Smart Scenic Guide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433831 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Smart Scenic Guide Market Size

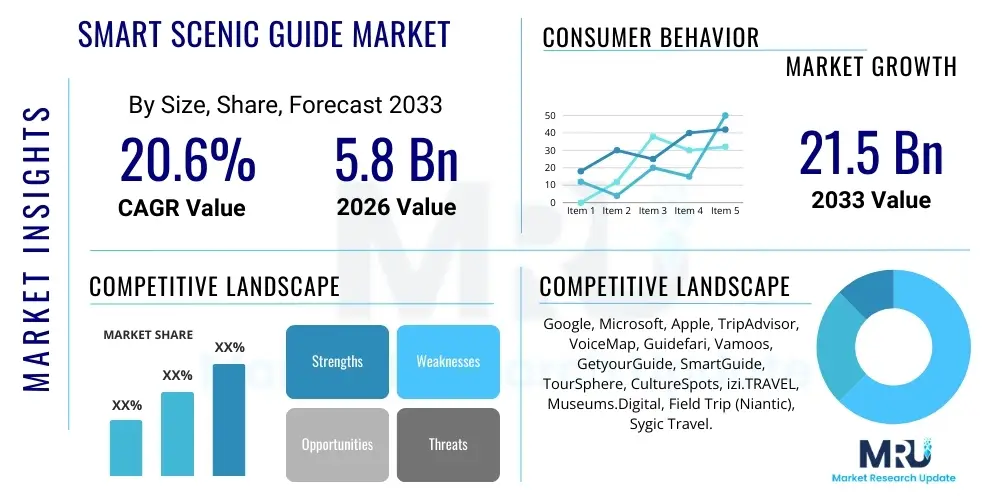

The Smart Scenic Guide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.6% between 2026 and 2033. The market is estimated at $5.8 Billion USD in 2026 and is projected to reach $21.5 Billion USD by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing integration of advanced technologies such as Artificial Intelligence (AI), Augmented Reality (AR), and the proliferation of 5G infrastructure, which facilitates seamless, personalized, and interactive travel experiences for global tourists. The shift from traditional static guides to dynamic, context-aware platforms is a major accelerator.

Smart Scenic Guide Market introduction

The Smart Scenic Guide Market encompasses digital solutions designed to enhance the tourist experience by providing real-time, personalized, and interactive information about scenic, cultural, and historical locations. These guides utilize a combination of technologies, including GPS, IoT sensors, mobile applications, and AI algorithms, to deliver context-specific content, navigation assistance, and multimedia experiences directly to the user's device. The primary product offering is sophisticated software platforms and accompanying hardware (such as dedicated audio devices or AR glasses) that replace static maps and human guides, offering multilingual support and tailored itineraries based on user preferences and physical location.

Major applications of Smart Scenic Guides include enhancing visitor engagement at museums, historical monuments, national parks, theme parks, and urban sightseeing routes. They provide significant benefits such as improved accessibility through multilingual content, enhanced visitor safety via real-time alerts, and optimized time management through personalized routing recommendations. Furthermore, these guides offer site operators invaluable data on visitor flow and popular attractions, enabling better infrastructure planning and resource allocation. The integration of gamification elements and virtual reconstructions significantly deepens the educational and entertainment value proposition.

The market is primarily driven by the global digitalization of the tourism sector, the rising consumer demand for highly personalized and immersive travel experiences, and the rapid evolution of mobile connectivity. Technological advancements in mobile computing power and battery life have made complex AR and AI applications feasible for mass adoption. Additionally, government initiatives promoting smart cities and digital heritage preservation efforts across developed and emerging economies are creating significant opportunities for Smart Scenic Guide providers to deploy their solutions at scale, transforming how cultural and scenic assets are experienced and managed.

Smart Scenic Guide Market Executive Summary

The Smart Scenic Guide Market is experiencing robust growth fueled by transformative business trends focusing on personalization and seamless integration across the travel ecosystem. Key business strategies currently revolve around forming strategic partnerships between technology developers, cultural institutions, and major travel aggregators to ensure content accuracy and broad deployment. Subscription models and B2B deployment services targeting municipal tourism boards and theme park operators are proving highly effective revenue streams, moving the market away from purely consumer-facing applications. The trend toward hyperlocal, data-driven content delivery is compelling market participants to invest heavily in machine learning capabilities to anticipate visitor needs and deliver hyper-relevant narratives, thereby increasing dwell time and overall visitor satisfaction.

Regionally, North America and Europe currently dominate the market due to high digital literacy, established tourism infrastructure, and significant historical investment in smart city initiatives. However, the Asia Pacific region, particularly countries like China, India, and South Korea, is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is attributed to rapid urbanization, massive investments in 5G network expansion, and a burgeoning middle class with disposable income increasingly seeking high-tech travel experiences. Governments in APAC are actively leveraging smart guides to manage large volumes of domestic and international tourists efficiently, especially around major cultural events and heritage sites.

Segment-wise, the Software component segment, particularly cloud-based platforms and mobile applications, holds the largest market share and is expected to maintain its dominance. Within technology, Augmented Reality (AR) solutions are poised for exponential growth, driven by consumer enthusiasm for immersive overlays that merge digital information with the physical environment. The application segment sees Historical and Cultural Sites as the leading end-use category, followed closely by Urban Sightseeing and Theme Parks, where the ability to provide real-time queue management and interactive storytelling is paramount. The increasing adoption of AI for dynamic content generation and real-time translation represents a significant segment trend improving cross-border travel accessibility.

AI Impact Analysis on Smart Scenic Guide Market

User inquiries regarding the impact of Artificial Intelligence on the Smart Scenic Guide Market frequently center on themes of hyper-personalization, the accuracy and contextual relevance of real-time information, and the potential for AI to displace human guides while simultaneously enhancing the educational depth of experiences. Common questions revolve around how AI handles instantaneous language translation, how machine learning models curate unique itineraries for individual users based on ephemeral data (like current weather or crowd levels), and the ethical implications of data privacy given the level of personal tracking involved. The overarching user expectation is that AI should provide a guide experience that is intuitive, predictive, and significantly superior to traditional methods, offering bespoke narratives that adapt dynamically to the user’s pace and interests.

The strategic deployment of AI algorithms is fundamentally transforming the market by shifting the focus from static databases to dynamic content delivery systems. AI enables semantic search capabilities, allowing users to ask complex, natural-language questions about a site and receive contextually accurate answers, mimicking the interaction with an expert human guide. Furthermore, predictive analytics powered by AI allows operators to forecast visitor density, optimize routing within a site to prevent bottlenecks, and personalize the duration of visits to specific exhibits based on observed user engagement data. This capability significantly enhances the operational efficiency of sites and drastically improves the visitor flow management, which is crucial in high-traffic tourist destinations globally.

Crucially, AI’s role extends to generating unique, adaptive narratives. Unlike programmed guides, AI systems can synthesize information from vast historical and cultural datasets to generate novel interpretations and connections, tailoring the depth and complexity of the information based on the user’s stated expertise or demographic profile. This deep personalization ensures that a first-time visitor receives accessible foundational knowledge, while a history enthusiast is provided with intricate details and academic sources. This capability is instrumental in future-proofing scenic guide solutions against content stagnation and reinforcing the market's value proposition as a necessity rather than a mere novelty in modern tourism infrastructure development.

- AI facilitates hyper-personalized itinerary creation and content curation based on user behavior and real-time location.

- Machine learning algorithms enable sophisticated semantic search and natural language processing (NLP) for interactive questioning.

- Real-time translation services powered by AI significantly break down language barriers for international tourism.

- Predictive analytics optimize visitor flow, crowd management, and resource allocation within high-traffic scenic areas.

- AI supports dynamic content generation, ensuring narratives are always current, relevant, and culturally sensitive.

- Computer vision and object recognition enhance AR overlays, accurately identifying landmarks and providing instant context.

DRO & Impact Forces Of Smart Scenic Guide Market

The Smart Scenic Guide Market growth is powerfully driven by the escalating global demand for personalized and immersive tourism experiences, catalyzed by pervasive mobile device ownership and widespread high-speed internet connectivity, particularly 5G deployment. Market dynamics are further influenced by technological advancements in AR and VR, which offer highly engaging and educational storytelling methods that traditional guides cannot match. Government backing for digital preservation initiatives and smart tourism policies in major tourist destinations acts as a significant external force propelling the adoption of these modern guiding systems, ensuring market momentum remains high throughout the forecast period.

However, the market faces significant restraints that challenge widespread deployment and mass adoption. Primary among these is the high initial cost associated with developing, integrating, and maintaining sophisticated hardware and software systems, which particularly affects smaller cultural institutions and heritage sites with limited operational budgets. Furthermore, concerns regarding data privacy and security, given the collection of detailed user location and behavioral data, remain a major barrier to consumer trust. Content quality assurance and the necessity for constant updates to maintain relevance and accuracy present ongoing operational hurdles that providers must consistently address to sustain market confidence and competitive edge.

Opportunities within the Smart Scenic Guide Market are substantial, particularly in untapped segments such as eco-tourism and adventure travel, where location-aware safety and guidance systems are critically valuable. Expansion into corporate and educational tourism (field trips, academic tours) represents a fertile ground for market penetration, leveraging AI capabilities for curriculum-aligned content delivery. Furthermore, the development of standardized, scalable Software as a Service (SaaS) platforms and integration with existing municipal tourism applications will lower the barrier to entry for smaller clients, dramatically expanding the total addressable market and driving innovation in user interface design and content delivery modalities.

Segmentation Analysis

The Smart Scenic Guide Market is comprehensively segmented based on Component, Technology, Application, and End-User, providing a detailed view of the varied adoption patterns and revenue streams within the industry. The Component segmentation separates the high-value proprietary Software platforms from the necessary underlying Hardware (like specialized IoT beacons or AR wearables) and the ongoing Services (such as content management, maintenance, and consulting). Technology segmentation highlights the reliance on core enablers like AI/Machine Learning for personalization and GPS/IoT for location accuracy, differentiating solutions based on their complexity and capability.

Analyzing the market by Application reveals the diversity of deployment environments, ranging from tightly controlled indoor spaces like museums to sprawling outdoor environments such as national parks and historical ruins. This segmentation is crucial as content requirements, bandwidth needs, and hardware ruggedness vary significantly between application types. Finally, the End-User segmentation distinguishes between individual tourists (B2C), tour operators, government agencies, and specific educational institutions (B2B/B2G), illustrating where the largest procurement budgets reside and identifying the key decision-makers driving institutional adoption of smart guide solutions across the globe.

Segmentation by Component

The Component segment is fundamentally divided into Software, Hardware, and Services. The Software segment typically accounts for the largest market share due to its flexibility, scalability, and the high intellectual property value associated with proprietary algorithms and content management systems. This segment includes mobile applications, cloud-based content delivery networks (CDNs), and AI-driven personalization engines. The core competitive advantage here lies in the robustness of the Content Management System (CMS), which allows cultural institutions to easily update multimedia assets, refine narratives, and integrate real-time operational data, such as exhibit closures or directional changes.

The Hardware segment encompasses the physical infrastructure required for deployment, which may include dedicated proprietary devices (e.g., audio guides, handheld scanners), IoT sensors, beacons, and specialized AR glasses. While often less flexible than software, this segment is critical for providing location-specific, highly accurate information, especially in environments where GPS signals are weak or non-existent, such as deep inside historical buildings or underground caves. The trend in hardware is towards smaller, more durable, and energy-efficient devices, capable of seamless integration with personal smartphones via Bluetooth Low Energy (BLE) or Wi-Fi.

The Services segment includes content creation, application maintenance, technical support, and data analytics consulting. As the complexity of smart guides increases, demand for expert services to manage and interpret visitor data (e.g., foot traffic patterns, popular points of interest) grows proportionally. This segment is highly reliant on recurring revenue models and long-term contracts, providing stable financial foundations for service providers. Furthermore, bespoke content localization and multilingual adaptation services are vital for major tourist destinations seeking to cater effectively to a diverse international audience, ensuring cultural sensitivity and linguistic accuracy.

- Software (Mobile Applications, Content Management Systems, AI Platforms)

- Hardware (Audio Devices, IoT Beacons, AR/VR Headsets, GPS Receivers)

- Services (Content Creation and Management, Technical Support, Data Analytics Consulting)

Segmentation by Technology

The Technology segment is dominated by the synergistic deployment of Artificial Intelligence (AI) and Machine Learning (ML), Global Positioning System (GPS), Internet of Things (IoT), and Augmented Reality (AR) or Virtual Reality (VR). AI and ML are the intelligence layer, responsible for processing user data, identifying behavioral patterns, and dynamically generating personalized routes and narratives. This technology moves the guide from being a passive database to an active, predictive companion, substantially improving user engagement and the perceived value of the solution.

GPS and IoT form the critical localization layer. GPS handles broad outdoor positioning, while IoT devices, such as Bluetooth beacons and RFID tags, provide high-precision indoor navigation and proximity awareness, ensuring content is triggered exactly when the user is standing in front of the relevant landmark or exhibit. The accuracy of this geolocation technology is paramount, as misfires can lead to significant user frustration and reduce trust in the system. The continuous improvement in sensor technology and battery longevity is bolstering the efficacy of the IoT components in complex architectural environments.

Augmented Reality (AR) and, to a lesser extent, Virtual Reality (VR) represent the experiential layer. AR overlays digital information, 3D reconstructions, or historical imagery directly onto the user's real-world view via their smartphone or specialized glasses. This capability is exceptionally powerful for showcasing ruined historical sites, demonstrating historical events, or providing visual context that is otherwise lost. VR, while more niche, is utilized for pre-visit experiences or for immersive deep dives into areas inaccessible to the public, such as restricted archaeological zones, providing unique value for educational and high-tier tourism offerings.

- Artificial Intelligence (AI) and Machine Learning (ML)

- Augmented Reality (AR) and Virtual Reality (VR)

- GPS and Geolocation Services

- Internet of Things (IoT) and Beacons

- Cloud Computing and Data Analytics

Segmentation by Application

The Application segment highlights where Smart Scenic Guides deliver the most impact. Historical and Cultural Sites, including museums, art galleries, and UNESCO World Heritage locations, represent the largest and most mature application area. These sites often possess dense, high-value content that benefits immensely from personalized, interactive delivery, helping visitors navigate complex exhibits and understand intricate historical narratives without the need for constant human intervention or cumbersome signage, thereby improving operational efficiency.

Urban Sightseeing and City Tours constitute another major application area, where smart guides replace traditional bus tours or static self-guided routes. In this context, the guides leverage GPS and real-time data integration to provide dynamic walking tours, public transit directions, and recommendations for dining or local events. The ability to integrate with third-party ticketing and booking systems adds substantial commercial value to these city-based applications, supporting local economies and offering convenience to the traveler.

Furthermore, Theme Parks and Entertainment Complexes are rapidly adopting smart guides for enhanced visitor management. Applications here focus heavily on operational efficiency, offering real-time queue times, personalized ride suggestions based on group demographics, and interactive maps. In this high-volume environment, the smart guide acts less as an educator and more as a powerful navigational and time-saving tool. National Parks and Wilderness Areas use these guides primarily for wayfinding, safety alerts, and providing geo-referenced information about ecology, wildlife, and required permits, often functioning offline due to connectivity limitations.

- Historical and Cultural Sites (Museums, Monuments, Heritage Locations)

- Urban Sightseeing and City Tours

- Theme Parks and Entertainment Complexes

- National Parks and Wilderness Areas (Eco-Tourism)

- Educational and Academic Tours

Segmentation by End-User

The End-User segment is categorized primarily into Individual Tourists, Tour Operators, and Government & Heritage Agencies. Individual Tourists represent the primary consumer base (B2C), driving demand for user-friendly mobile applications and downloadable content. Their purchasing decisions are highly influenced by ease of use, content quality, and affordability. The shift towards independent, flexible travel post-pandemic has reinforced the reliance of this segment on digital self-guided solutions, bypassing traditional group tour formats.

Tour Operators and Travel Agencies (B2B) are adopting smart guides to differentiate their service offerings, especially high-end luxury tours. By integrating sophisticated digital guides into their packages, operators can offer a premium, bespoke experience while reducing reliance on costly human guides in every location. This integration often involves white-label solutions that align the digital guide's branding and content directly with the operator's curated itinerary, providing a seamless and highly professional experience.

Government Agencies, Municipalities, and Heritage Preservation Bodies (B2G) represent substantial institutional clients. These entities purchase smart guide solutions not just for visitor experience improvement but also for cultural asset management, large-scale data collection on visitor movements, and compliance with accessibility regulations (e.g., providing audio description services). These contracts are typically large, long-term deployments that require high security and extensive customization, often incorporating multiple sites across a jurisdiction, establishing a crucial, stable revenue foundation for key market players.

- Individual Tourists (B2C)

- Tour Operators and Travel Agencies (B2B)

- Government Agencies and Municipalities

- Cultural Institutions and Heritage Site Managers (B2G)

- Educational Institutions

Value Chain Analysis For Smart Scenic Guide Market

The value chain for the Smart Scenic Guide Market is complex, beginning with upstream activities focused on content creation and foundational technology development, flowing through middleware integration and platform deployment, and concluding with downstream consumer engagement and service delivery. Upstream analysis involves highly specialized activities such as historical research, digitization of cultural assets, 3D modeling for AR applications, and the development of core software algorithms (AI/ML). Key players at this stage include specialized historical consultants, digital archiving firms, and advanced technology providers supplying the core hardware components like high-precision GPS units and low-power IoT chips.

Midstream activities center on platform development and integration. This involves combining the upstream content and technology into a functional, user-friendly application, managed via a robust, scalable cloud infrastructure. Smart guide providers focus on creating efficient Content Management Systems (CMS) and ensuring interoperability between diverse operating systems (iOS and Android). Distribution channels are predominantly direct-to-consumer via global app stores (indirect) and direct-to-institution via B2B licensing agreements (direct). The indirect channel, relying on Google Play and Apple App Store, generates high volume but lower margin per transaction, while the direct channel, focusing on cultural institutions and government contracts, yields high-value, long-term recurring revenue.

Downstream activities involve service delivery, maintenance, and consumer feedback loops. This phase ensures the continuous quality and accuracy of the guide, utilizing real-time analytics to understand user behavior, troubleshoot technical issues remotely, and plan necessary content updates. Service providers often offer ongoing technical support and consulting to site managers, helping them interpret visitor data for better site management. The effectiveness of the overall value chain is highly dependent on seamless collaboration between content creators and technology integrators to ensure the final product is both historically accurate and technologically flawless, maximizing visitor satisfaction and operational efficiency.

Smart Scenic Guide Market Potential Customers

The primary potential customers and end-users of Smart Scenic Guides span the entire global tourism and heritage ecosystem, seeking advanced digital tools to improve visitor engagement and operational management. The largest institutional buyers are Government Ministries of Culture, National Park Services, and City Tourism Boards, which require scalable, reliable platforms for managing vast public assets and providing accessible information to diverse populations. These organizations prioritize features such as multilingual support, ADA compliance, and robust data collection capabilities for infrastructure planning and funding justification.

Another crucial customer segment is private operators, including global Theme Park conglomerates, major hotel chains offering concierge-guided experiences, and private museum foundations. These commercial entities focus on guides that enhance the premium feel of their offering, utilizing features like exclusive content, personalized recommendations that drive retail spending, and integration with loyalty programs. For these customers, the return on investment (ROI) is measured by increased visitor satisfaction scores and higher on-site spending, making seamless integration with existing Point of Sale (POS) and reservation systems mandatory.

Finally, educational institutions, from primary schools to universities, represent an emerging but high-potential customer base. They utilize smart guides as interactive learning tools for field trips and remote education, demanding content that aligns with educational standards and offers interactive quizzes or assignments. This segment requires solutions that are easily managed by educators and provide analytical insights into student engagement, thereby justifying the investment as a modern pedagogical tool rather than just a leisure accessory.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion USD |

| Market Forecast in 2033 | $21.5 Billion USD |

| Growth Rate | 20.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google, Microsoft, Apple, TripAdvisor, VoiceMap, Guidefari, Vamoos, GetyourGuide, SmartGuide, TourSphere, CultureSpots, izi.TRAVEL, Museums.Digital, Field Trip (Niantic), Sygic Travel. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Scenic Guide Market Key Technology Landscape

The technological backbone of the Smart Scenic Guide Market is highly sophisticated, relying on the convergence of several high-growth domains, fundamentally shifting the user experience from passive listening to active engagement. Central to this landscape is the application of advanced geolocation services, primarily GPS coupled with indoor localization technologies such as Bluetooth Low Energy (BLE) beacons and Ultra-Wideband (UWB) tracking. This combination ensures centimeter-level accuracy, crucial for triggering relevant content precisely when the user approaches an exhibit or landmark, overcoming the long-standing issue of inaccurate positioning in dense urban or interior environments.

Artificial Intelligence and Machine Learning (AI/ML) form the intelligence layer, moving beyond simple data retrieval. AI is critical for predictive analytics, learning from aggregated user paths and preferences to dynamically optimize routes and suggest points of interest (POIs) that align with individual user profiles. Furthermore, ML powers Natural Language Processing (NLP) capabilities, enabling sophisticated voice-based interactions and real-time translation, which dramatically broadens the guide's accessibility. The integration of generative AI models is now being explored to create adaptive, context-sensitive storytelling, allowing the guide's narrative to evolve based on the user's real-time mood and level of engagement.

Augmented Reality (AR) technology, delivered predominantly through mobile device cameras but increasingly via specialized wearable hardware, is perhaps the most transformative technological force. AR allows digital overlays—such as 3D reconstructions of ancient buildings, informational graphics, or historical figures—to be seamlessly integrated into the physical world view, offering an immersive educational experience. The rapid deployment of 5G infrastructure is paramount here, as AR applications require massive bandwidth and extremely low latency to deliver smooth, high-fidelity visual experiences without lag, making the guide a truly responsive tool rather than a slow-loading application, thus solidifying its long-term viability in modern tourism infrastructure planning.

The role of cloud computing and edge computing is also significant. Cloud platforms provide the scalability required to host massive databases of high-resolution multimedia content and handle millions of concurrent user sessions globally. However, for remote or high-latency environments (like national parks or isolated historical sites), edge computing solutions are becoming essential, allowing key content and localization data to be processed locally on dedicated site servers. This hybrid approach ensures reliability and performance across all deployment environments, regardless of external connectivity constraints, ensuring that the smart guide remains operational and responsive even in challenging geographical conditions.

Regional Highlights

- North America: This region holds a significant market share, driven by rapid technology adoption, high consumer digital literacy, and strong investment in cultural tourism infrastructure, particularly in major urban centers and national parks. The market here is characterized by the presence of large tech giants and a focus on high-value B2G contracts for city-wide smart guide deployments and specialized AR experiences in large museums.

- Europe: Europe represents a mature market due to its high density of historical sites, UNESCO heritage locations, and established tourism flows. Market growth is heavily influenced by EU funding for cultural preservation and smart tourism initiatives. The region leads in the adoption of multilingual support and stringent data privacy regulations (GDPR), pushing providers to develop highly secure and compliant platforms.

- Asia Pacific (APAC): Expected to register the highest CAGR, APAC is a massive growth engine powered by 5G expansion, massive domestic tourism markets (China, India), and significant government investment in smart city development. The demand here is driven by large-scale applications for crowd management in metropolitan sightseeing and massive theme park complexes, emphasizing AI-driven real-time solutions.

- Latin America (LATAM): The LATAM market is emerging, with adoption concentrated in key historical and natural tourist destinations like Mexico, Brazil, and Peru. Growth is currently constrained by varying levels of digital infrastructure but presents substantial opportunities for mobile-first, cost-effective smart guide solutions tailored for cultural and eco-tourism sectors.

- Middle East and Africa (MEA): This region is characterized by targeted, high-profile investments, particularly in the UAE and Saudi Arabia, driven by major national development visions (e.g., Saudi Vision 2030) aiming to diversify economies through tourism. The market focuses on leveraging cutting-edge technology like high-fidelity VR and AR for showcasing modern architectural marvels and rapidly developing historical sites.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Scenic Guide Market.- Google LLC (USA)

- Microsoft Corporation (USA)

- Apple Inc. (USA)

- TripAdvisor (USA)

- GetYourGuide (Switzerland)

- VoiceMap (South Africa)

- Vamoos (UK)

- SmartGuide (Czech Republic)

- izi.TRAVEL (Netherlands)

- Guidefari (USA)

- TourSphere (USA)

- CultureSpots (USA)

- Sygic Travel (Slovakia)

- Guggenheim Digital (In-house technology)

- Field Trip (Niantic) (USA)

- Museums.Digital (Germany)

- Locatify (Iceland)

- Focusrite (UK)

- Audioguideme (Spain)

- Esri (USA)

Frequently Asked Questions

Analyze common user questions about the Smart Scenic Guide market and generate a concise list of summarized FAQs reflecting key topics and concerns.How does AI personalize the Smart Scenic Guide experience for individual users?

AI algorithms analyze user input, browsing history, real-time location, and time constraints to dynamically adjust the suggested route, the depth of historical information provided, and the pace of the narration, ensuring the content is highly relevant and customized to the individual’s interests and learning style.

What is the primary difference between a Smart Scenic Guide and a traditional audio guide?

A traditional audio guide offers static, pre-recorded content triggered by manual entry, whereas a Smart Scenic Guide uses GPS, IoT beacons, and AI for real-time, context-aware content delivery, incorporating interactive features, dynamic routing, and visual AR overlays.

Are Smart Scenic Guides capable of functioning in remote areas without internet connectivity?

Yes, many advanced Smart Scenic Guide applications offer offline mode capabilities. Users can download essential maps, content, and localization data prior to their visit, allowing core navigation and multimedia playback functions to operate fully in remote national parks or underground sites.

What are the main security concerns regarding the use of these guides?

The primary security concerns revolve around data privacy (the collection and storage of user location and behavioral data) and the protection of proprietary cultural content from piracy. Providers must adhere strictly to international data protection regulations like GDPR and ensure robust encryption protocols.

Which technological component drives the most immersive experience in the Smart Scenic Guide Market?

Augmented Reality (AR) technology is the key driver of immersion, as it overlays digital reconstructions, historical context, and interactive elements directly onto the user's real-world view via their mobile device or dedicated headset, creating a richer, more engaging visual connection to the site.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager