Smart PV Array Combiner Box Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436271 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Smart PV Array Combiner Box Market Size

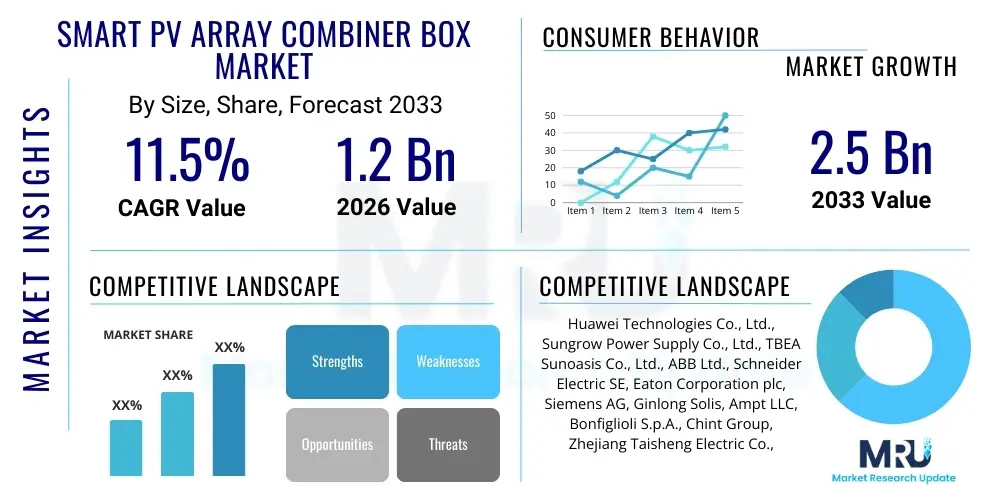

The Smart PV Array Combiner Box Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Smart PV Array Combiner Box Market introduction

The Smart PV Array Combiner Box market encompasses advanced electrical safety and monitoring devices essential for photovoltaic (PV) systems, particularly large-scale utility and commercial installations. These devices aggregate the output from multiple solar strings, integrating critical features like current monitoring, remote disconnect capabilities, surge protection, and fault detection, transforming the traditional combiner function into an intelligent data collection and management hub. This evolution is driven by the necessity for enhanced system efficiency, proactive maintenance scheduling, and improved safety compliance across geographically dispersed solar assets. The transition from basic junction boxes to smart solutions is foundational to maximizing the Levelized Cost of Energy (LCOE) for solar farm operators by minimizing downtime and optimizing yield, cementing their role as indispensable components in modern solar infrastructure development globally.

Product description highlights the technological integration of sensors, communication modules (such as RS485 or Ethernet), and microprocessors within a robust, weather-resistant enclosure. Unlike conventional combiner boxes which only perform passive current summation and protection, smart versions actively measure string current, voltage, and temperature, enabling real-time performance diagnostics. Major applications span utility-scale PV plants, commercial rooftop installations, and specialized industrial solar projects, where the sheer number of strings necessitates centralized, automated performance tracking. The primary benefit derived is the granular insight into system performance, allowing operators to rapidly identify and isolate underperforming strings due to shading, module degradation, or component failure, thereby sustaining optimal operational capacity.

Driving factors for market expansion include stringent regulatory mandates regarding PV system safety and interconnection standards, coupled with the global push for renewable energy capacity expansion. Furthermore, the declining cost of solar panels and the increasing complexity of large-scale solar farms necessitate sophisticated monitoring tools to manage operational risks effectively. The inherent advantage of reduced operational expenditures (OpEx) through predictive maintenance—enabled by the smart functionalities—provides a compelling business case for investors and developers, accelerating the adoption rate across mature and emerging solar markets alike. This technological convergence ensures that smart combiner boxes are not merely accessories but integral smart grid endpoints facilitating reliable and efficient renewable energy generation.

Smart PV Array Combiner Box Market Executive Summary

The Smart PV Array Combiner Box market is experiencing robust growth fueled by large-scale solar pipeline expansion, significant advancements in IoT and edge computing capabilities, and increasing sophistication in photovoltaic system management requirements. Key business trends indicate a strong move toward integrated solutions, where combiner boxes function as crucial data gateways, seamlessly communicating with SCADA systems and cloud-based monitoring platforms, driving partnerships between traditional electrical component manufacturers and software analytics providers. Regional trends show rapid adoption in Asia Pacific, particularly China and India, driven by ambitious national renewable energy targets and massive utility-scale project deployment, while Europe and North America prioritize high-reliability, sophisticated monitoring systems mandated by strict grid codes. Segment trends reflect increasing demand for high-voltage DC combiner boxes compatible with 1500V systems, optimizing system costs and increasing power density, alongside a growing preference for component redundancy and advanced fault detection algorithms utilizing machine learning for enhanced system resilience across all operational environments.

AI Impact Analysis on Smart PV Array Combiner Box Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) enhance the functionality and value proposition of Smart PV Array Combiner Boxes, specifically focusing on predictive maintenance accuracy, fault identification speed, and overall system optimization. Key concerns revolve around the data infrastructure required to support ML models, the cybersecurity implications of connecting smart devices to central AI platforms, and the tangible return on investment derived from implementing AI-driven monitoring. Expectations center on achieving zero-touch operations, where AI models autonomously identify anomalies, diagnose the root cause (e.g., potential induced degradation, snail trails, or hot spots), and prioritize maintenance tasks based on severity and economic impact. This shift transforms the combiner box from a passive data collector into an active, intelligent edge device capable of preprocessing data and executing local optimization commands, thereby minimizing latency and reducing reliance on continuous, high-bandwidth cloud communication for basic diagnostics, fundamentally improving the operational efficiency of solar assets.

- AI enables highly accurate predictive maintenance by analyzing historical string performance data against environmental variables (irradiance, temperature).

- Machine Learning algorithms enhance fault classification, distinguishing between temporary shading issues and permanent component failures (e.g., diode failures or faulty connections).

- Optimization of energy harvesting through AI-driven dynamic re-stringing or reconfiguration recommendations based on real-time irradiance patterns.

- Improved cybersecurity posture via AI-based anomaly detection, identifying unusual communication patterns indicative of a cyber threat or unauthorized access attempts.

- Reduction in false alarm rates compared to rule-based monitoring systems, leading to lower OpEx and more efficient deployment of field service personnel.

- Integration of deep learning for sensor data fusion, enhancing the reliability of measurements under diverse and challenging climatic conditions.

DRO & Impact Forces Of Smart PV Array Combiner Box Market

The market dynamics for Smart PV Array Combiner Boxes are characterized by powerful systemic drivers, necessary technological restraints, and significant opportunities arising from emerging market demands and technological convergence. Key drivers include the global mandate for decarbonization, leading to massive investments in large-scale solar projects, which inherently require sophisticated monitoring to manage scale and complexity, alongside regulatory pressures enforcing greater electrical safety standards, such as arc fault detection and rapid shutdown capabilities. Restraints primarily involve the higher initial capital expenditure required for smart components compared to basic combiner boxes, creating a cost sensitivity, particularly in nascent markets, and challenges related to interoperability across diverse monitoring platforms and sensor standards, requiring ongoing integration efforts from developers. Opportunities are abundant, centered on the expansion of 1500V DC systems, the integration of advanced energy storage systems (BESS) requiring specialized DC collection points, and the potential for offering value-added services like granular degradation modeling and performance forecasting based on the rich data collected by these smart devices, fundamentally shifting the market value proposition toward data intelligence.

Impact forces are heavily skewed toward technological advancement and regulatory support. Technological improvements, particularly in sensor accuracy, miniaturization of monitoring circuitry, and advancements in wireless communication protocols (like LoRaWAN for remote sites), continually push the feasibility and attractiveness of smart solutions. Regulatory impact, particularly in established markets like Germany and the US, mandates specific levels of fault detection and grid interaction capabilities, making basic combiner boxes obsolete for new utility-scale projects. Furthermore, the competitive landscape necessitates continuous product differentiation, forcing manufacturers to integrate more sophisticated features, such as remote diagnostics and firmware updates over the air, as standard offerings, increasing the overall technological bar for market entry and sustained relevance.

The increasing standardization of components, while initially a restraint due to component commoditization risk, is also becoming a driver, ensuring greater reliability and supply chain stability, which is critical for large, multi-gigawatt procurement tenders. The shift towards higher voltage architectures (1500V) significantly impacts the design requirements of these boxes, demanding higher rated components and enhanced thermal management, indirectly driving the necessity for embedded smart monitoring to ensure system integrity at these elevated operational parameters. The confluence of these forces ensures that the market trajectory remains highly positive, with intelligence and resilience becoming non-negotiable attributes for modern PV array collection infrastructure.

Segmentation Analysis

The Smart PV Array Combiner Box market is segmented based on critical technical specifications including the type of PV architecture supported, the specific components integrated for intelligence, and the end-user application scope, reflecting the diverse requirements across the solar industry ecosystem. This segmentation provides a granular view of market demand drivers, showing distinct preferences based on project size, system voltage, and geographical location. For instance, Utility-Scale applications overwhelmingly demand high-capacity, 1500V compatible combiners with extensive remote monitoring features, driving volume growth, whereas Commercial applications may prioritize ease of installation and integration with existing building management systems. Analyzing these segments is crucial for manufacturers to tailor product development, focus sales efforts, and optimize supply chain logistics to meet the specific technical and economic demands of different buyer groups.

The segmentation by product type typically differentiates between centralized and string inverter topologies, influencing the combiner box's current aggregation capacity and monitoring complexity. Centralized systems often utilize larger, fewer combiner boxes, focusing on robust protection and higher amperage handling. Conversely, string inverter architectures require a greater number of smaller, distributed smart combiner boxes, emphasizing individual string monitoring capabilities to feed data back to the distributed inverters, highlighting the interconnected nature of the PV system component selection. Component segmentation further allows for differentiation based on the level of intelligence integrated, ranging from basic current sensors and fuses to highly sophisticated modules incorporating arc fault circuit interruption (AFCI), communication gateways, and proprietary predictive analytics software, offering tiered solutions to customers based on budget and required reliability level.

Understanding the interplay between these segmentation layers is key to strategic market positioning. The fastest-growing segment, Application, emphasizes the dominance of utility-scale deployments globally, driven by government renewable portfolio standards. However, the commercial and industrial (C&I) segment is also gaining traction, particularly in regions with high electricity costs and favorable net metering policies, demanding highly resilient and smart solutions for complex rooftop installations. This detailed analysis supports accurate forecasting and allows stakeholders to invest strategically in R&D focusing on high-growth product categories, such as components optimized for demanding 1500V DC environments, ensuring compliance with evolving international electrical standards.

- By Type (Inverter Topology):

- For Centralized Inverters

- For String Inverters

- By Component:

- Fuses and Circuit Breakers (Protection)

- Monitoring and Communication Modules (Sensors, Data Loggers)

- Surge Protection Devices (SPDs)

- DC Disconnect Switches

- By Voltage Rating:

- 1000V DC Systems

- 1500V DC Systems

- By Application:

- Utility-Scale PV Power Plants

- Commercial and Industrial (C&I) Rooftops

- Residential Systems (Limited Use)

Value Chain Analysis For Smart PV Array Combiner Box Market

The value chain for the Smart PV Array Combiner Box market begins with upstream material suppliers, including manufacturers of high-grade enclosures (PC, ABS, or metallic alloys), electrical protection components (fuses, SPDs, DC circuit breakers), and, most critically, semiconductor suppliers providing the microprocessors, communication chips, and high-accuracy current sensors necessary for the ‘smart’ functionality. This upstream segment is characterized by stringent quality control requirements, as component reliability directly impacts the long-term operational integrity of the PV array. Manufacturers often rely on established global suppliers for specialized electronic components, though enclosure manufacturing may be localized to reduce logistics costs, emphasizing the critical importance of ensuring supply chain resilience, especially for microcontrollers which have faced global shortages in recent years, impacting production lead times and final product cost structures.

Midstream activities involve the core manufacturing and integration process, where the electronic components are assembled into the combiner box housing, rigorous quality testing, calibration of sensors, and the loading of proprietary firmware and communication protocols take place. Key players in this segment differentiate themselves not only through component quality but also through the sophistication of their software analytics capabilities, user interfaces, and ease of integration with third-party monitoring platforms (SCADA, DAS). Distribution channels are predominantly indirect, leveraging specialized solar distributors, electrical wholesalers, and engineering, procurement, and construction (EPC) firms who manage large-scale solar project deployment. Direct sales often occur for major utility-scale projects where manufacturers bid directly to project developers or independent power producers (IPPs), requiring specialized technical support and customization capabilities.

The downstream segment is defined by installation, commissioning, operation, and maintenance (O&M) services. EPC contractors integrate the combiner boxes into the PV array, performing initial wiring and testing. The long-term value in the downstream relies heavily on the intelligent data provided by the smart combiner box, enabling O&M providers to perform efficient fault isolation and predictive maintenance. This data loop closes the value chain, as performance feedback informs future product design, driving innovation in sensor technology and algorithm refinement. The increasing adoption of digital twin technology in O&M services is further increasing the value derived from the granular, real-time data outputted by these smart devices, creating a synergistic relationship between hardware providers and data analytics platforms throughout the operational lifecycle of the solar asset.

Smart PV Array Combiner Box Market Potential Customers

The primary end-users and buyers of Smart PV Array Combiner Boxes are highly sophisticated entities involved in the development and operation of large-scale renewable energy infrastructure, where system efficiency and guaranteed uptime are paramount financial considerations. Independent Power Producers (IPPs) and large utility companies constitute the largest customer segment, as they manage multi-megawatt to gigawatt-scale solar farms and require robust, centralized monitoring systems to manage thousands of PV strings efficiently across vast geographical areas. For these customers, the smart combiner box is a critical investment in asset protection and performance assurance, justifying the higher upfront cost through proven reductions in operational expenditures (OpEx) related to fault finding and maintenance over the 20-25 year lifespan of the asset, demanding high mean time between failures (MTBF) and comprehensive warranty support from manufacturers.

Engineering, Procurement, and Construction (EPC) firms represent a major indirect influence and direct purchasing segment. EPCs often specify the equipment during the project development phase, selecting smart combiner boxes based on cost, ease of installation, compliance with local grid codes, and the reputation for reliability. Their purchasing decisions are heavily influenced by minimizing installation complexity and ensuring rapid, trouble-free commissioning, often preferring manufacturers who offer pre-wired solutions and standardized communication protocols that integrate easily with the chosen inverter and SCADA systems. The C&I sector, including large corporations investing in captive solar power or energy management solutions for industrial facilities, represents a growing customer base, focused on minimizing energy costs and enhancing energy independence, where space constraints and rapid fault isolation are key purchase criteria.

Furthermore, specialized Operation and Maintenance (O&M) service providers increasingly exert influence, often recommending upgrades or replacements to smart combiner boxes in existing solar assets (retrofit market) to improve monitoring capabilities and extend asset life. These O&M firms view the detailed, actionable data provided by smart combiners—such as individual string current and voltage readings—as essential tools for optimizing their service delivery contracts and achieving guaranteed performance metrics for their clients. Consequently, manufacturers strategically target all three major customer groups—IPPs/Utilities, EPCs, and O&M providers—by offering products that balance cutting-edge technology, compliance, reliability, and cost-effectiveness across the entire project lifecycle, ensuring widespread market penetration and sustained demand growth across utility and distributed generation landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huawei Technologies Co., Ltd., Sungrow Power Supply Co., Ltd., TBEA Sunoasis Co., Ltd., ABB Ltd., Schneider Electric SE, Eaton Corporation plc, Siemens AG, Ginlong Solis, Ampt LLC, Bonfiglioli S.p.A., Chint Group, Zhejiang Taisheng Electric Co., Ltd., Generac Power Systems, Inc., SolarEdge Technologies, Inc., Fimer S.p.A., Enphase Energy, Inc., Delta Electronics, Inc., Vertiv Holdings Co, Alencon Systems LLC, Santak Power Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart PV Array Combiner Box Market Key Technology Landscape

The Smart PV Array Combiner Box market is defined by several converging technologies focused on enhancing data acquisition, protection, and communication within the harsh DC environment of a solar farm. A key technological focus is the development of highly accurate Hall-effect current sensors and shunts, optimized for the rapid and reliable measurement of individual string currents, which are essential inputs for fault detection algorithms. Coupled with these sensors are low-power microcontrollers (MCUs) that perform edge computing—processing raw data locally before transmitting aggregated statistics. This reduces the burden on centralized monitoring infrastructure and ensures quicker response times for critical events like arc faults. Furthermore, the integration of robust, industrial-grade communication modules (e.g., Modbus over RS485 or wireless standards like LoRaWAN, Cellular IoT) is paramount for ensuring reliable data transmission from remote and often geographically challenging locations back to the central SCADA system or cloud platform.

A second critical area of technology involves advanced safety and protection mechanisms. The incorporation of Arc Fault Circuit Interrupters (AFCI) compliant with standards like NEC 2020 has become mandatory in many markets. Smart combiner boxes utilize sophisticated signal processing techniques to distinguish between benign electrical noise and genuine, high-risk arc faults, enabling rapid shutdown sequences at the string level, dramatically enhancing system safety. Moreover, the shift toward 1500V DC systems necessitates advancements in surge protection devices (SPDs) and high-voltage DC components, requiring materials science innovation to manage increased thermal loads and maintain dielectric integrity over the long term. These components must be housed in highly durable, UV-resistant, and flame-retardant enclosures, often requiring specialized coatings and passive cooling solutions to ensure optimal performance in extreme temperature variations commonly encountered in utility-scale projects.

Finally, the technological landscape is increasingly shaped by software integration and platform interoperability. Leading manufacturers are focusing on creating open APIs and standardized data formats (such as SunSpec Modbus) to ensure seamless integration with various monitoring software platforms and Energy Management Systems (EMS). The future relies on embedding greater intelligence, moving beyond simple data logging to incorporating onboard diagnostics and machine learning capabilities that facilitate true predictive maintenance. This includes the implementation of robust, secure firmware update mechanisms (FOTA - Firmware Over The Air) to enable continuous enhancement of monitoring features and security patches throughout the life of the asset, solidifying the smart combiner box's role as a resilient, future-proof component within the evolving smart grid infrastructure.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Trajectory:

The Asia Pacific region, led by China and India, represents the largest and fastest-growing market for Smart PV Array Combiner Boxes, driven primarily by ambitious national solar capacity targets and supportive government policies such as feed-in tariffs and renewable portfolio standards. China, being the world's largest manufacturer and deployer of solar PV capacity, dictates global demand and pricing trends. The market in APAC is characterized by massive utility-scale project deployment, especially for 1500V systems, demanding high-density and highly reliable combiner boxes to optimize land use and reduce balance-of-system (BOS) costs. This region places a high emphasis on cost-effectiveness combined with basic smart monitoring features, though increasingly sophisticated projects are demanding predictive analytics capabilities.

Beyond China, emerging economies like India, Vietnam, and Australia are rapidly expanding their solar infrastructure, particularly in the utility and large commercial sectors. The intense environmental conditions in many parts of APAC, including high heat and humidity, mandate robust enclosure designs and enhanced thermal management features within the combiner boxes, pushing regional manufacturers to innovate in component selection and durability. The regulatory environment in these countries is quickly maturing, often adopting international safety standards, which further compels developers to integrate smart solutions capable of complying with modern grid codes and stringent fault detection requirements, cementing APAC’s role as the primary engine of global market growth.

- North America (NA) Focus on Safety and Advanced Monitoring:

The North American market, comprising the United States and Canada, is highly regulated, placing significant emphasis on safety features, particularly in residential and commercial installations mandated by the National Electrical Code (NEC). The requirement for arc-fault circuit interruption (AFCI) and rapid shutdown capabilities directly drives the adoption of advanced, smart combiner boxes that integrate these complex protective functions. While NA’s total installed capacity might be lower than APAC, the market commands a premium due to the high regulatory compliance costs and the demand for sophisticated, high-quality monitoring systems that integrate seamlessly with sophisticated asset management software platforms.

Utility-scale projects in the US are increasingly adopting 1500V architecture to maximize efficiency, fueling demand for high-voltage smart combiners with built-in predictive diagnostics to minimize operational risk and maximize financial returns. Furthermore, the rising complexity of grid interconnection and the increasing deployment of solar-plus-storage projects (BESS) require combiners capable of managing bi-directional power flow and integrating closely with DC-coupled battery systems, positioning North America as a leading market for technological innovation and high-value, feature-rich products tailored for high-reliability applications and complex grid environments.

- Europe’s Emphasis on Reliability and Grid Integration:

The European market is mature and characterized by a strong focus on maximizing the performance and longevity of solar assets, often operating under stringent environmental standards and complex national grid codes. Smart PV Array Combiner Boxes in Europe must offer superior data granularity and communication reliability to support advanced grid stability services and performance optimization schemes common in countries like Germany and the UK. The market exhibits a preference for high-quality components and comprehensive manufacturer support, reflecting a focus on lifetime LCOE optimization rather than just initial capital cost reduction.

While utility-scale growth continues, the distributed generation segment (C&I and large residential) remains robust in Europe, driving demand for flexible, modular smart combiners that can adapt to diverse installation types and spatial constraints. European regulations frequently dictate sophisticated anti-islanding and fault isolation mechanisms, accelerating the adoption of embedded intelligence within the combiner box itself. The emphasis on sustainability and digitalization also promotes the use of combiners that integrate seamlessly into broader digital energy platforms, contributing valuable data insights to aid in managing the transition to a decentralized energy system across the continent.

- Latin America (LATAM) Emerging Utility-Scale Demand:

The Latin American market, particularly countries such as Brazil, Mexico, and Chile, is experiencing significant growth in the utility-scale segment, driven by excellent solar resources and competitive renewable energy auctions. This region is a major consumer of standard and smart PV combiner boxes, with purchasing decisions heavily influenced by competitive pricing and proven product reliability in hot, sometimes remote, environments. Demand is strongly linked to the execution of large-scale infrastructure projects, where bulk procurement of 1500V systems dictates product specifications.

The primary driver for smart adoption in LATAM is the necessity for remote monitoring and diagnostics due to the vast distances and often challenging logistics involved in accessing solar sites. Smart features minimize site visits and allow operators to manage performance and troubleshoot issues remotely, a critical factor for maintaining operational continuity across scattered assets. As the region's solar market matures, there is a gradual shift towards more sophisticated monitoring required to comply with evolving local regulatory requirements for grid connection and power quality, increasing the adoption rate of combiner boxes with advanced communication capabilities.

- Middle East and Africa (MEA) Large Project Deployment and Extreme Conditions:

The MEA region is characterized by exceptionally high solar irradiance and the development of some of the world's largest, most ambitious solar projects, notably in the UAE and Saudi Arabia. Market demand is almost exclusively focused on utility-scale applications, demanding 1500V smart combiner boxes built to withstand extreme desert conditions, including high temperatures, dust ingress, and potential sand abrasion. Product reliability under these harsh operating parameters is the paramount selection criterion, leading to a demand for highly durable enclosures and superior thermal management solutions.

Smart functionalities are crucial in MEA for optimizing performance under thermal stress and minimizing water usage for panel cleaning, often integrating with automated washing systems. As these nations invest heavily in diversifying their energy mix, the sheer scale of the projects necessitates robust, intelligent monitoring to manage asset complexity and ensure system security against both physical and cyber threats. South Africa is also a notable regional market, prioritizing grid stability and system protection due to historical grid constraints, ensuring consistent, high demand for smart PV components with advanced fault detection features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart PV Array Combiner Box Market.- Huawei Technologies Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- TBEA Sunoasis Co., Ltd.

- ABB Ltd.

- Schneider Electric SE

- Eaton Corporation plc

- Siemens AG

- Ginlong Solis (Jiangsu Ginlong Technologies Co., Ltd.)

- Ampt LLC

- Bonfiglioli S.p.A.

- Chint Group (Zhejiang Chint Electric Co., Ltd.)

- Zhejiang Taisheng Electric Co., Ltd.

- Generac Power Systems, Inc.

- SolarEdge Technologies, Inc.

- Fimer S.p.A.

- Enphase Energy, Inc.

- Delta Electronics, Inc.

- Vertiv Holdings Co

- Alencon Systems LLC

- Santak Power Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Smart PV Array Combiner Box market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Smart PV Combiner Box and a standard one?

A Smart PV Combiner Box integrates advanced electronics, sensors, and communication modules to provide real-time, individual string monitoring, fault detection (like arc faults), and remote management capabilities, whereas a standard box only provides passive current aggregation and basic electrical protection (fuses/SPDs).

How do Smart Combiner Boxes contribute to reducing the Levelized Cost of Energy (LCOE)?

By enabling highly efficient predictive maintenance and rapid fault isolation, smart combiners minimize system downtime and maximize energy yield, significantly improving the overall performance and reliability of the PV asset, thereby lowering the LCOE over the project's operational lifespan.

What voltage rating systems are driving current market demand?

The market is rapidly shifting toward 1500V DC systems, particularly for utility-scale projects, as higher voltages reduce current losses, optimize cable costs, and increase power density, necessitating the use of specialized 1500V rated Smart PV Combiner Boxes.

What are the critical AI-enabled features being integrated into these smart devices?

AI features include predictive analytics for component failure, high-precision anomaly detection for complex string faults, and optimization algorithms that analyze environmental data to enhance energy harvesting efficiency, turning raw sensor data into actionable maintenance intelligence.

Which geographical region is expected to lead the market growth during the forecast period?

The Asia Pacific (APAC) region, driven primarily by China and India's massive utility-scale deployment programs and supportive regulatory environments, is projected to remain the dominant and fastest-growing market for Smart PV Array Combiner Boxes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager