Smart Retail System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434021 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Smart Retail System Market Size

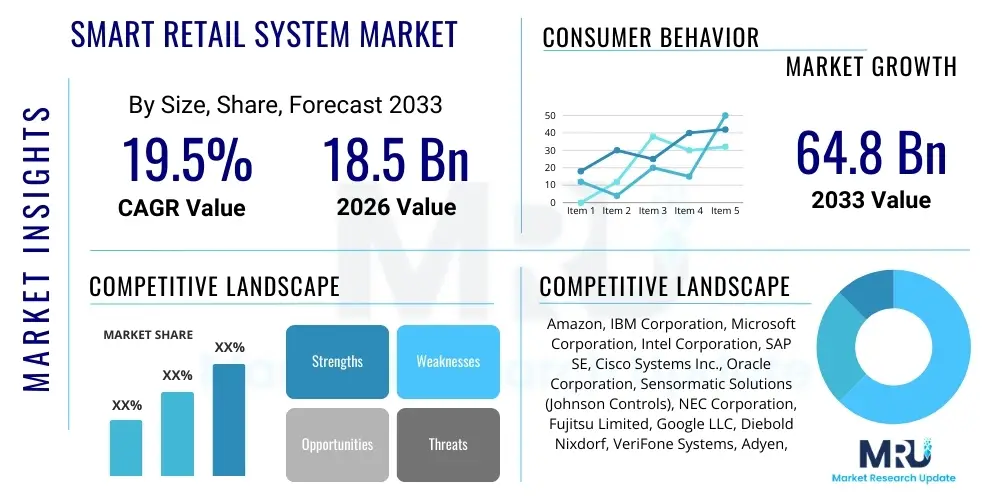

The Smart Retail System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 64.8 Billion by the end of the forecast period in 2033.

Smart Retail System Market introduction

The Smart Retail System Market encompasses the integration of advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), robotics, and big data analytics into the traditional retail environment to enhance operational efficiency, personalize customer experiences, and streamline supply chain management. These systems range from self-checkout kiosks and electronic shelf labels (ESLs) to sophisticated inventory tracking and personalized marketing platforms. The core objective of deploying smart retail solutions is to create seamless, omnichannel shopping journeys that cater to the modern consumer’s demand for speed, convenience, and customized interactions, thereby maximizing revenue opportunities and reducing labor costs in a highly competitive sector. The increasing penetration of e-commerce coupled with the necessity for physical stores to offer differentiated, experiential value drives the adoption of these transformative technologies.

Major applications of smart retail systems span across various facets of retail operations, including optimized store layouts based on real-time foot traffic analysis, predictive maintenance for store assets, and robust loss prevention through advanced surveillance and anomaly detection. Benefits realized by retailers include significant improvements in inventory accuracy, allowing for better stock management and reduced instances of out-of-stock situations, which historically lead to lost sales. Furthermore, the ability to collect and analyze granular customer data facilitates highly targeted advertising and loyalty programs, dramatically improving marketing ROI and fostering long-term customer relationships. The shift towards frictionless shopping experiences, enabled by mobile payments and smart carts, is fundamentally redefining the interaction between retailers and patrons.

Key driving factors accelerating market expansion include the global proliferation of high-speed internet and affordable sensor technologies, making system deployment economically viable even for small to medium-sized enterprises (SMEs). There is also immense pressure on brick-and-mortar retailers to compete effectively with online giants by leveraging digital tools to personalize the in-store experience, mirroring the convenience found online. Additionally, increasing labor costs and the ongoing drive for operational efficiency across large retail chains are compelling businesses to invest in automation tools such as robotic process automation (RPA) for repetitive tasks and AI-driven demand forecasting, securing the sustained growth trajectory of the smart retail system market globally.

Smart Retail System Market Executive Summary

The Smart Retail System Market is characterized by robust technological integration and accelerated deployment driven primarily by the need for operational resilience and enhanced customer engagement in the post-pandemic retail landscape. Current business trends indicate a significant shift towards unified commerce platforms where physical and digital sales channels are seamlessly merged, necessitating advanced infrastructure solutions capable of managing complex data streams from various touchpoints—including mobile apps, in-store sensors, and supply chain systems. Investment in Computer Vision (CV) technology for checkout-free experiences and theft prevention is peaking, representing a crucial competitive differentiator. Furthermore, sustainability initiatives are integrating into smart retail systems, with optimized energy management and efficient routing solutions gaining prominence as retailers seek to minimize their environmental footprint and appeal to eco-conscious consumers.

Regionally, North America and Europe remain the dominant markets, attributed to high technology adoption rates, the presence of major retail chains and tech vendors, and strong consumer readiness for digital shopping experiences. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth CAGR, fueled by rapid urbanization, massive infrastructural investments in countries like China and India, and the burgeoning e-commerce sectors driving demand for sophisticated warehouse automation and last-mile delivery optimization tools. Emerging economies in Latin America and the Middle East & Africa (MEA) are also showing promising acceleration, primarily focusing on digital payment infrastructure and basic inventory management systems as they modernize their fragmented retail ecosystems.

Segment trends reveal that the deployment of hardware components, particularly IoT sensors, smart shelves, and robotics, currently holds a substantial market share, acting as the foundational infrastructure for smart operations. Concurrently, the software and service segment, encompassing AI platforms, cloud-based analytics, and managed services, is expected to grow at a faster rate due to the recurring revenue models and the increasing sophistication required to interpret complex data generated by the hardware. Within applications, predictive analytics for inventory and personalized marketing services are experiencing particularly high demand, as retailers seek actionable insights to reduce waste and maximize personalized outreach, confirming the market’s pivot from purely operational improvements to strategic customer-centric intelligence.

AI Impact Analysis on Smart Retail System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Smart Retail System Market frequently revolve around three core themes: the extent of job displacement due to automation, the capabilities of AI in delivering hyper-personalization, and the security and ethical implications of using deep learning for customer surveillance and data processing. Users are keen to understand how generative AI might revolutionize product discovery and virtual try-ons, and they often express concerns about the necessary investment scale required to transition to an AI-powered retail model. The analysis shows a prevailing expectation that AI will move beyond simple operational automation (like inventory counting) into complex strategic decision-making, such such as real-time pricing adjustments, advanced fraud detection, and predictive demand modeling that anticipates consumer trends weeks in advance, positioning AI as the central nervous system of future retail operations.

AI's influence is profoundly reshaping the competitive landscape by enabling retailers to achieve unprecedented levels of efficiency and customer understanding. Machine learning algorithms are instrumental in optimizing complex logistical operations, including dynamic route planning for delivery fleets and warehouse management, significantly lowering operational expenditures. Moreover, AI-driven recommendation engines and conversational AI bots are enhancing the online and in-store service quality, providing instantaneous support and tailored product suggestions. The ability of deep learning models to process unstructured data, such as security camera footage and social media sentiment, is transforming loss prevention from a reactive task into a proactive, preventative measure, drastically cutting down shrinkage and internal theft.

Looking ahead, the integration of edge AI allows real-time processing of data directly at the retail location, reducing latency and enhancing immediate decision-making for tasks like crowd management and shelf restocking notifications. This distributed intelligence architecture is crucial for the scalability of autonomous stores. Ethical considerations and regulatory frameworks, particularly concerning data privacy (such as GDPR and CCPA), continue to shape AI deployment, pushing retailers towards explainable AI (XAI) models that ensure transparency and build consumer trust. The strategic deployment of AI is no longer optional but a fundamental requirement for retailers aiming to achieve market leadership in the dynamic global environment.

- Hyper-Personalization: AI algorithms enable dynamic pricing, personalized promotions, and customized product recommendations based on real-time shopper behavior and historical data.

- Frictionless Checkout: Computer Vision and deep learning facilitate autonomous stores and self-checkout systems, eliminating queue times and enhancing shopping convenience.

- Inventory Optimization: Predictive analytics forecasts demand fluctuations with high accuracy, minimizing stockouts and overstocking, leading to reduced capital tied up in inventory.

- Supply Chain Resilience: Machine learning models optimize logistics, track goods in real-time, and predict potential supply chain disruptions, ensuring operational continuity.

- Loss Prevention: AI-powered surveillance identifies unusual shopper movements or transaction anomalies indicative of fraud or theft, significantly lowering shrinkage rates.

- Conversational Commerce: AI chatbots and virtual assistants handle customer service inquiries 24/7, improving response times and efficiency while freeing up human staff for complex tasks.

DRO & Impact Forces Of Smart Retail System Market

The Smart Retail System Market is propelled by powerful market dynamics, counterbalanced by significant operational hurdles, yet offers expansive avenues for future growth, which collectively determine its trajectory. The primary drivers include the escalating need for retailers to deliver a unified and seamless omnichannel experience to meet modern consumer expectations, coupled with the necessity to leverage automation to offset rising labor costs and manage the complexities of global supply chains. However, substantial restraints exist, primarily revolving around the high initial capital investment required for infrastructure overhaul (e.g., implementing IoT sensor networks and upgrading legacy POS systems) and pervasive concerns regarding data security, privacy compliance, and the integration complexity when combining disparate technological solutions. The overarching opportunities lie in the untapped potential of emerging markets for scalable solutions, the further adoption of edge computing for enhanced real-time data processing, and the development of specialized AI solutions tailored for micro-retail environments, indicating a strong positive impact potential moderated by implementation challenges.

Key drivers center on technological innovation and consumer demand evolution. The rapid advancement and affordability of IoT devices, cloud computing platforms, and advanced analytics tools provide the foundational technology necessary for smart retail transformation. Consumers, now accustomed to the convenience and speed of e-commerce, demand similar frictionless experiences in physical stores, forcing retailers to invest in technologies like contactless payments, smart mirrors, and personalized mobile engagement tools. Furthermore, the global push towards efficiency mandates automation in inventory management and warehousing, making robotics and RFID technology critical for competitive advantage. These systemic factors create a continuous demand for advanced retail solutions that optimize every step of the value chain.

Conversely, significant restraints hinder widespread adoption, particularly among smaller retailers. The fragmentation of technological standards often makes integration difficult, leading to interoperability issues between systems supplied by different vendors. Furthermore, the reliance on continuous data flow raises profound security risks; a single breach can severely compromise customer trust and lead to heavy regulatory penalties, making cybersecurity investment a mandatory, costly component of any smart retail deployment. Despite these barriers, vast opportunities remain, especially through strategic partnerships between technology providers and retailers to develop affordable, modular solutions suitable for rapid deployment. The increasing maturity of 5G networks will unlock new possibilities for real-time mobile commerce and in-store augmented reality experiences, confirming that while risks exist, the potential rewards for market innovators are significant and market forces overwhelmingly favor technological adoption.

Segmentation Analysis

The Smart Retail System Market is meticulously segmented based on components, technology deployed, application type, and the scale of the retail format, providing a structured view of investment priorities across the sector. Component segmentation differentiates between hardware (sensors, cameras, displays, robotics), software (analytics, AI platforms, security management), and services (installation, maintenance, consulting), recognizing that successful deployment requires a synergistic blend of physical assets and intelligent digital capabilities. The analysis of these segments reveals where core innovation is focused—currently, high growth is seen in AI software and specialized integration services, while hardware forms the indispensable base layer for data collection. This comprehensive segmentation allows stakeholders to accurately gauge market penetration and identify specific areas of high return on investment.

Technology-based segmentation highlights the foundational systems driving smart retail, primarily focusing on the Internet of Things (IoT), Artificial Intelligence (AI), Cloud Computing, and Augmented/Virtual Reality (AR/VR). IoT sensors and RFID tags are foundational for inventory tracking, while AI underpins predictive analytics and personalized customer interactions. Application segmentation defines the usage areas, encompassing store operations management (including inventory and staff optimization), customer experience management (personalized marketing and digital signage), and supply chain management (logistics and warehouse automation). These distinctions are vital for technology providers to align their solutions with specific retail pain points, ensuring tailored products that deliver demonstrable operational improvements in designated functional areas.

Finally, segmentation by retail format recognizes the diverse needs of different retail environments, typically divided into Hypermarkets/Supermarkets, Specialty Stores, and E-commerce/Online Stores. Hypermarkets often prioritize large-scale automation like robotic cleaners and smart carts, whereas Specialty Stores focus on experiential technologies such as AR try-on mirrors and advanced personalization tools. The increasing overlap between physical and online channels necessitates solutions that bridge both environments, such as click-and-collect optimization and unified data platforms, confirming that segmentation reflects the varied operational demands within the global retail ecosystem.

- By Component:

- Hardware (Sensors, RFID Tags, Smart Shelves, Displays, Cameras, Robotics)

- Software (Analytics Platforms, AI/ML Software, Store Operations Management, Security Solutions)

- Services (Managed Services, Professional Services: Consulting, Integration, Maintenance)

- By Technology:

- Internet of Things (IoT)

- Artificial Intelligence (AI)

- Cloud Computing

- Augmented Reality (AR) and Virtual Reality (VR)

- Blockchain

- By Application:

- Store Operations Management (Inventory Management, Staff Management, Energy Optimization)

- Customer Experience Management (Personalized Marketing, Digital Signage, Smart Payment Systems)

- Supply Chain Management (Logistics Optimization, Warehouse Automation)

- By Retail Format:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- E-commerce and Online Stores

Value Chain Analysis For Smart Retail System Market

The value chain of the Smart Retail System Market begins upstream with foundational technology providers specializing in core components like sensors, microprocessors, cloud infrastructure, and advanced AI algorithms. This upstream segment is characterized by heavy R&D investment and fierce competition among semiconductor manufacturers and software developers who establish the fundamental capabilities of smart systems. Key activities here involve designing highly durable, low-power IoT devices and developing robust, scalable cloud architectures essential for handling the massive volume of data generated by retail operations. The quality and cost-effectiveness of these foundational components directly impact the profitability and performance of the entire downstream market, making strategic sourcing and component innovation crucial upstream activities.

Mid-stream activities are dominated by system integrators and solution providers who transform raw components into cohesive, tailored smart retail solutions. These players specialize in integrating disparate hardware and software components, customizing platforms for specific retail formats (e.g., grocery vs. apparel), and ensuring interoperability with existing legacy systems. Distribution channels are typically complex, involving both direct sales models for large-scale enterprise deployments and indirect channels through channel partners, VARs (Value-Added Resellers), and specialized distributors, particularly when targeting regional markets or SMEs. The success of mid-stream providers relies heavily on technical expertise in integration and robust project management capabilities to handle complex, multi-site rollouts efficiently.

Downstream, the value chain focuses on the end-user interaction and post-deployment support. This stage involves the physical installation, ongoing maintenance, and critical managed services necessary to keep smart retail systems operational and optimized. Direct channels involve large technology vendors offering comprehensive end-to-end solutions and support directly to Tier 1 retailers, ensuring high levels of customization and strategic alignment. Indirect channels, often local specialized IT service firms, handle regional implementation and immediate technical support, providing localized expertise. The ultimate value delivery is realized at this stage through measurable improvements in operational metrics (e.g., reduced shrinkage, increased labor efficiency) and enhanced customer satisfaction, solidifying the continuous relationship between the service provider and the retailer through recurring service contracts.

Smart Retail System Market Potential Customers

The primary customers and end-users of Smart Retail Systems are fundamentally any business involved in the sale of goods and services through physical or digital storefronts, exhibiting diverse technological needs based on scale and sector. Dominant buyers include large multinational retail chains, such as hypermarkets and department stores, which require scalable, enterprise-grade solutions for managing vast inventories, optimizing complex global supply chains, and deploying high-volume, automated checkout systems across hundreds or thousands of locations. These Tier 1 customers focus on ROI driven by labor efficiency and loss prevention, demanding sophisticated AI and robotics integration, representing the largest spending segment in the market.

A rapidly expanding customer base includes specialty retailers, convenience stores, and QSR (Quick Service Restaurant) chains, who often seek modular and easy-to-deploy solutions. For these customers, the emphasis shifts slightly towards enhancing in-store experience, utilizing digital signage, personalized marketing through mobile apps, and smart payment methods to differentiate themselves in highly localized markets. Their purchasing decisions are often influenced by cloud-based subscription models that reduce upfront capital expenditure and allow for quicker adoption and scalability, demonstrating a strong demand for 'Retail-as-a-Service' models tailored to their mid-market operational scale.

Furthermore, E-commerce and pure-play online retailers are increasingly adopting smart retail technologies, particularly for their fulfillment centers and logistics operations, utilizing advanced warehouse automation, drone delivery infrastructure, and sophisticated predictive analytics platforms to manage volatile online demand and optimize last-mile delivery. While they lack a traditional physical storefront, their investment in smart systems focuses heavily on data intelligence, fulfillment speed, and managing the reverse logistics processes efficiently. The growing necessity for omnichannel integration ensures that all these customer segments eventually converge on unified smart systems that seamlessly manage data flow across physical, mobile, and web touchpoints.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 64.8 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon, IBM Corporation, Microsoft Corporation, Intel Corporation, SAP SE, Cisco Systems Inc., Oracle Corporation, Sensormatic Solutions (Johnson Controls), NEC Corporation, Fujitsu Limited, Google LLC, Diebold Nixdorf, VeriFone Systems, Adyen, Zebra Technologies, Ingenico Group, AOPEN, RetailNext, Kabbage Inc., Bossa Nova Robotics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Retail System Market Key Technology Landscape

The Smart Retail System Market is fundamentally shaped by the convergence of several high-impact technologies, forming a complex ecosystem where data collection, processing, and application are highly interconnected. The Internet of Things (IoT) serves as the primary data acquisition layer, utilizing a vast network of sensors, RFID tags, smart shelves, and smart cameras deployed throughout the store and warehouse environment. These devices generate colossal amounts of real-time operational data, crucial for tasks such as automated inventory counting, monitoring equipment performance, and tracking customer paths. The maturity and decreasing cost of IoT hardware have made large-scale deployments feasible, establishing the necessary physical backbone for any sophisticated smart retail solution across all formats, from small convenience stores to massive hypermarkets.

Above the IoT layer, Artificial Intelligence (AI) and Machine Learning (ML) are the essential engines for deriving actionable insights from the collected data. AI algorithms power predictive analytics for demand forecasting, optimizing staffing levels, and executing dynamic pricing strategies that maximize profit margins in real time. Computer Vision (CV), a specialized subset of AI, is instrumental in enabling frictionless commerce (like "just walk out" stores), monitoring shelf compliance, and enhancing security through facial recognition and anomaly detection for loss prevention. Cloud Computing provides the indispensable infrastructure for housing and processing this massive data load, offering the scalability and elasticity required to support fluctuating retail demands and global operations without necessitating extensive on-premise hardware investment.

Additionally, technologies such as Augmented Reality (AR) and Virtual Reality (VR) are transforming the customer experience, offering virtual try-on experiences for apparel and cosmetics, or providing interactive in-store navigation guides that blend the digital and physical worlds. Blockchain technology is emerging as a critical tool for enhancing supply chain transparency and traceability, ensuring product authenticity and building consumer trust by providing immutable records of origin and handling. The integration of 5G connectivity is crucial for supporting this ecosystem, offering the ultra-low latency and high bandwidth necessary for edge computing applications, which process data instantaneously at the retail location, ensuring that real-time decisions, such as robotics control or instant mobile alerts, are executed without delay.

Regional Highlights

The global Smart Retail System Market exhibits significant regional disparities in terms of technological maturity, investment levels, and consumer readiness, influencing adoption rates across continents.

- North America: This region maintains market leadership due to high disposable income, early and widespread adoption of advanced technologies like AI and robotics, and the presence of numerous global retail and technology giants (e.g., Amazon, Walmart, Microsoft). Focus areas include frictionless checkout systems, advanced cybersecurity measures, and highly personalized customer engagement platforms.

- Europe: Characterized by stringent data privacy regulations (GDPR), the European market emphasizes secure, compliant, and sustainable smart retail solutions. Key adoption drivers are operational efficiency, waste reduction, and the implementation of Electronic Shelf Labels (ESLs) across major supermarket chains, particularly in Western European countries like Germany, the UK, and France.

- Asia Pacific (APAC): Expected to register the highest CAGR, APAC is driven by rapid digital transformation, high mobile penetration, and massive urbanization, particularly in China, Japan, and India. This region is a hotbed for innovation in mobile payment systems, warehouse automation, and the deployment of extensive IoT networks supported by strong governmental technology investments.

- Latin America (LATAM): Growth in LATAM is primarily concentrated in modernizing payment infrastructure and basic inventory management systems in countries like Brazil and Mexico. The market is still nascent but poised for substantial growth as retailers seek to combat high shrinkage rates and improve fragmented supply chain visibility.

- Middle East and Africa (MEA): Investment in MEA is highly concentrated in Gulf Cooperation Council (GCC) countries, focusing on luxury retail experiences and large-scale smart city projects, driving demand for premium digital signage, personalized AI assistants, and advanced security systems in high-end shopping destinations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Retail System Market.- Amazon

- IBM Corporation

- Microsoft Corporation

- Intel Corporation

- SAP SE

- Cisco Systems Inc.

- Oracle Corporation

- Sensormatic Solutions (Johnson Controls)

- NEC Corporation

- Fujitsu Limited

- Google LLC

- Diebold Nixdorf

- VeriFone Systems

- Adyen

- Zebra Technologies

- Ingenico Group

- AOPEN

- RetailNext

- Kabbage Inc.

- Bossa Nova Robotics

Frequently Asked Questions

Analyze common user questions about the Smart Retail System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Smart Retail System Market?

The Smart Retail System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033, driven primarily by the global demand for frictionless shopping experiences and operational automation.

What are the primary drivers accelerating the adoption of smart retail solutions?

Key drivers include the imperative for unified omnichannel retailing, the necessity to combat rising labor costs through automation (e.g., robotics and AI), and the widespread availability of affordable IoT sensors and high-speed network infrastructure.

Which technology segment holds the most promising growth potential?

The software and services segment, particularly Artificial Intelligence (AI) and Machine Learning (ML) platforms for predictive analytics and customer hyper-personalization, is expected to exhibit the highest growth rate due to its critical role in strategic decision-making and recurring revenue potential.

Which geographical region dominates the Smart Retail System Market?

North America currently dominates the market share due to its high technology maturity, significant presence of leading retailers and solution providers, and robust consumer adoption of advanced digital shopping solutions.

What are the main challenges hindering the widespread adoption of smart retail systems?

Major challenges include the high initial capital expenditure required for system integration, complex issues related to data security and regulatory compliance (like GDPR), and technical difficulties in integrating new systems with older, legacy retail infrastructure.

The extensive analysis provided herein confirms the dynamic nature of the Smart Retail System Market, highlighting strategic investment zones in AI and IoT integration, while underscoring the necessity for robust cybersecurity and adherence to global data privacy standards. The market trajectory is strongly upward, propelled by the unstoppable demand for seamless retail experiences.

The transformation of traditional retail outlets into smart, data-driven environments is a fundamental shift that requires continuous technological updating and strategic partnerships. Retailers must prioritize modular, scalable solutions that can evolve with consumer preferences and technological advancements. The future competitive landscape will be defined by those who effectively harness real-time data to create truly personalized and efficient shopping journeys, moving beyond mere automation to achieve deep customer intelligence and operational agility. The confluence of 5G, edge computing, and AI is set to redefine the operational blueprint for retail globally.

Furthermore, the focus on sustainable smart retail practices—such as optimized energy consumption through IoT systems and reduced waste through accurate AI demand forecasting—is not only an ethical consideration but increasingly a market differentiator. Consumers are favoring retailers who demonstrate environmental responsibility, making sustainability features integrated into smart systems a key growth driver. This dual emphasis on profitability through efficiency and responsibility through sustainable technology integration ensures the market's long-term vitality and relevance in the broader global economy.

The competitive environment is intensifying, characterized by both established tech giants entering the retail space with full-stack solutions and specialized startups providing niche, high-impact applications like Computer Vision for loss prevention. This competitive pressure drives innovation and lowers the eventual cost of deployment, making smart systems accessible to a wider range of retailers over the forecast period. Successful market players will be those who can provide integrated, end-to-end solutions that offer clear and measurable return on investment (ROI) across various retail formats, from convenience stores to large distribution centers.

The detailed segmentation analysis emphasizes that investment is diversifying, moving beyond foundational hardware towards sophisticated software that maximizes the utility of collected data. This pivot signifies the market's maturity, where the value is increasingly derived from intelligence and strategic application rather than simply the deployment of devices. Retailers must carefully evaluate their specific operational pain points and choose technology partners whose offerings align precisely with their business modernization goals and regulatory environments. The global market readiness for these sophisticated solutions is higher than ever, promising continued exponential growth.

Finally, the regional outlook confirms that while North America and Europe set the pace for innovation, APAC represents the most significant volume opportunity due to its sheer market size and rapid digital adoption curve. Companies aiming for global leadership must develop culturally and technologically flexible solutions capable of deployment in diverse regulatory and infrastructural environments, ensuring localization efforts are central to their market penetration strategies. The convergence of physical and digital retail, powered by smart systems, remains the defining mega-trend of the next decade in the retail sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager