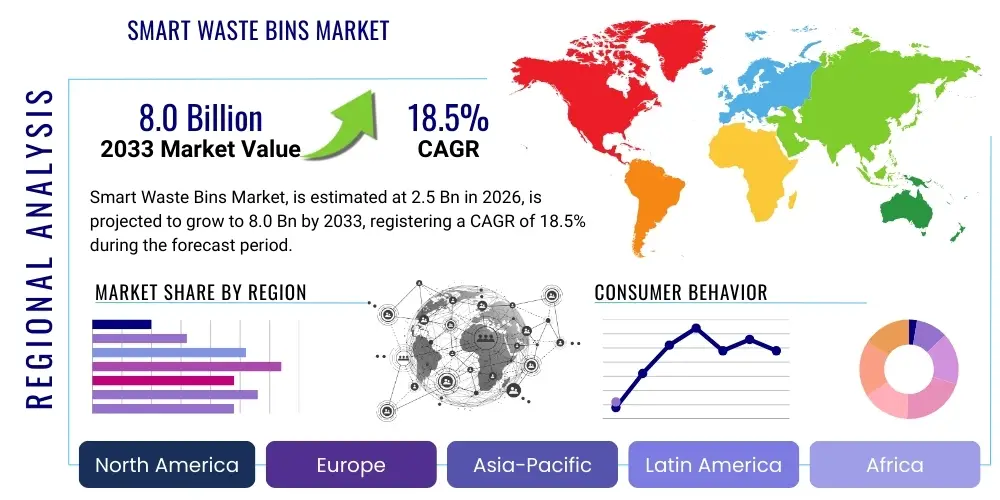

Smart Waste Bins Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440083 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Smart Waste Bins Market Size

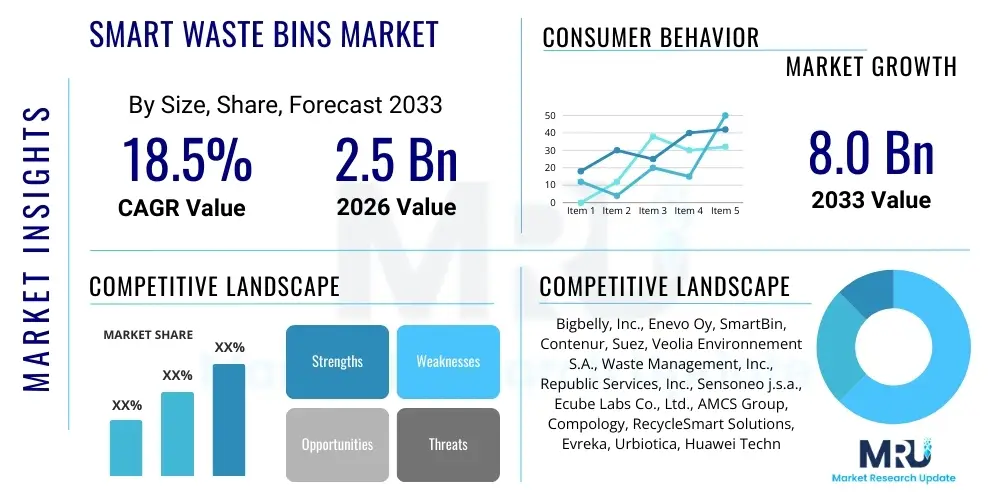

The Smart Waste Bins Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Smart Waste Bins Market introduction

The global Smart Waste Bins Market is experiencing robust growth driven by the escalating challenges of urban waste management, rapid urbanization, and an increasing focus on environmental sustainability. Smart waste bins represent a significant technological advancement over traditional waste collection systems, integrating Internet of Things (IoT) sensors, communication modules, and data analytics to optimize waste collection processes. These innovative solutions are designed to monitor fill levels in real-time, compact waste, and communicate data to central management platforms, thereby enabling more efficient routing for collection vehicles and reducing operational costs. Their primary applications span across smart cities, residential complexes, commercial establishments, and various industrial settings, offering substantial benefits in terms of improved public hygiene, reduced carbon footprint, and enhanced resource allocation.

The core product description of smart waste bins involves advanced features such as ultrasonic sensors that detect the fill level, GPS modules for location tracking, and often compaction mechanisms to increase capacity. Connectivity options, including cellular, Wi-Fi, LoRaWAN, and NB-IoT, facilitate seamless data transmission to cloud-based platforms. Major applications include public spaces within smart cities, where they contribute to a cleaner urban environment and optimize municipal services. In residential and commercial sectors, they offer convenience and efficiency, while in industrial settings, they aid in managing diverse waste streams more effectively. Key benefits encompass significant cost savings through optimized routes and reduced fuel consumption, minimized environmental impact due to fewer collections and lower emissions, and improved sanitation standards. The market is primarily driven by global environmental mandates, the increasing adoption of smart city initiatives, technological advancements in IoT and AI, and the rising demand for efficient and sustainable waste management solutions.

Smart Waste Bins Market Executive Summary

The Smart Waste Bins Market is currently shaped by several dynamic business, regional, and segment trends, reflecting a global shift towards intelligent urban infrastructure and sustainable practices. Business trends highlight a strong focus on strategic partnerships between technology providers and waste management companies, emphasizing integrated solutions that offer end-to-end waste collection and processing. There is also a growing trend towards subscription-based service models rather than outright product purchases, allowing municipalities and businesses to access advanced features with lower upfront investment. Furthermore, the market is seeing an increased demand for robust data analytics capabilities, leveraging AI and machine learning to derive actionable insights from waste generation patterns, further optimizing operational efficiency and predictive maintenance schedules for smart bins.

Regional trends indicate that North America and Europe are leading the adoption of smart waste bins, primarily due to advanced technological infrastructure, stringent environmental regulations, and significant investments in smart city projects. Countries like the United States, Germany, and the United Kingdom are at the forefront, showcasing mature markets with widespread deployment. The Asia Pacific region, particularly China and India, is emerging as a high-growth market, propelled by rapid urbanization, increasing waste generation, and government initiatives promoting smart city development and sustainable waste management practices. Latin America and the Middle East & Africa regions are also showing considerable potential, albeit at earlier stages of adoption, driven by infrastructure development and the need for modern waste solutions.

Segment trends reveal a diverse landscape. By type, compacting smart bins are gaining traction due to their ability to significantly increase capacity and reduce collection frequency, offering greater cost efficiencies. In terms of technology, the market is seeing a push towards more sophisticated sensor arrays that can not only detect fill levels but also potentially identify waste types for improved sorting. Connectivity-wise, a move towards low-power wide-area network (LPWAN) technologies like LoRaWAN and NB-IoT is evident, offering extended battery life and cost-effective data transmission suitable for large-scale deployments. End-user segmentation shows smart cities and commercial establishments as the primary adopters, with growing interest from residential complexes and industrial sectors seeking to modernize their waste infrastructure.

AI Impact Analysis on Smart Waste Bins Market

The integration of Artificial Intelligence (AI) is profoundly transforming the Smart Waste Bins Market, addressing key user concerns about efficiency, predictive capabilities, and overall sustainability. Users frequently inquire about how AI can move beyond simple fill-level detection to offer more sophisticated waste management solutions. The primary themes revolving around AI's influence include its ability to optimize collection routes dynamically based on real-time data, enabling predictive maintenance for bins, enhancing waste segregation and recycling efforts, and providing deeper analytical insights into waste generation patterns. AI-driven systems leverage historical data and live sensor inputs to forecast waste accumulation, preventing overflow situations while minimizing unnecessary collections, directly translating to significant operational savings and reduced environmental impact. This predictive capability is a major draw for municipalities and private waste management companies seeking to maximize resource utilization and improve public services.

Furthermore, AI plays a crucial role in enabling smarter decision-making beyond just logistics. It can analyze images or sensor data to differentiate between waste types, assisting in automated sorting processes within the bins themselves or at collection points, thereby boosting recycling rates and supporting circular economy initiatives. Users are keen to understand how AI can make the entire waste management ecosystem more proactive rather than reactive. By learning from continuous data streams, AI algorithms can identify anomalies, predict potential equipment failures before they occur, and even suggest optimal placement for new bins based on population density and waste generation hotspots. This advanced level of intelligence fundamentally shifts waste management from a labor-intensive, schedule-driven operation to a data-driven, demand-responsive system, meeting the public's and organizations' expectations for more intelligent and sustainable urban services.

- AI optimizes collection routes through predictive analytics, reducing fuel consumption and operational costs.

- Enables real-time monitoring and dynamic scheduling, preventing bin overflows and improving public hygiene.

- Facilitates advanced waste segregation and sorting through visual recognition and sensor data analysis.

- Supports predictive maintenance for smart bins, extending asset lifespan and minimizing downtime.

- Provides deeper insights into waste generation patterns, aiding in urban planning and resource allocation.

- Enhances overall sustainability by promoting efficient recycling and reducing carbon emissions.

- Integrates with broader smart city platforms for a holistic urban management approach.

DRO & Impact Forces Of Smart Waste Bins Market

The Smart Waste Bins Market is influenced by a confluence of drivers, restraints, and opportunities, alongside significant impact forces that collectively shape its growth trajectory. Key drivers include the global surge in urban populations and subsequent increase in waste generation, which necessitates more efficient and sustainable management solutions. Government initiatives focused on developing smart cities and promoting environmental sustainability, coupled with stringent waste disposal regulations, are compelling municipalities and businesses to adopt intelligent waste infrastructure. The inherent benefits of smart bins, such as significant operational cost reductions through optimized collection routes, reduced fuel consumption, and improved public sanitation, further accelerate market adoption. Technological advancements in IoT, sensor technologies, and data analytics also serve as powerful drivers, enabling more sophisticated and reliable smart waste management systems.

However, the market faces several notable restraints. The high initial capital investment required for the deployment of smart waste bin systems can be a significant barrier for smaller municipalities or organizations with limited budgets. Concerns regarding data security and privacy, especially with the transmission of real-time location and usage data, present challenges that need robust solutions. A lack of standardized infrastructure and interoperability across different smart waste management platforms can hinder widespread adoption and create integration complexities. Furthermore, limited awareness and understanding of the long-term benefits of smart waste solutions in certain regions, coupled with potential public resistance to new technologies, can slow down market penetration. Addressing these restraints will require collaborative efforts from technology providers, policymakers, and local communities to demonstrate value and build trust.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The untapped potential in emerging economies, driven by rapid urbanization and nascent smart city developments, offers significant growth avenues. The increasing integration of smart waste bins with broader IoT ecosystems and smart city platforms presents opportunities for more holistic urban management, creating synergistic benefits. Continued advancements in AI and machine learning for predictive analytics and waste stream optimization will unlock new levels of efficiency and environmental impact. Moreover, the growing global emphasis on the circular economy and resource recovery aligns perfectly with the capabilities of smart waste bins to facilitate better segregation and recycling, driving further investment and innovation in this sector. These opportunities, coupled with ongoing technological progress, are expected to fuel the market's trajectory.

Segmentation Analysis

The Smart Waste Bins Market is extensively segmented to provide a detailed understanding of its diverse components, end-users, and technological foundations. This segmentation allows for a granular analysis of market dynamics, growth drivers, and competitive landscapes across various dimensions. The primary segmentation categories typically include classification by type, such as compacting and non-compacting bins, which differentiates products based on their waste compaction capabilities and efficiency. Further differentiation is often based on the sensor types employed, covering ultrasonic, infrared, and GPS sensors, each offering distinct functionalities for fill-level detection and location tracking. Connectivity technologies form another critical segment, encompassing cellular networks (2G/3G/4G/5G), Wi-Fi, and various Low-Power Wide-Area Network (LPWAN) options like LoRaWAN and NB-IoT, which dictate data transmission capabilities and energy consumption.

The market is also segmented by application, identifying the diverse end-user environments where these smart solutions are deployed. This includes smart cities, which represent a significant segment due to large-scale municipal deployments in public spaces and urban infrastructure. Other key applications are found in residential areas, commercial establishments such as shopping malls and office complexes, and industrial settings where specific waste management needs arise. Institutional applications, including healthcare facilities, educational campuses, and retail sectors, also form important sub-segments, each with unique requirements for waste collection and management. Furthermore, the market can be segmented by the material composition of the bins, typically metal or plastic, and by capacity, ranging from small to large-sized bins, catering to different volumes of waste generation.

- By Type:

- Compacting Smart Bins

- Non-Compacting Smart Bins

- By Sensor Type:

- Ultrasonic Sensors

- Infrared Sensors

- GPS Sensors

- Other Sensors (e.g., optical, weight sensors)

- By Connectivity:

- Wi-Fi

- Cellular (2G/3G/4G/5G)

- LoRaWAN

- NB-IoT

- Sigfox

- Bluetooth

- By Application:

- Smart Cities

- Residential

- Commercial (Retail, Office Spaces, Hospitality)

- Industrial

- Institutions (Healthcare, Educational)

- By Material:

- Metal

- Plastic

- By Capacity:

- Small (Up to 100 Liters)

- Medium (101-500 Liters)

- Large (Above 500 Liters)

Value Chain Analysis For Smart Waste Bins Market

The value chain of the Smart Waste Bins Market is a complex ecosystem encompassing various stages, from raw material sourcing to end-user deployment and post-sales services. The upstream analysis begins with the suppliers of fundamental components and raw materials, including manufacturers of high-grade plastics and metals for bin construction, electronic component suppliers for sensors (ultrasonic, infrared, GPS), connectivity modules (LTE, LoRaWAN, NB-IoT), and battery technologies. These suppliers are critical as the quality and cost of these foundational elements directly impact the final product's performance and market competitiveness. Research and development activities also play a significant upstream role, driving innovation in sensor accuracy, energy efficiency, and data processing capabilities, often involving specialized IoT hardware and software developers.

Midstream activities involve the manufacturing and assembly of the smart waste bins, where various components are integrated into a cohesive unit. This stage often includes specialized engineering for compaction mechanisms, robust casing design for durability in diverse environments, and the embedding of software and firmware for data processing and communication. System integrators play a crucial role here, combining hardware from multiple vendors with proprietary software to create a complete solution. Downstream analysis focuses on distribution channels and end-user engagement. This includes direct sales to municipalities, smart city project developers, large commercial enterprises, and waste management service providers. Indirect channels involve partnerships with distributors, resellers, and regional value-added partners who offer localized installation, maintenance, and support services. The effectiveness of these distribution channels is paramount for market penetration and reaching a broad customer base.

Furthermore, the value chain extends into the operational phase, involving cloud service providers for data storage and analytics, software developers for user interfaces and management dashboards, and field service technicians for installation and ongoing maintenance. The interplay between direct and indirect distribution channels is critical; direct sales allow for closer customer relationships and customized solutions, particularly for large-scale municipal projects. Indirect channels, on the other hand, leverage established networks to reach a wider geographic spread and cater to smaller clients. The entire chain is supported by after-sales services, including technical support, software updates, and warranty services, which are vital for customer satisfaction and long-term market growth, ensuring the continuous optimal performance of smart waste management systems.

Smart Waste Bins Market Potential Customers

The Smart Waste Bins Market serves a diverse range of potential customers and end-users, all seeking to enhance their waste management efficiency and sustainability. The largest segment of buyers comprises municipal authorities and smart city initiatives worldwide, driven by the need to manage escalating urban waste, reduce operational costs associated with traditional collection methods, and improve public sanitation and environmental quality. These entities are interested in deploying smart bins in public parks, streets, transportation hubs, and government buildings to achieve cleaner urban environments and optimize resource allocation for waste collection services. The integration of smart bins into broader smart city platforms is a significant draw, allowing for synergistic benefits across urban infrastructure management.

Beyond municipal bodies, the commercial sector represents a substantial customer base. This includes large retail chains, shopping malls, corporate campuses, hotels, restaurants, and hospitality venues that generate significant volumes of waste daily. For these businesses, smart bins offer benefits such as reduced waste collection fees, improved aesthetics for their premises, and enhanced operational efficiency. Residential complexes and housing societies are also emerging as key customers, particularly in densely populated urban areas, where they seek to improve waste segregation, reduce odors, and ensure timely collection for their residents. The focus here is often on convenience, hygiene, and community sustainability initiatives, making smart bins an attractive investment for property managers and developers.

Furthermore, various industrial facilities, manufacturing plants, and logistics hubs are increasingly adopting smart waste solutions to manage their specific waste streams more effectively, comply with environmental regulations, and streamline internal operations. Healthcare facilities, educational institutions (universities and schools), and transportation sectors (airports, train stations) also constitute significant end-users. These organizations often have unique requirements for waste segregation, hygiene, and high-volume waste management, making smart waste bins an ideal solution to address their operational challenges. The collective demand from these varied customer segments underscores the broad applicability and growing necessity of intelligent waste management systems across different domains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bigbelly, Inc., Enevo Oy, SmartBin, Contenur, Suez, Veolia Environnement S.A., Waste Management, Inc., Republic Services, Inc., Sensoneo j.s.a., Ecube Labs Co., Ltd., AMCS Group, Compology, RecycleSmart Solutions, Evreka, Urbiotica, Huawei Technologies Co., Ltd., TOMRA Systems ASA, Bin-e, Nord Sense, Clean Robotics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Waste Bins Market Key Technology Landscape

The Smart Waste Bins Market is underpinned by an array of cutting-edge technologies that enable their intelligent functionality and operational efficiency. Central to these systems are Internet of Things (IoT) sensors, primarily ultrasonic and infrared sensors, which accurately detect the fill level of waste within the bins. These sensors provide real-time data, allowing for dynamic monitoring and predictive analysis of waste accumulation. GPS modules are also crucial, providing precise location data for each bin, which is essential for optimizing collection routes and asset management. The integration of these sensors transforms static waste receptacles into active data nodes within a larger smart city infrastructure, providing invaluable insights into urban waste generation patterns.

Connectivity is another cornerstone of the smart waste bins' technology landscape. Various communication technologies are employed to transmit data from the bins to central cloud-based platforms. These include traditional cellular networks (2G, 3G, 4G, and increasingly 5G for higher bandwidth and lower latency applications), Wi-Fi for localized deployments, and a growing adoption of Low-Power Wide-Area Network (LPWAN) technologies such as LoRaWAN, NB-IoT, and Sigfox. LPWANs are particularly advantageous due to their extended battery life, long-range communication capabilities, and lower operational costs, making them ideal for widespread deployments across urban and rural environments. This robust connectivity ensures that real-time data on fill levels, temperature, and status alerts are continuously available for decision-making.

Beyond sensors and connectivity, the technology landscape includes advanced data analytics, Artificial Intelligence (AI), and Machine Learning (ML) algorithms. These intelligent systems process the vast amounts of data collected from smart bins to generate actionable insights. AI and ML are used for predictive modeling of waste generation, dynamic optimization of collection routes, anomaly detection for maintenance, and even for preliminary waste segregation capabilities. Cloud computing platforms provide the necessary infrastructure for data storage, processing, and management, offering scalable solutions for municipalities and enterprises. Furthermore, compaction mechanisms integrated into smart bins utilize hydraulic or mechanical systems to compress waste, thereby increasing the bin's capacity and reducing the frequency of collections, which is a significant technological feature contributing to cost efficiency and reduced carbon footprint.

Regional Highlights

The Smart Waste Bins Market exhibits significant regional variations, influenced by differing levels of technological adoption, urbanization rates, environmental regulations, and investment in smart city initiatives. North America stands as a dominant region, characterized by high disposable incomes, advanced technological infrastructure, and a proactive approach towards smart city development. The United States and Canada are key contributors, with municipalities and private waste management companies heavily investing in IoT-enabled waste solutions to enhance operational efficiency and achieve sustainability targets. Stringent environmental regulations and a strong emphasis on reducing landfill waste also drive market growth in this region, leading to widespread adoption in urban centers and commercial establishments.

Europe is another leading market, propelled by strong governmental support for green initiatives, circular economy policies, and a high awareness of environmental issues. Countries like Germany, the United Kingdom, France, and Scandinavian nations are at the forefront of implementing smart waste management systems. These regions benefit from established smart city frameworks, significant R&D investments in sustainable technologies, and a consumer base that values eco-friendly solutions. The European Union's directives on waste reduction and recycling further accelerate the deployment of smart waste bins, as cities strive to meet ambitious environmental goals and optimize public services.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, driven by rapid urbanization, increasing waste generation, and substantial government investments in smart city projects, particularly in China, India, Japan, and South Korea. These countries face immense challenges in managing waste due to dense populations and expanding metropolitan areas, making smart waste solutions highly attractive. While initial adoption rates might vary, the sheer scale of urban development and the growing focus on environmental protection are creating massive opportunities. Latin America, the Middle East, and Africa (MEA) are emerging markets, characterized by ongoing infrastructure development and a growing recognition of the benefits of modern waste management. Countries in the GCC region, for instance, are investing heavily in smart city technologies, which includes intelligent waste solutions, albeit at an earlier stage compared to their North American and European counterparts.

- North America: Leading market due to advanced infrastructure, high adoption of smart city technologies, and strong environmental regulations. Key countries include the United States and Canada.

- Europe: Dominant market driven by robust governmental support for green initiatives, circular economy goals, and high environmental awareness. Key countries include Germany, UK, France, and Nordic nations.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid urbanization, increasing waste generation, and significant investments in smart city development. Key countries are China, India, Japan, and South Korea.

- Latin America: Emerging market with growing investments in urban infrastructure and increasing awareness of efficient waste management.

- Middle East & Africa (MEA): Developing market driven by smart city initiatives, particularly in the GCC countries, and a focus on modernizing urban services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Waste Bins Market.- Bigbelly, Inc.

- Enevo Oy

- SmartBin (subsidiary of Suez)

- Contenur

- Suez

- Veolia Environnement S.A.

- Waste Management, Inc.

- Republic Services, Inc.

- Sensoneo j.s.a.

- Ecube Labs Co., Ltd.

- AMCS Group

- Compology

- RecycleSmart Solutions

- Evreka

- Urbiotica

- Huawei Technologies Co., Ltd.

- TOMRA Systems ASA

- Bin-e

- Nord Sense

- Clean Robotics

Frequently Asked Questions

What are smart waste bins?

Smart waste bins are technologically advanced receptacles equipped with sensors and connectivity (IoT) that monitor fill levels, compact waste, and send real-time data to a central management system. This enables optimized collection routes, reduced operational costs, and improved public sanitation.

How do smart waste bins benefit cities and municipalities?

Smart waste bins significantly benefit cities by optimizing waste collection routes, reducing fuel consumption and operational costs by up to 50%, preventing overflowing bins, improving public hygiene, reducing carbon emissions, and providing valuable data for urban planning and resource allocation.

What key technologies are integrated into smart waste bins?

Key technologies include ultrasonic/infrared sensors for fill-level detection, GPS for location tracking, various connectivity options (cellular, Wi-Fi, LoRaWAN, NB-IoT) for data transmission, compaction mechanisms, and cloud-based platforms with AI/ML analytics for data processing and route optimization.

What are the primary drivers for the Smart Waste Bins Market growth?

The market is primarily driven by rapid urbanization, increasing waste generation globally, stringent environmental regulations, growing investments in smart city initiatives, and the demand for operational efficiency and cost reduction in waste management services.

What are the main challenges facing the Smart Waste Bins Market?

Key challenges include the high initial investment cost for deployment, concerns regarding data security and privacy, the lack of standardized infrastructure across different systems, and limited awareness or acceptance in some regions regarding the long-term benefits of these advanced solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager