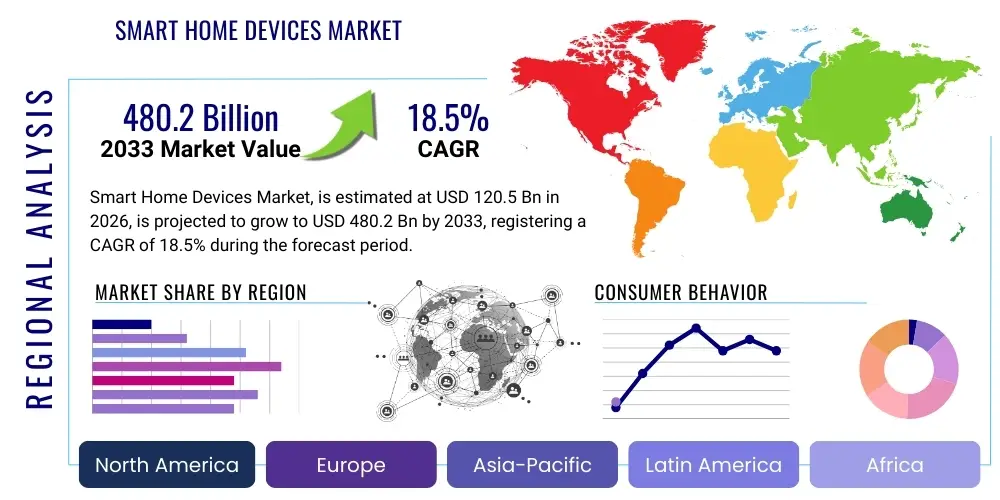

Smart Home Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438220 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Smart Home Devices Market Size

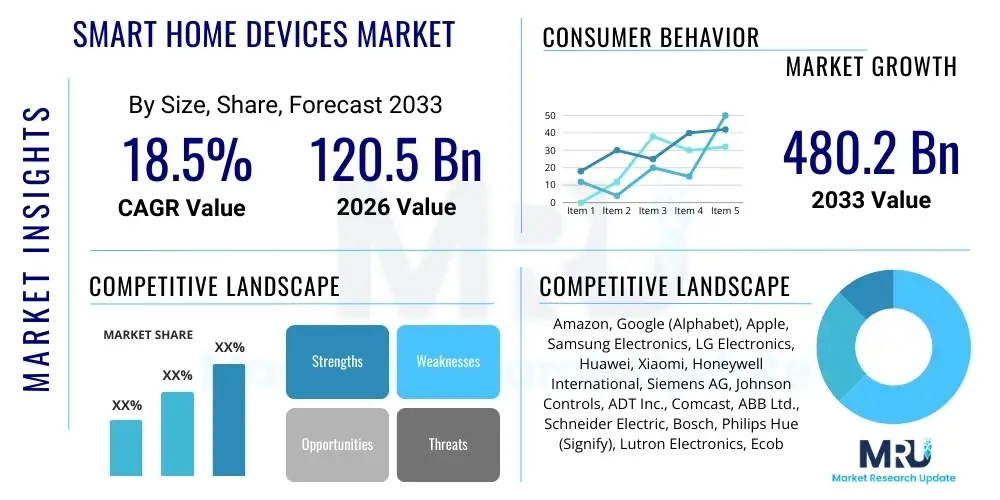

The Smart Home Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 120.5 Billion in 2026 and is projected to reach USD 480.2 Billion by the end of the forecast period in 2033.

Smart Home Devices Market introduction

The Smart Home Devices Market encompasses an evolving ecosystem of interconnected devices designed to automate, optimize, and centralize the control of household functions, enhancing convenience, security, and energy efficiency for residents. Initially driven by early adoption of fundamental systems like smart lighting and security cameras, the market has rapidly matured, incorporating complex technologies such as Artificial Intelligence (AI) and Machine Learning (ML) to facilitate predictive maintenance and highly personalized user experiences. These devices operate across various categories, including control and connectivity (hubs, voice assistants), security and surveillance (doorbells, locks), lighting, energy management (thermostats, smart meters), and entertainment systems, all unified through the Internet of Things (IoT) infrastructure.

Major applications of smart home technology span critical residential needs, including ensuring robust perimeter security through monitored systems, optimizing indoor climate control via learning thermostats, and managing utilities to minimize energy consumption and reduce environmental footprint. Beyond functional necessity, the devices offer significant lifestyle benefits, providing hands-free operation and remote access capabilities that cater to modern, busy lifestyles. The integration of devices into a single, cohesive platform, often managed via a central application or voice interface, is a key selling proposition that drives consumer interest and facilitates mass adoption across various demographic segments, including families, professionals, and the elderly seeking enhanced independence and safety.

The principal driving factors underpinning the market's robust expansion include the continuous decline in the cost of sensors and microprocessors, making devices more affordable for the mainstream consumer. Furthermore, the global proliferation of high-speed internet connectivity, including Fiber and 5G networks, ensures seamless device communication and data transfer, which is essential for real-time responsiveness and cloud-based processing. Crucially, increasing consumer awareness regarding sustainable living and the potential for significant energy bill savings through optimized energy management systems provides a powerful incentive for investment in smart appliances and control modules. The standardization of communication protocols, although still fragmented, is also improving interoperability, further cementing the market's growth trajectory.

Smart Home Devices Market Executive Summary

The Smart Home Devices Market is characterized by vigorous innovation and intense platform competition, shifting the focus from individual device sales to integrated ecosystem services. Key business trends include aggressive mergers and acquisitions aimed at consolidating market share and achieving greater interoperability across diverse product portfolios, exemplified by major tech giants acquiring niche hardware specialists. Subscription services for enhanced functionality, particularly in the security and health monitoring segments, are becoming vital revenue streams, moving the market toward a Hardware-as-a-Service (HaaS) model. Furthermore, growing concerns over data privacy are forcing manufacturers to adopt stronger encryption methods and transparent data usage policies, influencing consumer trust and purchasing decisions significantly, particularly in privacy-sensitive regions like Europe.

Regionally, North America maintains its position as the largest market, driven by high disposable incomes, early technology adoption, and robust broadband infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rapid urbanization, substantial government investment in smart city initiatives in countries like China and India, and a burgeoning middle class increasingly prioritizing convenience and security. Europe demonstrates steady growth, largely spurred by stringent regulatory mandates focused on energy efficiency (e.g., smart heating controls) and strong consumer demand for sustainable and eco-friendly home solutions. The varying regional regulatory frameworks regarding data localization and wireless spectrum allocation present unique challenges that companies must navigate.

Segmentation analysis reveals that the Security and Surveillance segment, encompassing smart cameras, video doorbells, and access control systems, continues to hold the dominant market share due to its fundamental value proposition of protecting assets and occupants. However, the Smart Energy Management segment, featuring smart thermostats, plugs, and automated blinds, is experiencing the fastest growth rate as energy costs fluctuate globally and environmental consciousness increases. Technology-wise, Wi-Fi remains the ubiquitous communication standard, but the adoption of mesh networking protocols like Thread and enhanced Bluetooth capabilities (Bluetooth Mesh, Low Energy) is crucial for improving device reliability and scaling large home networks, addressing persistent issues related to connectivity dropout and latency.

AI Impact Analysis on Smart Home Devices Market

Analysis of common user questions reveals significant interest and concern regarding the implementation of Artificial Intelligence in smart home environments. Users frequently inquire about how AI can genuinely personalize experiences, moving beyond simple automation to predictive behaviors, such as determining optimal lighting levels based on circadian rhythm or pre-heating a specific room just before arrival. A major theme centers on data privacy and security—specifically, how the vast amounts of household data collected by AI algorithms (e.g., voice commands, occupancy patterns) are managed, anonymized, and protected from breaches. Consumers also express high expectations for interoperability, asking if AI can finally bridge the gap between devices from competing ecosystems (e.g., Apple HomeKit and Google Home) to create a truly unified and friction-less user experience, regardless of brand loyalty. These inquiries underscore a user desire for sophisticated, invisible technology that enhances life without compromising security or necessitating complex manual configuration.

The primary impact of AI resides in its ability to transform reactive automation into proactive intelligence. Traditional smart homes rely on 'if this, then that' logic; however, AI utilizes machine learning to analyze long-term patterns related to user habits, weather fluctuations, energy pricing, and external events. This permits the creation of highly nuanced, adaptive routines. For instance, an AI-powered HVAC system can learn the thermal properties of a specific house over months, predictively adjusting temperatures minutes before a conventional system would react to a change, thereby maximizing comfort while minimizing energy waste. This shift from simple scheduling to dynamic optimization significantly increases the value proposition of smart home devices, driving higher consumer willingness to invest in premium, AI-integrated solutions.

Furthermore, AI is pivotal in enhancing the functionality of core smart home segments, especially security and wellness monitoring. In security, AI-powered computer vision dramatically reduces false alarms by accurately distinguishing between pets, vehicles, and genuine intruders, a long-standing consumer frustration. In wellness, machine learning algorithms analyze passive sensor data (sleep patterns, movement) to alert caregivers or occupants to potential health issues, facilitating the growth of ambient assisted living (AAL) technologies for the aging population. The increasing sophistication of natural language processing (NLP) also improves the accuracy and complexity of voice commands, making human-machine interaction feel more intuitive and natural, solidifying the role of voice assistants as the central control mechanism within the smart home ecosystem. This deep integration ensures AI is not merely a feature but the foundational operating layer.

- AI enables predictive maintenance by analyzing device usage anomalies.

- Machine Learning enhances personalized automation routines based on occupant behavior analysis.

- Computer Vision significantly improves smart security accuracy by reducing false positive alerts.

- Advanced NLP algorithms facilitate more nuanced and complex voice control interactions.

- AI drives energy optimization by dynamically adjusting HVAC and lighting based on real-time data and predictive modeling.

- Artificial Intelligence supports ambient assisted living through passive, non-intrusive health and movement monitoring.

- Algorithmic optimization improves cross-platform device interoperability and ecosystem stability.

DRO & Impact Forces Of Smart Home Devices Market

The Smart Home Devices Market is propelled by significant Drivers (D) such as the increasing global adoption of IoT technology and the exponential growth of high-speed internet access (5G and fiber networks), enabling seamless connectivity and reliable data exchange vital for complex smart ecosystems. Additionally, strong consumer demand for greater energy efficiency and sustainability, coupled with the desire for enhanced security and remote monitoring capabilities, provides continuous market momentum. However, growth faces considerable Restraints (R), including persistent concerns over cybersecurity vulnerabilities and the lack of robust data privacy protection standards, which erode consumer trust and deter mass adoption among security-conscious buyers. Furthermore, the initial high cost of installation and the fragmentation among competing proprietary platforms (lack of uniform interoperability standards) act as major barriers, complicating the setup process for non-technical users.

Opportunities (O) in this market are vast, centered primarily on the integration of smart home technologies into specialized sectors. The rapidly expanding elderly care segment presents a major opportunity for Ambient Assisted Living (AAL) solutions, which utilize discreet sensors and AI to monitor health and provide alerts, allowing seniors to live independently longer. The burgeoning smart cities movement also creates demand for integrated residential systems that communicate with urban infrastructure, optimizing energy distribution and waste management at a neighborhood level. Moreover, the evolution of Matter, a new industry standard designed to unify connectivity across multiple platforms, promises to solve long-standing interoperability issues, potentially unlocking significant untapped demand from mainstream consumers who have previously avoided smart homes due to complexity.

The collective Impact Forces shaping the market landscape are predominantly driven by technological advancement and regulatory scrutiny. The rapid pace of miniaturization and cost reduction in sensor technology lowers manufacturing barriers and increases functionality. Conversely, the market faces potent competitive forces from major technology conglomerates (Apple, Amazon, Google) that leverage their vast installed user bases and ecosystem integration capabilities, making it difficult for smaller, specialized manufacturers to compete. Regulatory bodies globally are increasingly focused on mandating specific security standards and ensuring consumer control over personal data, which acts as both a restraining compliance burden and an opportunity for established companies to differentiate themselves through certified security excellence, thereby building enhanced consumer confidence in their smart ecosystems.

Segmentation Analysis

The Smart Home Devices Market is systematically segmented across various dimensions, including device type, technology utilized, and the application area, providing a granular view of market dynamics and growth potential. Segmentation by device type is critical for understanding consumer spending patterns, ranging from the highly commoditized segment of smart plugs and light bulbs to high-value, complex installations such as comprehensive security systems and sophisticated climate control units. The complexity and associated price point of these device categories often dictate the sales channel and the required level of professional installation, influencing the overall market maturity and penetration rates within different geographical regions and socioeconomic groups. Analyzing these device segments helps manufacturers tailor product development and marketing strategies precisely.

Technology segmentation focuses on the underlying communication protocols that enable the smart home ecosystem to function effectively. While Wi-Fi remains dominant for devices requiring high data throughput (like streaming cameras), low-power, short-range technologies such as Zigbee and Z-Wave are crucial for maximizing battery life and ensuring mesh network reliability across large homes, particularly for smaller sensors and controls. The emergence of Bluetooth Low Energy (BLE) and the Matter protocol are instrumental in driving market harmonization, addressing the issue of protocol fragmentation that has historically hindered mass-market adoption. Understanding the prevalence and adoption rate of these technologies is paramount for assessing future compatibility trends and required infrastructure investments by consumers and service providers alike.

Finally, application segmentation reveals where the highest immediate and long-term value is being generated. The residential segment, covering single-family homes and multi-dwelling units (MDUs), currently represents the bulk of the market revenue, driven by convenience and energy-saving motives. However, the commercial application segment, which includes hotels, corporate offices, and retail spaces leveraging smart devices for optimized operations, security, and climate control, is experiencing rapid growth. This segment often requires enterprise-grade reliability and scalable deployment strategies. The analysis of these distinct application areas informs businesses about the required product robustness, integration capabilities, and regulatory compliance standards necessary to tap into specific high-growth verticals successfully.

- By Device Type:

- Smart Speakers and Voice Assistants

- Smart Security and Surveillance (Cameras, Locks, Doorbells)

- Smart Lighting Systems

- Smart Thermostats and HVAC Controls

- Smart Appliances (Refrigerators, Washers)

- Smart Plugs and Switches

- Home Healthcare and Assisted Living Devices

- By Technology:

- Wi-Fi

- Bluetooth/BLE (Low Energy)

- Zigbee

- Z-Wave

- Thread/Matter

- NFC

- By Application/End-User:

- Residential Sector (Individual Homes, MDUs)

- Commercial Sector (Hotels, Office Spaces, Retail)

Value Chain Analysis For Smart Home Devices Market

The Smart Home Devices Market value chain begins with the upstream analysis, which involves the supply of foundational components crucial for device functionality. This stage is dominated by specialized semiconductor manufacturers supplying microcontrollers, sensors (e.g., motion, light, temperature), and communication modules (Wi-Fi chips, Zigbee radios). Raw material procurement and component fabrication heavily influence final device cost and performance. Key activities at this stage include R&D for miniaturization and power optimization, along with securing reliable sources for specialized materials. High reliance on a few key suppliers in Asia for complex integrated circuits (ICs) introduces supply chain risks, making strong vendor relationship management paramount for maintaining production schedules and controlling input costs in a highly competitive hardware market.

The mid-stream of the value chain focuses on manufacturing, system integration, and software development. Device manufacturers, which range from established consumer electronics giants to innovative startups, assemble the components, design the user interfaces, and crucially, develop the proprietary or open-source operating platforms and cloud services that underpin the device ecosystem. System integration, particularly for complex installations like whole-home security or HVAC systems, often involves specialized installers who manage the configuration and networking of diverse devices. This phase generates significant value through brand recognition, quality assurance, and the creation of seamless software experiences, which is increasingly a key differentiator over raw hardware specifications. Direct and indirect distribution channels also play a major role in how products reach the end-user.

The downstream analysis involves the distribution, sales, and post-sales support activities. Distribution channels are varied, encompassing direct-to-consumer online sales (through company websites or major e-commerce platforms like Amazon), indirect retail sales (big-box stores, electronics retailers), and specialized professional channels (security firms, smart home integrators, electrical contractors). For high-value, complex systems, professional integrators offer consultation, installation, and ongoing maintenance, adding significant value and commanding higher margins. Post-sales services, including software updates, warranty fulfillment, cloud storage subscriptions, and customer technical support, are vital for maintaining customer satisfaction and driving recurring revenue streams, particularly for security and surveillance segments that rely heavily on cloud infrastructure.

Smart Home Devices Market Potential Customers

The primary potential customers in the Smart Home Devices Market can be broadly categorized into distinct residential segments, starting with Technology Enthusiasts and Early Adopters. These buyers are typically affluent, technologically literate individuals who prioritize owning the latest gadgets and integrating complex systems for optimization and status. They often drive demand for cutting-edge features like AI-driven personalization and bleeding-edge protocols like Thread/Matter. Their willingness to pay a premium and tolerate initial technological complexity makes them crucial for validating new product concepts and providing early feedback, influencing the subsequent feature sets rolled out to the mass market. This group heavily uses online forums and specialized review sites for purchase decisions.

The largest volume segment consists of the Mainstream Homeowners and Families. This demographic seeks practical value, prioritizing ease of installation, reliability, energy savings, and fundamental safety (security and smoke detection). They are driven less by novelty and more by pragmatic benefits, such as reducing utility bills through smart thermostats or gaining peace of mind via remote monitoring of their property. For this group, the price-to-value ratio and the simplicity of the user interface are critical determinants. Products marketed towards mainstream customers must emphasize guaranteed interoperability and long-term customer support, often relying heavily on well-known consumer brands and major retail distribution networks for purchase confidence.

Beyond traditional residential buyers, the market features substantial commercial and institutional potential customers. This includes Real Estate Developers and Home Builders who incorporate smart home technology as a standard feature in new construction projects (especially Multi-Dwelling Units or MDUs) to increase property value, attract modern buyers, and reduce long-term maintenance costs. The Hospitality Sector (hotels and short-term rentals) utilizes smart lighting, thermostats, and access control for optimized guest experience and operational efficiency. Furthermore, Healthcare Providers and Elder Care Facilities are emerging buyers, heavily investing in discreet monitoring and AAL devices to manage patient safety, streamline care delivery, and improve quality of life for residents, establishing a dedicated, high-growth vertical focused on continuous health surveillance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 120.5 Billion |

| Market Forecast in 2033 | USD 480.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon, Google (Alphabet), Apple, Samsung Electronics, LG Electronics, Huawei, Xiaomi, Honeywell International, Siemens AG, Johnson Controls, ADT Inc., Comcast, ABB Ltd., Schneider Electric, Bosch, Philips Hue (Signify), Lutron Electronics, Ecobee, Ring (Amazon Subsidiary), Arlo Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Home Devices Market Key Technology Landscape

The technological landscape of the Smart Home Devices Market is fundamentally defined by the convergence of the Internet of Things (IoT), advanced wireless communication protocols, and sophisticated Artificial Intelligence (AI) processing. Core to this ecosystem are the underlying IoT platforms (such as Amazon AWS IoT, Google Cloud IoT, and Microsoft Azure IoT), which manage device provisioning, data ingestion, and cloud-based analytics, enabling remote control and complex automation routines. The proliferation of low-power sensor technology, coupled with miniaturized microcontrollers, allows for discreet and battery-efficient deployment across numerous household items. Furthermore, the shift towards edge computing—processing data directly on the device rather than solely in the cloud—is crucial for improving responsiveness, enhancing privacy protection, and reducing network latency, particularly for critical functions like security monitoring.

Communication standards dictate device interoperability and network performance. While Wi-Fi handles high-bandwidth needs like video streaming, low-power mesh networking standards (Zigbee and Z-Wave) are essential for creating scalable, reliable networks that connect dozens of sensors and controls throughout a large property without draining battery life. Critically, the emergence of the industry-wide standard, Matter (built on IP and leveraging Thread/Wi-Fi), represents a paradigm shift toward guaranteed cross-platform compatibility. This unified protocol aims to eliminate the fragmentation currently plaguing the market, allowing devices from different manufacturers (e.g., Google, Apple, Samsung) to communicate seamlessly. This standardization is a major technological driver expected to accelerate mass-market penetration significantly.

Finally, the sophistication of user interface technology profoundly influences market adoption. Voice control interfaces, powered by advanced Natural Language Processing (NLP) and integrated through smart speakers (like Amazon Echo and Google Home), serve as the primary human-machine interaction point, enabling hands-free operation and complex routine activation. Moreover, machine learning algorithms are embedded within thermostats and security cameras to provide adaptive and predictive functionality. These learning capabilities allow systems to optimize energy use based on learned habits and differentiate between legitimate and suspicious activity in real time. Continued investment in AI and intuitive voice control remains a key competitive arena, determining which ecosystems offer the highest levels of convenience and efficiency.

Regional Highlights

- North America: Market Leadership and High Consumer Spending

North America, particularly the United States, holds the largest market share in the Smart Home Devices sector. This dominance is attributed to several key factors: high consumer disposable income, a strong culture of early technology adoption, and robust, widespread high-speed internet infrastructure (fiber and advanced LTE/5G). The region benefits from intense competition among major technology giants (Amazon, Google, Apple) who actively invest in expanding their ecosystems and offering aggressive pricing for entry-level devices like smart speakers and security cameras. The security and surveillance segment, driven by high perceived need for protection and prevalent subscription models (e.g., ADT, Ring Protect), is a primary revenue generator. Regulatory frameworks, while complex regarding data privacy, generally support technological innovation and deployment, creating a favorable business environment for device manufacturers and system integrators. Furthermore, the prevalence of large single-family homes necessitates extensive smart networking solutions, driving higher average expenditure per household.

The market trajectory in North America is increasingly focused on comprehensive whole-home integration rather than fragmented device sales. Consumers are demanding greater interoperability, which is accelerating the adoption of unified standards like Matter. Additionally, the increasing cost of energy is fueling significant uptake of smart energy management devices, particularly advanced, learning thermostats and load control switches that optimize grid interaction. Growth is shifting toward professional installation services for complex, high-value systems, reflecting a maturing consumer base that prioritizes reliability and professional expertise over DIY installation. The region continues to serve as the global benchmark for smart home innovation, with new product launches often prioritizing the U.S. market first.

- Europe: Focus on Energy Efficiency and Data Privacy Compliance

The European smart home market exhibits strong, steady growth, primarily differentiated by a robust focus on energy efficiency and strict regulatory adherence, particularly concerning the General Data Protection Regulation (GDPR). Demand for smart thermostats, smart meters, and climate control systems is exceptionally high, driven by stringent government mandates aimed at reducing carbon emissions and improving building energy performance across member states. Countries like Germany and the Nordic nations are leaders in adopting sophisticated energy management solutions. The market is highly diverse, with varying levels of infrastructure maturity and language fragmentation across the continent, requiring manufacturers to tailor software interfaces and voice assistant capabilities regionally.

European consumers demonstrate a higher sensitivity toward data security and privacy compared to their North American counterparts. This necessitates that smart device manufacturers employ robust encryption methods, ensure data localization, and provide transparent consent mechanisms, impacting product design and cloud architecture choices. The market penetration rate is currently lower than in North America but is rapidly accelerating, especially in Western European countries. Key growth segments include home healthcare devices addressing Europe’s aging demographic and connected appliances that offer utility and fault reporting. The gradual establishment of unified regulatory standards across the EU is expected to streamline market access and reduce compliance costs in the long term, fueling continued investment and expansion.

- Asia Pacific (APAC): Rapid Urbanization and Highest Growth Potential

The Asia Pacific region is forecast to be the fastest-growing market globally, driven by massive urbanization waves, increasing disposable incomes among a growing middle class, and proactive government investment in smart city infrastructure, notably in China, South Korea, Japan, and India. The APAC market is characterized by high density residential living (Multi-Dwelling Units are common), which presents unique challenges and opportunities for network scaling and signal penetration. Consumers in this region often prioritize connectivity and lifestyle integration, leading to high adoption rates of entertainment systems and smart appliances, particularly integrated into localized ecosystems like those dominated by Chinese or Korean manufacturers (e.g., Xiaomi, Samsung).

China is the single largest contributor to the APAC market, benefiting from strong domestic manufacturing capabilities and large-scale government support for domestic technology champions, fostering intense price competition. India is emerging as a significant growth engine due to increasing internet and mobile phone penetration, driving demand for affordable, entry-level smart devices. The market structure varies significantly, however; while established economies like Japan focus on sophisticated robotics and assisted living, developing economies emphasize basic security and connectivity solutions. The adoption of 5G technology is particularly critical in APAC, enabling the high-density communication required for future smart city and integrated smart home operations, positioning the region for exponential growth over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Home Devices Market.- Amazon (Ring, Echo, Eero)

- Google (Alphabet Inc.) (Nest, Google Home)

- Apple Inc. (HomeKit, HomePod)

- Samsung Electronics Co., Ltd. (SmartThings)

- LG Electronics Inc.

- Huawei Technologies Co., Ltd.

- Xiaomi Corporation

- Honeywell International Inc.

- Siemens AG

- Johnson Controls International plc

- ADT Inc.

- Comcast Corporation (Xfinity Home)

- ABB Ltd.

- Schneider Electric SE

- Robert Bosch GmbH

- Signify N.V. (Philips Hue)

- Lutron Electronics Co., Inc.

- Ecobee Inc.

- Arlo Technologies, Inc.

- Resideo Technologies, Inc.

Frequently Asked Questions

Analyze common user questions about the Smart Home Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the current growth of the Smart Home Devices Market?

The primary driving force is the increasing consumer demand for energy efficiency and security, coupled with the rapid integration of advanced IoT and AI technologies that enhance convenience. The decline in sensor component costs and the standardization of protocols like Matter further accelerate mass-market adoption by improving interoperability and affordability.

How significant is the Matter protocol in resolving smart home device interoperability issues?

The Matter protocol is highly significant, representing a unified connectivity standard built on IP that ensures devices from historically competing ecosystems (e.g., Google, Apple, Amazon) can communicate reliably. Its adoption is expected to simplify setup, improve stability, and mitigate the platform fragmentation that has deterred mainstream consumers.

What are the largest segments of the Smart Home Devices Market by revenue?

The largest segments by revenue are currently Smart Security and Surveillance (including smart locks and cameras) and Control and Connectivity devices (primarily smart speakers and hubs). However, the Smart Energy Management segment is showing the highest growth rate due to global efforts toward sustainable living and cost reduction.

What major restraints are impacting the widespread adoption of smart home technology?

Major restraints include persistent cybersecurity vulnerabilities and concerns regarding data privacy, which erode consumer trust. Additionally, the initial high cost of complex integrated systems and the historical lack of seamless cross-brand interoperability have been barriers for price-sensitive and non-technical consumers.

Which geographical region is projected to experience the fastest growth rate in the market?

The Asia Pacific (APAC) region is projected to experience the fastest Compound Annual Growth Rate (CAGR) due to rapid urbanization, substantial governmental investment in smart city initiatives, increasing disposable income in countries like China and India, and high consumer enthusiasm for digital lifestyle integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager