Smart Waste Management System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433701 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Smart Waste Management System Market Size

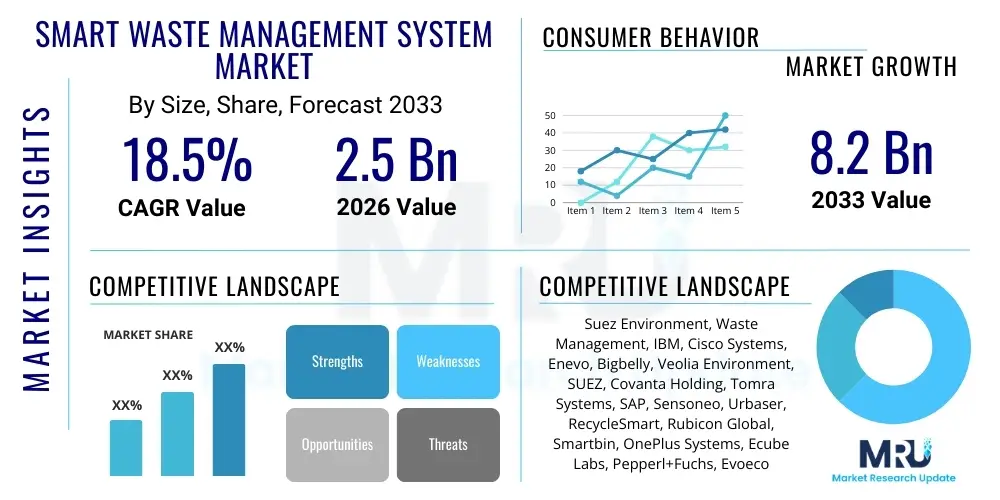

The Smart Waste Management System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $8.2 Billion by the end of the forecast period in 2033.

Smart Waste Management System Market introduction

The Smart Waste Management System (SWMS) market encompasses advanced technological solutions designed to optimize waste collection, sorting, transportation, and disposal processes. These systems primarily utilize Internet of Things (IoT) sensors, Artificial Intelligence (AI), Geographic Information Systems (GIS), and cloud computing to provide real-time data on waste levels, vehicle routes, and operational efficiency. The core objective is to reduce operational costs, minimize environmental impact, and enhance resource recovery rates by moving away from fixed schedules towards dynamic, needs-based waste services. This evolution is crucial for urban environments facing rapid population growth and increasing regulatory pressure regarding sustainability.

Major applications of SWMS include route optimization for collection vehicles, predictive maintenance of waste bins, sophisticated segregation at material recovery facilities (MRFs), and citizen engagement through mobile applications. The benefits derived from implementing these systems are substantial, encompassing reduced fuel consumption, lower carbon emissions, cleaner public spaces, and improved governmental transparency regarding waste management metrics. Furthermore, real-time monitoring prevents overflowing bins, thereby mitigating health hazards and environmental pollution associated with poorly managed urban refuse.

The market is predominantly driven by aggressive global urbanization trends, which necessitate scalable and efficient infrastructure solutions. Supportive government initiatives, particularly the widespread adoption of 'Smart City' frameworks across North America, Europe, and Asia Pacific, significantly propel demand for integrated SWMS platforms. Additionally, heightened public awareness regarding environmental degradation and stringent regulatory frameworks mandating higher recycling rates further incentivize municipalities and private waste operators to invest heavily in smart technologies.

Smart Waste Management System Market Executive Summary

The Smart Waste Management System market is experiencing rapid expansion, fueled by global commitments to circular economy principles and pervasive technological integration. Business trends indicate a strong move toward subscription-based Software as a Service (SaaS) models for data analytics and route optimization, shifting the focus from hardware sales (sensors and bins) to recurring revenue streams derived from operational intelligence. Strategic mergers and acquisitions are common, as major environmental service providers seek to integrate specialized technology startups to enhance their digital service offerings and achieve vertical integration across the waste value chain. The emphasis is increasingly placed on interoperable platforms that can seamlessly integrate disparate data sources from various municipal sensors and existing infrastructure.

Regionally, North America and Europe currently dominate the market due due to early technology adoption, high labor costs necessitating automation, and well-established regulatory environments promoting waste diversion. However, the Asia Pacific region is projected to exhibit the fastest growth over the forecast period, driven by massive investments in new urban infrastructure and the imperative for developing nations, such as India and China, to manage enormous volumes of waste generated by expanding populations. Latin America and MEA are slower to adopt, but significant opportunities exist in specific metropolitan hubs driven by environmental sustainability mandates often tied to global funding or international development projects.

Segment-wise, the IoT sensor segment remains critical for data capture, while the software segment (including data analytics and route planning) is expected to grow fastest, reflecting the higher value placed on actionable insights derived from the collected data. The end-user analysis shows that municipal and government bodies remain the largest consumers, but the commercial and industrial sectors are rapidly increasing adoption, particularly for large-scale logistics optimization and regulatory compliance adherence related to specialized waste streams.

AI Impact Analysis on Smart Waste Management System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Smart Waste Management System market typically center on efficiency gains, cost reduction, and enhanced sorting accuracy. Common questions revolve around how AI and Machine Learning (ML) improve route optimization beyond traditional algorithms, the feasibility of using computer vision for real-time waste classification, and the necessary data infrastructure requirements to deploy effective AI models. Key themes emerging from this analysis include the expectation that AI will be transformative in automating complex decision-making processes, shifting human labor from manual sorting and planning to oversight and maintenance, and fundamentally changing the cost structure of waste operations. Concerns often relate to data privacy, model bias in varied waste streams, and the initial capital investment required for high-resolution cameras and advanced processing hardware.

- AI-Powered Sorting: Utilizes computer vision and deep learning models to rapidly and accurately identify material types (plastics, metals, paper) on conveyor belts, significantly improving Material Recovery Facility (MRF) efficiency and purity rates.

- Predictive Maintenance: ML algorithms analyze sensor data from bins, trucks, and sorting machinery to predict equipment failure or maintenance needs, minimizing downtime and extending asset life.

- Dynamic Route Optimization: AI integrates real-time fill-level data, traffic patterns, historical weight data, and weather forecasts to generate the most fuel-efficient and timely collection routes dynamically, reducing operational costs by 15-30%.

- Demand Forecasting: ML models forecast future waste generation volumes based on seasonality, local events, and demographic data, enabling better resource allocation and infrastructure planning.

- Chatbots and Citizen Engagement: AI-driven customer service interfaces provide immediate responses to residents regarding collection schedules, recycling guidelines, and localized waste issues.

DRO & Impact Forces Of Smart Waste Management System Market

The Smart Waste Management System market is governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its growth trajectory and the nature of competitive dynamics. The fundamental driving force is the global imperative to transition toward sustainable resource management, supported by escalating urban populations that strain existing conventional waste infrastructure. Furthermore, increasing regulatory stringency, particularly in developed economies, enforces targets for recycling rates and landfill diversion, compelling municipalities and large enterprises to adopt smart technologies to ensure compliance and avoid heavy penalties. Technological advancements in sensor fidelity, battery life, and data processing capabilities have also reduced the cost and improved the reliability of smart solutions, making them economically viable for broader adoption.

Despite these strong drivers, the market faces significant restraints. High upfront capital investment required for hardware (IoT sensors, smart bins) and software integration presents a substantial barrier, especially for small municipalities or developing regions with limited budgetary flexibility. Concerns regarding data security, interoperability between different vendor platforms, and the complexity of integrating new digital systems with legacy infrastructure further restrict swift market penetration. Moreover, the lack of standardized communication protocols and data formats across the industry creates friction in large-scale system deployment.

Conversely, significant growth opportunities are presented by the expansion of the Smart City concept globally, positioning SWMS as a foundational component of modern urban planning. Developing countries, particularly in Asia and Latin America, represent untapped markets where rapid urbanization demands sustainable, scalable waste solutions from the outset. Further opportunities lie in developing highly specialized applications, such as managing hazardous or electronic waste using advanced robotics and sensing technologies, alongside integrating waste data into broader environmental monitoring and energy recovery systems (waste-to-energy optimization). These factors dictate the pace and direction of technological innovation and market maturation.

Segmentation Analysis

The Smart Waste Management System Market is strategically segmented across technology, application, and end-user, enabling focused analysis of market dynamics and adoption patterns. The technology segmentation highlights the essential hardware and software components driving intelligence, where IoT forms the foundational layer for data acquisition, followed by sophisticated analytics and AI engines for processing. Application segmentation distinguishes between the critical stages of the waste lifecycle—collection, sorting, and processing—allowing vendors to specialize in optimizing specific operational bottlenecks. The end-user categorization illustrates the varied needs and purchasing power of major customer groups, ranging from large metropolitan government bodies requiring comprehensive solutions to focused industrial clients needing specialized compliance monitoring.

- By Technology

- Hardware (Sensors, RFID Tags, Smart Bins)

- Software (Data Analytics, Route Optimization, Billing Systems)

- Services (Consulting, Integration, Maintenance)

- By Application

- Collection & Transportation

- Processing & Disposal (Sorting and Recycling)

- Monitoring & Tracking

- By End-User

- Residential

- Commercial

- Industrial

- Municipalities & Government

Value Chain Analysis For Smart Waste Management System Market

The value chain of the Smart Waste Management System market begins with upstream activities focused on the procurement of raw materials and the manufacturing of specialized hardware components. This includes the sourcing of semiconductors, communication modules (LoRaWAN, NB-IoT), and plastics used for producing smart bins and IoT sensor units. Key upstream players are technology component suppliers, electronic manufacturers, and specialized sensor developers. Efficiency and cost optimization at this stage are crucial, given the high initial investment cost associated with deploying thousands of sensors across a municipal area. Quality control and standardization of these components directly impact the reliability and longevity of the final SWMS solution deployed in harsh environmental conditions.

Midstream activities involve the crucial steps of system integration, software development, and deployment. This is where market leaders differentiate themselves by offering robust, scalable platforms incorporating advanced analytics, AI algorithms for optimization, and user-friendly dashboards. System integrators customize solutions based on specific client needs (e.g., population density, existing fleet size) and ensure seamless communication between disparate hardware devices and the central cloud platform. This stage requires high levels of technical expertise in cloud infrastructure, cybersecurity, and data modeling, contributing significantly to the value added.

Downstream activities center on the delivery of the service to the end-users—municipalities, businesses, or industrial facilities. Distribution channels are typically direct sales channels involving consulting and custom integration projects, especially for large city contracts. Indirect channels involve partnerships with large waste service providers (like Waste Management or Veolia) who incorporate smart technology into their comprehensive service contracts. The final delivery includes maintenance services, data reporting, training, and continuous software updates. The value realization for the customer comes through demonstrated operational cost savings, environmental compliance, and improved service quality, closing the feedback loop for future system enhancements and feature development.

Smart Waste Management System Market Potential Customers

The primary consumers and end-users of Smart Waste Management Systems are entities burdened by large volumes of waste generation and operational complexities, or those legally mandated to meet strict recycling targets. Municipalities and local government bodies represent the largest and most foundational customer base, utilizing SWMS to manage residential and public area waste collection, driven by the need to maintain public health, meet sustainability goals, and optimize tax-payer funded services. These customers typically seek comprehensive, long-term contracts covering both hardware deployment and ongoing data analysis services, prioritizing robustness and scalability across wide geographic areas.

The commercial sector, including large retail chains, hospitality venues, and major office complexes, constitutes another rapidly growing customer segment. These entities are motivated by the desire to reduce waste disposal costs, ensure brand sustainability, and accurately track waste generation metrics for internal reporting or ESG (Environmental, Social, and Governance) compliance. For these customers, the focus is often on optimizing internal logistics and ensuring efficient segregation at the source, preferring integrated solutions that easily interface with existing facility management systems.

Finally, the industrial sector, particularly manufacturing, construction, and specialized waste generators (e.g., healthcare facilities), represents highly valuable, albeit specialized, customers. Industrial waste often involves complex or hazardous materials requiring specific regulatory monitoring and tracking capabilities, making smart systems essential for compliance assurance and liability management. These users often require tailored sensor technology and highly granular data reporting, focusing on traceability and efficient material flow rather than purely on volume-based route optimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $8.2 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Suez Environment, Waste Management, IBM, Cisco Systems, Enevo, Bigbelly, Veolia Environment, SUEZ, Covanta Holding, Tomra Systems, SAP, Sensoneo, Urbaser, RecycleSmart, Rubicon Global, Smartbin, OnePlus Systems, Ecube Labs, Pepperl+Fuchs, Evoeco |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smart Waste Management System Market Key Technology Landscape

The technological backbone of the Smart Waste Management System market is multifaceted, integrating specialized hardware with advanced computational power. Central to this landscape is the Internet of Things (IoT), manifested through various types of fill-level sensors (ultrasonic, infrared, optical) deployed within waste containers. These sensors transmit real-time data regarding volume capacity, weight, and temperature using low-power wide-area networks (LPWAN) like LoRaWAN, Sigfox, or NB-IoT, ensuring energy efficiency and long-range connectivity essential for urban deployment. The shift towards robust, environmentally resistant hardware with extended battery life is a continuous area of development, aiming to minimize maintenance intervals and deployment costs.

Complementing the IoT hardware is the crucial role of Geographic Information Systems (GIS) and Global Positioning Systems (GPS) integrated into collection vehicles. GIS platforms aggregate the sensor data and map the distribution of waste containers, enabling centralized visualization and management. GPS data from trucks, combined with advanced cloud-based routing software, uses sophisticated algorithms to calculate the most efficient collection path, minimizing mileage, fuel consumption, and labor hours. This convergence of spatial data and real-time operational metrics forms the basis for predictive and dynamic scheduling solutions.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are rapidly emerging as differentiators, particularly in the downstream processing segment. High-speed computer vision systems powered by deep learning models are deployed in Material Recovery Facilities (MRFs) to identify and sort complex waste materials at industrial speeds with precision far exceeding human capabilities. Blockchain technology is also gaining traction for creating immutable, auditable records of waste transactions and tracking hazardous or regulated materials from generation point to final disposal, enhancing transparency and regulatory compliance across the supply chain.

Regional Highlights

- North America: Market Leader in Technology Adoption

North America holds a dominant share in the SWMS market, primarily due to the high operational costs associated with manual waste collection and a robust technology infrastructure ready for IoT integration. The US and Canada are pioneers in implementing large-scale smart bin networks and employing sophisticated route optimization software, particularly in major metropolitan areas like New York, Toronto, and Los Angeles. Stringent environmental regulations and substantial private investment by major waste operators (e.g., Waste Management, Republic Services) drive continuous innovation and solution scaling. The focus here is on maximizing efficiency and integrating solutions into broader smart city frameworks, leading to high maturity in the software and services segments.

- Europe: Focus on Circular Economy and Regulatory Compliance

Europe represents a highly mature market, heavily influenced by the European Union's ambitious Circular Economy Action Plan and binding targets for municipal waste recycling and reduction. Countries such as Germany, the UK, the Netherlands, and Scandinavia are leaders in deploying advanced smart recycling infrastructures. The region emphasizes data-driven waste prevention strategies, extended producer responsibility (EPR) schemes, and pay-as-you-throw (PAYT) systems, all requiring precise real-time data provided by SWMS. High government subsidies and a public focus on sustainability provide consistent demand, promoting vendors focused on environmental impact reduction and resource recovery.

- Asia Pacific (APAC): Fastest Growing Market Driven by Urbanization

The APAC region is anticipated to record the highest CAGR, propelled by rapid urbanization, monumental infrastructure development, and growing concerns over pollution in mega-cities like Shanghai, Delhi, and Jakarta. While adoption levels vary significantly, governmental initiatives in countries such as China, Japan, and South Korea are aggressively pushing for smart solutions to manage the increasing waste volumes. The market is primarily driven by the need for scalable, foundational solutions in developing economies, focusing heavily on cost-effective sensor deployment and basic route optimization. Significant opportunities exist for vendors offering localized, scalable, and affordable technologies adapted to diverse geographical and socio-economic conditions.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Opportunity Hubs

These regions are currently smaller contributors but show high potential, particularly in key metropolitan areas like Dubai, Riyadh, São Paulo, and Mexico City. Growth in LATAM is driven by efforts to modernize aging infrastructure and tackle environmental concerns related to uncontrolled landfills. In the MEA, the adoption is highly concentrated in GCC countries, fueled by ambitious smart city projects (e.g., NEOM in Saudi Arabia) and high governmental spending on sustainable infrastructure development. The primary adoption driver in these areas is the creation of efficient, modern urban environments from scratch, often utilizing leapfrog technologies, favoring integrated solution providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smart Waste Management System Market.- Suez Environment

- Waste Management, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- Enevo

- Bigbelly, Inc.

- Veolia Environment S.A.

- SUEZ (Suez Environnement)

- Covanta Holding Corporation

- Tomra Systems ASA

- SAP SE

- Sensoneo J. S. A.

- Urbaser, S.A.

- RecycleSmart Solutions

- Rubicon Global, LLC

- Smartbin

- OnePlus Systems Inc.

- Ecube Labs Co., Ltd.

- Pepperl+Fuchs SE

- Evoeco LLC

- Republic Services, Inc.

- AMCS Group

- Clean Harbors, Inc.

- Befesa SA

Frequently Asked Questions

Analyze common user questions about the Smart Waste Management System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of IoT sensors in Smart Waste Management Systems?

The primary function of IoT sensors is to measure the fill level, weight, and temperature of waste containers in real-time, transmitting this data wirelessly to a central platform. This real-time visibility enables dynamic collection scheduling, preventing overflowing bins, optimizing collection routes, and reducing unnecessary trips, thereby lowering operational costs significantly.

How does Smart Waste Management contribute to a Circular Economy?

Smart Waste Management contributes to the Circular Economy by enhancing material recovery efficiency through AI-powered sorting, reducing landfill waste, and providing highly accurate data on material streams. This data allows municipalities and producers to implement targeted recycling policies, improve source separation, and ensure higher quality secondary raw materials re-enter the production cycle.

Which technology segment is expected to drive the highest revenue growth?

The Software and Services segment, including cloud-based data analytics, predictive maintenance tools, and route optimization platforms, is expected to drive the highest revenue growth. While hardware deployment is foundational, the long-term value and recurring revenue are concentrated in the sophisticated algorithms and actionable operational intelligence derived from the collected data.

What are the main financial barriers to adopting Smart Waste Management Solutions?

The main financial barriers include the high initial capital expenditure required for purchasing and deploying a large network of durable IoT sensors and smart bins, alongside the significant investment needed for backend integration, data storage, and the complex software licensing fees associated with advanced AI and optimization tools.

Which region currently leads the global Smart Waste Management System market?

North America currently leads the global Smart Waste Management System market in terms of market value, driven by rapid technological adoption, strong regulatory support for sustainability, and the necessity to automate processes to counteract high labor costs. Europe follows closely, specializing in advanced recycling technologies and circular economy integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager