Smart Locker System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435542 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Smart Locker System Market Size

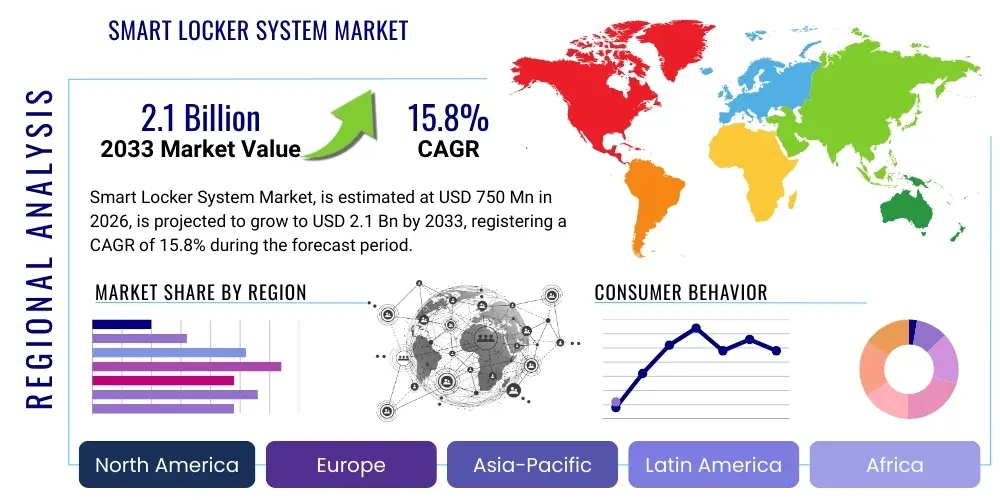

The Smart Locker System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $2.1 Billion by the end of the forecast period in 2033.

Smart Locker System Market introduction

The Smart Locker System Market encompasses technologically advanced storage and retrieval solutions designed to manage packages, assets, and personal items securely and efficiently, typically relying on IoT connectivity, sensor technology, and robust software management platforms. These systems replace traditional manual lockers with automated, cloud-connected units that offer controlled access via mobile applications, RFID, PIN codes, or biometric authentication, thereby enhancing security, accountability, and operational workflow. Major applications span high-volume e-commerce delivery logistics (the "last mile" problem), corporate asset management, residential package delivery hubs, and academic institutions seeking secure personal storage. The primary benefits include reduced package loss, optimized delivery processes, 24/7 self-service access, and valuable data collection on usage patterns, significantly improving the user experience and operational efficiency for businesses.

The core product description revolves around modular, interconnected physical locker units integrated with sophisticated operating systems and cloud infrastructure. These systems are crucial in addressing the surging volume of e-commerce parcels, which strain traditional delivery and receiving infrastructure in urban and multi-tenant environments. Driving factors include the persistent growth of online retail, increasing demand for automated security solutions in commercial spaces, and the necessity for contactless and self-service options, particularly post-pandemic. Furthermore, government initiatives promoting smart city development and the adoption of IoT infrastructure in real estate contribute significantly to market expansion, positioning smart lockers as foundational elements in modern logistical and building management strategies.

Smart Locker System Market Executive Summary

The Smart Locker System Market is currently experiencing robust growth, primarily driven by transformative business trends centered on automation and convenience, such as the massive proliferation of B2C and C2C e-commerce deliveries, necessitating secure and scalable last-mile delivery infrastructure. Key market segments showing rapid expansion include retail, where lockers facilitate click-and-collect (BOPIS) services, and the residential sector, where property managers adopt them to mitigate the overwhelming volume of tenant package deliveries. Technological advancements, particularly in integrating AI for predictive maintenance and enhanced security protocols (biometrics and computer vision), are reshaping service offerings and pushing vendors toward software-as-a-service (SaaS) models for management platforms, establishing recurring revenue streams and lowering entry barriers for end-users.

Regionally, North America and Europe dominate the market, characterized by mature e-commerce ecosystems, high labor costs favoring automation, and significant investment in smart city infrastructure. The Asia Pacific (APAC) region, however, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by the explosive growth of online shopping in countries like China and India, coupled with rapid urbanization and government support for digital infrastructure projects. Segment trends reveal a strong shift towards customized and heavy-duty industrial lockers designed for specific sectors like healthcare (managing medical supplies) and manufacturing (tool and asset check-out), moving beyond simple package delivery applications. The software component, including API integration capabilities with third-party logistics (3PL) providers and corporate systems, is increasingly becoming the primary differentiator among competitive offerings.

AI Impact Analysis on Smart Locker System Market

Common user questions regarding AI's impact on smart lockers frequently center on how AI can enhance security, streamline logistics optimization, and improve predictive maintenance capabilities. Users are keen to understand if AI can effectively recognize and categorize package contents to prevent misuse, dynamically allocate locker space based on real-time demand forecasting, and proactively identify hardware failures before they occur. The key themes summarized from user inquiries revolve around the transition from reactive management to predictive operations, the desire for hyper-personalized access experiences (e.g., facial recognition and behavioral analytics), and concerns about data privacy and the ethical deployment of surveillance technologies integrated into the locker systems. The market expects AI to transition smart lockers from mere storage units into intelligent logistical nodes capable of making autonomous operational decisions.

AI’s influence is profound, pivoting the market towards sophisticated operational management. By applying machine learning algorithms to historical usage data, AI enables dynamic pricing models for rental lockers or optimizes delivery routes for carriers based on predicted locker availability, significantly enhancing the overall efficiency of the logistical chain. Furthermore, Computer Vision (CV) integrated into smart locker systems allows for enhanced anomaly detection, verifying package drop-off integrity, and recognizing unauthorized access attempts with greater accuracy than traditional sensor arrays. This paradigm shift focuses on using AI to reduce labor dependency, minimize downtime through predictive insights, and offer highly customizable, secure access protocols tailored to individual end-user needs, thereby extending the utility and perceived value of the smart locker infrastructure across various sectors.

- Enhanced Dynamic Allocation: AI algorithms predict peak usage hours and optimally assign locker sizes and locations to maximize throughput and minimize carrier waiting times.

- Predictive Maintenance: Machine learning analyzes sensor data (temperature, locking mechanism stress, battery life) to forecast component failure, allowing maintenance scheduling before system downtime occurs.

- Advanced Security Verification: Integration of facial recognition and behavioral analytics for two-factor authentication and real-time detection of suspicious activities around the locker bank.

- Optimized Last-Mile Logistics: AI helps 3PLs integrate locker availability directly into their route optimization software, drastically reducing failed delivery attempts.

- Data-Driven Operational Insights: AI processes usage patterns to provide granular reports to facility managers on package volume fluctuations, demographics, and preferred access times.

DRO & Impact Forces Of Smart Locker System Market

The Smart Locker System Market is influenced by a complex set of Dynamics (Drivers, Restraints, Opportunities) and Impact Forces that determine its growth trajectory. The primary drivers stem from the exponential growth of e-commerce and the subsequent need for efficient last-mile delivery solutions, coupled with increasing demand for contactless and secure item transfer systems across residential, corporate, and retail settings. Restraints primarily involve the high initial capital expenditure required for large-scale deployments, challenges related to standardized API integration across diverse carrier networks, and growing public concern over data privacy and cyber security vulnerabilities associated with IoT-connected devices. These forces collectively shape a landscape where opportunities lie in developing niche applications (e.g., temperature-controlled medical lockers or industrial tool management) and expanding into underserved developing economies through scalable, modular solutions.

Opportunities are specifically centered on the proliferation of "smart cities" infrastructure, which provides governmental backing and standardized guidelines for deployment, creating new market avenues beyond traditional retail logistics. The growing trend of hybrid work models also creates demand for smart office solutions, including secure desk-to-desk item transfer and IT asset management using specialized smart lockers. Conversely, impact forces such as stringent regulatory requirements concerning data protection (like GDPR in Europe) compel manufacturers to heavily invest in robust encryption and compliance features, sometimes increasing development costs. The competitive force of substitution, mainly from alternative delivery methods like drone delivery (currently nascent but evolving) or intensified in-store pickup services, also exerts pressure, mandating continuous innovation in user interface design and operational reliability to maintain market relevance.

Segmentation Analysis

The Smart Locker System Market is meticulously segmented based on components, deployment models, applications, and technology, reflecting the diverse needs of end-users ranging from small residential complexes to large industrial facilities. Component segmentation highlights the crucial role played by software and services, moving beyond mere hardware sales, as providers seek sustainable revenue through subscription-based management platforms and maintenance contracts. Application segmentation underscores the dominance of retail and logistics due to high parcel volume, while deployment models emphasize the growing preference for cloud-based systems which offer flexibility, remote management, and easier integration with external logistical platforms compared to older, high-latency on-premise solutions. This granularity in segmentation is vital for vendors aiming to tailor their product offerings to specific industry requirements and regulatory compliance standards.

- By Component: Hardware (Locks, Modules, Sensors, Controllers), Software (Management Systems, Access Control Platforms, Integration APIs), Services (Installation, Maintenance, Cloud Subscriptions).

- By Application: Retail (Click-and-Collect), Logistics (Last-Mile Delivery, Carrier Hubs), Corporate/Office (Asset Management, Internal Mail), Residential (Apartment Complexes, Private Homes), Educational Institutions, Healthcare Facilities.

- By Deployment Model: On-Premise, Cloud-Based.

- By Mechanism/Access Technology: PIN Code Access, RFID/NFC Access, Biometric Access (Fingerprint, Facial Recognition), Mobile Application Access, QR Code/Barcode Scanning.

- By Type: Modular and Standardized Lockers, Customized and Heavy-Duty Industrial Lockers.

Value Chain Analysis For Smart Locker System Market

The value chain for the Smart Locker System Market begins with upstream activities focused on raw material procurement, the sourcing of crucial electronic components such as microcontrollers, IoT sensors, and advanced locking mechanisms, and the subsequent manufacturing of modular steel or composite structures. Key upstream challenges involve maintaining a stable supply chain for highly integrated electronics, which are subject to global semiconductor shortages, and ensuring component quality to meet durability and security standards. Manufacturers must strategically align with specialized electronics suppliers and metal fabricators to achieve cost efficiencies and scalability, particularly when developing highly customized industrial or refrigerated locker units that require specialized component integration.

Midstream activities involve the core manufacturing, software development, and system integration phases. This is where proprietary software management systems, APIs for carrier integration, and firmware updates are developed and integrated into the physical hardware. Downstream activities involve distribution, installation, and post-sales servicing. Distribution channels are predominantly direct sales to large corporate and logistical clients, supplemented by strong partnerships with facility management companies, system integrators, and real estate developers who bundle smart locker systems into larger property technology (PropTech) solutions. Post-sales services, particularly cloud maintenance and remote diagnostics, are critical for customer retention and recurring revenue generation in this technologically dependent market.

The distribution channel landscape is bifurcated into direct and indirect routes. Direct sales are crucial for large-scale, enterprise-level deployments (e.g., national logistics carriers or large university campuses) where customized planning, installation, and long-term service agreements are required, handled directly by the locker manufacturer. Indirect channels, involving third-party system integrators, IT consultants, and regional value-added resellers (VARs), are utilized to penetrate smaller markets, local businesses, and residential property management firms, leveraging the reseller’s local expertise and existing customer relationships. Effective channel management, including comprehensive training and technical support for partners, is essential to ensure consistent installation quality and end-user satisfaction across varied geographic and regulatory environments.

Smart Locker System Market Potential Customers

The potential customer base for smart locker systems is highly diversified, encompassing any organization or facility that manages high volumes of physical assets, mail, or parcels requiring secure, tracked, and accessible storage. The primary end-users fall into the logistics and e-commerce sectors, including major carriers (UPS, FedEx, DHL) and online retailers (Amazon, Alibaba), who utilize these systems for efficient last-mile delivery and reverse logistics (returns processing). Residential end-users, such as owners and management companies of multi-family housing, condominiums, and student dormitories, represent a fast-growing segment, seeking to mitigate the operational burden and liability associated with managing tenant package deliveries.

Beyond logistics, corporate and commercial real estate entities are significant buyers, deploying smart lockers for secure IT asset check-out, internal mail and document transfer, and secure storage for employee personal belongings in flexible or hot-desking office environments. Specialized end-users also include healthcare facilities for medication and equipment exchange, manufacturing plants for tool and specialized part inventory management (often requiring customized, ruggedized units), and educational institutions for book and equipment lending, highlighting the versatility and growing ubiquity of the technology. Market penetration strategies must be tailored to these distinct customer groups, addressing their specific operational pain points, whether it be parcel overflow in residential areas or enhanced inventory control in industrial settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $2.1 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DeBourgh Manufacturing Company, TZ Limited, Cleveron AS, KEBA AG, Quadient (Neopost), Smartbox Ecommerce Solutions Pvt. Ltd., Luxer One (Assa Abloy), American Locker Company, Inc., Metra Aus, Shenzhen Zhilai Sci & Tech Co., Ltd., Parcel Pending (Steliau Technology), Locker & Lock Pte Ltd, Smiota, Inc., RENOME SMART, Hangzhou Dongcheng Electronic Co., Ltd., Hollman, Inc., Setec Inc., Kern Ltd., Smart-Tek Services, Inc., Rittal GmbH & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Locker System Market Key Technology Landscape

The technological landscape of the Smart Locker System Market is defined by the confluence of robust hardware engineering and advanced Internet of Things (IoT) software integration. Key hardware technologies include resilient, modular locking mechanisms (electronic solenoids and motorized locks), integrated touch screens for user interaction, and a suite of sensors (proximity sensors, weight sensors, and climate control mechanisms for specialized units) crucial for real-time monitoring and inventory verification. Connectivity is paramount, typically relying on cellular (4G/5G) or robust Wi-Fi networks to ensure continuous communication between the locker bank and the cloud management platform. The increasing focus on energy efficiency necessitates the adoption of low-power consumption components and intelligent power management systems, especially for remote or solar-powered installations.

On the software front, the market is leveraging sophisticated cloud computing infrastructure, allowing for remote diagnostics, real-time access management, and seamless Over-the-Air (OTA) firmware updates. The core technological differentiator lies in the flexibility and security of the Application Programming Interfaces (APIs), which enable effortless integration with external enterprise resource planning (ERP) systems, carrier management platforms, and residential property management software. Furthermore, advancements in secure access technology are driving innovation, moving beyond simple PIN codes to incorporate highly secure biometric recognition (fingerprint and iris scanning) and mobile-based credentialing systems (NFC and Bluetooth Low Energy - BLE), significantly enhancing both convenience and security.

The integration of advanced security protocols is non-negotiable within this technology landscape. This includes end-to-end encryption for all data transmitted between the locker, the cloud, and the end-user’s mobile device, complying with strict industry standards. Furthermore, the development of specialized technologies, such as refrigerated or heated compartments for food and medical deliveries, is expanding the utility of smart lockers into new vertical markets. Future technological progress is expected to focus heavily on edge computing to reduce latency for authentication processes and the further deployment of AI/ML for demand forecasting and predictive maintenance, cementing the role of technology as the primary driver of competitive advantage.

Regional Highlights

The global distribution of the Smart Locker System Market reveals distinct regional characteristics driven by varying levels of e-commerce maturity, infrastructural development, and regulatory environments.

- North America: This region holds a dominant market share, characterized by high consumer acceptance of e-commerce and extensive investment in residential and corporate smart building technologies. The market here is highly competitive, with a strong focus on sophisticated software platforms, API integration with major carriers, and rapid expansion into university campuses and healthcare facilities. Urban package overflow issues drive demand heavily in major metropolitan areas, making residential solutions a high-growth segment.

- Europe: Europe represents a mature market, heavily influenced by strict data privacy regulations (GDPR), which mandate vendors to provide robust security features. Countries like Germany, the UK, and France are leaders in adopting click-and-collect services in retail, and government investment in logistics infrastructure is substantial. Eastern Europe shows emerging potential, primarily driven by logistics modernization efforts and increasing cross-border e-commerce activity.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive population growth, increasing internet penetration, and the unprecedented scale of e-commerce activity, particularly in China, India, and Southeast Asia. The focus in APAC is on high-volume, cost-effective deployments and overcoming infrastructural challenges in dense urban centers. Government initiatives supporting smart logistics and last-mile delivery improvements are critical accelerators in this region.

- Latin America (LATAM): The LATAM market is nascent but rapidly evolving, driven primarily by the need for enhanced package security due to high rates of parcel theft in certain areas. Growth is concentrated in logistics hubs and high-end residential developments in countries like Brazil and Mexico, emphasizing robust security features and reliable connectivity despite variable infrastructure quality.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated in the GCC states (UAE, Saudi Arabia) due to ambitious smart city projects and high per-capita spending on luxury goods and e-commerce. The climate often necessitates specialized, temperature-controlled lockers. African markets remain relatively undeveloped but show potential in South Africa and Nigeria as digital economies expand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Locker System Market.- Quadient (Neopost)

- Luxer One (Assa Abloy)

- Cleveron AS

- KEBA AG

- TZ Limited

- Parcel Pending (Steliau Technology)

- Smiota, Inc.

- American Locker Company, Inc.

- Metra Aus

- DeBourgh Manufacturing Company

- Shenzhen Zhilai Sci & Tech Co., Ltd.

- RENAME SMART

- Locker & Lock Pte Ltd

- Hollman, Inc.

- Setec Inc.

- Kern Ltd.

- Smart-Tek Services, Inc.

- Rittal GmbH & Co. KG

- Hangzhou Dongcheng Electronic Co., Ltd.

- Smartbox Ecommerce Solutions Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Smart Locker System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the growth of the Smart Locker System Market?

The primary growth drivers are e-commerce logistics, specifically addressing the last-mile delivery challenge in dense urban areas, and residential package management, where property managers adopt systems to handle the increasing volume of tenant parcels securely and efficiently.

How does the integration of IoT and AI specifically benefit smart locker deployments?

IoT provides continuous connectivity for real-time monitoring and remote access control. AI enhances security through anomaly detection and significantly optimizes operations by using predictive analytics for dynamic locker allocation, minimizing downtime and improving carrier throughput.

Which segmentation component is expected to grow fastest in the Smart Locker Market?

The Software and Services component segment is projected to exhibit the highest growth rate. This is driven by the shift towards subscription-based cloud management platforms, the necessity for robust API integrations with logistics carriers, and the demand for value-added services like predictive maintenance and data analytics.

What are the main regulatory and cost barriers restraining market expansion?

The main restraints are the substantial initial capital investment required for hardware and installation, which can be prohibitive for smaller businesses, and the increasingly stringent data privacy regulations (e.g., GDPR) requiring significant compliance investment for software platforms handling user access data.

Is the Smart Locker Market primarily focused on package delivery or asset management?

While historically driven by package delivery (Retail and Logistics applications), the market is increasingly diversifying into corporate and industrial asset management, where specialized smart lockers secure and track high-value items, tools, and IT equipment within commercial facilities, reflecting a broader shift in utility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager