Smart Pet Wearable Product Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439360 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Smart Pet Wearable Product Market Size

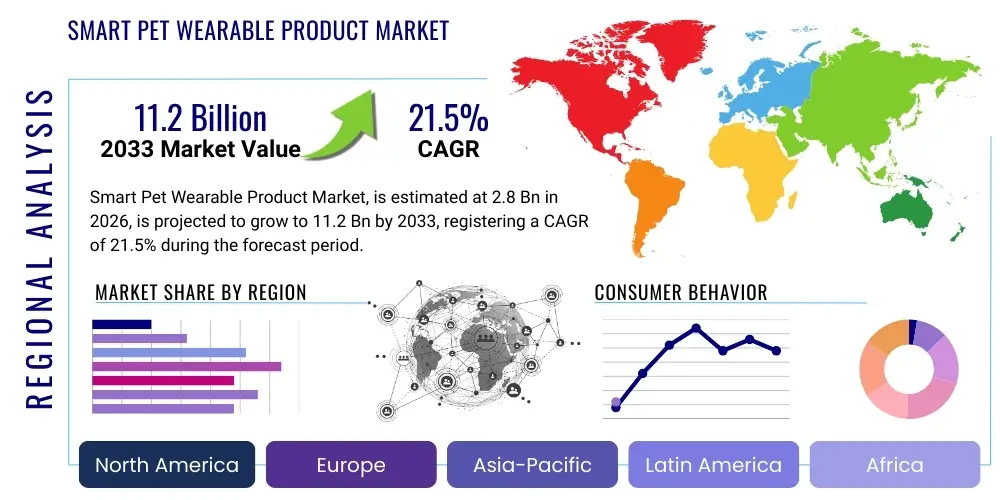

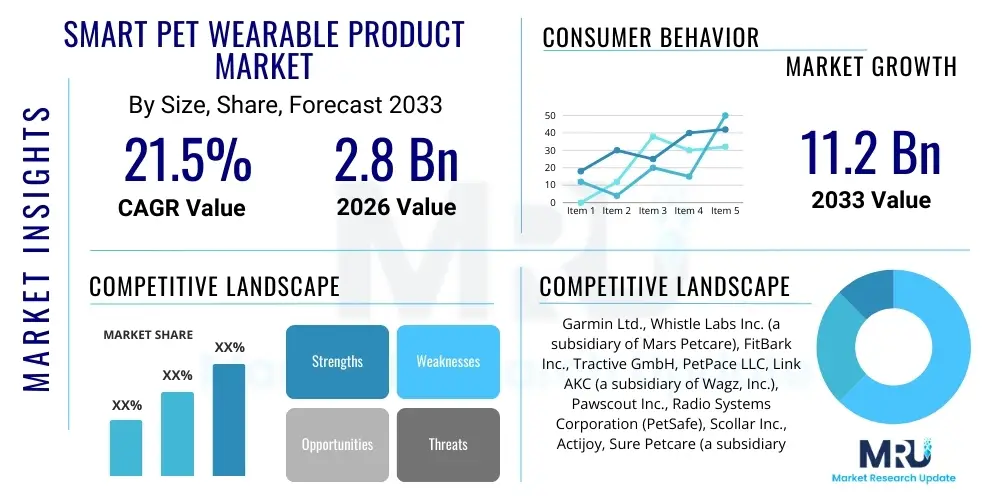

The Smart Pet Wearable Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 2.8 billion in 2026 and is projected to reach USD 11.2 billion by the end of the forecast period in 2033.

Smart Pet Wearable Product Market introduction

The Smart Pet Wearable Product Market encompasses a diverse range of technological devices designed to be worn by pets, offering functionalities that enhance their well-being, safety, and owner convenience. These innovative products leverage advancements in sensor technology, connectivity, and data analytics to provide real-time insights into a pet's health, location, and activity patterns. The market's primary objective is to bridge the communication gap between pets and their human companions, facilitating proactive care and fostering stronger bonds. Key products include GPS trackers for location monitoring, activity monitors for fitness and sleep tracking, health monitoring devices that measure vital signs, and smart collars integrating multiple functionalities.

Major applications of smart pet wearables span various aspects of pet care, from ensuring safety through geo-fencing and lost pet recovery to optimizing health management via early detection of anomalies and personalized activity recommendations. These devices are increasingly adopted by pet owners seeking to provide optimal care, particularly as pets become more integrated into family life. The benefits derived from these products are substantial, including enhanced pet safety, improved health outcomes, reduced anxiety for owners, and actionable data for veterinarians. They empower pet owners with unprecedented visibility into their pets' lives, contributing to a more informed and responsive approach to pet guardianship.

Driving factors propelling the growth of this market are multifaceted, anchored by the global trend of pet humanization, where pets are increasingly viewed as family members deserving of advanced care and attention. This sentiment fuels consumer willingness to invest in premium pet products and services. Furthermore, rising disposable incomes in developing economies, coupled with increasing pet ownership rates worldwide, create a fertile ground for market expansion. Technological advancements in miniaturization, battery life, and sensor accuracy continually enhance product capabilities, making these devices more practical and appealing. The growing awareness among pet owners about preventive healthcare and the potential for early disease detection offered by wearables also significantly contributes to market momentum, transforming how pet health is monitored and managed.

Smart Pet Wearable Product Market Executive Summary

The Smart Pet Wearable Product Market is undergoing rapid evolution, driven by a confluence of technological innovation and shifting consumer behaviors. Business trends indicate a strong emphasis on product diversification, with companies increasingly integrating advanced features such as AI-powered analytics, remote feeding capabilities, and comprehensive health tracking systems into a single device. Partnerships between technology firms and veterinary clinics are emerging, aiming to integrate wearable data directly into pet health records, thereby enhancing diagnostic accuracy and preventive care strategies. Moreover, the market is witnessing consolidation through mergers and acquisitions as larger tech companies seek to expand their pet tech portfolios and smaller innovative startups are acquired for their specialized technologies. Subscription models for data services and premium features are also gaining traction, offering recurring revenue streams and fostering long-term customer engagement, moving beyond a one-time product purchase.

Regional trends reveal distinct patterns in adoption and growth. North America and Europe currently dominate the market, characterized by high pet ownership rates, strong consumer spending power, and a high degree of pet humanization. These regions are early adopters of innovative pet technologies and possess robust regulatory frameworks for consumer electronics. The Asia Pacific region, particularly countries like China, Japan, and Australia, is poised for significant growth, fueled by rising disposable incomes, increasing urbanization, and a burgeoning middle class that is embracing pet ownership with modern amenities. Latin America and the Middle East & Africa, while starting from a smaller base, are demonstrating promising growth potential, driven by increasing awareness, improving economic conditions, and the growing influence of global pet care trends. Regional market strategies are often tailored to local cultural nuances regarding pet care and technological readiness, emphasizing affordability and essential functionalities in emerging markets.

Segmentation trends highlight a dynamic landscape where different product types, technologies, and animal categories contribute to market growth. GPS trackers and activity monitors remain foundational segments, but advanced health monitoring devices, including those for vital signs and behavioral analysis, are experiencing the fastest growth as pet owners prioritize health and wellness. The market for wearables specifically designed for dogs continues to be the largest, given their prevalence as companion animals and active lifestyles. However, the cat wearables segment is also expanding rapidly, driven by product innovations tailored to feline behavior and increasing cat ownership. Technological advancements are fostering convergence, with many devices now offering multi-functional capabilities, blurring the lines between traditional segment classifications. Distribution channels are also evolving, with online sales platforms playing a crucial role in market penetration, alongside specialized pet stores and veterinary clinics which provide expert advice and installation services.

AI Impact Analysis on Smart Pet Wearable Product Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Smart Pet Wearable Product Market frequently center on several key themes: the potential for more accurate and proactive health monitoring, the ability to personalize pet care, concerns about data privacy and security, and the future integration of AI with other smart home devices. Pet owners are keenly interested in how AI can move beyond simple data collection to offer predictive insights, such as anticipating illness before symptoms manifest or recommending optimal exercise routines based on individual pet characteristics. There's also a strong expectation for AI to enhance pet safety through more sophisticated tracking and behavioral anomaly detection, alongside questions about the ethical implications of using AI in pet care. The overarching expectation is that AI will transform pet wearables from mere data loggers into intelligent companions that actively contribute to a pet's holistic well-being.

- AI enables predictive analytics for early disease detection, identifying subtle changes in a pet's behavior or vital signs that may indicate an impending health issue, allowing for timely veterinary intervention.

- Personalized pet care recommendations are powered by AI algorithms that analyze individual pet data, including breed, age, activity levels, and dietary habits, to suggest tailored nutrition plans, exercise routines, and behavioral training strategies.

- Enhanced behavioral pattern recognition through AI helps detect anomalies such as increased anxiety, aggression, or unusual sleep patterns, providing owners with insights into their pet's emotional state and potential underlying issues.

- Improved GPS tracking and geofencing capabilities benefit from AI, which can learn a pet's typical routes and alert owners to deviations with greater accuracy, reducing false alarms and improving lost pet recovery rates.

- AI facilitates the development of smart feeding and watering systems that can monitor consumption, adjust portions based on activity data, and even identify changes in appetite that might signal health problems.

- Optimized battery management for wearable devices is achieved through AI, which learns usage patterns and conserves power more efficiently, extending device longevity between charges and improving user convenience.

- Integration with smart home ecosystems allows AI-powered pet wearables to communicate with other devices, such as smart doors, cameras, and climate control systems, creating a more integrated and responsive environment for pets.

- Data security and privacy measures are continually evolving with AI, employing advanced encryption and anomaly detection to protect sensitive pet data from unauthorized access and ensure compliance with privacy regulations.

- Development of advanced pet-specific language processing through AI could potentially lead to more nuanced interpretation of pet sounds and gestures, offering deeper insights into their needs and communication attempts.

- AI-driven virtual veterinary assistants or diagnostic tools are emerging, providing initial assessments based on wearable data and guiding owners on when professional veterinary consultation is necessary, streamlining pet healthcare access.

DRO & Impact Forces Of Smart Pet Wearable Product Market

The Smart Pet Wearable Product Market is significantly propelled by several impactful drivers. Foremost among these is the escalating trend of pet humanization globally, where pets are increasingly viewed as cherished family members, driving owners to invest more in their health, safety, and comfort. This emotional attachment fuels demand for technologies that offer peace of mind and enhance the quality of life for companion animals. Alongside this, the rising global pet ownership rates, particularly in emerging economies, expand the potential consumer base for these innovative products. Technological advancements in sensor miniaturization, battery efficiency, and connectivity options (such as 5G, Bluetooth Low Energy, and advanced GPS modules) continually improve product functionality, accuracy, and user experience, making smart wearables more attractive and practical for everyday use by pet owners.

Despite robust growth drivers, the market faces notable restraints that could temper its expansion. High initial product costs, especially for feature-rich devices, can deter price-sensitive consumers or those with multiple pets. The perceived value versus cost remains a critical consideration for widespread adoption. Data privacy and security concerns also present a significant hurdle; pet owners are increasingly wary of how their pet's data (and by extension, their own data) is collected, stored, and utilized by manufacturers, requiring stringent data protection measures and transparent policies. Furthermore, limited battery life in some sophisticated devices can lead to user frustration and inconvenience, while the lack of standardized regulations and interoperability across different platforms and devices poses challenges for seamless integration and widespread consumer acceptance. Some segments also face a lack of awareness or understanding about the true benefits of these technologies among traditional pet owners.

Opportunities within the Smart Pet Wearable Product Market are abundant and diverse, promising sustained growth. The integration of wearables with veterinary telemedicine services offers a substantial avenue for market expansion, allowing veterinarians to monitor pets remotely, provide timely advice, and manage chronic conditions more effectively. The development of specialized wearables for specific pet health conditions, such as diabetes monitoring or post-operative recovery, represents a niche yet high-value market segment. Expanding into companion animals beyond dogs and cats, such as horses or exotic pets, also presents new growth frontiers. Furthermore, strategic partnerships between wearable manufacturers, pet insurance providers, and pet food companies can create comprehensive wellness ecosystems, offering integrated solutions that enhance value for pet owners. The continuous innovation in AI and machine learning will unlock capabilities like advanced predictive health analytics, personalized training modules, and intelligent environmental control, positioning the market for long-term evolutionary growth and addressing increasingly sophisticated consumer demands.

Segmentation Analysis

The Smart Pet Wearable Product Market is segmented across various dimensions to provide a comprehensive understanding of its intricate dynamics and diverse consumer needs. This segmentation allows for targeted market analysis, identification of high-growth areas, and strategic development of products and services tailored to specific pet types, functionalities, and technological preferences. The market is primarily broken down by product type, technology, application, and animal type, reflecting the varied landscape of pet care solutions available. Each segment offers unique characteristics and growth opportunities, driven by distinct consumer requirements and technological advancements within the broader pet tech ecosystem. Understanding these segments is crucial for stakeholders aiming to capture market share and innovate effectively in this rapidly evolving industry.

- By Product Type:

- GPS Trackers: Devices primarily focused on real-time location tracking and geo-fencing capabilities for pet safety and recovery.

- Activity Monitors: Wearables designed to track a pet's physical activity levels, sleep patterns, and calorie expenditure, aiding in fitness management.

- Health Monitors: Devices that monitor vital signs such as heart rate, respiratory rate, temperature, and other physiological parameters for early detection of health issues.

- Smart Collars/Harnesses: Integrated devices offering multiple functionalities, combining tracking, activity monitoring, and sometimes health sensors into a single form factor.

- Smart Cameras: While not strictly wearable, these are often integrated into broader smart pet ecosystems, sometimes attached to collars for pet's-eye view.

- By Technology:

- GPS (Global Positioning System): Utilized for accurate outdoor location tracking.

- Bluetooth: Short-range wireless technology for activity tracking, data sync with smartphones, and indoor location services.

- Wi-Fi: Used for home-based tracking, data upload, and integration with smart home networks.

- Cellular (2G/3G/4G/5G): Enables long-range tracking and real-time communication without reliance on a smartphone.

- RFID (Radio-Frequency Identification): Passive identification for access control, automated feeders, and short-range tracking.

- Other Technologies: Including accelerometers, gyroscopes, biometric sensors, and specialized medical sensors for advanced monitoring.

- By Application:

- Tracking & Monitoring: Primarily for locating lost pets, geo-fencing, and monitoring their whereabouts.

- Behavioral Analysis & Training: Devices that help understand and modify pet behavior through vibrations, sounds, or data analysis.

- Health & Fitness: Focused on preventive health, monitoring vital signs, activity levels, and sleep quality to maintain overall well-being.

- Identification & Security: For unique pet identification, access control, and ensuring pet safety within designated areas.

- By Animal Type:

- Dogs: The largest segment, due to high dog ownership and a wide range of available products.

- Cats: A rapidly growing segment, with increasing product innovations tailored to feline behavior and preferences.

- Other Pets (e.g., Horses, Birds): Emerging segments with specialized needs and niche product offerings.

- By Distribution Channel:

- Online Retail: E-commerce platforms, brand websites, and online marketplaces.

- Offline Retail: Pet specialty stores, veterinary clinics, hypermarkets, and electronics stores.

Value Chain Analysis For Smart Pet Wearable Product Market

The value chain for the Smart Pet Wearable Product Market is intricate, involving multiple stages from raw material procurement to end-user consumption. Upstream activities are critical and include the sourcing of specialized components such as advanced microcontrollers, miniaturized GPS modules, Bluetooth chips, cellular connectivity modules, various biometric sensors (e.g., heart rate, temperature, activity), and durable, pet-safe materials for housings and straps. Suppliers in this segment include semiconductor manufacturers, sensor developers, and specialized plastics and textiles providers. The quality and innovation of these upstream components directly impact the performance, accuracy, and durability of the final wearable product, making strong supplier relationships and rigorous quality control essential for manufacturers in this competitive landscape.

Midstream activities primarily encompass research and development, design, manufacturing, and assembly. Manufacturers in this space invest heavily in R&D to innovate new sensor technologies, improve battery life, enhance connectivity, and develop sophisticated software algorithms for data analysis and user interface. Design focuses on ergonomics, pet comfort, and aesthetic appeal, ensuring products are safe, non-intrusive, and attractive to pet owners. Manufacturing involves precision engineering, assembly of complex electronic components, and stringent quality assurance processes to ensure product reliability and compliance with safety standards. This stage is also where software development for companion mobile applications and cloud-based data platforms occurs, translating raw sensor data into actionable insights for pet owners and veterinarians, thereby adding significant value to the product offering.

Downstream activities involve the distribution, marketing, sales, and post-sales support of smart pet wearables. Distribution channels are varied, including direct-to-consumer sales through company websites, online retail giants like Amazon and Chewy, specialized pet retail chains, and veterinary clinics. Marketing strategies often highlight the benefits of pet safety, health monitoring, and the peace of mind offered to owners, utilizing digital marketing, social media, and influencer partnerships. After-sales support, including customer service, technical assistance, and warranty provisions, is crucial for building customer loyalty and trust, especially for technology-intensive products. The direct channel allows manufacturers to maintain closer relationships with customers and gather direct feedback, while indirect channels leverage established retail networks and expert recommendations from veterinarians, enhancing market reach and consumer confidence in these innovative pet care solutions.

Smart Pet Wearable Product Market Potential Customers

The primary potential customers and end-users of smart pet wearable products are pet owners who are increasingly viewing their pets as integral family members. This demographic, often referred to as 'pet parents,' prioritizes their pet's health, safety, and well-being, and is willing to invest in advanced technologies that offer enhanced care and peace of mind. This segment includes a wide range of individuals, from young professionals living in urban environments who rely on technology to manage their busy lives, to affluent households seeking premium products for their beloved companions. These customers are typically tech-savvy, comfortable with mobile applications, and actively seek solutions that provide data-driven insights into their pet's behavior and health, allowing for proactive and informed pet management.

Beyond individual pet owners, another significant segment of potential customers includes professionals within the pet care industry. This encompasses veterinary clinics and animal hospitals, who can leverage smart wearable data for remote monitoring of patients, post-operative care, and early disease detection, integrating this data into their diagnostic and treatment protocols. Professional pet sitters and dog walkers also represent a growing customer base, utilizing GPS trackers to ensure the safety and whereabouts of pets under their care, providing an extra layer of reassurance to pet owners. Furthermore, animal shelters and rescue organizations can use these devices for monitoring the health and activity of animals awaiting adoption, improving their chances of finding a permanent home and streamlining operational efficiency.

A burgeoning customer segment also includes pet insurance companies, who might offer incentives or integrate wearable data to develop more personalized insurance plans based on a pet's health and activity levels, potentially leading to lower premiums for proactive pet owners. Breeders and trainers can utilize activity and behavioral monitors to track the development and training progress of their animals, optimizing their programs and ensuring the well-being of their stock. As smart pet wearables become more sophisticated and affordable, the customer base is expected to broaden further, reaching pet owners across various socioeconomic strata who increasingly recognize the tangible benefits these devices offer in extending the lifespan, improving the quality of life for their pets, and strengthening the human-animal bond through intelligent monitoring and proactive care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 billion |

| Market Forecast in 2033 | USD 11.2 billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garmin Ltd., Whistle Labs Inc. (a subsidiary of Mars Petcare), FitBark Inc., Tractive GmbH, PetPace LLC, Link AKC (a subsidiary of Wagz, Inc.), Pawscout Inc., Radio Systems Corporation (PetSafe), Scollar Inc., Actijoy, Sure Petcare (a subsidiary of Merck Animal Health), Motorola Solutions, Inc., Kippy S.r.l., Findster Technologies, Trackimo, Invoxia, Halo Collar, Wagz Inc., WagTag, Petfon |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Pet Wearable Product Market Key Technology Landscape

The Smart Pet Wearable Product Market is underpinned by a dynamic and continuously evolving technology landscape, where innovation is paramount to enhancing product capabilities and user experience. At its core, the market leverages advanced sensor technologies, including accelerometers and gyroscopes for activity tracking, sophisticated GPS modules for precise outdoor location, and an array of biometric sensors for health monitoring such as heart rate variability, respiratory rate, and temperature. Miniaturization of these sensors is a key trend, allowing for comfortable and less intrusive designs suitable for pets of varying sizes. The accuracy and reliability of these sensors are constantly being improved, providing pet owners with more trustworthy data and veterinarians with more actionable insights for diagnostic purposes and preventive care strategies.

Connectivity is another foundational pillar of this market, enabling real-time data transmission and seamless integration with various platforms. Bluetooth Low Energy (BLE) is widely used for short-range communication with smartphones and home hubs, essential for syncing activity data and device configuration. For long-range tracking and communication, cellular technologies (2G, 3G, 4G, and increasingly 5G) are crucial, allowing pet owners to monitor their pets remotely without proximity limitations. Wi-Fi integration facilitates faster data uploads and integration into smart home ecosystems, enabling features like automated feeding or climate control based on pet location. The development of robust, low-power connectivity solutions is vital for extending battery life, which remains a critical factor in consumer adoption and satisfaction. Future innovations will likely focus on even more efficient communication protocols and wider network coverage for ubiquitous pet monitoring.

The intelligence layer, primarily driven by Artificial Intelligence (AI) and Machine Learning (ML), is rapidly transforming raw data into actionable insights, marking a significant leap in the technological sophistication of pet wearables. AI algorithms analyze vast datasets of pet behavior, activity, and health parameters to identify patterns, detect anomalies, and predict potential health issues before they become critical. This includes advanced behavioral pattern recognition for early detection of stress or illness, and personalized recommendations for nutrition, exercise, and training. Cloud computing platforms are essential for processing and storing this immense volume of data, enabling scalable solutions and facilitating seamless access for pet owners and veterinarians alike. Furthermore, the integration of edge computing capabilities directly within the wearable devices themselves is an emerging trend, promising faster data processing, enhanced privacy, and reduced reliance on constant cloud connectivity, thereby making smart pet wearables even more autonomous and intelligent companions.

Regional Highlights

- North America: This region stands as a dominant force in the Smart Pet Wearable Product Market, characterized by high disposable incomes, significant pet ownership rates, and a strong cultural trend of pet humanization. Consumers in the U.S. and Canada are early adopters of innovative pet technologies, prioritizing advanced health monitoring and safety features. Robust research and development activities, coupled with the presence of key market players and a well-established distribution network, further solidify its leading position. The strong digital infrastructure also supports the widespread adoption of smart, connected pet devices and associated mobile applications, facilitating rapid market growth and sustained innovation.

- Europe: The European market demonstrates substantial growth, driven by increasing pet ownership, growing consumer awareness regarding pet health and wellness, and stringent animal welfare regulations. Countries like the UK, Germany, and France are at the forefront of adoption, with a focus on comprehensive pet care solutions that integrate tracking, activity monitoring, and health diagnostics. The region also benefits from a strong base of tech-savvy consumers and a mature market for connected devices, fostering a receptive environment for smart pet wearables. Regulatory support for data privacy and consumer protection further shapes product development and market entry strategies within the region.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate during the forecast period, fueled by rapidly urbanizing populations, rising disposable incomes, and a cultural shift towards increased pet ownership in countries such as China, Japan, South Korea, and Australia. While pet humanization trends are emerging, the market is also driven by practical concerns like pet safety in densely populated areas. Local manufacturers are innovating to meet region-specific demands, often focusing on affordability and essential functionalities initially, with a growing demand for premium, feature-rich products. The vast and diverse consumer base presents significant opportunities for market expansion, with tailored product offerings gaining traction.

- Latin America: This region is experiencing steady growth in the smart pet wearable market, driven by increasing pet ownership, particularly in urban centers, and a growing middle class with rising discretionary spending. Countries like Brazil, Mexico, and Argentina are leading the adoption, motivated by a desire to enhance pet safety and well-being. Market penetration is still lower compared to developed regions, but increasing awareness through digital marketing and the availability of more affordable entry-level products are contributing to its expansion. Local distributors and online platforms are playing a crucial role in making these products accessible to a broader consumer base.

- Middle East and Africa (MEA): The MEA market for smart pet wearables is in its nascent stages but shows promising growth potential. Factors contributing to this include a burgeoning expatriate population, increasing urbanization, and a gradual shift in pet ownership dynamics, especially in affluent countries of the Middle East. While cultural nuances regarding pet ownership vary, there is a growing recognition of the benefits of pet technology for safety and health monitoring. Investment in smart city initiatives and improving digital infrastructure are expected to further catalyze market growth, though market education and localized product offerings remain key strategies for successful market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Pet Wearable Product Market.- Garmin Ltd.

- Whistle Labs Inc. (a subsidiary of Mars Petcare)

- FitBark Inc.

- Tractive GmbH

- PetPace LLC

- Link AKC (a subsidiary of Wagz, Inc.)

- Pawscout Inc.

- Radio Systems Corporation (PetSafe)

- Scollar Inc.

- Actijoy

- Sure Petcare (a subsidiary of Merck Animal Health)

- Motorola Solutions, Inc.

- Kippy S.r.l.

- Findster Technologies

- Trackimo

- Invoxia

- Halo Collar

- Wagz Inc.

- WagTag

- Petfon

Frequently Asked Questions

Analyze common user questions about the Smart Pet Wearable Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using smart pet wearables for pet owners?

Smart pet wearables offer a multitude of benefits for pet owners, fundamentally enhancing pet safety, health monitoring, and overall peace of mind. For safety, GPS trackers enable real-time location tracking and geo-fencing, significantly reducing the risk of lost pets and aiding in their swift recovery. This feature is particularly valuable for pets with a tendency to wander or for owners living in large, open areas. In terms of health, these devices monitor vital signs, activity levels, and sleep patterns, providing valuable insights into a pet's well-being. This data can help owners and veterinarians detect early signs of illness, manage chronic conditions, and ensure pets maintain a healthy weight and activity regimen. Beyond these core functionalities, wearables foster a deeper bond between pets and owners by providing data-driven understanding of their pet's routines and behaviors. The ability to monitor pets remotely, even when owners are away from home, reduces anxiety and ensures consistent care. Ultimately, smart pet wearables empower owners with the information needed to provide proactive, informed care, leading to healthier, happier pets and more confident pet parents. The convenience of having consolidated data accessible via a smartphone app further streamlines pet management, making these devices an indispensable tool for modern pet care.

How accurate are smart pet wearables, especially concerning GPS tracking and health monitoring?

The accuracy of smart pet wearables has significantly improved due to advancements in sensor technology and data processing algorithms, though it can vary based on the device's quality, technology employed, and environmental factors. For GPS tracking, modern wearables often integrate multiple satellite systems (e.g., GPS, GLONASS, Galileo) and utilize cellular networks to achieve high accuracy, typically within a few meters outdoors. Factors like dense urban environments, heavy tree cover, or indoor usage can sometimes degrade GPS signal quality, leading to slight inaccuracies. However, many premium devices incorporate Wi-Fi triangulation for improved indoor location. Regarding health monitoring, devices use sophisticated biometric sensors to track heart rate, respiratory rate, and temperature, with an accuracy comparable to consumer-grade human fitness trackers. Activity monitors relying on accelerometers and gyroscopes provide reliable data on steps taken, distance covered, and calorie expenditure, aiding in fitness management. While these devices offer excellent indicators for trends and anomalies, they are generally not medical-grade diagnostic tools and should complement, not replace, professional veterinary care. Consistent advancements in sensor miniaturization, signal processing, and AI integration continue to push the boundaries of accuracy, making these wearables increasingly dependable for routine monitoring and early detection of potential issues.

What are the main privacy and security considerations for smart pet wearable data?

Privacy and security are critical considerations for smart pet wearable data, as these devices collect sensitive information about a pet's location, health, and activity, which can indirectly reveal insights about the owner's lifestyle and home. The main concerns revolve around data collection, storage, and sharing practices. Users are often apprehensive about who has access to their pet's data, how it's protected from cyber threats, and if it could be used for unsolicited marketing or sold to third parties. Manufacturers face the challenge of implementing robust encryption protocols for data transmission and storage, along with secure authentication mechanisms to prevent unauthorized access to user accounts. Compliance with global data protection regulations, such as GDPR in Europe and CCPA in California, is becoming increasingly important, requiring transparency in data policies and offering users control over their data. Beyond technical safeguards, clear and concise privacy policies are essential to inform users about data handling practices. Companies must build trust by demonstrating a commitment to data privacy, ensuring that pet data is primarily used to enhance the pet's well-being and device functionality, without compromising the owner's personal information. Neglecting these aspects can lead to significant reputational damage and hinder market adoption, emphasizing the need for a privacy-by-design approach in product development.

How does the cost of smart pet wearables impact their adoption, and what are the pricing trends?

The cost of smart pet wearables significantly impacts their adoption, particularly for price-sensitive consumers or those with multiple pets. High initial purchase prices for advanced, feature-rich devices can act as a barrier to entry, limiting the market primarily to affluent pet owners or those with very specific needs (e.g., a pet with a chronic condition or a history of wandering). Beyond the upfront cost, many premium wearables also involve recurring subscription fees for cellular connectivity, cloud data storage, or advanced AI-powered analytics, which can further increase the total cost of ownership over time. These subscription models, while providing continuous service and feature updates, can deter some users who prefer a one-time purchase. However, pricing trends in the market show a gradual movement towards more accessible options. As technology matures and production scales, manufacturers are introducing more affordable entry-level models that offer core functionalities like basic GPS tracking or activity monitoring. This democratization of technology is expanding the addressable market to a broader demographic. Additionally, competitive pressures are driving innovation in cost-effective manufacturing and component sourcing. In the long term, a diversified pricing strategy that includes both premium, feature-rich devices and more budget-friendly options, potentially bundled with pet insurance or veterinary services, will be crucial for accelerating widespread adoption and market growth. The perceived value versus cost remains a key purchasing decision factor for most consumers.

What role does Artificial Intelligence (AI) play in the evolution of smart pet wearables?

Artificial Intelligence (AI) is rapidly transforming smart pet wearables from mere data collection tools into intelligent, proactive pet care assistants. Its role is pivotal in enhancing functionality across multiple dimensions. Firstly, AI algorithms enable sophisticated data analysis, converting raw sensor data into meaningful, actionable insights about a pet's health, behavior, and activity patterns. This includes identifying subtle deviations from a pet's baseline, such as changes in gait, sleep duration, or eating habits, which could signal an early onset of illness or stress, allowing for timely veterinary intervention. Secondly, AI facilitates personalized recommendations; by processing data specific to an individual pet's breed, age, weight, and lifestyle, AI can suggest tailored nutrition plans, optimal exercise routines, and even identify training opportunities, moving beyond generic advice to truly customized care. Thirdly, AI significantly improves the accuracy and reliability of features like GPS tracking by filtering out noise and predicting movements, and enhances behavioral analysis by recognizing complex patterns. Furthermore, AI is crucial for optimizing device performance, such as managing battery life more efficiently by learning usage patterns. In the future, AI will drive the integration of wearables with smart home ecosystems, allowing for automated adjustments to a pet's environment, and potentially enable more advanced communication through interpretation of pet vocalizations and body language. This continuous evolution, powered by AI, positions smart pet wearables as indispensable tools for comprehensive, intelligent pet management, fostering healthier lives for pets and deeper understanding for their owners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager