Smart Pill Dispenser Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431538 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Smart Pill Dispenser Market Size

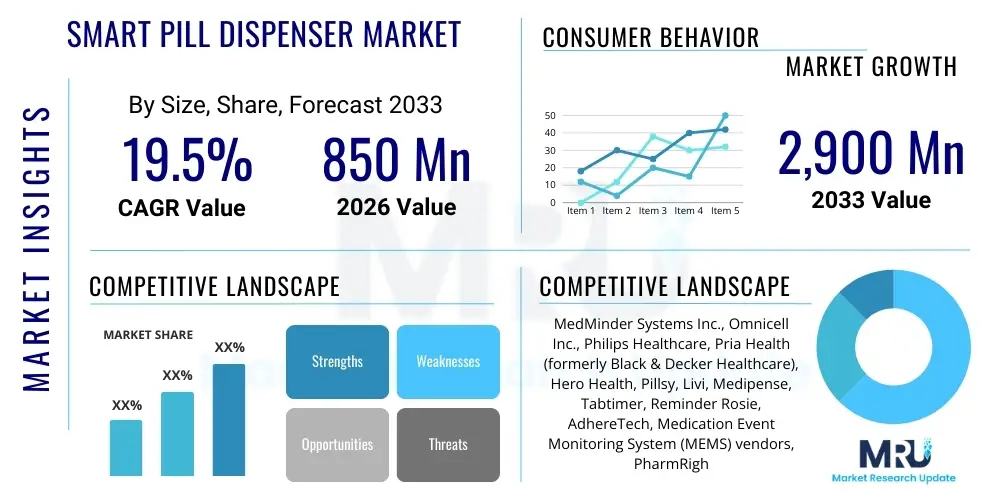

The Smart Pill Dispenser Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 2,900 Million by the end of the forecast period in 2033.

Smart Pill Dispenser Market introduction

The Smart Pill Dispenser Market encompasses automated medication management systems designed to improve patient adherence, especially among the elderly and those managing chronic conditions. These devices utilize integrated technology, such as wireless connectivity (Wi-Fi, Bluetooth), sensors, and software platforms, to schedule, dispense, and monitor medication intake remotely. The primary objective of these systems is to reduce medication errors, ensure timely dosing, and provide caregivers or healthcare professionals with real-time compliance data. Product complexity ranges from simple electronic reminder boxes to sophisticated robotic systems capable of handling multiple prescriptions simultaneously, often integrating with telehealth services for holistic patient care. The evolution of these devices reflects a broader shift towards proactive and personalized healthcare management, moving away from manual administration toward digitally guided therapeutic protocols.

Major applications of smart pill dispensers span home healthcare, assisted living facilities, and clinical trial management where strict adherence protocols are mandatory. The increasing prevalence of complex medication regimens for conditions like diabetes, cardiovascular diseases, and cancer necessitates reliable automated solutions. Key benefits include enhanced patient autonomy, significant reduction in hospital readmission rates due to non-adherence, and improved quality of life for long-term care residents. Driving factors fueling this robust market expansion include the rapidly aging global population requiring constant pharmaceutical supervision, the rising global burden of chronic diseases demanding polypharmacy management, and substantial technological advancements in IoT (Internet of Things) and connectivity infrastructure that enable sophisticated remote monitoring capabilities. Furthermore, growing awareness among consumers and healthcare providers regarding the economic impact of medication non-adherence is incentivizing the adoption of these smart devices as essential tools in preventative care pathways.

Smart Pill Dispenser Market Executive Summary

The Smart Pill Dispenser Market is characterized by vigorous competition and rapid technological innovation, driven fundamentally by demographic shifts and the pressing need for enhanced medication adherence in chronic care management. Business trends show a strong inclination towards subscription-based service models rather than outright hardware purchase, emphasizing integrated software platforms that offer data analytics, telehealth consultations, and interoperability with Electronic Health Records (EHRs). Strategic partnerships between device manufacturers, pharmaceutical companies, and insurance providers are increasingly common, aimed at subsidizing device costs for patients and embedding adherence tracking into value-based care initiatives. The market also observes a trend toward miniaturization, increased battery life, and enhanced user interfaces designed for elderly users, making the technology more accessible and less intrusive in daily life. Furthermore, security and privacy concerns related to sensitive patient data are driving investment in robust encryption and compliance with stringent regulations like HIPAA and GDPR, which is emerging as a critical competitive differentiator.

Regionally, North America maintains the dominant market share, primarily due to high healthcare expenditure, early adoption of advanced medical technologies, and the strong presence of key market players and supportive regulatory frameworks. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare infrastructure, massive geriatric populations in countries like Japan and China, and increasing government investments in digital health initiatives aimed at expanding access to remote patient monitoring tools. Segment trends indicate that the Automatic Dispensing System segment, which offers precise scheduling and automated alerts, holds the largest market share by product type. Meanwhile, the home care setting remains the largest end-user segment, although institutional settings like hospitals and long-term care facilities are accelerating their adoption rates to optimize internal pharmacy workflows and reduce staff burden associated with manual medication administration. Future growth will be significantly shaped by the integration of Artificial Intelligence (AI) for predictive analytics, personalized dosing adjustments, and early intervention based on behavioral patterns.

AI Impact Analysis on Smart Pill Dispenser Market

User queries regarding the impact of Artificial Intelligence (AI) on the Smart Pill Dispenser Market frequently revolve around personalization, predictive capabilities, and data security. Common questions include: "How can AI make pill dispensing smarter than just reminders?" "Will AI be able to detect if I miss a dose before it impacts my health?" and "What are the privacy implications of using AI to analyze my medication adherence data?" The central theme emerging from these inquiries is the expectation that AI should transform dispensing from a simple mechanical task into a highly personalized, proactive, and preventative healthcare intervention. Users anticipate AI models will analyze complex longitudinal data—including adherence history, biometric readings from wearable devices, and EHR information—to optimize dispensing schedules, flag potential adverse drug interactions, and predict future non-adherence risks well before they occur. This shift towards personalized intervention and risk stratification, guided by machine learning algorithms, represents the most significant expected functional evolution of smart pill dispensers.

The integration of AI is set to redefine medication adherence solutions by enabling sophisticated pattern recognition that transcends basic compliance tracking. AI algorithms can process vast datasets generated by connected dispensers to identify subtle behavioral deviations indicative of looming adherence issues, allowing for targeted, timely interventions by caregivers or telehealth providers. Beyond mere data aggregation, AI facilitates prescriptive analytics, suggesting optimized dosing times based on pharmacokinetic profiles and patient lifestyle factors, thereby maximizing therapeutic efficacy. However, the deployment of such powerful data processing necessitates strict governance and adherence to ethical guidelines, addressing user concerns regarding data ownership, algorithmic bias in intervention recommendations, and the secure storage of highly sensitive medical data. Successful AI integration will hinge on developing robust, explainable AI models that build trust and demonstrate tangible improvements in patient outcomes and safety. These models will move the market beyond simple compliance monitoring into the realm of true therapeutic support systems.

- AI-driven Predictive Analytics: Forecasts patient non-adherence risks based on historical data and environmental factors, enabling preemptive caregiver intervention.

- Personalized Dosing and Scheduling: Algorithms adjust reminder times based on patient circadian rhythms and medication pharmacokinetics for optimal efficacy.

- Enhanced Drug Interaction Monitoring: Real-time cross-referencing of dispensed medications against patient EHRs to flag potential harmful interactions.

- Natural Language Processing (NLP) Interfaces: Enables easier setup and troubleshooting for elderly users through voice commands and conversational interfaces.

- Automated Inventory Management: Machine learning optimizes restocking alerts and synchronizes with pharmacy services to prevent medication shortages.

- Behavioral Pattern Recognition: Identifies subtle changes in routine that might indicate declining cognitive function or increased risk of medication misuse.

- Optimized Telehealth Integration: AI prioritizes high-risk patients for remote consultations based on adherence and vital signs data reported by the device.

DRO & Impact Forces Of Smart Pill Dispenser Market

The Smart Pill Dispenser Market is propelled by a confluence of powerful demographic and technological drivers, yet simultaneously constrained by cost barriers and integration complexities, presenting significant opportunities for specialized innovation. The primary driver is the accelerating global aging population, which necessitates reliable, accessible tools for managing increasingly complex medication schedules associated with multiple chronic diseases. This demographic trend, combined with growing investments in digital health infrastructure globally, creates a fertile environment for market expansion. Conversely, major restraints include the high initial cost of sophisticated, robotic dispensing systems, which can limit accessibility, particularly in developing economies or among lower-income patient groups. Furthermore, achieving seamless interoperability between proprietary dispenser platforms and existing diverse Electronic Health Record (EHR) systems remains a significant technical challenge that impedes large-scale clinical adoption. The critical opportunity lies in leveraging advancements in low-cost sensors, standardized communication protocols (like FHIR), and AI to develop highly efficient, cost-effective, and fully integrated solutions that can penetrate emerging markets and be easily adopted within existing clinical workflows.

The impact forces within this market are predominantly structural and highly positive toward growth. The increasing awareness among payers—both government healthcare programs and private insurers—regarding the immense financial burden caused by medication non-adherence serves as a major force compelling reimbursement and subsidization policies for smart dispensing technologies. Non-adherence contributes billions of dollars annually to preventable hospitalizations and emergency room visits, making adherence technologies a critical cost-saving mechanism. Technological advancements, particularly in reliable long-range connectivity (5G, LPWAN), further enhance the market's trajectory by ensuring dependable remote monitoring even in rural or geographically dispersed areas. However, regulatory impact forces related to patient data privacy and medical device certification (FDA Class I/II, CE Mark) exert continuous pressure, requiring manufacturers to invest heavily in security and validation, serving as both a barrier to entry for smaller players and a force for maintaining high standards of quality and safety across the industry. The collective effect of these forces suggests a sustained high growth trajectory, favoring companies capable of navigating regulatory complexities while delivering cost-effective, reliable, and user-centric dispensing solutions.

Segmentation Analysis

The Smart Pill Dispenser Market segmentation provides a detailed framework for understanding the diverse product offerings, technological configurations, and end-user applications driving market dynamics. The market is primarily segmented based on product type, which distinguishes between Automated Dispensing Systems (more complex, multi-drug capable) and Blister Pack Systems (simpler, pre-filled compliance). Further segmentation by technology type differentiates connectivity methods (Wi-Fi, Bluetooth, Cellular), reflecting varying levels of sophistication in remote monitoring and data transmission capabilities. The primary application and end-user segments—Home Care Settings, Long-Term Care Facilities, and Hospitals—highlight the versatile deployment environments and specialized needs within each setting. This granular analysis is crucial for stakeholders to tailor their product development and market strategies to address specific functional requirements, such as high-volume dispensing needed in hospitals versus user-friendliness and simplicity paramount in home care environments, ensuring maximum clinical relevance and commercial success across the value chain.

- By Product Type:

- Automated Dispensing Systems

- Blister Pack Dispensing Systems

- Pill Organizer Systems (with advanced electronic features)

- By Technology:

- Wireless (Wi-Fi, Bluetooth)

- Cellular Network

- Telephony

- By End User:

- Home Healthcare

- Hospitals and Clinics

- Long-Term Care Facilities (LTCFs)

- By Application:

- Elderly Patients

- Chronic Disease Management

- Clinical Trials

Value Chain Analysis For Smart Pill Dispenser Market

The value chain for the Smart Pill Dispenser Market is complex, spanning from upstream component manufacturing to downstream patient service delivery, necessitating close collaboration among diverse entities. Upstream analysis involves the procurement and assembly of core technological components, including specialized microprocessors, communication modules (IoT chips), sensors, and precision mechanical parts necessary for accurate dispensing. Key players at this stage include specialized electronics manufacturers and software developers who provide the operating systems and adherence algorithms embedded within the devices. Quality control and supply chain robustness are paramount here, ensuring the reliability and safety of the final medical device. Successful upstream management relies on securing stable supplies of high-quality, cost-effective components compliant with stringent medical standards, often requiring custom manufacturing and rigorous testing protocols before integration.

Downstream analysis focuses on distribution, sales, and end-user service provision. Distribution channels are varied, incorporating direct sales to large institutional buyers (hospitals, LTCFs), indirect sales through medical equipment distributors and pharmacies, and increasingly, direct-to-consumer models facilitated by e-commerce and subscription services. The direct channel allows manufacturers greater control over installation and service but requires significant investment in sales infrastructure. The indirect channel offers wider market reach through established networks. Crucially, the final step involves patient training, ongoing technical support, and the provision of data services (cloud platforms, adherence analytics reports) to caregivers and clinicians. The efficiency of this downstream segment is highly dependent on effective patient education and reliable connectivity, ensuring that the smart features of the dispenser translate into measurable clinical outcomes, thus maximizing the perceived value of the product to the end-user and the prescribing clinician.

Smart Pill Dispenser Market Potential Customers

The primary customer base for Smart Pill Dispensers is multifaceted, centering on individuals who require rigorous medication management and the institutional providers responsible for their care. End-users or buyers fall into three main categories: elderly individuals managing polypharmacy independently in their homes, professional caregivers (family members or hired nurses) seeking tools to monitor adherence remotely, and institutional administrators looking to enhance medication security and staff efficiency. For the elderly patient segment, the need for simplicity and reliable reminders drives purchase decisions. Caregivers prioritize remote monitoring capabilities and reliable alert systems that mitigate the risks associated with missed doses, viewing the devices as essential peace-of-mind technologies that support independent living.

Institutional customers, including hospitals, clinics, and long-term care facilities, are major bulk buyers motivated by operational efficiency, regulatory compliance, and patient safety metrics. Hospitals utilize these systems, particularly in discharge planning, to ensure continuity of care when patients transition home, reducing readmission risks associated with poor medication adherence post-discharge. Long-term care facilities integrate automated dispensing to reduce labor costs associated with manual pill sorting and administration, simultaneously minimizing medication errors, a critical compliance and safety issue in these settings. Specialized customers also include pharmaceutical companies and Contract Research Organizations (CROs) utilizing smart dispensers in clinical trials where precise dose tracking and adherence validation are non-negotiable requirements for data integrity, making them crucial niche buyers focused on advanced technological features and robust data output.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 2,900 Million |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MedMinder Systems Inc., Omnicell Inc., Philips Healthcare, Pria Health (formerly Black & Decker Healthcare), Hero Health, Pillsy, Livi, Medipense, Tabtimer, Reminder Rosie, AdhereTech, Medication Event Monitoring System (MEMS) vendors, PharmRight Corporation, MedMee, Vaica Medical, SyncRx, Tricella, Carefusion (Becton, Dickinson and Company), Cardinal Health, ResMed (through connected health initiatives). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Pill Dispenser Market Key Technology Landscape

The technological landscape of the Smart Pill Dispenser Market is rapidly advancing, fundamentally leveraging the convergence of Internet of Things (IoT) platforms, advanced sensor technology, and cloud-based data analytics. Central to these devices is the integration of wireless connectivity protocols—primarily Wi-Fi and cellular (3G/4G/5G)—which facilitate seamless, real-time communication between the dispenser and remote monitoring platforms used by caregivers or healthcare providers. Precision dispensing mechanisms rely on sophisticated electromechanical systems and optical sensors to ensure accurate dose verification and prevent accidental overdosing or underdosing. The software component, often managed via a secure cloud infrastructure compliant with global health data standards, is equally crucial, handling scheduling, alert generation, remote programming, and secure data logging, transforming the hardware into a proactive health management tool.

Further innovation is concentrated on enhancing user experience and data utility. Advanced user interfaces, including high-resolution touchscreens and integrated voice assistants, are becoming standard, improving accessibility for users with limited dexterity or vision impairment. Battery life and energy efficiency are critical technological considerations, ensuring device function during power outages or for mobile users, often leveraging low-power wide-area network (LPWAN) technologies where cellular coverage is challenging. Emerging technologies include the incorporation of biometric authentication (e.g., fingerprint scanning) to ensure the medication is dispensed only to the correct individual, addressing critical security concerns in shared living environments. The future technology focus is strongly aligned with integrating predictive analytics through embedded AI and machine learning, allowing dispensers to evolve from passive notification systems into personalized, adaptive therapeutic assistants that optimize adherence based on environmental and physiological factors.

Regional Highlights

North America currently dominates the Smart Pill Dispenser Market, accounting for the largest revenue share, a position attributed to several structural advantages. The region benefits from high per-capita healthcare spending, resulting in greater acceptance and affordability of high-cost automated healthcare devices. The substantial prevalence of chronic diseases and the mature ecosystem of health insurance providers who increasingly incentivize adherence technologies drive market penetration. Furthermore, supportive regulatory policies from entities like the FDA facilitate faster market entry for innovative devices, while the early and widespread adoption of IoT and robust broadband connectivity ensures reliable performance of remote monitoring features. The strong presence of major technology and healthcare companies focused on digital health solutions solidifies North America’s leadership, making it a critical hub for product development and market maturity.

Europe represents the second-largest market, characterized by varying degrees of adoption shaped by national healthcare systems and reimbursement policies. Countries like Germany, the UK, and Scandinavia show high penetration rates, spurred by government initiatives promoting elderly care independence and digitalization of healthcare services. The market growth in Europe is steady, driven by strict adherence to GDPR regulations, which mandates secure data handling, thereby favoring manufacturers who prioritize data privacy and robust security features in their platforms. The diverse linguistic and regulatory landscape across the continent, however, necessitates country-specific strategies, impacting the standardization of product features and marketing campaigns across the European Union.

Asia Pacific (APAC) is projected to be the fastest-growing regional market throughout the forecast period. This rapid expansion is fundamentally driven by the enormous and rapidly expanding geriatric population, particularly in China, Japan, and South Korea, coupled with significant unmet needs for managing chronic conditions. While the initial device costs remain a barrier in certain lower-income segments, increasing government investment in public health infrastructure and telemedicine projects is rapidly improving accessibility. Local manufacturers are increasingly entering the market, often offering more cost-competitive, region-specific devices. The growing affluence and digitalization across urban centers in India and Southeast Asia are also contributing factors, leading to a strong demand surge for smart, connected healthcare devices that facilitate remote family caregiving.

- North America: Market dominance due to high healthcare expenditure, mature digital health infrastructure, high chronic disease prevalence, and favorable regulatory environment for medical technology.

- Europe: Strong growth driven by government-led initiatives for aging populations, established telehealth services, and adherence to strict data privacy standards (GDPR).

- Asia Pacific (APAC): Expected fastest growth fueled by rapid demographic aging, increasing disposable income, government investment in digital health, and rising adoption of mobile health technologies.

- Latin America and Middle East & Africa (MEA): Emerging markets characterized by infrastructural challenges but significant long-term potential driven by urbanization and improvements in local healthcare investment and infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Pill Dispenser Market.- MedMinder Systems Inc.

- Omnicell Inc.

- Koninklijke Philips N.V. (Philips Healthcare)

- Hero Health

- Pria Health (formerly Black & Decker Healthcare)

- AdhereTech

- Pillsy

- Livi

- Medipense

- Tabtimer

- PharmRight Corporation

- MedMee

- Vaica Medical

- SyncRx

- Tricella

- ResMed (Connected Health)

- Cardinal Health

- Becton, Dickinson and Company (BD)

- e-pill, LLC

- InstyMeds (now part of Omnicell)

Frequently Asked Questions

Analyze common user questions about the Smart Pill Dispenser market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using a smart pill dispenser over traditional pill boxes?

Smart pill dispensers offer significant advantages over traditional systems by providing automated, real-time medication management. Key benefits include precise scheduling and electronic reminders (visual, auditory, mobile alerts), remote monitoring capabilities for caregivers or clinicians, and data logging to track adherence patterns accurately. This automation drastically reduces human error, provides crucial feedback loops to the healthcare system, and substantially improves therapeutic outcomes, particularly for complex, multi-drug regimens.

How do Smart Pill Dispensers ensure patient data privacy and security?

Data privacy and security are paramount in the Smart Pill Dispenser Market. Leading manufacturers ensure compliance with international regulations such as HIPAA (in the US) and GDPR (in Europe) by implementing robust encryption protocols, secure cloud storage, and stringent access controls. Communication between the dispenser and the monitoring platform is typically encrypted end-to-end. Furthermore, device software is regularly updated to patch vulnerabilities, ensuring that sensitive patient adherence data and personal health information remain protected and accessible only to authorized individuals.

Is the Smart Pill Dispenser Market segmented by medication complexity or condition type?

Yes, the market is segmented by application, focusing heavily on Chronic Disease Management and Elderly Care, reflecting the core demand drivers. Devices range in complexity; some cater to simple once-daily regimens, while Automated Dispensing Systems (a segment by product type) handle multiple complex prescriptions, addressing the polypharmacy requirements typical of chronic conditions like cardiovascular disease, diabetes, and neurological disorders. Clinical trials also form a specialized application segment requiring devices capable of high-fidelity, auditable adherence tracking.

What role does IoT technology play in enhancing the functionality of these devices?

Internet of Things (IoT) technology is foundational to the functionality of smart pill dispensers. IoT sensors enable the device to detect when medication is successfully removed or missed, and wireless connectivity (Wi-Fi, cellular) allows this information to be transmitted instantly to cloud servers. This real-time data exchange facilitates essential features such as remote device programming, instant alert notifications to designated caregivers, and integration with broader telehealth and EHR systems, transforming the dispenser into a node within a connected healthcare ecosystem.

What is the key difference between Automated Dispensing Systems and Blister Pack Systems in the market?

Automated Dispensing Systems are typically designed to hold bulk quantities of multiple prescription medications, sorting and dispensing the exact required dose on schedule through mechanical means, often programmed remotely. Conversely, Blister Pack Systems utilize pre-packaged, pre-sorted medication cards (often prepared by a pharmacy), acting primarily as an electronic locker that unlocks or alerts the user when it is time to access a specific, already prepared dose. Automated systems offer higher flexibility and volume capacity, while blister pack systems simplify the reloading process for the end-user.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager