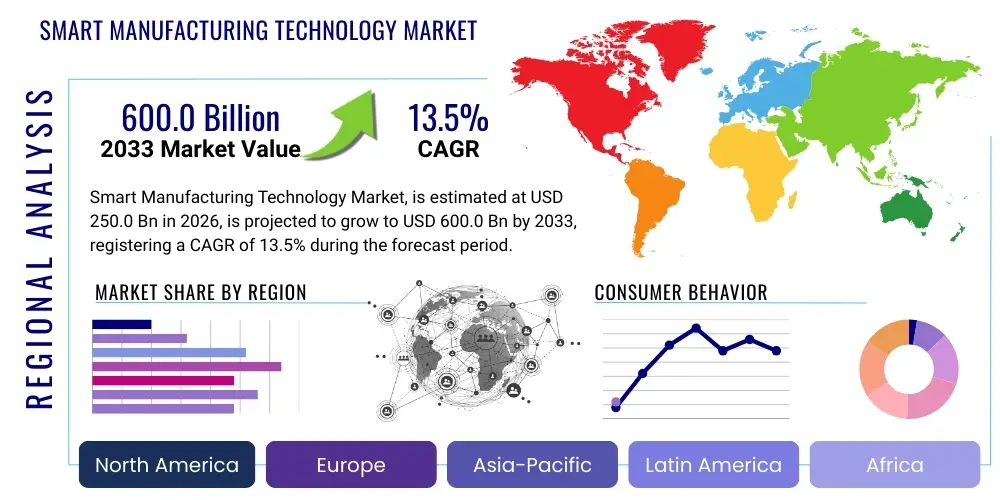

Smart Manufacturing Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437338 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Smart Manufacturing Technology Market Size

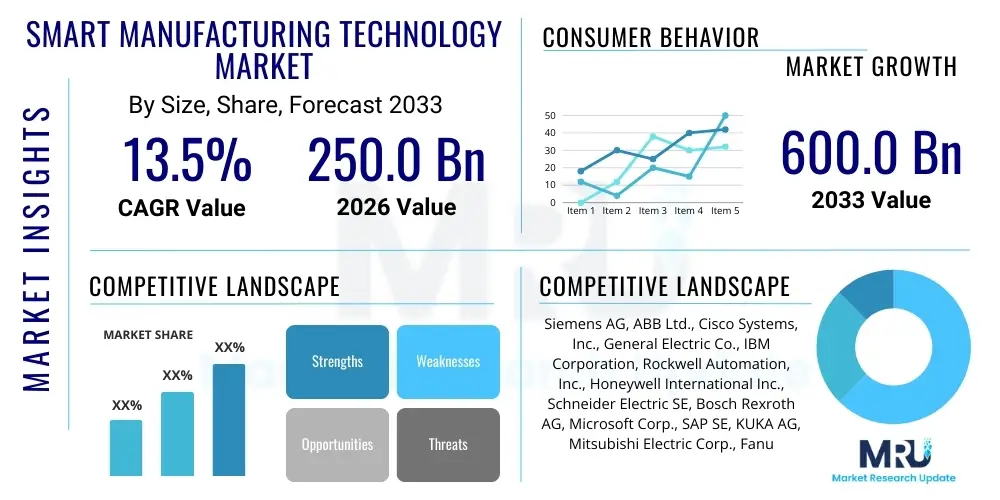

The Smart Manufacturing Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 250.0 Billion in 2026 and is projected to reach USD 600.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global imperative for optimized production efficiency, reduced operational costs, and the integration of advanced data analytics within industrial environments. The shift towards Industry 4.0 principles, characterized by hyper-connectivity and real-time decision-making, necessitates sophisticated smart manufacturing solutions, thus propelling market valuation.

Smart Manufacturing Technology Market introduction

The Smart Manufacturing Technology Market encompasses the integration of advanced technologies such as the Industrial Internet of Things (IIoT), Artificial Intelligence (AI), advanced robotics, cloud computing, and cybersecurity frameworks into manufacturing processes. These integrated systems facilitate data-driven decision-making, enabling optimized production flows, predictive maintenance, enhanced quality control, and highly personalized mass customization. The core objective of smart manufacturing is to create agile, interconnected, and self-optimizing factory ecosystems capable of responding dynamically to supply chain fluctuations and consumer demands. This evolution represents a paradigm shift from traditional, linear production models to adaptive, circular industrial frameworks, maximizing resource utilization and minimizing waste.

Key products within this domain include manufacturing execution systems (MES), enterprise resource planning (ERP) platforms tailored for smart factories, sensors and actuators, control hardware, and sophisticated analytical software suites designed for operational technology (OT) infrastructure. Major applications span across highly automated sectors such as automotive, aerospace and defense, electronics, pharmaceuticals, and heavy machinery, all seeking improved throughput and resilience. The immediate benefits derived from adopting these technologies include significant energy savings, minimized downtime through predictive diagnostics, faster time-to-market for new products, and a marked improvement in worker safety by automating hazardous tasks.

Market growth is strongly driven by increasing global labor costs, which incentivize automation investment, coupled with rapid advancements in 5G networking capabilities, providing the low latency and high bandwidth necessary for widespread IIoT deployment. Furthermore, government initiatives across developed and developing economies promoting digital transformation and industrial modernization acts as a critical catalyst. Challenges related to data security vulnerabilities and the high initial capital expenditure for system overhaul, however, necessitate strategic planning and standardized protocol adoption by industry stakeholders.

Smart Manufacturing Technology Market Executive Summary

The global Smart Manufacturing Technology Market is experiencing robust growth fueled primarily by technological advancements in AI and IIoT integration, coupled with the increasing necessity for sustainable and resilient supply chains. Business trends indicate a strong focus on platform-based solutions, where vendors offer comprehensive, integrated stacks covering everything from edge devices to cloud analytics, moving away from disparate, point-solution architectures. Furthermore, there is a pronounced trend towards collaborative robotics (cobots) which work alongside human operators, enhancing productivity without fully displacing the workforce. Investment in cybersecurity specific to OT environments has also become a mandatory business requirement, driving significant expenditure in specialized software and services aimed at protecting interconnected operational assets from cyber threats.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, largely due to massive investments in manufacturing infrastructure, particularly in China, South Korea, and Japan, coupled with favorable government policies promoting industrial digitalization (e.g., Made in China 2025). North America and Europe, while representing mature markets, maintain high revenue shares driven by early adoption of sophisticated technologies like predictive maintenance and digital twin modeling across their complex industrial bases, particularly in high-value sectors such as aerospace and automotive production. The focus in these regions is shifting towards refining existing smart systems for greater efficiency and circularity.

Segment trends reveal that the software segment, including MES, ERP, and advanced analytics platforms, is projected to command the largest market share owing to the continuous need for software updates and enhanced algorithmic capabilities crucial for optimizing production data. Among technologies, the Industrial IoT (IIoT) component, which encompasses sensors and connectivity infrastructure, remains foundational, but AI/ML technology is exhibiting the highest growth trajectory due to its pivotal role in enabling true predictive capabilities and autonomous decision-making within the factory setting. Application-wise, the automotive sector continues to be a primary consumer, leveraging smart manufacturing for complex assembly, quality control, and customization at scale.

AI Impact Analysis on Smart Manufacturing Technology Market

Common user questions regarding AI's impact on the Smart Manufacturing Technology Market frequently revolve around how Artificial Intelligence enhances productivity, whether AI leads to workforce displacement, and the feasibility of implementing AI-driven predictive maintenance systems across legacy infrastructure. Users are keen to understand the return on investment (ROI) from using machine learning models for quality inspection, and they often inquire about the necessary data infrastructure—specifically, data lakes and real-time processing capabilities—required to sustain effective AI operations. Key concerns center on data privacy, algorithmic transparency, and the potential for increased system complexity when integrating sophisticated AI tools into existing operational technology (OT) landscapes. The overall expectation is that AI will be the primary driver enabling true lights-out manufacturing and fully autonomous production chains.

AI’s influence is transformative, moving manufacturing processes beyond mere automation to genuine autonomy and optimization. AI algorithms are crucial for processing the vast quantities of data generated by IIoT devices, converting raw data into actionable insights for operational improvement. This allows for unparalleled precision in forecasting equipment failures (predictive maintenance), optimizing energy consumption patterns, and dynamically adjusting production schedules to minimize bottlenecks. Furthermore, AI-powered computer vision systems are revolutionizing quality control, identifying defects with higher accuracy and speed than human inspectors, significantly reducing waste and rework.

This deep integration of AI elevates smart manufacturing beyond simple connectivity, fostering systems that learn, adapt, and self-correct. The ability of AI to simulate complex scenarios through digital twins enables manufacturers to test changes and optimizations virtually before deployment, drastically cutting down on risk and time-to-market. Consequently, AI is not just a component; it is the central intelligence layer that unlocks the full potential of Industry 4.0, driving efficiency gains that were previously unattainable and fundamentally changing labor requirements, demanding a workforce skilled in managing and interpreting complex data systems.

- AI enables superior predictive maintenance, reducing unplanned downtime by up to 50%.

- Machine learning models optimize supply chain logistics and inventory management, minimizing storage costs.

- Computer vision systems enhance quality control and defect detection accuracy in real-time.

- AI facilitates hyper-personalization and mass customization of products through adaptive production lines.

- Generative AI tools assist in faster product design and simulation via digital twin environments.

- Automation fueled by AI addresses skills gaps and rising labor costs across high-wage regions.

DRO & Impact Forces Of Smart Manufacturing Technology Market

The Smart Manufacturing Technology Market is highly influenced by a complex interplay of Drivers, Restraints, Opportunities, and key Impact Forces that collectively shape its trajectory. The primary driver is the accelerating trend of digital transformation across all industrial sectors, pushed by the competitive necessity to improve productivity and reduce environmental footprint. Simultaneously, significant restraints, such particularly high initial investment costs associated with upgrading brownfield facilities and integrating legacy systems, often deter small and medium-sized enterprises (SMEs) from rapid adoption. The fundamental opportunity lies in leveraging edge computing and 5G connectivity to deliver real-time, low-latency processing, enabling entirely new use cases for autonomous factory operations. These factors create powerful impact forces, where standardization (or lack thereof) in communication protocols significantly influences market fragmentation and vendor interoperability, demanding collaborative industry effort.

Key drivers include the global push towards sustainable manufacturing practices and the regulatory mandates requiring greater energy efficiency, which smart technologies inherently support through optimization algorithms. Another critical driver is the technological convergence of robotics, AI, and IIoT, making sophisticated solutions more accessible and powerful than ever before. However, the market faces strong resistance due to the pervasive threat of cyberattacks targeting operational technology (OT) systems, requiring substantial investment in cybersecurity measures which can inflate project costs and extend deployment timelines. Furthermore, the specialized skills required to manage and maintain these complex systems present a significant workforce challenge.

Opportunities for expansion are abundant, particularly in developing economies where new greenfield manufacturing sites offer ideal testing grounds for fully integrated smart solutions without the burden of legacy system migration. The emergence of cloud-based manufacturing services (Manufacturing-as-a-Service) also lowers the entry barrier for smaller players, democratizing access to advanced tools. The most crucial impact force remains the pace of sensor miniaturization and cost reduction, which continually broadens the scope of feasible monitoring and automation applications. The shift towards open standards and modular, vendor-agnostic systems will dictate future market structure and competitive dynamics, favoring flexible and interoperable solutions.

Segmentation Analysis

The Smart Manufacturing Technology Market segmentation provides a granular view of its structure, typically categorized by component (hardware, software, services), technology (IIoT, AI/ML, Robotics, Cloud Computing, etc.), application (industry verticals), and geographic region. This framework is essential for understanding where investment flows are concentrated and which technological stacks are achieving the highest adoption rates. The services segment, encompassing consulting, integration, maintenance, and support, is increasingly vital as manufacturers require expert assistance to navigate complex system deployments and ensure continuous operational efficiency and security updates.

Analysis confirms that the software component dominates revenue, driven by the recurring need for advanced analytics and control platforms like MES and ERP systems designed for real-time factory floor management. Conversely, hardware components, including sensors, controllers, and advanced robotics, dictate the physical limits of automation and scalability. Technology adoption shows a clear trajectory: while IIoT forms the foundational layer for data acquisition, Artificial Intelligence represents the highest value-added layer, driving optimization and enabling truly predictive capabilities across all vertical applications, from precision engineering in aerospace to high-volume production in the consumer goods sector.

- By Component:

- Hardware (Sensors, RFID, Controllers, Robotics, Machine Vision Systems)

- Software (Manufacturing Execution Systems (MES), Enterprise Resource Planning (ERP), Product Lifecycle Management (PLM), Data Analytics Platform)

- Services (Consulting, System Integration, Maintenance and Support, Managed Services)

- By Technology:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Robotics (Industrial Robots, Collaborative Robots)

- Cloud Computing and Edge Computing

- Cybersecurity

- Additive Manufacturing (3D Printing)

- Augmented Reality (AR) and Virtual Reality (VR)

- By Application (Industry Vertical):

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Semiconductor

- Pharmaceutical and Biotechnology

- Chemical and Material

- Food and Beverage

- Energy and Utilities

- Heavy Machinery and Industrial Equipment

Value Chain Analysis For Smart Manufacturing Technology Market

The Value Chain for the Smart Manufacturing Technology Market involves several crucial stages, starting from upstream component manufacturing and specialized software development, extending through system integration and deployment, and concluding with downstream end-user operations and lifecycle support. Upstream activities are dominated by specialized technology providers, including semiconductor manufacturers producing IIoT chips and sensor manufacturers, alongside software developers creating proprietary AI/ML algorithms and cloud platforms. High entry barriers exist at this stage due to the necessity for deep R&D investment and intellectual property protection related to precision hardware and complex software architecture. The quality and reliability of these core components directly influence the performance of the entire smart factory ecosystem.

The middle segment of the value chain is characterized by system integrators and distributors, playing a vital role in customizing and installing solutions specific to various industrial environments. Due to the inherent complexity of integrating diverse technologies (e.g., legacy operational technology with modern information technology systems), specialized consulting and integration services are paramount. Distribution channels are typically a mix of direct sales for large, customized enterprise contracts and indirect channels (e.g., regional distributors or channel partners) for standardized hardware components and localized maintenance services. The effectiveness of these integrators often determines the speed of market adoption and the successful realization of projected efficiency gains for end-users.

Downstream activities focus on the manufacturers utilizing these smart systems. This includes continuous data monitoring, system maintenance, and performance optimization provided through ongoing service contracts. The long-term value capture in this market is increasingly shifting towards services and software subscription models rather than one-time hardware sales. This emphasis on post-deployment support and upgrades ensures the sustained relevance and high performance of the installed base, fostering durable relationships between technology providers and industrial consumers. Effective feedback loops from downstream operations back to upstream R&D drive iterative improvement and innovation in system capabilities, making the value chain highly dynamic and interdependent.

Smart Manufacturing Technology Market Potential Customers

The primary consumers, or potential customers, of Smart Manufacturing Technology are global manufacturing enterprises seeking competitive advantages through enhanced operational efficiency, product quality improvement, and capacity for mass customization. These buyers generally fall into two categories: large multinational corporations (MNCs) operating complex global supply chains and high-growth mid-sized enterprises (SMEs) focused on rapid scaling and niche market production. MNCs, especially those in the automotive, aerospace, and semiconductor industries, are foundational customers, demanding integrated, full-stack solutions tailored for high security and seamless global deployment across multiple facilities. Their purchasing decisions are driven by total cost of ownership (TCO) reduction and strategic mandates for Industry 4.0 adoption.

The adoption drivers for potential customers are varied but universally focused on cost containment and agility. Automotive manufacturers are high-value customers due to their dependence on precision assembly, high throughput, and the increasing complexity of electric vehicle manufacturing, which demands flexible production lines. Similarly, pharmaceutical and biotechnology companies are critical consumers, utilizing smart systems to ensure stringent regulatory compliance, batch traceability, and quality assurance during complex drug production processes. These highly regulated sectors prioritize reliability, validation services, and robust data integrity features within the smart manufacturing offerings.

Emerging potential customer segments include the Food and Beverage (F&B) sector, increasingly adopting smart technologies for supply chain visibility, temperature monitoring, and perishable inventory management to reduce spoilage and ensure safety standards. The utilities and energy sector also represents a growing customer base, using smart grid connectivity and predictive maintenance solutions for aging infrastructure, optimizing power generation efficiency, and minimizing localized downtime. The diversity of these end-user needs mandates that technology providers offer modular, scalable, and sector-specific customization capabilities to effectively penetrate these varied markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.0 Billion |

| Market Forecast in 2033 | USD 600.0 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, ABB Ltd., Cisco Systems, Inc., General Electric Co., IBM Corporation, Rockwell Automation, Inc., Honeywell International Inc., Schneider Electric SE, Bosch Rexroth AG, Microsoft Corp., SAP SE, KUKA AG, Mitsubishi Electric Corp., Fanuc Corp., Emerson Electric Co., Dassault Systèmes SE, Oracle Corp., PTC Inc., Stratasys Ltd., Yaskawa Electric Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Manufacturing Technology Market Key Technology Landscape

The Smart Manufacturing Technology Market is defined by the convergence of several high-impact technologies, forming a cohesive operational ecosystem aimed at achieving autonomous production. The foundational technology layer consists of the Industrial Internet of Things (IIoT), which utilizes advanced sensor networks, gateways, and communication protocols (like OPC UA and MQTT) to collect massive streams of real-time data from machinery and production assets. This pervasive connectivity, increasingly enabled by private 5G networks, provides the necessary backbone for high-volume, low-latency data transfer, essential for subsequent analytic processing and control actions. Without this robust IIoT infrastructure, higher-level smart functions cannot operate effectively.

Building upon the data backbone are the transformative technologies of Artificial Intelligence (AI) and Machine Learning (ML). These represent the 'intelligence' layer, using algorithms to analyze IIoT data for pattern recognition, anomaly detection, and predictive modeling. AI is utilized in several critical applications, including optimization of complex multivariate processes, predictive maintenance scheduling, and real-time quality control via machine vision. Crucially, the growth of edge computing allows these AI models to execute decisions locally on the factory floor, minimizing latency and reducing reliance on continuous cloud connectivity, thereby increasing system resilience and speed. Furthermore, Digital Twin technology, powered by advanced simulation tools, allows manufacturers to create virtual replicas of physical assets and processes, enabling risk-free testing and optimization before physical deployment.

Another essential part of the landscape is advanced robotics, including highly flexible and collaborative robots (cobots). Modern robots are equipped with advanced sensor fusion and AI capabilities, allowing them to perform intricate tasks alongside human workers safely and adaptively. Coupled with Additive Manufacturing (3D Printing), which enables rapid prototyping and decentralized production of parts, these technologies contribute significantly to supply chain resilience and customization capability. Finally, robust cybersecurity solutions, often incorporating AI-driven threat detection, are non-negotiable, acting as the critical protective layer for the interconnected OT/IT infrastructure against escalating industrial cyber threats, ensuring operational continuity and data integrity across the entire technology stack.

Regional Highlights

Geographic analysis reveals distinct patterns of technology adoption and market maturity across key regions. North America, particularly the United States, holds a significant market share driven by high technology penetration, substantial investment in defense and aerospace manufacturing, and the early adoption of advanced concepts like digital twins and integrated cloud manufacturing platforms. The region benefits from a mature ecosystem of key technology vendors and a strong institutional commitment to industrial digitalization, although high labor costs continue to fuel aggressive automation strategies across manufacturing plants.

Europe is another established market, largely influenced by the German government’s "Industrie 4.0" initiative, which has set a benchmark for smart factory standards globally. Key focus areas in Europe include energy efficiency optimization, circular economy initiatives, and the integration of highly skilled, collaborative robotic systems. The region emphasizes robust data governance and cybersecurity standards (e.g., GDPR compliance extending into industrial data), which dictate the types of cloud and connectivity solutions deployed within the manufacturing sector.

Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid industrialization, expansion of manufacturing capacity (especially in electronics and automotive sectors), and massive government investments in smart cities and industrial parks across China, India, and Southeast Asia. The region benefits from a high volume of greenfield projects, which are easier to equip with modern, integrated smart technologies compared to retrofitting legacy sites. However, market adoption rates can be highly uneven across different sub-regions due to varying economic development levels and regulatory landscapes. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by investments in resource extraction (Oil & Gas) and basic industrial modernization projects, often relying on imported technology and requiring local integration expertise.

- Asia Pacific (APAC): Leads in market growth due to expansive greenfield investment, strong government support for industrial modernization, and dominance in electronics and high-volume manufacturing (China, South Korea, Japan).

- North America: Market leader in sophisticated technology deployment (Digital Twins, Edge AI), driven by aerospace, defense, and high-tech manufacturing sectors, focusing on reducing labor reliance and optimizing complex supply chains.

- Europe: Highly influential through the Industrie 4.0 framework, focusing heavily on sustainability, complex integration of robotics, and stringent industrial cybersecurity and data protection standards.

- Latin America & MEA: Emerging markets with potential, primarily driven by efficiency improvements in commodity-heavy industries (mining, energy, resource processing) requiring foundational IIoT and monitoring solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Manufacturing Technology Market.- Siemens AG

- ABB Ltd.

- Cisco Systems, Inc.

- General Electric Co.

- IBM Corporation

- Rockwell Automation, Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Bosch Rexroth AG

- Microsoft Corp.

- SAP SE

- KUKA AG

- Mitsubishi Electric Corp.

- Fanuc Corp.

- Emerson Electric Co.

- Dassault Systèmes SE

- Oracle Corp.

- PTC Inc.

- Stratasys Ltd.

- Yaskawa Electric Corp.

Frequently Asked Questions

Analyze common user questions about the Smart Manufacturing Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Smart Manufacturing Technology Market?

The Smart Manufacturing Technology Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033, driven by global mandates for operational efficiency and the pervasive integration of AI and IIoT solutions.

Which technology segment drives the highest growth in smart manufacturing?

While the Industrial Internet of Things (IIoT) provides the foundational connectivity, Artificial Intelligence (AI) and Machine Learning (ML) are projected to be the fastest-growing technology segments, due to their essential role in enabling predictive maintenance, quality control, and autonomous decision-making in real-time factory environments.

How does Smart Manufacturing address the challenge of rising labor costs?

Smart Manufacturing addresses rising labor costs primarily through increased automation, utilizing advanced industrial and collaborative robots (cobots) to perform repetitive or hazardous tasks. This automation increases overall productivity and allows human capital to focus on high-value activities like system management and complex problem-solving.

Which geographic region is expected to show the fastest market expansion?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest market expansion, fueled by massive government investments in industrial digitalization, the continuous growth of regional manufacturing output, and significant capacity building in key sectors like electronics and automotive.

What is a Digital Twin and its importance in Smart Manufacturing?

A Digital Twin is a virtual replica of a physical asset, process, or system, created using real-time data from IIoT sensors. Its importance lies in enabling advanced simulation and analysis, allowing manufacturers to optimize performance, predict failures, and test changes virtually before impacting the physical production line, thereby mitigating risk and speeding up innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager