Smart Medication Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434057 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Smart Medication Packaging Market Size

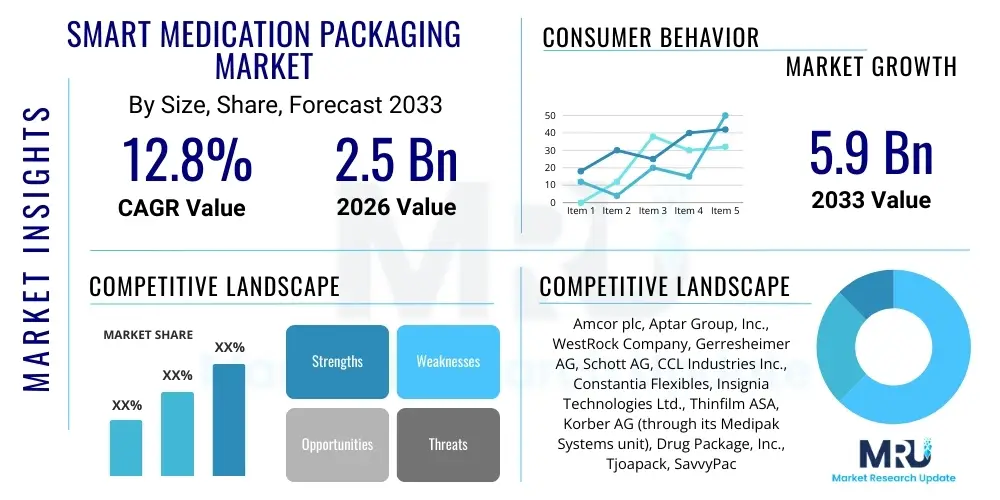

The Smart Medication Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Smart Medication Packaging Market introduction

Smart medication packaging represents a sophisticated and essential evolution in the pharmaceutical supply chain and patient care ecosystem, transforming passive containers into interactive digital tools. These advanced packaging solutions incorporate embedded electronics, connectivity features such as Near Field Communication (NFC) and Bluetooth Low Energy (BLE), and specialized sensors designed to monitor critical parameters like product environment, user interaction, and time of dispensing. The core differentiation of smart packaging lies in its ability to generate verifiable, real-time data, which is crucial for tackling global challenges like medication non-adherence, pharmaceutical counterfeiting, and ensuring cold chain integrity for sensitive biopharmaceuticals. This technology supports a shift from reactive healthcare management to proactive patient intervention and highly optimized logistics, establishing a digital bridge between the pill and the patient's electronic health record.

The applications of smart medication packaging are expanding rapidly across the pharmaceutical lifecycle. In clinical settings, smart vials and blister packs provide indispensable audit trails for ensuring protocol compliance and accurate data capture in clinical trials, significantly reducing operational variability and improving trial efficiency. For long-term chronic care, intelligent systems are designed to monitor dosing schedules for complex regimens, such as those required for diabetes or cardiology patients, utilizing light, sound, or haptic feedback to remind patients and automatically alert caregivers or pharmacists when doses are missed or regimens are incorrectly followed. Furthermore, the imperative for global traceability, driven by regulations like the European Union's Falsified Medicines Directive (FMD) and the U.S. Drug Supply Chain Security Act (DSCSA), mandates enhanced packaging security features, thereby accelerating the adoption of embedded authentication technologies like serialized RFID tags.

The driving forces behind this robust market expansion are multifaceted, encompassing macro-economic trends and specific healthcare necessities. Globally rising prevalence of chronic diseases, particularly among geriatric populations, intensifies the need for reliable adherence solutions that accommodate cognitive or physical impairments. Technologically, the cost of manufacturing miniaturized sensors and printed electronics is declining, making smart features economically viable for mass-market drugs. Moreover, the increasing integration of the Internet of Things (IoT) within healthcare, commonly termed the IoHT, provides the necessary connectivity infrastructure (5G and advanced wireless protocols) for secure and voluminous data transfer, facilitating seamless communication between smart packages and centralized data platforms. These benefits collectively position smart medication packaging as an indispensable tool for future patient safety and supply chain resilience.

Smart Medication Packaging Market Executive Summary

The Smart Medication Packaging Market is characterized by intense innovation and strategic collaborations, reflecting a rapid convergence between traditional packaging manufacturers, high-tech sensor developers, and software solution providers. A primary business trend involves the shift towards highly scalable, disposable smart solutions, leveraging printed electronics and low-cost NFC tags to meet mass-market demand while maintaining stringent cost control. Mergers and acquisitions are frequent, as established packaging giants seek to integrate proprietary sensing and connectivity technologies to offer comprehensive 'drug-device-data' solutions. Furthermore, pharmaceutical companies are increasingly viewing smart packaging not merely as a cost center but as a value-added service, recognizing its ability to generate valuable real-world evidence (RWE) that supports pay-for-performance models and informs future drug development strategies.

Geographically, market growth exhibits clear regional differentiation. North America, benefiting from aggressive digital health adoption policies and high consumer acceptance of connected health devices, maintains its leadership in market revenue, particularly in complex clinical trial applications and specialty drug tracking. In contrast, the Asia Pacific region is poised for explosive volumetric growth, driven by colossal pharmaceutical manufacturing expansion, rising disposable incomes leading to greater chronic care focus, and governmental pushes to modernize drug distribution channels to combat prevalent issues with illicit drug markets. European markets prioritize standardization and regulatory harmonization, focusing investment on secure, GDPR-compliant data transmission systems and sustainable packaging innovation, often leading in biodegradable smart component development.

From a segment perspective, adherence monitoring applications dominate the immediate growth trajectory, particularly utilizing smart blister packs that offer precise, pill-level usage recording—a necessity for phase III trials and specialty pharmacy services. The technology landscape is moving towards highly integrated systems, with Bluetooth Low Energy (BLE) gaining traction for its robust connectivity, complementing the high volume, low-cost authentication provided by NFC and passive RFID. End-user spending is heavily concentrated among large pharmaceutical and biotechnology firms, but expenditure by health systems focused on reducing preventable readmissions is accelerating. Overall, the market's trajectory is defined by a continuous push toward greater data fidelity, improved user experience, and enhanced cost-efficiency across all segments, ensuring its foundational role in future digitized healthcare delivery.

AI Impact Analysis on Smart Medication Packaging Market

User queries regarding the intersection of Artificial Intelligence (AI) and smart medication packaging center predominantly on three critical themes: enhancing predictive capabilities, ensuring data governance, and optimizing manufacturing efficiency. Users are keenly interested in how AI models can utilize the vast, continuous stream of data generated by smart packages—such as dose extraction times, environmental exposure, and even patient interactions via linked apps—to identify nuanced patterns signaling impending non-adherence or potential supply chain risks. Specifically, there is high expectation that AI can move beyond simple rule-based alerting systems to create highly personalized, predictive risk scores for individual patients, allowing healthcare providers to deploy timely and customized interventions, thereby maximizing therapeutic outcomes and minimizing unnecessary healthcare utilization costs linked to compliance failure.

Furthermore, AI is transformative in optimizing the highly complex pharmaceutical supply chain, particularly for cold chain logistics managed via smart packaging sensors. By applying machine learning to historical data on shipping routes, external weather conditions, container performance, and sensor readings (temperature, shock, vibration), AI algorithms can dynamically model and predict the probability of a temperature excursion for any given shipment in real time. This capability allows logistics managers to proactively reroute sensitive cargo or deploy mitigating actions before product viability is compromised, dramatically reducing waste of high-value biologics and improving inventory accuracy. This application shifts the operational model from expensive, static monitoring to cost-effective, predictive risk management, creating significant economic value across the distribution network.

On the manufacturing and technical front, AI is instrumental in increasing the precision and speed of integrating smart components into packaging substrates. Computer vision systems powered by AI are used for high-speed quality control checks, ensuring the flawless printing and placement of conductive inks, sensors, and microchips on blister foils or labels. Moreover, for issues concerning patient data privacy, advanced AI techniques such as Federated Learning (FL) are being explored. FL allows machine learning models to be trained across decentralized smart packaging data sets (e.g., across various hospitals or clinics) without requiring the sensitive raw patient adherence data ever to leave the local device or secure institutional server. This innovative approach satisfies stringent data privacy regulations (like HIPAA and GDPR) while still harnessing the power of collective data to improve global predictive models for adherence.

- AI algorithms enable sophisticated predictive adherence modeling by analyzing dose removal timing and frequency data captured by smart blister packs and vials.

- Machine learning models optimize cold chain logistics by utilizing smart sensor data (temperature, shock) to forecast integrity breaches and facilitate dynamic supply chain rerouting.

- Computer vision and AI are deployed in manufacturing for high-speed quality assurance of printed electronics and embedded sensor placement in packaging components.

- Federated Learning (FL) techniques utilize decentralized smart packaging data to train generalized adherence prediction models while maintaining strict patient data privacy and regulatory compliance.

- AI-driven systems personalize dosage reminders and educational content delivered via smart package interfaces based on individual patient usage history and cognitive profiles.

- Pattern recognition algorithms analyze smart packaging data streams to rapidly detect and flag potential illicit drug diversion or counterfeiting attempts within the distribution network.

DRO & Impact Forces Of Smart Medication Packaging Market

The core momentum propelling the Smart Medication Packaging Market is the incontrovertible economic and societal cost associated with sub-optimal patient adherence. The World Health Organization estimates that adherence rates for chronic therapies average only around 50%, resulting in substantial avoidable hospitalizations, emergency visits, and premature mortality, representing a cost measured in hundreds of billions of dollars globally. Smart packaging acts as a fundamental solution to this crisis by providing objective, verifiable data (the "Proof of Use") that conventional packaging lacks. This capability directly incentivizes healthcare payers and providers to adopt the technology, as it offers a quantifiable return on investment through reduced healthcare utilization. Furthermore, regulatory mandates in key pharmaceutical markets requiring sophisticated traceability and anti-counterfeiting measures for controlled substances and high-risk drugs serve as powerful, non-negotiable drivers.

However, the market's expansion is significantly constrained by factors related to capital expenditure and interoperability challenges. The initial costs involved in transitioning from conventional high-speed packaging lines to lines capable of integrating, activating, and verifying smart components (such as antennas, sensors, and batteries) are substantial, creating a significant barrier to entry, especially for generic manufacturers operating on tight margins. Furthermore, the lack of universal technical standards for data format and transmission protocols across diverse smart packaging platforms hinders seamless integration with the myriad of existing Electronic Health Records (EHRs) and Pharmacy Management Systems. This fragmentation necessitates complex, costly, and bespoke integration projects for every large-scale deployment, slowing market penetration and increasing the total cost of ownership for end users.

The long-term opportunities for market stakeholders are substantial and primarily center on technological breakthroughs and expansion into new verticals. Ongoing research into bio-degradable and environmentally friendly smart materials, including fully recyclable printed electronics and paper-based batteries, promises to mitigate current sustainability concerns, making the technology appealing in regulated European markets. Moreover, the convergence of smart packaging with companion diagnostics and precision medicine delivery systems—where individualized dosing requires meticulous adherence tracking—presents a high-value vertical. The imminent global rollout of 5G networks, offering enhanced bandwidth and minimal latency, creates the technological backbone necessary to support massive real-time data flow from millions of individual smart packages simultaneously, unlocking truly scalable population health management solutions.

Segmentation Analysis

Market segmentation provides a critical framework for understanding the diverse mechanisms, targets, and economic value streams within the Smart Medication Packaging industry. The differentiation across technologies highlights the spectrum of functionality available, from low-cost, passive authentication methods (like RFID used for bulk identification) to high-cost, active engagement systems (like BLE for real-time adherence monitoring). The increasing penetration rate of smartphones globally is influencing the transition towards NFC and BLE solutions, which leverage existing consumer devices, thereby reducing the need for proprietary reading hardware and lowering the adoption hurdle for patients and providers alike. Understanding this technological hierarchy is essential for strategists deciding on the appropriate balance between cost, data granularity, and user interaction.

Segmentation by Product Type, such as smart blister packs versus smart vials, is driven primarily by the required level of dosage precision and the nature of the drug format. Smart blister packs, which provide indisputable dose-level accountability, are increasingly preferred for clinical trials and high-risk chronic medications where adherence errors carry serious consequences. Conversely, smart vials, often used for bulk oral solids or liquids, focus more on overall inventory tracking and tamper evidence. The End User segmentation reveals the core purchasing dynamics: while pharmaceutical companies are interested in optimizing R&D and market protection, healthcare providers focus on improving patient outcomes and efficiency, leading to divergent requirements for software integration and data reporting capabilities.

The Application segment of Patient Adherence Monitoring currently commands the dominant market share globally, reflecting the immense economic pressure on healthcare systems to curb costs related to non-compliance. However, the Supply Chain Management application, particularly Cold Chain Monitoring, is expected to exhibit the fastest growth, driven by the increasing complexity and volume of temperature-sensitive biologic drugs (e.g., mRNA vaccines, monoclonal antibodies). This segment relies heavily on sophisticated, inexpensive temperature sensors integrated into secondary packaging, requiring specialized logistics providers capable of handling and interpreting the continuous data stream to maintain regulatory compliance and product efficacy until the point of dispensing.

- Technology:

- RFID (Radio-Frequency Identification) – Used primarily for inventory and authentication.

- NFC (Near Field Communication) – Cost-effective patient interaction and authentication via smartphone tap.

- Bluetooth Low Energy (BLE) – Enables continuous, active adherence monitoring and data logging over short distances.

- Sensors (Temperature, Humidity, Tamper-Evident) – Critical for cold chain and product integrity verification.

- Conductive Inks & Printed Electronics – Core technology for low-cost, scalable smart features on flexible substrates.

- Time and Temperature Indicators (TTI) – Simple visual indicators for irreversible temperature excursions.

- Product Type:

- Smart Vials and Bottles – Focused on bulk tracking, tamper evidence, and automated reminders.

- Smart Blister Packs – Essential for dose-level adherence tracking and clinical trial compliance.

- Smart Pouches and Sachets – Utilized for powder and liquid dosage forms requiring tamper detection.

- Smart Cartridges and Syringes – Focused on injectables, ensuring proper handling and temperature maintenance.

- Medication Dispensing Devices (Integrated Smart Packaging) – Automated systems with integrated connectivity and dispensing logs.

- Application:

- Patient Adherence Monitoring – Largest segment by revenue, focuses on compliance data gathering and intervention.

- Drug Counterfeiting and Tamper-Proofing – Utilizes security features like serialization and authentication tags.

- Supply Chain Management and Logistics (Cold Chain Monitoring) – Fastest growing segment, crucial for biologics tracking.

- Clinical Trials Management – Ensures high data fidelity and compliance tracking for investigational drugs.

- Dosage Verification and Prescription Management – Reduces dispensing errors and manages refill schedules automatically.

- End User:

- Pharmaceutical and Biotechnology Companies – Primary buyers for R&D, market protection, and adherence programs.

- Healthcare Providers (Hospitals and Clinics) – Focus on reducing readmission rates and managing complex patient cohorts.

- Retail Pharmacies and Drug Stores – Utilize for inventory management and enhanced customer service, including refill alerts.

- Patients and Caregivers (Homecare Settings) – Direct utilization for simplified medication management and peace of mind.

Value Chain Analysis For Smart Medication Packaging Market

The value chain for smart medication packaging begins with highly specialized upstream sourcing and manufacturing, demanding materials and components far exceeding those required for traditional packaging. The upstream segment is dominated by semiconductor manufacturers, sensor developers (including thermal, shock, and pressure sensors), and advanced materials science companies specializing in flexible, biocompatible substrates and conductive polymers. A critical element here is the production of low-power, flexible batteries or energy harvesting solutions designed to power the smart components for the duration of the drug's shelf life. Collaboration at this stage focuses on achieving ultra-miniaturization and driving down unit cost, balancing the need for technical complexity with the economic necessity of mass-scale pharmaceutical production.

Midstream processing involves the transformation of these raw components into functional packaging. This phase is characterized by sophisticated integration techniques, including roll-to-roll processing for applying printed electronics onto blister foil or label stock, high-precision chip placement (pick-and-place), and the subsequent serialization and activation of the connectivity feature. Leading contract packaging organizations (CPOs) and specialized packaging firms manage this stage, requiring significant investment in advanced machinery capable of handling smart components while maintaining sterile, GMP-compliant environments. Quality control at this stage is intensive, involving automated vision systems to ensure every embedded component is functional and correctly calibrated before the packaging is filled with medication.

Downstream activities center on distribution, dispensing, and data management. Distribution channels include both traditional pharmaceutical wholesalers and increasingly specialized cold chain logistics providers equipped to handle and monitor smart-enabled shipments. Dispensing occurs primarily through retail and hospital pharmacies, which must integrate proprietary or standardized reading hardware and software to register the product transfer and confirm authenticity. The final, and arguably most valuable, part of the downstream chain is the secure, cloud-based data platform that collects the adherence, temperature, and tracking data. This data is then analyzed and channeled back through direct interfaces to the end users—patients via mobile apps, healthcare providers via EHRs, and pharmaceutical companies for R&D insights, demonstrating a highly circular flow of information that completes the value proposition.

Smart Medication Packaging Market Potential Customers

The ecosystem of potential customers for smart medication packaging is broad, unified by the objective of enhancing the safety, efficacy, and accountability of pharmaceutical products. Pharmaceutical and Biotechnology Companies stand as the most financially significant segment. Their interest is multifaceted: they seek to gather regulatory-grade adherence data to demonstrate improved outcomes for new drug applications, protect their brand and revenue streams through advanced anti-counterfeiting measures, and gain competitive advantage by offering patient-centric digital engagement tools. For specialty drugs and high-value biologics, smart packaging is often a non-negotiable requirement to ensure product integrity and maximize investment return.

Healthcare Providers, including large hospital networks (Integrated Delivery Networks or IDNs) and specialist clinics, represent a growing segment driven by value-based care models. These organizations are incentivized to utilize smart packaging data to prevent medication-related complications, thereby reducing expensive hospital readmissions and improving quality metrics. The objective data provided by smart vials or blister packs allows clinicians to rapidly distinguish between true therapeutic failure and non-adherence, leading to quicker and more accurate adjustments to patient care plans. Furthermore, in-house pharmacies leverage smart inventory systems to minimize waste and optimize stocking levels for complex regimens.

The patient demographic, often supported by caregivers and home health organizations, is the ultimate beneficiary and an increasingly direct customer base. As the technology becomes more user-friendly and integrates seamlessly with common personal health devices, patients are purchasing solutions that simplify their complex dosing schedules, provide automated refill coordination, and facilitate communication with their clinical team. This consumer pull, particularly strong among tech-savvy individuals managing chronic conditions or older adults requiring assistance, is being actively addressed by specialty pharmacies offering smart-enabled dispensing services as a premium offering, cementing the role of the patient as a key influencing buyer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Aptar Group, Inc., WestRock Company, Gerresheimer AG, Schott AG, CCL Industries Inc., Constantia Flexibles, Insignia Technologies Ltd., Thinfilm ASA, Korber AG (through its Medipak Systems unit), Drug Package, Inc., Tjoapack, SavvyPack, Inc., Identipak, Inc., Information Mediary Corporation (IMC), Keystone Folding Box Co., Jones Packaging Inc., Catalent, Inc., Schreiner Group GmbH & Co. KG, Huhtamaki Oyj |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Medication Packaging Market Key Technology Landscape

The foundational technology underpinning modern smart medication packaging is the integration of printed electronics, which permits the creation of flexible, thin, and low-cost circuitry directly onto packaging substrates like paper, cardboard, or plastic film. This method utilizes conductive inks—composed of silver, carbon, or polymer materials—to print antennas, interconnects, and even some sensor elements. This shift from rigid circuit boards to flexible, printed components is crucial for achieving the necessary volume and low unit cost required for mass-market pharmaceuticals. Printed batteries and electrochromic displays are further refinements in this area, allowing packages to display simple adherence indicators or warnings without adding substantial bulk or cost, significantly enhancing both functionality and sustainability over traditional complex electronic integration.

Connectivity solutions are segmented primarily between passive and active systems. Passive systems, dominated by RFID (particularly UHF RFID) and NFC, require external power (typically from a reader or smartphone) to transmit data. These are extensively used for logistics tracking, bulk inventory management, and simple patient authentication checks due to their low cost and robustness. In contrast, active systems, predominantly using Bluetooth Low Energy (BLE), house small, integrated power sources and can actively log data (such as time-stamped dose removal) and communicate autonomously or semi-autonomously with nearby hubs or smartphones. BLE is the cornerstone of advanced adherence monitoring solutions, providing highly granular data necessary for clinical trials and specialized patient care programs, where continuous, verifiable data capture is paramount.

Sensor technology constitutes the intelligence layer of smart packaging, moving beyond simple identity verification. Time and Temperature Indicators (TTI) and specialized digital loggers are essential for maintaining the integrity of the cold chain, often incorporating highly accurate semiconductor sensors capable of logging data points every few minutes. More complex sensor integration includes tamper-evident circuits that immediately register any unauthorized opening or disruption of the packaging seal, crucial for ensuring patient safety and regulatory compliance for controlled substances. Advances in sensor miniaturization, coupled with ultra-low power consumption protocols (such as proprietary low-power wide-area networks or LPWAN variants), ensure these sensors remain operational for extended periods, enabling long-term monitoring vital for specialty drug distribution and adherence tracking across lengthy treatment periods.

Regional Highlights

North America commands the largest segment of the Smart Medication Packaging Market, driven by several interlocking factors, most notably the high per capita healthcare spending and a regulatory environment that actively encourages technological innovation in drug delivery and patient compliance. The United States market is defined by strong collaboration between leading pharmaceutical companies, technology providers, and major healthcare payers who are increasingly implementing value-based contracts dependent on verifiable patient adherence data. The early and widespread adoption of electronic health record systems (EHRs) and sophisticated supply chain traceability systems (driven by DSCSA requirements) provides the necessary digital infrastructure for scalable deployment of smart packaging solutions across retail, hospital, and homecare channels, setting a high benchmark for innovation.

Europe represents a mature market with a strong emphasis on regulatory compliance, sustainability, and cross-border logistics integrity. The implementation of the Falsified Medicines Directive (FMD) has driven significant investment in serialized packaging and authentication technologies, often integrated through NFC and RFID. Furthermore, European markets show a leading trend in demanding environmentally friendly smart packaging, pushing manufacturers to innovate with recyclable polymers, paper electronics, and bio-degradable components. While regulatory hurdles related to data privacy (GDPR) require rigorous security protocols, the unified commitment across key economies like Germany, France, and the UK to digitalize primary care ensures sustained, strong demand for adherence monitoring tools.

The Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by unprecedented growth in pharmaceutical manufacturing, especially in generics and biosimilars, and the urgent need to combat widespread pharmaceutical counterfeiting. Countries such as China, India, and Japan are rapidly expanding their healthcare infrastructure and implementing digital strategies to manage large, geographically dispersed populations with rising chronic disease burdens. The high penetration of smartphones and mobile data networks makes NFC and BLE-enabled packaging particularly viable for direct patient engagement. Government initiatives to improve cold chain infrastructure for vaccine distribution and high-value drugs are accelerating the deployment of sensor-based smart logistics solutions throughout the extensive regional supply chains.

- North America: Market leader; characterized by high digital health investment, mature regulatory framework (DSCSA, FDA), and strong demand from clinical trials for verifiable adherence data.

- Europe: Growth driven by strict FMD compliance, advanced cold chain standards, and a focus on sustainable, GDPR-compliant smart packaging solutions.

- Asia Pacific (APAC): Fastest-growing region; supported by vast manufacturing scale, urgent need for anti-counterfeiting measures, and mass adoption of mobile-enabled patient compliance tools.

- Latin America (LATAM): Developing market focused on increasing supply chain visibility and integrity, particularly for high-cost imported drugs and vaccines, often utilizing track-and-trace technology.

- Middle East and Africa (MEA): Emerging growth centered on securing the distribution of imported specialized medicines and managing extreme environmental conditions through advanced temperature monitoring solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Medication Packaging Market.- Amcor plc

- Aptar Group, Inc.

- WestRock Company

- Gerresheimer AG

- Schott AG

- CCL Industries Inc.

- Constantia Flexibles

- Insignia Technologies Ltd.

- Thinfilm ASA

- Korber AG (through its Medipak Systems unit)

- Drug Package, Inc.

- Tjoapack

- SavvyPack, Inc.

- Identipak, Inc.

- Information Mediary Corporation (IMC)

- Keystone Folding Box Co.

- Jones Packaging Inc.

- Catalent, Inc.

- Schreiner Group GmbH & Co. KG

- Huhtamaki Oyj

Frequently Asked Questions

Analyze common user questions about the Smart Medication Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of smart medication packaging in chronic disease management?

The primary function is to enhance patient adherence by providing automated, real-time reminders and recording the exact time of dose removal, transmitting this usage data securely to healthcare providers for proactive intervention and monitoring, thereby improving therapeutic outcomes.

How does smart packaging address the issue of pharmaceutical counterfeiting and security?

Smart packaging employs serialized RFID or NFC tags and tamper-evident sensors, enabling secure, unique identification and authentication of the product throughout the supply chain. This real-time tracking verifies product origin and alerts stakeholders to unauthorized access or diversion, drastically reducing counterfeiting risks.

What major challenges restrict the widespread adoption of smart medication packaging?

Key challenges include the high upfront capital investment required for integration into manufacturing lines, persistent concerns regarding the security and privacy of sensitive patient adherence data (data governance), and the lack of universal industry standards for data interoperability between diverse smart solutions and Electronic Health Records (EHRs).

Which technology segment currently holds the largest share in the smart medication packaging market?

While connectivity technologies like NFC and BLE are growing rapidly, the temperature and environmental sensor segment, particularly Time and Temperature Indicators (TTI) and data loggers, holds a substantial share due to stringent regulatory requirements for cold chain monitoring of high-value biopharmaceuticals and vaccines.

How are AI and machine learning integrated into smart packaging systems?

AI utilizes the data collected by smart packaging sensors to provide predictive adherence analytics, forecasting potential non-compliance before it occurs. It also optimizes supply chain logistics by predicting environmental risks (e.g., temperature excursions) and personalizes reminder timing and content for individual patients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager