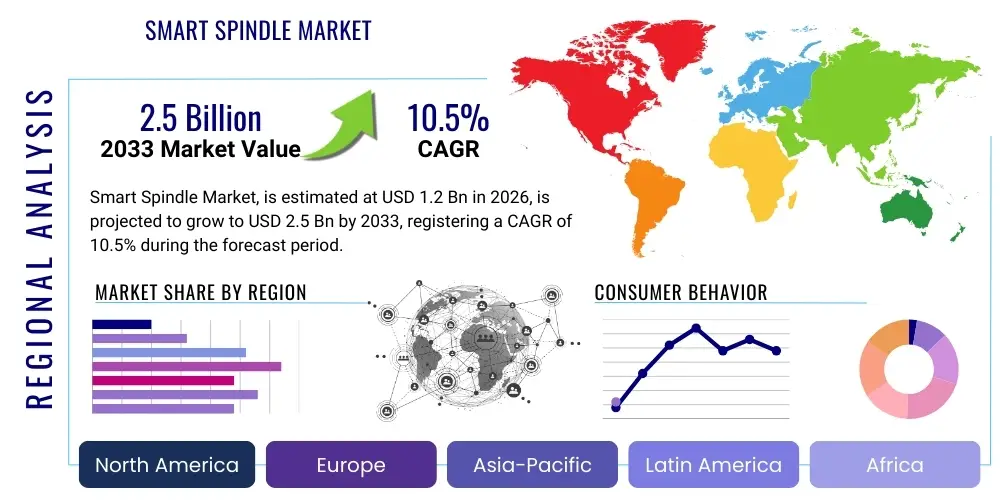

Smart Spindle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439136 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Smart Spindle Market Size

The Smart Spindle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.5 Billion by the end of the forecast period in 2033.

Smart Spindle Market introduction

The Smart Spindle Market encompasses sophisticated machine tool components integrated with advanced sensing, monitoring, and communication capabilities necessary for optimizing metal removal and material processing operations in modern manufacturing. These spindles transcend conventional mechanical functionality by incorporating sophisticated sensor arrays, embedded microprocessors, and secure communication modules, effectively serving as intelligent data collection nodes within the machine tool structure. The primary objective is to facilitate highly accurate, real-time assessment of operational health, which includes parameters such as thermal expansion, dynamic load distribution, bearing integrity, and tool interface conditions. This technology transforms standard machining centers into proactively managed assets, vital for maintaining tight tolerances and improving overall process reliability, particularly in demanding sectors requiring stringent quality control and maximum equipment uptime.

The core product offering is defined by its ability to perform in-situ diagnostics. Smart spindles utilize advanced sensor fusion techniques—combining input from accelerometers, proximity sensors, thermocouples, and acoustic emission sensors—to build a comprehensive profile of the spindle's operating condition. Key applications span high-speed milling, turning, grinding, and specialized multi-axis subtractive manufacturing across diverse industrial environments. Benefits derived from deploying smart spindles are substantial, including significantly reduced mean time to repair (MTTR) and enhanced mean time between failures (MTBF). Furthermore, the real-time data feedback loop allows for precise optimization of cutting parameters, which directly translates to improved surface finish quality, extended cutting tool life, and substantial reductions in energy consumption by operating the spindle at its optimized performance curve, thereby driving profitability in high-capital expenditure environments.

Market expansion is robustly driven by several macro-industrial factors. The global imperative for implementing Industry 4.0 principles, which necessitates data connectivity and cyber-physical systems, places smart spindles at the center of manufacturing digitalization efforts. The continuous rise of complex material processing (e.g., composites, high-nickel alloys) in sectors like aerospace and medical implants mandates superior process monitoring that only smart systems can reliably provide. Additionally, persistent challenges related to labor shortages, particularly for specialized machine maintenance technicians, escalate the attractiveness of automated, self-diagnostic components. Manufacturers are increasingly recognizing that the long-term operational savings derived from proactive failure prevention and optimized performance far outweigh the initial capital investment in smart technology, securing its position as an indispensable component of future production lines.

Smart Spindle Market Executive Summary

The global Smart Spindle Market is currently experiencing a phase of high integration and technological convergence, strongly influenced by the broader digital transformation across manufacturing industries. Key business trends highlight a shift towards offering integrated software platforms bundled with the hardware, focusing on user-friendly dashboards and cloud compatibility for fleet management and cross-site benchmarking. Competition is increasingly focused on the sophistication of the predictive algorithms, specifically the ability of the system to differentiate between process-related vibration (chatter) and mechanical failure signatures (bearing defects). Strategic consolidation, through mergers and acquisitions (M&A) between traditional machine tool component suppliers and specialized software analytics firms, is a defining characteristic of the evolving competitive landscape, aimed at creating comprehensive, vertically integrated smart solutions.

Regional dynamics illustrate a stark contrast between high-volume manufacturing hubs and technologically advanced, high-value manufacturing centers. Asia Pacific leads in capacity expansion and adoption velocity, leveraging smart spindles to enhance efficiency in massive production lines for electronics and electric vehicles. Meanwhile, North America and Western Europe maintain their leadership in pioneering technological deployment, demanding customized solutions with extremely high data fidelity for sensitive applications like defense and semiconductor manufacturing. Investment in 5G infrastructure in these Western regions is accelerating the feasibility of real-time, closed-loop control systems, moving diagnostic systems from mere monitoring to active, autonomous adjustment capabilities. The varying regional standards for data governance and connectivity resilience also dictate the market entry strategies for international vendors.

Segmentation trends confirm the increasing acceptance of retrofit solutions, catering to the large installed base of legacy CNC machines globally. This segment provides substantial market opportunity, especially for third-party sensor integration specialists. Concurrently, the OEM segment continues to push the boundaries of performance, integrating smart features into ultra-high-speed spindles (exceeding 60,000 RPM) necessary for intricate micro-machining. Material segmentation shows a growing need for application-specific smart spindles designed explicitly for processes involving difficult materials, where thermal deformation and excessive tool wear are critical issues. The focus remains heavily on improving the signal-to-noise ratio in data acquisition to ensure AI models deliver reliable, prescriptive instructions rather than simple diagnostic alerts.

AI Impact Analysis on Smart Spindle Market

User inquiries surrounding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Smart Spindle Market center on achieving unprecedented levels of automation and prognostic accuracy. Users frequently ask about the capabilities of deep learning models to predict bearing failure months in advance, the reliability of AI in diagnosing multi-fault scenarios, and the system's ability to learn and adapt to different machining schedules and materials without extensive manual intervention. The analysis indicates a strong market demand for AI systems that can seamlessly transition from merely recognizing patterns to issuing prescriptive commands—such as advising a specific bearing replacement date or automatically adjusting operational RPM to mitigate current imbalance—thereby realizing the true potential of autonomous manufacturing units. Key user expectations involve overcoming the limitations of fixed-threshold monitoring systems and achieving truly zero-downtime operations through intelligent, self-correcting spindle performance management.

AI algorithms are foundational to interpreting the massive, high-frequency datasets generated by smart spindles. Traditional condition monitoring relies on basic metrics (e.g., RMS velocity), which often fail to detect subtle, non-linear degradation. AI employs techniques such as spectral analysis and feature extraction from raw time-series data, identifying complex correlations between multiple sensor readings (temperature spikes, subtle frequency shifts in vibration, and acoustic changes) that human analysts or simpler software might miss. This advanced processing is critical for detecting early signs of common spindle failures, including lubrication breakdown, race wear, or dynamic runout issues. By training on vast historical datasets of both healthy and failed components, AI models achieve superior accuracy in determining the remaining useful life (RUL) of the spindle.

Beyond prediction, AI enables advanced adaptive machining control. When a smart spindle detects a vibration pattern indicating tool chatter—a frequent cause of poor surface finish and rapid tool wear—the integrated AI system can calculate the optimal adjustment parameters (speed, feed, depth of cut) and communicate them back to the CNC controller in milliseconds. This dynamic, closed-loop process ensures that the spindle constantly operates within its most stable and efficient envelope, maximizing material removal rate while minimizing damaging loads. The increasing computational power available at the edge (embedded in the machine tool) allows these complex AI inferences to be performed locally, eliminating reliance on external networks and ensuring reliability in high-stakes manufacturing operations where instantaneous response is paramount.

- AI-driven predictive maintenance significantly reduces unplanned machine downtime by accurately forecasting component failure.

- Machine Learning models optimize spindle rotational speed and feed rate based on real-time chatter and vibration analysis, improving surface finish and tool life.

- Deep learning algorithms enable enhanced fault signature recognition, differentiating critical mechanical anomalies from routine process noise and cutting forces with high precision.

- AI facilitates adaptive control, allowing smart spindles to self-adjust machining parameters for optimal material removal rates and thermal stability during complex cuts.

- Integration with cloud-based AI platforms allows for fleet-wide performance benchmarking, enabling manufacturers to centrally manage and optimize thousands of spindles globally.

- Reinforcement Learning is being explored to achieve autonomous optimization of machining processes for efficiency and longevity, minimizing energy consumption under variable load.

- AI enhances data security and integrity by monitoring access patterns and identifying potential compromises within the industrial control network, crucial for proprietary manufacturing data.

- Automated root cause analysis using AI dramatically accelerates troubleshooting processes, reducing the reliance on highly specialized maintenance personnel.

- AI supports dynamic thermal compensation, adjusting for heat-induced dimensional changes in the spindle structure to maintain micron-level accuracy throughout prolonged operations.

DRO & Impact Forces Of Smart Spindle Market

The dynamics of the Smart Spindle Market are governed by powerful drivers (D) related to industrial transformation, restrained (R) by implementation challenges, and fueled by significant technological opportunities (O), creating complex impact forces (I). The most compelling driver is the accelerating requirement for increased overall equipment effectiveness (OEE) in capital-intensive industries. As machine tool utilization rates increase and competition stiffens, manufacturers cannot afford prolonged, unscheduled downtime. Smart spindles directly address this by ensuring proactive intervention, making them a strategic investment rather than a discretionary upgrade. Furthermore, regulatory pressures in industries like medical devices and aerospace mandate comprehensive process monitoring and data logging for compliance and traceability, inherently favoring smart components capable of continuous, verifiable data generation.

However, market expansion faces notable restraints, primarily concerning the substantial financial outlay required for advanced smart spindle systems, which can be 20% to 40% higher than traditional counterparts, posing a major barrier for smaller manufacturers. Beyond the initial cost, the scarcity of industrial data scientists and maintenance technicians skilled in interpreting complex AI outputs and managing IIoT infrastructure presents a significant operational bottleneck. Cybersecurity also remains a pervasive restraint; connecting high-value production assets to external networks introduces risks of intellectual property theft or operational sabotage, requiring substantial investment in secure communication protocols and robust data management frameworks, which complicates rapid deployment.

Opportunities for growth are strategically aligned with the large-scale industrial need for modernization. The development of standardized, low-cost sensor packages and wireless connectivity solutions is making smart spindle retrofit kits increasingly accessible and cost-effective for legacy machinery, expanding the potential customer base dramatically. Moreover, technological advancements, such as the commercialization of reliable 5G networks and increasingly powerful edge computing capabilities, promise to unlock truly real-time, closed-loop control systems, moving smart spindles beyond mere diagnostics and into autonomous operational management. This convergence positions the market for a rapid transition from specialized high-end deployment to mainstream industrial application. The core impact force driving the market forward is the undeniable and measurable return on investment (ROI) derived from minimized unplanned downtime and substantial increases in overall productivity and throughput quality, which transforms the technology from a desirable feature into a competitive necessity.

Segmentation Analysis

The Smart Spindle Market is meticulously segmented across various technical and application dimensions to capture the diversity of demands within the manufacturing sector. The primary cleavage exists between the core hardware components, which include the spindle chassis, bearings, motor, and integrated sensor suite (vibration, thermal, acoustic), and the crucial software and service segment. The latter encompasses the sophisticated data acquisition software, predictive modeling algorithms, visualization dashboards, and the ongoing subscription services required for continuous AI model tuning and data hosting. Understanding this distinction is vital, as software revenue streams are often recurring and offer higher margins compared to the one-time sale of high-cost hardware units, influencing vendor business models heavily.

A critical market segmentation is based on the integration status: Original Equipment Manufacturer (OEM) integrated solutions versus aftermarket Retrofit solutions. OEM integration ensures optimal sensor placement, data routing, and seamless communication with the CNC controller, typically leading to superior performance in new high-end machines. Conversely, the Retrofit segment addresses the enormous global installed base of older, non-smart machine tools. Retrofit kits are easier to install and offer a lower entry point, enabling manufacturers with budgetary constraints to incrementally adopt Industry 4.0 capabilities. The choice between these two segments depends heavily on the end-user’s existing asset depreciation schedule, capital availability, and performance requirements.

Furthermore, segmentation by end-user industry dictates specific spindle requirements. Aerospace demands specialized high-torque, high-rigidity spindles for processing tough materials, where thermal stability monitoring is paramount. The Electronics industry requires ultra-high-speed (UHS) spindles for micro-machining, where sensor miniaturization and extremely low-vibration operation are key design drivers. By segmenting the market based on RPM (low, medium, high, ultra-high) and application, manufacturers can tailor their offerings to meet the unique performance envelope and durability standards of each specific industrial vertical, ensuring optimal product-market fit and maximizing technical efficiency for the user.

- By Type of Component:

- Hardware (Spindle Unit, High-Precision Bearings, Integrated Sensors, Encoders, Actuators, Inverters)

- Software & Services (Data Analytics Platforms, Cloud Connectivity Modules, Predictive Maintenance Software Licenses, Remote Monitoring Services)

- By Spindle Technology:

- Motorized Spindles (Integrated Motor)

- Belt-driven Spindles (External Motor)

- By Integration Status:

- OEM Integrated Solutions (Factory-fitted into new CNC machines)

- Retrofit Solutions (Aftermarket sensor kits and external monitoring systems for existing machines)

- By End-User Industry:

- Automotive & Transportation (Including next-generation EV component manufacturing)

- Aerospace & Defense (High-nickel alloy and composite machining)

- Medical Devices (Micro-machining and regulatory traceability)

- Electronics & Semiconductor (Ultra-high-speed PCB and component processing)

- Heavy Machinery & Construction

- Energy Sector (Turbine components, specialized drilling equipment)

- By Spindle Speed:

- Low Speed (Below 10,000 RPM, typically used in heavy-duty applications)

- Medium Speed (10,000 RPM - 30,000 RPM, general purpose machining)

- High Speed (Above 30,000 RPM, used for fine finishing and small tool machining)

Value Chain Analysis For Smart Spindle Market

The Smart Spindle value chain begins with specialized upstream suppliers who provide the enabling technologies that make the spindle "smart." This includes high-precision component manufacturers supplying ceramic hybrid bearings for thermal stability and high RPM capability, as well as sophisticated sensor manufacturers focusing on miniaturization (MEMS accelerometers, fiber optic temperature sensors), necessary for integration within tight spindle constraints. Raw material quality, especially for spindle housing and shaft steel, is highly critical as even minor material inconsistencies can affect vibration readings and data fidelity. Upstream players must maintain exceptionally high quality standards and often collaborate closely with spindle integrators to ensure component compatibility and reliable sensor placement.

Midstream activity is dominated by the core manufacturing and integration phase performed by specialized spindle companies (e.g., Fischer, Kessler) and large machine tool builders (e.g., DMG Mori, Mazak). This phase involves the meticulous assembly, dynamic balancing, and electronic integration of sensors and processing units within the spindle chassis. Success in this stage requires mastery of mechatronics—the synergy between mechanics, electronics, and control systems. Crucially, the midstream phase includes developing proprietary algorithms for initial data filtering and baseline establishment, calibrating the smart spindle before it reaches the end-user. This requires extensive testing under simulated operational loads to ensure sensor data accuracy across the full operational envelope.

Downstream activities involve market reach, sales, and comprehensive post-sales support. The distribution channel is often segmented: large, high-volume sales to OEMs are typically direct, managed via long-term contracts guaranteeing standardized quality and delivery schedules. In contrast, sales to the aftermarket and smaller contract manufacturers rely heavily on a highly trained network of indirect distributors and system integrators. These partners are crucial for providing localized technical expertise, performing complex retrofits, and integrating the smart spindle's data output into the customer’s existing factory IT network. Significant downstream value is generated through recurring revenue streams from long-term service contracts that cover software updates, cloud hosting, advanced analytical support, and proactive maintenance consultation, ensuring continuous performance optimization for the end-user.

Smart Spindle Market Potential Customers

The primary cohort of potential customers for Smart Spindle technology comprises large-scale, high-utilization manufacturers within the automotive, aerospace, and energy sectors, where machine downtime results in disproportionately high economic losses. Automotive manufacturers, facing increasing pressure to produce complex, high-quality components for electric powertrains (e.g., stators, rotors, housings), require the reliability and precision offered by smart spindles to maintain high throughput and minimize defect rates in automated production lines. Similarly, aerospace manufacturers utilize smart technology to validate machining processes when handling expensive, difficult-to-cut superalloys, ensuring that every cutting pass adheres to rigorous safety and quality standards defined by aviation authorities.

Beyond these major industrial customers, potential buyers also include specialized contract manufacturers (job shops) focused on medical devices and semiconductor equipment components. Medical device manufacturing demands micron-level precision and verifiable process data for regulatory compliance, making smart spindle monitoring essential for traceability. Furthermore, organizations that manage substantial fleets of existing CNC machinery, irrespective of the sector, represent the core target market for retrofit smart spindle solutions. These customers prioritize maximizing the lifespan and efficiency of their installed asset base, utilizing smart technology as a cost-effective way to achieve Industry 4.0 benefits without replacing entire factory floors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.5 Billion |

| Growth Rate | CAGR 10.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens, SKF, Kirloskar Electric Company, Fagor Automation, DMG Mori, NSK, KUKA, FANUC Corporation, Bosch Rexroth, Heidenhain, Mazak Corporation, GMN Spindle Technology, Fischer Spindle Group, Colgar SpA, Kessler GmbH, AET Spindles, IBAG Spindle, Step-Tec AG, HSD SpA, Setco |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Spindle Market Key Technology Landscape

The technological core of the Smart Spindle Market revolves around highly reliable, embedded sensor technology and sophisticated signal processing. The fundamental shift is from external, periodic monitoring to continuous, internal sensing. Modern smart spindles incorporate multi-channel vibration analysis using micro-electro-mechanical systems (MEMS) accelerometers embedded close to the bearings. Crucially, thermal management is tracked via multiple thermocouples to monitor temperature gradients within the bearing and coil areas, enabling the system to compensate for thermal growth dynamically and prevent over-heating, which is the leading cause of premature spindle failure in high-speed applications. The accuracy of these sensors, often sampling data at rates exceeding 50 kHz, dictates the ultimate prognostic capability of the entire system.

A significant technological focus is placed on data acquisition and edge intelligence. Spindles are equipped with microprocessors capable of performing Fourier Transforms and statistical analysis locally. This edge computing approach filters raw data noise and extracts meaningful health indicators (features) before transmitting compressed data packets via industrial protocols like EtherCAT or PROFINET. This not only significantly reduces network load but, more importantly, ensures ultra-low latency necessary for immediate safety responses, such as emergency stops triggered by excessive, unstable vibration (chatter). This reliance on local processing is essential for systems where network connectivity cannot be guaranteed or where milliseconds of delay could compromise machining quality or spindle integrity.

Furthermore, the materials science supporting high-performance smart spindles is integral to the technology landscape. The utilization of high-stiffness, damping materials for spindle housing minimizes signal interference, ensuring accurate sensor readings. Ceramic hybrid bearings, which feature silicon nitride balls, are standard for their superior hardness, reduced friction, and thermal stability, allowing the spindle to sustain higher speeds and loads while minimizing wear that would confuse diagnostic algorithms. The advancements in motor and inverter technology, particularly the use of high-power density Permanent Magnet Synchronous Motors (PMSMs) coupled with advanced vector control, ensure that the mechanical adjustments prescribed by the smart diagnostic system (e.g., minute RPM changes) are executed with extremely high fidelity and responsiveness, reinforcing the closed-loop control required for truly adaptive machining.

Regional Highlights

The Asia Pacific (APAC) region continues to dominate the global Smart Spindle Market, driven by the sheer scale of its manufacturing base, particularly in China and India. China's industrial modernization strategies, aimed at transitioning from low-cost labor to high-quality, smart manufacturing (Industry 4.0), have necessitated massive investment in automated CNC equipment integrating smart components. South Korea and Japan, leaders in high-precision electronics and automotive technology, maintain high demand for advanced, ultra-high-speed smart spindles, focusing on minimizing tool wear in high-volume production. This region’s high growth rate is further supported by competitive pricing from local manufacturers and government subsidies promoting the digitalization of factory floors across key industrial clusters, fueling both new equipment purchases and extensive retrofit projects.

Europe represents the second-largest market by value, characterized by stringent demands for specialized, high-performance technology suitable for niche industries such as defense, luxury vehicles, and precision components. Germany, a global leader in machine tool production, acts as both a major consumer and a technological innovator in the smart spindle field, driving the adoption of standardized communication protocols like OPC UA for seamless factory integration. European demand is heavily influenced by the 'Green Manufacturing' movement, where smart spindles are valued for their ability to optimize energy consumption through real-time efficiency monitoring and adaptive speed control, contributing to compliance with regional sustainability targets and demonstrating long-term cost savings on energy expenditure.

North America maintains a strong position in the market, driven by high labor costs which necessitate maximum operational efficiency and minimal unscheduled downtime. The US market is defined by rapid adoption of cloud-connected, fleet management solutions, especially across geographically dispersed manufacturing sites involved in aerospace and heavy equipment production. The focus here is not only on predictive maintenance but also on cybersecurity, with manufacturers demanding robust, encrypted data transmission solutions to protect proprietary machining parameters and operational data. The emerging markets of Latin America and MEA are seeing gradual uptake, primarily focused on modernizing critical infrastructure sectors like mining, oil & gas, and basic metal fabrication, typically sourcing smart spindle technology through specialized international turnkey providers and system integrators.

- Asia Pacific (APAC): Dominates volume growth; driven by large-scale investments in automotive, electronics, and governmental manufacturing modernization policies (China, South Korea, India). Highest expected CAGR due to rapid industrial scale-up.

- Europe: High-value market focused on extreme precision, aerospace, specialized machinery, and adherence to Green Manufacturing mandates (Germany, Switzerland, Italy). Strong technological innovation from regional OEMs.

- North America: Significant segment driven by high labor costs, necessity for maximum operational uptime, strong defense spending, and early integration of secure IIoT frameworks and cloud analytics.

- Latin America (LATAM): Nascent but growing, primarily focused on automotive assembly and modernization of infrastructure-related manufacturing; relies heavily on technology imports and specialized integrators.

- Middle East & Africa (MEA): Smallest but exhibiting potential growth in strategic sectors (oil & gas, defense, infrastructure) as regional governments prioritize industrial diversification and technological adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Spindle Market.- Siemens

- SKF

- Kirloskar Electric Company

- Fagor Automation

- DMG Mori

- NSK

- KUKA

- FANUC Corporation

- Bosch Rexroth

- Heidenhain

- Mazak Corporation

- GMN Spindle Technology

- Fischer Spindle Group

- Colgar SpA

- Kessler GmbH

- AET Spindles

- IBAG Spindle

- Step-Tec AG

- HSD SpA

- Setco

Frequently Asked Questions

Analyze common user questions about the Smart Spindle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Smart Spindle Market?

The Smart Spindle Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period from 2026 to 2033, driven primarily by the global implementation of Industry 4.0 principles and predictive maintenance necessity.

How does Smart Spindle technology contribute to predictive maintenance?

Smart spindles use integrated sensor arrays (vibration, thermal, acoustic) and AI analytics to continuously monitor machine health, allowing manufacturers to anticipate specific mechanical failures and schedule maintenance proactively, thereby virtually eliminating unplanned machine downtime.

Which industry segment is the largest end-user of Smart Spindles?

The Automotive and Transportation sector, driven heavily by the rapid global transition to Electric Vehicle (EV) component manufacturing requiring high precision and volume, currently represents the largest and fastest-growing end-user segment for smart spindles.

Are Smart Spindles primarily used in new CNC machines or can they be retrofitted?

Both applications are critical: while OEM integrated solutions offer maximum performance in new machines, the market is significantly bolstered by retrofit solutions, which provide cost-effective upgrades for the vast installed base of existing, legacy CNC machinery globally.

What is the primary technical challenge hindering widespread Smart Spindle adoption?

The primary challenge involves overcoming the high initial capital expenditure required for advanced systems and the complexity of ensuring seamless, secure integration of high-frequency sensor data with diverse industrial control systems and cloud infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager