Smart Retail Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439056 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Smart Retail Systems Market Size

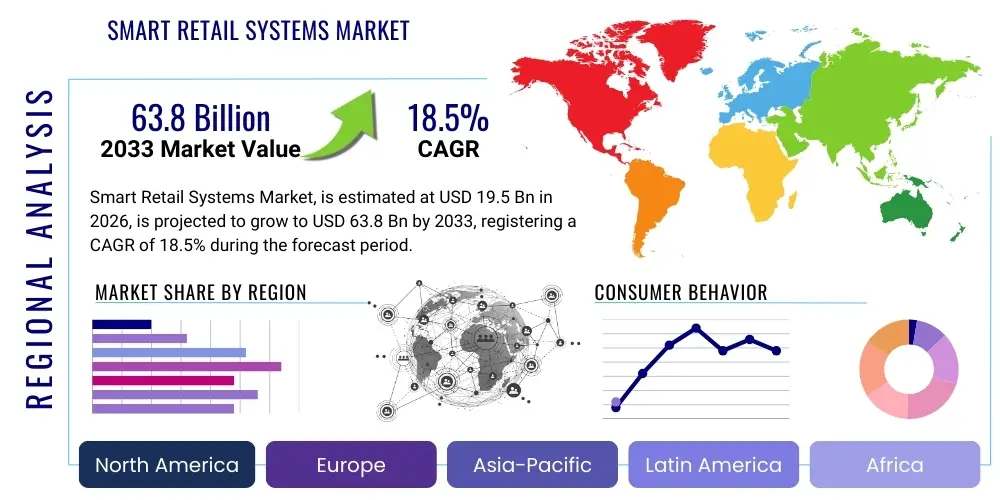

The Smart Retail Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 19.5 Billion in 2026 and is projected to reach USD 63.8 Billion by the end of the forecast period in 2033.

Smart Retail Systems Market introduction

The Smart Retail Systems Market encompasses the integration of advanced digital technologies—including the Internet of Things (IoT), Artificial Intelligence (AI), Machine Learning (ML), and robotics—into traditional retail environments to enhance operational efficiency, personalize customer experiences, and optimize supply chain management. These systems move beyond standard point-of-sale (POS) systems, incorporating sophisticated sensor networks, data analytics platforms, and immersive technologies to create a dynamic, interconnected shopping ecosystem. The primary objective is to transform physical and online stores into intelligent hubs capable of real-time decision-making, significantly improving inventory accuracy and reducing operational friction for both retailers and consumers. Key offerings within this market include intelligent automation solutions, predictive analytics software, and seamless omni-channel fulfillment tools designed to meet the evolving demands of the modern consumer.

Major applications of smart retail systems span across inventory tracking using RFID and computer vision, personalized marketing through customer relationship management (CRM) integration, automated checkout processes (e.g., grab-and-go stores), and robotic assistance for stocking and cleaning. The immediate benefits include drastically reduced labor costs, minimized shrinkage (loss due to theft or error), and dramatically improved customer satisfaction metrics derived from faster service and highly relevant product recommendations. These technologies enable retailers to gather granular data on shopper behavior, allowing for highly efficient store layouts and targeted promotions that maximize sales conversions and foster long-term customer loyalty.

The market is predominantly driven by the escalating demand for seamless omni-channel retail experiences and the competitive necessity for operational agility. Retailers are rapidly adopting these systems to counter rising operational costs and the pressure from e-commerce giants. Furthermore, advancements in sensor technology, coupled with the increasing affordability and processing power of edge computing devices, make large-scale deployment of smart infrastructure financially viable. Regulatory support for digital infrastructure modernization and consumer willingness to utilize self-service technologies further catalyze market expansion, positioning smart retail systems as indispensable tools for future retail success.

Smart Retail Systems Market Executive Summary

The Smart Retail Systems Market is experiencing robust growth fueled by technological innovation and shifting consumer expectations for instant, personalized shopping experiences. Key business trends indicate a strong move toward AI-driven predictive inventory management and the widespread adoption of frictionless payment technologies, reducing the reliance on traditional human-centric processes. The integration of IoT sensors within store shelves and apparel tracking systems is becoming standard practice, pushing efficiency boundaries and enabling hyper-localization of marketing efforts. Investment in cybersecurity measures related to smart retail infrastructure is also a critical emerging trend, given the sensitive nature of collected consumer data and transactional information, making data integrity a cornerstone of platform development.

Regionally, North America maintains its dominance due to high disposable income, early technological adoption rates, and the presence of major technology providers and pioneering large-scale retailers who drive innovation through pilot programs and aggressive rollouts. The Asia Pacific (APAC) region, however, is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by massive urbanization, the rapid expansion of organized retail in emerging economies like India and China, and government initiatives promoting digital transformation. Europe focuses heavily on sustainable and ethical smart retail solutions, often emphasizing energy efficiency and data privacy regulations (like GDPR) that shape system architecture.

Segment trends reveal that the Software component segment, particularly analytics and visualization platforms, holds a dominant market share due to the increasing need for actionable insights derived from vast amounts of operational and consumer data generated by smart hardware. Within the technology segment, AI-powered systems, including computer vision for checkout and robotics for warehouse automation, are showing the most aggressive year-over-year growth. End-user adoption is fastest among Supermarkets and Hypermarkets, where optimizing large-scale logistics and managing perishable inventory provides the highest tangible return on investment for smart system implementation. Specialized smart applications tailored for niche retail sectors, such as fashion and electronics, are also gaining traction, focusing on augmented reality (AR) fitting rooms and interactive product displays.

AI Impact Analysis on Smart Retail Systems Market

Users frequently inquire about AI's role in personalizing shopping journeys, automating manual tasks, and preventing retail loss (shrinkage). Key themes revolve around how AI can move beyond simple recommendation engines to truly predict consumer behavior, optimize dynamic pricing in real-time, and manage complex supply chain disruptions autonomously. Concerns often center on data privacy, the potential displacement of human labor, and the reliability and ethical implications of using computer vision systems for shopper tracking. The overall expectation is that AI will be the foundational technology enabling truly 'smart' retail—driving hyper-efficiency while fundamentally changing the customer-retailer interaction model toward proactive, personalized engagement.

- Real-time dynamic pricing optimization based on demand, inventory levels, and competitor analysis.

- Enhanced customer personalization via predictive analytics across all touchpoints (omni-channel consistency).

- Frictionless checkout and loss prevention through advanced computer vision and biometric authentication.

- Autonomous inventory management, forecasting, and automated reordering processes (AIOps for retail).

- Optimizing store layout and employee scheduling using spatial recognition and shopper flow analysis.

- Robotics integration for automated cleaning, stocking, and last-mile delivery tasks.

- Improved supply chain visibility and predictive maintenance for store infrastructure components.

- Development of sophisticated conversational AI for enhanced customer service and sales assistance.

DRO & Impact Forces Of Smart Retail Systems Market

The momentum of the Smart Retail Systems Market is primarily driven by the escalating competitive pressure forcing retailers to reduce operational overheads and the pervasive shift towards omni-channel retailing, which necessitates interconnected digital infrastructure. However, growth faces significant restraints, chiefly high initial capital expenditure required for system implementation and the complex issue of integrating new smart systems with legacy IT infrastructure that many established retailers utilize. Opportunities abound in emerging economies and through the specific deployment of hybrid cloud solutions that offer scalability and cost flexibility. These internal and external forces interact profoundly, determining the pace and direction of technological adoption across various retail formats and geographical zones, demanding a strategic, phased approach to implementation.

Key drivers include the imperative to mitigate retail shrinkage, which costs the global industry billions annually, and the demand from digitally native consumers for personalized, seamless shopping experiences devoid of traditional bottlenecks like long queues. The cost-effectiveness and maturation of core underlying technologies, such as IoT sensors and edge AI processing chips, further lower the barrier to entry for mid-sized retailers. This combination of economic necessity, customer pull, and technological readiness forms a powerful impetus for market growth, pushing retailers who previously resisted digitalization toward rapid modernization.

Restraints are dominated by the need for specialized IT talent capable of managing and maintaining complex integrated smart systems, creating a significant talent gap. Furthermore, consumer trust and the stringent regulatory environment surrounding data privacy (especially concerning biometric data collected by computer vision systems) present hurdles that require robust security and compliance measures. The impact forces manifest as the need for continuous technological updates to stay competitive, the intense market consolidation among solution providers offering integrated platforms, and the regulatory environment acting as both a catalyst (for standardization) and a constraint (for implementation speed).

Opportunities are substantial in leveraging Smart Retail Systems for sustainable practices, such as optimizing energy consumption in stores and reducing food waste through precise inventory control and real-time monitoring of perishable goods. Furthermore, the expansion into underserved markets, particularly rural areas in developing regions, offers growth avenues for modular, cost-effective smart solutions. The market impact is defined by the critical balance between achieving immediate operational cost savings and making long-term strategic investments in scalable infrastructure, where successful integration determines competitive advantage and market survival.

Segmentation Analysis

The Smart Retail Systems Market is comprehensively segmented based on the components utilized (Hardware, Software, Services), the technologies implemented (AI, IoT, Robotics), and the primary end-users served (Supermarkets, Specialty Stores, Department Stores). This segmentation provides a granular view of market dynamics, revealing where investment is most concentrated and which technological stacks are generating the highest returns. The complexity of modern retail demands that solution providers offer highly tailored packages, moving away from monolithic systems towards modular, scalable offerings that can be integrated incrementally into existing store infrastructure, thereby catering to diverse retailer sizes and technological readiness levels. The analysis confirms that the software and services segments are capturing increasing revenue share, highlighting the growing importance of data processing, analytical insights, and continuous system maintenance over initial hardware deployment costs.

- By Component:

- Hardware (POS Systems, RFID Tags and Readers, Sensors, Digital Signage, Security Systems)

- Software (Analytics & Visualization, Inventory Management, Customer Relationship Management (CRM), Supply Chain Management (SCM))

- Services (Managed Services, Professional Services, System Integration & Deployment)

- By Technology:

- Internet of Things (IoT)

- Artificial Intelligence (AI)

- Computer Vision

- Robotics

- Augmented and Virtual Reality (AR/VR)

- By Application:

- Inventory Optimization

- Frictionless Payment and Checkout

- Customer Experience Management

- Predictive Maintenance and Store Operations

- By End User:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Quick Service Restaurants (QSR)

- Convenience Stores

Value Chain Analysis For Smart Retail Systems Market

The value chain for the Smart Retail Systems Market is complex, beginning with upstream technology providers responsible for manufacturing core components like high-precision sensors, edge AI processors, specialized RFID hardware, and advanced software platforms (e.g., cloud services and machine learning toolkits). These providers ensure the foundational reliability and capability of the integrated systems. Success in the upstream segment depends heavily on achieving economies of scale and driving innovation in miniaturization and connectivity standards, setting the technological baseline for the entire market. Strategic partnerships between chip manufacturers and specialized retail software developers are crucial at this stage to ensure hardware optimization for specific retail use cases, such as high-speed video processing for loss prevention or low-power sensor networks for perishable goods monitoring.

The middle segment of the value chain is dominated by system integrators, software developers, and managed service providers (MSPs). Integrators play a pivotal role, customizing standardized technologies to meet the unique operational requirements of individual retailers, managing the complex task of integrating disparate systems—from legacy POS terminals to modern cloud analytics platforms. Distribution channels include both direct sales models, often employed by large companies like IBM and Microsoft targeting major global retailers, and indirect channels involving value-added resellers (VARs) and specialized retail technology distributors who cater effectively to small and medium-sized enterprises (SMEs). This distribution diversity is essential for achieving broad market penetration and providing localized support.

Downstream analysis focuses on deployment, maintenance, and the direct relationship with end-user retailers. After system installation, the ongoing provision of professional services, including data analytics consultation, security monitoring, and continuous software updates, becomes the most significant revenue stream. Retailers prioritize solution providers offering comprehensive post-deployment support and future-proofing capabilities, enabling them to adapt quickly to new retail trends and maintain system uptime. The continuous feedback loop from retailers regarding performance and required enhancements is critical for driving product evolution and ensuring that smart systems deliver demonstrable return on investment (ROI) in terms of reduced shrinkage and improved customer throughput.

Smart Retail Systems Market Potential Customers

The primary consumers of Smart Retail Systems are large-scale organized retail chains, including international supermarkets, hypermarkets, and big-box department stores, where the volume of transactions and inventory makes the investment highly justifiable for achieving marginal efficiency gains across massive operations. These large entities seek enterprise-grade, scalable solutions for centralized inventory control, sophisticated supply chain orchestration, and comprehensive customer data analytics required for large-scale personalized marketing campaigns. Their purchasing decisions are heavily influenced by proven ROI metrics related to loss prevention and labor optimization, demanding solutions that are interoperable with existing enterprise resource planning (ERP) systems and compliant with global security standards. The deployment scope often covers hundreds or thousands of physical locations, requiring robust cloud infrastructure and secure network architecture.

A rapidly growing segment of potential customers includes specialized retail formats, such as luxury goods boutiques, electronics outlets, and fashion retailers. These businesses prioritize customer experience management and interactive technologies like Augmented Reality (AR) mirrors and personalized digital signage, aiming to create unique, engaging in-store environments that justify premium pricing and foster brand loyalty. While their investment focus may be less on pure cost reduction and more on enhancing the aesthetic and experiential aspects of shopping, they represent crucial early adopters for cutting-edge technologies like computer vision analytics for emotional and engagement mapping, driving innovation within the customer-facing applications segment of the market.

Furthermore, the Quick Service Restaurant (QSR) and convenience store sectors are significant growth areas, driven by the need for speed and efficiency. These customers primarily adopt smart POS systems, self-ordering kiosks, robotic food preparation units, and advanced inventory tracking tailored for high-volume, low-margin transactions. The integration of IoT sensors to monitor food freshness and temperature compliance, coupled with AI systems for demand forecasting to minimize waste, provides crucial operational value. For these smaller, high-velocity environments, ease of deployment and minimal maintenance overhead are critical factors influencing procurement decisions, favoring standardized, cloud-based software-as-a-service (SaaS) models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.5 Billion |

| Market Forecast in 2033 | USD 63.8 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Oracle, SAP, Amazon Web Services (AWS), Intel, Cisco Systems, Toshiba, Fujitsu, Honeywell International, Ingenico, NCR Corporation, Diebold Nixdorf, Verifone, Salesforce, NEC Corporation, Samsung Electronics, Zebra Technologies, Schneider Electric, Bosch Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Retail Systems Market Key Technology Landscape

The technological landscape of the Smart Retail Systems Market is highly dynamic, centered around the convergence of four major pillars: IoT, Artificial Intelligence (AI) and Machine Learning (ML), Cloud Computing, and advanced sensor technologies like RFID and computer vision. IoT forms the physical backbone, involving networked devices, smart shelves, and environmental sensors that generate massive streams of operational data in real-time. This proliferation of connected devices necessitates robust and secure network infrastructure, often utilizing 5G connectivity and edge computing solutions to process data locally, minimizing latency for mission-critical applications such as autonomous vehicles in warehouses or real-time loss prevention monitoring at the storefront.

AI and ML represent the intelligence layer, transforming raw IoT data into actionable insights. This includes sophisticated algorithms used for demand forecasting, personalized recommendation engines, and dynamic pricing models that adjust based on instantaneous market conditions. Computer vision, a specific subset of AI, is rapidly becoming foundational for frictionless retail, powering cashier-less checkout systems, monitoring shelf stock levels automatically, and providing advanced shopper analytics related to traffic flow and dwell time without relying solely on traditional security cameras. The effective utilization of these algorithms is entirely dependent on large, high-quality datasets, pushing solution providers to focus heavily on data governance and ethical AI deployment.

Furthermore, cloud computing, particularly hybrid and multi-cloud architectures, provides the essential scalable infrastructure required to handle the computational load and storage demands of global retail operations. Retailers leverage cloud services for flexibility, disaster recovery, and the deployment of SaaS models for applications like CRM and complex supply chain optimization software. Emerging technologies such as Augmented Reality (AR) and Virtual Reality (VR) are also gaining prominence, particularly for customer engagement (virtual try-ons) and employee training (simulated warehouse environments). The strategic successful deployment in this market hinges upon seamless integration capabilities, ensuring that technologies from various vendors can communicate effectively to provide a unified, intelligent retail platform.

Current technological investment is shifting significantly towards optimizing the last mile and enhancing operational robotics. Robotics is moving beyond large, centralized fulfillment centers and entering the physical store environment for tasks such as floor cleaning, inventory audit, and customer guidance. This trend, coupled with the increasing sophistication of predictive maintenance tools, ensures higher reliability and lower total cost of ownership (TCO) for smart systems. The ongoing standardization efforts in connectivity protocols and data formats are crucial for reducing implementation complexity and accelerating global market adoption, highlighting the necessity for collaboration among hardware and software giants to ensure long-term viability and interoperability.

The technology lifecycle is accelerating, demanding that retailers invest in modular systems capable of frequent, non-disruptive upgrades. Blockchain technology, while still nascent in core retail operations, shows promise in improving transparency and traceability within the supply chain, particularly for high-value or highly regulated products, ensuring provenance and authenticity from manufacturer to shelf. The integration of advanced human-machine interface (HMI) technologies, including gesture control and enhanced voice recognition, is also improving the efficiency of store associates, allowing them to interact more intuitively with smart systems and focus more time on high-value customer interactions. This technological momentum suggests a future where the distinction between physical and digital retail experiences effectively vanishes.

Regional Highlights

- North America: This region holds the largest market share, characterized by high technological maturity, the early adoption of AI and computer vision systems by major retail giants (particularly in the US), and significant corporate investment in advanced supply chain automation. The focus here is on achieving cashier-less operations, enhancing real-time inventory visibility, and leveraging personalization through deep data integration. Canada and the United States are the core drivers, supported by robust venture capital funding directed toward specialized retail technology startups.

- Europe: The European market is growing steadily, with a strong emphasis on regulatory compliance, especially related to GDPR, which mandates strict data protection protocols for smart systems collecting consumer information. Western European countries like Germany, the UK, and France are leading adoption, focusing on sustainable smart retail solutions, optimizing energy consumption, and using smart systems to combat food waste. Deployment often favors modular, integrated systems compatible with diverse European retail cultures and existing infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region globally, driven by the massive expansion of organized retail in populous nations like China, India, and Southeast Asia. High mobile penetration and widespread acceptance of mobile payments and facial recognition technology accelerate the adoption of frictionless payment systems and sophisticated customer experience management solutions. Government support for digitalization and smart city initiatives further fuels market growth, particularly in areas focusing on last-mile delivery and efficient urban logistics management.

- Latin America (LATAM): Growth in LATAM is driven by the need to combat high rates of retail shrinkage and improve operational efficiency amid challenging logistical environments. Countries like Brazil and Mexico are witnessing increased investments in basic smart systems, such as advanced POS and security monitoring, often deployed as SaaS models to reduce initial financial outlay. Market penetration is currently focused on high-density urban areas, with opportunities expanding as digital infrastructure improves.

- Middle East and Africa (MEA): The MEA region is experiencing increasing digitalization, particularly in the GCC countries (UAE, Saudi Arabia) driven by large government-backed infrastructure projects and the establishment of global retail hubs. Smart system adoption is focused on creating futuristic, high-tech shopping experiences, integrating AR/VR and advanced robotics in flagship stores, aligning with regional visions for smart economic diversification and technological leadership.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Retail Systems Market.- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services (AWS)

- Intel Corporation

- Cisco Systems Inc.

- Toshiba Corporation

- Fujitsu Limited

- Honeywell International Inc.

- Ingenico (Worldline)

- NCR Corporation

- Diebold Nixdorf AG

- Verifone

- Salesforce Inc.

- NEC Corporation

- Samsung Electronics Co. Ltd.

- Zebra Technologies Corporation

- Schneider Electric SE

- Bosch Group (Robert Bosch GmbH)

Frequently Asked Questions

Analyze common user questions about the Smart Retail Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Smart Retail Systems Market?

The Smart Retail Systems Market is projected to grow at a strong Compound Annual Growth Rate (CAGR) of 18.5% between the forecast years of 2026 and 2033, driven primarily by the global demand for operational efficiency and omni-channel capabilities.

How does AI contribute to reducing retail shrinkage?

AI reduces retail shrinkage through advanced computer vision systems that monitor shopper behavior and self-checkout anomalies in real-time. It uses predictive analytics on transaction data to flag suspicious patterns and minimize internal theft and operational errors more effectively than traditional methods.

Which segment holds the largest share in the Smart Retail Systems Market?

The Software component segment, including advanced analytics, CRM, and inventory management platforms, currently holds the largest market share due to the increasing need for deep, actionable data insights derived from the connected IoT hardware infrastructure.

What are the primary restraints affecting market adoption?

The primary restraints include the high initial capital investment required for comprehensive system overhaul and the significant technical challenges associated with integrating modern, smart infrastructure with existing legacy IT systems used by established retailers.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, propelled by rapid urbanization, substantial growth in organized retail, and widespread consumer acceptance of digital and mobile-based smart retail technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager