications segment, which is overtaking general wellness in terms of revenue per user and specific product requirements. While the B2C segment (General Wellness Consumers) remains crucial for volume, the B2B segment (Hospitals, Clinical Nutritionists, Corporate Wellness Programs) demands higher precision, clinical validation, and comprehensive data security features, commanding premium pricing. Within the technology segment, advanced sensor technology that can accurately differentiate between liquid and solid intake, or even begin to estimate the viscosity or temperature of food, is trending upward. Furthermore, the integration of artificial intelligence for pattern recognition—identifying erratic eating behavior linked to stress or specific dietary triggers—is transforming the value proposition. This focus on deep behavioral analysis ensures that smart forks evolve beyond simple timing tools into sophisticated diagnostic and intervention devices, catering to a broader range of specialized dietary requirements and clinical research applications.

AI Impact Analysis on Smart Fork Market

User queries regarding the impact of Artificial Intelligence (AI) on the Smart Fork Market overwhelmingly center on two key themes: the enhancement of data accuracy and the personalization of behavioral intervention. Consumers frequently question how AI can move the technology beyond merely tracking eating speed to offering genuine nutritional assessment—specifically, "Can AI identify what I am eating?" and "How accurate will calorie counting become?" Additionally, users express expectations regarding sophisticated coaching: "Will the smart fork coach me in real-time based on my emotional state, not just my pace?" These questions highlight a demand for AI to bridge the current gap between movement data (how fast one eats) and nutritional context (what one eats and why). The collective user sentiment suggests that AI is expected to transform the smart fork from a reactive feedback mechanism into a proactive, personalized dietary assistant capable of generating highly nuanced, context-aware insights, dramatically increasing the device's utility and market appeal, especially within complex fields like metabolic health and chronic disease management.

The application of machine learning algorithms is critical for enhancing sensor interpretation. Current smart forks rely on basic movement heuristics; however, AI allows for the recognition of subtle variations in utensil handling, chewing force, and meal duration over hundreds of sessions. This sophisticated pattern recognition enables the device to detect deviations from a user's normal eating behavior, potentially signaling stress-induced overeating or emotional consumption, which are factors traditional trackers cannot isolate. Furthermore, AI facilitates improved calibration for different foods and densities. By processing data collected across thousands of users globally—a vast dataset representing various food textures and consumption methods—AI models can refine the correlation between movement profiles and actual intake volume, significantly improving the estimation of consumed quantity and, consequently, caloric intake. This increased precision is fundamental for achieving clinical credibility and broader integration into professional medical settings.

Crucially, AI personalization drives the shift toward true behavioral modification. Instead of providing generic advice, AI analyzes an individual’s historical data, physiological responses (potentially via integration with heart rate monitors), and contextual factors (time of day, day of the week) to deliver highly customized interventions. For example, if a user consistently rushes their dinner on Tuesdays after a stressful workday, the AI can trigger a personalized, preemptive notification hours before the meal, offering strategies for stress management or meal planning, rather than waiting for the fast eating to begin. This proactive and highly contextual coaching dramatically improves the user's chances of sustained behavioral change, solidifying the smart fork's position as a powerful tool in preventative health management and ensuring higher retention rates for both the device and associated subscription services, thereby fueling long-term market growth and profitability across the wellness technology sector.

- AI-driven behavior pattern recognition identifies stress-induced eating and emotional consumption triggers.

- Machine learning enhances the accuracy of bite detection, volume estimation, and potential caloric approximation across diverse food textures.

- Real-time, context-aware personalized coaching replaces generic feedback, optimizing intervention timing and effectiveness.

- AI algorithms facilitate predictive analytics, forecasting potential lapses in mindful eating based on historical user data and scheduling.

- Data fusion capabilities allow smart fork data to be combined with other wearable biometrics (e.g., heart rate, sleep data) for holistic health assessments.

- Natural Language Processing (NLP) integration improves the user interface by enabling conversational interaction and data querying regarding eating habits.

- AI supports clinical validation efforts by processing large datasets to demonstrate the efficacy of speed-based eating interventions.

DRO & Impact Forces Of Smart Fork Market

The Smart Fork Market's dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively exerting significant impact forces. Key drivers center on the global epidemic of obesity and the associated prevalence of chronic lifestyle diseases such as diabetes and cardiovascular conditions, compelling consumers and healthcare providers to seek measurable, behavioral solutions. The rapid advancements in IoT and miniaturized sensor technologies have made these sophisticated devices accessible and robust enough for daily use, acting as a crucial enabling factor. Furthermore, the rising consumer interest in quantified self-movement and personalized nutrition fuels the demand for tools that offer objective, quantifiable data about daily habits, moving dietary management beyond subjective diaries. These drivers collectively create a robust foundational demand, emphasizing the device’s role in modern preventative health paradigms and ensuring sustained investment in product development and market expansion across developed economies.

Conversely, significant restraints hinder widespread adoption. The primary constraint is the relatively high cost of the devices compared to traditional utensils, creating a barrier to entry for price-sensitive demographics. Furthermore, consumer skepticism regarding the necessity and long-term utility of the product, often viewed as a novelty gadget rather than a crucial health tool, limits market penetration. Data privacy concerns also represent a notable restraint; users are increasingly hesitant to share sensitive health and behavioral data, especially when integrated with third-party apps or cloud services. Beyond pricing and perception, technical limitations, such as the current inability of the device to autonomously and accurately identify the type of food being consumed without user input, restrict the comprehensive nutritional insight users expect from a "smart" device. Overcoming these perceptual and technical hurdles is essential for the market to transition from early adopters to mainstream consumers.

Opportunities for market growth lie predominantly in clinical validation and strategic integration. Achieving formal clinical validation for the device's effectiveness in managing specific conditions (e.g., Type 2 diabetes management or post-operative bariatric care) would transition the smart fork from a consumer gadget into a reimbursable medical device, significantly expanding the accessible market and enhancing trust among medical professionals. Another critical opportunity is the integration of smart forks into corporate wellness programs and insurance incentives, allowing businesses to promote employee health and potentially reduce healthcare costs. Technologically, opportunities exist in developing multi-sensing capabilities—integrating temperature, chemical sensors, or advanced AI visual recognition via companion devices—to achieve higher accuracy in food identification and nutritional profiling, thereby addressing the core technical restraint. These opportunities, if strategically leveraged, promise to unlock significant untapped value and elevate the market's stature within the broader digital health ecosystem, ensuring a strong, upward growth trajectory throughout the forecast period.

Segmentation Analysis

The Smart Fork Market is predominantly segmented based on Application, End-User, and Distribution Channel. This segmentation is crucial for targeted marketing and product development strategies, allowing companies to focus their resources on the most lucrative and rapidly evolving sectors. The application segment divides the market primarily into general wellness and specialized clinical uses, reflecting differing requirements for data precision and integration capabilities. End-User segmentation distinguishes between individual consumers and institutional buyers, such as hospitals, nutrition clinics, and corporate wellness organizations, each requiring distinct purchasing models and volume discounts. Distribution analysis provides insights into the effective channels for market reach, differentiating between online retail platforms, specialized medical supply distributors, and traditional brick-and-mortar consumer electronics outlets. Understanding these segments helps manufacturers tailor device features, pricing structures, and communication strategies to meet the specific needs of diverse customer cohorts globally.

Analysis by Application highlights the crucial divergence in market needs. The General Wellness segment seeks user-friendly interfaces, aesthetically pleasing designs, and integration with popular lifestyle apps, prioritizing affordability and ease of use over clinical-grade accuracy. Conversely, the Clinical/Medical segment requires stringent regulatory compliance, validated accuracy metrics, robust data encryption (like HIPAA compliance in the US), and compatibility with professional healthcare platforms. Products targeted at this segment often command higher prices due to the required validation and sophisticated data security features. This distinction drives product differentiation, where some manufacturers may focus on high-volume consumer appeal, while others concentrate on high-margin, specialized medical applications requiring B2B sales expertise and extensive clinical evidence to secure procurement contracts and physician endorsements, ensuring deep penetration into the healthcare infrastructure.

The geographical segmentation, while discussed separately, is critical within the overall analysis, as regional technological readiness and healthcare expenditure heavily influence segment dominance. For example, North America leads in both the consumer and clinical segments due to high awareness and healthcare spending. However, the rapidly expanding e-commerce infrastructure globally dictates that the Online Distribution Channel segment will continue to dominate sales volume, offering superior reach and logistics efficiency compared to traditional retail. Manufacturers must optimize their digital supply chain and fulfillment capabilities to capitalize on this prevailing distribution trend, ensuring seamless connectivity between product availability, digital marketing campaigns, and customer support services, which are vital for a connected device market. Overall, segmented analysis reveals that future growth will be most robust in the Clinical/Specialized Application segment distributed through online and specialized B2B channels.

- Application

- General Wellness and Fitness

- Clinical and Medical Applications (e.g., Post-Bariatric Surgery, Diabetes Management)

- End-User

- Individual Consumers

- Healthcare Providers (Hospitals, Clinics)

- Corporate Wellness Programs and Organizations

- Distribution Channel

- Online Retail (E-commerce Platforms, Direct-to-Consumer Websites)

- Offline Retail (Consumer Electronics Stores, Drug Stores)

- Specialized Distributors (Medical Equipment Suppliers)

- Technology

- Sensor-Based Monitoring (Accelerometer, Gyroscope)

- AI and Machine Learning Integrated Systems

Value Chain Analysis For Smart Fork Market

The value chain for the Smart Fork Market begins with the Upstream Analysis, which focuses primarily on the sourcing and manufacturing of sophisticated electronic components. Key upstream activities involve the procurement of high-precision micro-sensors (accelerometers and gyroscopes), specialized microprocessors optimized for low power consumption, long-life rechargeable batteries, and medical-grade, food-safe polymers for the utensil construction. The complexity of integrating these delicate electronics into a standard utensil form factor, which must also be waterproof and durable, requires specialized manufacturing capabilities, often involving high-precision injection molding and robust miniaturization techniques. Key suppliers in this segment are electronic component manufacturers and specialized plastics suppliers. Efficiency in this stage is heavily reliant on supply chain resilience, cost management of proprietary sensor arrays, and maintaining strict quality control to ensure product longevity and hygiene compliance, which significantly impacts the final product cost and reliability.

The downstream analysis primarily encompasses the activities related to software development, data analytics, branding, and packaging. A significant portion of the product's value is generated downstream through the proprietary algorithms and the accompanying mobile application. This software handles data synchronization, behavioral analysis, personalized coaching feedback, and integration with third-party health platforms (e.g., Apple Health, Google Fit). Effective downstream execution involves continuous application updates, robust cloud infrastructure for secure data storage, and the development of compelling user interfaces that translate raw data into actionable insights. Branding and marketing are critical here, emphasizing the device’s health benefits and technological sophistication rather than simply its function as a utensil, aiming to justify the premium price point and establish credibility as a legitimate health monitoring tool within the competitive digital health landscape.

Distribution channels for smart forks are multifaceted, spanning both direct and indirect routes. Direct distribution involves sales through the company's own e-commerce website, which offers maximum control over branding, pricing, and customer relationship management, and is often crucial for generating high-margin sales. Indirect channels include major online marketplaces (Amazon, specialized health retailers) and physical retail (consumer electronics stores, pharmacies, and increasingly, specialized medical equipment distributors). The choice of distribution channel often depends on the segment targeted; consumer electronics stores cater to the general wellness segment, while specialized medical distributors are essential for penetrating the high-value clinical and institutional markets (hospitals, clinics, and corporate wellness buyers). Optimizing the balance between the broad reach of online retail and the credibility provided by medical supply chains is paramount for maximizing market penetration and generating robust sales volumes globally, ensuring that logistics and fulfillment are agile enough to handle both high-volume consumer sales and precise, large-batch institutional orders.

Smart Fork Market Potential Customers

The potential customer base for the Smart Fork Market is broadly divided into health-conscious individual consumers and institutional purchasers with specific clinical or corporate wellness objectives. Individual end-users, representing the largest volume segment, include individuals actively pursuing weight management, those interested in the "quantified self" movement, and people seeking preventative health measures due to genetic predisposition or early signs of chronic conditions. These buyers are typically tech-savvy, possess disposable income, and are highly motivated by self-improvement and measurable progress. They prioritize sleek design, seamless app integration, battery life, and the simplicity of use. Effective marketing strategies target this group through digital platforms, social media wellness influencers, and partnerships with fitness and nutrition coaching services, emphasizing the smart fork's role as a sustainable, non-dieting approach to behavioral change.

The institutional end-users represent the high-value, specialized segment where the demand is driven by clinical efficacy and population health outcomes. This cohort includes bariatric clinics and surgeons who recommend the device post-surgery to ensure patients adopt slower eating habits, which is crucial for preventing complications and maximizing weight loss success. Similarly, diabetes management centers and clinical nutritionists utilize the objective data provided by smart forks to monitor patient compliance and tailor nutritional interventions far more effectively than relying on self-reported food diaries. Furthermore, corporate wellness programs are emerging as significant institutional buyers. Companies are increasingly investing in employee health technology to reduce health insurance costs and improve productivity, viewing the smart fork as an innovative tool to combat stress-related eating and improve general employee well-being, positioning this B2B segment as a critical growth engine for premium products.

Beyond the core segments, niche buyers such as sports nutritionists and researchers represent valuable, though smaller, customer groups. Sports nutritionists leverage the precise eating pace data to optimize nutrient timing and digestive efficiency for elite athletes, where even marginal gains in performance derived from better digestion are highly valued. Academic and commercial research institutions represent another vital customer segment, utilizing smart forks in clinical trials focused on behavioral science, appetite regulation, and the long-term impacts of mindful eating on physiological markers. These research applications demand high-fidelity data logging and specialized API access, driving demand for the most sophisticated and clinically validated versions of the smart fork technology. Consequently, market strategy must incorporate specific outreach and product configurations tailored to the rigorous data requirements and ethical compliance standards of the research community.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Million |

| Market Forecast in 2033 | USD 125.7 Million |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HAPILABS, Modius Health, Kolibree, Liftware (Google), Xiaomi, Shenzhen Huami, Samsung, Fitbit (Google), Withings, Garmin, Oura Health, Philips, Biobeat, Cue Health, Pacer Health, Omron Healthcare, Etekcity, Sensoria Health, Qardio, Apple |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Fork Market Key Technology Landscape

The technological landscape of the Smart Fork Market is defined by the integration of miniaturized sensory arrays and sophisticated data processing techniques. The foundational technology relies on Micro-Electro-Mechanical Systems (MEMS) sensors, specifically high-resolution accelerometers and gyroscopes. These sensors are embedded within the handle of the utensil and are crucial for accurately detecting the precise three-dimensional movements associated with lifting, consuming, and resting the fork. The effectiveness of the device hinges on the sensor fusion algorithms that process the raw data from these multiple motion detectors to accurately identify a distinct "bite" event, measure the time interval between bites, and calculate the total meal duration. Advanced implementations often incorporate haptic feedback mechanisms, such as small vibration motors, which are triggered by the internal microcontroller when the user's eating pace exceeds a pre-set threshold, providing immediate, non-intrusive behavioral correction in real-time. Powering these components efficiently requires ultra-low power microprocessors and specialized battery technology, often prioritizing size and weight for user comfort, while maintaining sufficient capacity for several days of continuous use without recharging.

The connectivity and data infrastructure form the secondary, equally critical layer of the technology landscape. Bluetooth Low Energy (BLE) remains the standard for seamless, short-range wireless communication, enabling the transfer of collected eating data from the fork to a paired smartphone or tablet. Beyond simple data transfer, the true value is unlocked by the proprietary algorithms residing in the companion mobile application and associated cloud services. These algorithms are responsible for processing the raw bite data, generating statistical summaries, identifying long-term behavioral trends, and delivering actionable user insights. Security protocols, particularly encryption standards (SSL/TLS), are mandatory for protecting this highly sensitive personal health information (PHI) both during transmission and storage, meeting regional compliance requirements such as GDPR and HIPAA. The overall ecosystem demands robust, scalable cloud infrastructure capable of handling high volumes of continuous data logging from a global user base, ensuring reliability and minimizing latency during data synchronization and analysis operations.

Future technological advancements are heavily focused on enhancing autonomy and predictive capabilities through the strategic infusion of Artificial Intelligence and Machine Learning (AI/ML). Research is currently directed toward developing complex classification models that can utilize motion data, and potentially integrate with non-invasive sensors (like impedance or temperature sensors), to infer the type of food being consumed, moving toward autonomous nutritional tracking. Furthermore, AI is crucial for optimizing the personalized coaching engine. Machine learning models analyze deviations from established healthy patterns and automatically adjust the behavioral interventions—such as modifying the vibration threshold or tailoring the timing of motivational prompts—to maximize the efficacy of the intervention for that specific user. The integration of advanced diagnostics, potentially allowing the smart fork to flag instances of erratic eating that might warrant clinical attention, demonstrates the evolving technological ambition to transform the smart fork from a simple timing tool into a sophisticated, interconnected diagnostic and preventative health platform, substantially increasing its functional scope and clinical relevance within the digital health sector.

Regional Highlights

Geographical segmentation reveals stark differences in market maturity, adoption rates, and growth potential driven by varying consumer health priorities, technological infrastructure, and healthcare expenditure across the globe. North America, specifically the United States and Canada, leads the global smart fork market in terms of revenue and early adoption. This dominance is attributable to the high prevalence of obesity and related chronic diseases, coupled with a highly proactive consumer segment that is receptive to expensive, high-tech wellness gadgets and behavioral modification tools. The region benefits from a robust ecosystem of digital health funding, aggressive marketing campaigns by consumer electronics firms, and significant private sector investment in corporate wellness programs. Furthermore, the strong integration of mobile technology and widespread acceptance of quantified self-tracking provide a fertile ground for market expansion, particularly within the specialized clinical applications where reimbursement potential exists for innovative diagnostic and monitoring tools, thereby validating the high cost of the technology.

Europe represents the second largest market, characterized by strong governmental emphasis on preventative medicine and a high level of health consciousness, particularly in Western European countries like Germany, France, and the UK. Market growth in Europe is steady, driven by both individual consumer adoption and increasing integration of these devices into national health service programs focused on managing lifestyle diseases. The European market demands high standards for data privacy (GDPR compliance), which manufacturers must rigorously adhere to, affecting software design and data handling protocols. While consumer adoption is strong, market penetration is slightly tempered compared to North America due to differing purchasing habits and, in some regions, a preference for lower-cost, holistic health solutions over expensive technological interventions. However, the region’s stability and high healthcare quality standards make it a reliable market for premium smart fork products focusing on validated clinical use cases.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is fueled by rapidly increasing middle-class disposable incomes, rising health awareness stemming from the proliferation of chronic diseases linked to rapid urbanization and dietary shifts, and massive digital penetration in countries like China, India, and South Korea. Government initiatives in countries like Japan and Singapore to promote elderly health and preventative care also boost the market. While price sensitivity remains a factor in large parts of the region, the sheer size of the population and the quick adoption of new technology ensure significant market potential. Manufacturers entering the APAC market often focus on strategic partnerships with local distributors and offering localized application content and language support to maximize accessibility and consumer trust. Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller market shares but are expected to experience moderate growth, primarily concentrated in urban centers with high internet penetration and private healthcare expenditure, as health monitoring devices gain acceptance as essential wellness tools. Strategic focus in these emerging markets centers on leveraging mobile connectivity and affordability to drive initial consumer trials.

- North America: Market leader driven by high disposable income, proactive consumer health management, and established digital health ecosystems, focusing heavily on B2C and clinical integration.

- Europe: Stable growth fueled by preventative healthcare initiatives, high data privacy standards (GDPR), and strong clinical adoption in major economies (Germany, UK, France).

- Asia Pacific (APAC): Fastest-growing region due to rising middle-class wealth, increasing urbanization-related lifestyle diseases, and rapid adoption of consumer electronics and IoT technology.

- Latin America (LATAM): Emerging market potential concentrated in Brazil and Mexico, characterized by growing chronic disease rates and increasing access to advanced consumer technology.

- Middle East and Africa (MEA): Limited but concentrated growth, primarily driven by high-net-worth individuals and targeted governmental health initiatives in Gulf Cooperation Council (GCC) countries focusing on obesity and diabetes control.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Fork Market.- HAPILABS

- Modius Health

- Kolibree

- Liftware (Google)

- Xiaomi

- Shenzhen Huami

- Samsung

- Fitbit (Google)

- Withings

- Garmin

- Oura Health

- Philips

- Biobeat

- Cue Health

- Pacer Health

- Omron Healthcare

- Etekcity

- Sensoria Health

- Qardio

- Apple

Frequently Asked Questions

Analyze common user questions about the Smart Fork market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a smart fork and how does it improve eating habits?

The primary function of a smart fork is to monitor eating pace and duration using embedded motion sensors. It helps improve habits by providing real-time feedback, typically haptic vibration alerts, when the user is eating too fast, thereby encouraging slower, more mindful consumption which aids in weight management and digestion. Data collected is synchronized to an app for long-term behavioral tracking and personalized coaching.

Are smart forks effective for long-term weight loss and chronic disease management?

Smart forks are highly effective as behavioral modification tools, especially when integrated into structured dietary programs. By promoting mindful and slow eating, they aid in increasing satiety, reducing caloric intake, and managing symptoms related to conditions like Type 2 diabetes and chronic acid reflux. Their efficacy is maximized when combined with nutritional guidance and consistent use, providing objective data for clinical monitoring.

What is the current estimated size and future growth rate of the Smart Fork Market?

The Smart Fork Market is estimated to be valued at USD 45.2 Million in 2026 and is projected to reach USD 125.7 Million by 2033. The market is forecasted to experience a robust growth rate of 15.8% CAGR between 2026 and 2033, driven by rising health awareness and technological advancements in personalized nutrition and IoT devices.

How is Artificial Intelligence (AI) impacting the development of smart fork technology?

AI is crucial for advancing smart fork technology by enabling sophisticated pattern recognition to differentiate between various eating styles and potential emotional triggers. AI enhances accuracy in bite detection and volume estimation, and, critically, facilitates the delivery of highly personalized, context-aware coaching and interventions, moving beyond simple speed monitoring to comprehensive behavioral analytics.

Which geographical regions are leading the adoption of smart forks and why?

North America currently leads the smart fork market in terms of revenue and adoption due to high consumer spending on wellness technology and a significant need for solutions addressing high rates of obesity and chronic diseases. Europe follows closely, benefiting from strong governmental focus on preventative medicine. The Asia Pacific region is expected to exhibit the highest future growth rate due to rapidly increasing disposable incomes and urbanization-related dietary shifts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager