Smart Garbage Classification Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432174 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Smart Garbage Classification Solution Market Size

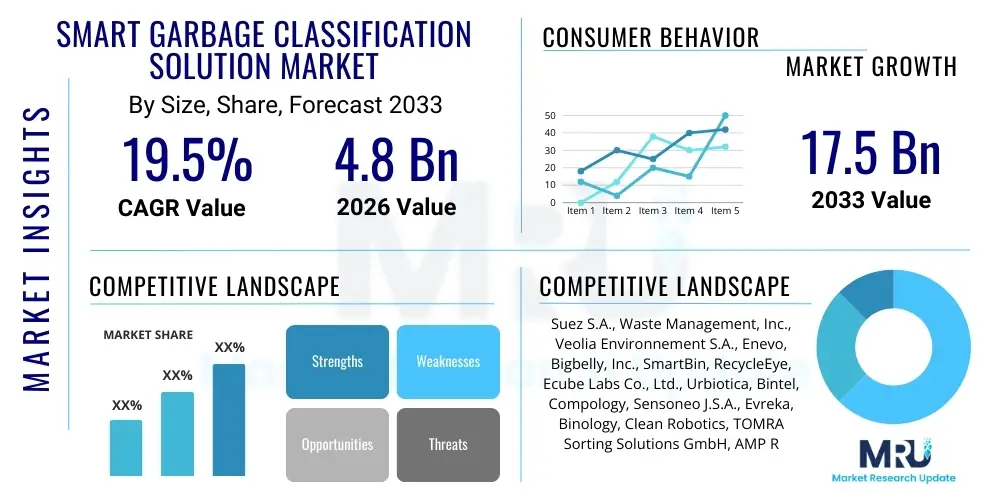

The Smart Garbage Classification Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 17.5 Billion by the end of the forecast period in 2033.

Smart Garbage Classification Solution Market introduction

The Smart Garbage Classification Solution Market encompasses advanced technologies, including IoT sensors, AI-driven computer vision systems, and robotic sorting mechanisms, designed to automate and optimize the process of waste segregation at various stages, from collection points to recycling facilities. These solutions provide real-time data on waste levels, composition, and collection efficiency, moving traditional waste management towards a highly efficient, sustainable, and data-driven circular economy model. The core product offering includes smart bins equipped with compaction and sensing capabilities, specialized software platforms for route optimization and data analytics, and automated material recovery systems that use machine learning to accurately classify diverse waste streams such as plastics, metals, paper, and organics. The sophistication of these systems ensures higher purity in recycled materials, significantly lowering operational costs and reducing environmental contamination associated with improper waste disposal.

Major applications of these smart solutions span residential complexes, municipal public spaces, large commercial establishments, and industrial manufacturing sectors, where waste generation is substantial and heterogeneous. In urban centers, smart bins deployed in high-traffic areas communicate fullness levels directly to centralized management systems, facilitating dynamic routing for collection vehicles. This shift from fixed schedules to demand-driven collection drastically reduces fuel consumption and operational expenditure, simultaneously minimizing traffic congestion and noise pollution. Furthermore, the integration of classification capabilities at the source, particularly in regions enforcing strict segregation policies, enhances compliance and prepares waste streams optimally for subsequent processing. The ability to monitor waste composition also provides crucial feedback to policymakers regarding consumption patterns and the effectiveness of local environmental campaigns.

Key benefits driving market penetration include significant improvements in environmental sustainability, operational cost reduction through efficiency gains, and enhanced public hygiene. Government initiatives worldwide promoting smart city infrastructure and stringent environmental regulations regarding landfill dependency and recycling targets act as powerful market accelerators. Technological driving factors involve the declining cost of IoT sensors, rapid advancements in AI algorithms capable of complex pattern recognition, and the ubiquitous deployment of high-speed wireless connectivity (5G), enabling seamless data transfer across vast municipal networks. The growing public awareness concerning climate change and resource scarcity further fuels the demand for transparent and efficient waste management processes, positioning smart classification solutions as indispensable tools for achieving global sustainability development goals.

Smart Garbage Classification Solution Market Executive Summary

The global Smart Garbage Classification Solution Market is experiencing robust acceleration, fundamentally driven by the confluence of mandatory environmental policies, rapid urbanization, and significant technological maturation. Business trends indicate a strong shift towards integration, where hardware providers are partnering with software and platform developers to offer comprehensive, end-to-end waste intelligence ecosystems rather than isolated smart bin solutions. Subscription-based service models (Waste-as-a-Service, or WaaS) are gaining traction, allowing municipal and commercial clients to adopt these capital-intensive technologies without major upfront investment, thereby lowering the barrier to entry and accelerating market adoption across diverse economic landscapes. Furthermore, there is a pronounced investment focus on advanced recycling infrastructure, utilizing robotics and AI vision systems to handle contaminated or mixed waste streams, dramatically boosting material recovery rates and driving profitability within the recycling value chain.

Regional trends highlight distinct stages of adoption. North America and Europe currently dominate the market share, characterized by high technological readiness, established environmental regulatory frameworks (such as the European Union’s Circular Economy Package), and significant private sector participation in waste management infrastructure. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This explosive growth is attributed to massive urbanization projects, burgeoning populations generating increasing waste volumes, and recent legislative mandates, particularly in countries like China and India, making waste segregation compulsory, thus creating an unprecedented demand for scalable classification technologies. The Middle East and Africa (MEA) are also showing promising growth, primarily fueled by smart city initiatives, such as NEOM in Saudi Arabia, emphasizing sustainable resource management from the ground up.

Segment trends reveal that the Software and Services component segment is poised for the most rapid growth, surpassing the traditional dominance of the Hardware segment. This shift emphasizes the market's value moving from physical assets to data intelligence, predictive analytics, and platform optimization. Within applications, the Municipal/Public Spaces segment remains the largest consumer, driven by government tenders for city-wide smart infrastructure deployment. However, the Industrial segment, specifically manufacturers aiming for ISO 14001 compliance and zero-waste-to-landfill targets, is exhibiting accelerated adoption rates for specialized classification robots capable of handling complex industrial by-products. Technology-wise, AI and Machine Learning (ML) solutions, particularly those involving deep learning for image recognition, are becoming the core differentiator, enabling granular classification previously unattainable by conventional methods.

AI Impact Analysis on Smart Garbage Classification Solution Market

User inquiries regarding the impact of Artificial Intelligence (AI) on smart waste management overwhelmingly center on efficiency, accuracy, and scalability. Common user questions probe how AI vision systems compare to traditional sensors in classifying complex waste materials, the cost implications of implementing machine learning algorithms for dynamic routing, and the expected reduction in human intervention required for sorting. There is a strong expectation that AI will solve the persistent challenge of contamination in recycling streams, which currently reduces the market value of recovered materials. Furthermore, users are keenly interested in predictive maintenance capabilities enabled by AI, ensuring the longevity and optimal performance of smart bins and robotic sorters deployed in demanding urban environments. The underlying theme is the anticipation that AI will transition smart waste management from merely ‘connected’ to genuinely ‘intelligent’ and autonomous.

AI's role transcends simple data collection; it is the engine driving high-precision classification and optimization throughout the waste lifecycle. Deep learning algorithms are trained on vast datasets of waste imagery, enabling classification accuracy exceeding 95% in distinguishing between various types of plastics (PET, HDPE, PVC), paper, and mixed materials, even when items are partially obscured or dirty. This level of granular classification is essential for meeting stringent recycling standards and maximizing the economic return on material recovery. Moreover, AI-powered predictive models analyze historical and real-time sensor data—including temperature, pressure, fill rate, and collection patterns—to predict optimal collection times, minimizing unnecessary trips and reducing the carbon footprint of fleet operations by up to 30%, optimizing fuel and labor resource allocation significantly.

The deployment of robotic sorting systems, powered by advanced AI and computer vision, represents the pinnacle of efficiency in Material Recovery Facilities (MRFs). These robotic arms can identify, select, and sort objects at speeds far surpassing human capability, operating 24/7 in challenging environments. The impact on workforce safety and purity rates is transformative. As smart city initiatives mature globally, the demand for scalable, replicable AI solutions capable of integrating across heterogeneous public and private waste systems will intensify, solidifying AI not just as an enhancement, but as a foundational necessity for any comprehensive smart garbage solution offering.

- AI-driven Computer Vision: Enables highly accurate, real-time identification and classification of complex waste materials, crucial for increasing recycling purity rates.

- Robotic Sorting Systems: Utilizes machine learning and robotics for high-speed, autonomous separation of waste streams in Material Recovery Facilities (MRFs).

- Predictive Analytics for Routing: Optimizes collection logistics by dynamically adjusting routes based on predictive fill-level modeling, reducing fuel consumption and operational costs.

- Waste Composition Analysis: Provides detailed insights into community consumption patterns and waste generation sources, informing policy and resource allocation strategies.

- Predictive Maintenance: AI monitors the performance and health of smart infrastructure (bins, sensors, compactors) to forecast failures, minimizing downtime and maintenance costs.

DRO & Impact Forces Of Smart Garbage Classification Solution Market

The Smart Garbage Classification Solution Market is primarily propelled by stringent global regulatory mandates promoting circular economy principles and significant governmental investment in smart city infrastructure development. The core driving force is the need for municipalities to manage escalating waste volumes efficiently while dramatically reducing landfill reliance and associated methane emissions. Restraints largely center around the high initial capital expenditure required for deploying intelligent hardware and integrated software platforms, alongside the complexity of integrating proprietary smart systems with legacy municipal infrastructure. However, vast opportunities exist in emerging economies with rapid urbanization and the growing necessity for sophisticated waste intelligence platforms that offer modular and scalable deployment options. The interplay of these forces dictates market trajectory, favoring vendors who can demonstrate clear Return on Investment (ROI) through measurable efficiency gains and proven environmental compliance.

Key drivers include the global mandate for waste reduction targets, notably in developed markets where penalties for poor segregation are increasing. Rapid technological advancement, particularly in high-speed sensor technology (LiDAR, ultrasonic) and advancements in connectivity protocols (5G, LoRaWAN), drastically improves the operational reliability and real-time data transmission capabilities of smart bins. Conversely, a significant restraint is the public skepticism or resistance to adopting source segregation practices, which limits the effectiveness of downstream classification technologies. Furthermore, data security and privacy concerns related to collecting granular information about waste generation patterns and individual habits pose regulatory and consumer trust challenges that market players must address through robust encryption and transparent data governance policies. The initial high cost of advanced robotic sorters remains a barrier for smaller recycling operations.

Opportunities are exceptionally strong in developing tailored solutions for decentralized waste management in remote or peri-urban areas, leveraging modular IoT architectures. There is also a substantial market opportunity in offering specialized waste audit and consulting services, utilizing classification data to help large corporations achieve ambitious Environmental, Social, and Governance (ESG) goals, particularly concerning Scope 3 emissions reporting. The market impact forces are categorized as high due to the non-negotiable nature of environmental compliance and the increasing pressure from consumer and investor groups demanding sustainable operational transparency. The shift from linear consumption models to circular value chains makes smart classification a critical infrastructure investment rather than an optional technological enhancement. Successful market navigation requires strategic focus on affordability through WaaS models and continuous innovation in AI accuracy to overcome the contamination hurdle.

Segmentation Analysis

The Smart Garbage Classification Solution Market is comprehensively segmented based on the component type, technology utilized, specific application area, and deployment model, allowing for detailed analysis of demand patterns and strategic investment areas. The segmentation reflects the diverse range of needs across municipal, commercial, and industrial sectors, from simple volume monitoring to complex material recovery. The market analysis confirms that while hardware (smart bins and sensors) still accounts for a significant portion of current spending, the long-term growth trajectory is dominated by the sophisticated software and highly scalable service offerings that derive intelligence from the collected data. Understanding these segmentation dynamics is crucial for vendors to tailor offerings that maximize value proposition across different geographical and operational maturity levels.

- By Component:

- Hardware (Smart Bins, IoT Sensors, Compaction Units, RFID/Barcode Readers)

- Software (Data Analytics Platforms, Route Optimization Software, Monitoring Dashboards)

- Services (Consulting, Implementation, Maintenance, Waste-as-a-Service (WaaS))

- By Technology:

- IoT & Sensor Technology

- Artificial Intelligence (AI) & Machine Learning (ML)

- Robotics & Automation (Robotic Sorting Arms)

- Cloud Computing

- By Application:

- Municipal & Public Spaces (Smart City Initiatives)

- Residential Complexes

- Commercial & Retail Centers

- Industrial Facilities & Manufacturing

- By Deployment:

- On-Premise

- Cloud-Based

Value Chain Analysis For Smart Garbage Classification Solution Market

The value chain of the Smart Garbage Classification Solution Market is characterized by a high degree of integration between upstream technology development and downstream service delivery, focusing heavily on data exchange and intelligence generation. The upstream segment involves the design and manufacture of specialized components, including ruggedized IoT sensors, high-resolution cameras, specialized robotic arms, and developing proprietary AI/ML classification algorithms. Key players in this phase are technology providers specializing in silicon, optics, and software development. Ensuring component reliability, low power consumption, and interoperability is critical here, as these components form the physical basis for intelligent operation in harsh environmental conditions. The value addition lies in miniaturization, cost reduction through economies of scale, and developing sophisticated firmware that processes data at the edge before transmission.

The midstream phase focuses on system integration and platform development. This involves assembling the hardware components into functional smart bins or sorting lines, developing the central software platforms (often cloud-based) that ingest the sensor data, perform analytics, and generate actionable insights (such as optimized routes and predictive maintenance alerts). Distribution channels play a vital role in reaching the diverse customer base. Direct channels are predominantly used for large municipal tenders or high-value industrial automation projects, where custom integration and ongoing technical consultation are necessary. Indirect channels, involving system integrators, municipal contractors, and regional distributors, are crucial for scaling standardized smart bin deployments and providing localized implementation support and maintenance services.

The downstream segment centers on deployment, operational services, and maximizing data utilization. This phase involves installing the solutions on-site, providing ongoing maintenance, and most importantly, offering the Waste-as-a-Service (WaaS) business models. WaaS shifts the focus from a one-time product sale to a continuous relationship, providing clients with access to real-time data dashboards, detailed waste composition reports, and continuous software updates. The final point of value capture is the generation and monetization of waste intelligence, which helps municipalities and businesses refine waste reduction strategies and achieve compliance targets, completing the loop in the circular economy model. The efficiency of the distribution channel, particularly the expertise of integrators, is paramount for ensuring seamless rollout and high utilization rates of the installed smart infrastructure.

Smart Garbage Classification Solution Market Potential Customers

The primary consumers and beneficiaries of Smart Garbage Classification Solutions are diverse, ranging from large governmental bodies responsible for public hygiene and environmental compliance to private corporations aiming for sustainable operations. Municipalities worldwide represent the largest segment of potential customers, driven by the pressing need to cope with escalating urban waste generation, reduce collection costs, and meet increasingly strict recycling quotas imposed by national and international bodies. These customers demand scalable, robust, and interoperable solutions that integrate seamlessly with existing city infrastructure and offer dynamic optimization of logistics, such as vehicle routing and staffing allocation. Their purchasing decisions are heavily influenced by proven ROI metrics related to cost savings in fuel and labor, as well as documented improvements in recycling rates and environmental KPIs.

The second major group comprises the Commercial and Retail sectors, including large shopping malls, hotel chains, universities, and corporate campuses. These entities are motivated by both regulatory compliance and strong internal Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) mandates. For commercial clients, smart classification solutions help them manage diverse, high-volume waste streams efficiently, often requiring compactors and internal monitoring systems that ensure compliance with internal sustainability targets and reduce disposal costs. They typically prefer cloud-based systems for ease of management across multiple locations and look for solutions that provide transparent, auditable reporting of waste diversion metrics to stakeholders.

Furthermore, Industrial facilities, particularly those in manufacturing, pharmaceuticals, and complex material processing, constitute a specialized high-value customer segment. These customers require highly sophisticated, robotic-based classification solutions capable of handling hazardous or specialized industrial by-products with high precision and safety standards. Their need is driven by zero-waste-to-landfill targets and regulatory requirements for tracking and treating complex waste streams. Other growing segments include private waste management companies (who use these solutions to enhance their service offerings and competitiveness) and residential housing developers who integrate smart waste systems as a premium feature in modern, sustainable communities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 17.5 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suez S.A., Waste Management, Inc., Veolia Environnement S.A., Enevo, Bigbelly, Inc., SmartBin, RecycleEye, Ecube Labs Co., Ltd., Urbiotica, Bintel, Compology, Sensoneo J.S.A., Evreka, Binology, Clean Robotics, TOMRA Sorting Solutions GmbH, AMP Robotics Corp., ZenRobotics Ltd., Rehrig Pacific Company, Max-AI by Bulk Handling Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Garbage Classification Solution Market Key Technology Landscape

The technological core of the Smart Garbage Classification Solution Market rests on the robust integration of sensing, data processing, and automation capabilities. Internet of Things (IoT) sensors, including ultrasonic, LiDAR, and pressure transducers, form the foundation by accurately measuring fill levels, temperature (monitoring for fire risk), and weight within containers. These sensors are increasingly becoming sophisticated, incorporating low-power wide-area network (LPWAN) protocols like LoRaWAN and Narrowband IoT (NB-IoT) to ensure reliable, long-range data transmission with minimal battery consumption, crucial for urban environments. The transition from simple level monitoring to complex composition analysis is driven by the declining cost and miniaturization of these integrated sensor packages, making large-scale deployment economically viable for municipalities.

The most critical technological advancement driving market growth is the application of Artificial Intelligence (AI) and Machine Learning (ML), particularly Deep Learning models used in conjunction with high-resolution computer vision systems. These AI systems are utilized in two primary areas: firstly, at the point of source collection, where smart bins use cameras and AI to verify correct waste segregation by users, providing immediate feedback; and secondly, in Material Recovery Facilities (MRFs), where robotic sorting arms equipped with spectral imaging (NIR and VIS) and trained AI models identify materials instantaneously. This enables accurate classification of materials that look visually similar but have different chemical compositions, thus dramatically increasing the purity of recyclates and creating higher-value outputs for recycling operations. The speed and precision of AI-powered systems are setting new benchmarks for efficiency in waste processing.

Furthermore, cloud computing platforms and big data analytics are indispensable for centralizing the massive volume of data generated by thousands of connected sensors and classification units. These platforms provide municipalities and service providers with dashboards for real-time operational oversight, enabling predictive modeling for collection logistics and long-term planning based on waste generation trends. Robotics, particularly collaborative robots (cobots) designed to work safely alongside humans, are rapidly penetrating MRFs, replacing manual labor in repetitive and hazardous sorting tasks. Blockchain technology is also emerging as a supplementary technology for creating immutable, auditable records of waste flow and compliance, enhancing transparency throughout the complex waste management supply chain and satisfying increasing stakeholder demands for accountability.

Regional Highlights

- North America: This region commands a significant market share, driven by high disposable income, established technology adoption curves, and robust governmental support for smart city initiatives, particularly in the United States and Canada. The market here is characterized by the presence of major industry players and a strong focus on advanced data analytics and AI-driven solutions for route optimization and efficiency gains. Environmental regulations, such as landfill diversion targets and increasing recycling mandates across state lines, pressure waste management companies to integrate smart classification technologies rapidly. High labor costs also accelerate the adoption of robotic sorting solutions in MRFs. Investment in pilot projects testing novel sensors and predictive maintenance platforms is prevalent, cementing North America's role as an early adopter of cutting-edge smart waste infrastructure.

- Europe: Europe is characterized by highly ambitious, legally binding environmental targets set by the European Union, most notably through the Circular Economy Action Plan, which mandates high material recovery and recycling rates. This regulatory environment is the primary market driver, pushing widespread adoption of smart bins and localized classification technologies at the municipal level. Countries like Germany, Sweden, and the Netherlands lead in deployment density and technological sophistication, emphasizing source segregation verification using RFID and smart technology integration. The focus is strongly on sustainability and reducing ecological footprint, driving demand for accurate compositional data and low-emission fleet management using smart routing. Public-private partnerships are common, facilitating large-scale infrastructure overhauls.

- Asia Pacific (APAC): Expected to be the fastest-growing region, the APAC market is defined by unparalleled urbanization rates, massive population density, and rapidly changing governmental policies regarding waste management, notably in China, India, and Southeast Asian nations. The region is transitioning from traditional, often inefficient, waste collection methods directly to advanced smart solutions to cope with burgeoning waste streams. The implementation of mandatory waste segregation policies in major Chinese and Indian cities has created explosive demand for smart classification hardware and localized monitoring software. While capital expenditure remains a constraint in some developing areas, the massive scale and necessity for modern infrastructure make APAC the most promising region for volume growth and decentralized solution deployment.

- Latin America: The market in Latin America is nascent but rapidly developing, primarily concentrated in major metropolitan areas such as São Paulo, Mexico City, and Santiago, driven by local governmental efforts to modernize public services and improve sanitation standards. Market growth is heavily reliant on foreign investment and technology imports. The adoption focus is currently on basic IoT-enabled smart bins for fill-level monitoring and route optimization to improve collection efficiency and resource allocation in dense urban areas. Challenges include complex logistics, economic volatility, and the need for localized solutions tailored to specific socioeconomic conditions and infrastructure limitations.

- Middle East and Africa (MEA): Growth in the MEA region is strongly tied to large-scale, visionary smart city projects, such as those in the GCC nations (UAE and Saudi Arabia). These nations aim to establish world-class sustainable cities from the foundation up, positioning smart waste management as a core component of sustainable urban living. High purchasing power in the Gulf countries facilitates the deployment of premium, high-tech solutions, including advanced robotic sorting centers and comprehensive waste intelligence platforms. In Africa, the market is emerging, with adoption driven by sanitation improvements and environmental goals, primarily in major commercial hubs and utilizing affordable, scalable IoT solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Garbage Classification Solution Market.- Suez S.A.

- Waste Management, Inc.

- Veolia Environnement S.A.

- Enevo

- Bigbelly, Inc.

- SmartBin

- RecycleEye

- Ecube Labs Co., Ltd.

- Urbiotica

- Bintel

- Compology

- Sensoneo J.S.A.

- Evreka

- Binology

- Clean Robotics

- TOMRA Sorting Solutions GmbH

- AMP Robotics Corp.

- ZenRobotics Ltd.

- Rehrig Pacific Company

- Max-AI by Bulk Handling Systems

Frequently Asked Questions

Analyze common user questions about the Smart Garbage Classification Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of AI in smart garbage classification solutions?

The primary function of AI is to ensure high-accuracy classification and segregation of mixed waste streams. AI-powered computer vision systems identify waste materials based on composition, shape, and size, enabling robotic sorters to separate items quickly (often at speeds exceeding 80 picks per minute), significantly increasing the purity and hence the market value of recycled commodities and reducing contamination.

How do smart garbage solutions achieve operational cost savings for municipalities?

Operational cost savings are primarily achieved through optimized logistics and demand-driven collection. IoT sensors provide real-time fill-level data, allowing AI algorithms to generate dynamic, efficient collection routes, eliminating unnecessary stops and reducing fleet operational costs (fuel, labor, maintenance) typically by 20% to 40% compared to traditional fixed-schedule routing.

What is the projected CAGR for the Smart Garbage Classification Solution Market between 2026 and 2033?

The Smart Garbage Classification Solution Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period from 2026 to 2033, driven by increasing urbanization and global mandates for sustainable waste management practices.

Which geographical region is expected to show the highest growth rate, and why?

The Asia Pacific (APAC) region is expected to demonstrate the highest growth rate. This acceleration is fueled by massive urbanization, burgeoning populations, and recent widespread implementation of compulsory waste segregation policies in high-density countries like China and India, creating substantial demand for scalable technological solutions.

What are the main barriers to widespread adoption of these solutions?

The main barriers include the significant initial capital investment required for purchasing and deploying smart infrastructure, challenges related to integrating proprietary smart systems with existing legacy municipal IT and logistics frameworks, and regulatory hurdles concerning data privacy and security when collecting granular waste generation data.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager