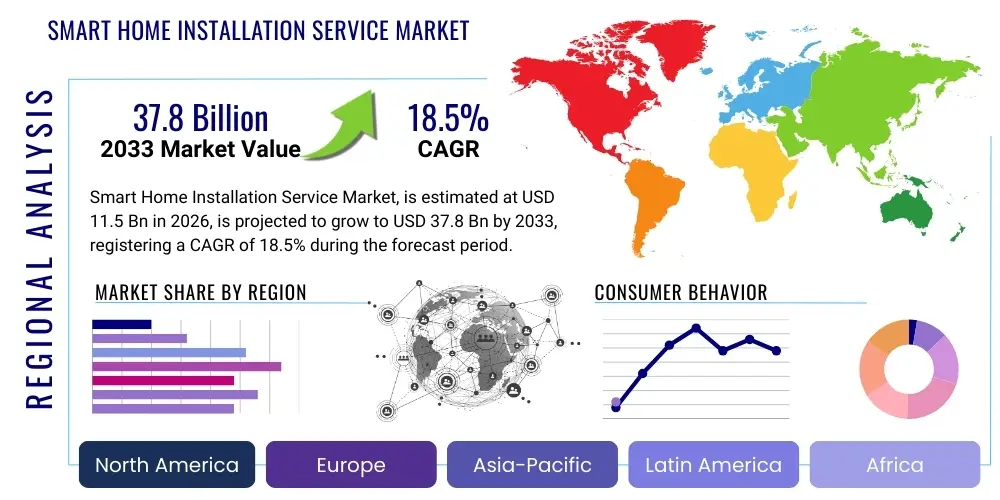

Smart Home Installation Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438464 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Smart Home Installation Service Market Size

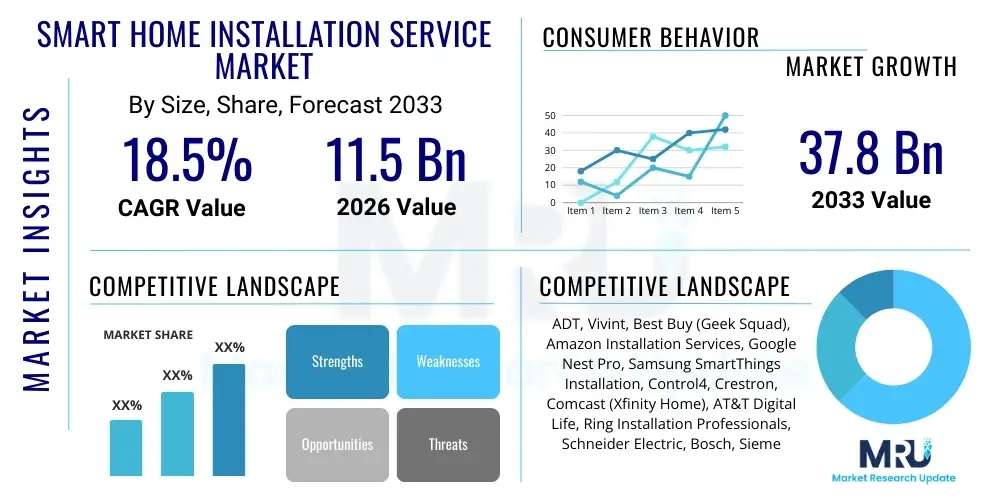

The Smart Home Installation Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

The substantial growth trajectory is underpinned by the increasing consumer adoption of interconnected devices and the rising complexity of integrated smart home ecosystems. As the number of installed devices per household increases, ranging from simple smart lighting and thermostats to complex security systems and multi-room entertainment solutions, the necessity for professional installation and setup becomes paramount. This shift moves the market away from simple DIY solutions toward specialized service providers capable of ensuring seamless interoperability across various protocols (e.g., Z-Wave, Zigbee, Wi-Fi, Thread). The professional installation segment is particularly driven by high-net-worth individuals and consumers investing in comprehensive, whole-home automation packages, where system integration and network stability are critical success factors.

Furthermore, regulatory changes concerning energy efficiency and home safety standards in developed economies, particularly across North America and Europe, further accelerate the demand for certified installation services. Installers play a crucial role in ensuring that complex systems, such as smart HVAC or specialized security sensors, comply with local building codes and insurance requirements. The professional service market benefits significantly from the need for robust cybersecurity configurations, which the average consumer often lacks the technical expertise to manage effectively. The increasing accessibility of high-speed internet infrastructure and the lowering costs of smart devices globally also contribute to market penetration, pushing the installation service sector into emerging markets where technical expertise is less readily available, thereby emphasizing the role of professional services.

Smart Home Installation Service Market introduction

The Smart Home Installation Service Market encompasses the provisioning of expert setup, configuration, and integration services for connected devices and automated systems within residential and commercial properties. These services extend beyond mere physical mounting to include crucial network provisioning, software setup, user training, and ensuring interoperability among heterogeneous devices originating from multiple vendors. Key products involved in these installations range widely, including smart security systems, climate control (HVAC), lighting automation, entertainment systems, smart appliances, and sophisticated energy management platforms. The professionalization of installation is vital given the escalating technical complexity of whole-home ecosystems, often requiring deep knowledge of IoT protocols, network topology, and cloud service integration.

Major applications of these services span new construction projects requiring pre-wired smart infrastructure, retrofit installations in existing homes, and targeted commercial applications such as smart offices or hospitality venues. These services guarantee optimal performance, system reliability, and enhanced cybersecurity, which are critical components for consumer satisfaction and trust. The primary benefits derived from utilizing professional installation services include time savings for the consumer, reduced risk of installation errors, optimization of system performance, and access to ongoing maintenance and support contracts. These services transform disparate devices into a cohesive, functional smart environment.

The market is significantly driven by several macroeconomic factors and consumer trends, including the sharp rise in disposable income in urban centers enabling luxury smart upgrades, the increased awareness regarding energy conservation facilitated by smart metering and HVAC controls, and the pervasive need for enhanced home security solutions. Furthermore, partnerships between device manufacturers and specialized installation providers are standardizing service quality and expanding geographic coverage. The increasing prevalence of voice-controlled interfaces and artificial intelligence (AI) in smart home devices necessitates expert setup to calibrate these advanced features effectively, thereby serving as a robust driving force for market expansion and sophisticated service delivery.

Smart Home Installation Service Market Executive Summary

The Smart Home Installation Service Market is characterized by vigorous growth, primarily fueled by the accelerating adoption of IoT devices and the consumer shift towards holistic, integrated smart ecosystems rather than fragmented device usage. Business trends indicate a strong move toward subscription-based service models, where installation is often bundled with long-term maintenance, monitoring, and security services, ensuring recurring revenue streams for service providers. Key players, including major retailers, specialized integrators, and telecommunication companies, are intensely focused on standardizing the installation process and leveraging certified technician networks to build consumer confidence and ensure quality service delivery across geographically dispersed markets. Consolidation remains a notable trend, as larger technology firms acquire smaller, highly specialized integration firms to enhance technical capabilities and expand regional footprints, particularly in lucrative urban and affluent suburban areas.

Regionally, North America maintains market leadership due to high consumer spending on advanced technologies, mature broadband penetration, and the strong presence of major smart home platform providers (Google, Amazon, Apple). However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, propelled by massive residential construction activities, rapid urbanization, and government initiatives promoting smart cities and energy-efficient building technologies, especially in China, India, and Southeast Asia. Europe remains a stable growth market, driven primarily by stringent environmental regulations necessitating smart energy management solutions and a high demand for premium, customized installation services in countries like Germany and the UK. Market maturity in different regions significantly influences the dominant segment, with mature markets focusing on retrofit customization and emerging markets prioritizing fundamental security and lighting installations.

Segment trends highlight the professional installation segment's dominance over DIY methods, especially for complex systems involving multiple subsystems (e.g., integrated HVAC and security). Within service types, installation services account for the largest share, but repair and maintenance services are exhibiting rapid growth, driven by the aging installed base and the continuous need for software updates, troubleshooting, and hardware replacement within interconnected environments. The residential end-user segment is the primary revenue generator, although the commercial sector, encompassing small to mid-sized businesses (SMBs) utilizing smart office solutions, is poised for significant expansion, demanding highly specialized, scalable integration services that professional installers are uniquely positioned to provide.

AI Impact Analysis on Smart Home Installation Service Market

Users frequently inquire how Artificial Intelligence (AI) will fundamentally alter the skill set required for smart home installation technicians, focusing on the transition from hardware integration to advanced software configuration and predictive maintenance. Common user concerns revolve around whether AI-powered diagnostic tools will replace human installers or merely augment their capabilities, specifically questioning how AI aids in troubleshooting interoperability issues between disparate devices and optimizing complex automation routines. Users also seek information on the economic implications, such as the potential for AI algorithms to design optimal smart home layouts, thereby reducing pre-installation consultation time and improving the efficiency of the physical installation process, and how AI can ensure the ongoing cybersecurity of complex, interconnected smart grids installed by professionals.

- AI-driven pre-installation design and simulation optimizes component placement and network topology, minimizing site visit time and material waste.

- Predictive maintenance algorithms analyze system usage data to schedule preventative service calls, shifting the business model from reactive repair to proactive system management.

- AI facilitates advanced diagnostics by quickly identifying and resolving device communication failures and software conflicts, significantly reducing troubleshooting duration during or after installation.

- Voice-command configuration tools, leveraging natural language processing (NLP), streamline the device pairing and routine setup process, enhancing technician efficiency.

- AI enhances personalized automation creation, allowing installers to offer more sophisticated, context-aware routines (e.g., dynamic lighting based on user presence and time of day) through simplified programming interfaces.

- Automated inventory and supply chain management driven by AI ensures technicians have the correct replacement parts or components on-site, minimizing installation delays.

- AI platforms provide real-time training and support to field technicians, delivering immediate access to relevant technical documentation and step-by-step resolution guides based on installed equipment models.

DRO & Impact Forces Of Smart Home Installation Service Market

The market is primarily driven by the exponential growth in the sales of smart home devices, coupled with the increasing complexity inherent in integrating multiple vendor ecosystems, making professional installation services indispensable for the average consumer. Restraints include the high initial cost associated with complex, professionally installed systems, which can limit adoption among lower-income demographics, and the pervasive consumer concern regarding data privacy and the cybersecurity vulnerabilities associated with interconnected IoT environments, which necessitates careful system selection and secure setup. Opportunities are abundant, specifically in developing personalized, high-value maintenance and monitoring subscription services, expanding into the lucrative commercial sector (smart offices, retail), and leveraging emerging standards like Matter to simplify cross-platform interoperability, creating new revenue streams through system upgrades and specialized consultancy services. These forces collectively propel the industry toward professionalization, higher service complexity, and a greater emphasis on certified technical expertise to deliver reliable smart living experiences.

Key drivers center around consumer desire for convenience, energy efficiency, and enhanced security, all delivered optimally through expert configuration. The surge in remote work models post-pandemic has further necessitated reliable home networking and specialized smart office setups, driving demand for tailored installation packages. Conversely, the significant fragmentation within the smart device market, characterized by numerous proprietary protocols and frequent software updates, acts as a primary restraint, often leading to compatibility challenges that must be navigated by specialized installers, thereby increasing service complexity and cost. Furthermore, a shortage of highly skilled, certified technicians capable of handling both IT networking and traditional electrical/HVAC systems poses a significant structural challenge to scaling operations efficiently across diverse geographic regions.

Impact forces indicate that technological advancement, specifically in standardized protocols (like Matter and Thread) aimed at simplifying device integration, holds the potential to reduce the complexity barrier, although it simultaneously requires installers to constantly update their technical knowledge. Economic factors, such as sustained low interest rates and robust housing markets in developed regions, positively impact market growth by encouraging investment in home improvements and automation technologies. Societal trends emphasize sustainability, pushing consumers toward smart energy and water management solutions that require precise, professional calibration to achieve expected cost savings. Competitive intensity is high, driven by the entry of large retail chains and telecommunications companies into the service provision space, increasing the pressure on specialized integrators to differentiate through superior expertise, premium service delivery, and comprehensive post-installation support contracts to maintain market share.

Segmentation Analysis

The Smart Home Installation Service Market is comprehensively segmented based on Service Type, Installation Type, End-User, and Technology, providing a granular view of market dynamics and revenue concentration. This segmentation highlights the diverse needs of consumers and businesses ranging from simple, standardized installations to complex, highly customized whole-home integrations. The market structure reflects a growing specialization among service providers, driven by the need to manage various technologies, including sophisticated security platforms and advanced energy management systems. The dominance of the professional segment underscores the technical barriers to entry for DIY installations, particularly in high-value or multi-device setups where integration complexity is high and system stability is paramount for user satisfaction.

- By Service Type: Installation, Repair & Maintenance, Customized Solutions, Consultation & Training.

- By Installation Type: Professional Installation, DIY (Do-It-Yourself) Support Services.

- By End-User: Residential (Single-Family Homes, Multi-Family Units), Commercial (Hotels, Offices, Retail Stores).

- By Technology: Smart Security & Surveillance, Smart Lighting Control, Smart HVAC & Climate Control, Smart Entertainment & Connectivity, Smart Kitchen & Appliances, Smart Utilities & Energy Management.

Value Chain Analysis For Smart Home Installation Service Market

The value chain for the Smart Home Installation Service Market begins upstream with Component Manufacturers (producing chips, sensors, and connectivity modules) and Device Manufacturers (producing the actual smart thermostats, locks, cameras, etc.). These entities focus on innovation, standardization (e.g., Matter compliance), and supply chain efficiency. The next critical stage involves Distribution Channels, which include large retail chains (physical and e-commerce), specialized distributors, and direct sales channels that handle the inventory and logistics of smart devices before they reach the installer or the end-user. The efficacy of the upstream segment dictates the quality and compatibility of the devices being installed, fundamentally influencing the service complexity.

The core of the value chain is the Service Provision segment, which involves specialized smart home integrators, certified professional installers, and larger entities like telecommunications companies (Comcast, AT&T) or security firms (ADT, Vivint) offering installation as a core service. This segment focuses on technical expertise, certification, seamless integration, network setup, and post-installation support. Downstream activities involve After-Sales Services, including maintenance contracts, remote monitoring, software updates, and customer support, which are crucial for maintaining system reliability and generating long-term recurring revenue. The effectiveness of this downstream support is a major differentiator in the competitive landscape.

Distribution channels are multifaceted, utilizing both direct and indirect routes. Direct channels involve manufacturers (like Google Nest Pro or Ring) selling directly to certified installers who then service the end customer, often providing proprietary training and components. Indirect channels dominate the retail landscape, where consumers purchase devices from stores (Best Buy, Home Depot) or online marketplaces (Amazon) and then seek installation services independently or through a retailer-affiliated service network (like Best Buy’s Geek Squad). Successful players often manage a hybrid channel strategy, ensuring product availability while simultaneously controlling the quality and certification of the installation workforce, thereby enhancing market reach and maintaining high service standards.

Smart Home Installation Service Market Potential Customers

The primary consumers, or End-Users, of smart home installation services are categorized broadly into Residential and Commercial segments, each possessing distinct needs and purchasing drivers. Within the Residential Segment, the most lucrative customers are high-net-worth individuals and affluent households undertaking whole-home automation projects, requiring custom-designed, multi-subsystem integrations for security, lighting, and entertainment. Another substantial segment includes technology-savvy millennials and Gen Z consumers purchasing individual devices (e.g., smart speakers, DIY security kits) but requiring professional assistance for initial network setup and complex connectivity troubleshooting. Finally, a crucial demographic includes elderly individuals or those with mobility challenges who rely on professional installers for accessibility-enhancing technologies and medical alert systems, prioritizing reliability and ease of use.

The Commercial Segment represents a rapidly expanding customer base, particularly small and medium-sized enterprises (SMEs) looking to optimize energy consumption and enhance employee safety through smart office solutions. This includes automated lighting systems, access control, and smart meeting room setups. Furthermore, sectors like hospitality (hotels adopting smart room controls for guest convenience and operational efficiency) and multi-family residential unit developers (building integrated smart infrastructure into new developments) are key buyers. These commercial customers typically demand scalable solutions, enterprise-grade security protocols, and robust service level agreements (SLAs) for rapid maintenance, emphasizing the need for specialized commercial installation expertise over basic residential services.

In terms of purchasing behavior, potential customers are increasingly seeking bundled solutions that combine hardware, installation, and long-term monitoring or maintenance contracts, favoring providers who can offer a comprehensive, single-point-of-contact service. The decision-making process is heavily influenced by installer certification, reputation (validated through online reviews and references), and the ability to seamlessly integrate diverse platforms without proprietary lock-in. Reliability, cybersecurity assurances, and the provision of adequate training on complex interfaces are paramount factors influencing the final selection of an installation service provider across all potential end-user segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ADT, Vivint, Best Buy (Geek Squad), Amazon Installation Services, Google Nest Pro, Samsung SmartThings Installation, Control4, Crestron, Comcast (Xfinity Home), AT&T Digital Life, Ring Installation Professionals, Schneider Electric, Bosch, Siemens, Legrand, Lutron, Apple HomeKit Installers, SmartRent. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Home Installation Service Market Key Technology Landscape

The technological landscape underpinning the Smart Home Installation Service Market is defined by the interoperability standards, connectivity protocols, and software platforms utilized during system deployment. The most prevalent foundational technologies include wireless protocols such as Wi-Fi, Bluetooth Low Energy (BLE), Zigbee, and Z-Wave, which facilitate device-to-device communication and network integration. Professional installers must possess deep expertise in configuring mesh networks utilizing these diverse protocols to ensure comprehensive coverage and minimal latency, particularly in large residential or commercial environments where traditional Wi-Fi alone is insufficient. The emergence of Thread and the Matter connectivity standard is rapidly transforming this landscape, aiming to simplify the complexity by creating a unified application layer protocol that allows devices from different manufacturers to communicate seamlessly, significantly reducing the integration challenges currently faced by service providers.

Cloud computing and edge computing represent critical technological layers for service delivery. Professional installation often involves configuring devices to connect securely to proprietary or third-party cloud platforms (like Amazon AWS IoT, Google Cloud, or dedicated security provider clouds) for remote management, data analytics, and over-the-air (OTA) software updates. Furthermore, the increasing reliance on advanced edge devices, such as local hubs and smart gateways, for localized processing and immediate decision-making (especially for security and privacy-sensitive functions) requires precise setup by technicians to maximize efficiency and minimize reliance on constant internet connectivity. The optimization of these cloud-edge architectures is central to delivering high-performance smart home experiences.

Finally, the toolkit utilized by professional installers is evolving rapidly, incorporating advanced diagnostic software and augmented reality (AR) tools. Diagnostic technologies allow technicians to rapidly identify network bottlenecks, signal interference, and configuration errors, significantly shortening installation and troubleshooting times. AR tools provide guided installation overlays, training simulations, and real-time technical support visualization, improving the efficiency and accuracy of complex physical installations, especially those involving integrating smart components into existing electrical or HVAC infrastructure. Mastering these sophisticated software and diagnostic technologies is increasingly becoming a prerequisite for professional certification and competitive success in the modern smart home installation sector, moving the required skillset beyond simple hardware mounting to sophisticated IT system integration.

Regional Highlights

The market dynamics of the Smart Home Installation Service Market vary significantly across major geographical regions, influenced by economic stability, consumer affluence, technological readiness, and local regulatory environments. North America, encompassing the United States and Canada, stands as the most mature and dominant market, driven by high disposable income, early and widespread adoption of IoT devices, and the strong market presence of major technology ecosystems (Amazon Alexa, Google Home, Apple HomeKit). The region shows a high propensity for subscription-based security and home monitoring services, where installation is integral. Service providers in North America frequently focus on whole-home integration and premium customization services for luxury residential markets, ensuring complex systems like integrated audio-visual networks and advanced climate controls are meticulously configured.

Asia Pacific (APAC) represents the fastest-growing region globally, primarily fueled by rapid urbanization, massive infrastructural investments in smart cities (particularly in China, India, Singapore, and South Korea), and the emergence of a technology-eager middle class. The installation market here is bifurcated: high-volume, standardized installations dominate new residential complexes, while customization and advanced solutions are confined to affluent urban centers. Government policies promoting energy efficiency and sustainable development significantly boost the demand for professional installation of smart utility meters and energy management systems. However, fragmentation in product standards and varied language interfaces present unique challenges that specialized local installers must overcome.

Europe exhibits steady, sustained growth, characterized by strong consumer emphasis on energy efficiency and data privacy compliance (GDPR). Germany, the United Kingdom, and the Nordic countries are leaders in the adoption of smart heating, ventilation, and air conditioning (HVAC) systems, driven by stringent energy regulations, thus requiring certified technicians for compliance and optimal calibration. The European market highly values specialized integrators capable of offering bespoke solutions that adhere to diverse national building codes and security standards. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets, primarily focused on fundamental smart security installations driven by security concerns and rapidly increasing internet penetration, though high import duties and economic volatility can sometimes restrict high-end professional service growth.

- North America (NA): Market leader, driven by high-value integrations, mature subscription models, and dominance of major tech platforms. Focus on security, entertainment, and whole-home automation.

- Asia Pacific (APAC): Fastest growing, fueled by urbanization, smart city projects, and mass deployment in new residential buildings. Key countries include China, Japan, and India.

- Europe (EU): Stable growth, driven by stringent energy efficiency regulations and demand for localized, custom-fit smart HVAC and lighting control systems. High demand for GDPR-compliant security installations.

- Latin America (LATAM): Emerging market concentrated on security and surveillance installations; growth constrained by economic factors but buoyed by rising internet access.

- Middle East & Africa (MEA): Growing demand, particularly in the UAE and Saudi Arabia, driven by luxurious, large-scale smart residential and commercial projects requiring premium, complex installation services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Home Installation Service Market.- ADT Inc.

- Vivint Smart Home Inc.

- Best Buy Co. Inc. (Geek Squad)

- Amazon Installation Services

- Google Nest Pro Program

- Samsung SmartThings Installation Services

- Control4 Corporation (Snap One)

- Crestron Electronics, Inc.

- Comcast Corporation (Xfinity Home)

- AT&T Digital Life

- Ring (an Amazon company) Installation Professionals

- Schneider Electric SE

- Robert Bosch GmbH

- Siemens AG

- Legrand SA

- Lutron Electronics Co. Inc.

- Apple HomeKit Installers Network

- Honeywell International Inc.

- SmartRent Inc.

- Assa Abloy Group

Frequently Asked Questions

Analyze common user questions about the Smart Home Installation Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth rate for the Smart Home Installation Service Market?

The Smart Home Installation Service Market is projected to exhibit robust expansion, anticipated to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033, driven by increasing device complexity and the need for professional system integration.

Which smart home segments require professional installation most frequently?

The most frequent professional installation services are required for complex security and surveillance systems, integrated smart HVAC and climate control systems, and whole-home entertainment networks, due to the critical nature of network stability and cross-platform interoperability in these segments.

How does the Matter connectivity standard impact smart home installation services?

Matter simplifies the installation process by creating a unified, interoperable application layer, reducing compatibility issues between devices from different manufacturers. This standard allows installers to focus more on advanced configuration and less on basic device pairing, improving efficiency and reliability for consumers.

Is North America the dominant region for smart home installation services?

Yes, North America currently holds the largest market share in the Smart Home Installation Service Market, attributed to high consumer affluence, mature broadband infrastructure, early technology adoption, and significant demand for premium, integrated smart security and automation solutions.

What are the primary factors restraining market growth in professional installation services?

Key restraints include the high initial investment cost associated with professionally installed, multi-device ecosystems, persistent consumer concerns regarding IoT security and data privacy, and the existing shortage of highly skilled, certified technicians capable of handling the convergence of IT and traditional home systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Smart Home Installation Service Market Statistics 2025 Analysis By Application (Commercial, Household), By Type (Home Monitoring/Security, Lighting Control, Video Entertainment, Smart Appliances, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Smart Home Installation Service Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Home Monitoring/Security, Lighting Controls, Smart Speakers, Thermostats, Video Entertainment, Smart Appliances, Others), By Application (Retailers, E-commerce, OEM), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager