Smart Switch Garage Door System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437654 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Smart Switch Garage Door System Market Size

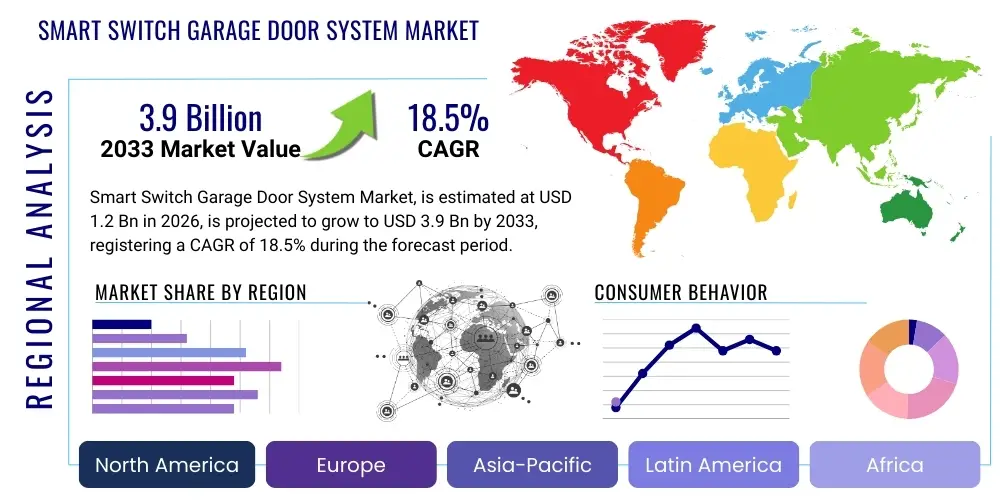

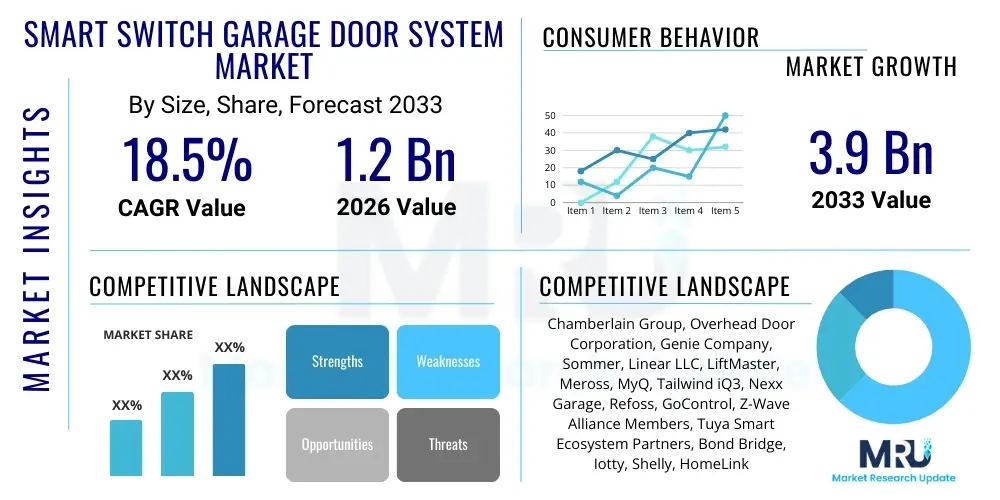

The Smart Switch Garage Door System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. This substantial growth is underpinned by the accelerating integration of IoT devices within residential and commercial infrastructures globally. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.9 Billion by the end of the forecast period in 2033. This trajectory reflects increasing consumer demand for enhanced home security, remote operational capabilities, and seamless integration with existing smart home ecosystems.

The valuation surge is directly linked to the continuous technological advancements in connectivity protocols, such as Wi-Fi 6 and Z-Wave, which enhance device reliability and reduce latency. Furthermore, the rising penetration of high-speed internet in emerging economies is broadening the consumer base capable of adopting these sophisticated connected systems. Market players are heavily investing in research and development to introduce user-friendly interfaces and robust security features, which further validates the high growth forecast for the coming years.

Smart Switch Garage Door System Market introduction

The Smart Switch Garage Door System Market encompasses devices and integrated solutions that enable the remote monitoring and control of garage door operations via smart devices, such as smartphones, tablets, or voice assistants. These systems utilize connectivity modules, including Wi-Fi, Bluetooth, and specialized smart home protocols (like Z-Wave or Zigbee), linked to existing garage door openers. The core product, the smart switch or controller, serves as the intermediary, translating digital commands into physical door movement, while providing real-time status updates regarding the door's position and security status.

Major applications for these systems span both residential and commercial sectors. In residential settings, they provide homeowners with unparalleled convenience and peace of mind through features like geo-fencing, scheduling capabilities, and instant notifications if the door is left open. Commercially, they are crucial for managing access control in small warehouses, fleet parking areas, and private business storage units, often integrating with comprehensive building management systems to streamline operations and enhance perimeter security protocols efficiently.

Key driving factors fueling market expansion include the overarching global trend towards smart homes and automated living environments. The substantial benefits derived from these systems—namely enhanced security through activity logging, energy efficiency via better insulation management, and considerable convenience—are compelling consumers to upgrade traditional systems. Additionally, advancements in sensor technology and the development of intuitive mobile applications have significantly lowered the barrier to entry for widespread consumer adoption, making these systems highly desirable across various demographic segments.

Smart Switch Garage Door System Market Executive Summary

The Smart Switch Garage Door System Market is positioned for robust expansion, characterized by rapid technological assimilation and broadening application scope. Business trends indicate a strong move toward platform integration, where standalone smart switches are evolving into interconnected components of broader smart security or home automation hubs, particularly those supporting major ecosystems like Amazon Alexa, Google Home, and Apple HomeKit. This shift requires strategic partnerships between device manufacturers and software platform providers to ensure seamless user experience and maximum interoperability, defining the competitive landscape through ecosystem strength rather than just hardware capability.

Regional trends highlight North America and Europe as the dominant markets, driven by high disposable incomes, mature smart home infrastructure penetration, and strict regulatory standards regarding residential security and access control. However, the Asia Pacific region is demonstrating the highest growth trajectory, spurred by rapid urbanization, increasing digitalization, and rising middle-class disposable income favoring smart device adoption in metropolitan areas. Investment in localized manufacturing and tailored connectivity solutions is crucial for capturing the nascent demand in these dynamic APAC markets.

Segmentation trends reveal that Wi-Fi enabled controllers currently hold the largest market share due to ease of installation and widespread router availability, although dedicated low-power mesh network technologies like Z-Wave and Zigbee are gaining traction due to superior reliability and integration capabilities within complex smart home setups. Furthermore, the residential segment remains the primary revenue generator, but the commercial sector is poised for accelerated growth, specifically within small-to-medium enterprises seeking cost-effective and remotely manageable access solutions for logistical operations and enhanced asset security.

AI Impact Analysis on Smart Switch Garage Door System Market

User inquiries frequently center on how Artificial Intelligence (AI) enhances the reliability, security, and predictive maintenance capabilities of smart garage door systems. Users are concerned about whether AI can truly differentiate between authorized activity and potential threats, and how it reduces the incidence of system failures. The key themes revolve around AI's ability to learn usage patterns for personalized automation (e.g., predicting arrival times or preferred access methods), improve diagnostic accuracy, and fortify cyber defenses against sophisticated intrusion attempts. Consumers expect AI to transition the system from a reactive control mechanism to a proactive security and management tool, mitigating manual intervention and increasing overall system intelligence.

AI integration is fundamentally transforming the value proposition of smart garage door systems, moving beyond simple remote control functionality. Machine learning algorithms analyze vast datasets related to operational cycles, environmental variables (temperature, humidity), and user behavior to establish baseline operational norms. Deviations from these norms, such as unusual noises, slower-than-average opening speeds, or atypical access attempts, trigger immediate alerts or proactive maintenance recommendations, significantly extending the lifespan of mechanical components and ensuring continuous security. This predictive capability is a major differentiator in the premium smart home segment.

Furthermore, AI algorithms are critical in enhancing the security features of the system. By leveraging facial recognition or advanced behavioral biometrics integrated through connected cameras, AI can accurately verify authorized users before granting access, minimizing reliance solely on PIN codes or standard remote controls. This layer of intelligent verification, coupled with adaptive learning capabilities in cybersecurity protocols that detect and neutralize evolving threats, elevates the system’s protective efficacy and addresses critical consumer concerns regarding privacy and physical safety, making the system demonstrably smarter and more secure.

- AI facilitates predictive maintenance by monitoring motor wear, spring tension, and lubrication needs.

- Machine learning optimizes energy use by adjusting operation schedules based on learned daylight and temperature patterns.

- Advanced algorithms enable sophisticated anomaly detection, alerting users to forced entry attempts or mechanical malfunctions immediately.

- AI supports personalized automation, adapting access permissions and geo-fencing based on learned routines and user proximity.

- Enhanced cybersecurity features utilize AI to detect and mitigate evolving network threats and unauthorized remote access attempts.

DRO & Impact Forces Of Smart Switch Garage Door System Market

The market trajectory is primarily shaped by the confluence of substantial drivers related to technological convergence and escalating consumer expectations for connectivity, balanced against inherent restraints such as high integration complexity and cybersecurity risks. Opportunities abound in developing customized solutions for multi-dwelling units (MDUs) and leveraging emerging 5G infrastructure for ultra-low latency control. These internal factors are constantly interacting with external impact forces, particularly the rapid pace of IoT hardware standardization and stringent regulatory requirements for data privacy and encryption, dictating market speed and direction.

Key drivers include the global expansion of the smart home ecosystem, which normalizes the integration of connected devices into daily life. The increasing consumer awareness regarding residential security, coupled with the desire for convenient remote access management, compels rapid adoption. Conversely, major restraints involve the necessity for professional installation or complex DIY setup, which can deter technologically less-savvy consumers. Furthermore, concerns over potential system hacking or data breaches remain a significant inhibitor, requiring substantial investment in robust, military-grade encryption and secure authentication processes by manufacturers to build and maintain user trust.

Opportunities for growth lie in tapping into the commercial sector by providing integrated solutions for fleet management and logistics control points, alongside potential advancements through partnerships with insurance companies offering discounts for homes equipped with proven smart security systems. The impact forces determining the market’s competitive structure are primarily technological—how quickly proprietary systems can adopt universal connectivity standards (like Matter)—and economic, specifically the volatility in component pricing and the influence of global supply chain stability on final product costs and market accessibility. Successful market players must navigate these forces by balancing innovation speed with cost-efficiency and security assurance.

Segmentation Analysis

The Smart Switch Garage Door System Market is segmented based on component type, underlying technology, primary application, and distribution channel, providing a granular view of market dynamics and revenue generation streams. Understanding these segmentations is critical for manufacturers tailoring product offerings and for investors assessing potential high-growth niches. The market structure reflects a transition from simple standalone switches to complex, highly integrated sensor-based systems that offer comprehensive monitoring capabilities, pushing growth in the advanced component segment.

Segmentation by technology is particularly vital, reflecting the competitive dynamics between proprietary standards and open protocols. While older systems relied on basic Wi-Fi connectivity, the increasing demand for reliability and network mesh capabilities has amplified the adoption of Z-Wave and Zigbee in densely connected smart homes. Application segmentation demonstrates the resilience of the residential sector as the bedrock of the market, though commercial applications represent a significant untapped reservoir of future potential, particularly in scalable management solutions for large installations.

The dominant segments are currently defined by mainstream technology adoption and the primary residential application area. Future market growth, however, is projected to be driven by innovation in sensor technology—moving from simple tilt sensors to highly accurate laser or radar sensors—and expanding penetration through efficient distribution channels, specifically leveraging e-commerce platforms and specialized IoT installers to reach a wider, geographically dispersed customer base efficiently.

- By Component

- Smart Switches/Controllers (Central processing unit and communication module)

- Sensors (Proximity sensors, Tilt sensors, Infrared sensors, Safety reversal sensors)

- Gateways/Hubs (For integrating multiple protocols like Z-Wave/Zigbee with Wi-Fi)

- Power Supplies and Backup Battery Systems

- By Technology

- Wi-Fi (Dominant due to ubiquity)

- Bluetooth Low Energy (BLE) (For local control and initial setup)

- Z-Wave (For robust mesh networking and low power consumption)

- Zigbee (Competitor to Z-Wave, strong in integration with established ecosystems)

- Proprietary RF Communication Protocols

- By Application

- Residential (Single-family homes, Multi-dwelling units)

- Commercial (Small businesses, Warehouses, Logistics hubs, Specialized vehicle storage)

- By Distribution Channel

- Online Retail (E-commerce platforms, Manufacturer websites)

- Offline Retail (Home improvement stores, Electronics retailers)

- Direct Sales and Professional Installation Channels

Value Chain Analysis For Smart Switch Garage Door System Market

The value chain for the Smart Switch Garage Door System Market begins with upstream activities involving the sourcing and manufacturing of complex electronic components, including integrated circuits (ICs), communication modules (Wi-Fi, Z-Wave chips), and various sensor arrays. Key players in this stage are semiconductor manufacturers and specialized contract electronic manufacturers (CEMs). Efficiency and cost optimization at this stage are critical, as component costs significantly influence the final product's market price. Robust supplier relationships and secure, diversified sourcing strategies are paramount to mitigating global supply chain risks and ensuring high-quality electronic reliability.

Midstream activities focus on the final assembly, software development, and quality assurance of the smart switch hardware and accompanying mobile applications. Manufacturers often specialize in developing proprietary firmware and connectivity protocols that ensure seamless interaction with various garage door opener brands. This stage incorporates stringent testing for cyber vulnerabilities, environmental resilience, and long-term durability, ensuring compliance with international safety standards (e.g., UL listings). Successful firms invest heavily in UX/UI design for the mobile app, recognizing that the software interface is often the primary point of user interaction.

Downstream activities involve distribution and sales through both direct and indirect channels. Indirect distribution heavily relies on major online retail platforms (Amazon, specialized IoT retailers) and large brick-and-mortar home improvement chains (Home Depot, Lowe's), leveraging their wide geographic reach. Direct channels include sales through professional garage door installers and specialized system integrators who bundle the smart switch system with full installation and setup services, often targeting the commercial application segment requiring tailored solutions and professional integration support. Post-sales service and ongoing software updates are vital components of the downstream value delivery, ensuring customer satisfaction and system longevity.

Smart Switch Garage Door System Market Potential Customers

The primary customer base for Smart Switch Garage Door Systems overwhelmingly resides within the residential sector, specifically tech-savvy homeowners and individuals seeking heightened security and operational convenience for single-family homes. These end-users prioritize features such as remote monitoring capability, integration with existing smart home security cameras and lighting, and real-time alerts. Customers are often categorized by their propensity to adopt technology early, focusing on integrated solutions that enhance property value and provide tangible benefits like geo-fencing for automated door operation upon arrival or departure.

A rapidly expanding customer segment includes owners and operators of small-to-medium enterprises (SMEs), particularly those involved in logistics, warehousing, or requiring secure, managed access to inventory or equipment storage areas. Commercial buyers prioritize features such as multi-user management capabilities, activity logs for auditing purposes, and compatibility with larger, industrial-grade garage door mechanisms. For this segment, the system serves less as a convenience feature and more as an essential tool for operational efficiency, accountability, and physical security compliance, leading to higher average expenditure per installation unit.

Furthermore, property developers and managers of multi-dwelling units (MDUs) represent a growing B2B customer segment. These buyers seek centralized, scalable solutions that can manage access for numerous residents efficiently and securely, often looking for systems that can be integrated into communal security networks and managed remotely by property staff. The emphasis here is on reliability, scalability, ease of centralized management, and minimizing maintenance overhead, positioning themselves as high-volume, continuous procurement buyers for system standardization across new developments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.9 Billion |

| Growth Rate | CAGR 18.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chamberlain Group, Overhead Door Corporation, Genie Company, Sommer, Linear LLC, LiftMaster, Meross, MyQ, Tailwind iQ3, Nexx Garage, Refoss, GoControl, Z-Wave Alliance Members, Tuya Smart Ecosystem Partners, Bond Bridge, Iotty, Shelly, HomeLink Integration Providers, Ryobi (Defunct System Support), Marantec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Switch Garage Door System Market Key Technology Landscape

The Smart Switch Garage Door System market is characterized by a reliance on several key foundational technologies centered around connectivity, sensing, and interoperability standards. Connectivity is primarily dominated by Wi-Fi, offering the easiest setup process due to existing residential infrastructure, although this can be power-intensive. More advanced systems increasingly utilize dedicated Low-Power Wide-Area Network (LPWAN) protocols, specifically Z-Wave and Zigbee, which provide superior mesh networking capabilities, allowing devices to relay signals over greater distances and ensuring consistent connectivity even in garages located far from the main Wi-Fi router. The adoption of these low-power standards is crucial for minimizing battery drain in remote sensors and providing a stable, scalable platform for complex automation routines.

Sensor technology is another critical pillar, moving beyond simple magnetic contact or tilt sensors to incorporate sophisticated proximity and light-based sensors. Modern systems use highly accurate laser measurement or ultrasonic sensors to determine the exact position of the door (e.g., fully closed, 50% open) rather than just a binary open/closed status. This granular positional data is vital for advanced features like predictive safety protocols and precise remote monitoring. Furthermore, the integration of high-definition video cameras and motion detectors into the smart switch unit allows for real-time visual verification of the garage status, significantly enhancing security and providing context to automated alerts.

Interoperability and cloud infrastructure form the final critical layer. The success of a smart switch system hinges on its ability to integrate seamlessly with major smart home platforms such as Amazon Alexa, Google Assistant, Samsung SmartThings, and increasingly, the new Matter standard. This requires robust cloud infrastructure for secure data transmission, remote command processing, and over-the-air (OTA) firmware updates. Manufacturers must ensure their cloud services are compliant with stringent regional data privacy regulations and offer high uptime, as any failure in the cloud or connectivity layer directly compromises the security and functionality expected by the end-user. The ongoing transition to edge computing, where some data processing occurs locally on the device, is further enhancing response times and security protocols.

Regional Highlights

- North America: Dominates the market share due to high consumer spending on smart home technology, the mature infrastructure for IoT devices, and strong consumer focus on security solutions. The presence of major market leaders like Chamberlain Group and Genie Company further solidifies its leading position. Adoption is driven by integration with existing home security systems and advanced automation features.

- Europe: Characterized by stringent data privacy regulations (GDPR), which push manufacturers to develop highly secure, local processing capabilities. Western European countries, particularly Germany and the UK, show high demand driven by energy efficiency benefits and the desire for sophisticated access control management in both residential and light commercial settings.

- Asia Pacific (APAC): Exhibits the highest projected Compound Annual Growth Rate (CAGR). This growth is propelled by rapid urbanization, increasing disposable incomes, and widespread adoption of mobile-first technologies in countries like China, India, and South Korea. Market expansion here requires cost-effective, locally tailored solutions that address diverse residential configurations and varying internet infrastructure quality.

- Latin America (LATAM): Growth is steady, primarily concentrated in metropolitan areas of Brazil and Mexico, driven by a strong focus on property security solutions. The market is sensitive to price, favoring systems that offer maximum functionality at competitive entry points, often relying on basic Wi-Fi connectivity rather than expensive proprietary hubs.

- Middle East and Africa (MEA): Represents an emerging market, with adoption concentrated in wealthy Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia). Investment in large-scale residential and commercial property developments, coupled with a high interest in premium smart living technologies, provides significant long-term growth opportunities, although extreme climate conditions necessitate robust, high-durability hardware.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Switch Garage Door System Market.- Chamberlain Group (LiftMaster, MyQ)

- Overhead Door Corporation (Genie Company)

- Sommer

- Linear LLC

- Meross

- Tailwind iQ3

- Nexx Garage

- Refoss

- GoControl

- Z-Wave Alliance (Ecosystem influence)

- Tuya Smart (Platform Provider)

- Bond Bridge (Integration Specialist)

- Iotty

- Shelly

- HomeLink (Automotive Integration)

- Marantec

- ASSA ABLOY (Through smart lock integration)

- Kwikset (Smart access solution synergy)

- Vivint Smart Home (Service providers bundling the technology)

- ADT Security Services (Integrated security solutions)

Frequently Asked Questions

Analyze common user questions about the Smart Switch Garage Door System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of upgrading to a Smart Switch Garage Door System?

The primary benefit is enhanced remote monitoring and control, allowing users to open, close, and check the status of their garage door from anywhere via a smartphone application, significantly improving home security and convenience. This capability also provides real-time alerts if the door is accessed unexpectedly or left open.

Are Smart Switch Garage Door Systems compatible with all existing garage door openers?

Compatibility is high, but not universal. Most smart switches are designed to work with openers manufactured after 1993 that utilize standard safety sensors. However, newer openers featuring proprietary security+ 2.0 or specific rolling code technologies may require an approved adapter or specific brand controllers to ensure full functionality and integration.

How do Smart Switch systems ensure protection against cyberattacks and unauthorized access?

Security is maintained through multiple layers, including end-to-end encryption (AES-128 or higher) for all data transmission, secure cloud authentication protocols, and frequent over-the-air firmware updates to patch vulnerabilities. Many systems also require two-factor authentication for remote access control to prevent unauthorized use.

Which connectivity technologies are most reliable for Smart Switch Garage Door Systems?

While Wi-Fi is the most common and convenient, dedicated mesh networking protocols like Z-Wave and Zigbee offer superior reliability and range, particularly in large properties where the garage is distant from the main router. These protocols consume less power and create a more robust, interconnected network of smart devices.

What is the typical lifespan and maintenance requirement of a Smart Garage Door Controller?

The electronic controller itself typically lasts 5-10 years, depending on environmental factors and usage. Maintenance is minimal, primarily involving ensuring the connected sensors are clean and functional, and applying regular software updates provided by the manufacturer. Systems incorporating AI features may also offer predictive maintenance alerts for mechanical components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager